We structure our empirical study in the following way. First, we describe the data and construction of the portfolios in

Section 4.1. Second, we estimate the time series models and provide the corresponding diagnostics in

Section 4.2, where we compare the HAR approaches with simple AR(1) and AR(5) alternatives. Finally, in

Section 4.3, we evaluate the performance of our approach by investigating whether our measures are suitable for reducing the portfolio variance from the investors’ perspective.

4.1. Data and Construction of Portfolios

Our sample consisted of 10 stocks listed in

Table 1 ranging from 1 February 2001–31 December 2009 with

observations in total. This sample was investigated by

Noureldin et al. (

2012) and is available through

Heber et al. (

2009). We used the period until 28 February 2005 with 1022 observations as the in-sample to estimate our models.

Table 2 displays the average in-sample and out-of-sample daily realized variances of all assets.

For our purposes, we constructed three portfolios, namely the equally-weighted portfolio with 10 assets denoted as , as well as two equally weighted portfolios from five stocks each with the highest and lowest average in-sample daily realized variances, denoted as and , respectively. In the out-of-sample period, which was manifested by the subprime mortgage crisis 2007–2009, the average portfolio variance increased compared to the in-sample period by 150.29% for , by 75.13% for , and only by 5.01% for .

We consider now the following setting: the investor holds the portfolio and considers the possibility to reduce the portfolio risk by including the portfolio as an additional asset. For this approach, we computed the realized diversification measures and the realized GMVP weights , which correspond to the proportion of in the new portfolio.

In

Figure 1 and

Figure 2, we provide the autocorrelation function for

and

for both the in-sample and out-of-sample. Both measures appeared to be rather persistent, which is also taken into account by time series modeling in

Section 4.2.

4.2. Time Series Modeling

For time series modeling of

and

, we applied the HAR models as in (

14) and (

15). Moreover, we considered both the AR(1) and AR(5) models as simple benchmarks for both processes with, e.g., AR(5) for the realized

, parameterized as:

All three models were estimated by OLS with the results reported in

Table 3.

Almost all model coefficients proved to be significantly different from zero. Considering the

, the HAR model gave the best fit, followed by the AR(5). Moreover, the AR(5) and HAR both had lower values for AIC and BIC than the AR(1) model. Next, we analyzed the in-sample regression residuals to further check the models’ adequacy. In

Figure 3,

Figure 4 and

Figure 5, we show the Autocorrelation Functions (ACF) of the models’ residuals and their squares.

Based on the ACF plots, we conclude that our HAR and AR(5) modeling removed residual autocorrelation, whereas some autocorrelation remained for the AR(1) approach. Furthermore, there appeared to be no autocorrelation in the squared residuals for all models. Additionally, in

Table 4, we provide the results of residual tests, namely the Ljung–Box (LB) test for autocorrelation, the ARCH-LM test for heteroskedasticity, and Shapiro–Wilk (SW) test for the normality assumption.

Supporting the evidence from the ACF plots, the tests failed to reject the null hypotheses of no serial correlation and no ARCH effects for the HAR and AR(5) models. On the other hand, the Ljung–Box test rejected the null “no autocorrelation” for AR(1), indicating that this model does not reflect the underlying dynamics well enough. The normality assumption was clearly rejected for all models.

Next, we estimated the HAR, AR(5), and AR(1) models for the process of realized weights

, with, e.g., the AR(5) model given as:

Similar to

Table 3, in

Table 5, we show the estimation results, whereas the model diagnostics are presented in

Table 6. As for the case of

, the model coefficient for

were mostly highly significant. At first glance, AR(5) appeared to be preferred by AIC compared to AR(1) and HAR; however, judging by the adjusted

, the HAR still seemed to be the best specification among the considered models.

In

Figure 6,

Figure 7 and

Figure 8, we show the in-sample residual ACFs. As for

, in the case of

, the ACFs for the HAR and AR(5) residuals showed no remaining autocorrelation, whereas for AR(1), there was still some autocorrelation left. The in-sample diagnostic test results are shown in

Table 6. The HAR and AR(5) models for

seemed to pass all the tests, whereas AR(1) residuals showed some residual autocorrelation.

Summarizing our time series modeling, we could conclude that both HAR and AR(5) models seemed to be appropriate for modeling realized diversification benefits

and realized portfolio weights

. Next, we conduct out-of-sample analysis in

Section 4.3 in order to investigate whether this modeling would be helpful to achieve lower portfolio variances.

4.3. Economic Evaluation

Now we provide the out-of-sample analysis within the following framework. Consider the investor holding the portfolio and willing to know whether he/she should diversify it further by including the portfolio as a potential additional asset. Based on the in-sample data, we estimated the time series models both for and and denote the corresponding one-step-ahead out-of-sample forecasts by and , respectively.

Next, consider that the investor is eager to diversify only if volatility could be reduced at least by a certain amount, for example because of the transaction costs argument. In practice, investors often make decisions by relying not on statistical significance, but on some (naive) empirical criteria; see, e.g.,

Brandt et al. (

2009). In order to resemble this setting, we assumed that the investor seeks to diversify away at least

of portfolio risk, so that the ratio

must not exceed 0.95. This can be translated into a threshold

ℓ for the log diversification measure

with the value

. Thus, the corresponding decision rule would be to diversify if the forecast

and to stay by the initial portfolio if

. Then, given the realized measures

, one could learn in the next period whether this decision was correct or not. The resulting frequencies are visualized using

decision matrices in

Table 7.

Judging only from the percentage of correct predictions, and , the HAR model appeared to perform better than both AR(5) and AR(1). Note that the HAR approach is a rather conservative one, as it leads to frequent recommendations not to diversify compared, e.g., with AR(5). To sum up, the HAR produced the most correct predictions and, moreover, resulted in the fewest wrong and costly diversification signals.

As a next step, we incorporated into the decision procedure the forecasted portfolio weight

in order to quantify the amount of a possible portfolio variance reduction. The strategy would be as follows: select the diversified portfolio with the forecasted weight

in the case of

, which would lead to the variance

, or remain by the initial portfolio

in the case of

with the variance

. We denote the resulting portfolio variance from this diversification rule as

, as we considered its ratio to the variances from three benchmark approaches:

corresponding to the ex-post GMVP,

, and

for the portfolio with 50% in

and 50% in

. The comparison of different models is provided in

Table 8.

The realized GMVP benchmark provided the lower boundary, so it was reported primarily for comparison purposes. Concerning the portfolio , the HAR model provided the possibility to reduce its variance by diversifying in more than 43% of days, leading to wrong decisions only in 12.3% of days. Similar evidence was found for the equally-weighted portfolio . The results became worse the for AR(5) models and appeared to be really unsatisfactory for the AR(1) approaches, where holding led to a lower portfolio variance in more than 50% of days.

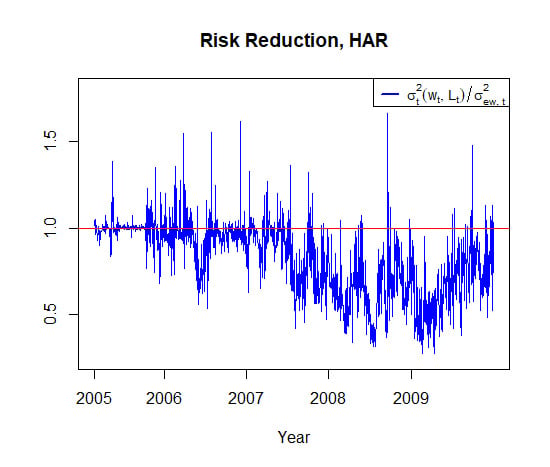

For a further illustration of our our results, we visualize the time series of portfolio variance ratios with respect to the benchmarks of

and

. In particular, for the HAR, AR(5), and AR(1) approaches, we report the time series of

and

in

Figure 9 and

Figure 10, respectively.

In

Figure 9 for the benchmark

, we observe that the HAR-based approach suggested to diversify only at a comparatively small number of days, whereas most of the time, the ratio was equal to one, i.e., no diversification was recommended. It provided the major correct recommendation before the start of the crisis. The AR(5) suggested very often diversification decisions; however, they appeared to be mostly disadvantageous from the start of the subprime mortgage crisis in the middle of 2007. The AR(1) model provided mostly wrong diversification decisions, especially during the crisis year 2008. Note that the reasons for these false recommendations could be attributed to either

or

forecasting models. Hence, it is apparent that AR(1) is not really suitable for our purposes here.

Different from the case above, in

Figure 10, for the benchmark

, we observe that the HAR model provided reasonable diversification recommendations especially since the crisis began in 2007; however, it was not really useful before the crisis start. Surprisingly, the other two approaches—AR(5) and AR(1)—also performed similarly to the HAR for this equally-weighted portfolio benchmark. We interpreted these findings as evidence that not only the choice of the time series model, but also the choice of the benchmark could determine the success of a portfolio diversification strategy.