Recovering Historical Inflation Data from Postage Stamps Prices

Abstract

:1. Introduction and Motivation

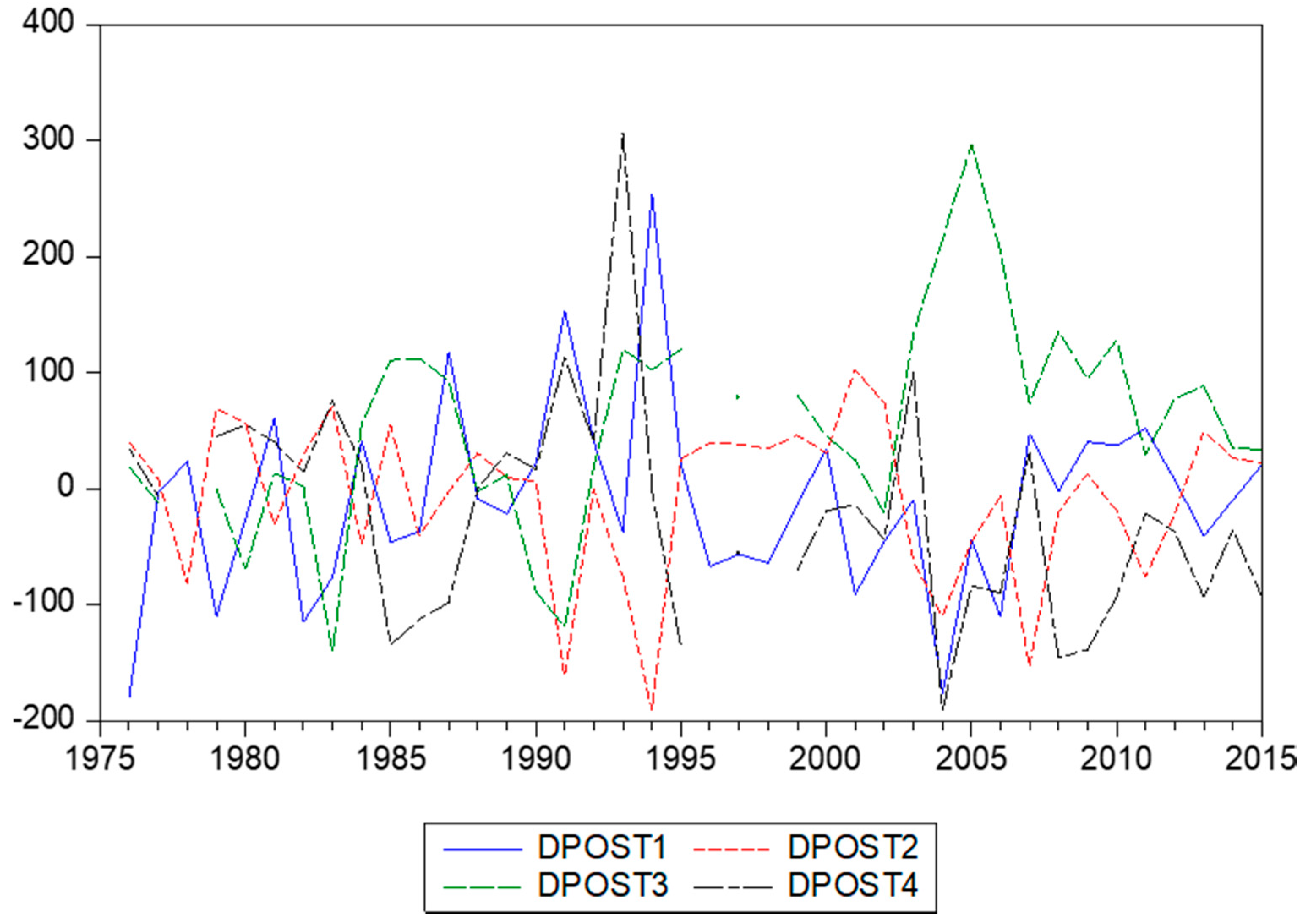

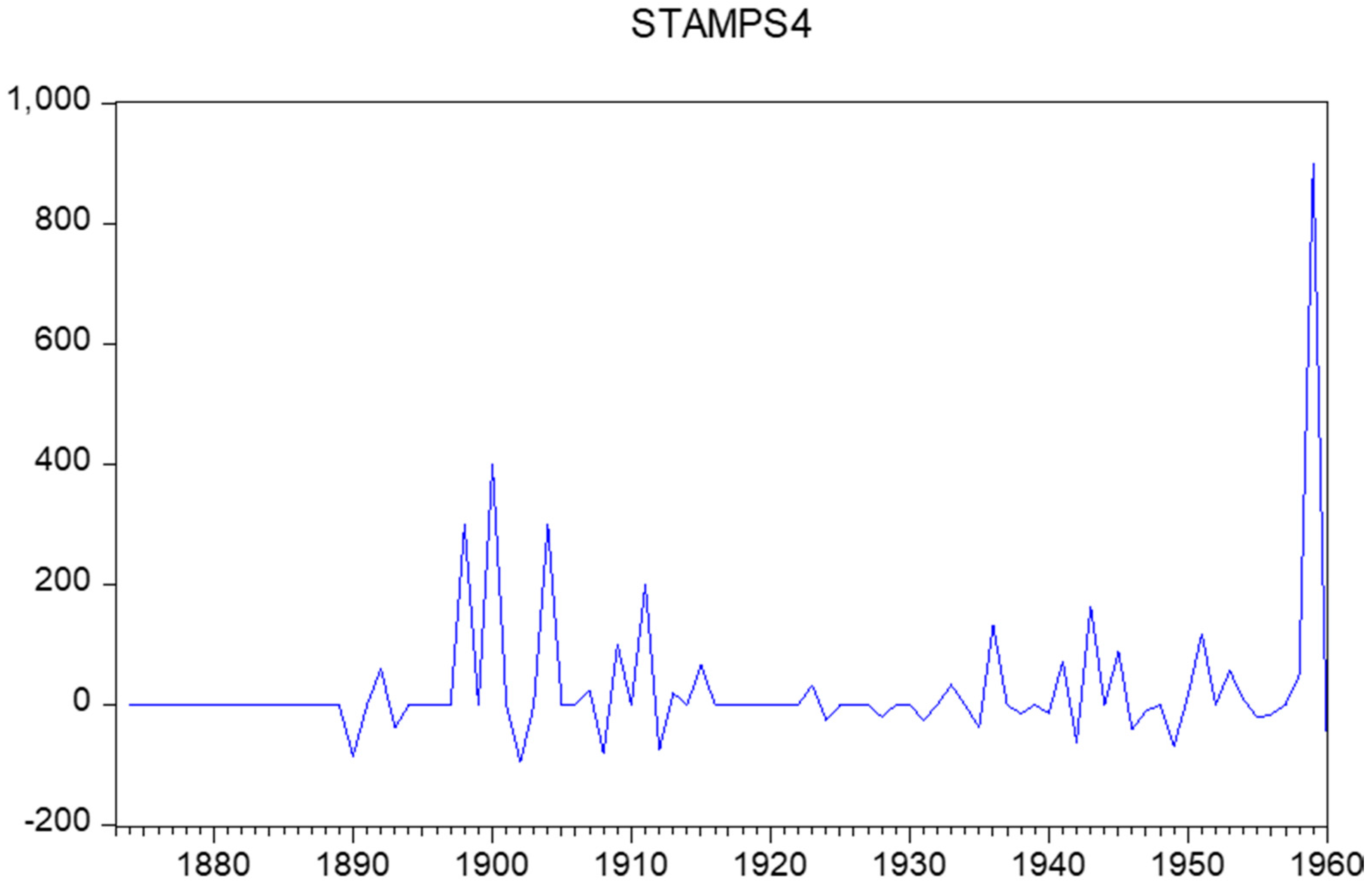

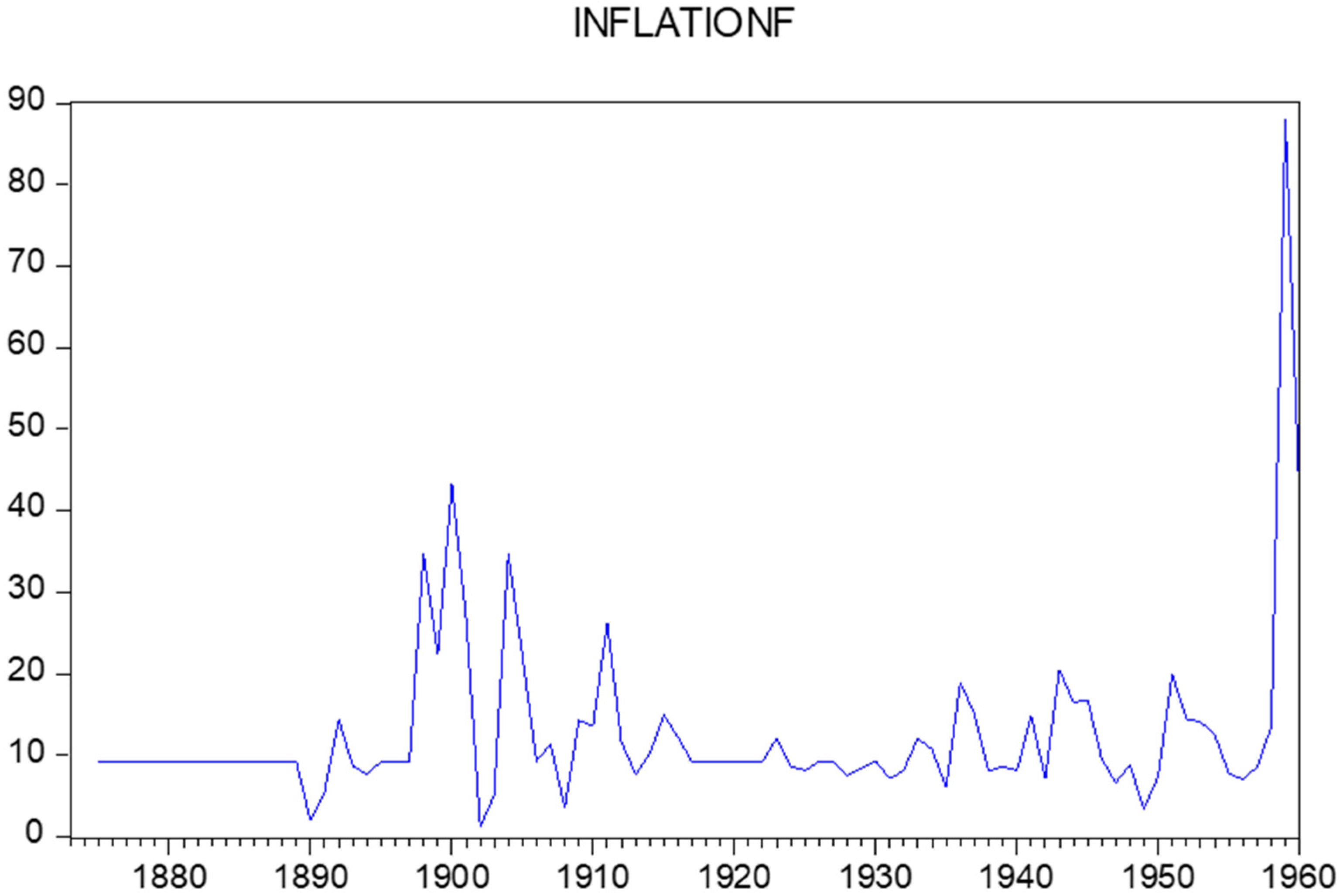

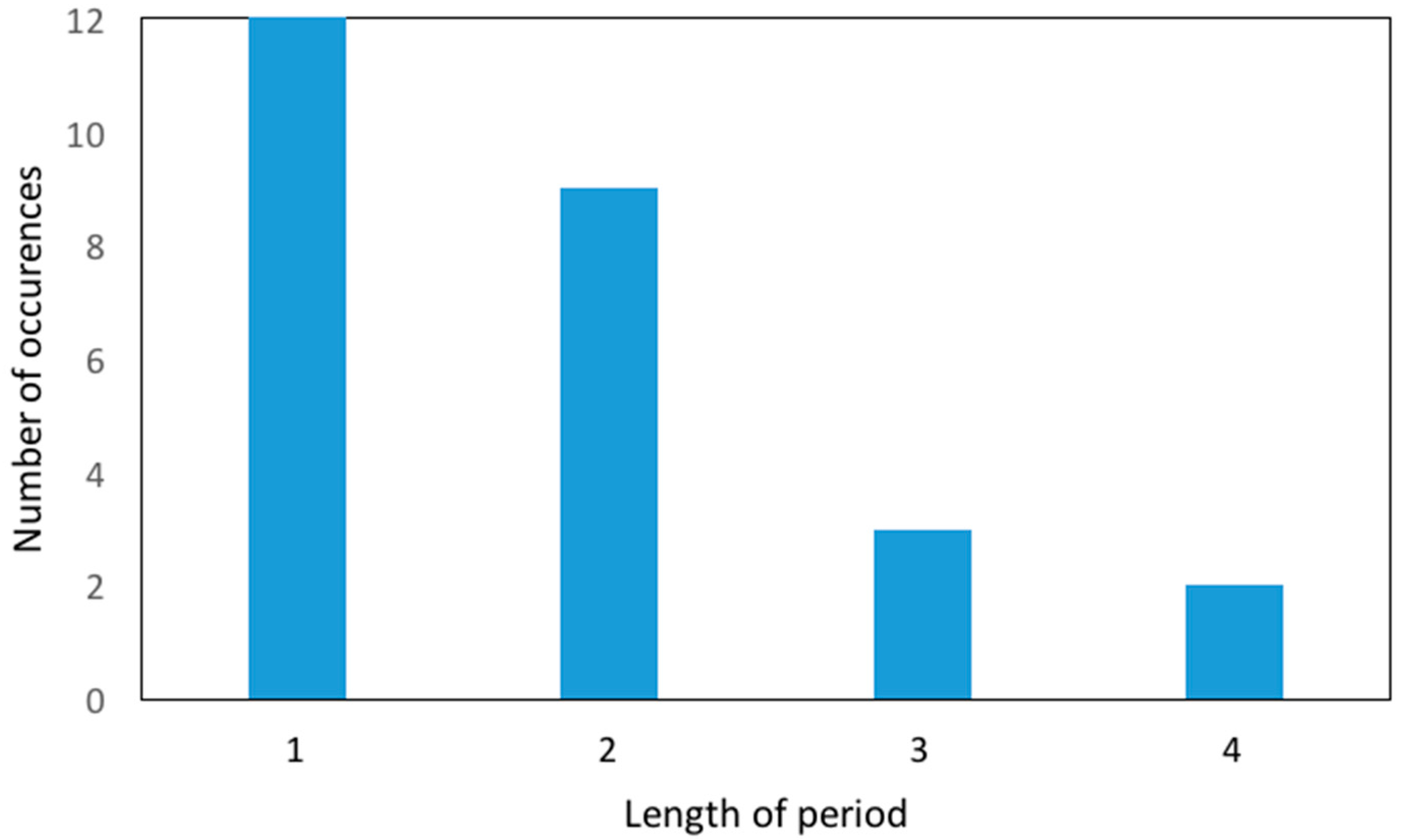

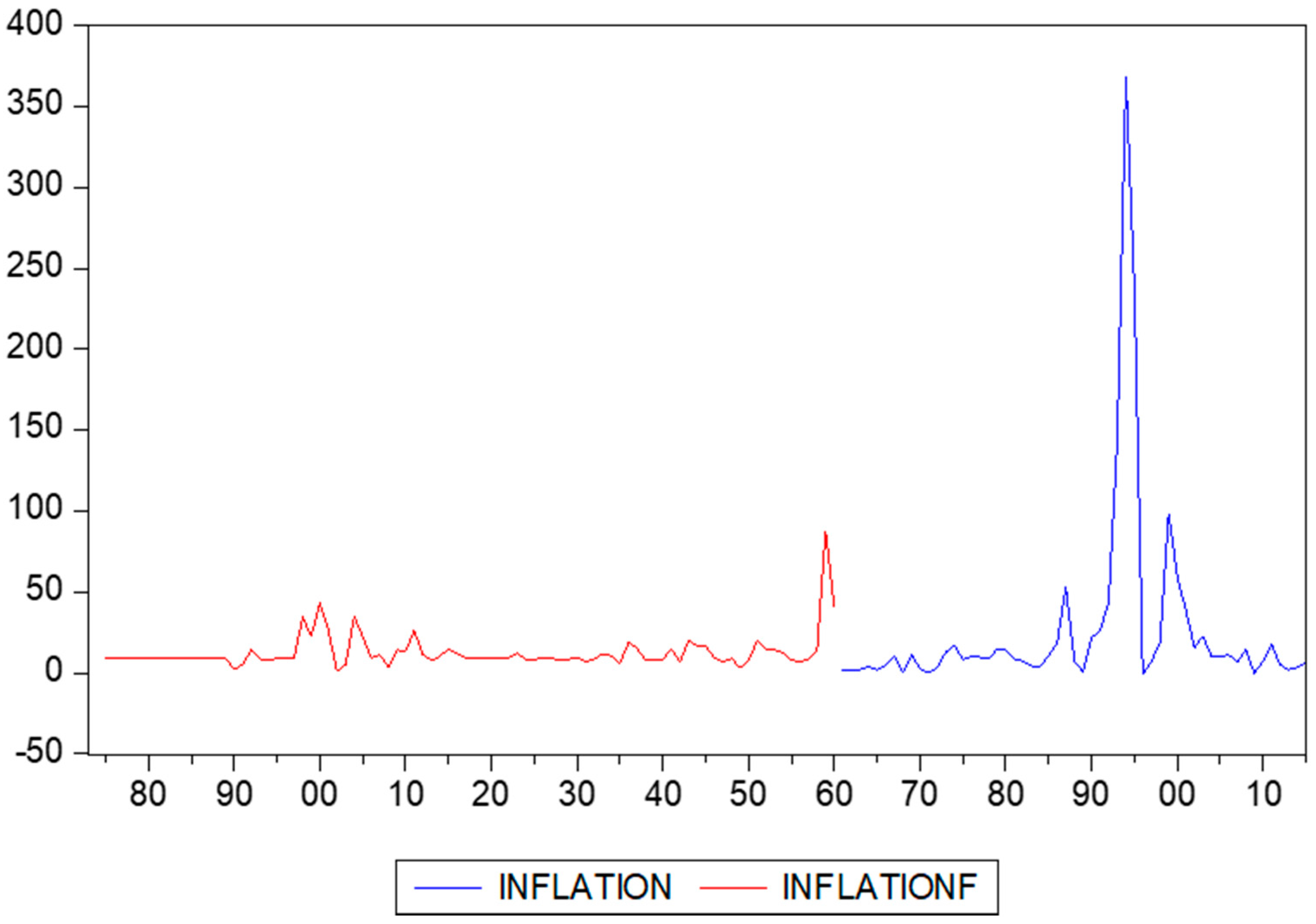

2. The Data

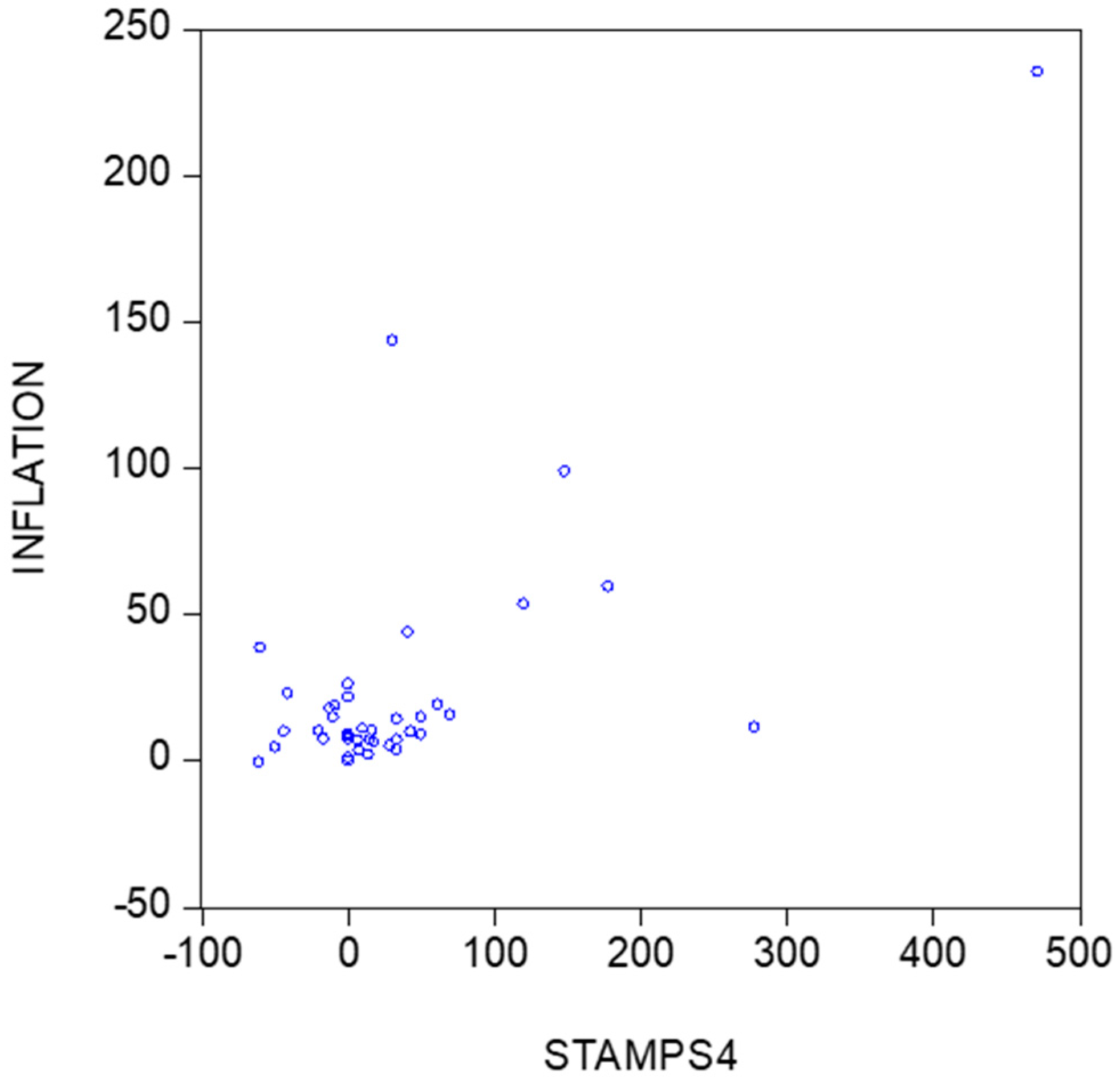

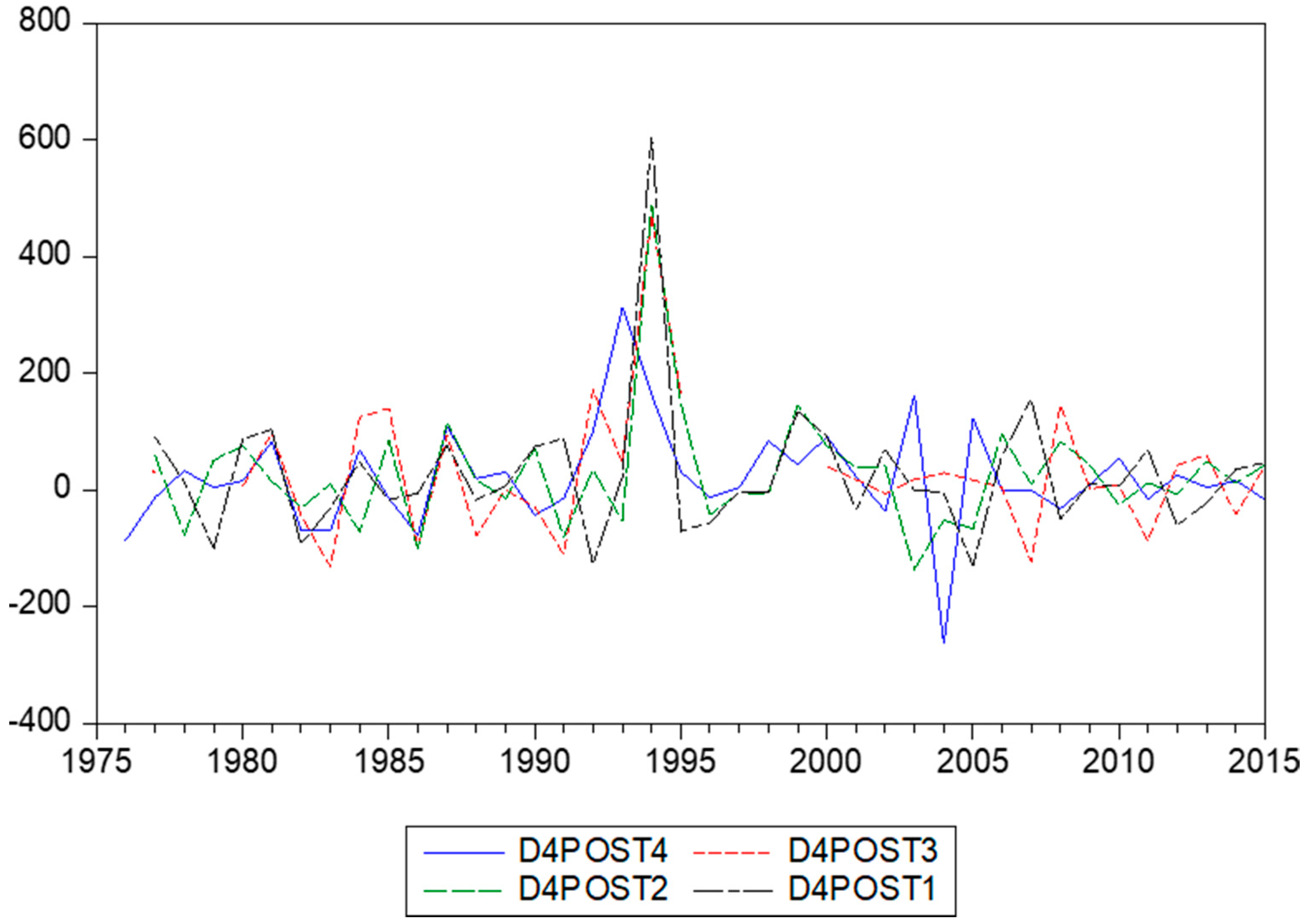

3. Two Econometric Models

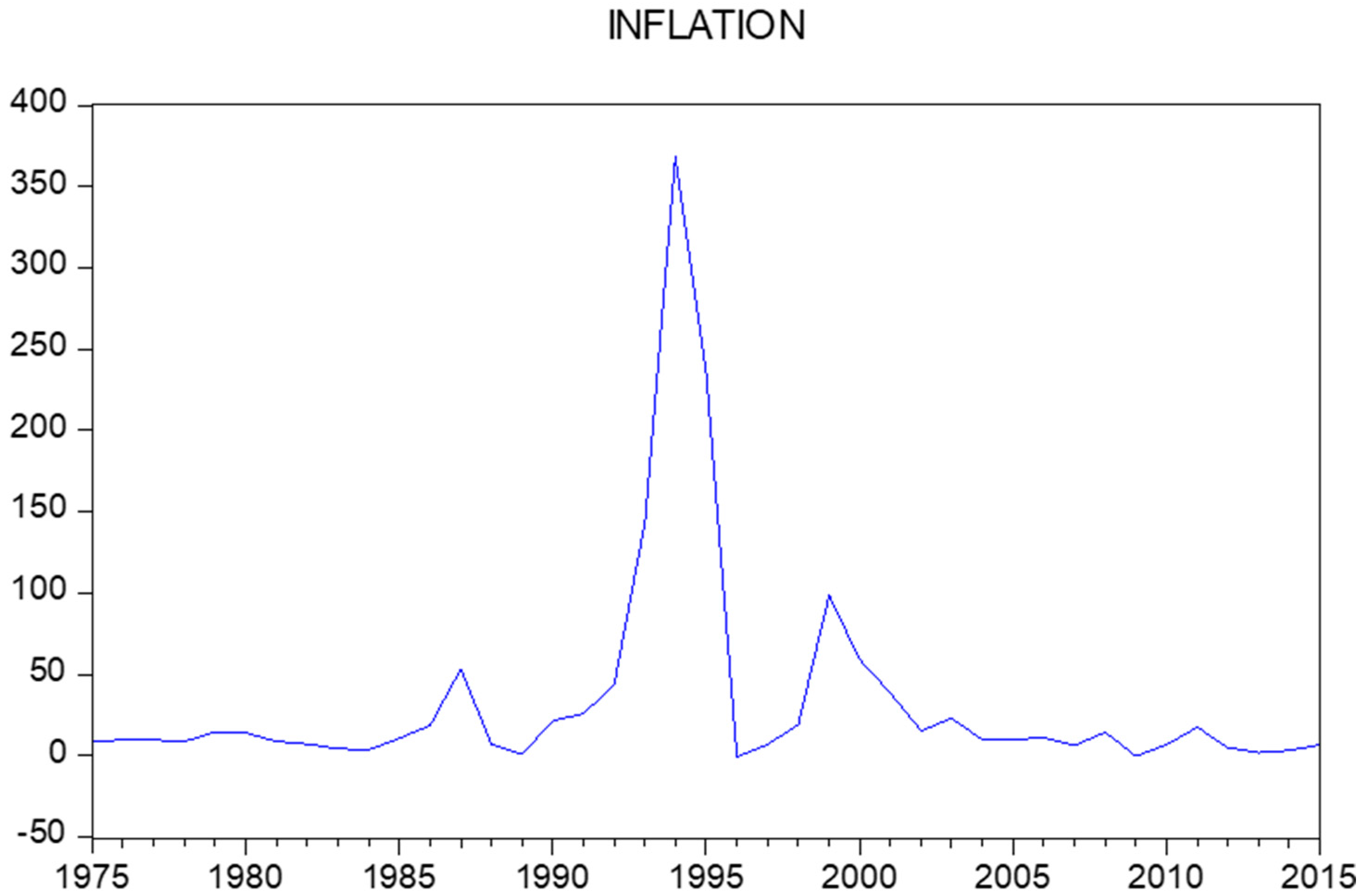

4. Recovery of Historical Inflation Rates

5. Conclusions

Author Contributions

Conflicts of Interest

References

- Allen, Robert C., Jean-Pascal Bassino, Debin Ma, Christine Moll-Murata, and Jan Luiten van Zanden. 2011. Wages, prices, and living standards in China, 1738–1925: In comparison with Europe, Japan, and India. Economic History Review 64: 8–38. [Google Scholar] [CrossRef] [Green Version]

- Andreou, Elena, Eric Ghysels, and Andros Kourtellos. 2010. Regression models with mixed sampling frequencies. Journal of Econometrics 158: 246–61. [Google Scholar] [CrossRef]

- Bolt, Jutta, and Jan Luiten van Zanden. 2014. The Maddison Project: Collaborative research on historical national accounts. Economic History Review 67: 627–51. [Google Scholar] [CrossRef]

- Cendejas Bueno, Jose Luis, and Cecilia Font de Villanueva. 2015. Convergence of inflation with a common cycle: Estimating and modelling Spanish historical inflation from the 16th to the 18th centuries. Empirical Economics 48: 1643–65. [Google Scholar] [CrossRef]

- Chang, Chia-Lin, and Michael McAleer. 2017. The correct regularity condition and interpretation of asymmetry in EGARCH. Economics Letters 161: 52–55. [Google Scholar] [CrossRef]

- Clements, Michael P., and Anna B. Galvao. 2008. Macroeconomic forecasting with mixed-frequency data. Journal of Business and Economic Statistics 26: 546–54. [Google Scholar] [CrossRef]

- Deaton, Angus, and Alan Heston. 2010. Understanding PPPs and PPP-based national accounts. American Economic Journal: Macroeconomics 2: 1–35. [Google Scholar] [CrossRef]

- Frankema, Ewout H. P., and Marlous van Waijenburg. 2012. Structural impediments to African growth? New evidence from real wages in British Africa, 1880–1965. Journal of Economic History 72: 895–926. [Google Scholar] [CrossRef]

- Franses, Philip Hans, and Rianne Legerstee. 2014. Statistical institutes and economic prosperity. Quality and Quantity 48: 507–20. [Google Scholar] [CrossRef]

- Ghysels, Eric, Pedro Santa-Clara, and Rossen Valkanov. 2004. The MIDAS Touch: Mixed Data Sampling Regression Models. CIRANO Working Paper 2004s-20. Montreal, QC, Canada: CIRANO. [Google Scholar]

- Ghysels, Eric, Arthur Sinko, and Rossen Valkanov. 2007. Midas regressions: Further results and new directions. Econometric Reviews 26: 53–90. [Google Scholar] [CrossRef]

- Hoefte, Rosemarijn. 2013. Suriname in the Long Twentieth Century: Domination, Contestation, Globalization. Berlin: Springer. [Google Scholar]

- Jerven, Morten. 2009. The relativity of poverty and income: How reliable are African economic statistics? African Affairs 109: 77–96. [Google Scholar] [CrossRef]

- McAleer, Michael, and Christiaan Hafner. 2014. A one line derivation of EGARCH. Econometrics 2: 92–97. [Google Scholar] [CrossRef] [Green Version]

- Van Velzen, Thoden, and Wim Hoogbergen. 2013. Een Zwarte Vrijstaat in Suriname (Deel 2): De Okaanse Samenleving in de Negentiende en Twintigste Eeuw. Leiden: Brill. [Google Scholar]

| 1 | See Franses and Legerstee (2014) for a table with dates for 106 countries when statistical bureaus were founded. |

| 2 | Important references to MIDAS regression are Andreou et al. (2010), Clements and Galvao (2008), Ghysels et al. (2004), and Ghysels et al. (2007). |

| 3 | |

| 4 | |

| 5 | See Chang and McAleer (2017) and McAleer and Hafner (2014) for two recent studies on this very useful model. |

| 1961 | 1.7 | 1971 | 0.2 | 1981 | 8.8 |

| 1962 | 2.1 | 1972 | 3.2 | 1982 | 7.3 |

| 1963 | 2.1 | 1973 | 12.9 | 1983 | 4.4 |

| 1964 | 4.2 | 1974 | 16.9 | 1984 | 3.7 |

| 1965 | 1.9 | 1975 | 8.4 | 1985 | 10.9 |

| 1966 | 4.7 | 1976 | 10.1 | 1986 | 18.7 |

| 1967 | 10.7 | 1977 | 9.7 | 1987 | 53.4 |

| 1968 | 0.2 | 1978 | 8.8 | 1988 | 7.3 |

| 1969 | 11.3 | 1979 | 14.8 | 1989 | 0.8 |

| 1970 | 2.6 | 1980 | 14.1 | 1990 | 21.7 |

| 1991 | 26 | 2001 | 38.6 | 2011 | 17.7 |

| 1992 | 43.7 | 2002 | 15.5 | 2012 | 5 |

| 1993 | 143.5 | 2003 | 23 | 2013 | 2 |

| 1994 | 368.5 | 2004 | 10 | 2014 | 3.3 |

| 1995 | 235.6 | 2005 | 9.9 | 2015 | 6.9 |

| 1996 | −0.7 | 2006 | 11.3 | ||

| 1997 | 7.1 | 2007 | 6.4 | ||

| 1998 | 19 | 2008 | 14.7 | ||

| 1999 | 98.8 | 2009 | −0.2 | ||

| 2000 | 59.4 | 2010 | 6.9 |

| 1961 | 33.33 | 1971 | 8.7 | 1981 | 50 |

| 1962 | −30 | 1972 | 20 | 1982 | −16.67 |

| 1963 | 0 | 1973 | 0 | 1983 | −50 |

| 1964 | 3.57 | 1974 | 0 | 1984 | 33.33 |

| 1965 | 3.45 | 1975 | 0 | 1985 | 10 |

| 1966 | 33.33 | 1976 | 16.67 | 1986 | −9.09 |

| 1967 | 25 | 1977 | 42.86 | 1987 | 120 |

| 1968 | 0 | 1978 | 0 | 1988 | 0 |

| 1969 | 0 | 1979 | −10 | 1989 | 0 |

| 1970 | −8 | 1980 | 33.33 | 1990 | 0 |

| 1991 | 0 | 2001 | −60 | 2011 | −12.5 |

| 1992 | 40.91 | 2002 | 70 | 2012 | 28.57 |

| 1993 | 30.65 | 2003 | −41.18 | 2013 | 13.89 |

| 1994 | 4220.99 | 2004 | −20 | 2014 | 7.32 |

| 1995 | 471.43 | 2005 | −43.75 | 2015 | 6.82 |

| 1996 | −61 | 2006 | 277.78 | ||

| 1997 | 15.38 | 2007 | 17.65 | ||

| 1998 | 61.11 | 2008 | 50 | ||

| 1999 | 148.28 | 2009 | 0 | ||

| 2000 | 177.78 | 2010 | 33.33 |

| Sample | Sample | Sample | |

|---|---|---|---|

| Variable | 1975–2015 | 1975–2015 (without 1993, 1999) | 1961–2015 (without 1993, 1999) |

| Intercept | 15.683 (5.398) | 11.032 (2.796) | 9.288 (2.171) |

| 0.026 (0.162) | |||

| 0.083 (0.005) | 0.085 (0.001) | 0.085 (0.001) | |

| 0.040 (0.013) | 0.043 (0.001) | 0.044 (0.001) | |

| R2 | 0.858 | 0.967 | 0.964 |

| p value tests | |||

| Normality | 0.000 | 0.131 | 0.000 |

| Autocorrelation | 0.010 | 0.037 | 0.008 |

| Variable | Version 1 | Variable | Version 2 | ||

|---|---|---|---|---|---|

| Intercept | 1.828 | (3.240) | Intercept | 0.315 | (2.811) |

| 0.554 | (0.037) | 0.893 | (0.134) | ||

| 0.240 | (0.066) | 0.190 | (0.065) | ||

| 0.209 | (0.060) | 0.051 | (0.099) | ||

| 0.190 | (0.085) | −0.023 | (0.078) | ||

| 0.402 | (0.068) | 0.232 | (0.061) | ||

| 0.430 | (0.073) | 0.049 | (0.050) | ||

| 0.319 | (0.100) | 0.084 | (0.050) | ||

| −0.264 | (0.098) | ||||

| R2 | 0.932 | 0.944 | |||

| p value tests | |||||

| Normality | 0.184 | 0.645 | |||

| Autocorrelation | 0.149 | 0.740 | |||

| RMSPE, in sample | 19.305 | 18.363 | |||

| Years | Potential Causes |

|---|---|

| 1900s | Gold rush (Lawa railway construction) |

| 1930s | Economic decline, social upheaval in the form of riots |

| 1940s | WW II |

| 1957 | Establishment of the Central Bank of Suriname, Brokopondo-agreement with Alcoa and Eisenhower Recession |

| Parameters | Sample | |||

|---|---|---|---|---|

| 1961–2015 | 1873–2015 | |||

| μ | 1.457 | (0.200) | 1.595 | (0.219) |

| ρ | 0.327 | (0.089) | 0.314 | (0.096) |

| ω | −0.939 | (0.249) | −0.311 | (0.103) |

| 1.073 | (0.308) | 0.311 | (0.113) | |

| 0.711 | (0.182) | 0.208 | (0.095) | |

| 0.659 | (0.146) | 0.855 | (0.048) | |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Franses, P.H.; Janssens, E. Recovering Historical Inflation Data from Postage Stamps Prices. J. Risk Financial Manag. 2017, 10, 21. https://doi.org/10.3390/jrfm10040021

Franses PH, Janssens E. Recovering Historical Inflation Data from Postage Stamps Prices. Journal of Risk and Financial Management. 2017; 10(4):21. https://doi.org/10.3390/jrfm10040021

Chicago/Turabian StyleFranses, Philip Hans, and Eva Janssens. 2017. "Recovering Historical Inflation Data from Postage Stamps Prices" Journal of Risk and Financial Management 10, no. 4: 21. https://doi.org/10.3390/jrfm10040021