AIIB Investment and Economic Development of India: The Case of the Gujarat Road Project

Abstract

:1. Introduction

2. Literature Review

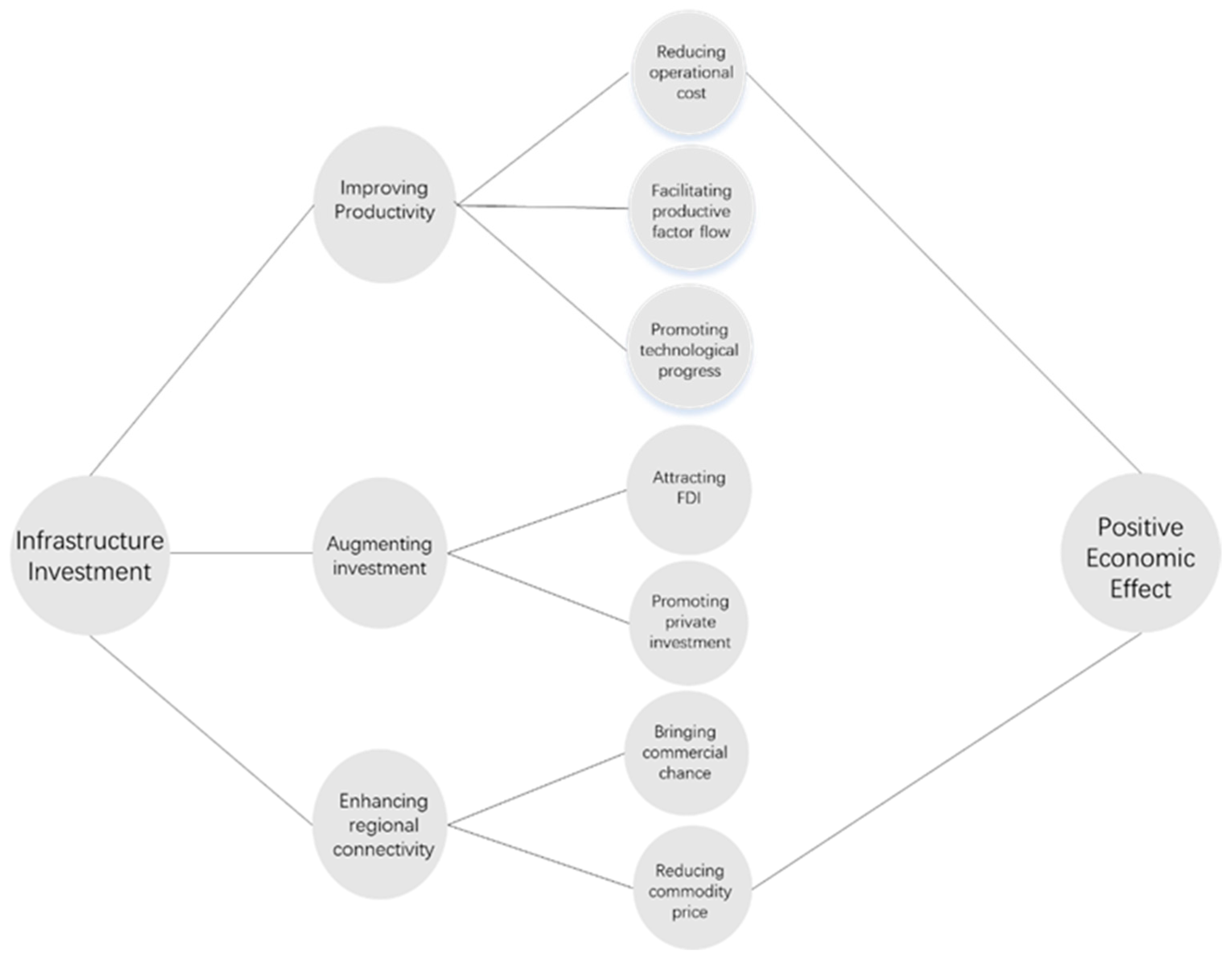

2.1. Theoretical Background of Infrastructure Investment and the AIIB

2.2. Current Infrastructure Construction in India

2.3. Introduction to and Existing Literature on the Random Forest Model

3. Data and Method

3.1. Data

3.2. Methodology

3.2.1. LASSO Method

3.2.2. Random Forest Model

- Using the bootstrap sample method, for the training set of size N, N training samples are randomly selected from the training set as the training set of each tree.

- If there are M features, M feature dimensions (m << M) are randomly selected from M when each node is split, and the best features (maximizing information gain) among these m feature dimensions are used to segment the nodes. During the growth of the forest, the value of m remains constant (Breiman 1996).

4. Results Analysis

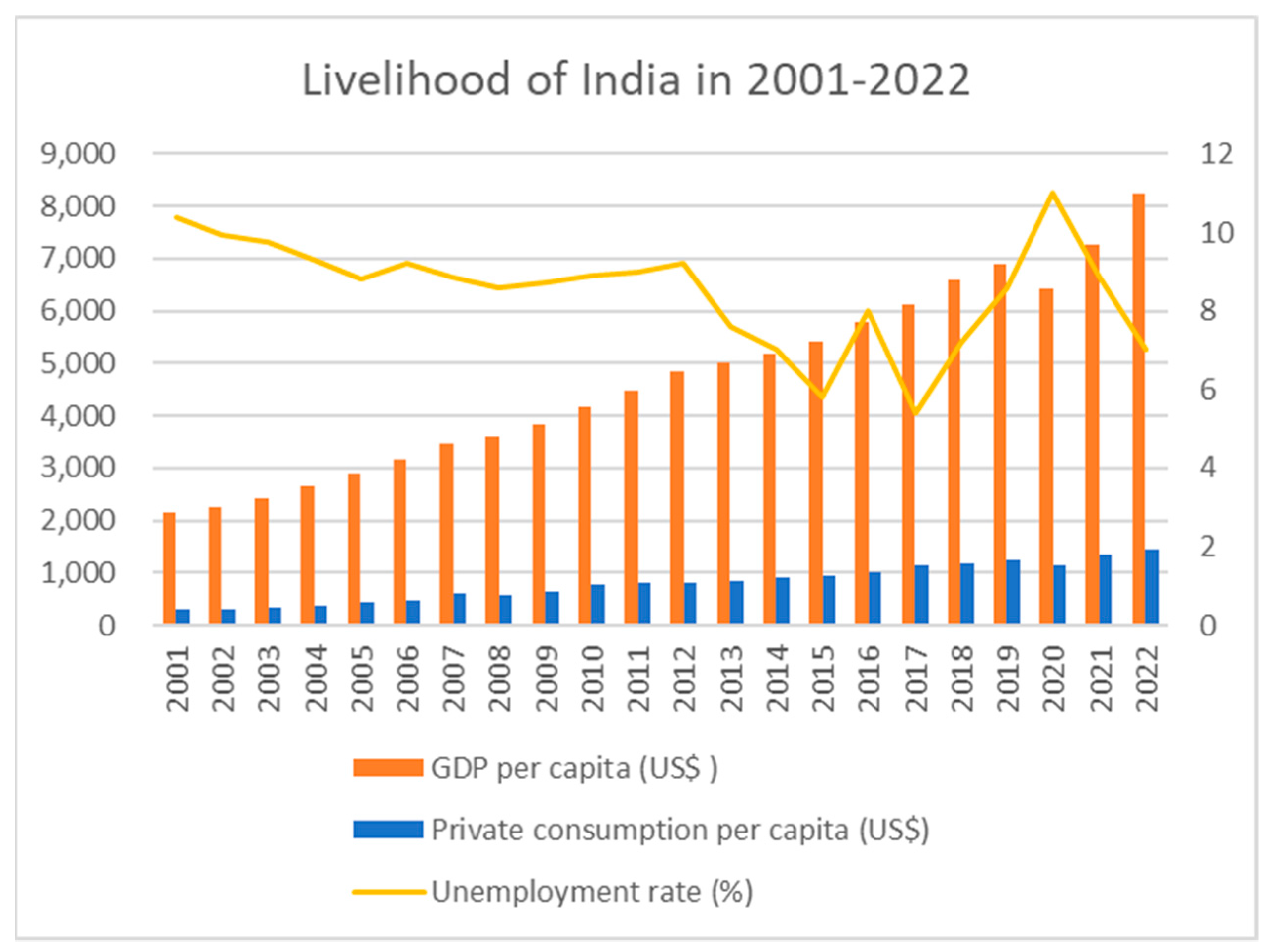

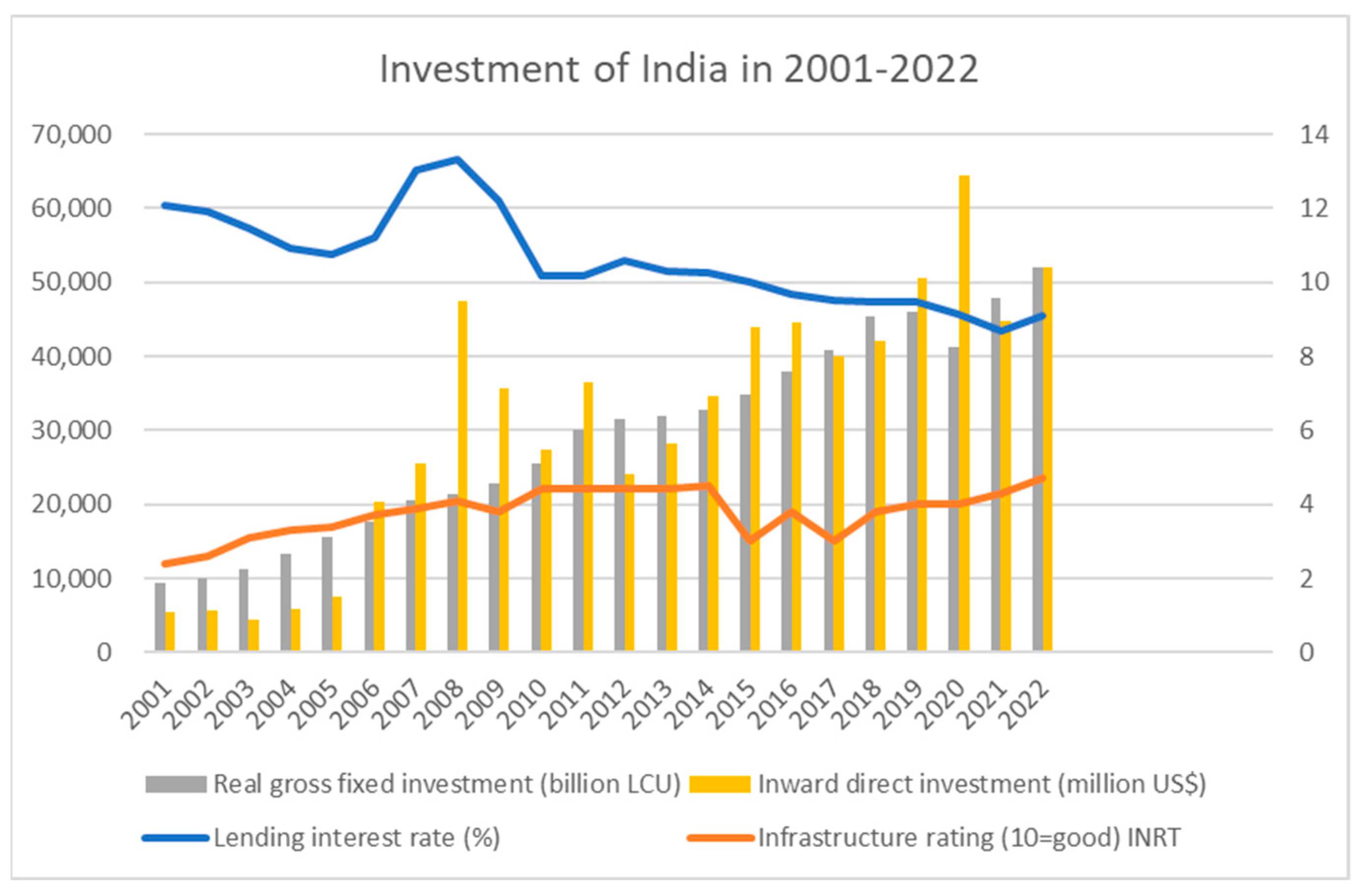

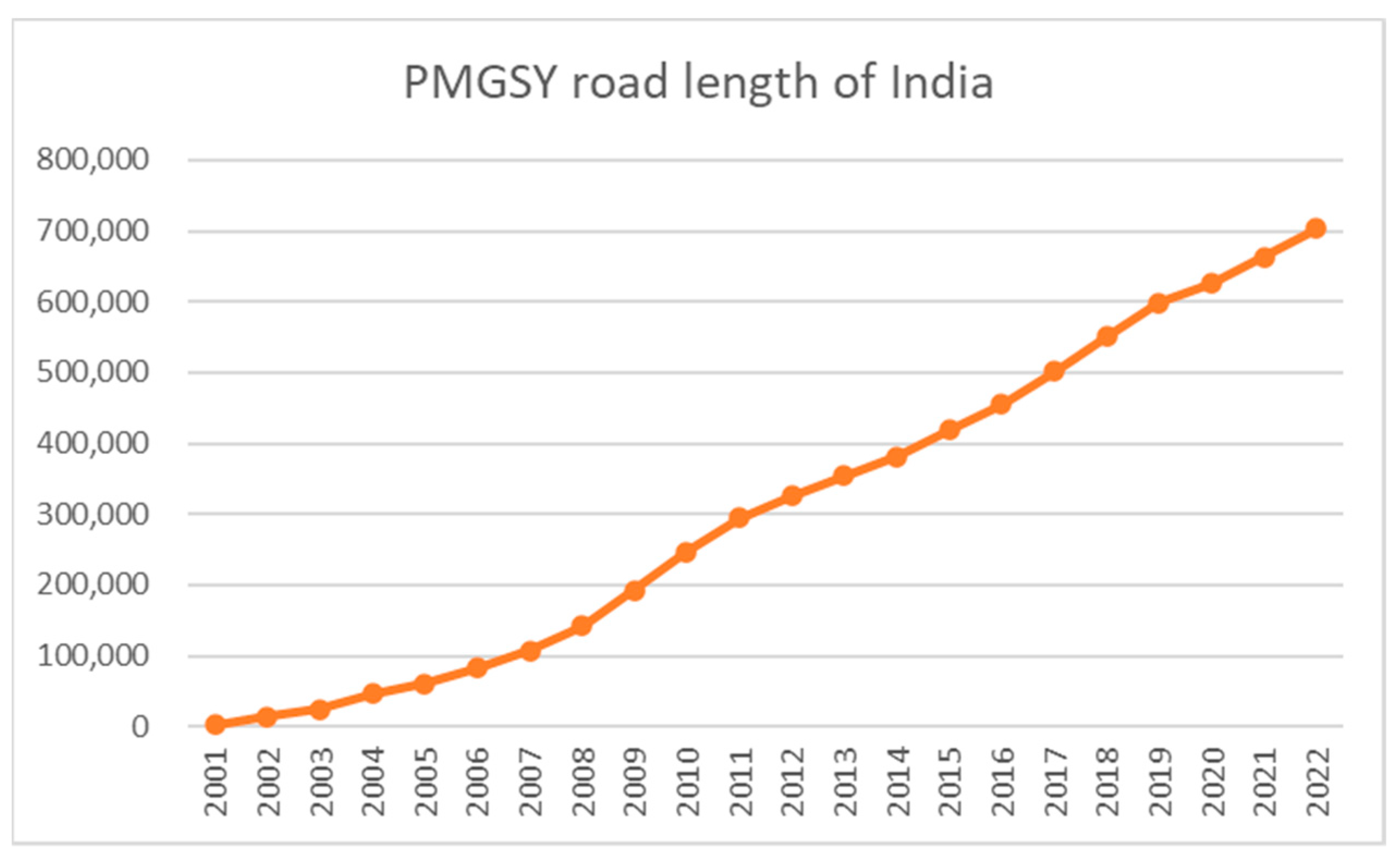

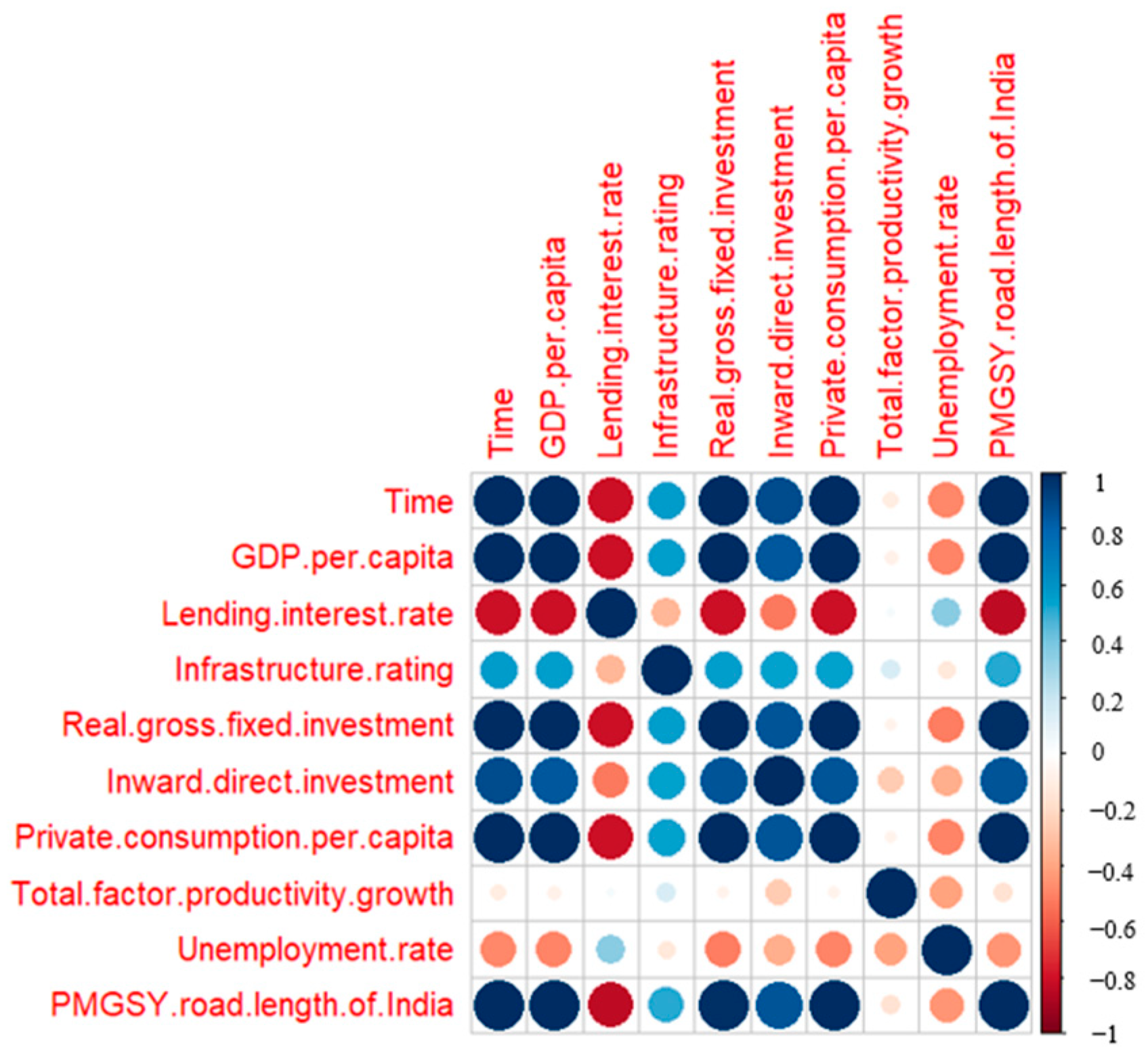

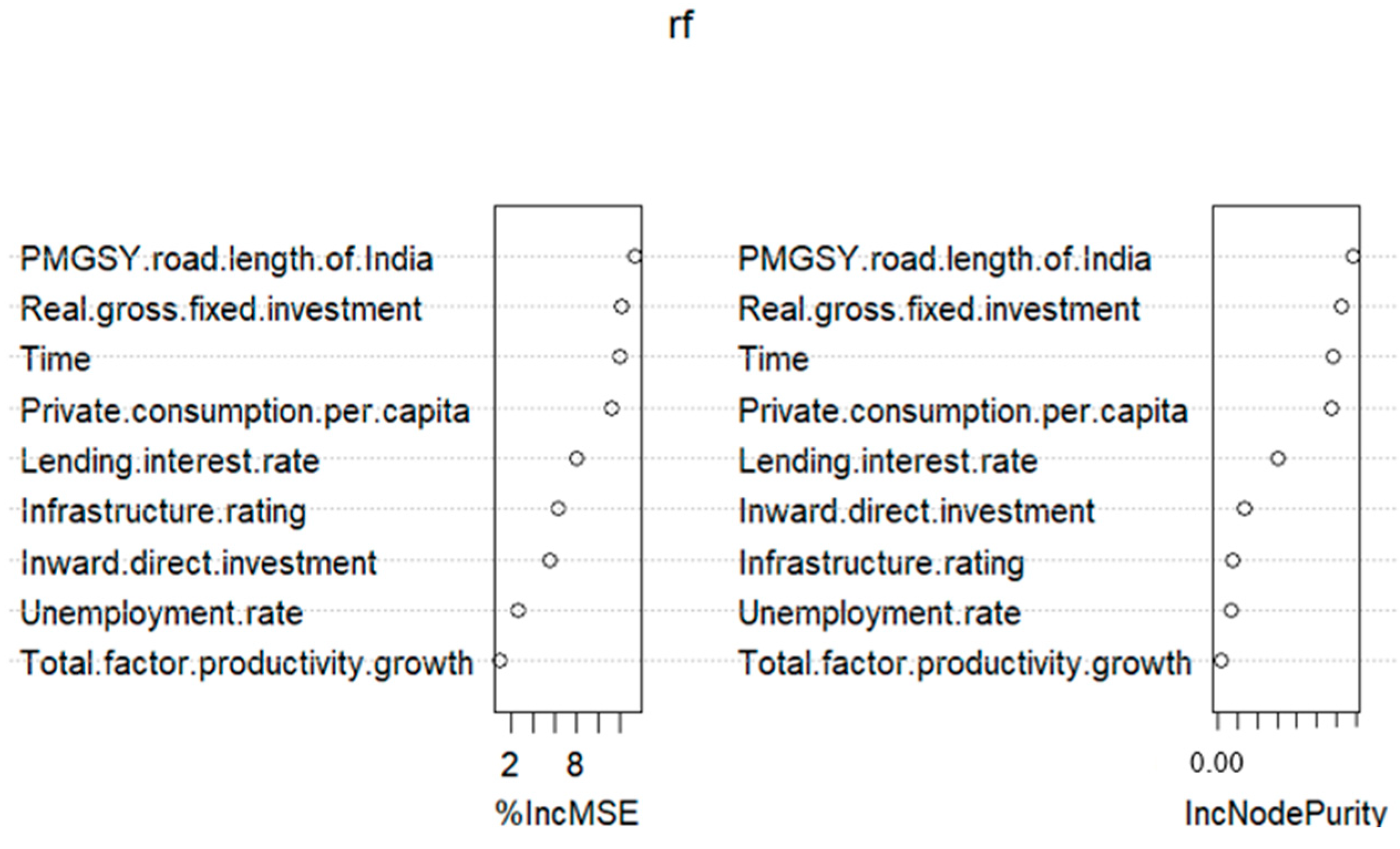

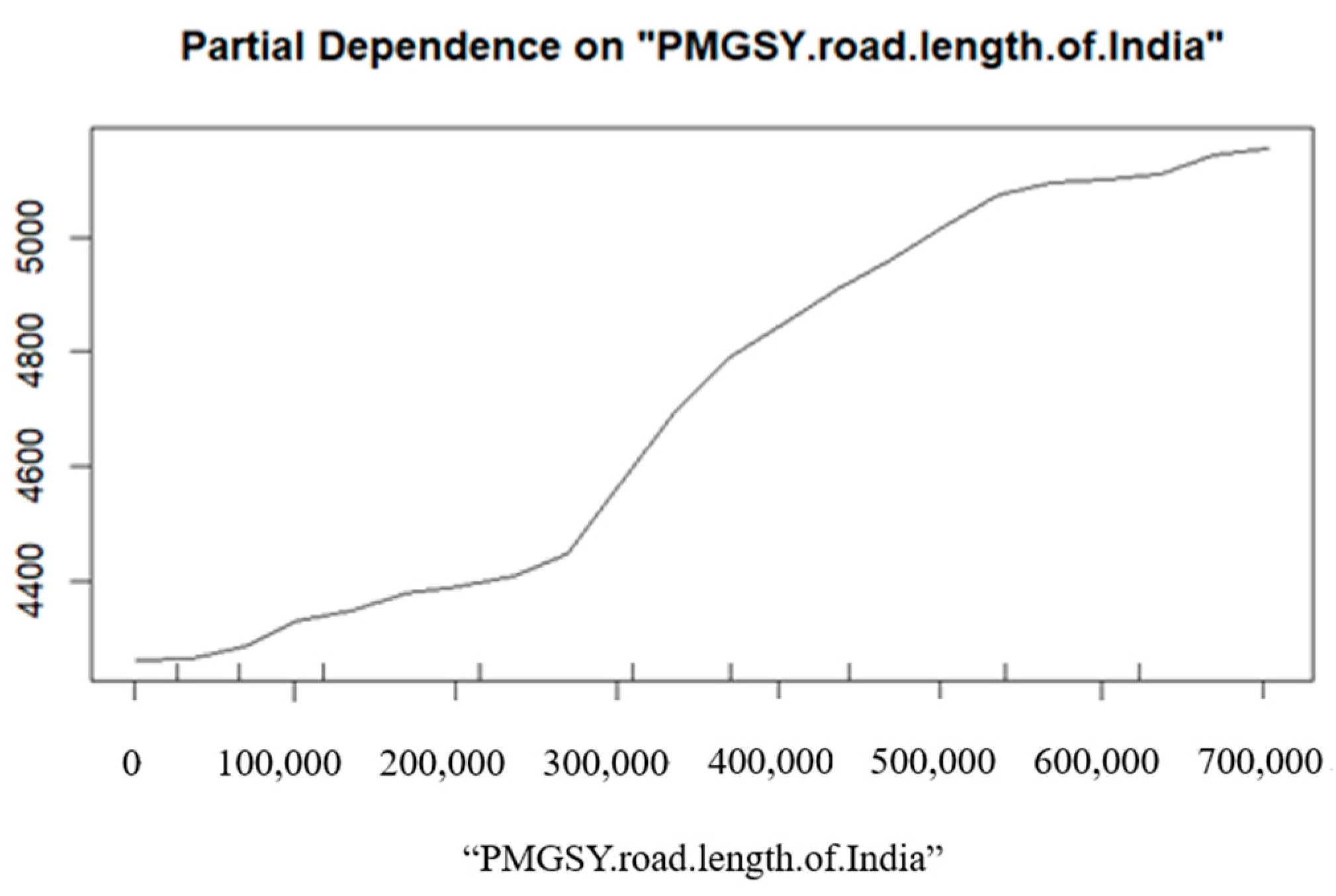

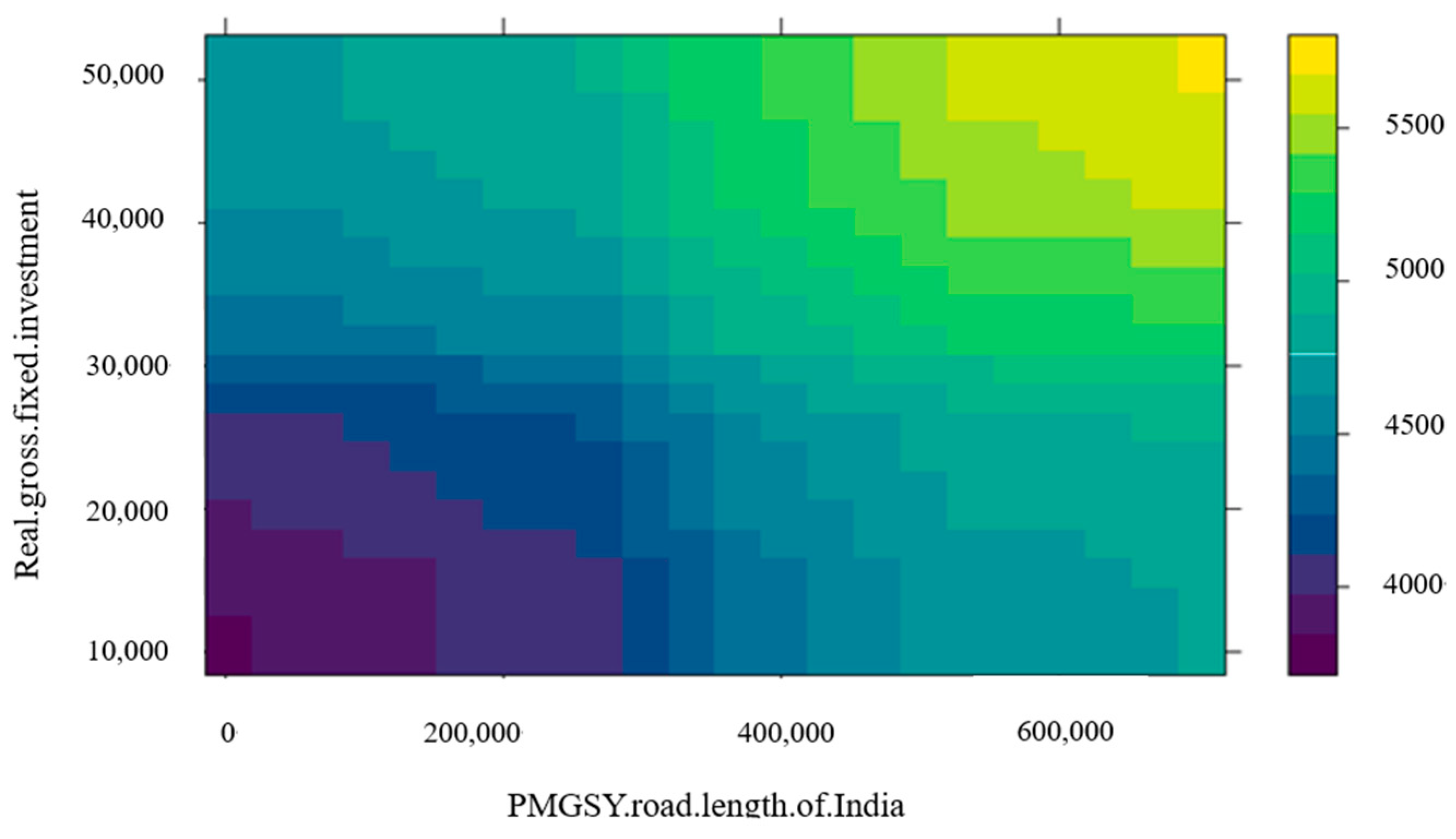

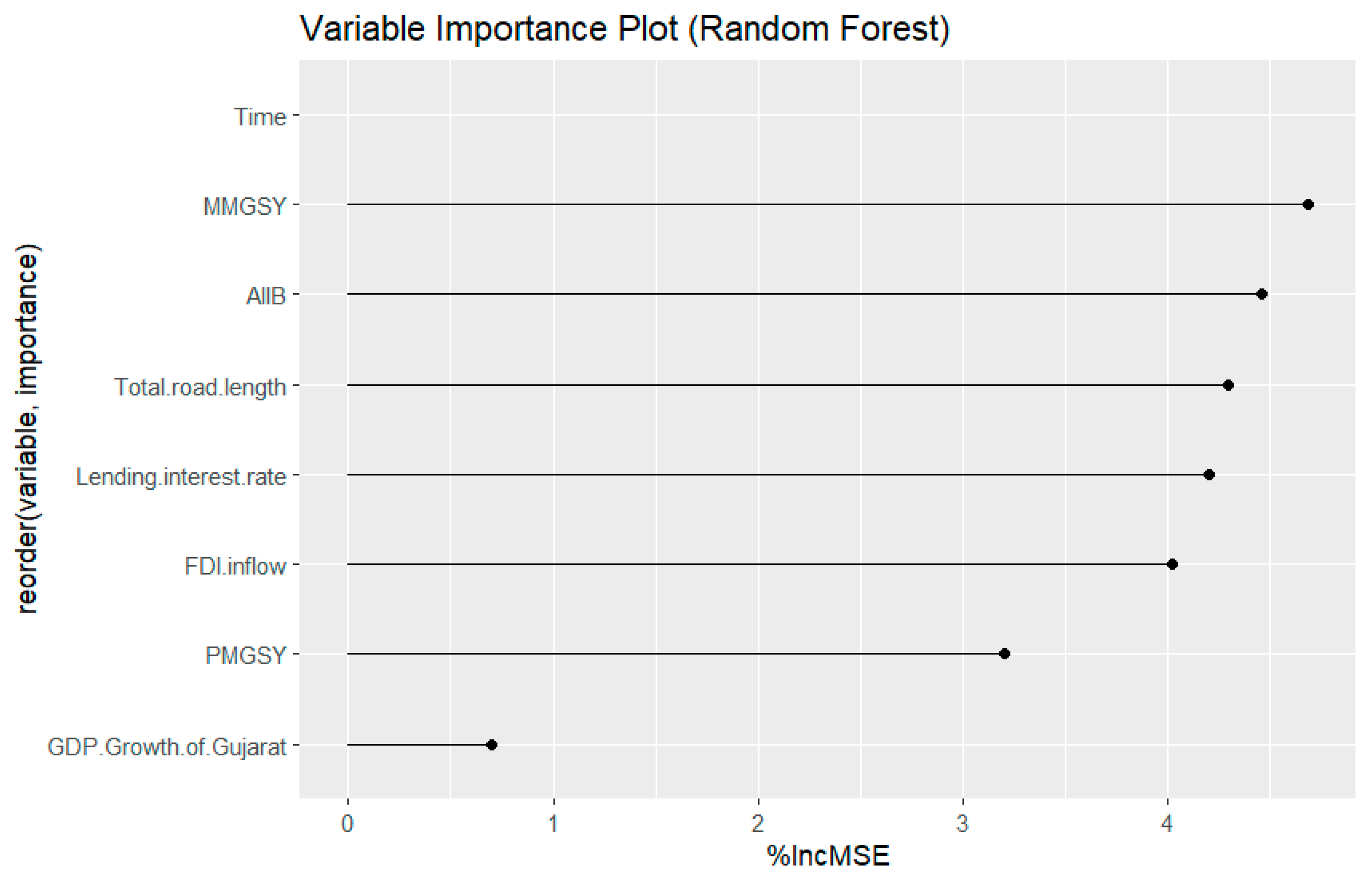

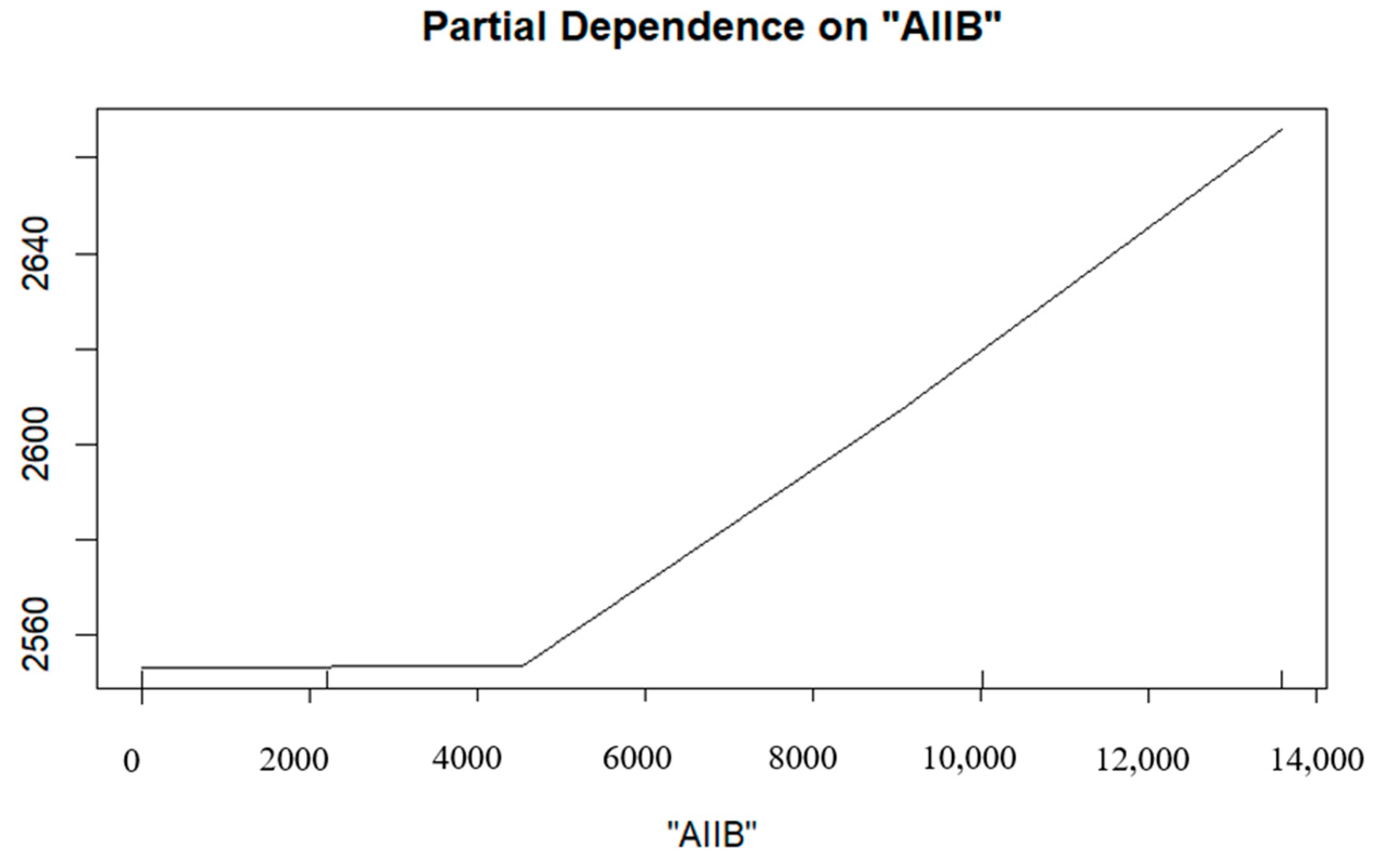

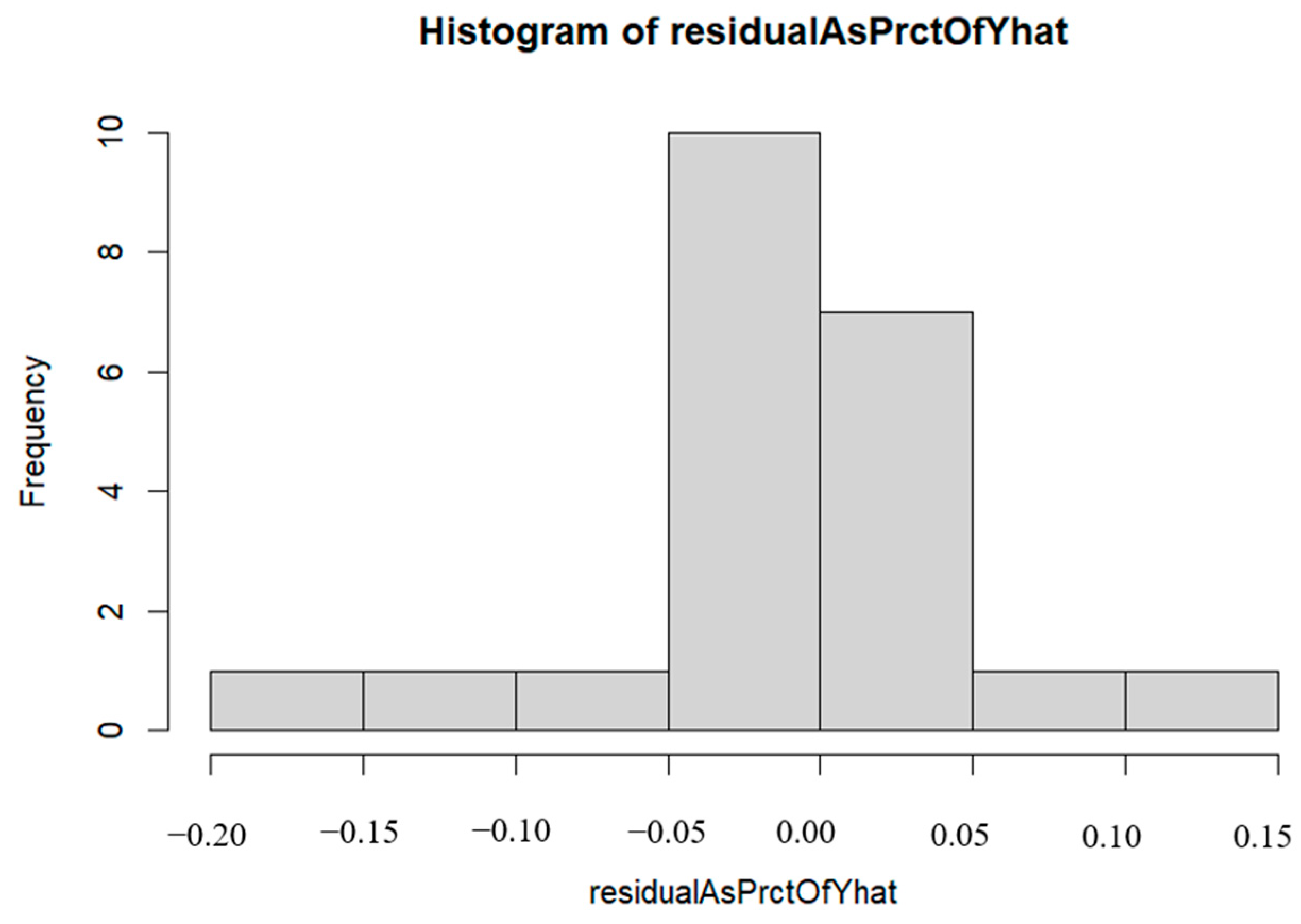

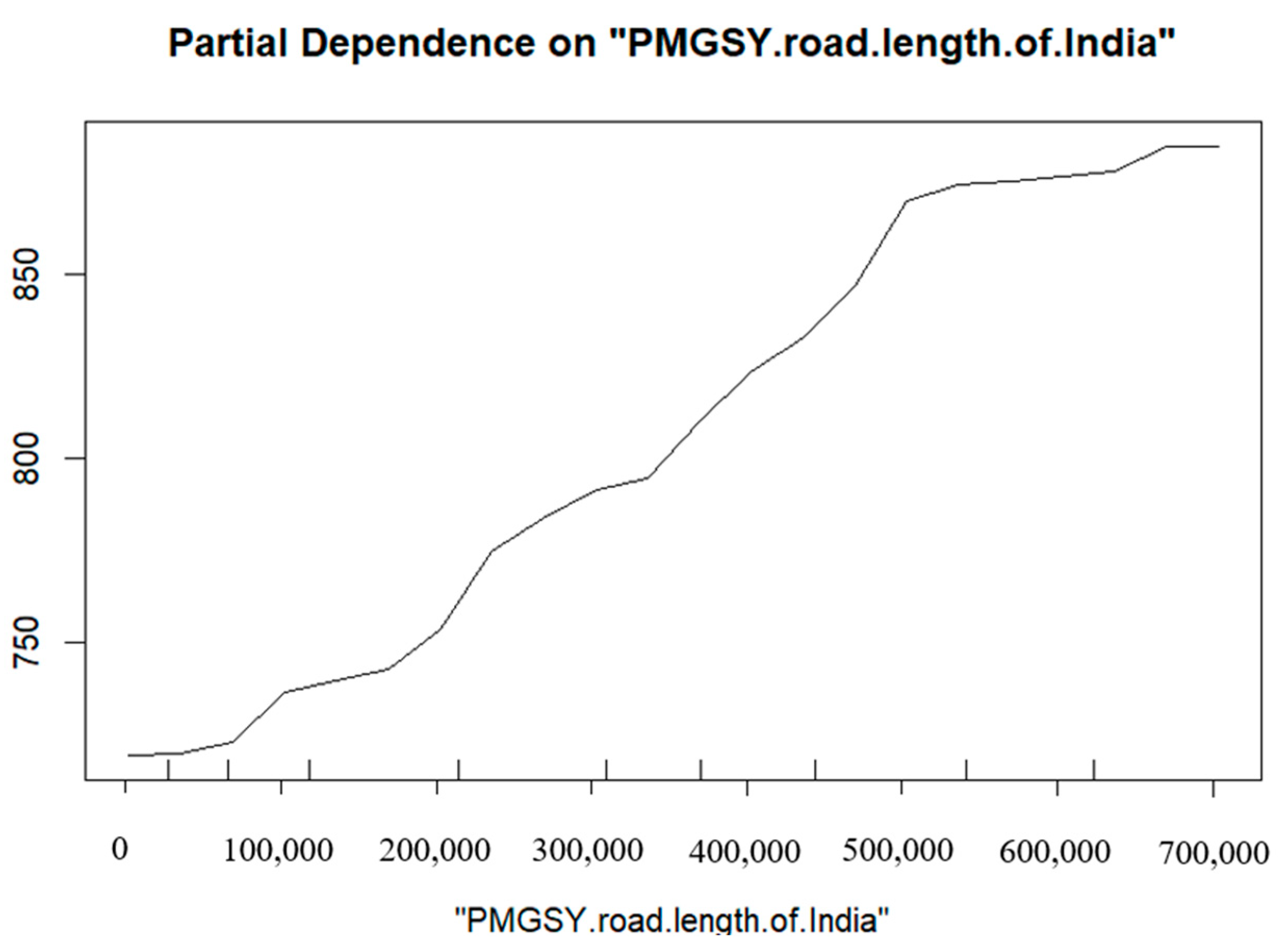

4.1. Analysis at the National Level

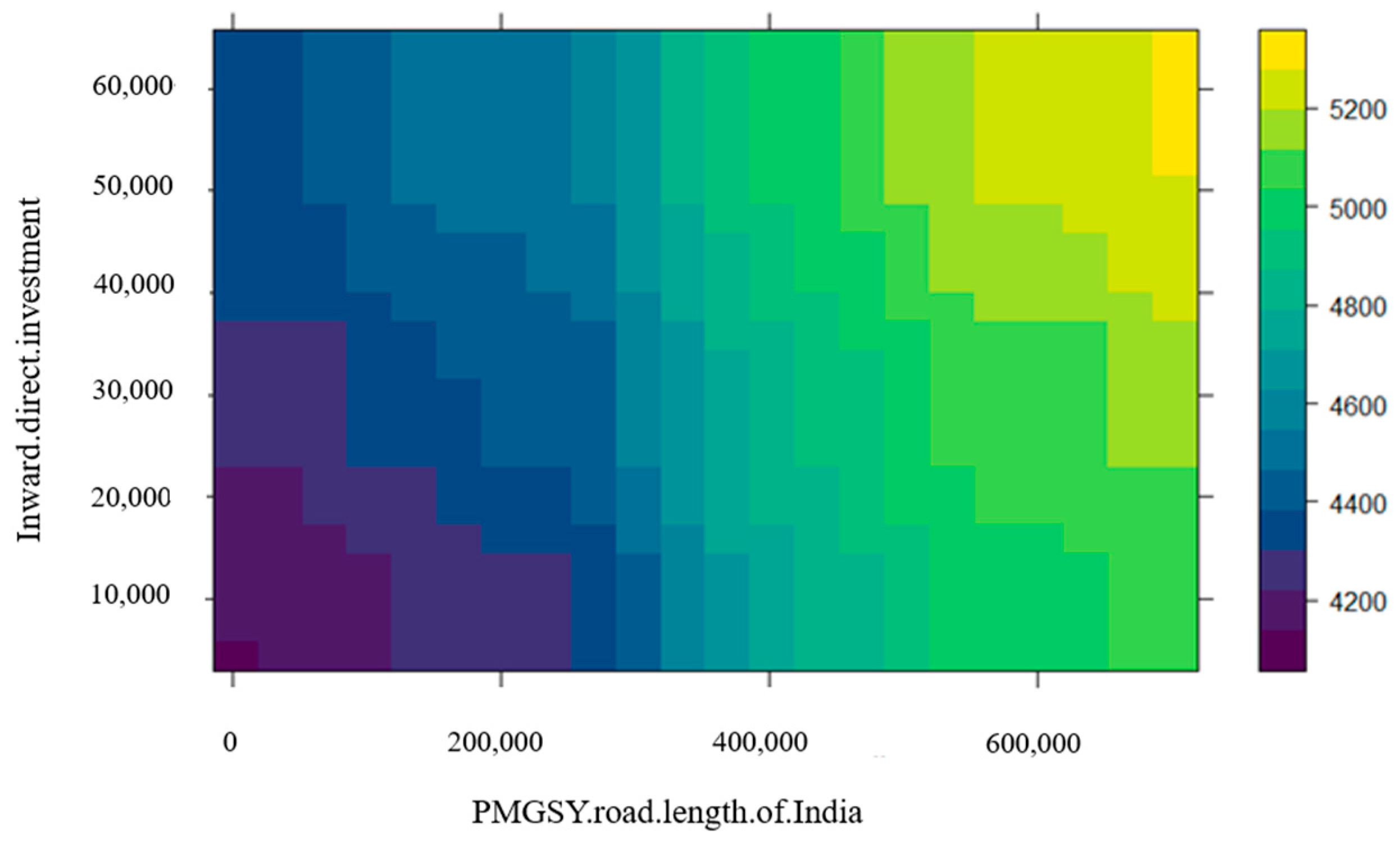

4.2. Analysis of Gujarat

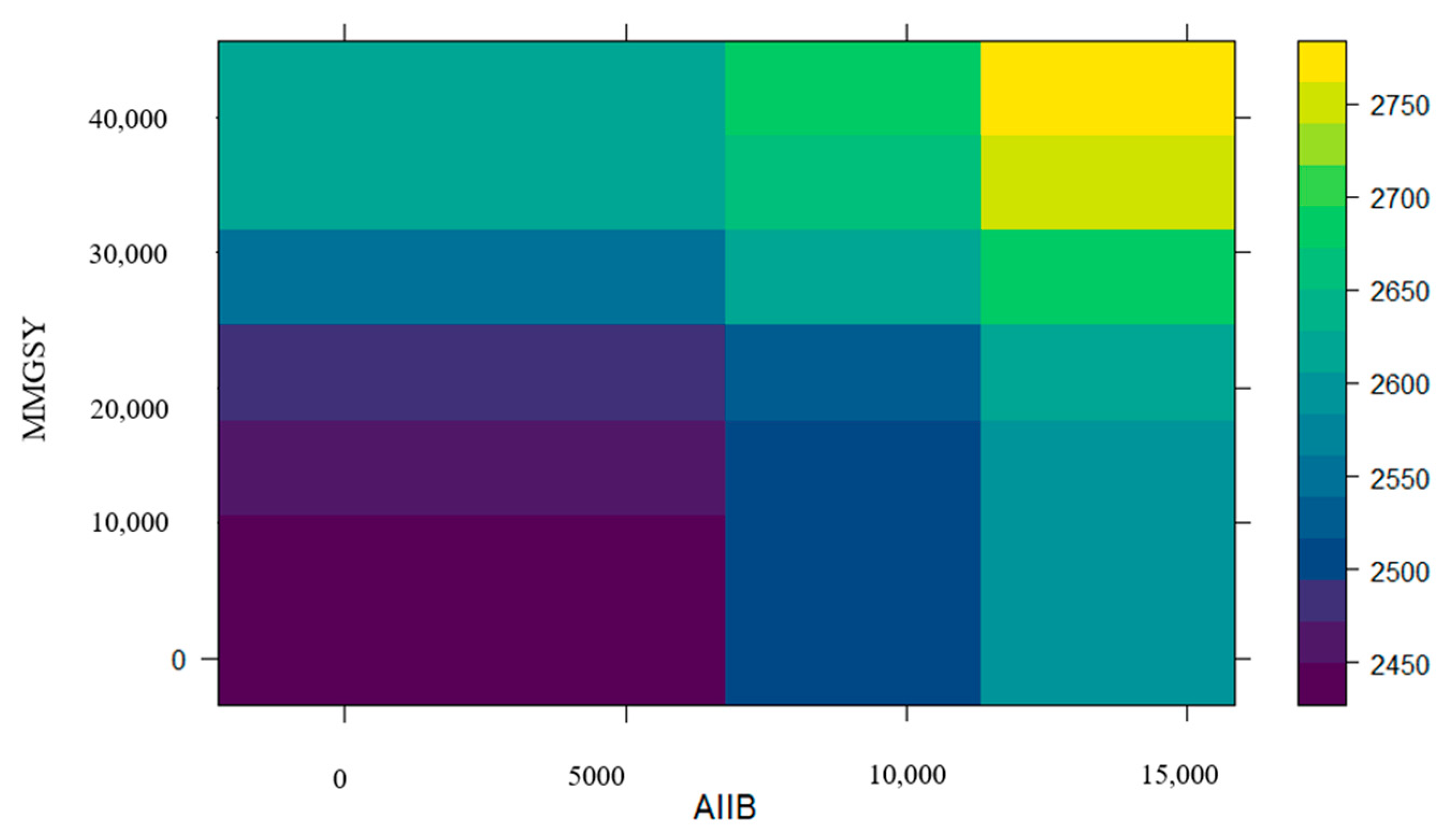

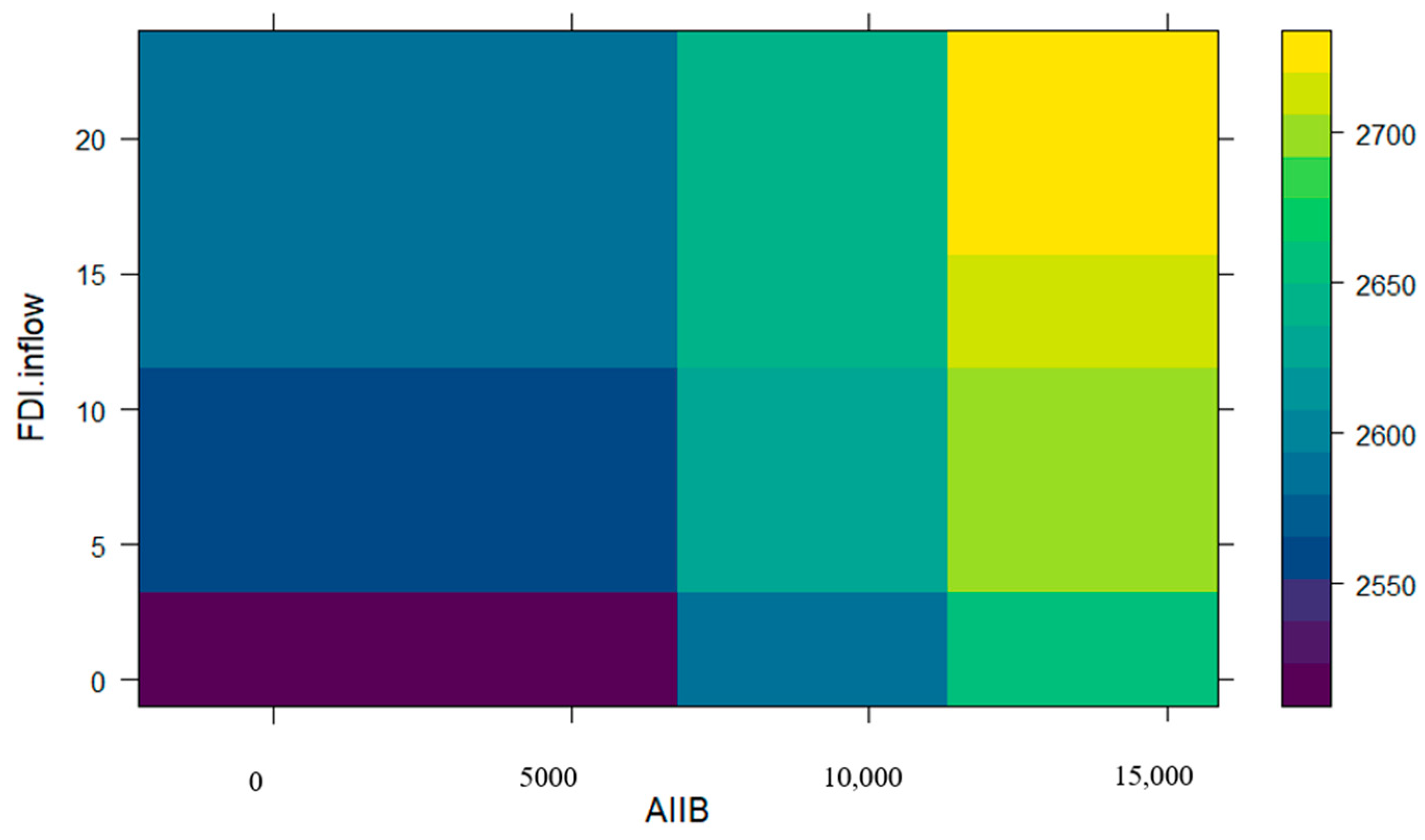

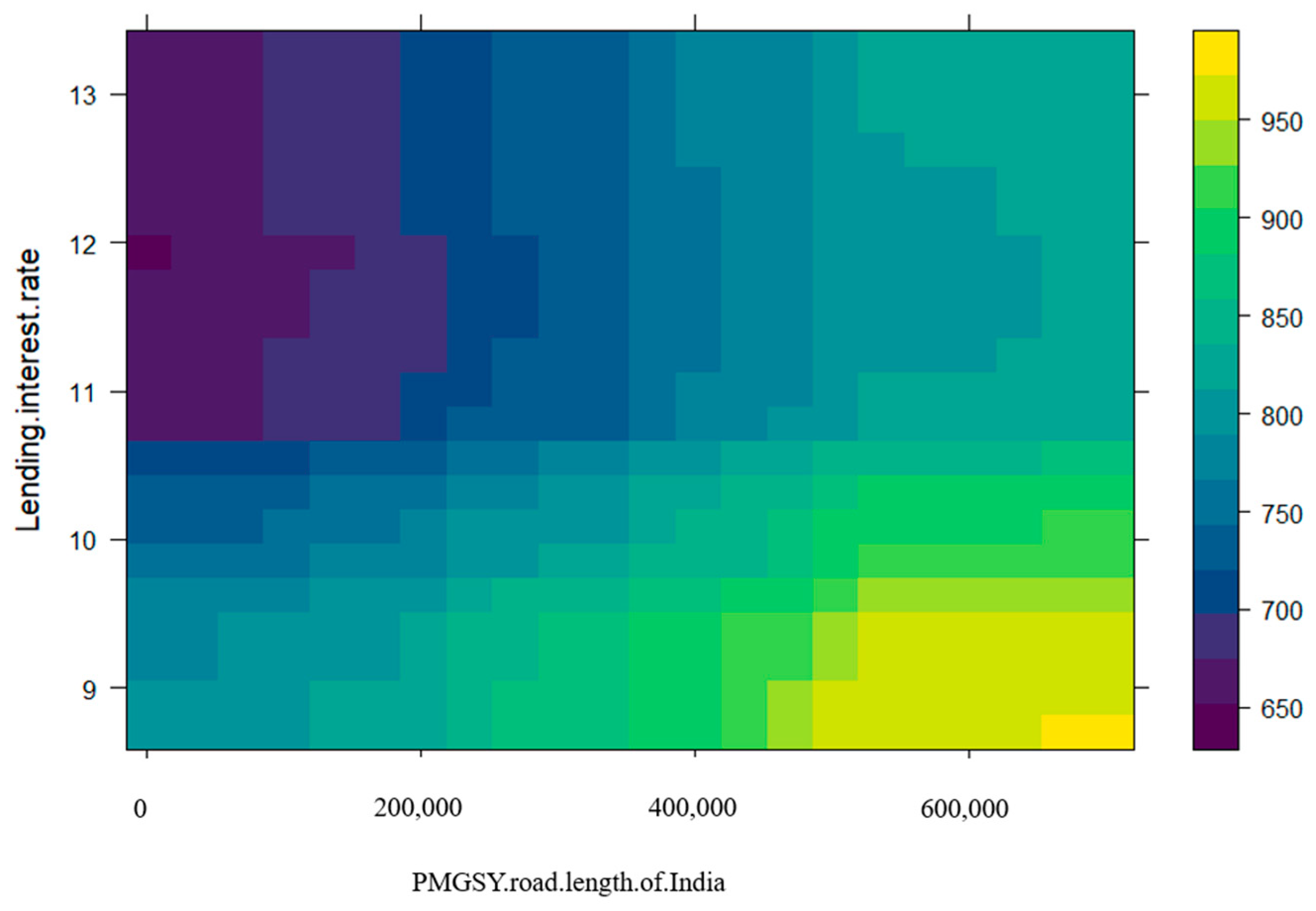

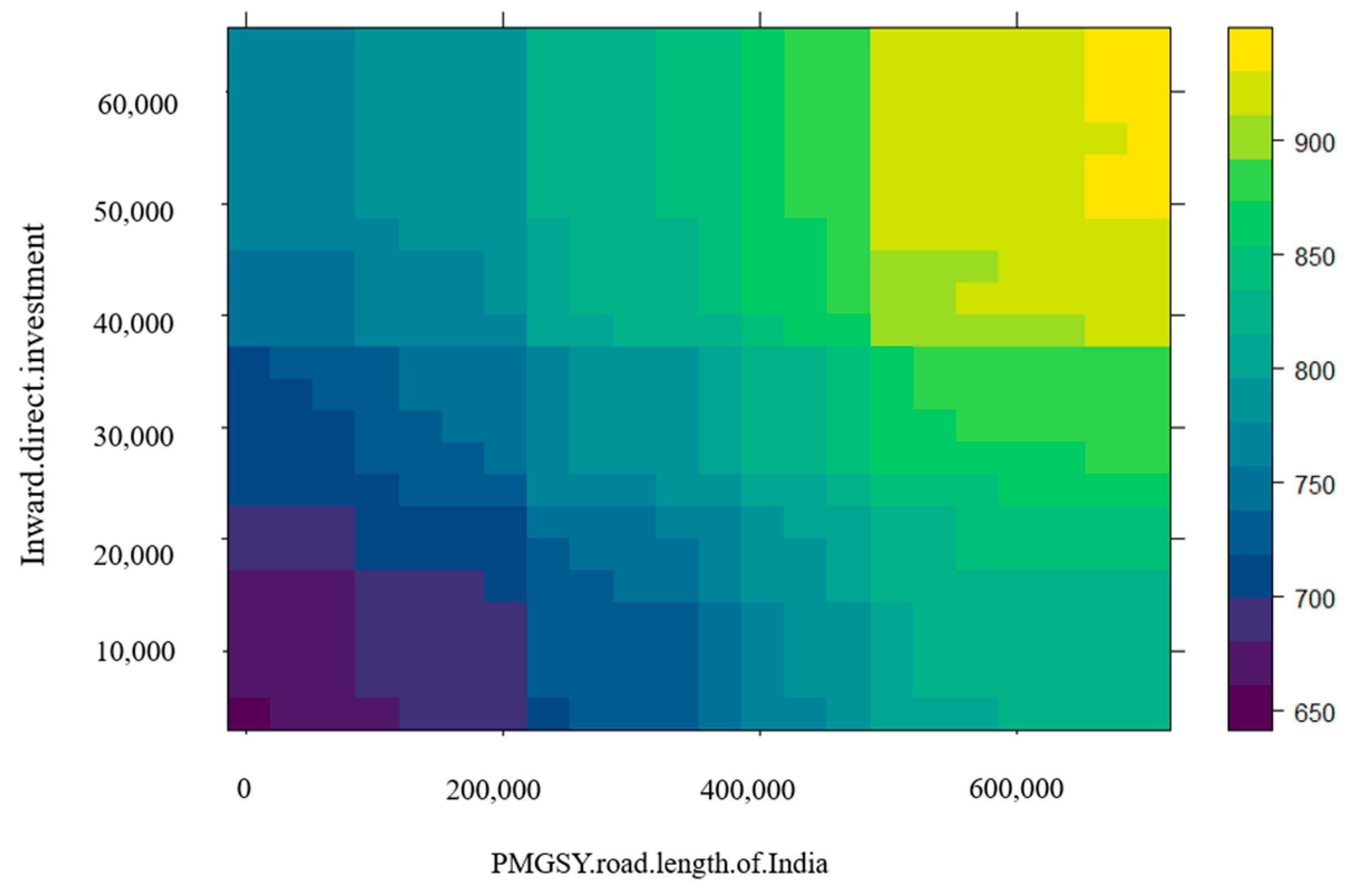

4.3. Analysis of Other Economic Variables

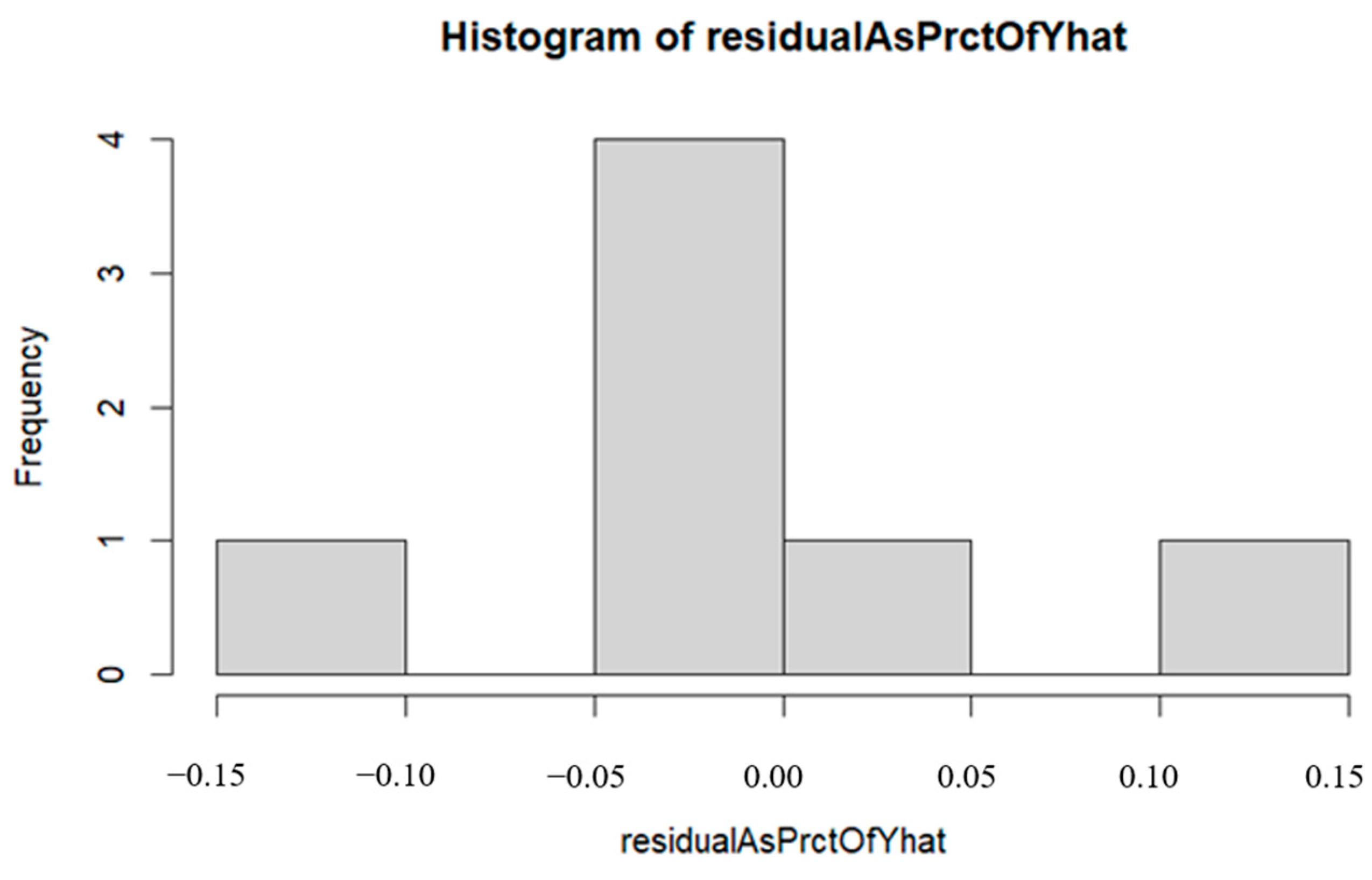

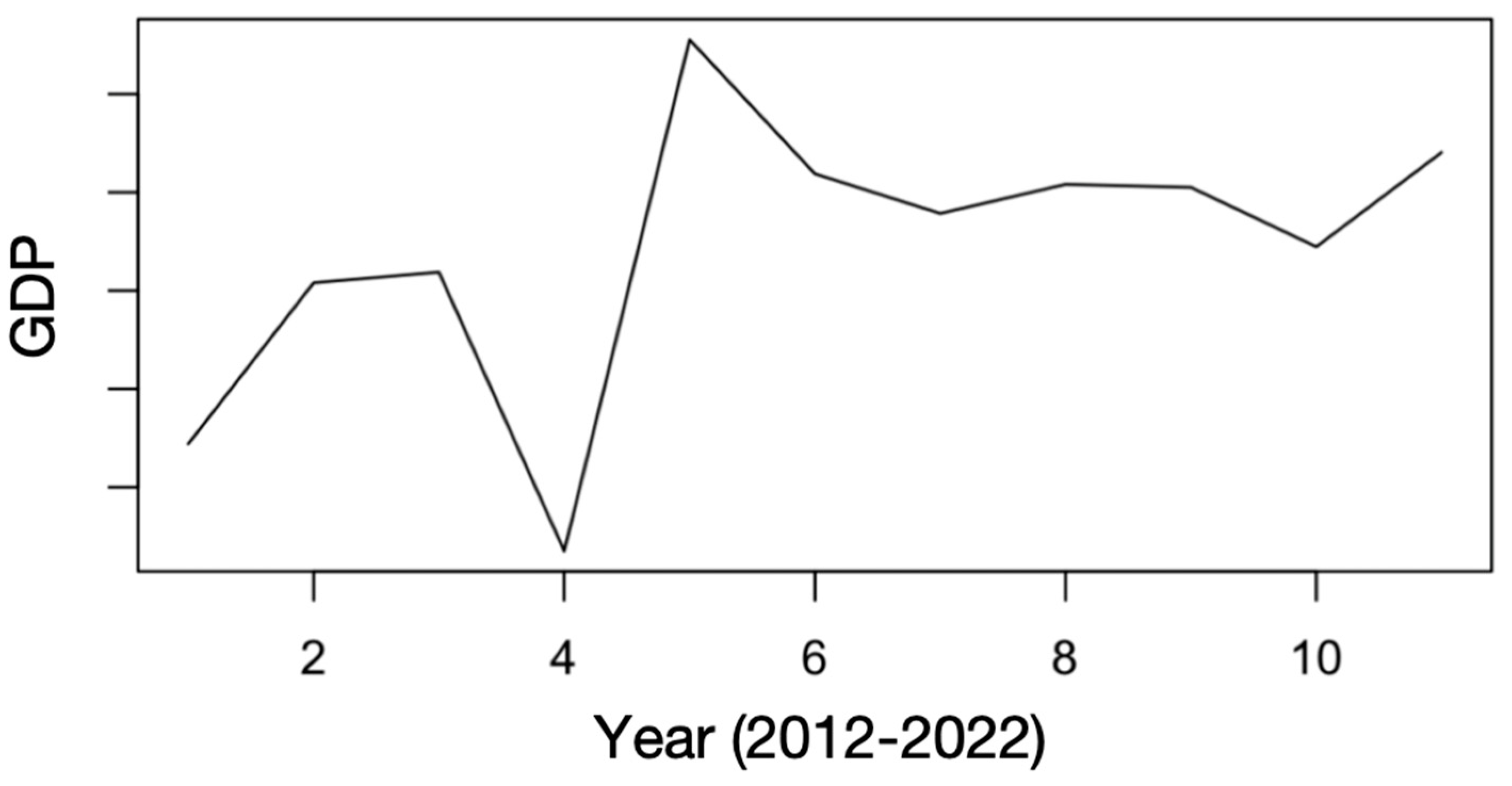

4.4. Analysis Based on the Time Series Forecasting Model

5. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Aggarwal, Shilpa. 2018. Do Rural Roads Create Pathways out of Poverty? Evidence from India. Journal of Development Economics 133: 375–95. [Google Scholar] [CrossRef]

- Aiello, Francesco, Alfonsina Iona, and Leone Leonida. 2012. Regional Infrastructure and Firm Investment: Theory and Empirical Evidence for Italy. Empirical Economics 42: 835–62. [Google Scholar] [CrossRef]

- AIIB. 2016. Asian Infrastructure Investment Bank. Articles of Agreement. Beijing: AIIB. [Google Scholar]

- AIIB. 2023a. Our Projects. Available online: https://www.aiib.org/en/projects/list/index.html (accessed on 14 April 2023).

- AIIB. 2023b. Our Projects. Available online: https://www.aiib.org/en/projects/list/year/All/member/India/sector/All/financing_type/All/status/Approved (accessed on 14 April 2023).

- AIIB. 2023c. Our Projects. Available online: https://www.aiib.org/en/projects/list/year/All/member/All/sector/Transport/financing_type/All/status/Approved (accessed on 14 April 2023).

- Aschauer, David Alan. 1989. Is Public Expenditure Productive? Journal of Monetary Economics 23: 177–200. [Google Scholar] [CrossRef]

- Beutel, Johannes, Sophia List, and Gregor von Schweinitz. 2019. Does Machine Learning Help Us Predict Banking Crises? Journal of Financial Stability 45: 100693. [Google Scholar] [CrossRef]

- Breiman, Leo. 1996. Bagging predictors. Machine Learning 24: 123–40. [Google Scholar] [CrossRef]

- Breiman, Leo. 2001. Random Forests. Machine Learning 45: 5–32. [Google Scholar] [CrossRef]

- Chandra, Amitabh, and Eric Thompson. 2000. Does Public Infrastructure Affect Economic Activity? Evidence from the Rural Interstate Highway System. Regional Science and Urban Economics 30: 457–90. [Google Scholar] [CrossRef]

- De Jonge, Alice. 2017. Perspectives on the Emerging Role of the Asian Infrastructure Investment Bank. International Affairs 93: 1061–84. [Google Scholar] [CrossRef]

- Donaubauer, Julian, Birgit Meyer, and Peter Nunnenkamp. 2016. Aid, Infrastructure, and FDI: Assessing the Transmission Channel with a New Index of Infrastructure. IDEAS Working Paper Series from RePEc; Vienna: Research Centre International Economics. [Google Scholar]

- Ghosh, Prabir Kumar, and Soumyananda Dinda. 2022. Revisited the Relationship Between Economic Growth and Transport Infrastructure in India: An Empirical Study. Indian Economic Journal 70: 34–52. [Google Scholar] [CrossRef]

- Gu, Bin. 2017. Chinese Multilateralism in the AIIB. Journal of International Economic Law 20: 137–58. [Google Scholar] [CrossRef]

- Guild, Robert L. 2000. Infrastructure Investment and Interregional Development: Theory, Evidence, and Implications for Planning. Public Works Management & Policy 4: 274–85. [Google Scholar]

- Hasnat, Tanzeem. 2021. Infrastructure Investment in India: Squaring Theory, Data and Common Sense. Indian Economic Journal 69: 174–78. [Google Scholar] [CrossRef]

- Ho, Tin Kam. 1995. Random Decision Forests. Paper presented at 3rd International Conference on Document Analysis and Recognition, Montreal, QC, Canada, August 14–16; vol. 1, pp. 278–82. [Google Scholar]

- Hong, Haoyuan, Hamid Reza Pourghasemi, and Zohre Sadat Pourtaghi. 2016. Landslide Susceptibility Assessment in Lianhua County (China): A Comparison between a Random Forest Data Mining Technique and Bivariate and Multivariate Statistical Models. Geomorphology 259: 105–18. [Google Scholar] [CrossRef]

- Khadaroo, Jameel, and Boopen Seetanah. 2009. The Role of Transport Infrastructure in FDI: Evidence from Africa Using GMM Estimates. Journal of Transport Economics and Policy 43: 365–84. [Google Scholar]

- Kumar, Nagesh, and Ojasvee Arora. 2019. Financing Sustainable Infrastructure Development in South Asia: The Case of AIIB. Global Policy 10: 619–24. [Google Scholar] [CrossRef]

- Leduc, Sylvain, and Daniel Wilson. 2013. Roads to Prosperity or Bridges to Nowhere? Theory and Evidence on the Impact of Public Infrastructure Investment. NBER Macroeconomics Annual 27: 89–142. [Google Scholar] [CrossRef]

- Levantesi, Susanna, and Gabriella Piscopo. 2020. The Importance of Economic Variables on London Real Estate Market: A Random Forest Approach. Risks 8: 112. [Google Scholar] [CrossRef]

- Liu, Yingxia, Gerard B. M. Heuvelink, Zhanguo Bai, Ping He, Xinpeng Xu, Wencheng Ding, and Shaohui Huang. 2021. Analysis of Spatio-Temporal Variation of Crop Yield in China Using Stepwise Multiple Linear Regression. Field Crops Research 264: 108098. [Google Scholar] [CrossRef]

- Maparu, Tuhin Subhra, and Tarak Nath Mazumder. 2017. Transport Infrastructure, Economic Development and Urbanization in India (1990–2011): Is There Any Causal Relationship? Transportation Research. Part A, Policy and Practice 100: 319–36. [Google Scholar] [CrossRef]

- Ministry of Statistics and Program Implementation. 2023. Basic Road Statistics of India; Public Document. Available online: https://www.mospi.gov.in (accessed on 14 April 2023).

- Netirith, Narthsirinth, and Mingjun Ji. 2022. Analysis of the Efficiency of Transport Infrastructure Connectivity and Trade. Sustainability 14: 9613. [Google Scholar] [CrossRef]

- Pradhan, Rudra P., Neville R. Norman, Yuosre Badir, and Bele Samadhan. 2013. Transport Infrastructure, Foreign Direct Investment and Economic Growth Interactions in India: The ARDL Bounds Testing Approach. Procedia, Social and Behavioral Sciences 104: 914–21. [Google Scholar] [CrossRef]

- Saini, Shalu, and Jagat Narayan Giri. 2022. Infrastructure Development in India: The Way Ahead. Journal of Infrastructure Development 14: 37–44. [Google Scholar] [CrossRef]

- Sarania, Rahul. 2021. Interactions among Infrastructure, Trade Openness, Foreign Direct Investments and Economic Growth in India. Journal of Infrastructure Development 13: 21–43. [Google Scholar] [CrossRef]

- Satyanand, Premila Nazareth. 2012. India, FDI and Infrastructure: Some Observations on the Past Twenty Years. Review of Market Integration 4: 239–82. [Google Scholar] [CrossRef]

- Song, Ge. 2021. Road versus Rail: Assessing the Implications of Transport Infrastructure for Spatial Growth Pattern in China’s Megaregions. Journal of Urban Planning and Development 147: 04020050. [Google Scholar] [CrossRef]

- Stephen, Matthew D., and David Skidmore. 2019. The AIIB in the Liberal International Order. The Chinese Journal of International Politics 12: 61–91. [Google Scholar] [CrossRef]

- Stumpf, André, and Norman Kerle. 2011. Object-Oriented Mapping of Landslides Using Random Forests. Remote Sensing of Environment 115: 2564–77. [Google Scholar] [CrossRef]

- Suarez-Villa, Luis, and Syed A. Hasnath. 1993. The Effect of Infrastructure on Invention: Innovative Capacity and the Dynamics of Public Construction Investment. Technological Forecasting & Social Change 44: 333–58. [Google Scholar]

- Tanaka, Katsuyuki, Takuji Kinkyo, and Shigeyuki Hamori. 2016. Random Forests-Based Early Warning System for Bank Failures. Economics Letters 148: 118–21. [Google Scholar] [CrossRef]

- Tibshirani, Robert. 1996. Regression Shrinkage and Selection via the Lasso. Journal of the Royal Statistical Society. Series B, Methodological 58: 267–88. [Google Scholar] [CrossRef]

- Unnikrishnan, Nishija, and Thomas Paul Kattookaran. 2020. Impact of Public and Private Infrastructure Investment on Economic Growth: Evidence from India. Journal of Infrastructure Development 12: 119–38. [Google Scholar] [CrossRef]

- Zhao, Hong. 2016. AIIB Portents Significant Impact on Global Financial Governance. ISEAS Perspective 41: 11. [Google Scholar]

| Df Deviance | Deviance | AIC | |

|---|---|---|---|

| <none> | 288,127 | 285.00 | |

| Infrastructure rating | 1 | 281,029 | 286.45 |

| Inward direct investment | 1 | 325,714 | 287.69 |

| Total factor productivity growth | 1 | 329,864 | 287.97 |

| Lending interest rate | 1 | 370,585 | 290.53 |

| Real gross fixed investment | 1 | 388,203 | 291.56 |

| PMGSY road length of India | 1 | 545,594 | 299.04 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, J.; Cai, B. AIIB Investment and Economic Development of India: The Case of the Gujarat Road Project. J. Risk Financial Manag. 2024, 17, 64. https://doi.org/10.3390/jrfm17020064

Chen J, Cai B. AIIB Investment and Economic Development of India: The Case of the Gujarat Road Project. Journal of Risk and Financial Management. 2024; 17(2):64. https://doi.org/10.3390/jrfm17020064

Chicago/Turabian StyleChen, Jinxi, and Bowen Cai. 2024. "AIIB Investment and Economic Development of India: The Case of the Gujarat Road Project" Journal of Risk and Financial Management 17, no. 2: 64. https://doi.org/10.3390/jrfm17020064