Fossil Fuel-Based versus Electric Vehicles: A Volatility Spillover Perspective Regarding the Environment

Abstract

:1. Introduction

2. Literature Review

2.1. Theoretical Background

2.2. Copper Prices and ESG

2.3. Crude Oil Prices and ESG

3. Data and Methodology

3.1. Data Collection

3.2. Methodology

3.3. M-GARCH Models

3.4. Bivariate BEKK GARCH (BG) Model

- (a)

- The Ht shows the variance of the error term in the BG model.is specified as:

- (b)

- Where C0 is the N × N matrix (upper triangular), and E and F are the N × N parameter matrix having elements of shock effects and price effects, respectively. is the residual vector at time t. The diagonal terms of the Ht matrix are conditional variance represented by hii,t. Here, i = j showing the same markets. However, off-diagonal terms are represented by hij,t Similarly, the diagonal elements in matrix E show the connection among shock effects in the same market (eii), and the off-diagonal elements show cross-market shock effects (eij). Similarly, diagonal elements in matrix F show the VSE connection in the same market (fii) and off-diagonal elements show cross-market VSE (fij) (Campbell and Hentschel 1992). The bivariate BEKK (1,1) model is implemented using the following equation:eij and fij are the elements of the parameter matrixes E and F, respectively. These elements indicate the shock spillover effect (short-term effects) and price volatility spillover (long-term effects), eij represents shock spillover effects, and fij represents price spillover effects. eij and fij observe volatility effects in the identical market if i = j; else, they show volatility effects transferring from market i to j (cross-market). ‘i’ is a representation of the market as it observes the relationship between two markets; hence, it has values of 1 and 2. The conditional variance and covariance matrix Ht has the elements These elements are derived by Equation (4).

3.5. DCC-GARCH (DG) Model

4. Empirical Results

4.1. Descriptive Statistics and Correlation

4.2. BEKK GARCH Outcomes

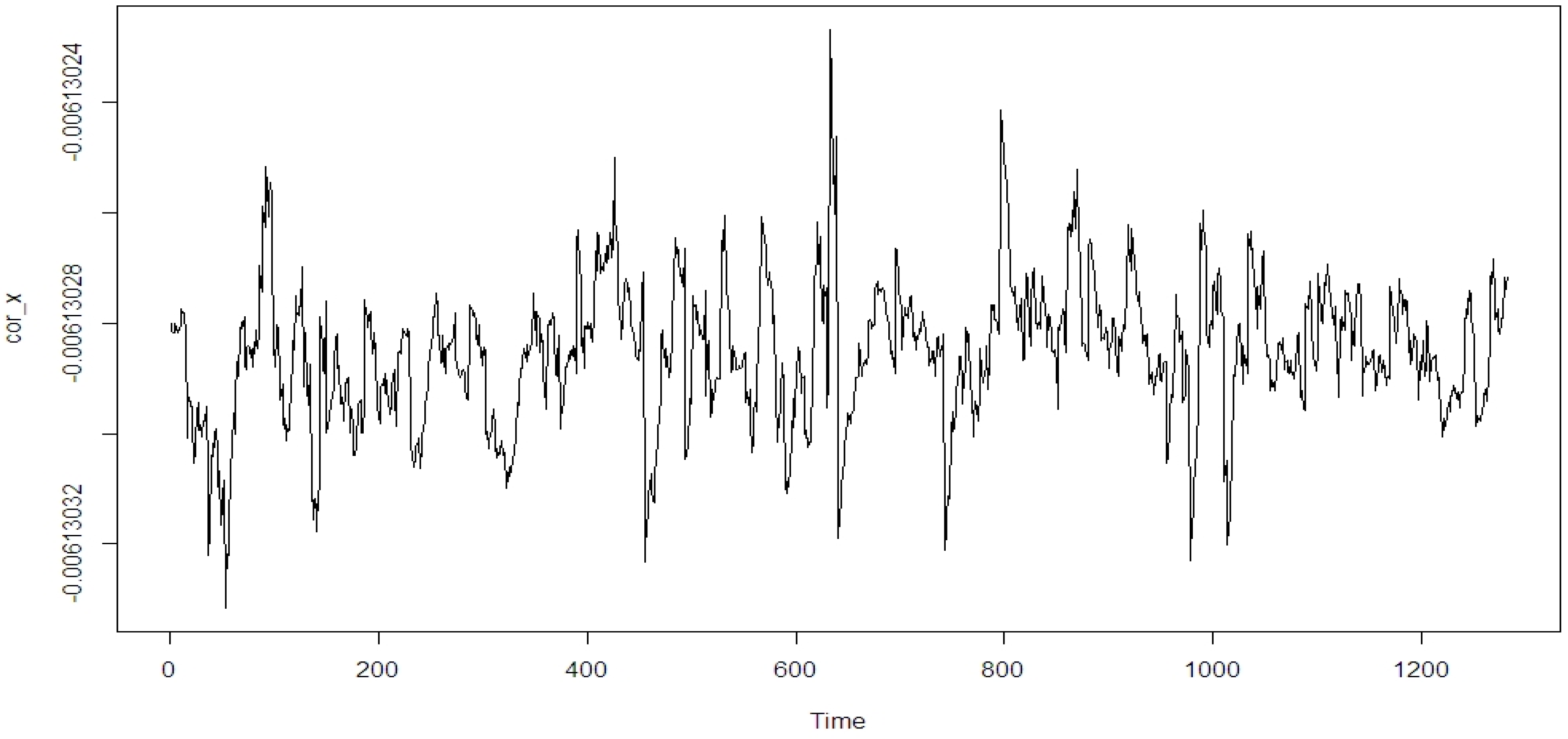

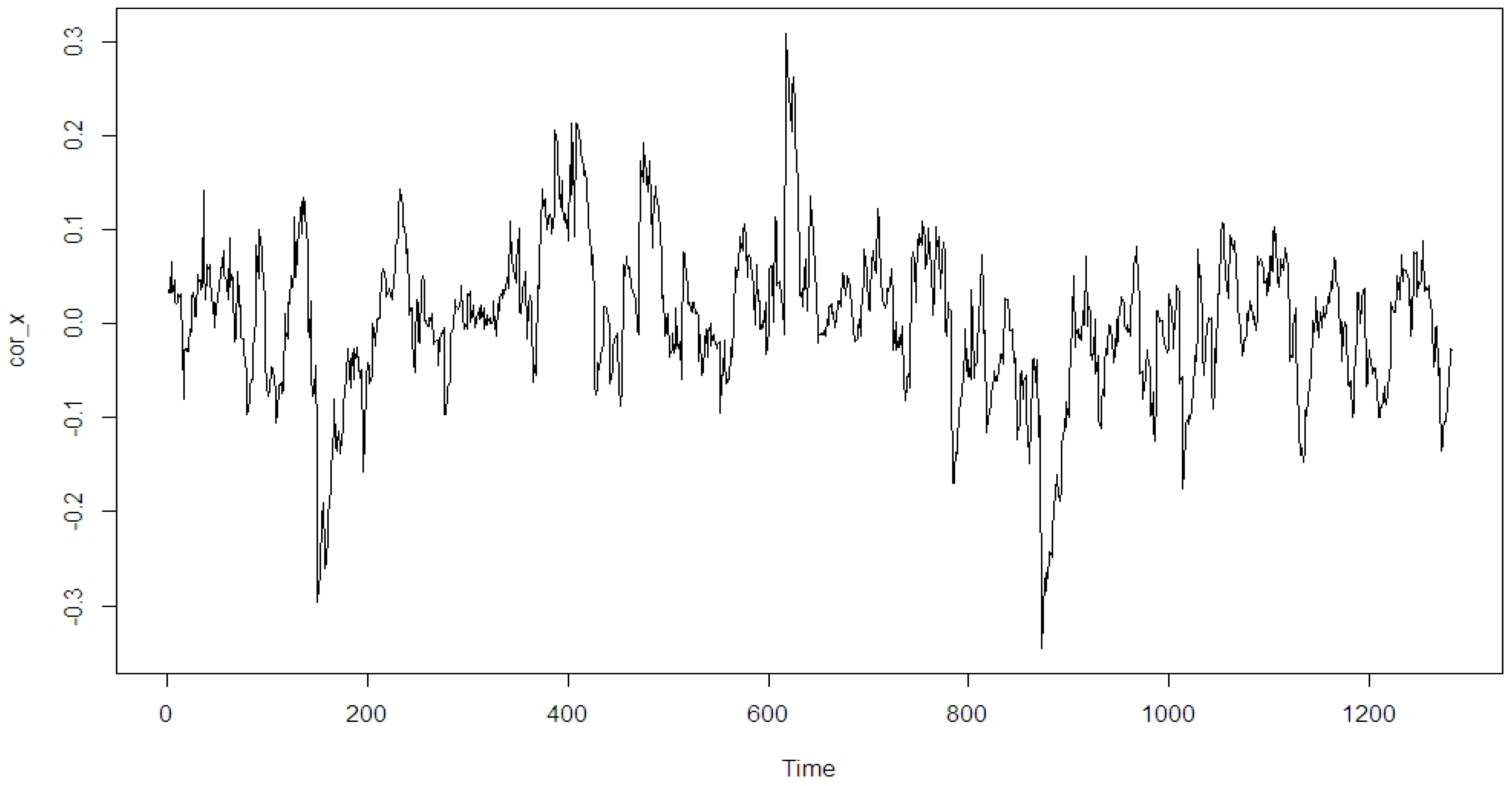

4.3. DCC-GARCH Outcomes

4.4. Results Robustness

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abas, Naeem, A. Kalair, and Nasrullah Khan. 2015. Review of fossil fuels and future energy technologies. Futures 69: 31–49. [Google Scholar] [CrossRef]

- Ahluwalia, Rohini, H. Rao Unnava, and Robert E. Burnkrant. 2001. The moderating role of commitment on the spillover effect of marketing communications. Journal of Marketing Research 38: 458–70. [Google Scholar] [CrossRef]

- Astbury, Graham. 2008. A review of the properties and hazards of some alternative fuels. Process Safety and Environmental Protection 86: 397–414. [Google Scholar] [CrossRef]

- Baker, Jack W., Matthias Schubert, and Michael H. Faber. 2008. On the assessment of robustness. Structural Safety 30: 253–67. [Google Scholar] [CrossRef]

- Baumöhl, Eduard, Evžen Kočenda, Štefan Lyócsa, and Tomáš Výrost. 2018. Networks of volatility spillovers among stock markets. Physica A: Statistical Mechanics and Its Applications 490: 1555–74. [Google Scholar] [CrossRef]

- Bauwens, Luc, Sébastien Laurent, and Jeroen V. K. Rombouts. 2006. Multivariate GARCH models: A survey. Journal of Applied Econometrics 21: 79–109. [Google Scholar] [CrossRef]

- Bekaert, Geert, Campbell R. Harvey, and Angela Ng. 2005. Market Integration and Contagion. Journal of Business 78: 1–35. [Google Scholar]

- Bollerslev, Tim. 1990. Modelling the coherence in short-run nominal exchange rates: A multivariate generalized ARCH model. The Review of Economics and Statistics 72: 498–505. [Google Scholar] [CrossRef]

- Bonilla, David, Héctor Arias Soberon, and Oscar Ugarteche Galarza. 2022. Electric vehicle deployment & fossil fuel tax revenue in Mexico to 2050. Energy Policy 171: 113276. [Google Scholar]

- Bruhn, Nádia Campos Pereira, Cristina Lelis Leal Calegário, Francisval de Melo Carvalho, Renato Silvério Campos, and Antônio Carlos dos Santos. 2017. Mergers and acquisitions in Brazilian industry: A study of spillover effects. International Journal of Productivity and Performance Management 66: 51–77. [Google Scholar] [CrossRef]

- Cagli, Efe C. Caglar, Pinar Evrim Mandaci, and Dilvin Taşkın. 2022. Environmental, social, and governance (ESG) investing and commodities: Dynamic connectedness and risk management strategies. Sustainability Accounting, Management and Policy Journal 14: 1052–74. [Google Scholar] [CrossRef]

- Campbell, John Y., and Ludger Hentschel. 1992. No news is good news: An asymmetric model of changing volatility in stock returns. Journal of Financial Economics 31: 281–318. [Google Scholar] [CrossRef]

- Clark, Woodrow W., II, and Jeremy Rifkin. 2006. A green hydrogen economy. Energy Policy 34: 2630–39. [Google Scholar] [CrossRef]

- Connolly, Robert A., and F. Albert Wang. 2003. International equity market comovements: Economic fundamentals or contagion? Pacific-Basin Finance Journal 11: 23–43. [Google Scholar] [CrossRef]

- D’Aleo, Vittorio, and Bruno S. Sergi. 2017. Does logistics influence economic growth? The European experience. Management Decision 55: 1613–28. [Google Scholar] [CrossRef]

- De Liz, Ana. 2020. ESG Agenda, Fiscal Policies, Chinese Dynamics to Set 2021 Copper Price, Analysts Say. Metal Bulletin Daily. Available online: https://search.ebscohost.com/login.aspx?direct=true&AuthType=ip,sso&db=bsx&AN=147787531&site=eds-live&custid=ns080070 (accessed on 1 January 2020).

- Dickey, David A., and Wayne A. Fuller. 1981. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica: Journal of the Econometric Society 49: 1057–72. [Google Scholar] [CrossRef]

- Engle, Robert F., and Kenneth F. Kroner. 1995. Multivariate simultaneous generalized ARCH. Econometric Theory 11: 122–50. [Google Scholar] [CrossRef]

- Engle, Robert. 2002a. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar]

- Engle, Robert. 2002b. New frontiers for ARCH models. Journal of Applied Econometrics 17: 425–46. [Google Scholar] [CrossRef]

- Fuentes, Marcelo, Moira Negrete, Sebastian Herrera-León, and Andrzej Kraslawski. 2021. Classification of indicators measuring environmental sustainability of mining and processing of copper. Minerals Engineering 170: 107033. [Google Scholar] [CrossRef]

- Ghimire, Krishna Prasad, and Shreejan Ram Shrestha. 2014. Estimating vehicular emission in Kathmandu valley, Nepal. International Journal of Environment 3: 133–46. [Google Scholar] [CrossRef]

- Gondal, Irfan Ahmad, Syed Athar Masood, and Rafiullah Khan. 2018. Green hydrogen production potential for developing a hydrogen economy in Pakistan. International Journal of Hydrogen Energy 43: 6011–39. [Google Scholar] [CrossRef]

- Güngör, Nevzat, and Yasin Şeker. 2022. The relationship between board characteristics and esg performance: Evidence from the oil, gas and coal sector. Stratejik ve Sosyal Araştırmalar Dergisi 6: 17–37. [Google Scholar] [CrossRef]

- Hatayama, Hiroki. 2022. The metals industry and the Sustainable Development Goals: The relationship explored based on SDG reporting. Resources, Conservation and Recycling 178: 106081. [Google Scholar] [CrossRef]

- Herndon, J. Marvin. 2018. Air pollution, not greenhouse gases: The principal cause of global warming. Journal of Geography, Environment and Earth Science International 17: 1–8. [Google Scholar] [CrossRef]

- Inumaru, Jun, Takeharu Hasegawa, Hiromi Shirai, Hiroyuki Nishida, Naoki Noda, and Seiichi Ohyama. 2021. Fossil fuels combustion and environmental issues. In Advances in Power Boilers. Edited by Mamoru Ozawa and Hitoshi Asano. Amsterdam: Elsevier. [Google Scholar]

- Jarque, Carlos M., and Anil K. Bera. 1987. A Test for Normality of Observations and Regression Residuals. International Statistical Review/Revue Internationale de Statistique 55: 163–72. [Google Scholar] [CrossRef]

- Jebran, Khalil, Shihua Chen, Irfan Ullah, and Sultan Sikandar Mirza. 2017. Does volatility spillover among stock markets varies from normal to turbulent periods? Evidence from emerging markets of Asia. The Journal of Finance and Data Science 3: 20–30. [Google Scholar] [CrossRef]

- Kazemizadeh, Abdul Amir, Dariush Hassanvand, Kamjoo Seyed Parviz Jalili, and Farhad Tarhami. 2021. Assessing the Effect of Overflow of Foreign Exchange Reserves of the Central Bank of Iran on the Inflation Rate Using the MGARCH-BEEK Model. Journal of Economic Research (Tahghighat-E-Eghtesadi) 56: 87–110. [Google Scholar]

- King, Mervyn A., and Sushil Wadhwani. 1990. Transmission of volatility between stock markets. The Review of Financial Studies 3: 5–33. [Google Scholar] [CrossRef]

- Knizhnikov, Alexey, Evgeny Shvarts, Lioudmila Ametistova, Alexander Pakhalov, Natalia Rozhkova, and Daria Yudaeva. 2021. Environmental transparency of Russian mining and metal companies: Evidence from independent ranking system. The Extractive Industries and Society 8: 100937. [Google Scholar] [CrossRef]

- Lanzini, Pietro, and John Thøgersen. 2014. Behavioural spillover in the environmental domain: An intervention study. Journal of Environmental Psychology 40: 381–90. [Google Scholar] [CrossRef]

- Lean, Hooi Hooi, Wei Huang, and Junjie Hong. 2014. Logistics and economic development: Experience from China. Transport Policy 32: 96–104. [Google Scholar] [CrossRef]

- Lèbre, Éléonore, John R. Owen, Deanna Kemp, and Rick K. Valenta. 2022. Complex orebodies and future global metal supply: An introduction. Resources Policy 77: 102696. [Google Scholar] [CrossRef]

- Lee, Hsiang-Tai, and Jonathan Yoder. 2007. Optimal hedging with a regime-switching time-varying correlation GARCH model. Journal of Futures Markets: Futures, Options, and Other Derivative Products 27: 495–516. [Google Scholar] [CrossRef]

- Lei, Heng, Minggao Xue, Huiling Liu, and Jing Ye. 2023. Precious metal as a safe haven for global ESG stocks: Portfolio implications for socially responsible investing. Resources Policy 80: 103170. [Google Scholar] [CrossRef]

- Liu, Tiantian, Tadahiro Nakajima, and Shigeyuki Hamori. 2021. Which Factors Will Affect the ESG Index in the USA and Europe: Stock, Crude Oil, or Gold? In ESG Investment in the Global Economy. Singapore: Springer. [Google Scholar]

- Liu, Zhiqiang. 2008. Foreign direct investment and technology spillovers: Theory and evidence. Journal of Development Economics 85: 176–93. [Google Scholar] [CrossRef]

- Malik, Yashpal, Nirupama Prakash, and Ajay Kapoor. 2018. Green Transport: A Way Forward for Environmental Sustainability. In Environment, Politics, and Society. Bingley: Emerald Publishing Limited. [Google Scholar]

- Mutter, Amelia. 2021. Embedding imaginaries-electric vehicles in Sweden’s fossil fuel free future. Futures 129: 102742. [Google Scholar] [CrossRef]

- Nilsson, Andreas, Magnus Bergquist, and Wesley P. Schultz. 2017. Spillover effects in environmental behaviors, across time and context: A review and research agenda. Environmental Education Research 23: 573–89. [Google Scholar] [CrossRef]

- Nortey, Ezekiel N. N., Delali D. Ngoh, Kwabena Doku-Amponsah, and Kenneth Ofori-Boateng. 2015. Modeling inflation rates and exchange rates in Ghana: Application of multivariate GARCH models. SpringerPlus 4: 1–10. [Google Scholar] [CrossRef]

- Paas, Tiiu, and Andres Kuusk. 2012. Contagion of financial crises: What does the empirical evidence show? Baltic Journal of Management 7: 25–48. [Google Scholar] [CrossRef]

- Philip, Abey. 2008. An analytical study of market integration hypothesis for natural rubber cultivation of Kerala. Icfai University Journal of Agricultural Economics 5: 31–40. [Google Scholar]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for a unit root in time series regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Poortinga, Wouter, Lorraine Whitmarsh, and Christine Suffolk. 2013. The introduction of a single-use carrier bag charge in Wales: Attitude change and behavioural spillover effects. Journal of Environmental Psychology 36: 240–47. [Google Scholar] [CrossRef]

- Popova, Irina, Ludmila Leonteva, Igor Danilov, Aleksandr Marusin, Alexey Marusin, and Irina Makarova. 2021. Impact of vehicular pollution on the Arctic. Transportation Research Procedia 57: 479–88. [Google Scholar] [CrossRef]

- Rangel, J. 2021. Metal and Mineral Supply Chain Management: Environmental, Social, and Governance Risk Analysis Framework Design of the Copper Supply Chain. Available online: https://www.researchgate.net/profile/Jennifer_Rangel5/publication/358243676_Metal_and_Mineral_Supply_Chain_Management_Environmental_Social_and_Governance_Risk_Analysis_framework_design_of_the_copper_supply_chain/links/61f80b07007fb50447292fa7/Metal-and-Mineral-Supply-Chain-Management-Environmental-Social-and-Governance-Risk-Analysis-framework-design-of-the-copper-supply-chain.pdf (accessed on 1 January 2020).

- Rastogi, Shailesh, Adesh Doifode, Jagjeevan Kanoujiya, and Satyendra Pratap Singh. 2021. Volatility integration of gold and crude oil prices with the interest rates in India. South Asian Journal of Business Studies 12: 444–61. [Google Scholar] [CrossRef]

- Rastogi, Shailesh, and Jagjeevan Kanoujiya. 2022. The volatility spillover effect of macroeconomic indicators and strategic commodities on inflation: Evidence from India. South Asian Journal of Business Studies, ahead-of-print. [Google Scholar] [CrossRef]

- Raufeisen, Xenia, Linda Wulf, Sören Köcher, Ulya Faupel, and Hartmut H Holzmüller. 2019. Spillover effects in marketing: Integrating core research domains. AMS Review 9: 249–67. [Google Scholar] [CrossRef]

- Ruckelshaus, William D. 1989. Toward a sustainable world. Scientific American 261: 166–75. [Google Scholar] [CrossRef]

- Sahoo, Sudarsana, Harendra Behera, and Pushpa Trivedi. 2018. Volatility spillovers between forex and stock markets in India. RBI Occasional Papers 38: 33–63. [Google Scholar]

- Salvi, B. L., K. A. Subramanian, and N. L. Panwar. 2013. Alternative fuels for transportation vehicles: A technical review. Renewable and Sustainable Energy Reviews 25: 404–19. [Google Scholar] [CrossRef]

- Sardar, Naafey, and Shahil Sharma. 2022. Oil prices & stock returns: Modeling the asymmetric effects around the zero lower bound. Energy Economics 107: 105814. [Google Scholar]

- Schade, Wolfgang, Fabian Kley, Jonathan Köhler, and Anja Peters. 2012. Contextual Requirements for Electric Vehicles in Developed and Developing Countries: The Example of China. In Sustainable Transport for Chinese Cities. Edited by Roger L. Mackett, Anthony D. May, Masanobu Kii and Haixiao Pan. Bingley: Emerald Group Publishing Limited. [Google Scholar]

- Siddiqui, Taufeeque Ahmad, and Mazia Fatima Khan. 2018. Analyzing spillovers in international stock markets: A multivariate GARCH approach. IMJ 10: 57–63. [Google Scholar]

- Sohel Azad, A. S. M. 2009. Efficiency, cointegration and contagion in equity markets: Evidence from China, Japan and South Korea. Asian Economic Journal 23: 93–118. [Google Scholar] [CrossRef]

- Tai, Chu-Sheng. 2007. Market integration and contagion: Evidence from Asian emerging stock and foreign exchange markets. Emerging Markets Review 8: 264–83. [Google Scholar] [CrossRef]

- Teske, Sven, Thomas Pregger, Sonja Simon, Tobias Naegler, Wina Graus, and Christine Lins. 2011. Energy [R] evolution 2010—A sustainable world energy outlook. Energy Efficiency 4: 409–33. [Google Scholar] [CrossRef]

- Truelove, Heather Barnes, Amanda R. Carrico, Elke U. Weber, Kaitlin Toner Raimi, and Michael P. Vandenbergh. 2014. Positive and negative spillover of pro-environmental behavior: An integrative review and theoretical framework. Global Environmental Change 29: 127–38. [Google Scholar] [CrossRef]

- Valenta, Rick K., Deanna Kemp, John R. Owen, Glen D. Corder, and Éléonore Lèbre. 2019. Re-thinking complex orebodies: Consequences for the future world supply of copper. Journal of Cleaner Production 220: 816–26. [Google Scholar] [CrossRef]

- Van Rookhuijzen, Merije, Emely De Vet, and Marieke A. Adriaanse. 2021. The Effects of Nudges: One-Shot Only? Exploring the Temporal Spillover Effects of a Default Nudge. Frontiers in Psychology 12: 683262. [Google Scholar] [CrossRef]

- Verfuerth, Caroline, Christopher R. Jones, Diana Gregory-Smith, and Caroline Oates. 2019. Understanding contextual spillover: Using identity process theory as a lens for analyzing behavioral responses to a workplace dietary choice intervention. Frontiers in Psychology 10: 345–55. [Google Scholar] [CrossRef]

- Xiong, Zhengde, and Lijun Han. 2015. Volatility spillover effect between financial markets: Evidence since the reform of the RMB exchange rate mechanism. Financial Innovation 1: 9. [Google Scholar] [CrossRef]

- Young, Kevin A. 2022. Fossil Fuels, the Ruling Class, and Prospects for the Climate Movement. In Trump and the Deeper Crisis. Edited by Kevin A. Young, Michael Schwartz and Richard Lachmann. Bingley: Emerald Publishing Limited. [Google Scholar]

- Yu, Nannan, Martin de Jong, Servaas Storm, and Jianing Mi. 2013. Spatial spillover effects of transport infrastructure: Evidence from Chinese regions. Journal of Transport Geography 28: 56–66. [Google Scholar] [CrossRef]

| Name | Description |

|---|---|

| COP | Copper Spot Price |

| CRUDE | WTI Crude Oil Spot Price |

| EXR | USD/INR Currency Spot Price |

| ESG | S&P BSE 100 ESG Equity Index Price |

| 1 November 2017 to 20 September 2022 | ||||

|---|---|---|---|---|

| COP | CRU | EXR | ESG | |

| Mean | 0.0001 | −0.0020 | 0.0001 | 0.0005 |

| Maximum | 0.0617 | 0.3766 | 0.0234 | 0.0864 |

| Minimum | −0.0659 | −3.0590 | −0.0195 | −0.1272 |

| Standard Deviation | 0.0136 | 0.0983 | 0.0035 | 0.0122 |

| Skewness | −0.1522 | −25.007 | 0.3640 | −1.1069 |

| Kurtosis | 1.869 | 751.213 | 3.959 | 16.014 |

| Jarque–Bera | 189.21 *** | 300.43 *** | 857.4 *** | 138.47 *** |

| Observation | 1284 | 1284 | 1284 | 1284 |

| ARCH (LM) Test | 37.288 *** | 36.561 *** | 70.44 ** | 454.88 *** |

| Unit Root Tests | ||||

| Augmented Dickey–Fucker | −10.104 *** | −12.426 *** | −10.494 *** | −10.481 *** |

| Philips–Perron | −1312.3 | −797.59 *** | −1294 *** | −1369 *** |

| COP | CRU | EXR | ESG | |

|---|---|---|---|---|

| COP | 1.000 | |||

| CRUDE | 0.0052 | 1.000 | ||

| EXR | −0.0470 | −0.0390 | 1.000 | |

| ESG | 0.0475 | −0.0778 * | −0.0022 | 1.000 |

| COP (1) ESG (2) | CRUD (1) ESG (2) | EXR (1) ESG (2) | |

|---|---|---|---|

| Variance Equation: | |||

| D11 | 0.0060 ** | 0.0983 *** | 0.0352 *** |

| D21 | 0.0001 | −0.0009 | −0.0271 |

| D22 | 0.0024 *** | 0.0121 *** | 0.0122 |

| E11 | 0.2283 *** | 0.1000 *** | 0.0010 *** |

| E12 | 0.1122 ** | 0.0200 | 0.0020 |

| E21 | −0.0039 | 0.0200 ** | 0.0020 |

| E22 | 0.3622 | 0.1000 ** | 0.0010 |

| F11 | 0.8606 ** | 0.9000 *** | 0.0900 *** |

| F12 | −0.0636 ** | 0.0100 | 0.0010 *** |

| F21 | 0.0139 | 0.0510 *** | 0.0510 *** |

| F22 | 0.9062 *** | 0.9000 *** | 0.0900 *** |

| Model Diagnostics: | |||

| log-likelihood | 7788.671 | 2805.558 | 8105.918 |

| COP (1) ESG (2) | CRUDE (1) ESG (2) | EXR (1) ESG (2) | |

|---|---|---|---|

| Optimal Parameters: | |||

| 0.0001 | 0.0013 ** | 0.0001 | |

| 0.0000 *** | 0.0000 *** | 0.0000 | |

| 0.0348 *** | 0.2774 *** | 0.0872 *** | |

| 0.9377 *** | 0.7038 *** | 0.8588 *** | |

| 0.0008 | 0.0008 | 0.0008 | |

| 0.0000 | 0.0000 | 0.0000 | |

| 0.1420 * | 0.1420 * | 0.1420 * | |

| 0.8267 ** | 0.8267 ** | 0.8267 ** | |

| 0.0147 | 0.0000 | 0.0291 * | |

| 0.8160 *** | 0.9112 *** | 0.9005 *** | |

| Model Diagnostics: | |||

| Log-likelihood | 7803.865 | 7046.464 | 9581.053 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rastogi, S.; Kanoujiya, J.; Singh, S.P.; Doifode, A.; Parashar, N.; Tejasmayee, P. Fossil Fuel-Based versus Electric Vehicles: A Volatility Spillover Perspective Regarding the Environment. J. Risk Financial Manag. 2023, 16, 494. https://doi.org/10.3390/jrfm16120494

Rastogi S, Kanoujiya J, Singh SP, Doifode A, Parashar N, Tejasmayee P. Fossil Fuel-Based versus Electric Vehicles: A Volatility Spillover Perspective Regarding the Environment. Journal of Risk and Financial Management. 2023; 16(12):494. https://doi.org/10.3390/jrfm16120494

Chicago/Turabian StyleRastogi, Shailesh, Jagjeevan Kanoujiya, Satyendra Pratap Singh, Adesh Doifode, Neha Parashar, and Pracheta Tejasmayee. 2023. "Fossil Fuel-Based versus Electric Vehicles: A Volatility Spillover Perspective Regarding the Environment" Journal of Risk and Financial Management 16, no. 12: 494. https://doi.org/10.3390/jrfm16120494