The Impact of Corporate Diversification and Financial Structure on Firm Performance: Evidence from South Asian Countries

Abstract

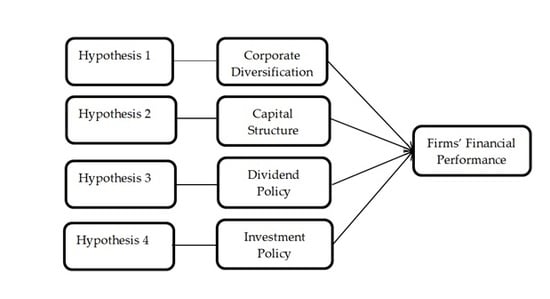

:1. Introduction

2. Review of Literature

3. Methodology

3.1. Data

3.2. Statistics

β8AQi,t + β9ACSIZEi,t + β10ACAi,t + β11AGEi,t + β12GRTHi,t + β13SIZEi,t + εi,t,

β8AQi,t + β9ACSIZEi,t + β10ACAi,t + β11AGEi,t + β12GRTHi,t + β13SIZEi,t + εi,t,

β8AQi,t + β9ACSIZEi,t + β10ACAi,t + β11AGEi,t + β12GRTHi,t + β13SIZEi,t + εi,t.

4. Empirical Analysis

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Adamu, Nasiru, Ibrahim Khalil Zubairu, Yahya Makarfi Ibrahim, and Aliyu Makarfi Ibrahim. 2011. Evaluating the Impact of Product Diversification on Financial Performance of Selected Nigerian Construction Firms. Journal of Construction in Developing Countries 16: 91–114. [Google Scholar]

- Afza, Talat, Choudhary Slahudin, and Mian Sajid Nazir. 2008. Diversification and Corporate Performance: An Evaluation of Pakistani Firms. South Asian Journal of Management 15: 7–18. [Google Scholar]

- Aivazian, Varouj A., Ying Ge, and Jiaping Qiu. 2005. The Impact of Leverage on Firm Investment: Canadian Evidence. Journal of Corporate Finance 11: 277–91. [Google Scholar] [CrossRef]

- Ali, Adnan, Farzand Ali Jan, and Maryam Atta. 2015. The Impact of Dividend Policy on Firm Performance under High or Low Leverage; Evidence from Pakistan. Journal of Management Information 8: 50–83. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Azim, Mohammad I. 2012. Corporate Governance Mechanisms and their Impact on Company Performance: A Structural Equation Model Analysis. Australian Journal of Management 37: 481–505. [Google Scholar] [CrossRef]

- Baker, H. Kent, E. Theodore Veit, and Gary E. Powell. 2001. Factors influencing Dividend Policy Decisions of Nasdaq Firms. The Financial Review 36: 19–37. [Google Scholar] [CrossRef]

- Bauer, Rob, Piet Eichholtz, and Nils Kok. 2009. Corporate Governance and Performance: The Reit Effect. Real Estate Economics 38: 1–29. [Google Scholar] [CrossRef]

- Beck, Thorsten, and Asli Demirguc-Kunt. 2006. Small and Medium-Size Enterprises: Access to Finance as a Growth Constraint. Journal of Banking and Finance 30: 2931–43. [Google Scholar] [CrossRef]

- Berger, Philip G., and Eli Ofek. 1995. Diversification’s Effect on Firm Value. Journal of Financial Economics 37: 39–65. [Google Scholar] [CrossRef]

- Bhaduri, Saumitra N. 2002. Determinants of Corporate Borrowing: Some Evidence from the Indian Corporate Structure Corporate Structure. Journal of Economics and Finance 26: 200–15. [Google Scholar] [CrossRef]

- Bhagat, Sanjai, and Brian Bolton. 2008. Corporate Governance and Firm Performance. Journal of Corporate Finance 14: 257–73. [Google Scholar] [CrossRef]

- Black, Bernard, Antonio Gledson de Carvalho, and Erica Gorga. 2009. The Corporate Governance of Privately Controlled Brazilian Firms. Revista Brasileira de Finanças 7: 358–428. [Google Scholar]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Boubaker, Sabri, and Duc Khuong Nguyen. 2012. Board Directors and Corporate Social Responsibility. Houndmills: Palgrave Macmillan. [Google Scholar]

- Boubaker, Sabri, and Duc Khuong Nguyen. 2015. Corporate Governance and Corporate Social Responsibility: Emerging Markets Focus. Hackensack: World Scientific. [Google Scholar]

- Butt, Babar Zaheer, Ahmed Imran Hunjra, and Kashif-Ur Rehman. 2010. Financial Management Practices and their Impact on Organizational Performance. World Applied Sciences Journal 9: 997–1002. [Google Scholar]

- Campa, Jose Manuel, and Simi Kedia. 2002. Explaining the diversification discount. The Journal of Finance 57: 1731–62. [Google Scholar] [CrossRef]

- Carcello, Joseph V., and Terry L. Neal. 2003. Audit Committee Independence and Disclosure: Choice for Financially Distressed Firms. Corporate Governance 11: 289–99. [Google Scholar] [CrossRef]

- Chen, Sheng-Syan, and Kim Wai Ho. 1997. Market Response to Product-Strategy and Capital Expenditure Announcements in Singapore: Investment Opportunities and Free Cash Flow. Financial Management 26: 82–88. [Google Scholar] [CrossRef]

- Chen, Chia-Wei, J. Barry Lin, and Bingsheng Yi. 2008. CEO Duality and Firm Performance—An Endogenous Issue. Corporate Ownership & Control 6: 58–65. [Google Scholar]

- Chung, Kee H., Peter Wright, and Charlie Charoenwong. 1998. Investment Opportunities and Market Reaction to Capital Expenditure Decisions. Journal of Banking and Finance 22: 41–60. [Google Scholar] [CrossRef]

- Claessens, Stijn, and B. Burcin Yurtoglu. 2013. Corporate governance in emerging markets: A survey. Emerging Markets Review 15: 1–33. [Google Scholar] [CrossRef]

- Cooper, Michael J., Huseyin Gulen, and Michael J. Schill. 2008. Asset Growth and the Cross Section of Stock Returns. Journal of Finance 63: 1609–51. [Google Scholar] [CrossRef]

- Dar, Laiba, Muhammad Akram Naseem, Ghulam Shabbir Khan Niazi, and Ramiz Ur Rehman. 2011. Corporate Governance and Firm Performance: A Case Study of Pakistan Oil and Gas Companies Listed in Karachi Stock Exchange. Global Journal of Management and Business Research 11: 1–10. [Google Scholar]

- DeAngelo, Linda Elizabeth. 1981. Auditor Size and Audit Quality. Journal of Accounting and Economics 3: 183–99. [Google Scholar] [CrossRef]

- Denis, David J., Diane K. Denis, and Atulya Sarin. 1997. Agency Problems, Equity Ownership and Corporate Diversification. Journal of Finance 52: 135–60. [Google Scholar] [CrossRef]

- Donaldson, Lex, and James H. Davis. 1991. Stewardship Theory or Agency Theory: CEO Governance and Shareholder Returns. Australian Journal of Management 16: 49–64. [Google Scholar] [CrossRef] [Green Version]

- Ehikioya, Benjamin I. 2009. Corporate Governance Structure and Firm Performance in Developing Economies: Evidence from Nigeria. Corporate Governance 9: 231–43. [Google Scholar] [CrossRef]

- Erickson, John, Yun W. Park, Joe Reising, and Hyun-Han Shin. 2005. Board Composition and Firm Value under Concentrated Ownership: The Canadian Evidence. Pacific-Basin Finance Journal 13: 387–410. [Google Scholar] [CrossRef]

- Francis, Jere R., and Michael D. Yu. 2009. Big 4 Office Size and Audit Quality. The Accounting Review 84: 1521–52. [Google Scholar] [CrossRef]

- Frank, Murray Z., and Vidhan K. Goyal. 2003. Testing the Pecking Order Theory of Capital Structure. Journal of Financial Economics 67: 217–48. [Google Scholar] [CrossRef]

- Gao, Wenlian, and Julia Chou. 2015. Innovation Efficiency, Global Diversification, and Firm Value. Journal of Corporate Finance 30: 278–98. [Google Scholar] [CrossRef]

- Gleason, Kimberly C., Lynette Knowles Mathur, and Ike Mathur. 2000. The Interrelationship between Culture, Capital Structure, and Performance: Evidence from European Retailers. Journal of Business Research 50: 185–91. [Google Scholar] [CrossRef]

- Gomes, Joao, and Dmitry Livdan. 2004. Optimal Diversification: Reconciling Theory and Evidence. The Journal of Finance 59: 507–35. [Google Scholar] [CrossRef]

- Gordon, Myron J. 1963. Optimal Investment and Financing Policy. The Journal of Finance 18: 264–72. [Google Scholar]

- Hengartner, Lukas. 2006. Explaining Executive Pay: The Roles of Managerial Power and Complexity. Ph.D. dissertation, University of St Gallen, Sankt Gallen, Switzerland. [Google Scholar]

- Hunjra, Ahmed Imran. 2018. Mediating role of dividend policy among its determinants and organizational financial performance. Cogent Economics and Finance 6: 1–16. [Google Scholar] [CrossRef]

- Hunjra, Ahmed Imran, Muhammad Irfan Chani, Sehrish Javed, Sana Naeem, and Muhammad Shahzad Ijaz. 2014. Impact of Micro Economic Variables on Firms Performance. International Journal of Economics and Empirical Research 2: 65–73. [Google Scholar]

- Hunjra, Ahmed Imran, Hadia Naeem, Ayesha Noor, and Amna Saleem. 2016. Does Corporate Governance Play Role In Firms’ Performance? A Comparative Study of Pakistan, India and Bangladesh. International Journal of Economics and Empirical Research 4: 450–64. [Google Scholar]

- Iqbal, Athar, Irfan Hameed, and Majid Qadeer. 2012. Impact of Diversification on Firms’ Performance. American Journal of Scientific Research 80: 42–53. [Google Scholar]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Jiang, Ching-Hai, Hsiang-Lan Chen, and Yen-Sheng Huang. 2006. Capital Expenditures and Corporate Earnings: Evidence from the Taiwan Stock Exchange. Managerial Finance 32: 853–61. [Google Scholar] [CrossRef]

- Kiel, Geoffrey C., and Gavin J. Nicholson. 2003. Board Composition and Corporate Performance: How the Australian Experience Inform Contrasting Theories of Corporate Governance. Corporate Governance 11: 189–205. [Google Scholar] [CrossRef]

- Kotšina, Svetlana, and Aaro Hazak. 2012. Does Investment Intensity Impact Company Profitability? A Cross-Country Empirical Study. Paper presented at the 2nd International Conference on Economics, Trade and Development, Bangkok, Thailand, April 7–8; pp. 157–161. [Google Scholar]

- Lazar, Sebastian. 2016. Determinants of Firm Performance: Evidence from Romanian Listed Companies. Review of Economic and Business Studies 9: 53–69. [Google Scholar] [CrossRef] [Green Version]

- Lewellen, Wilbur G. 1971. A pure Financial Rationale for the Conglomerate Merger. The Journal of Finance 26: 521–37. [Google Scholar] [CrossRef]

- Lins, Karl V., and Henri Servaes. 2002. Is Corporate Diversification Beneficial in Emerging Markets? Financial Management 31: 5–31. [Google Scholar] [CrossRef]

- Mak, Yuen Teen, and Yuanto Kusnadi. 2005. Size really matters: Further evidence on the negative relationship between board size and firm value. Pacific-Basin Finance Journal 13: 301–18. [Google Scholar] [CrossRef]

- Markowitz, Harry. 1952. Portfolio selection. The Journal of Finance 7: 77–91. [Google Scholar]

- Miller, Merton H., and Franco Modigliani. 1961. Dividend policy, Growth, and the Valuation of Shares. The Journal of Business 34: 411–33. [Google Scholar] [CrossRef]

- Modigliani, Franco, and Merton H. Miller. 1958. The cost of capital, corporation finance and the theory of investment. The American Economic Review 48: 261–97. [Google Scholar]

- Modigliani, Franco, and Merton H. Miller. 1963. Corporate Income Taxes and the Cost of Capital: A Correction. The American Economic Review 53: 433–43. [Google Scholar]

- Muritala, Taiwo Adewale. 2012. An Empirical Analysis of Capital Structure on Firms’ Performance in Nigeria. International Journal of Advances in Management and Economics 1: 116–24. [Google Scholar]

- Myers, Stewart C. 1984. The Capital Structure Puzzle. Journal of Finance 39: 575–92. [Google Scholar] [CrossRef]

- Myers, Stewart C., and Nicholas S. Majluf. 1984. Corporate Financing and Investment Decisions when firms have Information that Investors do not have. Journal of Financial Economics 13: 187–221. [Google Scholar] [CrossRef]

- Oloidi, Adebayo G., and Patrick O. Adeyeye. 2014. Determinants of Dividend per Share: Evidence from the Nigerian Stock Exchange. International Journal of Economics and Empirical Research 2: 496–501. [Google Scholar]

- Pandya, Anil M., and Narendar V. Rao. 1998. Diversification and Firm Performance: An Empirical Evaluation. Journal of Financial and Strategic Decisions 11: 67–81. [Google Scholar]

- Pearce, John A., and Shaker A. Zahra. 1992. Board Composition from a Strategic Contingency Perspective. Journal of Management Studies 29: 411–38. [Google Scholar] [CrossRef]

- Pervan, Maja, Ivica Pervan, and Marijana Ćurak. 2017. The Influence of Age on Firm Performance: Evidence from the Croatian Food Industry. Journal of Eastern Europe Research in Business and Economics 2017: 1–9. [Google Scholar] [CrossRef]

- Phung, Duc Nam, and Anil V. Mishra. 2016. Corporation Diversification and Firm Performance: Evidence from Vietnamese Listed Firms. Australian Economic Papers 55: 386–408. [Google Scholar] [CrossRef]

- Safieddine, Assem, and Sheridan Titman. 1999. Leverage and Corporate Performance: Evidence from Unsuccessful Takeovers. Journal of Finance 54: 547–80. [Google Scholar] [CrossRef]

- Salim, Mahfuzah, and Raj Yadav. 2012. Capital Structure and Firm Performance: Evidence from Malaysian Listed Companies. Procedia-Social and Behavioral Sciences 65: 156–66. [Google Scholar] [CrossRef]

- Schmid, Markus M., and Ingo Walter. 2012. Geographic Diversification and Firm Value in the Financial Services Industry. Journal of Empirical Finance 19: 109–22. [Google Scholar] [CrossRef]

- Titman, Sheridan, and Roberto Wessels. 1988. The determinants of capital structure choice. Journal of Finance 43: 1–19. [Google Scholar] [CrossRef]

- Titman, Sheridan, Kuo-Chiang John Wei, and Feixue Xie. 2004. Capital Investments and Stock Returns. Journal of Financial and Quantitative Analysis 39: 677–700. [Google Scholar] [CrossRef]

- Vafeas, Nikos. 1999. Board Meeting Frequency and Firm Performance. Journal of Financial Economics 53: 113–42. [Google Scholar] [CrossRef]

- Vatavu, Sorana. 2015. The Impact of Capital Structure on Financial Performance in Romanian Listed Companies. Procedia Economics and Finance 32: 1314–1322. [Google Scholar] [CrossRef] [Green Version]

- Walter, James E. 1963. Dividend policy: Its influence on the value of the enterprise. The Journal of Finance 18: 280–91. [Google Scholar] [CrossRef]

- Wernerfelt, Birger. 1997. On the Nature and Scope of the Firm: An Adjustment-Cost Theory. The Journal of Business 70: 489–514. [Google Scholar] [CrossRef]

- Xie, Biao, Wallace N. Davidson III, and Peter J. DaDalt. 2003. Earnings Management and Corporate Governance: The Role of the Board and the Audit Committee. Journal of Corporate Finance 9: 295–316. [Google Scholar] [CrossRef]

- Yat Hung, Chiang, Chan Ping Chuen Albert, and Hui Chi Man Eddie. 2002. Capital Structure and Profitability of the Property and Construction Sectors in Hong Kong. Journal of Property Investment and Finance 20: 434–53. [Google Scholar] [CrossRef]

- Yermack, David. 1996. Higher Market Valuation of Companies with a Small Board of Directors. Journal of Financial Economics 40: 185–213. [Google Scholar] [CrossRef]

- Zulkafli, Abdul Hadi, Ahmad Husni Hamzah, and Norhidayah Abu Bakar. 2015. Board Governance and Financing Policy: Evidence Form Public Listed Company in Malaysia. Advanced Science Letters 21: 961–65. [Google Scholar] [CrossRef]

| Countries | Diversified Firms | Single Product Firms | Total |

|---|---|---|---|

| Pakistan | 225 | 38 | 263 |

| India | 87 | 30 | 117 |

| Sri Lanka | 74 | 21 | 95 |

| Bangladesh | 29 | 16 | 45 |

| Total | 415 | 105 | 520 |

| Study Issue | Variable/s | Symbols | Definition/Calculation | Reference/s |

|---|---|---|---|---|

| Firms’ Financial Performance | Return on Assets | ROA | Net income Available to Common Shareholders/Book value of assets | Afza et al. (2008); Iqbal et al. (2012) |

| Return on Equity | ROE | Net income/Shareholders equity | Afza et al. (2008); Iqbal et al. (2012) | |

| Tobin’s Q | TQ | The market value of equity plus book value of liabilities divided by book value of Assets | Wernerfelt (1997); Afza et al. (2008) | |

| Corporate Diversification | Product Diversification | PD | Value 1, if a firm operates in more than one product, otherwise 0. | Afza et al. (2008) |

| Geographic Diversification | GD | Foreign sales divided by Total sales. | Schmid and Walter (2012) | |

| Financial Structure | Investment Policy | IP | Change in Investment in Fixed Assets | Aivazian et al. (2005) |

| Capital Structure/Financing Policy | CS | Total debts divided by total assets | Bhaduri (2002) | |

| Dividend per share | DP | Total dividends paid out in a year/outstanding common shares | Oloidi and Adeyeye (2014) | |

| Corporate Governance and Audit Quality Characteristics as Control Variables | Board Size | BSIZE | Number of Members in Board | Bhagat and Bolton (2008) |

| CEO duality | CEOD | Value 1 if the CEO also acts as chairman of the board, otherwise 0. | Bhagat and Bolton (2008) | |

| Audit quality | AQ | Value 1, if the firms get their accounts audited with big four audit professionals (Deloittee Touche Tohmatsu, PwC, Ernst & Young and KPMG), otherwise 0. | Francis and Yu (2009) | |

| Audit Committee Size | ACSIZE | Total number of members in the audit committee | Azim (2012) | |

| Audit Committee Activity | ACA | The frequency of audit committee meetings in a financial year. | Xie et al. (2003) | |

| Other Control Variables | Size | SIZE | Natural Log of Total Assets | Hunjra et al. (2014) |

| Growth | GRTH | Percentage change in sales | Muritala (2012); | |

| Age | AGE | Difference between the year in which the firm starts and the year in which the firm exists in the sample | Muritala (2012); Hunjra et al. (2014) |

| Pakistan | India | Sri Lanka | Bangladesh | Overall | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | S.D. | Mean | S.D. | Mean | S.D. | Mean | S.D. | Mean | S.D. | |

| ROA | 0.039 | 0.124 | 0.051 | 0.197 | 0.079 | 0.191 | 0.087 | 0.106 | 0.051 | 0.155 |

| ROE | 0.138 | 0.385 | 0.177 | 0.458 | 0.137 | 0.334 | 0.190 | 0.383 | 0.150 | 0.396 |

| TQ | 1.224 | 0.978 | 0.712 | 0.465 | 0.575 | 0.359 | 0.537 | 0.276 | 0.962 | 0.831 |

| PD | 0.835 | 0.371 | 0.747 | 0.435 | 0.770 | 0.421 | 0.656 | 0.476 | 0.794 | 0.405 |

| GD | 0.155 | 0.258 | 0.124 | 0.233 | 0.079 | 0.239 | 0.128 | 0.310 | 0.135 | 0.255 |

| CS | 0.587 | 0.286 | 0.566 | 0.243 | 0.442 | 0.229 | 0.434 | 0.217 | 0.550 | 0.271 |

| DP | 4.930 | 20.215 | 0.007 | 0.039 | 0.105 | 0.823 | 0.208 | 1.565 | 2.760 | 15.232 |

| IP | 0.137 | 0.503 | 0.154 | 0.556 | 0.146 | 0.598 | 0.184 | 0.728 | 0.145 | 0.547 |

| BSIZE | 7.854 | 1.345 | 8.234 | 3.340 | 8.159 | 2.524 | 8.274 | 2.566 | 8.014 | 2.230 |

| CEOD | 0.282 | 0.450 | 0.550 | 0.498 | 0.137 | 0.344 | 0.081 | 0.273 | 0.307 | 0.461 |

| AQ | 0.460 | 0.498 | 0.082 | 0.275 | 0.843 | 0.364 | 0.065 | 0.246 | 0.409 | 0.492 |

| ACSIZE | 3.243 | 0.597 | 3.531 | 1.339 | 2.843 | 0.779 | 3.780 | 1.191 | 3.280 | 0.921 |

| ACA | 4.169 | 0.599 | 4.191 | 1.614 | 4.093 | 1.439 | 4.215 | 1.285 | 4.165 | 1.104 |

| AGE | 34.445 | 18.860 | 38.245 | 28.112 | 47.449 | 36.822 | 28.481 | 23.069 | 36.960 | 25.434 |

| GRTH | 0.164 | 0.690 | 0.163 | 0.455 | 0.146 | 2.068 | 0.238 | 0.986 | 0.169 | 1.065 |

| SIZE | 21.764 | 1.557 | 15.519 | 1.553 | 14.917 | 1.520 | 16.028 | 1.683 | 18.914 | 3.545 |

| ROA | ROE | TQ | PD | GD | CS | DP | IP | BSIZE | CEOD | AQ | ACSIZE | ACA | AGE | GRTH | SIZE | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 1 | |||||||||||||||

| ROE | 0.325 | 1 | ||||||||||||||

| TQ | 0.052 | 0.102 | 1 | |||||||||||||

| PD | −0.010 | 0.019 | 0.074 | 1 | ||||||||||||

| GD | 0.007 | −0.009 | −0.076 | 0.030 | 1 | |||||||||||

| CS | −0.147 | −0.017 | 0.092 | 0.017 | 0.034 | 1 | ||||||||||

| DP | 0.132 | 0.125 | 0.317 | 0.066 | −0.025 | −0.009 | 1 | |||||||||

| IP | 0.039 | −0.010 | 0.008 | 0.008 | −0.013 | −0.002 | 0.009 | 1 | ||||||||

| BSIZE | 0.053 | 0.019 | 0.031 | −0.083 | −0.057 | −0.042 | 0.028 | 0.051 | 1 | |||||||

| CEOD | −0.116 | 0.000 | −0.017 | 0.018 | 0.057 | 0.125 | −0.033 | −0.019 | 0.062 | 1 | ||||||

| AQ | 0.172 | 0.028 | 0.157 | 0.039 | −0.079 | −0.170 | 0.162 | 0.027 | 0.111 | −0.261 | 1 | |||||

| ACSIZE | 0.053 | 0.017 | 0.062 | −0.024 | −0.010 | −0.046 | 0.050 | 0.047 | 0.508 | 0.074 | 0.009 | 1 | ||||

| ACA | −0.048 | −0.001 | 0.005 | 0.014 | 0.024 | 0.000 | 0.003 | 0.042 | 0.359 | 0.110 | 0.050 | 0.366 | 1 | |||

| AGE | 0.051 | −0.016 | −0.010 | −0.017 | −0.031 | −0.104 | 0.058 | 0.011 | 0.125 | −0.015 | 0.127 | 0.099 | −0.026 | 1 | ||

| GRTH | 0.035 | 0.007 | −0.008 | −0.030 | −0.013 | −0.018 | −0.005 | 0.033 | −0.006 | −0.017 | 0.006 | 0.011 | −0.010 | 0.026 | 1 | |

| SIZE | −0.046 | −0.010 | 0.341 | 0.092 | 0.101 | 0.156 | 0.201 | 0.021 | 0.043 | −0.070 | 0.179 | 0.069 | 0.069 | −0.045 | 0.015 | 1 |

| Dependent Variable (ROA) | Dependent Variable (ROE) | Dependent Variable (TQ) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| L1. | 0.241 *** | 0.243 *** | 0.244 *** | 0.163 *** | 0.165 *** | 0.165 *** | 0.393 *** | 0.391 *** | 0.390 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| L2. | 0.143 *** | 0.133 *** | 0.134 *** | 0.039 *** | 0.042 *** | 0.044 *** | −0.047 *** | −0.047 *** | −0.049 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| PD | 0.026 * | -- | 0.017 | 0.124 *** | -- | 0.091 ** | 0.184 *** | -- | 0.207 *** |

| (0.085) | (0.264) | (0.005) | (0.033) | (0.001) | (0.000) | ||||

| GD | -- | 0.030 *** | 0.026 *** | -- | 0.066 | 0.056 | -- | −0.086 *** | −0.103 *** |

| (0.003) | (0.008) | (0.103) | (0.157) | (0.003) | (0.001) | ||||

| CS | −0.040 *** | −0.044 *** | −0.043 *** | −0.040 | −0.060 * | −0.060 * | 0.292 *** | 0.274 *** | 0.277 *** |

| (0.000) | (0.000) | (0.000) | (0.252) | (0.090) | (0.089) | (0.000) | (0.000) | (0.000) | |

| DP | 0.0002 *** | 0.0002 *** | 0.0002 *** | −0.001 * | 0.000 | −0.000 | −0.001 *** | −0.001 ** | −0.001 *** |

| (0.007) | (0.004) | (0.004) | (0.065) | (0.147) | (0.136) | (0.008) | (0.010) | (0.007) | |

| IP | 0.000 | −0.001 | −0.002 | −0.001 | −0.001 | −0.003 | −0.007 | −0.011 ** | −0.010 * |

| (0.861) | (0.620) | (0.493) | (0.878) | (0.828) | (0.687) | (0.189) | (0.037) | (0.054) | |

| BSIZE | 0.000 | 0.000 | 0.000 | −0.001 | 0.001 | 0.001 | 0.005 | 0.004 | 0.005 |

| (0.978) | (0.834) | (0.810) | (0.858) | (0.799) | (0.881) | (0.250) | (0.389) | (0.313) | |

| CEOD | 0.007 | 0.004 | 0.005 | 0.012 | 0.002 | 0.006 | −0.040 * | −0.030 | −0.036 |

| (0.230) | (0.473) | (0.436) | (0.566) | (0.939) | (0.779) | (0.071) | (0.191) | (0.110) | |

| AQ | 0.006 | 0.004 | 0.004 | −0.010 | −0.001 | −0.009 | 0.171 *** | 0.166 *** | 0.162 *** |

| (0.322) | (0.481) | (0.493) | (0.653) | (0.960) | (0.686) | (0.000) | (0.000) | (0.000) | |

| ACSIZE | 0.005 ** | 0.002 | 0.003 | 0.008 | −0.003 | −0.003 | 0.033 *** | 0.033 *** | 0.034 *** |

| (0.049) | (0.285) | (0.243) | (0.458) | (0.801) | (0.823) | (0.002) | (0.001) | (0.001) | |

| ACA | 0.000 | −0.001 | −0.001 | 0.004 | 0.005 | 0.006 | 0.001 | 0.002 | 0.001 |

| (0.835) | (0.526) | (0.533) | (0.377) | (0.336) | (0.249) | (0.807) | (0.680) | (0.810) | |

| AGE | −0.002 *** | −0.003 *** | −0.003 *** | −0.006 *** | −0.005 *** | −0.005 *** | −0.011 *** | −0.011 *** | −0.011 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.001) | (0.000) | (0.000) | (0.000) | |

| GRTH | 0.008 ** | 0.008 ** | 0.007 ** | 0.014 | 0.016 * | 0.015 * | 0.000 | 0.000 | 0.000 |

| (0.024) | (0.024) | (0.028) | (0.107) | (0.052) | (0.064) | (0.980) | (0.948) | (0.999) | |

| SIZE | −0.018 *** | −0.014 *** | −0.013 *** | 0.008 | −0.003 | −0.004 | 0.060 *** | 0.066 *** | 0.063 *** |

| (0.000) | (0.000) | (0.000) | (0.463) | (0.730) | (0.679) | (0.000) | (0.000) | (0.000) | |

| C | 0.436 *** | 0.407 *** | 0.386 *** | 0.041 | 0.357 ** | 0.283 * | −0.676 *** | −0.624 *** | −0.715 *** |

| (0.000) | (0.000) | (0.000) | (0.827) | (0.030) | (0.097) | (0.000) | (0.001) | (0.000) | |

| Pakistan | India | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dependent Variable (ROA) | Dependent Variable (ROE) | Dependent Variable (TQ) | Dependent Variable (ROA) | Dependent Variable (ROE) | Dependent Variable (TQ) | |||||||||||||

| L1. | 0.223 *** | 0.224 *** | 0.223 *** | 0.098 *** | 0.103 *** | 0.099 *** | 0.340 *** | 0.338 *** | 0.338 *** | 0.293 *** | 0.290 *** | 0.291 *** | 0.145 *** | 0.143 *** | 0.144 *** | 0.616 *** | 0.617 *** | 0.616 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| L2. | 0.119 *** | 0.118 *** | 0.119 *** | 0.050 *** | 0.056 *** | 0.049 *** | −0.074 *** | −0.073 *** | −0.076 *** | 0.229 *** | 0.229 *** | 0.229 *** | 0.057 *** | 0.057 *** | 0.058 *** | −0.159 *** | −0.164 *** | −0.163 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| PD | 0.026 ** | -- | 0.022 * | 0.144 *** | -- | 0.121 *** | 0.318 *** | -- | 0.384 *** | −0.031 *** | -- | −0.032 *** | −0.086 *** | -- | −0.078 *** | −0.009 | -- | −0.01 1* |

| (0.020) | (0.053) | (0.000) | (0.001) | (0.001) | (0.000) | (0.000) | (0.000) | (0.003) | (0.004) | (0.181) | (0.086) | |||||||

| GD | -- | 0.027 *** | 0.024 *** | -- | 0.168 *** | 0.151 *** | -- | −0.185 *** | −0.246 *** | -- | 0.006 *** | 0.008 *** | -- | −0.017 *** | −0.019 *** | -- | −0.025 *** | −0.027 *** |

| (0.003) | (0.007) | (0.000) | (0.000) | (0.000) | (0.000) | (0.003) | (0.000) | (0.000) | (0.000) | (0.006) | (0.004) | |||||||

| CS | −0.087 *** | −0.089 *** | −0.089 *** | −0.079 *** | −0.073 *** | −0.074 *** | −0.071 * | −0.096 ** | −0.086 ** | 0.020 *** | 0.020 *** | 0.021 *** | −0.343 *** | −0.353 *** | −0.350 *** | 0.522 *** | 0.518 *** | 0.520 *** |

| (0.000) | (0.000) | (0.000) | (0.003) | (0.007) | (0.006) | (0.069) | (0.010) | (0.027) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| DP | 0.0004 *** | 0.0004 *** | 0.0004 *** | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.319 *** | 0.320 *** | 0.321 *** | 0.564 *** | 0.541 *** | 0.550 *** | 0.408 *** | 0.432 *** | 0.447 *** |

| (0.000) | (0.000) | (0.000) | (0.272) | (0.294) | (0.362) | (0.212) | (0.140) | (0.353) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| IP | −0.005 *** | −0.005 *** | −0.005 *** | −0.012 * | −0.007 | −0.009 | 0.037 *** | 0.030 *** | 0.034 *** | 0.020 *** | 0.021 *** | 0.021 *** | 0.004 | 0.001 | 0.001 | −0.041 *** | −0.040 *** | −0.041 *** |

| (0.008) | (0.002) | (0.002) | (0.070) | (0.347) | (0.194) | (0.000) | (0.001) | (0.000) | (0.000) | (0.000) | (0.000) | (0.119) | (0.693) | (0.584) | (0.000) | (0.000) | (0.000) | |

| BSIZE | −0.002 | −0.002 | −0.002 | 0.004 | 0.005 | 0.006 | 0.026 * | 0.024 * | 0.025 * | 0.003 *** | 0.003 *** | 0.003 *** | 0.003 ** | 0.002 * | 0.003 * | 0.025 *** | 0.024 *** | 0.025 *** |

| (0.186) | (0.124) | (0.175) | (0.542) | (0.426) | (0.329) | (0.071) | (0.089) | (0.080) | (0.000) | (0.000) | (0.000) | (0.020) | (0.070) | (0.050) | (0.000) | (0.000) | (0.000) | |

| CEOD | −0.004 | −0.005 | −0.005 | −0.012 | −0.009 | −0.015 | −0.188 *** | −0.183 *** | −0.177 *** | −0.059 *** | −0.061 *** | −0.063 *** | 0.042 *** | 0.052 *** | 0.048 *** | −0.153 *** | −0.159 *** | −0.160 *** |

| (0.456) | (0.441) | (0.412) | (0.491) | (0.616) | (0.446) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| AQ | −0.002 | −0.001 | −0.002 | −0.137 *** | −0.130 *** | −0.131 *** | 0.566 *** | 0.561 *** | 0.545 *** | −0.006 *** | −0.009 | −0.008 | −0.027 * | −0.025 * | −0.023 | 0.661 *** | 0.654 *** | 0.667 *** |

| (0.706) | (0.845) | (0.742) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.244) | (0.254) | (0.057) | (0.067) | (0.112) | (0.000) | (0.000) | (0.000) | |

| ACSIZE | 0.012 *** | 0.012 *** | 0.012 *** | 0.035** | 0.029** | 0.032** | 0.209 *** | 0.204 *** | 0.208 *** | 0.014 *** | 0.013 *** | 0.013 *** | −0.015 *** | −0.015 *** | −0.015 *** | −0.007 * | −0.006 * | −0.006 |

| (0.000) | (0.000) | (0.000) | (0.018) | (0.049) | (0.035) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.057) | (0.097) | (0.114) | |

| ACA | −0.00 * | −0.005 * | −0.005* | 0.004 | 0.001 | 0.001 | −0.001 | 0.004 | 0.002 | −0.011 *** | −0.011 *** | −0.011 *** | 0.009 *** | 0.010 *** | 0.009 *** | 0.023 *** | 0.024 *** | 0.024 *** |

| (0.073) | (0.054) | (0.062) | (0.482) | (0.835) | (0.884) | (0.926) | (0.780) | (0.876) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| AGE | −0.003 *** | −0.003 *** | −0.003 *** | −0.002 * | 0.000 | −0.001 | 0.022 *** | 0.020 *** | 0.022 *** | −0.001 *** | −0.001 *** | −0.001 *** | −0.007 *** | −0.008 *** | −0.007 *** | −0.012 *** | −0.012 *** | −0.012 *** |

| (0.000) | (0.000) | (0.000) | (0.051) | (0.879) | (0.422) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| GRTH | 0.019 *** | 0.019 *** | 0.019 *** | 0.028 *** | 0.030 *** | 0.029 *** | 0.014 ** | 0.015 *** | 0.016 *** | 0.022 *** | 0.021 *** | 0.022 *** | 0.075 *** | 0.072 *** | 0.073 *** | −0.043 *** | −0.043 *** | −0.042 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.022) | (0.006) | (0.009) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| SIZE | 0.019 *** | 0.018 *** | 0.017 *** | −0.003 | −0.008 | −0.007 | −0.450 *** | −0.430 *** | −0.444 *** | −0.051 *** | −0.050 *** | −0.051 *** | −0.090 *** | −0.086 *** | −0.087 *** | 0.184 *** | 0.184 *** | 0.184 *** |

| (0.000) | (0.000) | (0.000) | (0.808) | (0.548) | (0.624) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| C | −0.255 *** | −0.223 *** | −0.234 *** | 0.070 | 0.230 | 0.120 | 8.561 *** | 8.515 *** | 8.410 *** | 0.871 *** | 0.848 *** | 0.875 *** | 2.025 *** | 1.922 *** | 1.989 *** | −2.569 *** | −2.592 *** | −2.583 *** |

| (0.000) | (0.000) | (0.000) | (0.781) | (0.380) | (0.656) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Sri Lanka | Bangladesh | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dependent Variable (ROA) | Dependent Variable (ROE) | Dependent Variable (TQ) | Dependent Variable (ROA) | Dependent Variable (ROE) | Dependent Variable (TQ) | |||||||||||||

| L1. | 0.430 *** | 0.400 *** | 0.393 *** | 0.084 *** | 0.106 *** | 0.112 *** | 0.390 *** | 0.391 *** | 0.402 *** | 0.122 *** | 0.103 *** | 0.094 ** | 0.124 *** | 0.073 *** | 0.088 *** | 0.466 *** | 0.507 *** | 0.479 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.021) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| L2. | 0.370 *** | 0.277 *** | 0.274 *** | 0.056 *** | 0.001 | 0.011 *** | −0.144 *** | −0.122 *** | −0.146 *** | 0.170 *** | 0.132 *** | 0.163 *** | −0.229 *** | −0.203 *** | −0.189 *** | −0.134 *** | −0.147 *** | −0.102 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.317) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.004) | |

| PD | −0.006 | -- | −0.073 *** | 0.599 *** | -- | 0.224 *** | −0.292 *** | -- | −0.312 *** | 0.204 *** | -- | 0.209 *** | 1.505 *** | -- | 1.471 *** | 0.063 | -- | −0.157 |

| (0.362) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.482) | (0.130) | |||||||

| GD | -- | 0.217 *** | 0.201 *** | -- | −0.575 *** | −0.508 *** | -- | 0.018 * | −0.005 | -- | 0.018 *** | 0.017 *** | -- | −0.187 *** | −0.152 *** | -- | 0.035 *** | 0.031 ** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.061) | (0.498) | (0.003) | (0.007) | (0.000) | (0.000) | (0.006) | (0.011) | |||||||

| CS | −0.201 *** | −0.201 *** | −0.196 *** | −0.493 *** | −0.477 *** | −0.473 *** | 0.989 *** | 0.972 *** | 0.989 *** | 0.027 ** | 0.005 | 0.030 ** | 1.021 *** | 0.599 *** | 0.519 *** | 0.492 *** | 0.479 *** | 0.508 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.019) | (0.544) | (0.025) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| DP | −0.003 *** | −0.003 *** | −0.003 *** | 0.029 *** | 0.020 *** | 0.019 *** | −0.007 *** | −0.001 *** | −0.007 *** | −0.001 | 0.001 | 0.000 | −0.018 *** | −0.023 *** | −0.019 *** | −0.021 *** | −0.017 *** | −0.016 *** |

| (0.000) | (0.000) | (0.001) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.220) | (0.281) | (0.935) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| IP | 0.049 *** | 0.053 *** | 0.053 *** | −0.066 *** | −0.075 *** | −0.075 *** | −0.004 *** | 0.004 *** | −0.006 *** | −0.002 | −0.004 * | −0.002 | 0.009 | −0.027 *** | −0.018 ** | 0.030 *** | 0.035 *** | 0.029 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.498) | (0.070) | (0.234) | (0.111) | (0.000) | (0.026) | (0.000) | (0.000) | (0.000) | |

| BSIZE | 0.001 | 0.005 *** | 0.004 *** | −0.028 *** | −0.021 *** | −0.020 *** | 0.008 *** | 0.010 *** | 0.007 *** | 0.002 * | 0.004 | 0.005 *** | 0.046 *** | −0.030 *** | 0.011 ** | −0.001 | 0.005 | −0.007 |

| (0.161) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.099) | (0.008) | (0.002) | (0.000) | (0.000) | (0.031) | (0.832) | (0.436) | (0.242) | |

| CEOD | −0.001 | 0.050 *** | 0.051 *** | −0.064 *** | −0.068 *** | −0.064 *** | 0.101 *** | 0.103 *** | 0.094 *** | −0.034 ** | −0.014 | −0.030 ** | −0.192 *** | −0.190 *** | −0.192 *** | 0.029 | 0.175 ** | 0.126 |

| (0.848) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.014) | (0.269) | (0.048) | (0.000) | (0.000) | (0.000) | (0.490) | (0.024) | (0.130) | |

| AQ | 0.036 *** | −0.173 *** | −0.177 *** | 0.483 *** | 0.429 *** | 0.366 *** | −0.193 *** | −0.270 *** | −0.178 *** | 0.047 *** | 0.040 *** | 0.044 *** | −0.024 | −0.003 | 0.047 | −0.033 | −0.018 | 0.001 |

| (0.001) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.661) | (0.918) | (0.376) | (0.569) | (0.188) | (0.943) | |

| ACSIZE | 0.013 *** | 0.029 *** | 0.033 *** | −0.134 *** | −0.130 *** | −0.134 *** | 0.004 | −0.016 *** | 0.003 | 0.019 *** | 0.020 *** | 0.022 *** | 0.084 *** | 0.036 *** | 0.072 *** | −0.009 | −0.004 | −0.017 ** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.481) | (0.000) | (0.624) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.331) | (0.526) | (0.021) | |

| ACA | −0.004 *** | −0.006 *** | −0.005 *** | 0.017 *** | 0.001 | 0.005 ** | 0.001 | 0.001 | 0.000 | −0.006 *** | −0.005 *** | −0.005 * | −0.012 | 0.066 *** | 0.033 ** | −0.022 *** | −0.030 *** | −0.028 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.675) | (0.018) | (0.221) | (0.324) | (0.837) | (0.008) | (0.006) | (0.093) | (0.471) | (0.000) | (0.022) | (0.000) | (0.000) | (0.000) | |

| AGE | −0.013 *** | −0.010 *** | −0.009 *** | 0.006 *** | 0.005 *** | 0.006 *** | 0.011 *** | 0.012 *** | 0.011 *** | −0.003 *** | −0.0005 * | −0.002 *** | −0.032 *** | −0.023 *** | −0.039 *** | 0.000 | 0.004 *** | 0.004 ** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.074) | (0.002) | (0.000) | (0.000) | (0.000) | (0.925) | (0.000) | (0.017) | |

| GRTH | 0.003 *** | 0.004 *** | 0.004 *** | 0.002 *** | 0.004 | 0.005 | 0.004 *** | 0.003 *** | 0.003 *** | 0.012 *** | 0.009 *** | 0.020 *** | 0.047 *** | −0.037 *** | 0.021 *** | 0.003 | −0.003 | −0.007 |

| (0.000) | (0.003) | (0.006) | (0.628) | (0.226) | (0.220) | (0.000) | (0.002) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.004) | (0.519) | (0.276) | (0.106) | |

| SIZE | 0.019 *** | −0.025 *** | −0.026 *** | −0.140 *** | −0.161 *** | −0.160 *** | −0.019 *** | −0.035 *** | −0.016 *** | 0.004 | −0.022 *** | −0.008 | 0.139 *** | 0.130 *** | 0.094 *** | −0.019 ** | −0.018 ** | −0.026 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.475) | (0.000) | (0.189) | (0.000) | (0.000) | (0.001) | (0.044) | (0.047) | (0.001) | |

| C | 0.386 *** | 0.966 *** | 1.027 *** | 1.834 *** | 2.726 *** | 2.536 *** | 0.025 | 0.124 *** | 0.030 | −0.149 * | 0.325 *** | −0.030 | −3.231 *** | −1.610 *** | −1.782 *** | 0.528 *** | 0.398 ** | 0.734 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.533) | (0.000) | (0.553) | (0.071) | (0.000) | (0.747) | (0.000) | (0.000) | (0.000) | (0.004) | (0.037) | (0.000) | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mehmood, R.; Hunjra, A.I.; Chani, M.I. The Impact of Corporate Diversification and Financial Structure on Firm Performance: Evidence from South Asian Countries. J. Risk Financial Manag. 2019, 12, 49. https://doi.org/10.3390/jrfm12010049

Mehmood R, Hunjra AI, Chani MI. The Impact of Corporate Diversification and Financial Structure on Firm Performance: Evidence from South Asian Countries. Journal of Risk and Financial Management. 2019; 12(1):49. https://doi.org/10.3390/jrfm12010049

Chicago/Turabian StyleMehmood, Rashid, Ahmed Imran Hunjra, and Muhammad Irfan Chani. 2019. "The Impact of Corporate Diversification and Financial Structure on Firm Performance: Evidence from South Asian Countries" Journal of Risk and Financial Management 12, no. 1: 49. https://doi.org/10.3390/jrfm12010049