Are Bank Employees Stressed? Job Perception and Positivity in the Banking Sector: An Italian Observational Study

Abstract

:1. Introduction

2. Material and Methods

2.1. Study Design and Setting

- -

- power 80%;

- -

- significance level 95%;

- -

- size of the target population N = 2000 (workers in the Banking sector from the Pisa District) [22];

- -

- the reference mean value of stress level in the administrative sector: the mean of Job demand is 67 (SD = 18.3) [23]);

- -

- a worst value of ±5: Job Demand ranged 67 ± 5.

2.2. Statistical Analyses

- -

- description of the demographic-job characteristics and the positive outlook of the sample;

- -

- description of the working context perception (BEST8′s items and demand-control scores);

- -

- univariate analysis in order to assess the differences in workplace context perception by gender, age, job characteristics, occupational stress level and positive outlook;

- -

- a post hoc chi-square analysis, using the standardized residual for each cell can be used to determine which discrepancies between observed and expected values are larger than might be expected by chance [24];

- -

- eight logistic regression models were computed, estimating OR with 95% confidence intervals (95% CIs): the dependent variable in the models was each item of the BEST8 tool, and the independent variables were the demographic-job characteristics, job demand, decision latitude and positivity scale;

- -

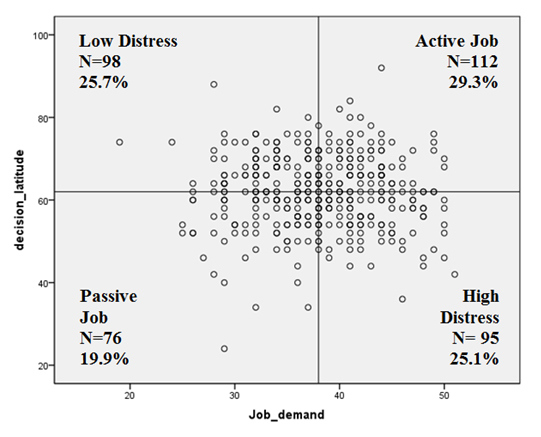

- analysis of JDCM was performed using tables and scatter-plots, stratifying by gender, age group, type of job, commercial role, type of bank.

3. Results

BEST8 Test Results

4. Discussion

5. Conclusions

Supplementary Materials

Acknowledgments

Author Contributions

Conflicts of Interest

Funding

References

- Petarli, G.B.; Zandonade, E.; Salaroli, L.B.; Bissoli, N.S. Assessment of occupational stress and associated factors among bank employees in Vitoria, State of Espírito Santo, Brazil. Cienc. Saude Coletiva 2015, 20, 3925–3934. [Google Scholar] [CrossRef] [PubMed]

- Neelamegam, R.; Asrafi, S. Work Stress among Employees of Dindigul District Central Cooperative Bank, Tamil Nadu: A Study. J. Manag. Res. 2010, 9, 57–69. [Google Scholar]

- Giorgi, G.; Arcangeli, G.; Perminiene, M.; Lorini, C.; Ariza-Montes, A.; Fiz-Perez, J.; Di Fabio, A.; Mucci, N. Work-Related Stress in the Banking Sector: A Review of Incidence, Correlated Factors, and Major Consequences. Front. Psychol. 2017, 8, 2166. [Google Scholar] [CrossRef] [PubMed]

- Leka, S.; Griffiths, A.; Cox, T. Protecting Workers’ Health Series No. 3. Work Organization and Stress; WHO: Geneva, Switzerland, 2005. [Google Scholar]

- Rao, J.V.; Chandraiah, K. Occupational stress, mental health and coping among information technology professionals. Indian J. Occup. Environ. Med. 2012, 16, 22–26. [Google Scholar] [CrossRef] [PubMed]

- Kumar, S.G.; Dharanipriya, A. Prevalence and pattern of occupational injuries at workplace among welders in coastal south India. Indian J. Occup. Environ. Med. 2014, 18, 135–139. [Google Scholar] [CrossRef] [PubMed]

- Kumar, S.G.; Sundaram, N.D. Prevalence of stress level among Bank employees in urban Puducherry, India. Ind. Psychiatry J. 2014, 23, 15–17. [Google Scholar] [CrossRef] [PubMed]

- Del Rio, G. Stress e Lavoro nei Servizi. Sintomi, Cause e Rimedi del Burnout, 2nd ed.; Carocci: Roma, Italy, 2000; ISBN 978-88-430-0066-1. [Google Scholar]

- Avallone, F.; Paplomatas, A. Salute Organizzativa; Raffaello Cortina Editore: Milan, Italy, 2005; ISBN 978-88-7078-929-4. [Google Scholar]

- Baldasseroni, A.; Camerino, D.; Cesana, G.C.; Fattorini, E.; Ferrario, M.; Mariani, M.; Tartaglia, R. La Valutazione dei Fattori Psicosociali. Proposta della Versione Italiana del Job Content Questionnaire. Fogli di Informazione ISPESL 2001, 14, 20–32. [Google Scholar]

- Mucci, N.; Giorgi, G.; Fiz Perez, J.; Iavicoli, I.; Arcangeli, G. Predictors of trauma in bank employee robbery victims. Neuropsychiatr. Dis. Treat. 2015, 11, 2605–2612. [Google Scholar] [CrossRef] [PubMed]

- Converso, D.; Viotti, S. Post-traumatic stress reaction in a sample of bank employees victims of robbery in the workplace: The role of pre-trauma and peri-trauma factors. Med. Lav. 2014, 105, 243–254. [Google Scholar] [PubMed]

- Fichera, G.P.; Fattori, A.; Neri, L.; Musti, M.; Coggiola, M.; Costa, G. Post-traumatic stress disorder among bank employee victims of robbery. Occup. Med. Oxf. Engl. 2015, 65, 283–289. [Google Scholar] [CrossRef] [PubMed]

- Hansen, M.; Elklit, A. Predictors of acute stress disorder in response to bank robbery. Eur. J. Psychotraumatol. 2011, 2, 5864. [Google Scholar] [CrossRef] [PubMed]

- Michailidis, M.; Georgiou, Y. Employee occupational stress in banking. Work Read. Mass 2005, 24, 123–137. [Google Scholar]

- Amigo, I.; Asensio, E.; Menéndez, I. Working in direct contact with the public as a predictor of burnout in the banking sector. Psicothema 2014, 26, 222–226. [Google Scholar] [CrossRef]

- Seegers, G.; van Elderen, T. Examining a Model of Stress Reactions of Bank Directors. Eur. J. Psychol. Assess. 1996, 12, 212–223. [Google Scholar] [CrossRef]

- Mannocci, A.; Marchini, L.; Scognamiglio, A.; La Torre, G. A set of key questions to assess the stress among bank employees and its reliability. Senses Sci. 2017, 4, 335–357. [Google Scholar] [CrossRef]

- De Lange, A.H.; Taris, T.W.; Kompier, M.A.J.; Houtman, I.L.D.; Bongers, P.M. “The very best of the millennium”: Longitudinal research and the demand-control-(support) model. J. Occup. Health Psychol. 2003, 8, 282–305. [Google Scholar] [CrossRef] [PubMed]

- Karasek, R.; Brisson, C.; Kawakami, N.; Houtman, I.; Bongers, P.; Amick, B. The Job Content Questionnaire (JCQ): An instrument for internationally comparative assessments of psychosocial job characteristics. J. Occup. Health Psychol. 1998, 3, 322–355. [Google Scholar] [CrossRef] [PubMed]

- Caprara, G.V.; Alessandri, G.; Eisenberg, N.; Kupfer, A.; Steca, P.; Caprara, M.G.; Yamaguchi, S.; Fukuzawa, A.; Abela, J. The positivity scale. Psychol. Assess. 2012, 24, 701–712. [Google Scholar] [CrossRef] [PubMed]

- Banca d’Italia EUROSISTEMA Banca d’Italia—Bollettino Statistico IV 2016. Available online: https://www.bancaditalia.it/pubblicazioni/bollettino-statistico/index.html (accessed on 6 December 2017).

- Kuper, H.; Marmot, M. Job strain, job demands, decision latitude, and risk of coronary heart disease within the Whitehall II study. J. Epidemiol. Commun. Health 2003, 57, 147–153. [Google Scholar] [CrossRef]

- Beasley, T.M.; Schumacker, R.E. Multiple Regression Approach to Analyzing Contingency Tables: Post Hoc and Planned Comparison Procedures. J. Exp. Educ. 1995, 64, 79–93. [Google Scholar] [CrossRef]

- MacCallum, R.C.; Zhang, S.; Preacher, K.J.; Rucker, D.D. On the practice of dichotomization of quantitative variables. Psychol. Methods 2002, 7, 19–40. [Google Scholar] [CrossRef] [PubMed]

- Valente, M.S.S.; Menezes, P.R.; Pastor-Valero, M.; Lopes, C.S. Depressive symptoms and psychosocial aspects of work in bank employees. Occup. Med. Oxf. Engl. 2016, 66, 54–61. [Google Scholar] [CrossRef] [PubMed]

- Li, J.; Ding, H.; Han, W.; Jin, L.; Kong, L.-N.; Mao, K.-N.; Wang, H.; Wu, J.-P.; Wu, Y.; Yang, L.; et al. The association of work stress with somatic symptoms in Chinese working women: A large cross-sectional survey. J. Psychosom. Res. 2016, 89, 7–10. [Google Scholar] [CrossRef] [PubMed]

- Lin, Y.-H.; Chen, C.-Y.; Hong, W.-H.; Lin, Y.-C. Perceived job stress and health complaints at a bank call center: Comparison between inbound and outbound services. Ind. Health 2010, 48, 349–356. [Google Scholar] [CrossRef] [PubMed]

- Colamesta, V.; Marchini, L.; Bertazzoni, G.; Polimeni, A.; Torre, G.L. Gender differences in reaching top roles in banking: A cross-sectional study performed by bankers work in province of Pisa. Epidemiol. Biostat. Public Health 2015, 12. [Google Scholar] [CrossRef]

- Granleese, J. Occupational pressures in banking: Gender differences. Women Manag. Rev. 2004, 19, 219–226. [Google Scholar] [CrossRef]

- Giga, S.; Hoel, H.; Cooper, C. Violence and Stress at Work in the Postal Sector; International Labour Organization: Geneva, Switzerland, 2003. [Google Scholar]

- Hausmann, N.; Mueller, K.; Hattrup, K.; Spiess, S.-O. An Investigation of the Relationships between Affective Organisational Commitment and National Differences in Positivity and Life Satisfaction: Positivity and organisational commitment. Appl. Psychol. 2013, 62, 260–285. [Google Scholar] [CrossRef]

- Bashir, U.; Ramay, M.I. Impact of Stress on Employees Job Performance a Study on Banking Sector of Pakistan. Int. J. Mark. Stud. 2010, 2, 122–126. [Google Scholar] [CrossRef]

- Springer, G.J. A Study of Job Motivation, Satisfaction, and Performance among Bank Employees. J. Glob. Bus. 2011, 5, 29. [Google Scholar]

- Zeb, A.; Rehman, G.S. The impact of job stress on employee’s performance: Investigating the moderating effect of employees motivation. City Univ. Res. J. 2015, 5, 120–129. [Google Scholar]

- Goswami, T.G. Indian Journal of Commerce & Management Studies. Ndian J. Commer. Manag. Stud. 2015, 6, 51–56. [Google Scholar]

| Qualitative Variables | N (%) | |

|---|---|---|

| Gender | Male | 174 (45.3) |

| Female | 210 (54.7) | |

| Age (years) | ≤44 | 170 (29.4) |

| 45–55 | 201 (52.4) | |

| Over 55 | 70 (18.2) | |

| Civil status | Single | 52 (13.5) |

| Married/domestic partnership | 296 (77.1) | |

| Separated/divorced | 32 (8.3) | |

| Widowed | 4 (1.0) | |

| Sons | Yes | 271 (70.6) |

| No | 113 (29.4) | |

| Daily Smoker | No | 306 (79.7) |

| Yes | 78 (20.3) | |

| Antidepressants or sedatives drugs a | No | 276 (71.9) |

| Yes | 108 (28.1) | |

| Bank | Local | 148 (38.5) |

| National | 236 (61.5) | |

| Job position | Employee | 286 (74.5) |

| Manager | 98 (25.5) | |

| Job contracts | Indeterminate | 372 (97) |

| Fixed term | 11 (3.0) | |

| Commercial role | No | 115 (30.0) |

| Yes | 269 (70.0) | |

| BEST8 Questionnaire | ||

| 1-In terms of safety, It makes me uncomfortable thinking about a possible robbery on my desk. | I agree | 289 (75.1) |

| I don’t agree | 95 (24.9) | |

| 2-The failure to achieve the budgets targets causes me anxiety, because there are risks of geographical mobility and/or of the switch of duties. | I agree | 315 (82.4) |

| I don’t agree | 69 (17.6) | |

| 3-The pace of change on work place exceeds my capacity for adaptation. | I agree | 225 (58.5) |

| I don’t agree | 159 (41.5) | |

| 4-I’m not comfortable recommending a bank product just because in the budget. | I agree | 322 (83.4) |

| I don’t agree | 62 (16.6) | |

| 5-Frequent Company’s re-organization makes me feel uncomfortable. | I agree | 300 (77.9) |

| I don’t agree | 84 (22.1) | |

| 6-The requests of sales and/or consultations are in conflict with what I consider morally right. | Yes | 123 (68.5) |

| No | 242 (31.5) | |

| 7-I have time to dedicate myself to my hobbies/activities/stuff. | Yes | 175 (46.1) |

| No | 206 (53.9) | |

| 8-My colleagues or superiors ask me to be more flexible with the job. | Yes | 242 (63.6) |

| No | 139 (36.4) | |

| Quantitative variables | Mean (SD) | |

| Job Demand | 37.9 (5.8) | |

| Decision Latitude | 62.0 (9.0) | |

| Positivity Scale | 24.0 (4.2) | |

| Job Demand-Control Model | |||||||

|---|---|---|---|---|---|---|---|

| Active Job | Low Distress | Passive Job | High Distress | ||||

| N (%) | N (%) | N (%) | N (%) | Tot | p b | ||

| Qualitative Characteristic | |||||||

| Gender | Male | 51 (29) | 42 (24) | 43 (25) | 38 (22) | 174 | 0.145 |

| Female | 61 (29) | 56 (27) | 33 (16) | 58 (28) | 208 | ||

| Age (years) | ≤44 | 50 (30) | 44 (26) | 29 (17) | 46 (27) | 169 | 0.020 |

| 45–55 | 47 (33) | 40 (28) | 22 (15) | 35 (24) | 144 | ||

| Over 55 | 15 (22) | 14 (20) | 25 (36) e | 15 (22) | 69 | ||

| Civil status | Single | 16 (31) | 14 (27) | 10 (19) | 12 (23) | 52 | c |

| Married/domestic partnership | 91 (31) | 70 (24) | 58 (20) | 76 (26) | 295 | ||

| Separated/divorce | 4 (13) | 13 (42) | 7 (23) | 7 (23) | 31 | ||

| Widowed | 1 (25) | 1 (25) | 1 (25) | 1 (25) | 0 | ||

| Children | Yes | 83 (31) | 69 (26) | 57 (21) | 61 (23) | 270 | 0.298 |

| No | 29 (26) | 29 (26) | 19 (17) | 35 (31) | 112 | ||

| Daily Smoker | No | 87 (29) | 80 (26) | 66 (22) | 71 (23) | 304 | 0.184 |

| Yes | 25 (32) | 18 (23) | 10 (13) | 25 (32) | 78 | ||

| Antidepressants or sedatives (drugs) a | No | 79 (29) | 83 (30) d | 58 (21) | 56 (20)d | 276 | 0.001 |

| Yes | 33 (31) | 15 (14) d | 18 (17) | 40 (38)d | 106 | ||

| Bank | Local | 40 (27) | 52 (35) d | 29 (20) | 26 (18) | 147 | 0.002 |

| National | 72 (31) | 46 (20) d | 47 (20) | 70 (30) | 235 | ||

| Job position | Employee | 70 (25) d | 77 (27) | 58 (20) | 79 (28) | 284 | 0.006 |

| Manager | 42 (43) d | 21 (21) | 18 (18) | 17 (17) | 98 | ||

| Commercial role | No | 23 (20) | 34 (30) | 35 (30) d | 23 (20) | 115 | 0.001 |

| Yes | 89 (33) | 64 (24) | 41 (15) d | 73 (27) | 267 | ||

| BEST8 Questionnaire | |||||||

| 1. In terms of safety, It makes me uncomfortable thinking about a possible robbery at my desk. | I agree | 83 (29) | 76 (26) | 51 (18) | 78 (27) | 288 | 0.177 |

| I don’t agree | 29 (31) | 22 (23) | 25 (27) | 18 (19) | 94 | ||

| 2. The failure to achieve the budget targets causes me anxiety, because there are risks of geographical transfer (mobility) and/or of a switch of duties. | I agree | 98 (31) | 67 (21) d | 59 (19) | 90 (29) d | 314 | <0.001 |

| I don’t agree | 14 (21) | 31 (46) d | 17 (25) | 6 (9) d | 68 | ||

| 3. The pace of change in the workplace exceeds my capacity for adaptation. | I agree | 73 (33) | 42 (19) d | 41 (18) | 68 (30) | 224 | <0.001 |

| I don’t agree | 39 (25) | 56 (35) d | 35 (22) | 28 (18) | 158 | ||

| 4. I’m not comfortable recommending a bank product just because it is in the budget. | I agree | 96 (30) | 70 (22) d | 64 (20) | 91 (28) d | 321 | <0.001 |

| I don’t agree | 16 (26) | 28 (46) d | 12 (20) | 5 (8) d | 61 | ||

| 5. Frequent Company re-organization makes me feel uncomfortable. | I agree | 96 (32) | 59 (20) d | 61 (20) d | 83 (28) | 299 | <0.001 |

| I don’t agree | 16 (19) | 39 (47) d | 15 (18) d | 13 (16) | 83 | ||

| 6. The sales requests and/or consultations are in conflict with what I consider to be morally right. | Yes | 67 (28) | 39 (16) d | 53 (22) | 82 (34) d | 241 | <0.001 |

| No | 40 (33) | 49 (40) d | 20 (16) | 13 (11) d | 122 | ||

| 7. I have time to dedicate myself to hobbies/activities/stuff. | Yes | 36 (21) d | 59 (34) d | 45 (26) | 34 (19) | 174 | <0.001 |

| No | 74 (36) d | 39 (19) d | 30 (15) | 62 (30) | 205 | ||

| 8. My colleagues or superiors ask me to be more flexible with the job. | Yes | 77 (32) | 42 (17) d | 48 (20) | 75 (31) d | 242 | <0.001 |

| No | 35 (26) | 55 (40) d | 27 (20) | 20 (15) d | 137 | ||

| Covariates | In Terms of Safety, It Makes Me Uncomfortable Thinking about a Possible Robbery on My Desk | The Failure to Achieve the Budget Targets Causes Me Anxiety, Because There Are Risks of Geographical Mobility and/or of the Switch of Duties | The Pace of Change on Work Place Exceeds My Capacity for Adaptation | I’m Not Comfortable Recommending a Bank Product Just Because in the Budget | |||||

|---|---|---|---|---|---|---|---|---|---|

| OR | 95% CI | OR | 95% CI | OR | 95% CI | OR | 95% CI | ||

| Gender | Male b | 1 | 1 | 1 | 1 | ||||

| Female | 2.42 | 1.50; 3.91 * | 1.92 | 1.07; 3.45 * | 1.47 | 0.94; 2.34 | 2.3 | 1.26; 4.18 * | |

| Age | <45 b | 1 | 1 | 1 | 1 | ||||

| 45–54 | 1.42 | 0.86; 2.38 | 0.50 | 0.27; 0.91 * | 1.23 | 0.72; 2.08 | 0.81 | 0.40; 1.62 | |

| >54 | 1.63 | 0.81; 3.27 | 0.69 | 0.30; 1.59 | 1.97 | 1.07; 3.65 * | 0.69 | 0.33; 1.45 | |

| Children | No b | 1 | 1 | 1 | 1 | ||||

| Yes | 0.67 | 0.38; 1.17 | 0.55 | 0.27; 1.12 | 0.93 | 0.55; 1.58 | 0.78 | 0.38; 1.60 | |

| Bank | Local b | 1 | 1 | 1 | 1 | ||||

| National | 0.94 | 0.55; 1.61 | 1.93 | 1.07; 3.48 * | 1.85 | 1.17; 2.93 * | 1.5 | 0.83; 2.71 | |

| Commercial role | No b | 1 | 1 | 1 | 1 | ||||

| Yes | 0.9 | 0.52; 1.58 | 1.02 | 0.53; 1.97 | 1.14 | 0.66; 1.96 | 0.89 | 0.45; 1.75 | |

| Job position | Employee b | 1 | 1 | 1 | 1 | ||||

| Manager | 1.03 | 0.55; 1.94 | 1.38 | 0.68; 2.83 | 0.81 | 0.46; 1.40 | 0.98 | 0.47; 2.08 | |

| Smoker | No b | 1 | 1 | 1 | 1 | ||||

| Yes | 1.7 | 0.89; 3.22 | 0.72 | 0.35; 1.49 | 0.93 | 0.52; 1.96 | 0.77 | 0.37; 1.59 | |

| Drugs a | No b | 1 | 1 | 1 | 1 | ||||

| Yes | 1.09 | 0.61; 1.95 | 3.77 | 1.51; 9.42 * | 2.00 | 1.16; 3.46 * | 0.52 | 0.26; 1.04 | |

| Positivity Scale | 1.04 | 0.98; 1.10 | 1.01 | 0.94; 1.09 | 0.88 | 0.83; 0.93 * | 0.92 | 0.85; 0.99 * | |

| Job Demand | 1.01 | 0.96; 1.05 | 1.11 | 1.05; 1.17 * | 1.07 | 1.02; 1.11 * | 1.10 | 1.04; 1.16 * | |

| Decision Latitude | 0.99 | 0.97; 1.02 | 0.96 | 0.93; 0.99 * | 0.98 | 0.95; 1.01 | 0.95 | 0.92; 0.99 * | |

| Hosmer-Lemeshow’s Test | 0.364 | 0.827 | 0.290 | 0.413 | |||||

| Covariates | Frequent Company’s Re-Organization Make Me Feel Uncomfortable | The Requests of Sales and/or Consultations Are in Conflict with What I Consider Morally Right | I have Time to Dedicate Myself to My Hobbies/Activities/Stuff | My Colleagues or Superiors Ask Me to Be More Flexible with the Job | |||||

|---|---|---|---|---|---|---|---|---|---|

| OR | 95% CI | OR | 95% CI | OR | 95% CI | OR | 95% CI | ||

| Gender | Male b | 1 | 1 | 1 | 1 | ||||

| Female | 1.08 | 0.63; 1.84 | 2.31 | 1.38; 3.87 * | 0.58 | 0.37; 0.90 * | 1.72 | 1.10; 2.70 * | |

| Age | <45 b | 1 | 1 | 1 | 1 | ||||

| 45–54 | 0.81 | 0.48; 1.39 | 0.78 | 0.50; 3.87 | 1.30 | 0.81; 2.11 | 0.89 | 0.52; 1.53 | |

| >54 | 0.88 | 0.41; 1.88 | 0.68 | 0.30; 1.58 | 1.23 | 0.60; 2.52 | 0.78 | 0.42; 1.44 | |

| Sons | No b | 1 | 1 | 1 | 1 | ||||

| Yes | 0.86 | 0.47; 1.56 | 1.51 | 0.85; 2.69 | 0.48 | 0.29; 0.79 * | 0.85 | 0.50; 1.44 | |

| Bank | Local b | 1 | 1 | 1 | 1 | ||||

| National | 1.51 | 0.90; 2.55 | 4.24 | 2.45; 7.34 * | 1.97 | 1.22; 3.18 * | 1.25 | 0.79; 1.99 | |

| Commercial role | No b | 1 | 1 | 1 | 1 | ||||

| Yes | 1.05 | 0.90; 2.55 | 0.42 | 0.22; 0.79 * | 1.27 | 0.75; 2.16 | 1.01 | 0.59; 1.72 | |

| Job position | Employee b | 1 | 1 | 1 | 1 | ||||

| Manager | 1.11 | 0.57; 2.16 | 0.65 | 0.36; 1.17 | 0.73 | 0.43; 1.25 | 1.18 | 0.69; 2.00 | |

| Smoker | No b | 1 | 1 | 1 | 1 | ||||

| Yes | 1.26 | 0.64; 2.48 | 0.69 | 0.36; 1.31 | 1.80 | 1.01; 3.20 * | 0.81 | 0.46; 1.42 | |

| Drugs a | No b | 1 | 1 | 1 | 1 | ||||

| Yes | 1.61 | 0.83; 3.12 | 1.19 | 0.64; 2.22 | 0.59 | 0.34; 0.99 | 1.27 | 0.74; 2.19 | |

| Positivity scale | 0.95 | 0.92; 0.98 * | 0.90 | 0.84; 0.96 * | 1.06 | 1.01; 1.13 * | 1.01 | 0.94; 1.07 | |

| Job demand | 1.09 | 1.04; 1.14 * | 1.08 | 1.03; 1.13 * | 0.89 | 0.85; 0.93 * | 1.18 | 1.07; 1.16 * | |

| Decision Latitude | 0.95 | 0.92; 0.98 * | 0.94 | 0.91; 0.97 * | 0.99 | 0.97; 1.03 | 0.95 | 0.93; 0.98 * | |

| Hosmer-Lemeshow’s Test | 0.232 | 0.821 | 0.190 | 0.970 | |||||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mannocci, A.; Marchini, L.; Scognamiglio, A.; Sinopoli, A.; De Sio, S.; Sernia, S.; La Torre, G. Are Bank Employees Stressed? Job Perception and Positivity in the Banking Sector: An Italian Observational Study. Int. J. Environ. Res. Public Health 2018, 15, 707. https://doi.org/10.3390/ijerph15040707

Mannocci A, Marchini L, Scognamiglio A, Sinopoli A, De Sio S, Sernia S, La Torre G. Are Bank Employees Stressed? Job Perception and Positivity in the Banking Sector: An Italian Observational Study. International Journal of Environmental Research and Public Health. 2018; 15(4):707. https://doi.org/10.3390/ijerph15040707

Chicago/Turabian StyleMannocci, Alice, Laura Marchini, Alfredo Scognamiglio, Alessandra Sinopoli, Simone De Sio, Sabina Sernia, and Giuseppe La Torre. 2018. "Are Bank Employees Stressed? Job Perception and Positivity in the Banking Sector: An Italian Observational Study" International Journal of Environmental Research and Public Health 15, no. 4: 707. https://doi.org/10.3390/ijerph15040707

APA StyleMannocci, A., Marchini, L., Scognamiglio, A., Sinopoli, A., De Sio, S., Sernia, S., & La Torre, G. (2018). Are Bank Employees Stressed? Job Perception and Positivity in the Banking Sector: An Italian Observational Study. International Journal of Environmental Research and Public Health, 15(4), 707. https://doi.org/10.3390/ijerph15040707