Break-Even Points of Battery Energy Storage Systems for Peak Shaving Applications

Abstract

:1. Introduction

- The reduction of network reinforcement needs: the electrical infrastructure in the DN does not has to be sized for the highest power demand anymore but for a more flattened generation profile [3].

- The reduction of the electricity bill: depending on the market conditions, the DN customers can decrease their total energy costs by taking advantage of energy price differences between peak and off-peak load periods [4]. This way, if the energy price during the peak load periods of the day is more expensive than the price during the off-peak periods, a sound strategy for the ESS scheduling would lead to an electricity bill reduction.

- Power applications: this includes ESSs with high power density and the ability to respond in short time frames (few seconds to some minutes). These technologies are usually applied to improve power quality [7] and also for frequency regulation.

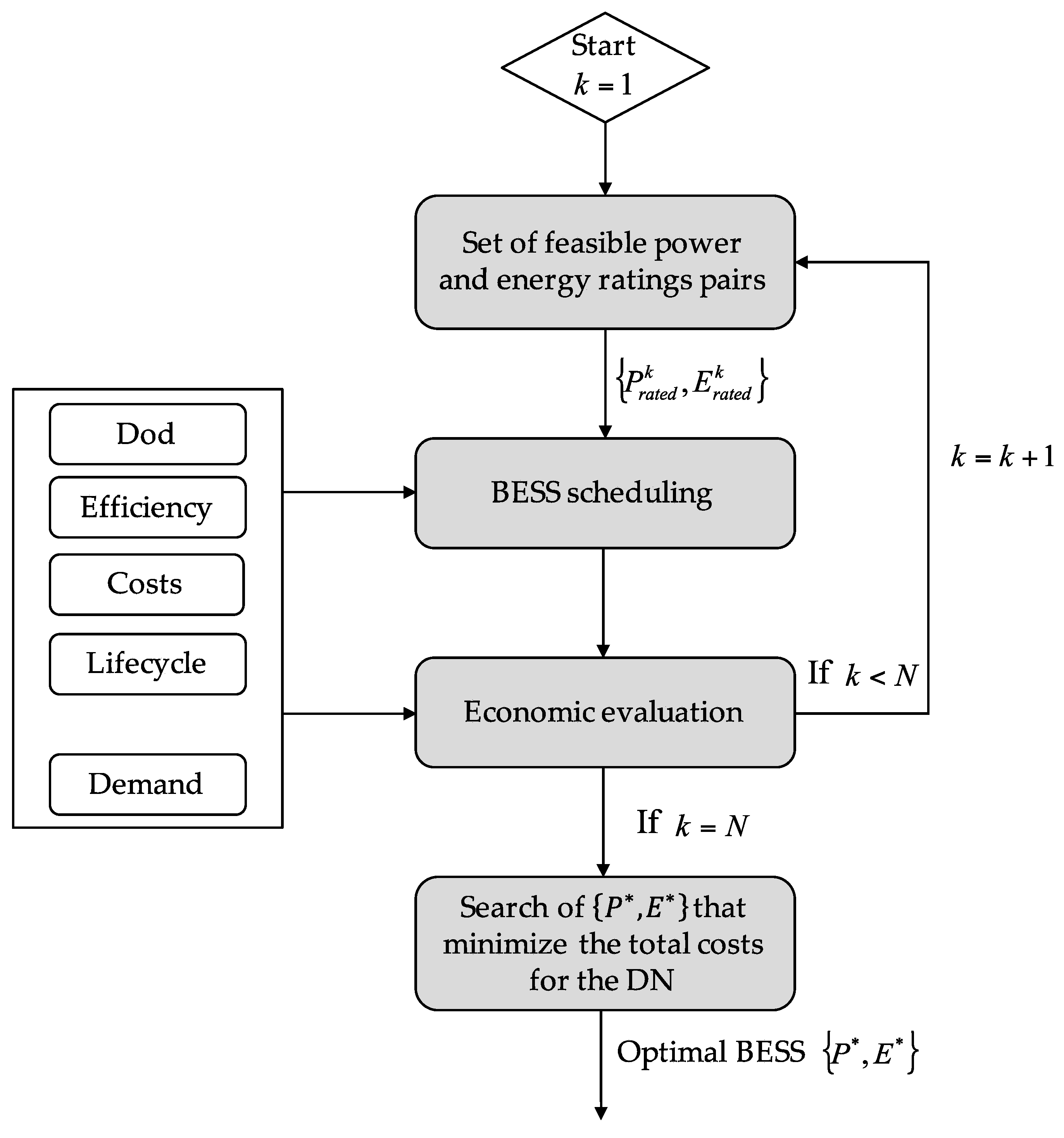

2. Proposed Methodology for BESS Selection for Peak-Shaving Applications

2.1. Set of Feasible Power and Energy Ratings Pairs

2.2. BESS Scheduling

2.3. Economic Evaluation

2.4. Search of That Minimize the Total Costs for the DN

3. Case Study: Chilectra Distribution Network

3.1. Demand Charges in Chile

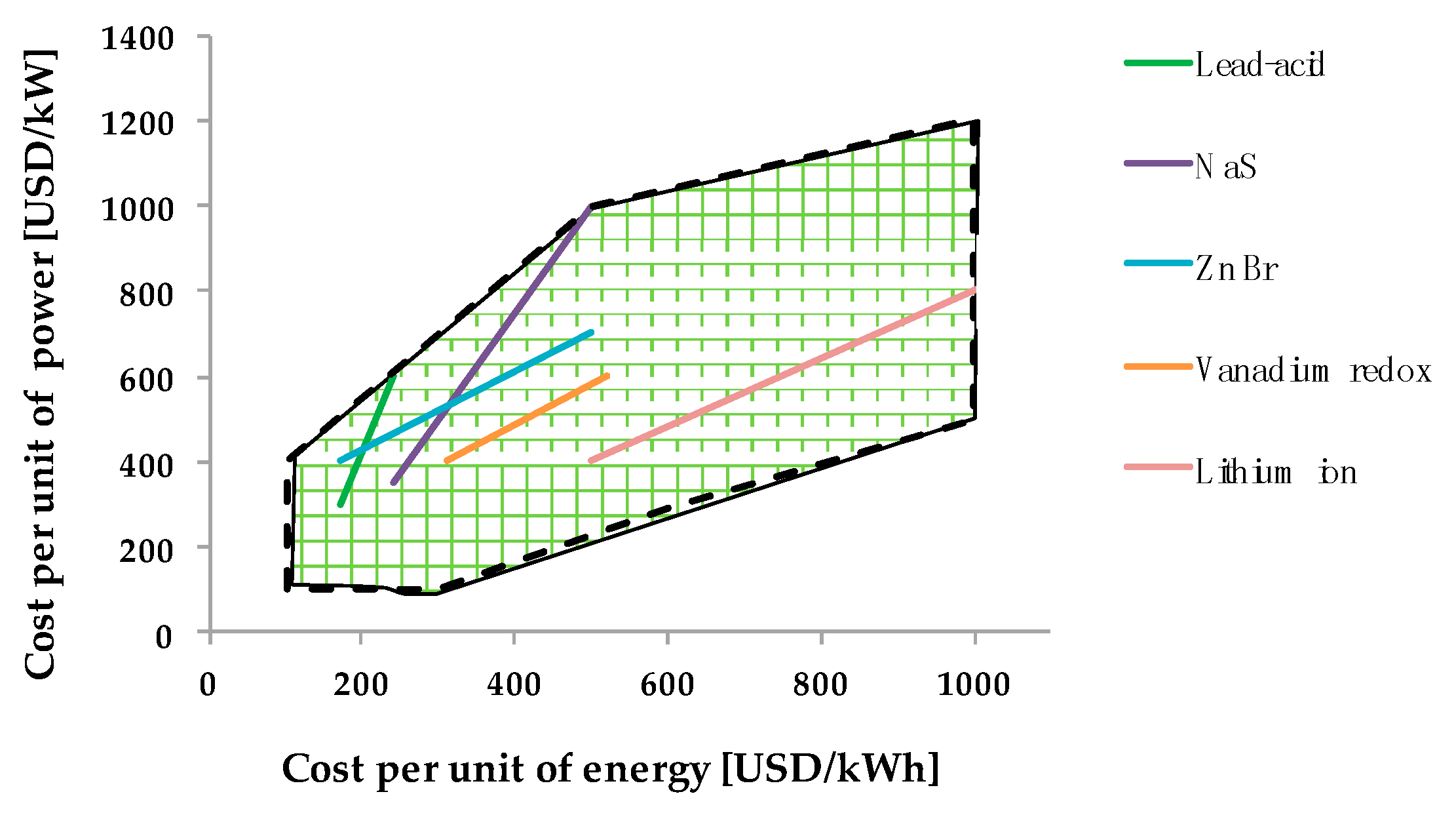

3.2. Feasible Pairs of Energy and Power

3.3. Considered Costs of Energy and Power

4. Results

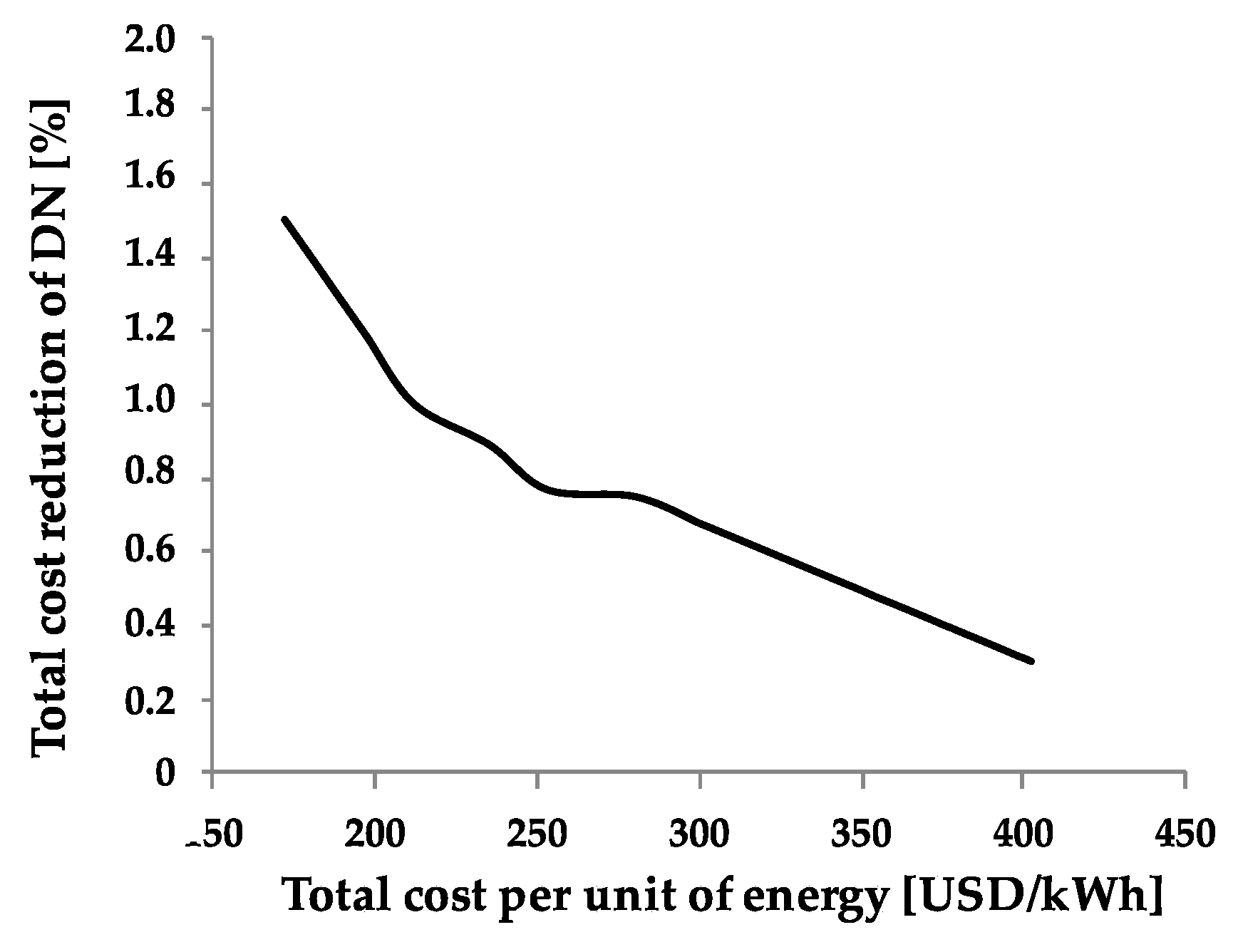

4.1. Break-Even Points for the SB

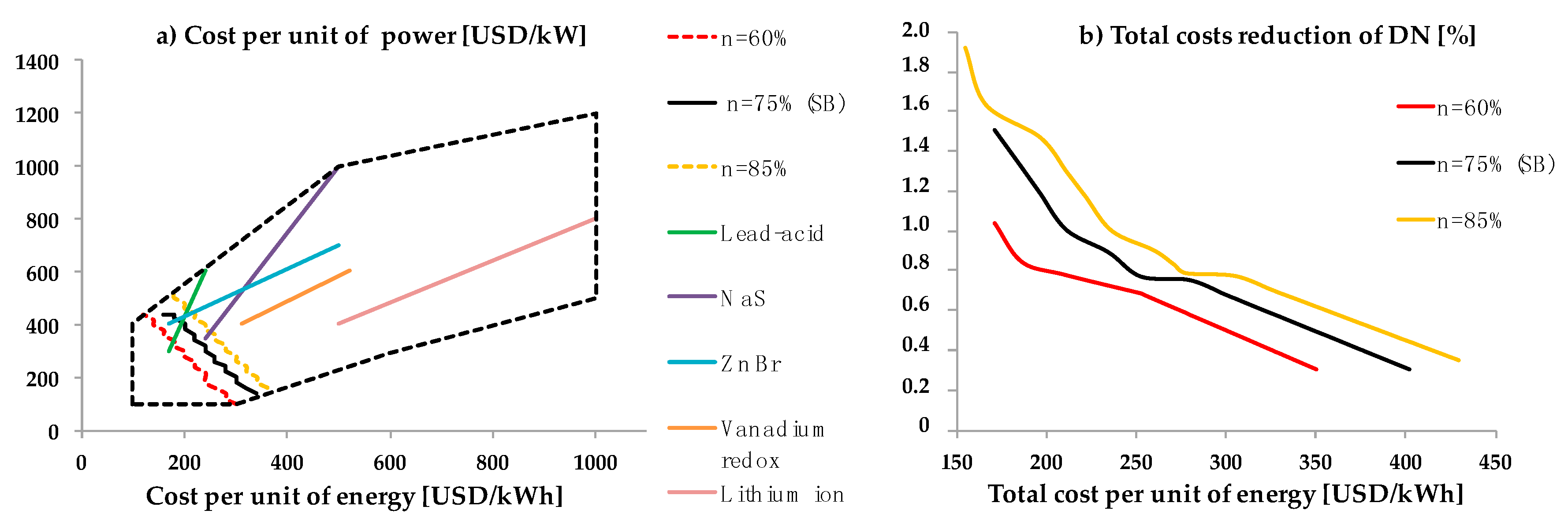

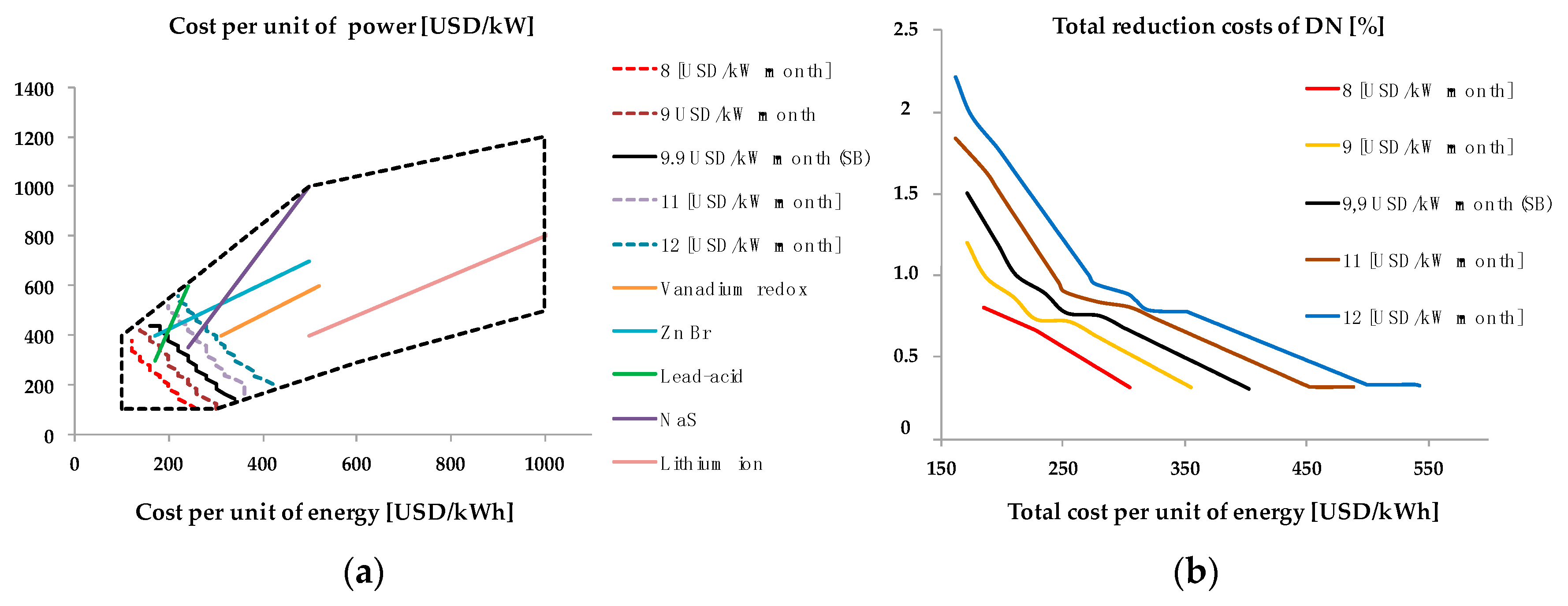

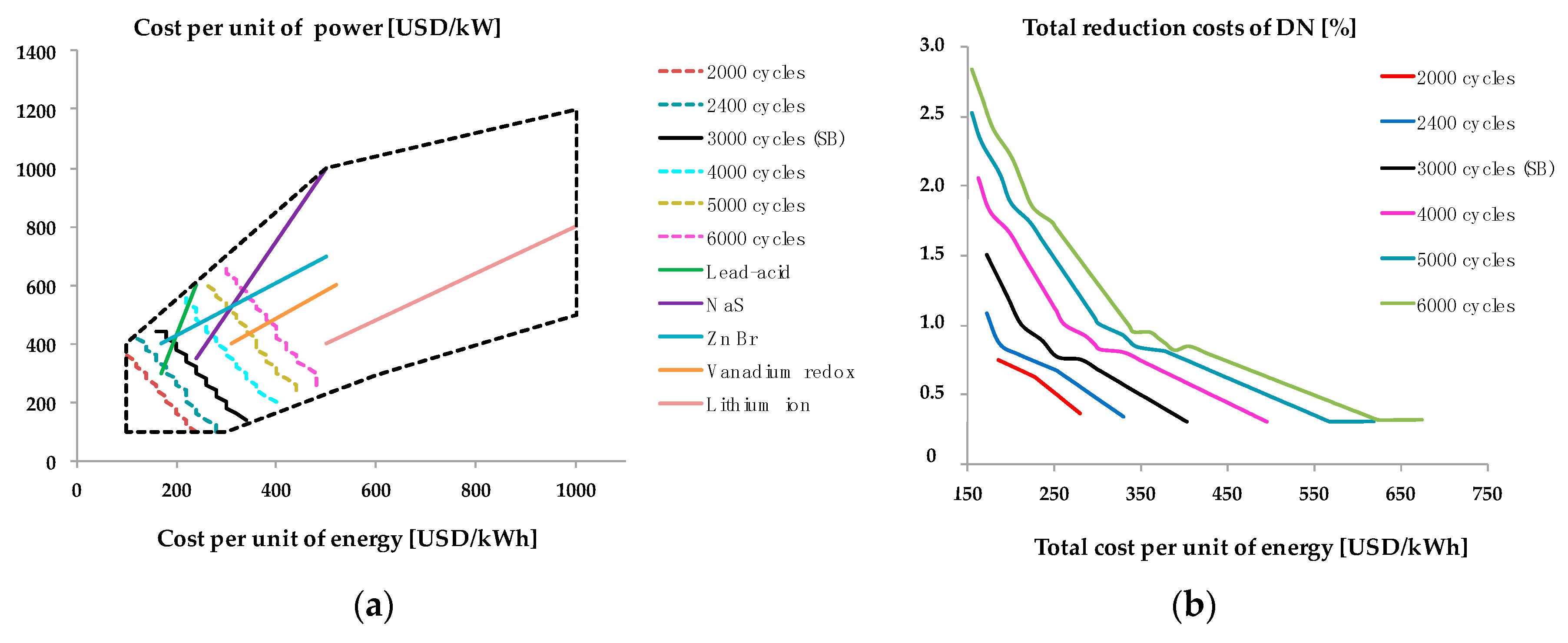

4.2. Sensitivity Analysis

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Even, A.; Neyens, J.; Demouselle, A. Peak shaving with batteries. In Proceedings of the 12th International Conference on Electricity Distribution, Birmingham, UK, 17–21 May 1993. [Google Scholar]

- Wang, Z.; Wang, S. Grid Power Peak Shaving and Valley Filling Using Vehicle-to-Grid Systems. IEEE Trans. Power Deliv. 2013, 28, 1822–1829. [Google Scholar] [CrossRef]

- Nykamp, S.; Molderink, A.; Hurink, J.L.; Smit, G.J.M. Storage operation for peak shaving of distributed PV and wind generation. In Proceedings of the IEEE PES Innovative Smart Grid Technologies Conference, Washington, DC, USA, 24–27 February 2013. [Google Scholar]

- Venu, C.; Riffonneau, Y.; Bacha, S.; Baghzouz, Y. Battery Storage System sizing in distribution feeders with distributed photovoltaic systems. In Proceedings of the IEEE PowerTech, Bucharest, Romania, 28 June–2 July 2009. [Google Scholar]

- Guerrero, M.A.; Romero, E.; Barrero, F.; Milanes, M.I.; González, E. Overview of Medium Scale Energy Storage Systems. In Proceedings of the Compatibility and Power Electronics, Badajoz, Spain, 20–22 May 2009. [Google Scholar]

- Chen, H.; Cong, T.N.; Yang, W.; Tan, C.; Li, Y.; Ding, Y. Progress in electrical energy storage system: A critical review. Prog. Nat. Sci. 2009, 19, 291–312. [Google Scholar] [CrossRef]

- Masaud, T.M.; Lee, K.; Sen, P.K. An overview of energy storage technologies in electric power systems: What is the future? In Proceedings of the North American Power Symposium, Arlington, TX, USA, 26–28 September 2010. [Google Scholar]

- Manz, D.; Keller, J.; Miller, N. Value Propositions for Utility-Scale Energy Storage. In Proceedings of the IEEE/PES Power Systems Conference and Exposition, Phoenix, AZ, USA, 20–23 March 2011. [Google Scholar]

- Geurin, S.O.; Barnes, A.K.; Balda, J.C. Smart Grid Applications of Selected Energy Storage Technologies. In Proceedings of the IEEE PES Innovative Smart Grid Technologies, Washington, DC, USA, 16–20 January 2012. [Google Scholar]

- Poonpun, P.; Jewell, W.T. Analysis of the Cost per Kilowatt Hour to Store Electricity. IEEE Trans. Energy Convers. 2008, 23, 529–534. [Google Scholar] [CrossRef]

- Bahramirad, S.; Reder, W.; Khodaei, A. Reliability-Constrained Optimal Sizing of Energy Storage System in a Microgrid. IEEE Trans. Smart Grid 2012, 3, 2056–2062. [Google Scholar] [CrossRef]

- Bahramirad, S.; Daneshi, H. Optimal Sizing of Smart Grid Storage Management System in a Microgrid. In Proceedings of the IEEE PES Innovative Smart Grid Technologies, Washington, DC, USA, 16–20 January 2012. [Google Scholar]

- Chen, S.X.; Gooi, H.B.; Wang, M.Q. Sizing of energy storage for microgrids. IEEE Trans. Smart Grid 2012, 3, 142–151. [Google Scholar] [CrossRef]

- Ross, M.; Hidalgo, R.; Abbey, C.; Joos, G. Analysis of Energy Storage Sizing and Technologies. In Proceedings of the IEEE Electric Power & Energy Conference, Halifax, NS, USA, 25–27 August 2010. [Google Scholar]

- Bahmani-Firouzi, B.; Azizipanah-Abarghooee, R. Optimal sizing of battery energy storage for micro-grid operation management using a new improved bat algorithm. Int. J. Electr. Power Energy Syst. 2014, 56, 42–54. [Google Scholar] [CrossRef]

- Aghamohammadi, M.R.; Abdolahinia, H. A new approach for optimal sizing of battery energy storage system for primary frequency control of islanded Microgrid. Int. J. Electr. Power Energy Syst. 2014, 54, 325–333. [Google Scholar] [CrossRef]

- Le, H.T.; Nguyen, T.Q. Sizing energy storage systems for wind power firming: An analytical approach and a cost-benefit analysis. In Proceedings of the IEEE Power and Energy Society General Meeting–Conversion and Delivery of Electrical Energy in the 21st Century, Pittsburgh, PA, USA, 20–24 July 2008. [Google Scholar]

- Brekken, T.K.A.; Yokochi, A.; von Jouanne, A.; Yen, Z.Z.; Hapke, H.M.; Halamay, D.A. Optimal Energy Storage Sizing and Control for Wind Power Applications. IEEE Trans. Sustain. Energy 2011, 2, 69–77. [Google Scholar] [CrossRef]

- Bludszuweit, H.; Dominguez-Navarro, J.A. A Probabilistic Method for Energy Storage Sizing Based on Wind Power Forecast Uncertainty. IEEE Trans. Power Syst. 2011, 26, 1651–1658. [Google Scholar] [CrossRef]

- Wang, X.Y.; Vilathgamuwa, D.M.; Choi, S.S. Determination of Battery Storage Capacity in Energy Buffer for Wind Farm. IEEE Trans. Energy Convers. 2008, 23, 868–878. [Google Scholar] [CrossRef]

- Ru, Y.; Kleissl, J.; Martinez, S. Storage Size Determination for Grid-Connected Photovoltaic Systems. IEEE Trans. Sustain. Energy 2013, 4, 68–81. [Google Scholar] [CrossRef]

- Kaldellis, J.K.; Zafirakis, D.; Kondili, E. Optimum sizing of photovoltaic-energy storage systems for autonomous small islands. Int. J. Electr. Power Energy Syst. 2010, 32, 24–36. [Google Scholar] [CrossRef]

- Akatsuka, M.; Hara, R.; Kita, H.; Ito, T.; Ueda, Y.; Saito, Y. Estimation of battery capacity for suppression of a PV power plant output fluctuation. In Proceedings of the 35th IEEE Photovoltaic Specialists Conference, Honolulu, HI, USA, 20–25 June 2010. [Google Scholar]

- Chacra, F.A.; Bastard, P.; Fleury, G.; Clavreul, R. Impact of Energy Storage Costs on Economical Performance in a Distribution Substation. IEEE Trans. Power Syst. 2005, 20, 684–691. [Google Scholar] [CrossRef]

- Dunn, B.; Kamath, H.; Tarascon, J.-M. Electrical Energy Storage for the grid: A battery of Choices. Sci. Mag. 2011, 334, 928–935. [Google Scholar] [CrossRef] [PubMed]

- Mercier, P.; Cherkaoui, R.; Oudalov, A. Optimizing a Battery Energy Storage System for Frequency Control Application in an Isolated Power System. IEEE Trans. Power Syst. 2009, 24, 684–691. [Google Scholar] [CrossRef]

- Chen, C.; Duan, S.; Cai, T.; Liu, B.; Hu, G. Optimal Allocation and Economic Analysis of Energy Storage System in Microgrids. IEEE Trans. Power Electron. 2011, 26, 2762–2773. [Google Scholar] [CrossRef]

- Miranda, I.; Silva, N.; Leite, H. Distribution Storage System Optimal Sizing and Techno-Economic Robustness. In Proceedings of the IEEE International Energy Conference and Exhibition, Florence, Italy, 9–12 September 2012. [Google Scholar]

- Miranda, I.; Silva, N.; Leite, H. Technical and Economic Assessment for Optimal Sizing of Distributed Storage. In Proceedings of the 3rd IEEE PES International Conference and Exhibition on Innovative Smart Grid Technologies, Berlin, Germany, 14–17 October 2012. [Google Scholar]

- Chakraborty, S.; Senjyu, T.; Toyama, H.; Saber, A.Y.; Funabashi, T. Determination methodology for optimising the energy storage size for power system. IET Gener. Transm. Distrib. 2009, 3, 987–999. [Google Scholar] [CrossRef]

- Makarov, Y.V.; Du, P.; Kintner-Meyer, M.C.W.; Jin, C.; Illian, H. Sizing Energy Storage to Accommodate High Penetration of Variable Energy Resources. IEEE Trans. Sustain. Energy 2012, 3, 34–40. [Google Scholar] [CrossRef]

- Schoenung, S. Energy Storage Systems Cost Update: A Study for the DOE Energy Storage Systems Program; Sandia National Laboratories: Albuquerque, NM, USA, 2011.

- Carnegie, R.; Gotham, D.; Nderitu, D.; Preckel, P.V. Utility Scale Energy Storage Systems. Internal Report of the State Utility Forecasting Group, 2013. Available online: https://www.purdue.edu/discoverypark/energy/assets/pdfs/SUFG/publications/SUFG%20Energy%20Storage%20Report.pdf (accessed on 16 June 2017).

- Atwa, Y.M.; El-Saadany, E.F. Optimal Allocation of ESS in Distribution Systems with a High Penetration of Wind Energy. IEEE Trans. Power Syst. 2010, 25, 1815–1822. [Google Scholar] [CrossRef]

- Díaz-Gonzalez, F.; Sumper, A.; Gomis-Bellmunt, O.; Villafáfila-Robles, R. A review of energy storage technologies for wind power applications. Renew. Sustain. Energy Rev. 2012, 16, 2154–2171. [Google Scholar] [CrossRef]

- Rastler, D. Electricity Energy Storage Technology Options: A White Paper Primer on Applications, Costs, and Benefits; Electric Power Research Institute: Palo Alto, CA, USA, December 2010. [Google Scholar]

- Divya, K.C.; Ostergaard, J. Battery energy storage technology for power systems—An overview. Electr. Power Syst. Res. 2009, 79, 511–520. [Google Scholar] [CrossRef]

| Technology | Cost Per Unit of Power [$/kW] | Cost Per Unit of Energy [$/kWh] |

|---|---|---|

| Lead acid | 300–600 | 170–240 |

| NaS | 350–1000 | 240–500 |

| ZnBr | 400–700 | 170–500 |

| Vanadium Redox | 400–600 | 310–520 |

| Lithium ion | 400–1200 | 500–1500 |

| Technology | O&M Costs [$/kW/Year] |

|---|---|

| Lead acid | 24.1–56.5 |

| NaS | 25.7–46.7 |

| ZnBr | 38.8–55.9 |

| Vanadium Redox | 32.2–56.4 |

| Lithium ion | 25 |

| Parameter | Value | Unite |

|---|---|---|

| Peak power price (PPP) | 9.9 | USD/kWmonth |

| Energy price (EP) | 90.3 | USD /MWh |

| Interest rate | 10 | % |

| Annual growth rate of the peak power price | 5 | % |

| Parameter | Value |

|---|---|

| Depth of discharge (DoD) | 80% |

| Round trip efficiency | 75% |

| Cycles | 3000 |

| Parameters | Minimum | Maximum |

|---|---|---|

| Round trip efficiency [%] | 60 | 85 |

| Energy price [USD/MWh] | 50 | 150 |

| Power price [USD/kWmonth] | 8 | 12 |

| Cycles | 2000 | 6000 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rahmann, C.; Mac-Clure, B.; Vittal, V.; Valencia, F. Break-Even Points of Battery Energy Storage Systems for Peak Shaving Applications. Energies 2017, 10, 833. https://doi.org/10.3390/en10070833

Rahmann C, Mac-Clure B, Vittal V, Valencia F. Break-Even Points of Battery Energy Storage Systems for Peak Shaving Applications. Energies. 2017; 10(7):833. https://doi.org/10.3390/en10070833

Chicago/Turabian StyleRahmann, Claudia, Benjamin Mac-Clure, Vijay Vittal, and Felipe Valencia. 2017. "Break-Even Points of Battery Energy Storage Systems for Peak Shaving Applications" Energies 10, no. 7: 833. https://doi.org/10.3390/en10070833