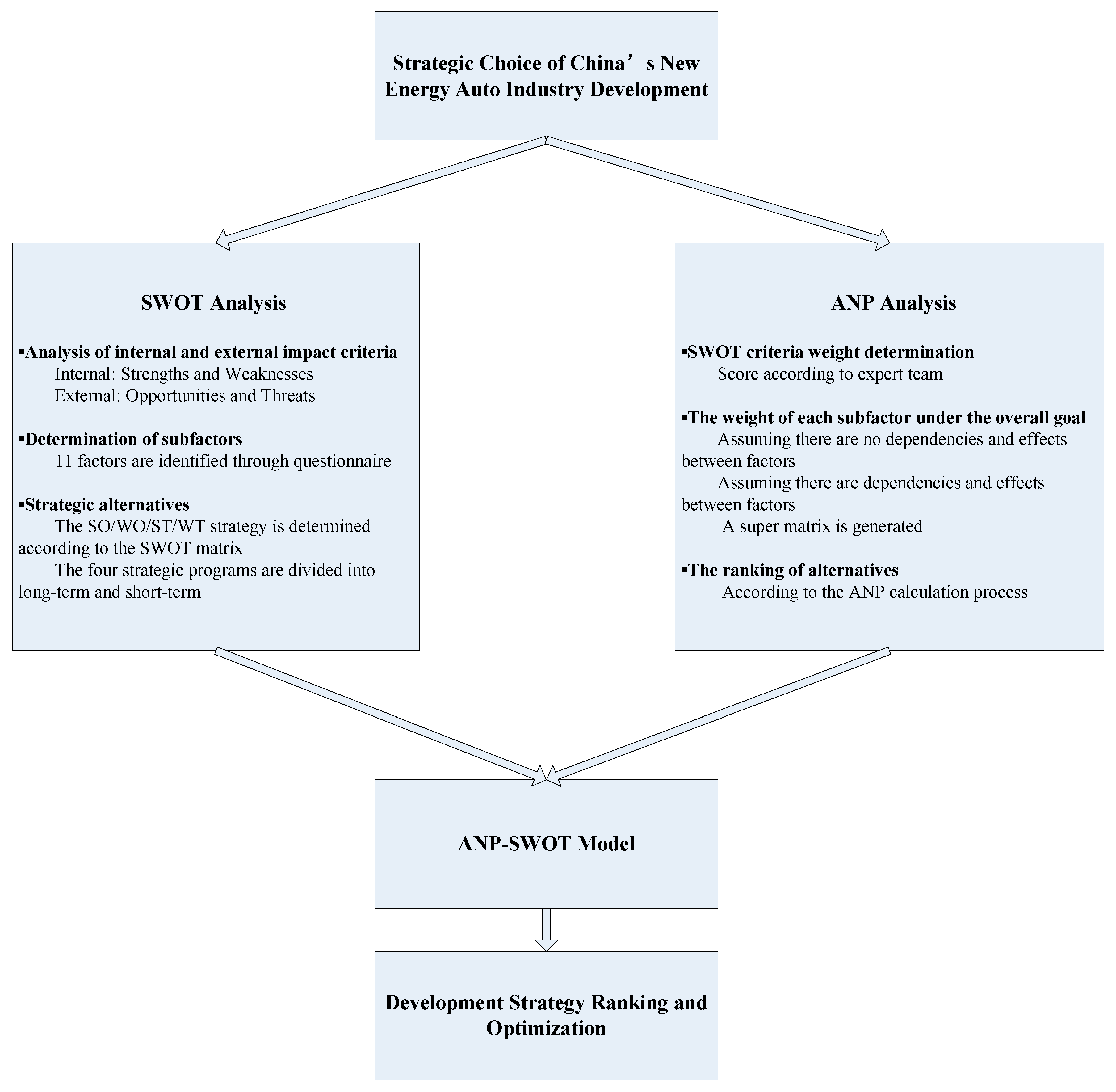

3.1. The Evaluation Criteria and Alternatives via SWOT

To more accurately and scientifically analyze the internal environment (strengths and weaknesses) and the external environment (opportunities and threats) of China’s new energy automotive industry, this paper builds an ANP-SWOT model to assess the development strategy of China’s new energy vehicle industry, and proposes Optimization options. We defer to experts within automotive-related areas such as the China Association of Automobile Manufacturers and the 2016 “New Energy Vehicles, Power Batteries and Key Materials Technology Summit” in this assessment.

The procedure to solve strategy selection problem is following: (1) 15 experts in China, who have extensive experiences in New Energy Vehicles, were invited to assist to identify 11 industry influencing factors and eight alternatives according to SWOT, The team of experts from Chery Automobile (three people), JAC (five people), China Association of Automobile Manufacturers (five people), Hefei University of Technology Automotive Institute (two people), the identification is based on two considerations: industry actual state and the existence; (2) 12 of these experts were further invited to assist to measure the weight through scoring survey. We collected experts’ suggestions and selected 11 influencing factors, which were what we discussed above, as criteria to evaluate leading industrial strategy selections; (3) consider the relationship between factors; (4) we used the ANP to calculate each alternative’s global weight and ultimately obtain the overall ranking of the strategies. Specific steps are as follows:

Step 1:

Screening of influencing factors. Using a questionnaire survey (questions of the questionnaire shown in

Appendix A), the expert team is evaluated and screened for the external (superiority, inferiority) and internal (opportunity, threat) impact factors relating to China’s new energy automobile industry.

Step 2:

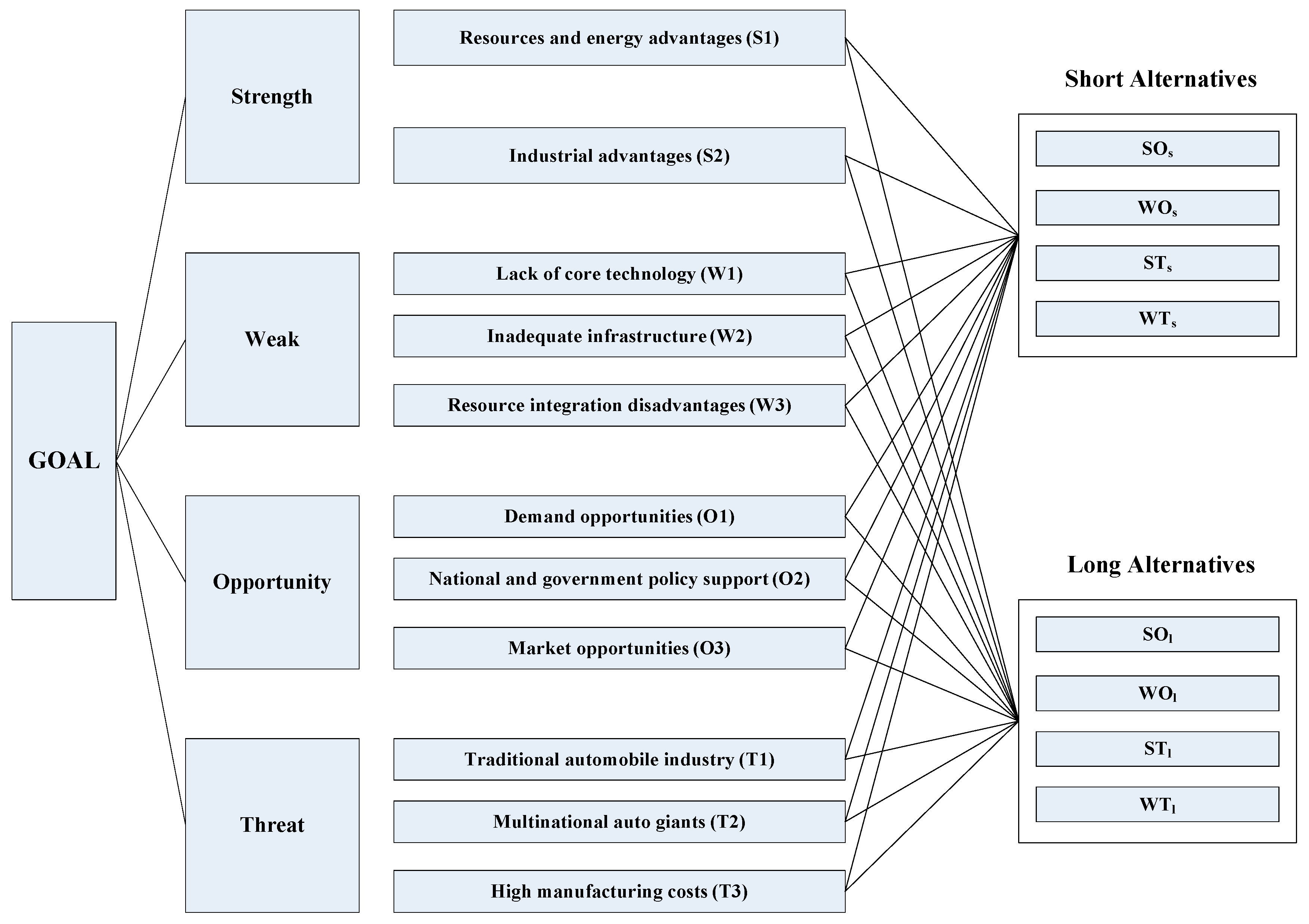

Determination of strategic alternatives. A panel discussion which used a scoring method further defined 11 sub-influencing factors within China’s new energy automotive industry, as shown in

Figure 3.

Simultaneously, four short-term and four long-term development strategies are presented using a combination of SO, ST, WO and WT.

Step 3:

Design the network hierarchy. Identification of the ideal strategy for development of China’s new energy automobile industry is the overall objective of the model ANP evaluation and four SWOT factors, which include the internal and external factors as the basis for the standard layer, and the SWOT matrix strategy options as the basis for the program layer. The framework for the development of China’s new energy automotive industry is proposed as a hierarchical structure, as shown in

Figure 4.

Step 4:

Evaluate the importance of the influencing factor set. To achieve this, the expert group used a scale of 1–9 to rank and provide a weighted value of four pairs of influential factors (the questionnaire single form is designed for pairwise comparison (See

Table 2)).

Taking into account the interplay between the criteria proposed by the panel and the dependencies (see

Figure 5), we identified a correlation between influencing factors in the evaluation of strategic alternatives.

Step 5:

Determine the relationship and importance of influencing factors. In this step, we first draw the relationship between internal and external factors, according to criteria determined by the expert team, as shown in

Figure 6.

Next, the expert team evaluates the relative importance of influencing factors, taking into account the dependence and feedback relationships between the factors, as well as the absence of dependency and feedback relationships.

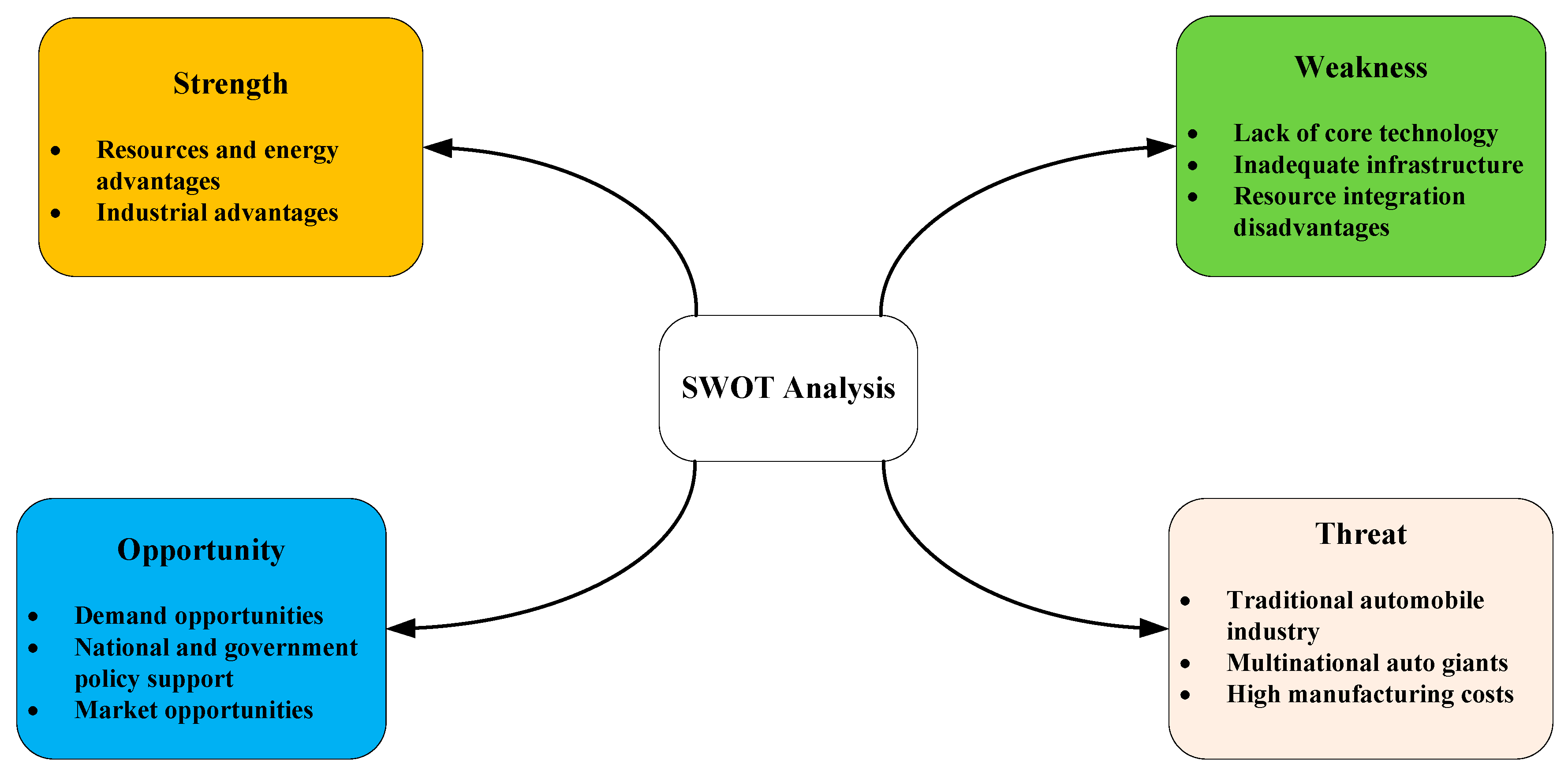

3.2. The SWOT Analysis and Strategy Formulation for the Development of China's New Energy Automobile Industry

3.2.1. Strength

Resources and Energy Advantages: In terms of natural resources advantages, China has a natural advantage, vast territory, rich in resources. The key components of new energy vehicles—batteries and motors and other raw materials required in China are extremely rich. Manganese, iron, vanadium, phosphorus, rare earth permanent magnet materials in China are rich resources. In addition, in the development of alternative fuel vehicles, alternative fuels are relatively adequate raw materials, such as coal resources in northwest China, natural gas resources in Sichuan, the central region of the rich biomass resources. In terms of energy advantages, China’s electricity is sufficient, the power installed capacity of 800 million kilowatts, for 4000–5000 million electric car charging. Electricity sources are very diverse and adequate, such as wind power, nuclear power and solar energy resource. These condition provide adequate resources and energy assurance for the development of new energy vehicles in China.

Industrial Advantages: In recent years, China’s electric bicycle and electric motorcycle industries have experienced a rapid development, which led to an advancement of core components such as batteries, drive motor and other related technologies. Presently, large-scale production and cost control measures have been established for these parts production systems. As such, a solid foundation has been created for new energy vehicles, which utilize similar technologies for power batteries, drive motor and other common technologies.

3.2.2. Weakness

The Key Technology is Weak, and the Core Technology is Insufficient: Compared with the world’s automobile industry, China has not had any breakthrough success with its core technology, which is still categorized at the “improved technology innovation” level. In addition, the independent innovation capability is weak in terms of battery, motor, electronic control and other core technologies which are still in need of more research and development.

Inadequate Infrastructure: At present, China’s facilities dedicated to new energy vehicles are relatively small and cannot support the demand for new energy automotive development, which is an important factor that impacts this industry.

Resource Integration Disadvantages: Although China has entered the new energy automotive industry, its fragmented enterprises lead to resource dispersion, in which China cannot form any short-term technical breakthrough. Low-level repetitive R&D occupies many resources. Research institutes and industry associations cannot participate in these studies. China struggles to find ways to integrate and optimize the allocation of resources.

3.2.3. Opportunity

Demand Opportunities: Rising oil prices, increasing motor vehicle pollution and other serious energy and emissions problems facilitate the need for new energy vehicle development.

National and Governmental Policy Support: The state is implementing policies which support the development of the new energy automotive industry. Local governments have also introduced relative local incentives to encourage local automobile companies to produce new energy vehicles.

Market Opportunities: Given China’s market diversification, the development potential for new energy vehicles is enormous. China’s economic development varies by region, with different income levels at various locations. These factors give rise to a diversified and differentiated demand, which will determine different prices, features and other needs, to accommodate such diverse consumer characteristics. The presence of specific consumer groups will influence the promotion of and need for new energy automotive products.

3.2.4. Threat

Traditional Automobile Industry: China’s traditional automobile industry is currently in a rapid growth period, in which the industry profit margins are high. As such, there is little incentive for automobile companies to produce new energy vehicles.

Multinational Auto Giants: Multinational automobile companies are in the mature phases of new energy vehicle development, with many having launched these products to achieve high-volume sales. Toyota, GM, Volkswagen and other auto giants have already established sales of new energy vehicles in China. One example of a successful new energy vehicle is the Toyota Prius hybrid which has achieved cumulative sales of more than 1.5 million worldwide. In contrast, China has not yet established any large-scale sales of new energy vehicles.

High Manufacturing Costs: Factors such as car pre-research funding and small-volume production increase the cost of new energy vehicles. Therefore, there is no price advantage to the production of these vehicles.

Based on the above SWOT analysis of China’s new energy automotive industry and the assessment provided by the expert team, there are four proposed strategies, namely the SO, WO, ST and WT strategies. In considering the best development strategy for the new energy automotive industry, it is important to consider the long-term sustainable development of the industry as well as the short-term strategy. New energy vehicles in China are still in the early stages of development and must go through a process that provides a realistic approach to each stage of the strategy, which is geared towards a long-term sustainable development process. Production needs must be fulfilled using short-term development strategies that play a crucial role in the ability of this industry to achieve and guarantee long-term sustainability. Throughout this paper these four types of strategies are divided into long-term and short-term strategies. Specific strategies are as follows:

Making use of the Chinese New Vehicle Industry’s strength and opportunity to develop its short-term and long-term strategy to enhance the Chinese New Vehicle Industry’s development:

: The new energy industry market segments and the use of industrial advantages give priority to the development of a new market segment of the energy vehicles;

: New energy vehicle policies support the use of resources, which actively develop core components.

Making use of the Chinese New Vehicle Industry’s opportunity and overcoming the weakness to develop its short-term and long-term strategy to enhance the Chinese New Vehicle Industry’s development:

: Accelerate the construction of facilities dedicated to the production of new energy vehicles;

: In accordance with national policy, integrate resources to focus on technology research and development.

Making use of the Chinese New Vehicle Industry’s strength and defend against its threat to develop its short-term and long-term strategy to enhance the Chinese New Vehicle Industry’s development:

: Make full use of resources to increase scientific research;

: Make use of local industry advantages, including cost control, etc., to enhance the competitiveness of the local new energy automotive industry.

Reducing the Chinese New Vehicle Industry’s weakness, avoid the threat to develop its short-term and long-term strategy to enhance the Chinese New Vehicle Industry’s development:

: Increase the construction and investment infrastructure;

: Formulate a technological innovation platform to strengthen research and development efforts. Strive to advance the core components, comparable to international standards of technology.

3.3. Analysis and Evaluation of Long-Term Development Strategies for China’s New Energy Auto Industry

In accordance with the evaluation of the four influencing factors of the new energy automobile industry in China, we first form a pair wise comparison matrix, and then calculate the weighted value of each factor to set and judge the consistency ratio (

CR) of the matrix.

Table 3 shows the SWOT factor comparison results.

The weighting matrix of the SWOT factor at this time:

Then, we assume that there are no dependencies and feedback relationships among the influencing factors. According to the scoring results of the expert team in step 5, the comparison matrix of the influence factors and the weighted values are shown in

Table 4.

We then consider the SWOT internal dependency matrix with four factor sets as the criterion, as shown in

Appendix B. We obtain a matrix:

The weight of the interdependent SWOT factor (

) is calculated by multiplying the dependency matrix (

) and the SWOT factor weight matrix (

):

At this point, we can obtain the weighted value of the influencing factors using the hypothesis condition shown in

Table 5.

The dependence and feedback relationship gives the internal and external factors and the correlation between the two pairs of the comparison matrix (see

Appendix C). The resulting relative importance weights are used to produce the unweighted hyper-matrices (see

Appendix C).

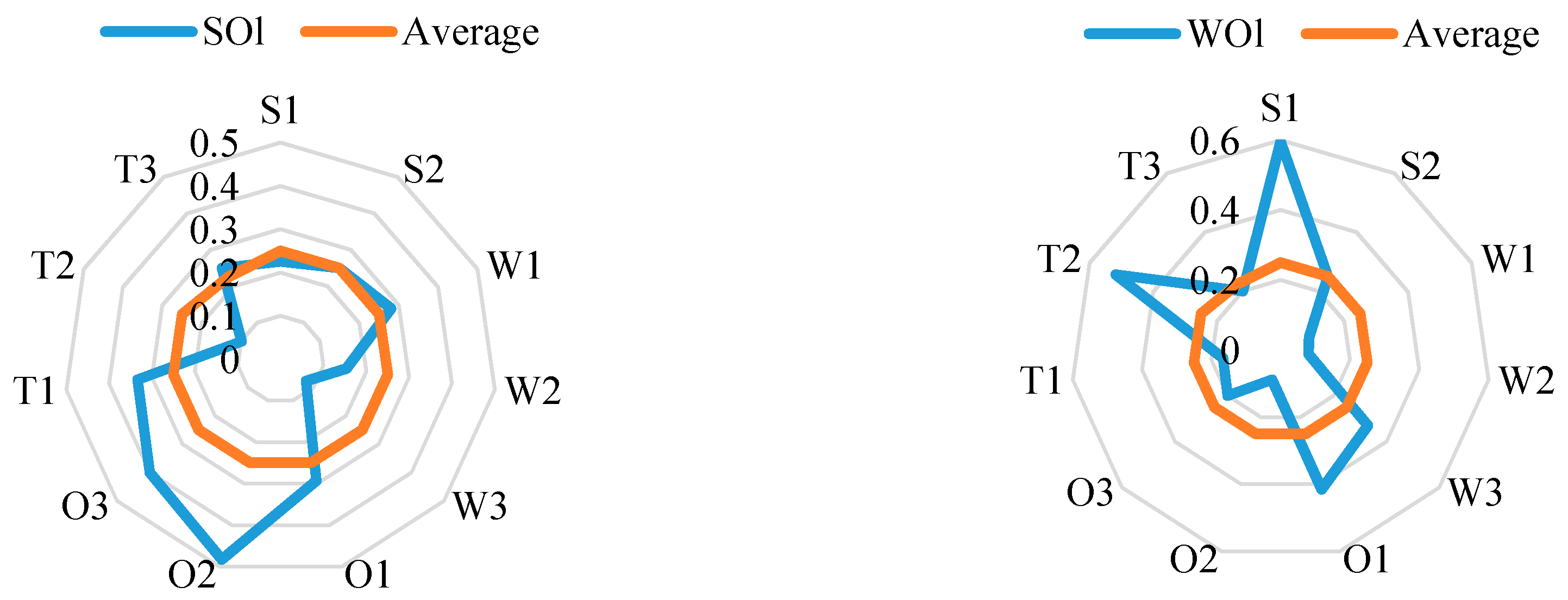

Here, we see the resulting 11 internal and external factors affecting the weight:

According to our survey results we see that the most influential factor in the development of the new energy automotive industry in China is the “

National and government support (

O2: 0.1777)”, where the state has developed various preferential policies and subsidies to develop the new energy automotive industry. China’s recent two years of increased development in this industry is attributed to these important achievements. This is consistent with the notion of Mazzucato (2013), who maintains that major innovations only occur with government support [

37]. The second most influential factor is the “

Demand opportunity (

O1: 0.1185)”, while the dominant “

Industrial advantages (

S2: 0.1064)” factor has a greater impact on Chinas new energy automotive industry. “

Inadequate infrastructure (

W2: 0.1275)”, “

Resource integration (

W3: 0.0940)” and “

Traditional automobile industry (

T1: 0.0636)” factors are detrimental to the development of China’s new energy vehicle industry. Therefore, we should make the best use of China’s own energy, resource and industrial advantages, using a rational integration of resources and optimization strategy, and consider risk aversion to ensure a more comprehensive and safe development of China’s new energy automotive industry.

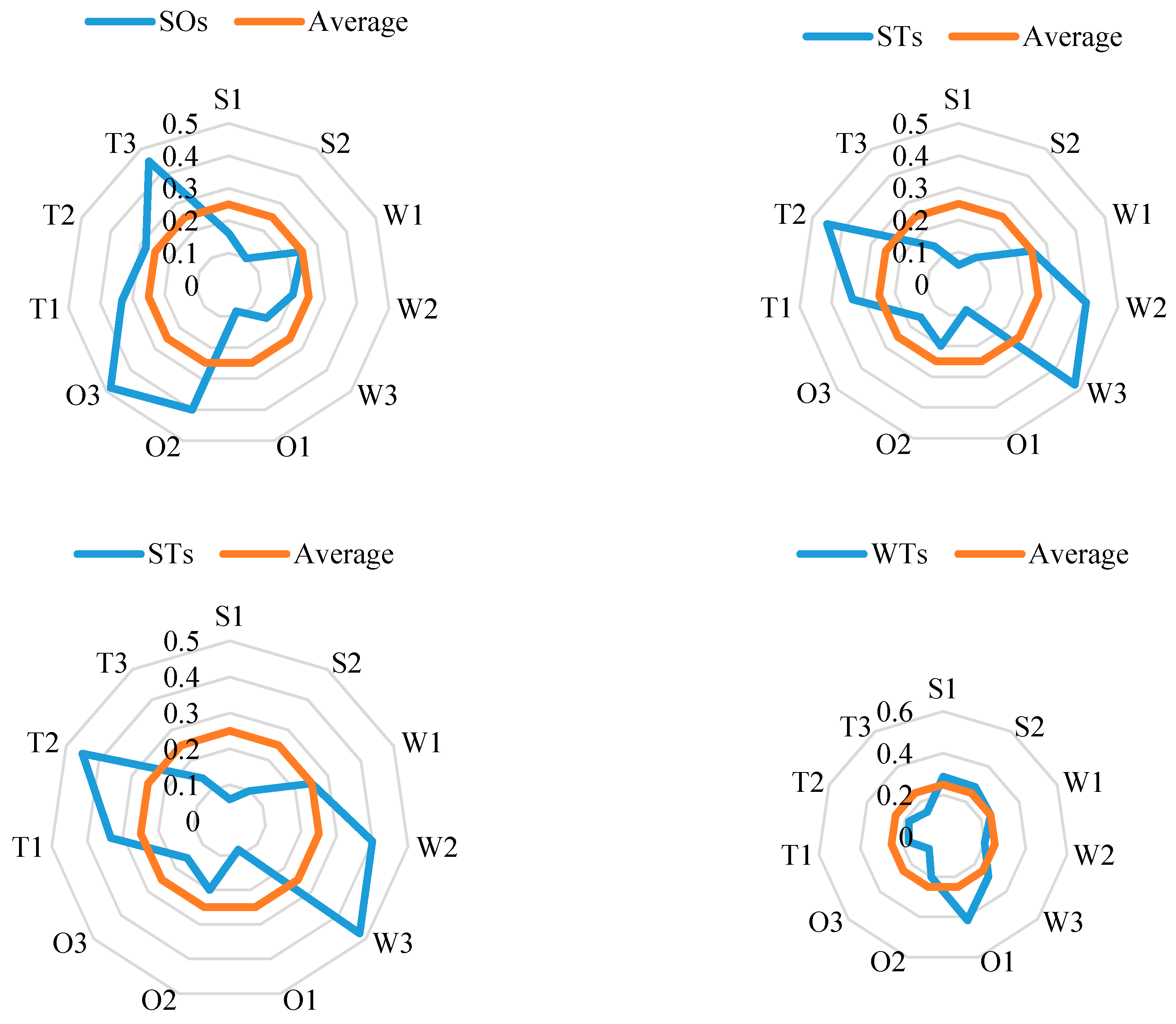

The following strategy options evaluate the development of China’s new energy automotive industry. First, four long-term development strategies are evaluated with each influencing factor as a criterion. See

Appendix D for details. Thus we can get the weighted matrix of each factor under the ANP analysis for each long-term development program (as shown in

Table 6).

The weighted matrix of the alternatives under each influencing factor provides various weights to alternatives:

The weight and final ranking of China’s new energy vehicle industry long-term development strategy, as shown in

Table 7.

In

Table 7, which shows the final weighted value and ranking of the

strategy, it is evident that the use of local advantages enhance the competitiveness of the industry through cost control, and serves as the best long-term development strategy. Creation of core competences is fundamental to the advancement of the new energy automotive industry. A quote which applies to the overall importance of future development is, “To forge iron, one must be strong”. The use of new energy vehicles in China will help to enhance competitiveness within the international automotive industry. The results of the strategic comparison are shown in

Figure 7.

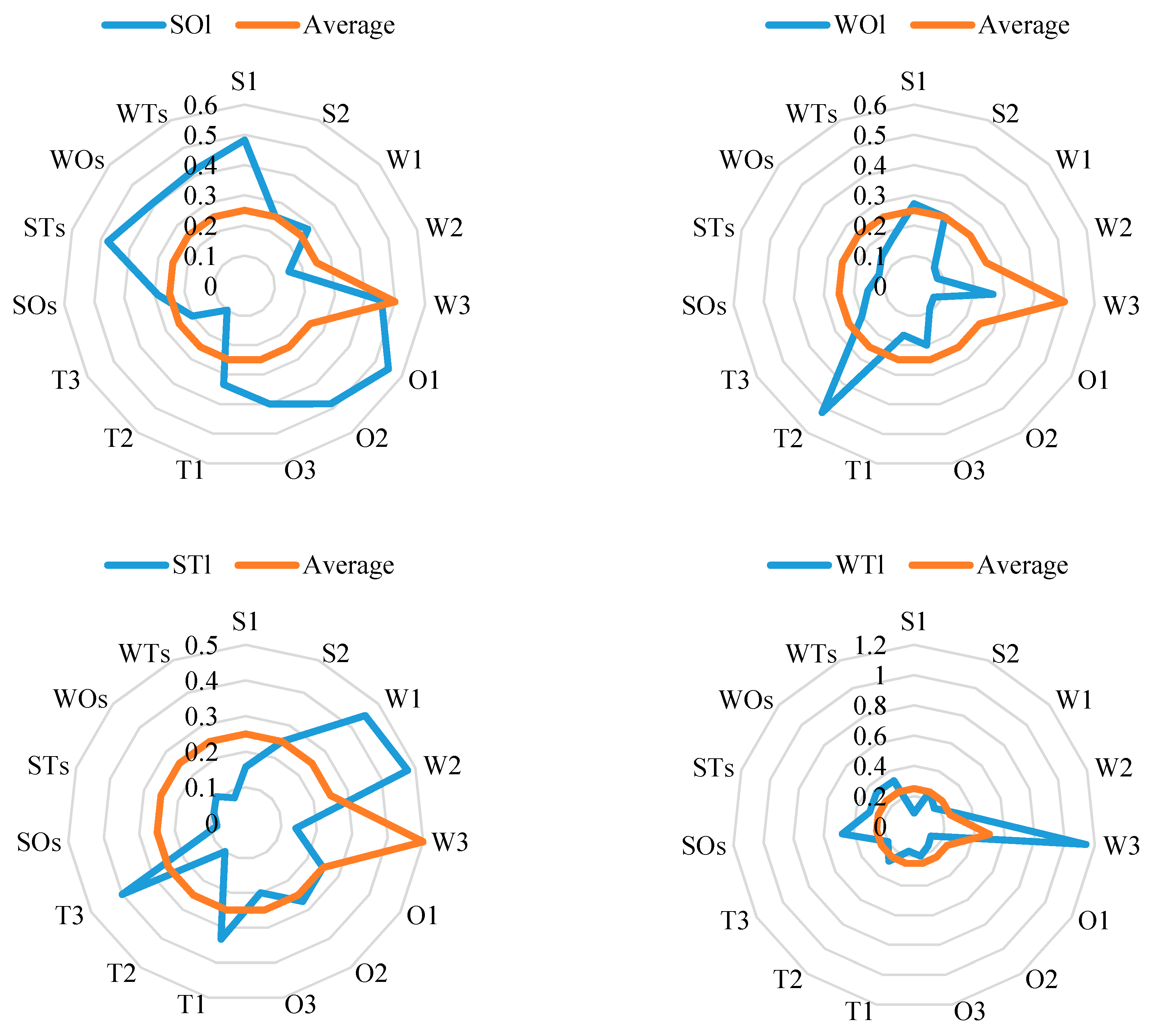

3.4. Analysis and Evaluation of Short-Term Development Strategies for China’s New Energy Auto Industry

The four short-term development strategies are evaluated with each influencing factor as the criterion (See

Appendix E for details). Thus, we can get the weighted values using a matrix of each factor under the ANP analysis for each short-term development program (as shown in

Table 8).

Using the weighting matrix of the alternatives under each influencing factor, the weights to alternatives are as follows:

For the short-term development strategy to China’s new energy automotive industry see

Table 9 for weights and final rankings.

When not considering the relationship between the species strategy from the evaluation results, and the WOs strategy, the optimal short-term development strategy is to avoid disadvantages and accelerate the construction of facilities designated for new energy vehicles.

Short-term development strategies are very important, as China’s new energy automotive industry is in the early stages of rapid development. Such strategies can transition into essential long-term development strategies. Infrastructure construction is crucial to the development of new energy vehicles such as pure electric vehicles and rechargeable hybrid vehicles that must rely on charging network coverage.

This strategy should be given priority, as it is important to the early developmental stages of the new energy automotive industry. The results of the strategic comparison are shown in

Figure 8.

3.5. Outcomes and Considerations for the Impact of Short-Term Strategy on Long-Term Strategy

In the above analysis, we assume that there is no relationship between long-term development strategies and short-term development strategies. However, to some extent the long-term development strategy will be affected by the short-term development strategy. We will consider the impact short-term development strategy has on the long-term strategic ranking to ensure the sustainable development of China’s new energy automotive industry. This mutual influence relationship is shown in

Figure 9.

Taking into account the impact of short-term developmental strategies, we use four short-term development strategies as the criterion, and the four sustainable development strategies to evaluate the impact. See

Appendix F.

Table 10 shows this impact.

The weights of the alternatives under the influence of the short-term development strategy are obtained by using the weight formation matrix of alternatives:

Consider the impact of short-term development strategy on the long-term development strategy using the weights and the final ranking in

Table 11.

The evaluation results show that the strategy, which is the new energy automotive industry “market segmentation” strategy, gives priority to the use of industrial advantages for the development of a market segment of new energy vehicles and is therefore the best long-term development strategy.

The final ranking of importance changes, taking into account the impact of short-term development strategies on long-term development strategies, shown in

Table 12.

This change in long-term development strategy results from factors that affect long-term development strategy, the short-term development strategy to take into account, the four long-term development strategy to join, the impact of strategic factors on the impact of options. Here, we see the weighted values have changed. The results of the strategic comparison are shown in

Figure 10.