A Unified Trading Model Based on Robust Optimization for Day-Ahead and Real-Time Markets with Wind Power Integration

Abstract

:1. Introduction

- (1)

- A unified trading model of the day-ahead and real-time markets based on robust optimization is described considering the uncertainty of the load, wind power, and real-time market price, where the hourly purchase power is regarded as an optimized variable instead of forecast in the day-ahead market.

- (2)

- The static character of the quantum-behaved particle swarm algorithm (QPSO) is analyzed to show its limitations in solving the problem and an improved QPSO algorithm (IQPSO) is presented.

- (3)

- In order to demonstrate the superiority of the robust unified trading model, we compare it with a separate trading scheme in the day-ahead and real-time markets. Additionally, an analysis is conducted to examine the impacts of several key influencing factors on the trading results, including the robust coefficient, forecast accuracy of wind power, load, and real-time market price.

2. Scheme of Unified Trading with Wind Power

3. Model of Unified Trading

3.1. Objective Function

3.2. Constraints

4. Solving the Model: IQPSO

4.1. QPSO Introduction

4.2. IQPSO

- (1)

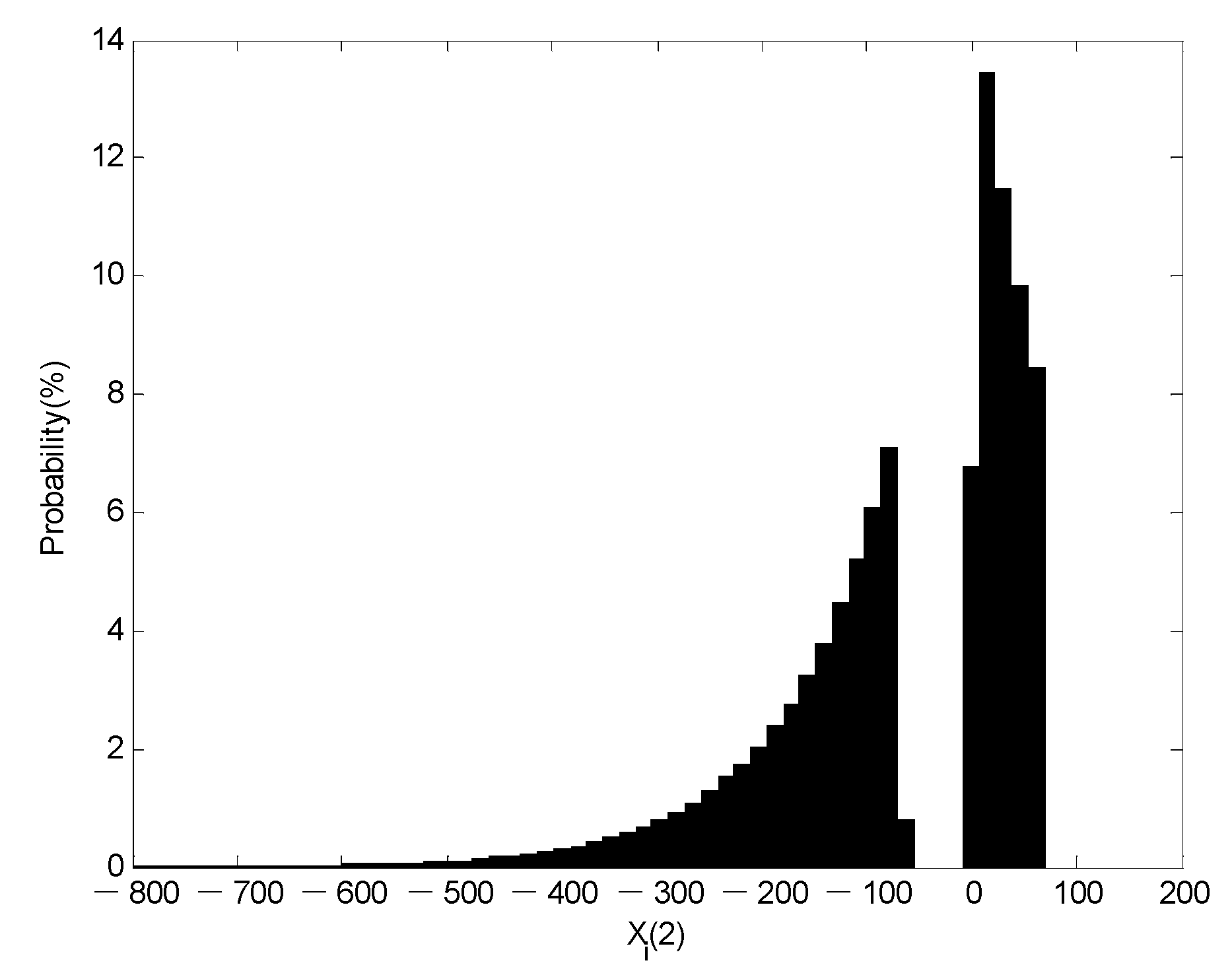

- The upward search ability of QPSO is limited because the probability of Xi(2) > 70 is zero. Meanwhile, the downward search ability of QPSO is limited because the probability of −70 < Xi(2) < 0 is zero. There are dead-band searching problems for QPSO and the dead zones vary with the number of iterations.

- (2)

- There is a higher convergence speed when the optimal solution is close to the lower boundary because the static character of QPSO is asymmetric on both sides of Pi and there is a lower convergence speed when the optimal solution is close to the upper boundary.

- (3)

- There are different dead zones for every iteration and a particle needs at least two iterations in order to search the dead-band space, which reduces the search ability and increases the number of iterations when the optimal solution is in the dead-band space.

- (1)

- There is no dead zone.

- (2)

- It is symmetric on both sides of Pi.

- (3)

- There is higher search probability in the neighborhood of Pi to guarantee the local search ability, and there is a certain search probability even if the space is far away from Pi to guarantee the global search ability by mutating.

4.3. Programming of IQPSO

- (1)

- Some parameters are set such as ε, maxgen, M, and βz.

- (2)

- The population with the dimensions of Nt × Nj is initialized.

- (3)

- h is set equal to 1.

- (4)

- The fitness value CU(i) of particle i is calculated, according to Equation (25).

- (5)

- The best previous personal position Pbesti and the best personal fitness value fPbesti of particle i are obtained, and the global best position Gbest and the global best fitness value fGbest are obtained.

- (6)

- If max[CU(i)] − min[CU(i)] < ε or h = maxgen, it proceeds to step (11), otherwise to step (7).

- (7)

- Pi and mbest are calculated according to Equations (42) and (43).

- (8)

- α is calculated according to Equation (45).

- (9)

- The position of particle i is updated according to Equation (44).

- (10)

- h = h + 1, and then it proceeds to step (4).

- (11)

- The global best position Gbest and the global best fitness value fGbest are obtained.

5. Case Studies

5.1. Test System Data

5.2. Algorithm Comparison

5.3. Comparison of Purchase Power in the Day-Ahead Market for the Unified and Separate Trading

5.4. Impact Analysis of Price Forecast in the Real-Time Market

5.5. Impact of σr, Γ, er

6. Conclusions

- The unified trading model based on robust optimization can optimize the purchase power in the day-ahead market and reduce the total cost for the two markets, which shows it is superior to the separate trading model due to large-scale wind power connected into the power systems.

- It is proven that the IQPSO has a higher convergence speed and stronger global search ability when compared with the standard QPSO.

- ♦

- The strategy of purchasing power in the day-ahead market is directly affected by the real-time price. The optimized purchase power will increase in the day-ahead market with higher purchase power prices and lower sale power prices in the real-time market and vice versa.

- ♦

- The unified trading model is superior when the power forecast errors become greater.

- ♦

- The lower the accuracy of the real-time market prices forecast, the worse the economic environment of the real-time market is. This reduces the economic efficiency of the unified trading model because the purchase strategy in the day-ahead market is more conservative.

- ♦

- The economic efficiency of the unified trading model is degraded when the confidence level is higher with the increase of the uncertain operator Γ. We can use the rational value of Γ to improve the economic efficiency as much as possible, following the requirement of the confidence level.

Author Contributions

Conflicts of Interest

Nomenclature

| Indices | |

| t Index of time periods | Running from 1 to Nt, 1 h for every time period |

| j Index of dispatchable generators | Running from 1 to Nj |

| l Index of line | Running from 1 to L |

| m, n | Index of bus of line l |

| Decision Variables | |

| (t) | Optimized purchase power at time t in the day-ahead market |

| Pj(t) | Power purchase schedule for dispatchable generator j at time t in the day-ahead market |

| (t)/(t) | Upward/downward regulating power for generator j at time t in the real-time market |

| Other Variables | |

| Load forecast error at time t in the day-ahead market | |

| Wind power forecast error at time t in the day-ahead market | |

| / | Real load/real wind power at time t |

| / | Load forecast/wind power forecast standard deviation at time t in the day-ahead market |

| / | Load forecast/wind power forecast at time t in the day-ahead market |

| Imbalance power at time t in the real-time market | |

| (t) | Purchase power forecast at time t in the day-ahead market |

| CD | Purchase cost in the day-ahead market |

| Day-ahead market clearing price at time t | |

| / | Revenue/purchase cost in the real-time market |

| / | Purchase power/sale power price at time t in the real-time market |

| ΔPr(t)+/ΔPr(t)− | Power shortage/power surplus expectation at time t in the real-time market |

| β+(t)/β−(t) | Probability of ‘upward regulation’/‘downward regulation’ at time t in the real-time market |

| Difference between purchase power forecast and the optimized purchase power at time t | |

| Imbalance power standard deviation in the unified trading scheme at time t | |

| Total cost of the unified trading | |

| z = z+(t), z−(t) | Random variables in [–1, 1] |

| μz | Mean value of interval variables z+(t) and z−(t) |

| σz | Standard deviation of interval variables z+(t) and z−(t) |

| Vm/Vn | Voltage magnitudes at bus m/bus n of line l |

| θmn | Difference of voltage phase-angle between at bus m and bus n of line l |

| μ(h) | Random variable for the hth iteration in [0, 1] |

| Xi(h) | Position of particle i for the hth iteration |

| Pi | Center of the potential well |

| h | Number of current iterations |

| Random variable in [0, 1] | |

| mbest | Central position of personal best positions |

| Pbesti | Personal best position of particle i |

| Gbest | Global best position |

| Stochastic variable with standard normal distribution | |

| Constants and Parameters | |

| er | Deviation ratio to the expected price in the real-time market |

| / | Deviation from the expected price at time t in the real-time market |

| / | Purchase power/sale power expected price at time t in the real-time market |

| Γ | Degree of uncertainty for random variables |

| J | Number of interval variables z+(t) and z−(t) |

| / | Minimum/maximum capacity of the dispatchable generator j |

| / | Ramp down/up rate limit of the generator j |

| Upper limit for power flow of line l | |

| gmn/bmn | Conductance/susceptance of line l |

| M | Population size |

| α | Contraction-Expansion Coefficient |

| ε | Convergence accuracy |

| βz | Interval confidence level |

| maxgen | Maximum number of iterations |

| aj(t), bj(t) | Thermal generators’ quotation parameters of generator j at time t |

References

- Aparicio, N.; MacGill, I.; Abbad, J.R.; Beltran, H. Comparison of wind energy support policy and electricity market design in Europe, the United States, and Australia. IEEE Trans. Sustain. Energy 2012, 3, 809–818. [Google Scholar] [CrossRef]

- Martín, S.; Smeers, Y.; Aguado, J.A. A stochastic two settlement equilibrium model for electricity markets with wind generation. IEEE Trans. Power Syst. 2015, 30, 1–13. [Google Scholar] [CrossRef]

- Abbaspourtorbati, F.; Conejo, A.; Wang, J.; Cherkaoui, R. Pricing electricity through a stochastic non-convex market-clearing model. IEEE Trans. Power Syst. 2017, 32, 1248–1259. [Google Scholar] [CrossRef]

- Gil, H.A.; Lin, J. Wind power and electricity prices at the PJM market. IEEE Trans. Power Syst. 2013, 28, 3945–3953. [Google Scholar] [CrossRef]

- Yousefi, A.; Iu, H.H.C.; Fernando, T.; Trinh, H. An approach for wind power integration using demand side resources. IEEE Trans. Sustain. Energy 2013, 4, 917–924. [Google Scholar] [CrossRef]

- Papavasiliou, A.; Oren, S.S. Large-scale integration of deferrable demand and renewable energy sources. IEEE Trans. Power Syst. 2014, 29, 489–499. [Google Scholar] [CrossRef]

- Khodayar, M.E.; Manshadi, S.D.; Wu, H.; Lin, J. Multiple period ramping processes in day-Ahead electricity markets. IEEE Trans. Sustain. Energy 2016, 7, 1634–1645. [Google Scholar] [CrossRef]

- Wu, H.; Shahidehpour, M.; Li, Z.; Tian, W. Chance-constrained day-ahead scheduling in stochastic power system operation. IEEE Trans. Power Syst. 2014, 29, 1583–1591. [Google Scholar] [CrossRef]

- Hu, B.; Wu, L.; Marwali, M. On the robust solution to SCUC with load and wind uncertainty correlations. IEEE Trans. Power Syst. 2014, 29, 2952–2964. [Google Scholar] [CrossRef]

- Yuewen, J.; Buying, W. Real-time market dispatch based on ultra-short-term forecast error of wind power. Electr. Power Autom. Equip. 2015, 35, 12–17. (In Chinese) [Google Scholar]

- Wang, Q.; Zhang, C.; Ding, Y.; Xydis, G.; Wang, J.; Østergaard, J. Review of real-time electricity markets for integrating distributed energy resources and demand response. Appl. Energy 2015, 138, 695–706. [Google Scholar] [CrossRef]

- Farahmand, H.; Aigner, T.; Doorman, G.L.; Korpas, M.; Huertas-Hernando, D. Balancing market integration in the Northern European continent: A 2030 case study. IEEE Trans. Sustain. Energy 2012, 3, 918–930. [Google Scholar] [CrossRef]

- Dai, T.; Qiao, W. Optimal bidding strategy of a strategic wind power producer in the short-term market. IEEE Trans. Sustain. Energy 2015, 6, 207–219. [Google Scholar] [CrossRef]

- Liu, G.; Xu, Y.; Tomsovic, K. Bidding strategy for microgrid in day-ahead market based on hybrid stochastic/robust optimization. IEEE Trans. Smart Grid 2016, 7, 227–237. [Google Scholar] [CrossRef]

- Reddy, S.S.; Bijwe, P.R.; Abhyankar, A.R. Optimal posturing in day-ahead market clearing for uncertainties considering anticipated real-time adjustment costs. IEEE Syst. J. 2015, 9, 177–190. [Google Scholar] [CrossRef]

- Bai, H.; Miao, S.; Ran, X.; Ye, X. Optimal dispatch strategy of a virtual power plant containing battery switch stations in a unified electricity market. Energies 2015, 8, 2268–2289. [Google Scholar] [CrossRef]

- Conejo, A.J.; Morales, J.M.; Martinez, J.A. Tools for the analysis and design of distributed resources-part III: Market studies. IEEE Trans. Power Deliv. 2011, 16, 1663–1670. [Google Scholar] [CrossRef]

- Fanzeres, B.; Street, A.; Barroso, L.A. Contracting strategies for renewable generators: A hybrid stochastic and robust optimization approach. IEEE Trans. Power Syst. 2015, 30, 1825–1837. [Google Scholar] [CrossRef]

- Baughman, M.L.; Lee, W.W. A Monte Carlo model for calculating spot market prices of electricity. IEEE Trans. Power Syst. 1992, 7, 584–590. [Google Scholar] [CrossRef]

- Bertsimas, D.; Litvinov, E.; Sun, X.A.; Zhao, J.; Zheng, T. Adaptive robust optimization for the security constrained unit commitment problem. IEEE Trans. Power Syst. 2013, 28, 52–63. [Google Scholar] [CrossRef]

- Wu, L.; Shahidehpour, M.; Li, Z. Comparison of scenario-based and interval optimization approaches to stochastic SCUC. IEEE Trans. Power Syst. 2012, 27, 913–921. [Google Scholar] [CrossRef]

- Bo, R.; Li, F. Impact of load forecast uncertainty on LMP. In Proceedings of the 2009 Power Systems Conference and Exposition, Seattle, WA, USA, 15–18 March 2009; pp. 1–6. [Google Scholar]

- Doherty, R.; O’Malley, M. A new approach to quantify reserve demand in systems with significant installed wind capacity. IEEE Trans. Power Syst. 2005, 20, 587–595. [Google Scholar] [CrossRef]

- Bertsimas, D.; Sim, M. The price of robustness. Oper. Res. 2004, 52, 35–53. [Google Scholar] [CrossRef]

- Vlachogiannis, J.G.; Lee, K.Y. A comparative study on particle swarm optimization for optimal steady-state performance of power systems. IEEE Trans. Power Syst. 2006, 21, 1718–1728. [Google Scholar] [CrossRef]

- Meng, K.; Wang, H.G.; Dong, Z.Y.; Wong, K.P. Quantum-inspired particle swarm optimization for valve-point economic load dispatch. IEEE Trans. Power Syst. 2010, 25, 215–222. [Google Scholar] [CrossRef]

- Sun, J.; Feng, B.; Xu, W. Particle swarm optimization with particles having quantum behavior. In Proceedings of the 2004 Congress on Evolutionary Computation, Portland, OR, USA, 19–23 June 2004; Volume 1, pp. 325–331. [Google Scholar]

- Huang, W.Y.; Xu, X.J.; Pan, X.B.; Sun, Y.J.; Li, S. Control strategy of contraction-expansion coefficient in quantum-behaved particle swarm optimization. Appl. Res. Comput. 2016, 33, 2592–2595. (In Chinese) [Google Scholar]

- Zhao, L.; Zeng, B. Robust unit commitment problem with demand response and wind energy. In Proceedings of the 2012 IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 22–26 July 2012; pp. 1–8. [Google Scholar]

| Generator Bus | 1 | 2 | 5 | 8 | 11 | 13 |

|---|---|---|---|---|---|---|

| Maximum capacity (MW) | 200 | 80 | 50 | 35 | 30 | 40 |

| Minimum capacity (MW) | 80 | 30 | 15 | 10 | 12 | 18 |

| Algorithms | Optimal Total Cost ($) | The Number of Iterations |

|---|---|---|

| QPSO | 4.260 × 105 | 2000 |

| IQPSO | 4.064 × 105 | 1447 |

| Hour | UT BUS1 | ST BUS1 | UT BUS2 | ST BUS2 | UT BUS5 | ST BUS5 | UT BUS8 | ST BUS8 | UT BUS 11 | ST BUS 11 | UT BUS 13 | ST BUS 13 | UT TOTAL | ST TOTAL |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 89.62 | 87.74 | 68.94 | 70.32 | 49.81 | 49.60 | 27.13 | 34.76 | 29.91 | 28.08 | 18.00 | 18.00 | 283.4 | 288.5 |

| 2 | 87.94 | 89.28 | 79.97 | 55.10 | 25.84 | 36.25 | 26.23 | 33.83 | 16.48 | 27.34 | 18.00 | 18.00 | 254.5 | 259.8 |

| 3 | 86.18 | 85.61 | 32.21 | 78.91 | 49.54 | 15.20 | 21.72 | 13.89 | 28.60 | 29.99 | 18.00 | 18.00 | 236.3 | 241.6 |

| 4 | 87.03 | 91.76 | 30.01 | 30.28 | 49.56 | 46.20 | 29.59 | 34.99 | 14.73 | 13.27 | 18.00 | 18.00 | 228.9 | 234.5 |

| 5 | 84.74 | 86.62 | 35.16 | 35.44 | 49.21 | 34.63 | 12.05 | 34.21 | 29.80 | 25.50 | 18.00 | 18.00 | 229.0 | 234.4 |

| 6 | 83.85 | 82.08 | 41.64 | 53.72 | 47.89 | 23.88 | 14.84 | 34.45 | 29.88 | 29.77 | 18.00 | 18.00 | 236.1 | 241.9 |

| 7 | 87.96 | 87.28 | 56.77 | 44.73 | 46.78 | 48.92 | 12.08 | 27.79 | 17.19 | 18.17 | 18.01 | 18.00 | 238.8 | 244.9 |

| 8 | 93.44 | 95.08 | 54.14 | 74.06 | 43.56 | 37.90 | 32.94 | 12.15 | 17.03 | 28.51 | 18.00 | 18.00 | 259.1 | 265.7 |

| 9 | 91.07 | 99.72 | 77.47 | 77.36 | 45.58 | 47.72 | 32.30 | 33.78 | 29.96 | 24.92 | 18.01 | 18.00 | 294.4 | 301.5 |

| 10 | 104.1 | 107.8 | 79.89 | 80.00 | 49.99 | 50.00 | 35.00 | 35.00 | 29.99 | 29.99 | 19.11 | 23.28 | 318.0 | 326.1 |

| 11 | 116.6 | 120.6 | 79.66 | 80.00 | 49.98 | 50.00 | 35.00 | 35.00 | 29.84 | 30.00 | 26.06 | 30.56 | 337.2 | 346.2 |

| 12 | 119.9 | 124.1 | 80.00 | 80.00 | 50.00 | 50.00 | 34.98 | 35.00 | 29.76 | 30.00 | 29.74 | 34.46 | 344.4 | 353.6 |

| 13 | 124.5 | 127.7 | 79.81 | 80.00 | 50.00 | 50.00 | 34.85 | 35.00 | 29.98 | 30.00 | 34.90 | 38.47 | 354.1 | 361.2 |

| 14 | 110.4 | 114.3 | 79.99 | 80.00 | 49.96 | 50.00 | 34.98 | 35.00 | 29.94 | 30.00 | 19.05 | 23.43 | 324.3 | 332.7 |

| 15 | 98.76 | 96.35 | 79.91 | 79.98 | 49.88 | 48.55 | 27.40 | 34.74 | 27.44 | 29.38 | 18.00 | 18.00 | 301.4 | 307.0 |

| 16 | 101.9 | 105.4 | 79.99 | 80.00 | 49.57 | 50.00 | 34.40 | 35.00 | 29.92 | 30.00 | 18.00 | 20.65 | 313.8 | 321.1 |

| 17 | 106.2 | 111.8 | 79.98 | 80.00 | 50.00 | 50.00 | 34.94 | 35.00 | 29.97 | 30.00 | 27.52 | 33.70 | 328.5 | 340.5 |

| 18 | 109.6 | 115.6 | 79.98 | 80.00 | 49.95 | 50.00 | 34.86 | 35.00 | 29.99 | 30.00 | 31.28 | 37.89 | 335.7 | 348.5 |

| 19 | 114.0 | 120.6 | 79.99 | 80.00 | 49.98 | 50.00 | 34.98 | 35.00 | 29.99 | 30.00 | 36.06 | 40.00 | 344.9 | 355.6 |

| 20 | 127.7 | 139.4 | 79.99 | 80.00 | 50.00 | 50.00 | 34.99 | 35.00 | 29.98 | 30.00 | 38.46 | 40.00 | 361.1 | 374.4 |

| 21 | 129.5 | 144.3 | 80.00 | 80.00 | 50.00 | 50.00 | 35.00 | 35.00 | 30.00 | 30.00 | 39.97 | 40.00 | 364.5 | 379.3 |

| 22 | 121.3 | 124.0 | 79.97 | 80.00 | 49.99 | 50.00 | 34.88 | 35.00 | 28.62 | 30.00 | 31.23 | 34.30 | 346.0 | 353.3 |

| 23 | 100.9 | 104.2 | 79.97 | 80.00 | 49.82 | 50.00 | 33.86 | 35.00 | 29.93 | 30.00 | 27.00 | 30.60 | 321.5 | 329.8 |

| 24 | 92.55 | 94.41 | 79.18 | 80.00 | 49.94 | 50.00 | 34.38 | 35.00 | 30.00 | 30.00 | 18.00 | 19.89 | 304.1 | 309.3 |

| Multiple of σr | Total Cost of the Unified Trading (UTTC) ($) | Total Cost of the Separate Trading (STTC) ($ ) | Reduction Ratio of Cost (%) |

|---|---|---|---|

| 1 | 4.066 × 105 | 4.078 × 105 | 0.33 |

| 2 | 4.078 × 105 | 4.103 × 105 | 0.59 |

| 3 | 4.092 × 105 | 4.127 × 105 | 0.85 |

| 4 | 4.108 × 105 | 4.152 × 105 | 1.06 |

| er (%) | Total Cost of the Unified Trading ($ ) | Total Cost of the Separate Trading ($ ) | Reduction Ratio of Cost (%) |

|---|---|---|---|

| 10 | 4.066 × 105 | 4.078 × 105 | 0.33 |

| 20 | 4.077 × 105 | 4.085 × 105 | 0.20 |

| 30 | 4.088 × 105 | 4.092 × 105 | 0.11 |

| 40 | 4.096 × 105 | 4.099 × 105 | 0.07 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, Y.; Chen, M.; You, S. A Unified Trading Model Based on Robust Optimization for Day-Ahead and Real-Time Markets with Wind Power Integration. Energies 2017, 10, 554. https://doi.org/10.3390/en10040554

Jiang Y, Chen M, You S. A Unified Trading Model Based on Robust Optimization for Day-Ahead and Real-Time Markets with Wind Power Integration. Energies. 2017; 10(4):554. https://doi.org/10.3390/en10040554

Chicago/Turabian StyleJiang, Yuewen, Meisen Chen, and Shi You. 2017. "A Unified Trading Model Based on Robust Optimization for Day-Ahead and Real-Time Markets with Wind Power Integration" Energies 10, no. 4: 554. https://doi.org/10.3390/en10040554