The Use of Artificial Intelligence and Audit Quality: An Analysis from the Perspectives of External Auditors in the UAE

Abstract

:1. Introduction

2. Literature Review and Hypotheses Development

2.1. Theoretical Framework

2.2. Literature Review

2.2.1. Application of AI in Auditing

2.2.2. Risks and Benefits of Artificial Intelligence

2.2.3. Technology Acceptance Model

2.2.4. Perceived Contribution and Acceptance of AI

2.2.5. Research Gap

2.3. Hypotheses Development

3. Research Design

3.1. Sample and Data

3.2. Dependent Variable

3.3. Independent Variable

4. Data Analysis and Results

4.1. Validity and Reliability Test of the Instrument

4.2. Demographic Analysis

4.3. Descriptive Statistics

4.4. Hypotheses Testing

4.5. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Aduloju, Kunle, Olowokudejo Folake, and Obalola Musa. 2014. Information technology and customer service performance among insurance companies in Nigeria. European Journal of Business and Management 6: 80–87. [Google Scholar] [CrossRef] [Green Version]

- Al-Aroud, Shaher Falah. 2020. The Impact Of Artificial Intelligence Technologies On Audit Evidence. Academy of Accounting and Financial Studies Journal 24: 1–11. [Google Scholar]

- Albawwat, Ibrahim, and Frijat Yaser. 2021. An analysis of auditors’ perceptions towards Artificial Intelligence and its contribution to audit quality. Accounting 7: 755–62. [Google Scholar] [CrossRef]

- Askary, Saeed, Nasser Abu-Ghazaleh, and Yasean Tahat. 2018. Artificial Intelligence and reliability of accounting information. Lecture Notes in Computer Science 11195: 315–24. [Google Scholar] [CrossRef]

- Avianna Accounting. 2021. How Artificial Intelligence will Change the Auditing Function in Dubai, UAE. Available online: https://aviaanaccounting.com/best-audit-firms-in-dubai-uae/ (accessed on 12 May 2022).

- Baldwin, Amelia, Carol E. Brown, and Brad S. Trinkle. 2006. Opportunities for Artificial Intelligence Development in the Accounting Domain: The Case for Auditing. Intelligent Systems in Accounting, Finance and Management 14: 77–86. [Google Scholar] [CrossRef]

- Balios, Dimitris, Panagiotis Kotsilaras, Nikolaos Eriotis, and Dimitris Vasiliou. 2020. Big data, data analytics and external auditing. Journal of Modern Accounting and Auditing 16: 211–19. [Google Scholar]

- Chassignol, Maud, Aleksandr Khoroshavin, Alexandra Klimova, and Anna Bilyatdinova. 2018. Artificial Intelligence trends in education: A narrative overview. Procedia Computer Science 136: 16–24. [Google Scholar] [CrossRef]

- Chukwuani, Victoria Nnenna, and Modeska Amaka Egiyi. 2020. Automation of Accounting Processes: Impact of Artificial Intelligence. International Journal of Research and Innovation in Social Science (IJRISS) 4: 444–49. Available online: https://www.rsisinternational.org/journals/ijriss/Digital-Library/volume-4-issue-8/444-449.pdf (accessed on 12 May 2022).

- Chukwudi, O. Longinus, Silas C. Echefu, Uche Boniface, and Nnenna V. Chukwuani. 2018. Effect of Artificial Intelligence on the Performance of Accounting Operations among Accounting Firms in South East Nigeria. Asian Journal of Economics, Business and Accounting 7: 1–11. [Google Scholar] [CrossRef]

- Davis, Fred D. 1989. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly 13: 319–40. [Google Scholar] [CrossRef] [Green Version]

- Demski, Joel S. 2007. Is accounting an academic discipline? Accounting Horizons 21: 153. [Google Scholar] [CrossRef] [Green Version]

- Deniz, Appelbaum, and Jeffery Sorenson. 2022. Artificial Intelligence and the Auditor: Are You Ready? Available online: https://idea.caseware.com/ai-auditor-are-you-ready/ (accessed on 3 June 2022).

- Gentner, Daniel, Birgit Stelzer, Bujar Ramosaj, and Leo Brecht. 2018. Strategic foresight of future b2b customer opportunities through machine learning. Technology Innovation Management Review 8: 5–17. [Google Scholar] [CrossRef]

- Greenman, Cindy. 2017. Exploring the impact of Artificial Intelligence on the accounting profession. Journal of Research in Business, Economics and Management 8: 1451. [Google Scholar]

- Hassan, Rizvan Ahmed. 2022. Artificial Intelligence (AI) in accounting & auditing: A Literature review. Open Journal of Business and Management 10: 440–65. [Google Scholar]

- Hemin, Ali Qadir. 2017. Will Artificial Intelligence Brighten or Threaten the Future Science, Ethics, and Society. Available online: https://www.researchgate.net/publication/323535179_Will_Artificial_Intelligence_Brighten_or (accessed on 6 June 2022).

- ICAEW. 2016. Artificial Intelligence and the Future of Accountancy. Available online: https://www.icaew.com/-/media/corporate/files/technical/information-technology/thoughtleadership/artificial-intelligence-report.ashx (accessed on 6 June 2022).

- Jariwala, Harsha Vijaykumar. 2015. Analysis of financial literacy level of retail individual investors of Gujarat State and its effect on investment decision. Journal of Business & Finance Librarianship 20: 133–58. [Google Scholar]

- Kaplan, Andreas, and Michael Haenlein. 2019. Siri, Siri, in my hand: Who’s the fairest in the land? On the interpretations, illustrations, and implications of Artificial Intelligence. Business Horizons 62: 15–25. [Google Scholar] [CrossRef]

- Khamis, Abdullah. 2021. The Impact of Artificial Intelligence in Auditing and Accounting Decision Making. Available online: https://www.researchgate.net/publication/352166419_The_Impact_of_Artificial_Intelligence_inAuditing_and_Accounting_Decision_Making (accessed on 23 May 2022).

- Kokina, Julia, and Thomas H. Davenport. 2017. The Emergence of Artificial Intelligence: How Automation Is Changing Auditing. Journal of Emerging Technologies in Accounting 14: 115–22. [Google Scholar] [CrossRef]

- Lee, Cheah Saw, and Farzana P. Tajudeen. 2020. Usage and Impact of Artificial Intelligence on Accounting: 213 Evidence from Malaysian Organisations. Asian Journal of Business and Accounting 13: 213–40. [Google Scholar] [CrossRef]

- Lin, Paul, and Tom Hazelbaker. 2019. Meeting the challenge of Artificial Intelligence. CPA Journal 89: 48–52. Available online: https://www.cpajournal.com/2019/07/03/meeting-the-challenge-of-artificial-intelligence/ (accessed on 27 May 2022).

- Lina, Dagiliene, and Lina Kloviene. 2019. Motivation to use Big Data and Big Data Analytics in external auditing. Managerial Auditing Journal 34: 750–82. [Google Scholar]

- Luo, Yuchuan, Ming Xu, Kai Huang, Dongsheng Wang, and Shaojing Fu. 2018. Efficient auditing for shared data in the cloud with secure user revocation and computations outsourcing. Computers & Security 73: 492–506. [Google Scholar]

- Moffitt, Kevin C., Andrea M. Rozario, and Miklos A. Vasarhelyi. 2018. Robotic process automation for auditing. Journal of Emerging Technologies in Accounting 15: 1–10. [Google Scholar] [CrossRef] [Green Version]

- Nickerson, Mark A. 2019. AI: New Risks and Rewards. Available online: https://sfmagazine.com/post-entry/april2019-ai-new-risks-and-rewards (accessed on 11 May 2022).

- Nwakaego, Duru Anastesia, and Okpe Innocent Ikechukwu. 2015. The effect of accounts payable ratio on the financial performance of food and beverages manufacturing companies in Nigeria. Journal of Research in Business and Management 3: 15–21. [Google Scholar]

- Omoteso, Kamil. 2012. The application of Artificial Intelligence in Auditing: Looking back to the future. Expert Systems with Applications 39: 8490–95. [Google Scholar] [CrossRef]

- Puthukulam, Gopalan, Anitha Ravikumar, Ravi Vinod Kumar Sharma, and Krishna Murthy Meesaala. 2021. Auditors’ Perception on the Impact of Artificial Intelligence on Professional Skepticism and Judgment in Oman. Universal Journal of Accounting and Finance 9: 1184–90. [Google Scholar] [CrossRef]

- Raji, Inioluwa, and Joy Buolamwini. 2019. Actionable Auditing: Investigating the Impact of Publicly Naming Biased Performance Results of Commercial AI Products. Paper presented at the 2019 AAAI/ACM Conference on Artificial Intelligence, Ethics, and Society, Honolulu, HI, USA, January 27–28. [Google Scholar]

- Solaimani, Reem, Fatima Rashed, Shahad Mohammed, and Walaa Wahid ElKelish. 2020. The impact of artificial intelligence on corporate control. Corporate Ownership and Control 17: 171–78. [Google Scholar] [CrossRef]

- Salem, Mohamed S. M. 2012. An overview of research on auditor’s responsibility to detect fraud on financial statements. Journal of Global Business Management 8: 218. [Google Scholar]

- Schulenberg, Jennifer L. 2007. Analysing police decision-making: Assessing the application of a mixed-method/mixed-model research design. International Journal of Social Research Methodology 10: 99–119. [Google Scholar] [CrossRef]

- The Organization for Economic Co-operation and Development (OECD). 2021. Available online: Oecd.org (accessed on 3 May 2022).

- Vasarhelyi, Miklos A., and Alex Kogan. 1998. Artificial Intelligence in Accounting and Auditing: Towards New Paradigms. Princeton: Markus Wiener Publishers, vol. 4. [Google Scholar]

| Item Code | Items for Perceived Contribution to Audit Quality (Adapted from Albawwat and Frijat 2021) |

|---|---|

| PC1 | Using AI systems and tools in auditing will aid my professional skepticism. |

| PC2 | Using AI systems and tools in auditing will automate routine audit processes and procedures, allowing more time to focus on areas of significant judgment. |

| PC3 | Using AI systems and tools in auditing will deepen my understanding of the entity and its processes. |

| PC4 | Using AI systems and tools in auditing will facilitate robust risk assessment through the analysis of entire populations. |

| PC5 | Using AI systems and tools in auditing will enable ongoing risk assessment throughout the audit process. |

| PC6 | Using AI systems and tools in auditing will facilitate the focus of audit testing on the areas of the highest risk through the stratification of large populations. |

| PC7 | Using AI systems and tools in auditing will enable me to perform tests on large or complex datasets where a manual approach would not be feasible. |

| PC8 | Using AI systems and tools in auditing will enable the independent re-performance of complex calculations and modeling. |

| PC9 | Using AI systems and tools in auditing will improve consistency and central oversight in group audits. |

| PC10 | Using AI systems and tools in auditing will identify instances of potential fraud. |

| PC11 | Using AI systems and tools in auditing will identify unusual patterns and exceptions that might not be discernible using more traditional audit techniques. |

| Cronbach’s Alpha | Number of Items |

|---|---|

| 0.96 | 11 |

| Demographic Items | Frequency | Response Rates | |

|---|---|---|---|

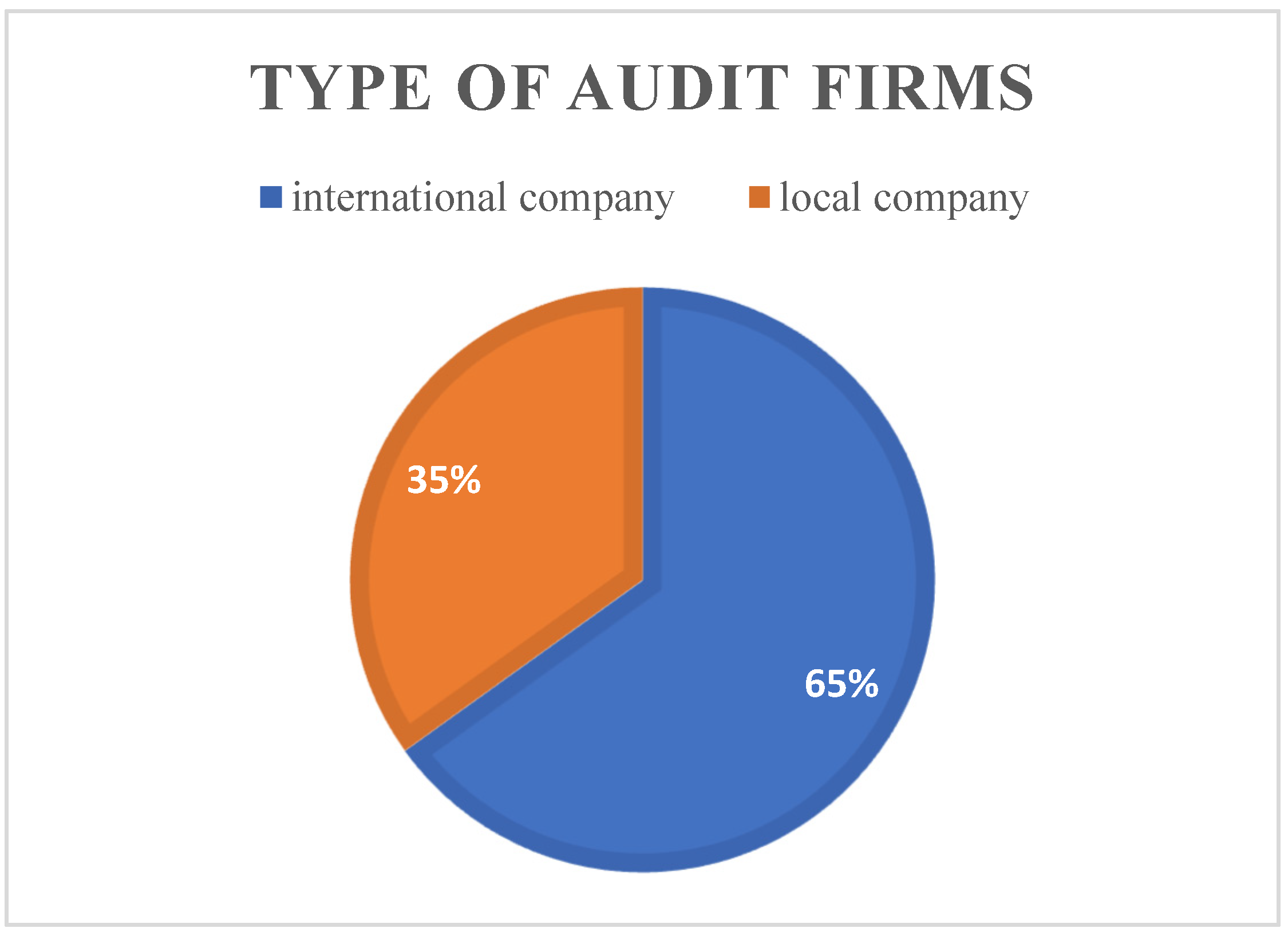

| Type of Audit Firms | Local Audit Firms | 22 | 35% |

| International Audit Firms | 41 | 65% | |

| Gender | Female | 33 | 52% |

| Male | 30 | 48% | |

| Education Degree | Bachelor’s Degree | 36 | 57% |

| Master’s Degree | 18 | 28% | |

| Ph.D. Degree | 1 | 2% | |

| Other | 8 | 13% | |

| Years of Experience | 0–2 Years | 16 | 25% |

| Above 2, less than 4 | 10 | 16% | |

| Above 4, less than 6 | 13 | 21% | |

| More than 6 years | 24 | 38% | |

| Job Position | Audit Partner | 14 | 22% |

| Audit Manager | 14 | 22% | |

| Senior Auditor | 13 | 21% | |

| Other | 22 | 35% | |

| Perceived Contributions | ||

|---|---|---|

| (1) Local Audit Firms | (2) Int. Audit Firms | |

| Valid | 22 | 41 |

| Mean | 3.975 | 3.927 |

| Std. Deviation | 0.736 | 0.768 |

| PC4 | PC10 | |||

|---|---|---|---|---|

| (1) Local Audit Firms | (2) Int. Audit Firms | (1) Local Audit Firms | (2) Int. Audit Firms | |

| Valid | 22 | 41 | 22 | 41 |

| Mean | 4.091 | 3.878 | 4.091 | 4.000 |

| Std. Deviation | 0.921 | 0.900 | 0.921 | 0.922 |

| Independent Samples t-Test | |||||||

|---|---|---|---|---|---|---|---|

| 95% CI for Mean Difference | |||||||

| t | df | p | Mean Difference | SE Difference | Lower | Upper | |

| PEOU | 0.242 | 61 | 0.810 | 0.048 | 0.200 | −0.352 | 0.448 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Noordin, N.A.; Hussainey, K.; Hayek, A.F. The Use of Artificial Intelligence and Audit Quality: An Analysis from the Perspectives of External Auditors in the UAE. J. Risk Financial Manag. 2022, 15, 339. https://doi.org/10.3390/jrfm15080339

Noordin NA, Hussainey K, Hayek AF. The Use of Artificial Intelligence and Audit Quality: An Analysis from the Perspectives of External Auditors in the UAE. Journal of Risk and Financial Management. 2022; 15(8):339. https://doi.org/10.3390/jrfm15080339

Chicago/Turabian StyleNoordin, Nora Azima, Khaled Hussainey, and Ahmad Faisal Hayek. 2022. "The Use of Artificial Intelligence and Audit Quality: An Analysis from the Perspectives of External Auditors in the UAE" Journal of Risk and Financial Management 15, no. 8: 339. https://doi.org/10.3390/jrfm15080339