Developing Novel Technique for Investigating Guidelines and Frameworks: A Text Mining Comparison between International and Japanese Green Bonds

Abstract

:1. Introduction

2. Related Studies

3. Materials and Methods

3.1. Selection of Models

3.2. Data Preparation

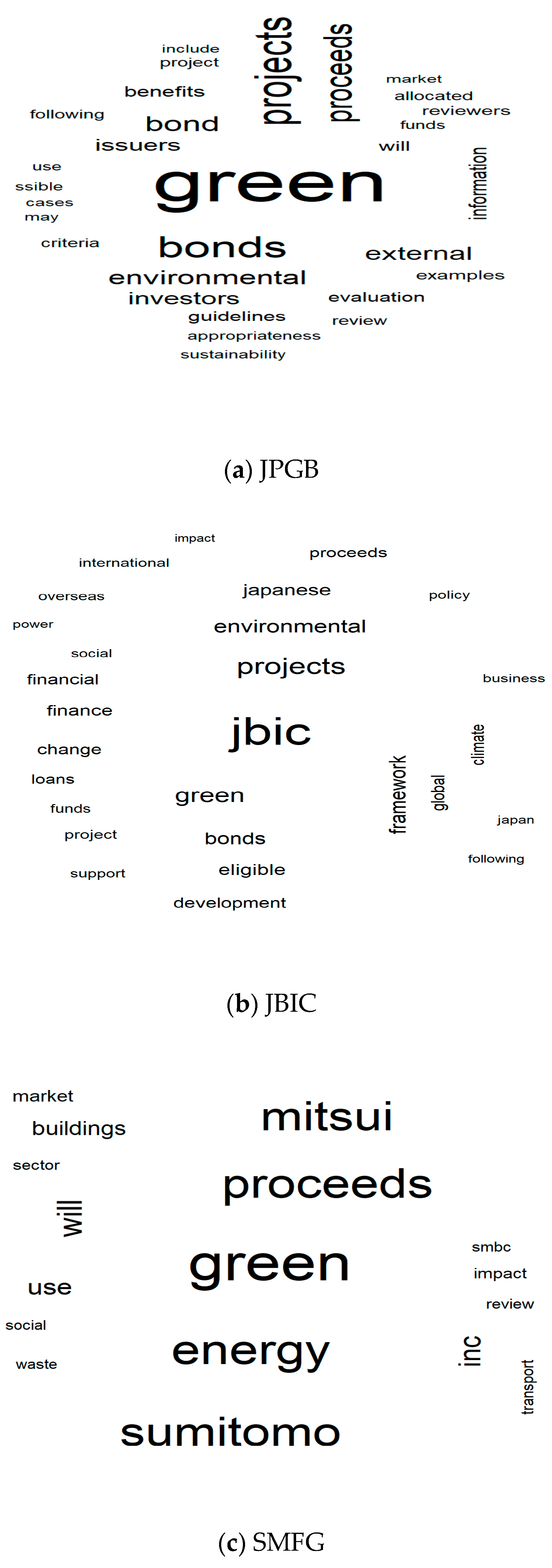

3.3. Word Cloud

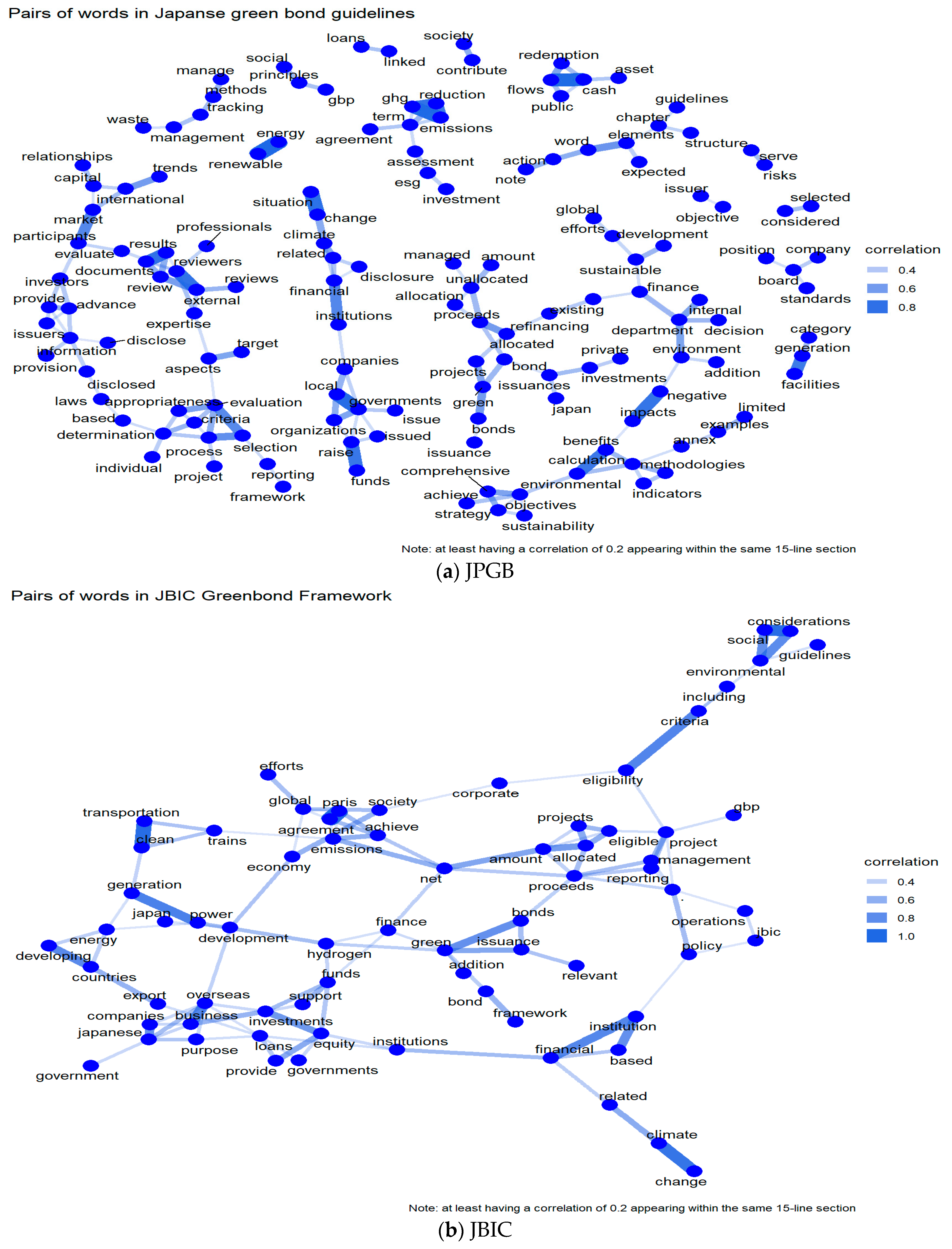

3.4. Network Matrix

4. Results

5. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

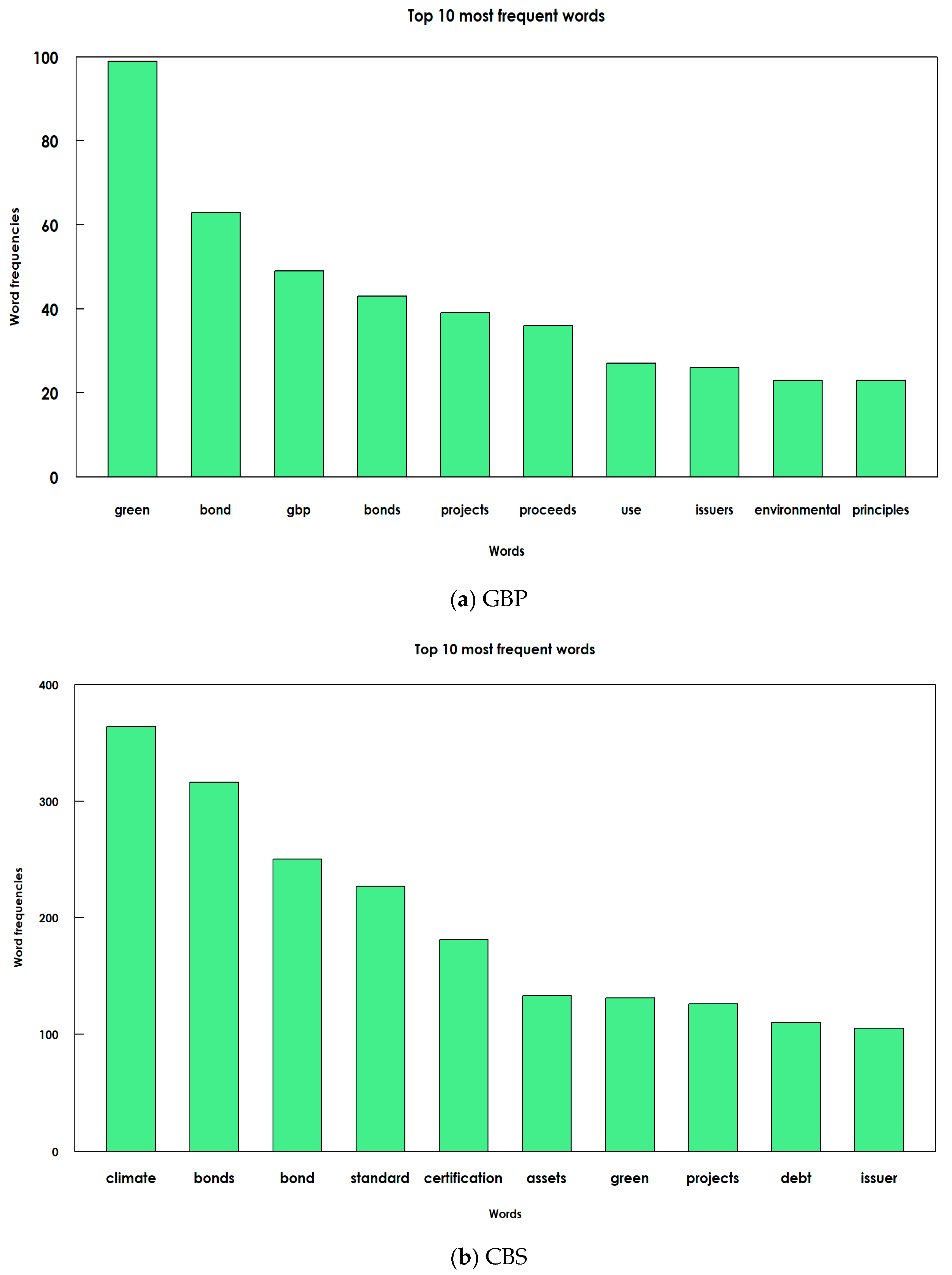

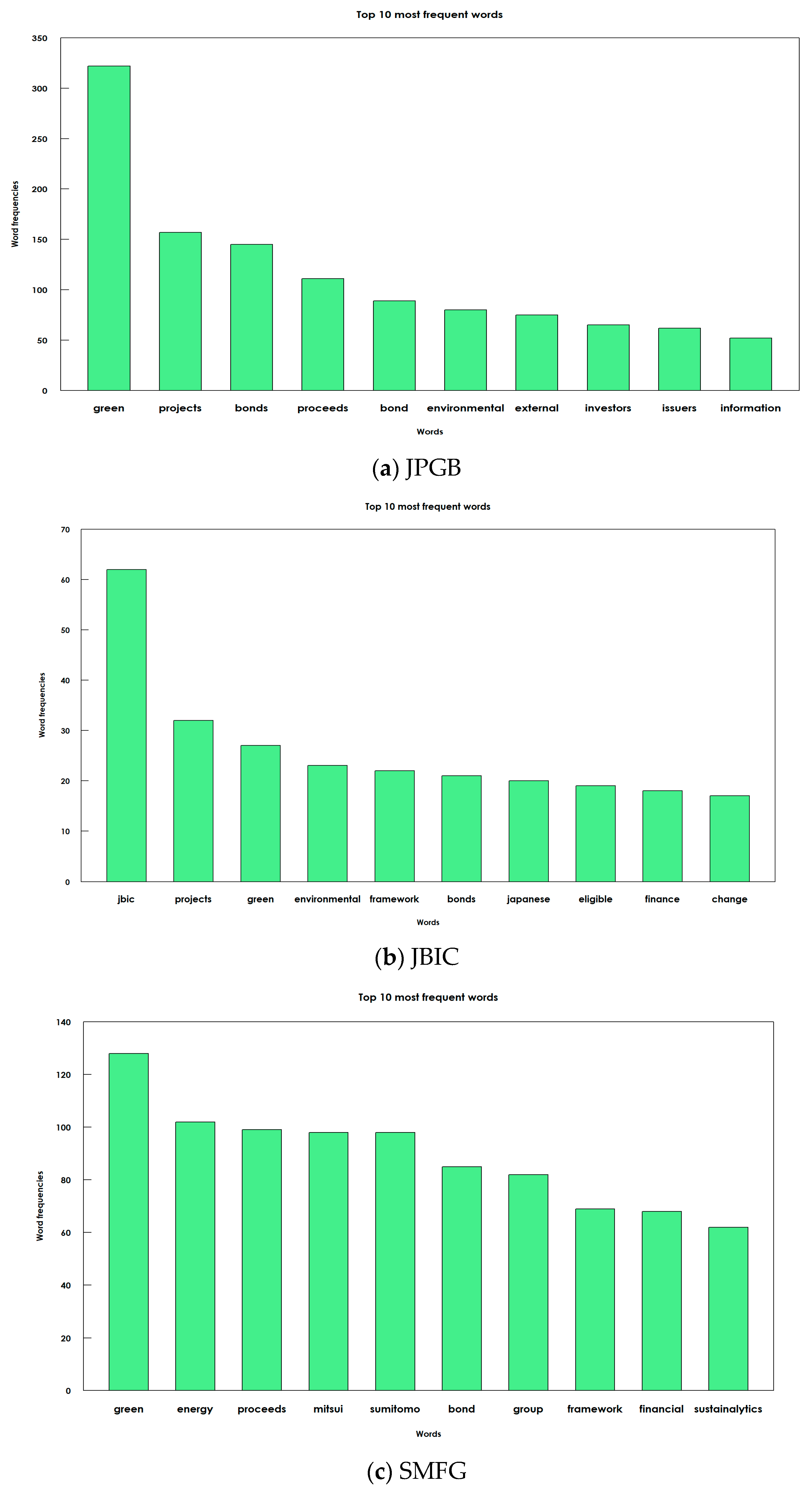

| International | National | Local Companies | ||

|---|---|---|---|---|

| GBP File | CBS File | JPGB File | JBIC File | SMFG File |

| green | climate | green | Jbic | green |

| bond | bonds | projects | projects | energy |

| gbp | bond | bonds | Green | proceeds |

| bonds | standard | proceeds | environmental | mitsui |

| projects | certification | bond | framework | sumitomo |

| proceeds | assets | environmental | Bonds | bond |

| use | green | external | Japanese | group |

| issuers | projects | investors | eligible | framework |

| environmental | debt | issuers | finance | financial |

| principles | issuer | information | change | sustainalytics |

References

- Al-Hasan, Abrar, Dobin Yim, and Henry C. Lucas. 2018. A Tale of Two Movements: Egypt during the Arab Spring and Occupy Wall Street. IEEE Transactions on Engineering Management 66: 84–97. [Google Scholar] [CrossRef]

- Anandarajan, Murugan, Chelsey Hill, and Thomas Nolan. 2019. Text Preprocessing. In Practical Text Analytics: Maximizing the Value of Text Data. Edited by Murugan Anandarajan, Chelsey Hill and Thomas Nolan. Advances in Analytics and Data Science. Cham: Springer International Publishing, pp. 45–59. [Google Scholar] [CrossRef]

- Anh, Tu Chuc, Tapan Sarker, and Ehsan Rasoulinezhad. 2020. Factors Influencing the Green Bond Market Expansion: Evidence from a Multi-Dimensional Analysis. Journal of Risk and Financial Management 13: 126. [Google Scholar] [CrossRef]

- Baker, Kent H., Satish Kumar, and Debidutta Pattnaik. 2021. Twenty-five years of the Journal of Corporate Finance: A scientometric analysis. Journal of Corporate Finance 66: 101572. [Google Scholar] [CrossRef]

- Climate Bonds Initiative. 2019. Climate Bonds Standard Version 3.0. Available online: https://www.climatebonds.net/files/files/climate-bonds-standard-v3-20191210.pdf (accessed on 15 May 2022).

- Climate Bonds Initiative. 2021. Record $269. 5bn green issuance for 2020: Late Surge Sees Pandemic Year Pip 2019 Total by $3bn. Available online: https://www.climatebonds.net/2021/01/record-2695bn-green-issuance-2020-late-surge-sees-pandemic-year-pip-2019-total-3bn? (accessed on 15 June 2022).

- Climate Bond Initiative. 2022a. Certification under the Climate Bonds Standard. Available online: https://www.climatebonds.net/certification (accessed on 15 June 2022).

- Climate Bond Initiative. 2022b. Japan GB Market Review 2020: Latest Collaboration with Green Bond Promotion Platform. Available online: https://www.climatebonds.net/2021/03/japan-gb-market-review-2020-latest-collaboration-green-bond-promotion-platform (accessed on 3 August 2022).

- Climate Bond Initiative. 2022c. Green Bond Principles & Climate Bonds Standard. Available online: https://www.climatebonds.net/market/best-practice-guidelines (accessed on 15 June 2022).

- Climate Bonds Initiative. 2022d. $500bn Green Issuance 2021: Social and Sustainable Acceleration: Annual Green $1tn in Sight: Market Expansion Forecasts for 2022 and 2025. Available online: https://www.climatebonds.net/2022/01/500bn-green-issuance-2021-social-and-sustainable-acceleration-annual-green-1tn-sight-market (accessed on 15 June 2022).

- Chowdhury, S. M. Mazharul Hoque, Priyanka Ghosh, Sheikh Abujar, Most. Arina Afrin, and Syed Akhter Hossain. 2018. Sentiment Analysis of Tweet Data: The Study of Sentimental State of Human from Tweet Text. In Emerging Technologies in Data Mining and Information Security. Edited by A. Abraham, P. Dutta, J. Mandal, A. Bhattacharya and S. Dutta. Advances in Intelligent Systems and Computing. Singapore: Springer, p. 813. [Google Scholar] [CrossRef]

- Corporation’s Green Bond Framework. 2021. Available online: https://www.smfg.co.jp/english/sustainability/materiality/environment/procurement/pdf/GREEN_BOND.pdf (accessed on 5 July 2022).

- Cortellini, Giuseppe, and Ida Claudia Panetta. 2021. Green Bond: A Systematic Literature Review for Future Research Agendas. Journal of Risk and Financial Management 14: 589. [Google Scholar] [CrossRef]

- Deschryver, Pauline, and Frederic de Mariz. 2020. What Future for the Green Bond Market? How Can Policymakers, Companies, and Investors Unlock the Potential of the Green Bond Market? Journal of Risk and Financial Management 13: 61. [Google Scholar] [CrossRef]

- Donthu, Naveen, Satish Kumar, Debmalya Mukherjee, Nitesh Pandey, and Weng Marc Lim. 2021. How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research 133: 285–96. [Google Scholar] [CrossRef]

- Ehlers, Torsten, and Frank Packer. 2017. Green Bond Finance and Certification. BIS Quarterly Review September 2017. Available online: https://www.bis.org/publ/qtrpdf/r_qt1709h.htm (accessed on 3 August 2022).

- Fan, Weiguo, Linda Wallace, Stephanie Rich, and Zhongju Zhang. 2006. Tapping the power of text mining. Communications of the ACM 49: 76–82. [Google Scholar] [CrossRef]

- Green Finance Portal. 2022. Major Green Bond Issuance Cases in Japan. Available online: http://greenfinanceportal.env.go.jp/en/bond/issuance_data/issuance_list.html (accessed on 15 June 2022).

- Gupta, Aaryan, Vinya Dengre, Hamza Abubakar Kheruwala, and Shah Manan. 2020. Comprehensive review of text-mining applications in finance. Financial Innovation 6: 39. [Google Scholar] [CrossRef]

- Hale, Roger. 2005. Text mining: Getting more value from literature resources. Drug Discovery Today 10: 377–379. [Google Scholar] [CrossRef]

- He, Wu. 2013. Examining students’ online interaction in a live video streaming environment using data mining and text mining. Computers in Human Behavior 29: 90–102. [Google Scholar] [CrossRef]

- Holtz, Yan. 2021. The Wordcloud2 Library. Available online: https://www.r-graph-gallery.com/196-the-wordcloud2-library.html (accessed on 6 June 2022).

- Hossain, Arafat, Md. Karimuzzaman, Md. Moyazzem Hossain, and Azizur Rahman. 2021. Text Mining and Sentiment Analysis of Newspaper Headlines. Information 12: 414. [Google Scholar] [CrossRef]

- International Capital Market Association (ICMA). 2021. The Green Bond Principles (GBP). Available online: https://www.icmagroup.org/sustainable-finance/the-principles-guidelines-and-handbooks/green-bond-principles-gbp/ (accessed on 15 June 2022).

- International Finance Corporation (IFC). 2016. Mobilizing Private Climate Finance–Green Bonds and Beyond. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/30351/110881-BRI-EMCompass-Note-25-Green-Bonds-FINAL-12-5-PUBLIC.pdf (accessed on 8 May 2022).

- Japan Bank for International Cooperation (JBIC). 2021. Japan Bank for International Cooperation (JBIC) Green Bond Framework. Available online: https://www.jbic.go.jp/ja/ir/contents/JBIC_greenbond_framework_en.pdf (accessed on 22 August 2022).

- Karanikas, Haralampos, Christos Tjortjis, and Babis Theodoulidis. 2000. An approach to text mining using information extraction. Paper presentend at Workshop of Knowledge Management: Theory and Applications, Lyon, France, September 13–16. [Google Scholar]

- Kojaku, Sadamori, and Naoki Masuda. 2019. Constructing networks by filtering correlation matrices: A null model approach. Procedings of the Royal Society A 475. [Google Scholar] [CrossRef]

- Kumar, Satish, Vinodh Madhaven, and Riya Sureka. 2020. The Journal of Emerging Market Finance: A Bibliometric Overview (2002–2019). Journal of Emerging Market Finance 19: 326–352. [Google Scholar] [CrossRef]

- Kumar, Sunil, Kar Arpan Kumar, and P. Vigneswara Ilavarasan. 2021. Applications of text mining in services management: A systematic literature review. International Journal of Information Management Data Insights 1: 100008. [Google Scholar] [CrossRef]

- Larcker, David F., and Edward M. Watts. 2020. Where’s the greenium. Journal of Accounting and Economics 69: 101312. [Google Scholar] [CrossRef]

- Liao, Shu-Hsien, Pei-Hui Chu, and Pei-Yuan Hsiao. 2012. Data mining techniques and applications—A decade review from 2000 to 2011. Expert Systems with Applications 39: 11303–11311. [Google Scholar] [CrossRef]

- Ministry of the Environment Government of Japan (MOE). 2020. Green Bond Guidelines 2020. Available online: https://www.env.go.jp/policy/guidelines_set_version_with%20cover.pdf. (accessed on 15 June 2022).

- Ministry of the Environment Government of Japan (MOE). 2021. Green Bond ni Kansuru Kankyoushyo no Torikumi ni Tuite (Initiatives Taken by the MOE on Green Bond). Available online: https://www.fsa.go.jp/singi/social_bond/siryou/20210310/03.pdf (accessed on 15 June 2022). (In Japanese)

- Ministry of the Environment, Japan (MOEJ). 2017. Green Bond Guidelines, 2017. Available online: https://www.env.go.jp/en/policy/economy/gb/guidelines.html (accessed on 3 August 2022).

- Morningstar Sustainalytics. 2021. Morningstar Sustainalytics Recognized as the Largest Verifier for Certified Climate Bonds by Climate Bonds Initiative for a Fifth Consecutive Year. Available online: https://www.sustainalytics.com/esg-news/news-details/2022/06/06/morningstar-sustainalytics-recognized-as-the-largest-verifier-for-certified-climate-bonds-by-climate-bonds-initiative-for-a-fifth-consecutive-year? (accessed on 15 June 2022).

- Nanayakkara, Madurika, and Sisira Colombage. 2019. Do investors in Green Bond market pay a premium? Global evidence. Applied Economics 51: 4425–4437. [Google Scholar] [CrossRef]

- Newman, Mark E. J. 2003. The structure and function of complex networks. SIAM Reveiw 45: 167–256. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, Anh Huu, Thinh Gia Hoang, Duy Thanh Nguyen, Loan Quynh Thi Nguyen, and Duong Thuy Doan. 2022. The Development of Green Bond in Developing Countries: Insights from Southeast Asia Market Participants. The European Journal of Development Research 21: 1–23. [Google Scholar] [CrossRef]

- Onnela, Jukka-Pekka, Kimmo Kaski, and Janos Kertész. 2004. Clustering and information in correlation based financial networks. European Physical Journal B 38: 353–362. [Google Scholar] [CrossRef]

- Padhy, Neelamadhab, Dr. Pragnyaban Mishra, and Rasmita Panigrahi. 2012. The survey of data mining applications and feature scope. International Journal of Computer Science, Engineering and Information Technology 2: 43–58. [Google Scholar] [CrossRef]

- Partridge, Candace, and Francesca Romana Medda. 2020. The evolution of pricing performance of green municipal bonds. Journal of Sustainable Finance & Investment 10: 44–64. [Google Scholar] [CrossRef]

- Rao, Ramana. 2003. From unstructured data to actionable intelligence. IT Professional 5: 29–35. [Google Scholar] [CrossRef]

- Shimizu, Noriko, Maiko Morishita, Naoki Mori, and Abdessalem Rabhi. 2021. Current Status, Issues and Recommendations on Impact Reporting: A Case Study of Green Bonds for Renewable Energy Sector in Japan. Institute for Global Environmental Strategies, 2021. Available online: https://www.iges.or.jp/en/pub/gbimpactreporting/en (accessed on 22 June 2022).

- Sustainalytics. 2021. Second-Party Opinion Download. Sumitomo Mitsui Financial Group, Inc./Sumitomo Mitsui Banking. Available online: https://www.sustainalytics.com/corporate-solutions/sustainable-finance-and-lending/published-projects/project/sumitomo-mitsui-financial-group-inc-sumitomo-mitsui-banking-corporation/sumitomo-mitsui-financial-group-inc-sumitomo-mitsui-banking-corporation-(2021)/sumitomo-mitsui-financial-group-inc-sumitomo-mitsui-banking-corporation-(2021) (accessed on 22 June 2022).

- Takeuchi, Hironori, Shiho Ogino, Hideo Watanabe, and Shirata Yoshiko. 2008. Context-based Text Mining for Insights in Long Documents. In International Conference on Practical Aspects of Knowledge Management (PAKM2008). Berlin and Heidelberg: Springer, pp. 123–34. [Google Scholar]

- Text Mining. 2020. Available online: https://en.wikipedia.org/wiki/Text_mining (accessed on 6 June 2022).

- Wang, Zhouhao, Enda Liu, Hiroki Sakaji, Tomoki Ito, Kiyoshi Izumi, Kota Tsubouchi, and Tatsuo Yamashita. 2018. Estimation of Cross-Lingual News Similarities Using Text-Mining Methods. Journal of Risk and Financial Management 11: 8. [Google Scholar] [CrossRef]

- Zanin, Massimiliano, Pedro Sousa, David Papo, Bajo Ricardo, García-Prieto Juan, Francisco del Pozo, Ernestina Menasalvas, and Boccaletti Stefano. 2012. Optimizing Functional Network Representation of Multivariate Time Series. Scientific Reports 2: 630. [Google Scholar] [CrossRef]

- Zerbib, Olivier David. 2019. The effect of pro-environmental preferences on bond prices: Evidence from green bonds. Journal of Banking & Finance 98: 39–60. [Google Scholar] [CrossRef]

- Zhang, Hao. 2020. Regulating green bond in China: Definition divergence and implications for policy making. Journal of Sustainable Finance & Investment 10: 141–56. [Google Scholar] [CrossRef]

| Contains X2 | Does Not Contain X2 | |

|---|---|---|

| Contains word X1 | A | B |

| Does not contain word X1 | C | D |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Aruga, K.; Islam, M.M.; Zenno, Y.; Jannat, A. Developing Novel Technique for Investigating Guidelines and Frameworks: A Text Mining Comparison between International and Japanese Green Bonds. J. Risk Financial Manag. 2022, 15, 382. https://doi.org/10.3390/jrfm15090382

Aruga K, Islam MM, Zenno Y, Jannat A. Developing Novel Technique for Investigating Guidelines and Frameworks: A Text Mining Comparison between International and Japanese Green Bonds. Journal of Risk and Financial Management. 2022; 15(9):382. https://doi.org/10.3390/jrfm15090382

Chicago/Turabian StyleAruga, Kentaka, Md. Monirul Islam, Yoshihiro Zenno, and Arifa Jannat. 2022. "Developing Novel Technique for Investigating Guidelines and Frameworks: A Text Mining Comparison between International and Japanese Green Bonds" Journal of Risk and Financial Management 15, no. 9: 382. https://doi.org/10.3390/jrfm15090382