Solvency Risk and Corporate Performance: A Case Study on European Retailers

Abstract

:1. Introduction

2. Research Background

3. Research Methodology

4. Results and Discussion

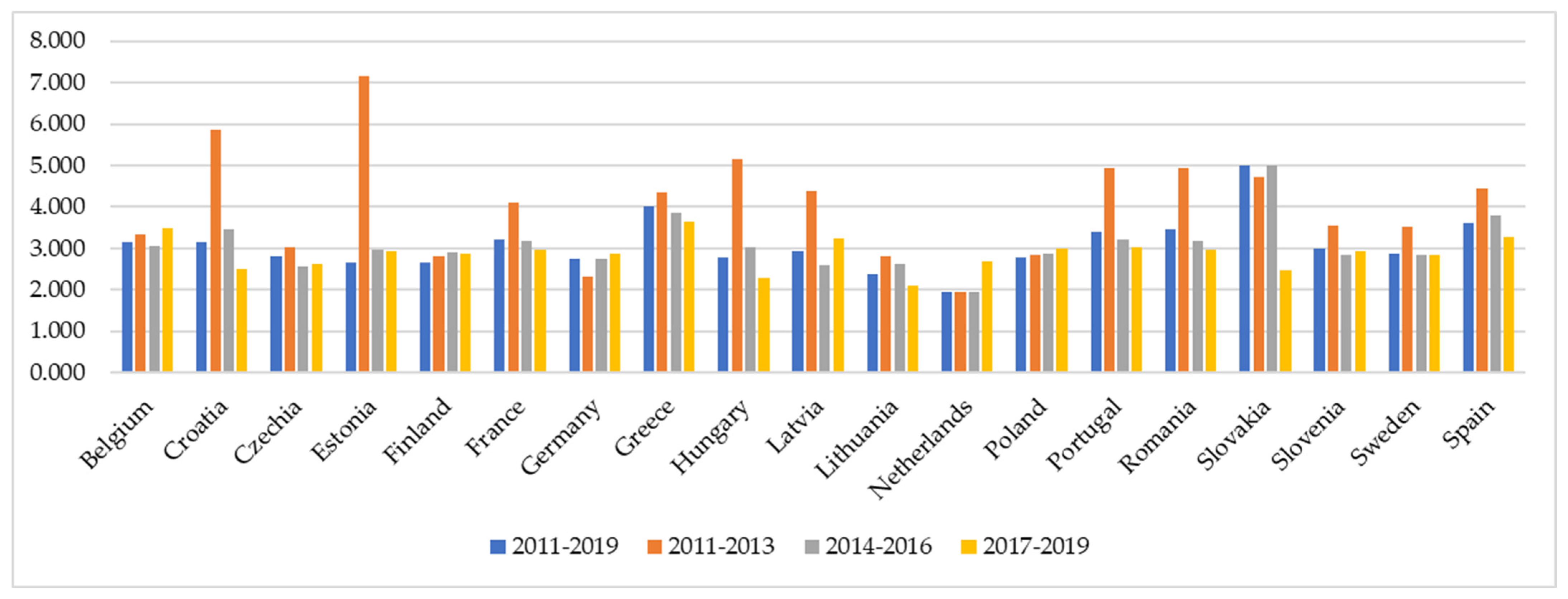

4.1. Solvency Risk in EU Food Retail—An Overview

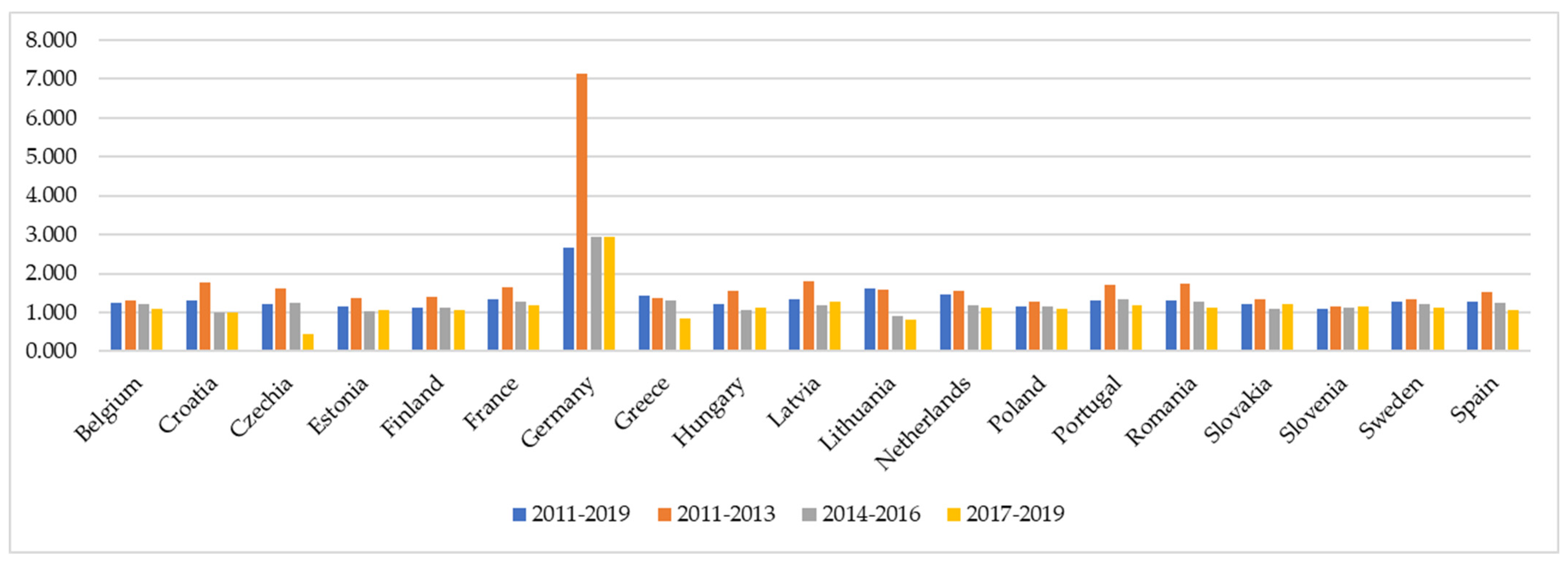

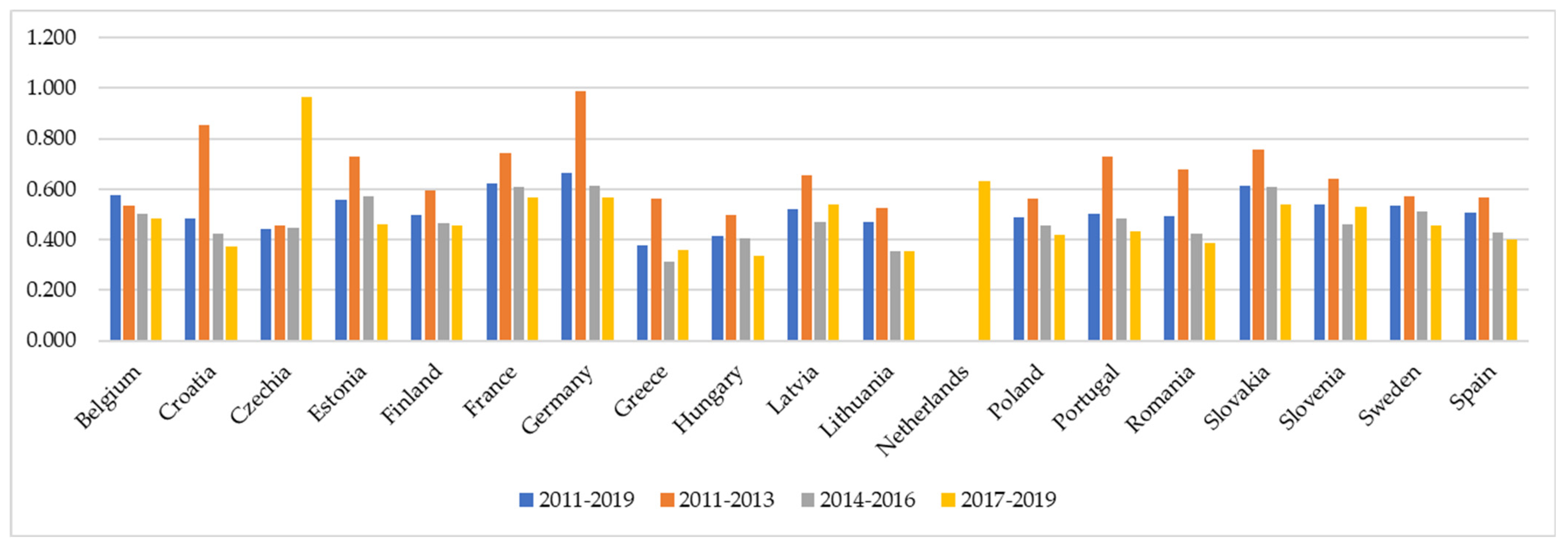

4.2. Trade-Offs in Solvency, Liquidity, Profitability, and Efficiency

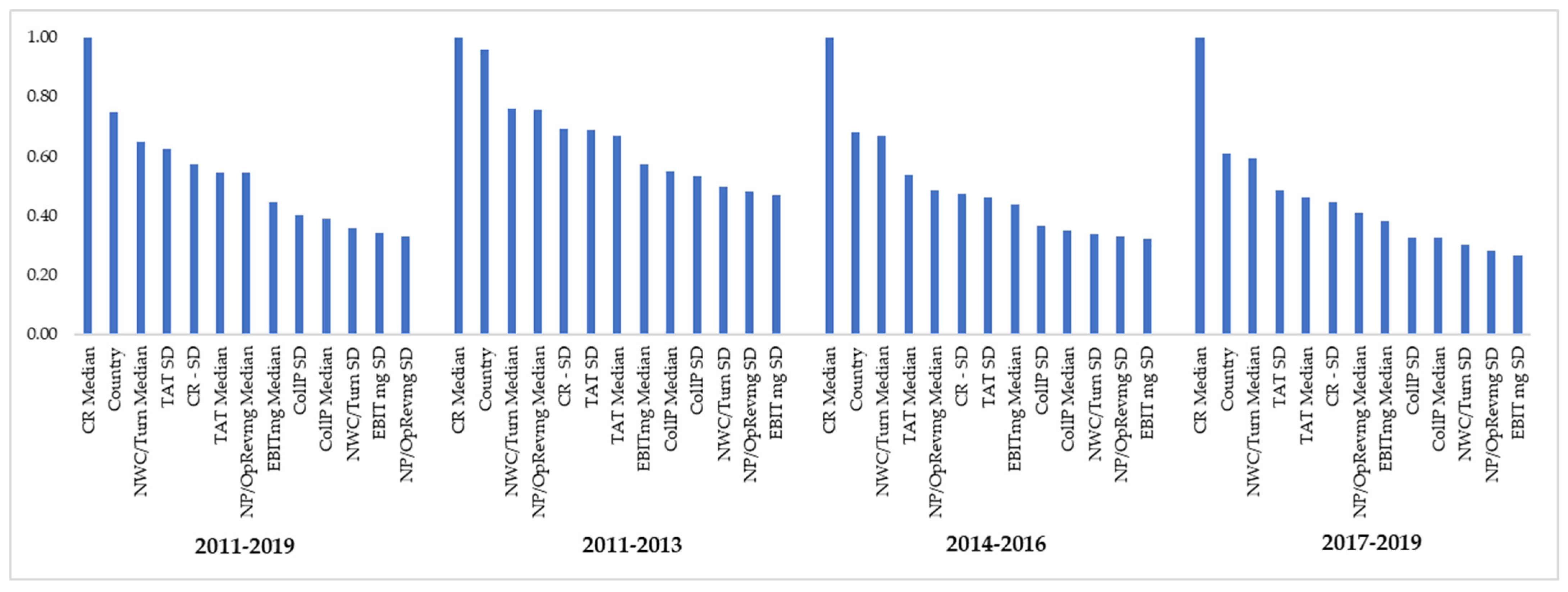

4.3. Drivers of Solvency Risk in EU Retail

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Country | Number of Companies | Mean | Minimum | Maximum | Standard Deviation | Lower Quartile | Median | Upper Quartile |

|---|---|---|---|---|---|---|---|---|

| Belgium | 54 | 2.182 | 0.221 | 6.232 | 1.534 | 1.000 | 1.762 | 3.094 |

| Croatia | 65 | 1.952 | 0.160 | 12.587 | 2.232 | 0.607 | 1.082 | 2.585 |

| Czech Republic | 46 | 0.764 | 0.141 | 3.030 | 0.656 | 0.402 | 0.628 | 0.827 |

| Estonia | 42 | 1.600 | 0.232 | 9.307 | 2.053 | 0.543 | 0.822 | 1.643 |

| Finland | 195 | 1.126 | 0.116 | 8.399 | 1.034 | 0.489 | 0.797 | 1.392 |

| France | 1271 | 2.449 | 0.230 | 14.202 | 1.991 | 1.121 | 1.874 | 3.106 |

| Germany | 12 | 2.235 | 0.245 | 8.043 | 2.147 | 0.750 | 1.726 | 2.571 |

| Greece | 19 | 3.196 | 0.140 | 9.733 | 2.594 | 0.814 | 2.825 | 4.860 |

| Hungary | 63 | 1.229 | 0.158 | 9.415 | 1.539 | 0.400 | 0.820 | 1.485 |

| Ireland | 2 | 0.635 | 0.615 | 0.654 | 0.028 | 0.615 | 0.635 | 0.654 |

| Latvia | 77 | 1.734 | 0.173 | 6.366 | 1.492 | 0.623 | 1.225 | 2.106 |

| Lithuania | 13 | 1.226 | 0.222 | 3.743 | 1.114 | 0.449 | 0.804 | 2.062 |

| Netherlands | 9 | 1.702 | 0.882 | 2.875 | 0.581 | 1.201 | 1.719 | 1.941 |

| Poland | 541 | 1.208 | 0.105 | 11.352 | 1.222 | 0.477 | 0.827 | 1.436 |

| Portugal | 298 | 1.962 | 0.125 | 14.074 | 2.124 | 0.681 | 1.295 | 2.224 |

| Romania | 644 | 1.971 | 0.103 | 13.311 | 2.073 | 0.633 | 1.275 | 2.376 |

| Slovakia | 43 | 2.061 | 0.319 | 10.766 | 2.219 | 0.783 | 1.162 | 2.251 |

| Slovenia | 37 | 1.854 | 0.136 | 5.423 | 1.439 | 0.818 | 1.144 | 2.958 |

| Sweden | 799 | 1.667 | 0.105 | 12.722 | 1.605 | 0.682 | 1.195 | 1.993 |

| Spain | 366 | 2.136 | 0.115 | 13.793 | 2.521 | 0.596 | 1.159 | 2.606 |

| Full sample | 4596 | 1.912 | 0.103 | 14.202 | 1.919 | 0.692 | 1.281 | 2.363 |

| Country | Categories TD/SF | Mean | Number of Companies | Percentage of Total Number of Companies | Minimum | Maximum | Standard Deviation | Lower Quartile | Median | Upper Quartile |

|---|---|---|---|---|---|---|---|---|---|---|

| Belgium | High solvency risk | 3.444 | 26 | 48.1% | 1.920 | 6.232 | 1.261 | 2.219 | 3.145 | 4.169 |

| Medium solvency risk | 1.244 | 19 | 35.2% | 0.925 | 1.799 | 0.271 | 1.000 | 1.245 | 1.347 | |

| Low solvency risk | 0.515 | 9 | 16.7% | 0.221 | 0.795 | 0.225 | 0.268 | 0.578 | 0.721 | |

| Croatia | High solvency risk | 4.084 | 23 | 35.4% | 1.924 | 12.587 | 2.600 | 2.314 | 3.139 | 4.803 |

| Medium solvency risk | 1.281 | 15 | 23.1% | 0.887 | 1.889 | 0.300 | 0.999 | 1.322 | 1.527 | |

| Low solvency risk | 0.510 | 27 | 41.5% | 0.160 | 0.853 | 0.239 | 0.266 | 0.485 | 0.741 | |

| Czechia | High solvency risk | 2.832 | 3 | 6.5% | 2.670 | 3.030 | 0.183 | 2.670 | 2.797 | 3.030 |

| Medium solvency risk | 1.275 | 7 | 15.2% | 0.943 | 1.700 | 0.305 | 0.953 | 1.215 | 1.548 | |

| Low solvency risk | 0.492 | 36 | 78.3% | 0.141 | 0.838 | 0.203 | 0.330 | 0.443 | 0.656 | |

| Estonia | High solvency risk | 4.623 | 9 | 21.4% | 2.040 | 9.307 | 2.812 | 2.359 | 2.653 | 6.783 |

| Medium solvency risk | 1.214 | 11 | 26.2% | 0.899 | 1.818 | 0.306 | 0.947 | 1.163 | 1.395 | |

| Low solvency risk | 0.557 | 22 | 52.4% | 0.232 | 0.827 | 0.192 | 0.375 | 0.557 | 0.750 | |

| Finland | High solvency risk | 2.993 | 32 | 16.4% | 1.996 | 8.399 | 1.230 | 2.193 | 2.657 | 3.182 |

| Medium solvency risk | 1.209 | 58 | 29.7% | 0.872 | 1.896 | 0.296 | 0.942 | 1.130 | 1.395 | |

| Low solvency risk | 0.510 | 105 | 53.8% | 0.116 | 0.848 | 0.195 | 0.372 | 0.497 | 0.671 | |

| France | High solvency risk | 3.834 | 621 | 48.9% | 1.912 | 14.202 | 2.043 | 2.391 | 3.208 | 4.570 |

| Medium solvency risk | 1.355 | 450 | 35.4% | 0.866 | 1.908 | 0.290 | 1.113 | 1.343 | 1.584 | |

| Low solvency risk | 0.610 | 200 | 15.7% | 0.230 | 0.862 | 0.162 | 0.508 | 0.625 | 0.745 | |

| Germany | High solvency risk | 3.915 | 5 | 41.7% | 2.044 | 8.043 | 2.470 | 2.390 | 2.751 | 4.345 |

| Medium solvency risk | 1.630 | 3 | 25.0% | 1.438 | 1.852 | 0.209 | 1.438 | 1.600 | 1.852 | |

| Low solvency risk | 0.589 | 4 | 33.3% | 0.245 | 0.779 | 0.240 | 0.429 | 0.667 | 0.750 | |

| Greece | High solvency risk | 4.625 | 12 | 63.2% | 2.392 | 9.733 | 2.185 | 2.873 | 4.026 | 5.893 |

| Medium solvency risk | 1.437 | 2 | 10.5% | 1.057 | 1.817 | 0.537 | 1.057 | 1.437 | 1.817 | |

| Low solvency risk | 0.469 | 5 | 26.3% | 0.140 | 0.814 | 0.307 | 0.244 | 0.378 | 0.771 | |

| Hungary | High solvency risk | 4.003 | 9 | 14.3% | 2.065 | 9.415 | 2.605 | 2.287 | 2.769 | 5.224 |

| Medium solvency risk | 1.288 | 20 | 31.7% | 0.909 | 1.908 | 0.329 | 0.963 | 1.220 | 1.561 | |

| Low solvency risk | 0.459 | 34 | 54.0% | 0.158 | 0.848 | 0.171 | 0.343 | 0.417 | 0.526 | |

| Ireland | Low solvency risk | 0.635 | 2 | 100.0% | 0.615 | 0.654 | 0.028 | 0.615 | 0.635 | 0.654 |

| Latvia | High solvency risk | 3.524 | 24 | 31.2% | 2.003 | 6.366 | 1.390 | 2.292 | 2.932 | 4.571 |

| Medium solvency risk | 1.353 | 26 | 33.8% | 0.878 | 1.903 | 0.331 | 1.072 | 1.343 | 1.676 | |

| Low solvency risk | 0.510 | 27 | 35.1% | 0.173 | 0.812 | 0.187 | 0.351 | 0.521 | 0.630 | |

| Lithuania | High solvency risk | 2.636 | 4 | 12.5% | 2.062 | 3.743 | 0.785 | 2.079 | 2.370 | 3.194 |

| Medium solvency risk | 1.606 | 1 | 3.1% | 1.606 | 1.606 | 1.606 | 1.606 | 1.606 | ||

| Low solvency risk | 0.474 | 8 | 47.1% | 0.222 | 0.856 | 0.248 | 0.238 | 0.470 | 0.649 | |

| Netherlands | High solvency risk | 2.259 | 3 | 33.3% | 1.941 | 2.875 | 0.534 | 1.941 | 1.961 | 2.875 |

| Medium solvency risk | 1.423 | 6 | 66.7% | 0.882 | 1.841 | 0.383 | 1.194 | 1.451 | 1.719 | |

| Poland | High solvency risk | 3.269 | 95 | 17.6% | 1.910 | 11.352 | 1.570 | 2.294 | 2.780 | 3.643 |

| Medium solvency risk | 1.249 | 164 | 30.3% | 0.875 | 1.900 | 0.281 | 1.044 | 1.163 | 1.428 | |

| Low solvency risk | 0.490 | 282 | 52.1% | 0.105 | 0.862 | 0.209 | 0.301 | 0.491 | 0.647 | |

| Portugal | High solvency risk | 4.262 | 93 | 31.2% | 1.912 | 14.074 | 2.498 | 2.362 | 3.401 | 5.609 |

| Medium solvency risk | 1.333 | 103 | 34.6% | 0.869 | 1.908 | 0.319 | 1.032 | 1.316 | 1.587 | |

| Low solvency risk | 0.500 | 102 | 34.2% | 0.125 | 0.854 | 0.208 | 0.322 | 0.504 | 0.692 | |

| Romania | High solvency risk | 4.176 | 213 | 33.1% | 1.909 | 13.311 | 2.284 | 2.383 | 3.469 | 5.311 |

| Medium solvency risk | 1.350 | 198 | 30.7% | 0.877 | 1.905 | 0.302 | 1.093 | 1.323 | 1.612 | |

| Low solvency risk | 0.483 | 233 | 36.2% | 0.103 | 0.862 | 0.222 | 0.292 | 0.493 | 0.674 | |

| Slovakia | High solvency risk | 4.842 | 12 | 27.9% | 2.022 | 10.766 | 2.569 | 2.567 | 5.001 | 6.259 |

| Medium solvency risk | 1.291 | 17 | 39.5% | 0.916 | 1.857 | 0.319 | 1.025 | 1.205 | 1.580 | |

| Low solvency risk | 0.613 | 14 | 32.6% | 0.319 | 0.864 | 0.176 | 0.441 | 0.614 | 0.783 | |

| Slovenia | High solvency risk | 3.299 | 15 | 40.5% | 2.060 | 5.423 | 1.139 | 2.206 | 3.007 | 4.591 |

| Medium solvency risk | 1.164 | 12 | 32.4% | 0.866 | 1.852 | 0.283 | 0.985 | 1.098 | 1.266 | |

| Low solvency risk | 0.514 | 10 | 27.0% | 0.136 | 0.818 | 0.244 | 0.263 | 0.539 | 0.709 | |

| Sweden | High solvency risk | 3.619 | 214 | 26.8% | 1.919 | 12.722 | 1.954 | 2.256 | 2.878 | 4.261 |

| Medium solvency risk | 1.315 | 318 | 39.8% | 0.865 | 1.908 | 0.294 | 1.068 | 1.266 | 1.560 | |

| Low solvency risk | 0.521 | 267 | 33.4% | 0.105 | 0.856 | 0.204 | 0.350 | 0.536 | 0.684 | |

| Spain | High solvency risk | 4.846 | 119 | 32.5% | 1.911 | 13.793 | 2.868 | 2.645 | 3.619 | 6.141 |

| Medium solvency risk | 1.304 | 102 | 27.9% | 0.867 | 1.905 | 0.297 | 1.048 | 1.281 | 1.561 | |

| Low solvency risk | 0.498 | 145 | 39.6% | 0.115 | 0.863 | 0.210 | 0.323 | 0.508 | 0.682 |

Appendix B

| Indicator | Mean | Median | Minimum | Maximum | Lower Quartile | Upper Quartile | Standard Deviation |

|---|---|---|---|---|---|---|---|

| CR Median | 1.065 | 1.039 | 0.379 | 5.762 | 0.840 | 1.221 | 0.400 |

| CR—SD | 1.017 | 0.179 | 0.016 | 622.051 | 0.110 | 0.295 | 19.516 |

| CR Trend | 0.040 | −0.009 | −1.987 | 44.389 | −0.043 | 0.021 | 1.398 |

| NWC/S Median | 0.002 | 0.004 | −0.182 | 0.297 | −0.021 | 0.026 | 0.052 |

| NWC/S SD | 0.077 | 0.023 | 0.003 | 52.456 | 0.014 | 0.040 | 1.350 |

| NWC/SD Trend | 0.008 | −0.001 | −1.041 | 16.217 | −0.006 | 0.003 | 0.416 |

| TAT Median | 4.760 | 4.577 | 0.537 | 10.196 | 3.224 | 6.165 | 1.998 |

| TAT SD | 0.912 | 0.721 | 0.042 | 7.433 | 0.429 | 1.200 | 0.717 |

| TAT Trend | 0.011 | −0.002 | −1.174 | 1.438 | −0.128 | 0.139 | 0.283 |

| CollP Median | 5.530 | 1.903 | 0.000 | 71.428 | 0.911 | 5.221 | 9.418 |

| CollP SD | 3.197 | 0.902 | 0.000 | 194.336 | 0.370 | 3.060 | 7.720 |

| CollP Trend | 0.042 | 0.000 | −15.079 | 56.106 | −0.127 | 0.139 | 2.086 |

| EBITmg Median | 1.899 | 1.509 | −1.944 | 13.661 | 0.765 | 2.628 | 1.682 |

| EBIT mg SD | 2.509 | 1.056 | 0.043 | 1134.253 | 0.682 | 1.757 | 29.302 |

| EBIT mg Trend | −0.212 | −0.015 | −329.253 | 27.101 | −0.208 | 0.148 | 8.464 |

| NP/OpRevmg Median | 1.377 | 1.104 | −1.907 | 9.748 | 0.499 | 1.904 | 1.240 |

| NP/OpRevmg SD | 1.947 | 0.860 | 0.000 | 890.287 | 0.511 | 1.469 | 22.943 |

| NP/OpRevmg Trend | −0.242 | −0.043 | −254.464 | 15.115 | −0.202 | 0.067 | 6.528 |

| ROA Median | 7.677 | 5.822 | −14.910 | 50.739 | 2.302 | 10.955 | 7.630 |

| ROA SD | 6.121 | 5.164 | 0.109 | 37.870 | 3.176 | 7.893 | 4.296 |

| ROA Trend | −0.299 | −0.177 | −10.939 | 6.311 | −1.050 | 0.530 | 1.594 |

| ROE Median | 33.609 | 25.651 | −128.342 | 420.458 | 11.152 | 47.697 | 33.886 |

| ROE SD | 34.089 | 22.136 | 0.457 | 387.244 | 12.775 | 37.939 | 42.123 |

| ROE Trend | 0.112 | 0.256 | −89.458 | 117.105 | −3.124 | 3.920 | 10.405 |

| Indicator | Mean | Median | Minimum | Maximum | Lower Quartile | Upper Quartile | Standard Deviation |

|---|---|---|---|---|---|---|---|

| CR Median | 1.347 | 1.286 | 0.382 | 7.978 | 1.029 | 1.550 | 0.608 |

| CR—SD | 0.563 | 0.259 | 0.017 | 33.105 | 0.161 | 0.423 | 1.941 |

| CR Trend | −0.023 | −0.017 | −6.377 | 6.271 | −0.075 | 0.027 | 0.385 |

| NWC/S Median | 0.032 | 0.027 | −0.169 | 0.523 | 0.003 | 0.057 | 0.057 |

| NWC/S SD | 0.102 | 0.025 | 0.001 | 53.000 | 0.016 | 0.042 | 1.618 |

| NWC/SD Trend | 0.009 | −0.002 | −0.315 | 12.176 | −0.008 | 0.003 | 0.340 |

| TAT Median | 4.507 | 4.264 | 0.428 | 9.907 | 3.097 | 5.806 | 1.883 |

| TAT SD | 0.786 | 0.595 | 0.042 | 11.220 | 0.354 | 1.022 | 0.717 |

| TAT Trend | 0.029 | 0.024 | −2.539 | 2.319 | −0.085 | 0.148 | 0.261 |

| CollP Median | 4.744 | 1.771 | 0.000 | 72.525 | 0.839 | 4.352 | 8.552 |

| CollP SD | 2.732 | 0.770 | 0.000 | 220.900 | 0.313 | 2.156 | 8.820 |

| CollP Trend | −0.046 | 0.003 | −46.270 | 9.218 | −0.111 | 0.123 | 2.032 |

| EBITmg Median | 2.486 | 2.142 | −2.094 | 13.434 | 1.057 | 3.477 | 2.022 |

| EBIT mg SD | 2.300 | 1.111 | 0.047 | 505.631 | 0.738 | 1.829 | 15.130 |

| EBIT mg Trend | −0.098 | −0.030 | −111.003 | 52.394 | −0.233 | 0.133 | 3.270 |

| NP/OpRevmg Median | 1.908 | 1.633 | −1.903 | 11.221 | 0.808 | 2.639 | 1.594 |

| NP/OpRevmg SD | 1.726 | 0.934 | 0.022 | 303.583 | 0.571 | 1.556 | 8.875 |

| NP/OpRevmg Trend | −0.125 | −0.043 | −69.614 | 24.872 | −0.215 | 0.077 | 1.979 |

| ROA Median | 10.518 | 8.603 | −13.968 | 67.037 | 3.561 | 15.104 | 9.425 |

| ROA SD | 6.263 | 5.305 | 0.103 | 40.555 | 3.130 | 8.247 | 4.428 |

| ROA Trend | −0.242 | −0.150 | −9.931 | 7.670 | −1.032 | 0.584 | 1.685 |

| ROE Median | 24.689 | 20.644 | −31.795 | 170.366 | 8.370 | 35.313 | 22.415 |

| ROE SD | 17.627 | 12.663 | 0.292 | 311.905 | 7.153 | 21.785 | 21.448 |

| ROE Trend | 0.250 | 0.091 | −46.018 | 68.504 | −1.578 | 2.079 | 5.682 |

| Indicator | Mean | Median | Minimum | Maximum | Lower Quartile | Upper Quartile | Standard Deviation |

|---|---|---|---|---|---|---|---|

| CR Median | 2.224 | 1.886 | 0.376 | 8.690 | 1.341 | 2.648 | 1.306 |

| CR—SD | 1.620 | 0.484 | 0.041 | 953.245 | 0.264 | 0.970 | 24.488 |

| CR Trend | −0.203 | −0.047 | −190.850 | 11.387 | −0.146 | 0.031 | 4.909 |

| NWC/S Median | 0.088 | 0.070 | −0.155 | 0.526 | 0.030 | 0.125 | 0.090 |

| NWC/S SD | 0.128 | 0.033 | 0.005 | 106.005 | 0.020 | 0.054 | 2.713 |

| NWC/SD Trend | −0.020 | −0.004 | −21.597 | 0.397 | −0.012 | 0.002 | 0.553 |

| TAT Median | 3.560 | 3.317 | 0.487 | 10.185 | 2.395 | 4.423 | 1.604 |

| TAT SD | 0.609 | 0.434 | 0.037 | 7.287 | 0.247 | 0.783 | 0.574 |

| TAT Trend | 0.042 | 0.029 | −1.627 | 2.018 | −0.054 | 0.134 | 0.225 |

| CollP Median | 5.719 | 2.658 | 0.000 | 74.445 | 0.908 | 6.182 | 9.275 |

| CollP SD | 3.243 | 1.177 | 0.000 | 144.526 | 0.438 | 2.922 | 7.740 |

| CollP Trend | 0.004 | 0.015 | −27.757 | 30.726 | −0.121 | 0.228 | 1.879 |

| EBITmg Median | 3.049 | 2.605 | −1.955 | 13.505 | 1.125 | 4.487 | 2.508 |

| EBIT mg SD | 2.699 | 1.296 | 0.085 | 592.563 | 0.785 | 2.204 | 15.715 |

| EBIT mg Trend | 0.085 | −0.035 | −5.949 | 103.766 | −0.260 | 0.167 | 2.790 |

| NP/OpRevmg Median | 2.547 | 2.194 | −1.803 | 11.915 | 0.961 | 3.664 | 2.110 |

| NP/OpRevmg SD | 2.231 | 1.077 | 0.054 | 606.530 | 0.682 | 1.867 | 16.214 |

| NP/OpRevmg Trend | 0.021 | −0.065 | −6.163 | 109.888 | −0.251 | 0.089 | 3.040 |

| ROA Median | 10.852 | 8.746 | −8.019 | 64.433 | 3.354 | 15.733 | 9.919 |

| ROA SD | 5.861 | 4.613 | 0.121 | 38.290 | 2.752 | 7.612 | 4.631 |

| ROA Trend | −0.191 | −0.060 | −12.734 | 7.227 | −0.858 | 0.645 | 1.714 |

| ROE Median | 16.774 | 13.393 | −11.916 | 117.513 | 4.936 | 23.531 | 16.078 |

| ROE SD | 10.815 | 7.236 | 0.115 | 316.942 | 4.201 | 12.839 | 15.508 |

| ROE Trend | 0.192 | 0.048 | −65.048 | 56.491 | −1.064 | 1.355 | 4.161 |

References

- Abraham, Facundo, Juan Jose Cortina Lorente, and Sergio L. Schmukler. 2020. Growth of Global Corporate Debt: Main Facts and Policy Challenges. World Bank Policy Research Working Paper 9394. Washington, DC: World Bank. [Google Scholar]

- Ahmed, Naweed, and Talat Afza. 2019. Capital structure, competitive intensity and firm performance: Evidence from Pakistan. Journal of Advances in Management Research 16: 796–813. [Google Scholar] [CrossRef]

- Alan, Yasin, and Michael A. Lapré. 2018. Investigating operational predictors of future financial distress in the US airline industry. Production and Operations Management 27: 734–55. [Google Scholar] [CrossRef]

- Alessi, Lucia, and Roberto Savona. 2021. Machine Learning for Financial Stability. In Data Science for Economics and Finance. Edited by Sergio Consoli, Diego Reforgiato Recupero and Michaela Saisana. Cham: Springer, pp. 65–87. [Google Scholar]

- Al-Hadi, Ahmed, Bikram Chatterjee, Ali Yaftian, Grantley Taylor, and Mostafa Monzur Hasan. 2019. Corporate social responsibility performance, financial distress and firm life cycle: Evidence from Australia. Accounting & Finance 59: 961–89. [Google Scholar]

- Almamy, Jeehan, John Aston, and Leonard N. Ngwa. 2016. An evaluation of Altman’s Z-score using cash flow ratio to predict corporate failure amid the recent financial crisis: Evidence from the UK. Journal of Corporate Finance 36: 278–85. [Google Scholar] [CrossRef]

- Altman, Edward I. 1968. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Altman, Edward I., and Edith Hotchkiss. 2010. Corporate Financial Distress and Bankruptcy: Predict and Avoid Bankruptcy, Analyze and Invest in Distressed Debt. Hoboken: John Wiley & Sons, vol. 289. [Google Scholar]

- Altman, Edward I., Małgorzata Iwanicz-Drozdowska, Erkki K. Laitinen, and Arto Suvas. 2017. Financial distress prediction in an international context: A review and empirical analysis of Altman’s Z-score model. Journal of International Financial Management & Accounting 28: 131–71. [Google Scholar]

- Altman, Edward I., Tara K. N. Baidya, and Luis Manoel Ribeiro Dias. 1979. Assessing potential financial problems for firms in Brazil. Journal of International Business Studies 10: 9–24. [Google Scholar] [CrossRef]

- Arel-Bundock, Vincent. 2017. The political determinants of foreign direct investment: A firm-level analysis. International Interactions 43: 424–52. [Google Scholar] [CrossRef] [Green Version]

- Bae, Jae Kwon. 2012. Predicting financial distress of the South Korean manufacturing industries. Expert Systems with Applications 39: 9159–65. [Google Scholar] [CrossRef]

- Balasubramanian, Senthil Arasu, G. S. Radhakrishna, P. Sridevi, and Thamaraiselvan Natarajan. 2019. Modeling corporate financial distress using financial and non-financial variables: The case of Indian listed companies. International Journal of Law and Management 61: 457–84. [Google Scholar] [CrossRef]

- Barnett, Michael L., and Robert M. Salomon. 2012. Does it pay to be really good? Addressing the shape of the relationship between social and financial performance. Strategic Management Journal 33: 1304–20. [Google Scholar] [CrossRef]

- Bauman, Mark P. 2014. Forecasting operating profitability with DuPont analysis: Further evidence. Review of Accounting and Finance 13: 191–205. [Google Scholar] [CrossRef]

- Beaver, W. H. 1966. Financial ratios as predictors of failure. Journal of Accounting Research 4: 71–111. [Google Scholar] [CrossRef]

- Behr, Andreas, and Jurij Weinblat. 2017a. Default patterns in seven EU countries: A random forest approach. International Journal of the Economics of Business 24: 181–222. [Google Scholar] [CrossRef]

- Behr, Andreas, and Jurij Weinblat. 2017b. Default prediction using balance-sheet data: A comparison of models. The Journal of Risk Finance 18. [Google Scholar] [CrossRef]

- Behr, Andreas, Schiwy Christopher, and Jurij Weinblat. 2019. Investment, default propensity score and cash flow sensitivity in six EU member states: Evidence based on firm-level panel data. Applied Economics 51: 5345–68. [Google Scholar] [CrossRef]

- Berk, Jonathan B., and Peter DeMarzo. 2019. Corporate Finance, Global Edition, 5th ed. Harlow: Pearson. [Google Scholar]

- Bertrand, Jean-Louis, and Miia Parnaudeau. 2019. Understanding the economic effects of abnormal weather to mitigate the risk of business failures. Journal of Business Research 98: 391–402. [Google Scholar] [CrossRef]

- Biau, Gérard. 2012. Analysis of a random forests model. The Journal of Machine Learning Research 13: 1063–95. [Google Scholar]

- Boďa, Martin, and Vladimír Úradníček. 2016. The portability of Altman’s Z-score model to predicting corporate financial distress of Slovak companies. Technological and Economic Development of Economy 22: 532–53. [Google Scholar] [CrossRef] [Green Version]

- Brealey, Richard, Stewart Myers, and Franklin Allen. 2019. Principles of Corporate Finance, 13th ed. New York: McGraw-Hill Education. [Google Scholar]

- Breiman, Leo. 2001. Random forests. Machine Learning 45: 5–32. [Google Scholar] [CrossRef] [Green Version]

- Brusov, Peter, Tatiana Filatova, and Natali Orekhova. 2014. Mechanism of formation of the company optimal capital structure, different from suggested by trade off theory. Cogent Economics & Finance 2: 946150. [Google Scholar]

- Chadha, Saurabh, and Anil K. Sharma. 2015. Capital structure and firm performance: Empirical evidence from India. Vision: The Journal of Business Perspective 19: 295–302. [Google Scholar] [CrossRef]

- Chen, Suduan, and Zong-De Shen. 2020. Financial Distress Prediction Using Hybrid Machine Learning Techniques. Asian Journal of Economics, Business and Accounting, 1–12. [Google Scholar] [CrossRef]

- Cheng, Ching-Hsue, and Ssu-Hsiang Wang. 2015. A quarterly time-series classifier based on a reduced-dimension generated rules method for identifying financial distress. Quantitative Finance 15: 1979–94. [Google Scholar] [CrossRef]

- Council Directive (EU). 2016. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32016L1164&from=EN (accessed on 3 August 2021).

- Cultrera, Loredana, and Xavier Bredart. 2016. Bankruptcy prediction: The case of Belgian SMEs. Review of Accounting and Finance 15: 101–19. [Google Scholar] [CrossRef]

- Dawar, Varun. 2014. Agency theory, capital structure and firm performance: Some Indian evidence. Managerial Finance 40: 1190–206. [Google Scholar] [CrossRef]

- De Jong, Abe, Rezaul Kabir, and Thuy Thu Nguyen. 2008. Capital structure around the world: The roles of firm-and country-specific determinants. Journal of Banking & Finance 32: 1954–69. [Google Scholar]

- Deloitte. 2020a. Global Powers of Retailing 2020a. Available online: https://www2.deloitte.com/ph/en/pages/consumer-business/articles/global-powers-of-retailing.html (accessed on 3 August 2021).

- Deloitte. 2020b. Recession 2.0. The Retail Evolution’s Great Acceleration. Available online: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/consumer-business/us-cb-covid-recession-2020.pdf (accessed on 3 September 2021).

- Doorasamy, Michelle. 2016. Using DuPont analysis to assess the financial performance of the top 3 JSE listed companies in the food industry. Investment Management and Financial Innovations 13: 29–44. [Google Scholar] [CrossRef] [Green Version]

- Dufour, Dominique, Philippe Luu, and Pierre Teller. 2018. The influence of cash flow on the speed of adjustment to the optimal capital structure. Research in International Business and Finance 45: 62–71. [Google Scholar] [CrossRef]

- Ebeke, Christian, Nemanja Jovanovic, Laura Valderrama, and Jing Zhou. 2021. Corporate Liquidity and Solvency in Europe during COVID-19: The Role of Policies. Washington, DC: International Monetary Fund. [Google Scholar]

- EUROSTAT. 2021. Statistics Explained. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Retail_trade_volume_index_overview#Turnover_for_retail_and_wholesale_trade (accessed on 12 September 2021).

- Fantazzini, Dean, and Silvia Figini. 2009. Random survival forests models for SME credit risk measurement. Methodology and Computing in Applied Probability 11: 29–45. [Google Scholar] [CrossRef]

- Fawagreh, Khaled, Mohamed Medhat Gaber, and Eyad Elyan. 2014. Random forests: From early developments to recent advancements. Systems Science & Control Engineering: An Open Access Journal 2: 602–9. [Google Scholar]

- Garg, Akhil, and Kang Tai. 2013. Comparison of statistical and machine learning methods in modelling of data with multicollinearity. International Journal of Modelling, Identification and Control 18: 295–312. [Google Scholar] [CrossRef]

- Geng, Zhaoyuan, Lan Tan, Xiaoli Gao, Yining Ma, Lufeng Feng, and Jiaying Zhu. 2011. Financial distress prediction models of listed companies by using non-financial determinants in Bayesian criterion. Paper presented at the 2011 International Conference on Management and Service Science, Wuhan, China, August 12–14; pp. 1–5. [Google Scholar]

- Gerantonis, Nickolaos, Konstantinos Vergos, and Apostolos G. Christopoulos. 2009. Can Altman Z-score Models Predict Business Failures in Greece? Research Journal of International Studies 12: 21–28. [Google Scholar]

- GfK. 2021. GfK Study, European Retail in 2020 and 2021, Growth from Knowledge. Available online: https://insights.gfk.com/gfk-study-on-european-retail (accessed on 3 August 2021).

- Gleason, Kimberly C., Lynette Knowles Mathur, and Ike Mathur. 2000. The interrelationship between culture, capital structure, and performance: Evidence from European retailers. Journal of Business Research 50: 185–91. [Google Scholar] [CrossRef]

- Gray, J. Brian, and Guangzhe Fan. 2008. Classification tree analysis using TARGET. Computational Statistics & Data Analysis 52: 1362–72. [Google Scholar]

- Gregova, Elena, Katarina Valaskova, Peter Adamko, Milos Tumpach, and Jaroslav Jaros. 2020. Predicting financial distress of Slovak enterprises: Comparison of selected traditional and learning algorithms methods. Sustainability 12: 3954. [Google Scholar] [CrossRef]

- Gruszczynski, Marek. 2004. Financial distress of companies in Poland. International Advances in Economic Research 10: 249–56. [Google Scholar] [CrossRef]

- Gudmundsson, Sveinn Vidar. 2002. Airline distress prediction using non-financial indicators. Journal of Air Transportation 7: 3–24. [Google Scholar]

- Hastie, Trevor, Robert Tibshirani, and Ryan J. Tibshirani. 2016. The Elements of Statistical Learning: Data Mining, Inference and Prediction, 2nd ed. Springer Series in Statistics; New York: Springer. [Google Scholar]

- Hayes, Timothy, Satoshi Usami, Ross Jacobucci, and John J. McArdle. 2015. Using Classification and Regression Trees (CART) and random forests to analyze attrition: Results from two simulations. Psychology and Aging 30: 911. [Google Scholar] [CrossRef] [Green Version]

- Heine, Michael. 2000. Predicting Financial Distress of Companies: Revisiting the Z-Score and ZETA. Available online: http://pages.stern.nyu.edu/~ealtman/Zscores.pdf (accessed on 16 August 2021).

- Hu, Yu-Chiang, and Jake Ansell. 2007. Measuring retail company performance using credit scoring techniques. European Journal of Operational Research 183: 1595–606. [Google Scholar] [CrossRef]

- Ibrahim, Salma. 2007. The Relationship between Non-Financial Information and Financial Distress. The AAA 2008 MAS Meeting Paper. Available online: https://ssrn.com/abstract=997870 (accessed on 10 August 2021).

- Jabeur, Sami Ben, and Youssef Fahmi. 2018. Forecasting financial distress for French firms: A comparative study. Empirical Economics 54: 1173–86. [Google Scholar] [CrossRef]

- Jensen, Michael, and William Meckling. 1976. Theory of the Firm: Managerial Behavior, Agency Costs, and Capital Structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Kaiser, Ulrich. 2001. Moving in and Out of Financial Distress: Evidence for Newly Founded Service Sector Firms. ZEW Discussion Paper No. 01-09. Mannheim: Zentrum für Europäische Wirtschaftsforschung. [Google Scholar] [CrossRef] [Green Version]

- Kane, Gregory D., Frederick M. Richardson, and Patricia Graybeal. 1996. Recession-induced stress and the prediction of corporate failure. Contemporary Accounting Research 13: 631–50. [Google Scholar] [CrossRef]

- Kaufinger, Gregory G., and Chris Neuenschwander. 2020. Retail Apocalypse? Maybe blame accounting. Investigating inventory valuation as a determinant of retail firm failure. American Journal of Business 35. [Google Scholar] [CrossRef]

- Khan, Kanwal Iqbal, Faisal Qadeer, Mário Nuno Mata, José Chavaglia Neto, Qurat ul An Sabir, Jéssica Nunes Martins, and José António Filipe. 2021. Core predictors of debt specialization: A new insight to optimal capital structure. Mathematics 9: 975. [Google Scholar] [CrossRef]

- Kirkos, Efstathios. 2015. Assessing methodologies for intelligent bankruptcy prediction. Artificial Intelligence Review 43: 83–123. [Google Scholar] [CrossRef]

- Klepáč, Václav, and David Hampel. 2018. Predicting bankruptcy of manufacturing companies in EU. Economics and Management 21: 159–174. [Google Scholar] [CrossRef]

- Ko, Yu-Chien, Hamido Fujita, and Tianrui Lin. 2017. An evidential analysis of Altman Z-score for financial predictions: Case study on solar energy companies. Applied Soft Computing 52: 748–59. [Google Scholar] [CrossRef]

- Kraus, Alan, and Robert H. Litzenberger. 1973. A State-Preference Model of Optimal Financial Leverage. Journal of Finance 28: 911–22. [Google Scholar] [CrossRef]

- Lee, Li-Tze, Chiang Ku Fan, Hsiang-Wen Hung, and Yu-Chun Ling. 2010. Analysis of Financial Distress Prediction Models. Journal of Testing and Evaluation 38: 635–40. [Google Scholar]

- Lenka, Strýčková. 2017. The relationship between company returns and leverage depending on the business sector: Empirical evidence from the Czech Republic. Journal of Competitiveness 9: 98–110. [Google Scholar]

- Lennox, Clive. 1999. Identifying failing companies: A re-evaluation of the logit, probit and DA approaches. Journal of Economics and Business 51: 347–64. [Google Scholar] [CrossRef]

- Liang, Deron, Chih-Fong Tsai, An-Jie Dai, and William Eberle. 2018. A novel classifier ensemble approach for financial distress prediction. Knowledge and Information Systems 54: 437–62. [Google Scholar] [CrossRef]

- Liang, Deron, Chia-Chi Lu, Chi-Fong Tsai, and G. A. Guan-An Shih. 2016. Financial ratios and corporate governance indicators in bankruptcy prediction: A comprehensive study. European Journal of Operational Research 252: 561–72. [Google Scholar] [CrossRef]

- Lin, Fengyi, Deron Liang, and Wing-Sang Chu. 2010. The role of non-financial features related to corporate governance in business crisis prediction. Journal of Marine Science and Technology 18: 4. [Google Scholar] [CrossRef]

- Lin, Tzong-Huei. 2009. A cross model study of corporate financial distress prediction in Taiwan: Multiple discriminant analysis, logit, probit and neural networks models. Neurocomputing 72: 3507–16. [Google Scholar] [CrossRef]

- Liou, Dah-Kwei. 2007. Macroeconomic Variables and Financial Distress. Journal of Accounting, Business & Management 14. [Google Scholar]

- Lisboa, Inês. 2017. Capital structure of exporter SMEs during the financial crisis: Evidence from Portugal. European Journal of Management Studies 22: 25–49. [Google Scholar]

- Lo, Andrew W. 1986. Logit versus discriminant analysis: A specification test and application to corporate bankruptcies. Journal of Econometrics 31: 151–78. [Google Scholar] [CrossRef]

- Lopes, Fernanda Cristina, and Luciana Carvalho. 2021. Intangible assets and business performance in Latin America. RAUSP Management Journal. Ahead of print. [Google Scholar] [CrossRef]

- Lund, Susan, Jonathan Woetzel, Eckart Windhagen, Richard Dobbs, and Diana Goldshtein. 2018. Rising Corporate Debt: Peril or Promise? McKinsey Global Institute Discussion Paper. Available online: https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/rising-corporate-debt-peril-or-promise (accessed on 5 September 2021).

- Lund, Susan. 2018. Are We in a Corporate Debt Bubble? Project Syndicate. Available online: https://www.project-syndicate.org/commentary/growing-corporate-debt-crisis-risks-by-susan-lund-2018-06 (accessed on 3 August 2021).

- Lustig, Nora, and Jorge Mariscal. 2020. 20 How COVID-19 Could Be Like the Global Financial Crisis (or Worse). In Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes. Edited by R. Baldwin and B. Weder di Mauro. London: CEPR Press, pp. 185–90. [Google Scholar]

- MacCarthy, James. 2017. Using Altman Z-score and Beneish M-score models to detect financial fraud and corporate failure: A case study of Enron Corporation. International Journal of Finance and Accounting 6: 159–66. [Google Scholar]

- Majumdar, Raju. 2014. The determinants of indebtedness of unlisted manufacturing firms in India: A panel data analysis. Management Research Review 37: 833–54. [Google Scholar] [CrossRef] [Green Version]

- Malakauskas, Aidas, and Aušrinė Lakštutienė. 2021. Financial Distress Prediction for Small and Medium Enterprises Using Machine Learning Techniques. Engineering Economics 32: 4–14. [Google Scholar] [CrossRef]

- Marinakos, Georgios, Sophia Daskalaki, and Theodoros Ntrinias. 2014. Defensive financial decisions support for retailers in Greek pharmaceutical industry. Central European Journal of Operations Research 22: 525–51. [Google Scholar] [CrossRef]

- Maripuu, Peeter, and Kadri Männasoo. 2014. Financial distress and cycle-sensitive corporate investments. Baltic Journal of Economics 14: 181–93. [Google Scholar] [CrossRef]

- Martin, Daniel. 1997. Early warning of bank failure: A logit regression approach. Journal of Banking & Finance 1: 249–76. [Google Scholar]

- McGurr, Paul T., and Sharon A. DeVaney. 1998. Predicting business failure of retail firms: An analysis using mixed industry models. Journal of Business Research 43: 169–76. [Google Scholar] [CrossRef]

- Modigliani, Franco, and Merton H. Miller. 1958. The Cost of Capital, Corporation Finance and Theory of Investment. The American Economic Review 48: 261–97. [Google Scholar]

- Modigliani, Franco, and Merton H. Miller. 1963. Corporate Income Taxes and the Cost of Capital: A Correction. The American Economic Review 53: 433–43. [Google Scholar]

- Mojon, Benoit, Daniel Rees, and C. Christian Schmieder. 2021. How Much Stress Could Covid Put on Corporate Credit? Evidence Using Sectoral Data. Basel: BIS Quarterly Review, March. [Google Scholar]

- Mselmi, Nada, Amine Lahiani, and Taher Hamza. 2017. Financial distress prediction: The case of French small and medium-sized firms. International Review of Financial Analysis 50: 67–80. [Google Scholar] [CrossRef]

- Nwogugu, Michael. 2007. Decision-making, risk and corporate governance: A critique of methodological issues in bankruptcy/recovery prediction models. Applied Mathematics and Computation 185: 178–96. [Google Scholar] [CrossRef]

- Odom, Marcus D., and Ramesh Sharda. 1990. A neural network model for bankruptcy prediction. Paper presented at the 1990 IJCNN International Joint Conference on Neural Networks, San Diego, CA, USA, June 17–21; pp. 163–68. [Google Scholar]

- Ohlson, James A. 1980. Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research 18: 109–31. [Google Scholar] [CrossRef] [Green Version]

- Omoshagba, Toyin Praise, and Umaru M. Zubairu. 2018. A Systematic Review of the Field of Debt Financing. Covenant Journal of Entrepreneurship 2: 34–49. [Google Scholar]

- Ong, Shuk-Wern, Voon Choong Yap, and Roy W. L. Khong. 2011. Corporate failure prediction: A study of public listed companies in Malaysia. Managerial Finance 91: 114–26. [Google Scholar] [CrossRef]

- Opler, Tim C., and Sheridan Titman. 1994. Financial distress and corporate performance. The Journal of Finance 49: 1015–40. [Google Scholar] [CrossRef]

- Pacheco, Luis, and Fernando Tavares. 2017. Capital structure determinants of hospitality sector SMEs. Tourism Economics 23: 113–32. [Google Scholar] [CrossRef]

- Pálinkó, Éva, and Ágnes Svoób. 2016. Main causes and process of financial distress. Public Finance Quarterly 61: 516. [Google Scholar]

- Paul, Pinku. 2021. A Study of Multilayered Profitability Analysis by Using DuPont Model: Evidence from Indian Pharmaceutical Industry. Global Business Review. [Google Scholar] [CrossRef]

- Priego-de-la-Cruz, Albá Maria, Esteban Alfaro-Cortés, and Monserrat Manzaneque-Lizano. 2020. Understanding the stakeholders’ role in a business failure situation: An empirical boosting approach. Spanish Accounting Review 23: 113–26. [Google Scholar] [CrossRef]

- Proença, Pedro, Raul M. S. Laureano, and Luis M. S. Laureano. 2014. Determinants of capital structure and the 2008 financial crisis: Evidence from Portuguese SMEs. Social Behavioral Sciences 150: 182–91. [Google Scholar] [CrossRef] [Green Version]

- Rahman, Mahfuzur, Cheong Li Sa, and Md KaiumMasud. 2021. Predicting Firms’ Financial Distress: An Empirical Analysis Using the F-Score Model. Journal of Risk and Financial Management 14: 199. [Google Scholar] [CrossRef]

- Routledge, James, and David Gadenne. 2000. Financial distress, reorganization and corporate performance. Accounting & Finance 40: 233–59. [Google Scholar]

- Russ, Robert W., Wendy W. Peffley, and Alfred C. Greenfield. 2004. The Altman Z-Score Revisited. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=484923 (accessed on 15 July 2021). [CrossRef]

- Ruxanda, Gheorghe, Cătălina Zamfir, and Andreea Muraru. 2018. Predicting financial distress for Romanian companies. Technological and Economic Development of Economy 24: 2318–37. [Google Scholar] [CrossRef] [Green Version]

- Scalzer, Rodrigo S., A. Rodrigues, M. Á. D. S. Macedo, and P. Wanke. 2019. Financial distress in electricity distributors from the perspective of Brazilian regulation. Energy Policy 125: 250–59. [Google Scholar] [CrossRef]

- Sehgal, Sanjay, R. K. Mishra, F. Deisting, and R. Vashisht. 2021. On the determinants and prediction of corporate financial distress in India. Managerial Finance 47: 1428–47. [Google Scholar] [CrossRef]

- Serrano-Cinca, Carlos. 1996. Self organizing neural networks for financial diagnosis. Decision Support Systems 17: 227–38. [Google Scholar] [CrossRef]

- Shetty, Shilpa H., and Theresa Nithila Vincent. 2021. Corporate Default Prediction Model: Evidence from the Indian Industrial Sector. Vision, 1–17. [Google Scholar] [CrossRef]

- Silva, Marta, Luis Gomes, and Isabel Cristina Lopes. 2020. Explanatory factors of the capital structure. Emerging Science Journal 4: 519–29. [Google Scholar] [CrossRef]

- Soliman, Mark T. 2008. The use of DuPont analysis by market participants. The Accounting Review 83: 823–53. [Google Scholar] [CrossRef]

- Staňková, Michaela, and David Hampel. 2018. Bankruptcy prediction of engineering companies in the EU using classification methods. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis 66: 1347–56. [Google Scholar] [CrossRef] [Green Version]

- Succurro, Marianna. 2017. Financial bankruptcy across European countries. International Journal of Economics and Finance 9: 132–46. [Google Scholar] [CrossRef] [Green Version]

- Titman, Sheridan, and Sergey Tsyplakov. 2007. A dynamic model of optimal capital structure. Review of Finance 11: 401–51. [Google Scholar] [CrossRef]

- Tomas Žiković, Ivana. 2018. Challenges in Predicting Financial Distress in Emerging Economies: The Case of Croatia. Eastern European Economics 56: 1–27. [Google Scholar] [CrossRef]

- Utami, Devi Wahyu, Heni Hirawati, and Axel Giovanni. 2020. Capital Structure and Financial Distress: Empirical Study of Companies in the Mining Sector and the Infrastructure, Utilities & Transportation Sector. Journal of Research in Business, Economics, and Education 2: 1370–80. [Google Scholar]

- Vakhitova, R. Z., N. G. Vishnevskaya, and O. V. Aleshkina. 2018. Modeling the Impact of Enterprise Bankruptcy on Unemployment Rate. In The International Science and Technology Conference “FarEastCon”. Cham: Springer, pp. 340–48. [Google Scholar]

- Valencia, Carlos, Sergio Cabrales, Laura Garcia, Juan Ramirez, and Diego Calderona. 2019. Generalized additive model with embedded variable selection for bankruptcy prediction: Prediction versus interpretation. Cogent Economics & Finance 7: 1597956. [Google Scholar]

- Vieira, Armando S., João Duarte, Bernadete Ribeiro, and João C. Neves. 2009. Accurate prediction of financial distress of companies with machine learning algorithms. Paper presented at the International Conference on Adaptive and Natural Computing Algorithms, Kuopio, Finland, April 23–25; Berlin and Heidelberg: Springer, pp. 569–76. [Google Scholar]

- Wu, Yuanbo, Clive Gaunt, and Steven Gray. 2010. A Comparison of Alternative Bankruptcy Prediction Models. Journal of Contemporary Accounting & Economics 6: 34–45. [Google Scholar]

- Yazdanfar, Darush, and Peter Öhman. 2015. Debt financing and firm performance: An empirical study based on Swedish data. The Journal of Risk Finance 16: 102–18. [Google Scholar] [CrossRef]

- Yim, Juliana, and Heather Mitchell. 2003. A comparison of corporate failure models in Australia: Hybrid neural networks, logit models and discriminant analysis. Paper presented at the International Conference on Industrial, Engineering and Other Applications of Applied Intelligent Systems, Kuala Lumpur, Malaysia, July 26–29; Berlin and Heidelberg: Springer, pp. 348–58. [Google Scholar]

- Zavgren, Christine V. 1985. Assessing the vulnerability to failure of American industrial firms: A logistic analysis. Journal of Business Finance & Accounting 12: 19–45. [Google Scholar]

| Indicators | Calculation | Explanation | Calculation |

|---|---|---|---|

| Performance area: solvency—debt share in total company financing | |||

| Debt-to-equity ratio (TD/SF) | A higher value designates higher solvency risk. | Authors’ calculations based on Orbis data for total debt and shareholder funds (an approximation of how much the shareholders would receive if a business were to liquidate, which includes common and preferred stock, retained earnings, and treasury stock accounts). | |

| Performance area: liquidity—ability to pay for short-term obligations, as they become due | |||

| Current ratio (CR) | The company is in a better position to pay its short-term obligations when the CR and NWC/turn are higher. | Authors’ calculations based on Orbis data for current assets, current liabilities, and turnover. | |

| Net working capital share in turnover (NWC/turn) | |||

| Performance area: efficiency—ability to generate sales and turnover from the assets used by the company | |||

| Total assets turnover (TAT) | A higher value for TAT means that the company generates more sales from the total assets it uses. | Authors’ calculations based on Orbis data for turnover and total assets. | |

| Average collection period (CollP) | A lower value means that customers pay over shorter periods; thus, lowering the asset use efficiency. | Available directly on Orbis database. | |

| Performance area: Profitability—business ability to manage costs and generate profits | |||

| EBIT (Earnings before Interest and Taxes) margin (EBITmg) | A higher value indicates better operational profitability before the payment of financial obligations and taxes. | Authors’ calculations based on Orbis data for EBIT and turnover. | |

| Net profit margin (NP/OpRevmg) | A higher value indicates better operational profitability on a net basis (after the payment of financial obligations and taxes). | Authors’ calculations based on Orbis data for net profit and operating revenues. | |

| Return on assets (ROA) | A higher value shows a better operational performance based on the profit obtained when using all the assets of the firm. | Available directly on Orbis database as ROA before tax. | |

| Return on equity (ROE) | A higher value means higher returns available to shareholders. | Available directly on Orbis database as ROE before tax. | |

| Number of Companies | Mean | Median | Minimum | Maximum | Lower Quartile | Upper Quartile | Standard Deviation | |

|---|---|---|---|---|---|---|---|---|

| 2011–2019 | ||||||||

| Full sample | 4596 | 1.912 | 1.281 | 0.103 | 14.202 | 0.692 | 2.363 | 1.919 |

| High solvency risk | 1532 | 3.902 | 3.098 | 1.909 | 14.202 | 2.363 | 4.723 | 2.157 |

| Medium solvency risk | 1532 | 1.319 | 1.281 | 0.865 | 1.908 | 1.059 | 1.566 | 0.298 |

| Low solvency risk | 1532 | 0.516 | 0.524 | 0.103 | 0.864 | 0.340 | 0.692 | 0.206 |

| 2011–2013 | ||||||||

| Full sample | 4596 | 2.855 | 1.538 | 0.025 | 208.205 | 0.800 | 3.150 | 5.280 |

| High solvency risk | 1532 | 5.873 | 4.033 | 0.054 | 208.205 | 2.623 | 6.732 | 8.102 |

| Medium solvency risk | 1532 | 1.942 | 1.513 | 0.025 | 21.153 | 1.133 | 2.081 | 1.784 |

| Low solvency risk | 1532 | 0.748 | 0.626 | 0.027 | 10.670 | 0.396 | 0.877 | 0.683 |

| 2014–2016 | ||||||||

| Full sample | 4596 | 1.975 | 1.241 | 0.053 | 36.452 | 0.657 | 2.329 | 2.395 |

| High solvency risk | 1532 | 4.176 | 3.133 | 1.866 | 36.452 | 2.329 | 4.873 | 3.083 |

| Medium solvency risk | 1532 | 1.267 | 1.241 | 0.815 | 1.864 | 1.003 | 1.516 | 0.296 |

| Low solvency risk | 1532 | 0.483 | 0.490 | 0.053 | 0.815 | 0.314 | 0.657 | 0.200 |

| 2017–2019 | ||||||||

| Full sample | 4596 | 1.893 | 1.142 | 0.025 | 63.353 | 0.601 | 2.211 | 2.899 |

| High solvency risk | 1532 | 4.061 | 2.946 | 1.740 | 63.353 | 2.211 | 4.390 | 4.217 |

| Medium solvency risk | 1532 | 1.177 | 1.142 | 0.757 | 1.736 | 0.926 | 1.409 | 0.283 |

| Low solvency risk | 1532 | 0.440 | 0.443 | 0.025 | 0.756 | 0.287 | 0.601 | 0.185 |

| Trend | Solvency Risk | Number of Companies | TD/SF Mean | Minimum | Maximum | Standard Deviation | Lower Quartile | Median | Upper Quartile |

|---|---|---|---|---|---|---|---|---|---|

| UPWARD | High | 1038 | 3.876 | 1.909 | 14.202 | 2.112 | 2.354 | 3.079 | 4.776 |

| Medium | 1015 | 1.314 | 0.865 | 1.908 | 0.299 | 1.052 | 1.276 | 1.563 | |

| Low | 1046 | 0.519 | 0.103 | 0.864 | 0.206 | 0.340 | 0.530 | 0.696 | |

| Total | 3099 | ||||||||

| DOWNWARD | High | 494 | 3.959 | 1.910 | 14.071 | 2.249 | 2.389 | 3.122 | 4.662 |

| Medium | 517 | 1.328 | 0.866 | 1.908 | 0.297 | 1.088 | 1.296 | 1.567 | |

| Low | 486 | 0.508 | 0.105 | 0.863 | 0.208 | 0.338 | 0.510 | 0.684 | |

| Total | 1497 | ||||||||

| First Sub-Period 2011–2013 | Second Sub-Period 2014–2016 | Third Sub-Period: 2017–2019 | ||

|---|---|---|---|---|

| High | Medium | Low | ||

| High 1532 | High—1151 | 883 | 243 | 25 |

| Medium—334 | 75 | 193 | 66 | |

| Low—47 | 1 | 14 | 32 | |

| Total | 959 | 450 | 123 | |

| Medium 1532 companies | High—328 | 233 | 84 | 11 |

| Medium—918 | 193 | 565 | 160 | |

| Low—286 | 16 | 71 | 199 | |

| Total | 442 | 720 | 370 | |

| Low 1532 companies | High—53 | 33 | 18 | 2 |

| Medium—280 | 55 | 163 | 62 | |

| Low—1199 | 43 | 181 | 975 | |

| Total | 131 | 362 | 1039 | |

| Performance Area | Indicator | Mean | Median | Minimum | Maximum | Lower Quartile | Upper Quartile | Standard Deviation |

|---|---|---|---|---|---|---|---|---|

| Liquidity | CR Median | 1.545 | 1.271 | 0.376 | 8.690 | 0.986 | 1.721 | 0.994 |

| CR—SD | 1.067 | 0.271 | 0.016 | 953.245 | 0.155 | 0.514 | 18.115 | |

| CR Trend | −0.062 | −0.019 | −190.850 | 44.389 | −0.081 | 0.024 | 2.956 | |

| NWC/S Median | 0.041 | 0.027 | −0.182 | 0.526 | −0.002 | 0.068 | 0.077 | |

| NWC/S SD | 0.102 | 0.026 | 0.001 | 106.005 | 0.016 | 0.045 | 1.983 | |

| NWC/SD Trend | −0.001 | −0.002 | −21.597 | 16.217 | −0.008 | 0.003 | 0.445 | |

| Efficiency | TAT Median | 4.276 | 3.977 | 0.428 | 10.196 | 2.847 | 5.517 | 1.907 |

| TAT SD | 0.769 | 0.583 | 0.037 | 11.220 | 0.335 | 0.990 | 0.684 | |

| TAT Trend | 0.027 | 0.018 | −2.539 | 2.319 | −0.086 | 0.140 | 0.258 | |

| CollP Median | 5.331 | 2.039 | 0.000 | 74.445 | 0.887 | 5.278 | 9.097 | |

| CollP SD | 3.057 | 0.935 | 0.000 | 220.900 | 0.361 | 2.688 | 8.111 | |

| CollP Trend | 0.000 | 0.006 | −46.270 | 56.106 | −0.119 | 0.162 | 2.001 | |

| Profitability | EBITmg Median | 2.478 | 2.014 | −2.094 | 13.661 | 0.943 | 3.539 | 2.150 |

| EBIT mg SD | 2.503 | 1.138 | 0.043 | 1134.253 | 0.736 | 1.913 | 21.087 | |

| EBIT mg Trend | −0.075 | −0.027 | −329.253 | 103.766 | −0.233 | 0.147 | 5.481 | |

| NP/OpRevmg Median | 1.944 | 1.569 | −1.907 | 11.915 | 0.706 | 2.772 | 1.753 | |

| NP/OpRevmg SD | 1.968 | 0.949 | 0.000 | 890.287 | 0.579 | 1.621 | 17.008 | |

| NP/OpRevmg Trend | −0.115 | −0.049 | −254.464 | 109.888 | −0.222 | 0.076 | 4.312 | |

| Aggregate performance | ROA Median | 9.683 | 7.665 | −14.910 | 67.037 | 2.944 | 13.821 | 9.155 |

| ROA SD | 6.082 | 5.010 | 0.103 | 40.555 | 2.992 | 7.890 | 4.456 | |

| ROA Trend | −0.244 | −0.131 | −12.734 | 7.670 | −0.979 | 0.585 | 1.665 | |

| ROE Median | 25.024 | 18.709 | −128.342 | 420.458 | 7.691 | 34.754 | 26.142 | |

| ROE SD | 20.844 | 12.753 | 0.115 | 387.244 | 6.515 | 23.866 | 30.333 | |

| ROE Trend | 0.185 | 0.091 | −89.458 | 117.105 | −1.662 | 2.236 | 7.253 |

| 2011–2019 | 2011–2013 | 2014–2016 | 2017–2019 | |||||

|---|---|---|---|---|---|---|---|---|

| Samples | Risk Estimate | Standard Error | Risk Estimate | Standard Error | Risk Estimate | Standard Error | Risk Estimate | Standard Error |

| Train | 0.312 | 0.008 | 0.349 | 0.008 | 0.326 | 0.008 | 0.319 | 0.008 |

| Test | 0.348 | 0.013 | 0.414 | 0.013 | 0.376 | 0.013 | 0.361 | 0.013 |

| Solvency Risk Category | OBSERVED Cases (Firms) | Predicted Solvency Risk | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2011–2019 | 2011–2013 | 2014–2016 | 2017–2019 | ||||||||||

| High | Medium | Low | High | Medium | Low | High | Medium | Low | High | Medium | Low | ||

| High | 1532 | 1121 | 352 | 59 | 1055 | 349 | 128 | 1109 | 345 | 78 | 1112 | 360 | 60% |

| 73.17% | 22.98% | 3.85% | 68.86% | 22.78% | 8.36% | 72.39% | 22.52% | 5.09% | 72.58% | 23.50% | 3.92% | ||

| Medium | 1532 | 385 | 924 | 223 | 412 | 827 | 293 | 386 | 883 | 263 | 382 | 943 | 207 |

| 25.13% | 60.31% | 14.56% | 26.89% | 53.98% | 19.13% | 25.20% | 57.64% | 17.17% | 24.93% | 61.55% | 13.51% | ||

| Low | 1532 | 103 | 364 | 1065 | 150 | 363 | 1019 | 97 | 400 | 1035 | 90 | 393 | 1049 |

| 6.72% | 23.76% | 69.52% | 9.79% | 23.69% | 66.51% | 6.33% | 26.11% | 67.56% | 5.87% | 25.65% | 68.47% | ||

| All | 4596 | 1609 | 1640 | 1347 | 1617 | 1539 | 1440 | 1592 | 1628 | 1376 | 1584 | 1696 | 1316 |

| 35.01% | 35.68% | 29.31% | 35.18% | 33.49% | 31.33% | 34.64% | 35.42% | 29.94% | 34.46% | 36.90% | 28.63% | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Horobet, A.; Curea, S.C.; Smedoiu Popoviciu, A.; Botoroga, C.-A.; Belascu, L.; Dumitrescu, D.G. Solvency Risk and Corporate Performance: A Case Study on European Retailers. J. Risk Financial Manag. 2021, 14, 536. https://doi.org/10.3390/jrfm14110536

Horobet A, Curea SC, Smedoiu Popoviciu A, Botoroga C-A, Belascu L, Dumitrescu DG. Solvency Risk and Corporate Performance: A Case Study on European Retailers. Journal of Risk and Financial Management. 2021; 14(11):536. https://doi.org/10.3390/jrfm14110536

Chicago/Turabian StyleHorobet, Alexandra, Stefania Cristina Curea, Alexandra Smedoiu Popoviciu, Cosmin-Alin Botoroga, Lucian Belascu, and Dan Gabriel Dumitrescu. 2021. "Solvency Risk and Corporate Performance: A Case Study on European Retailers" Journal of Risk and Financial Management 14, no. 11: 536. https://doi.org/10.3390/jrfm14110536