Schedule-Based Operation Method Using Market Data for an Energy Storage System of a Customer in the Ontario Electricity Market

Abstract

:1. Introduction

1.1. Motivation

1.2. Literature Survey

1.3. Contributions

- The OPCC, which is the largest portion of the target customer in this paper, is represented in the scheduling problem to reduce the electricity cost. In addition, a method to determine the price of the OPCC for each time interval is presented using the historic data and forecasting data given by the IESO.

- To reduce forecasting errors in the public data provided by the IESO, a correction method is proposed for the predicted data of the current time interval.

- For the scheduling problem, an additional constraint on the state-of-charge (SOC) is introduced to secure a reserve for coping with prediction errors.

- The effects of the proposed method were verified from the actual field tests in Canada.

1.4. Organization

2. Ontario Electricity Market

2.1. Classification of Electricity Charges

2.2. Cost Formulation

2.3. IESO Website Data

- HOEP and Ontario demand predictions

- MCP and Ontario demand records

- Top ten Ontario peak demands recordThe top ten Ontario peak demands for the current base period are reported. The top ten Ontario peak demands record can be obtained from reference [29].

3. ESS Output Control Method

3.1. ESS Operation Strategy

3.2. Expected Increases in the Costs

3.3. Formulation of the Scheduling Problem

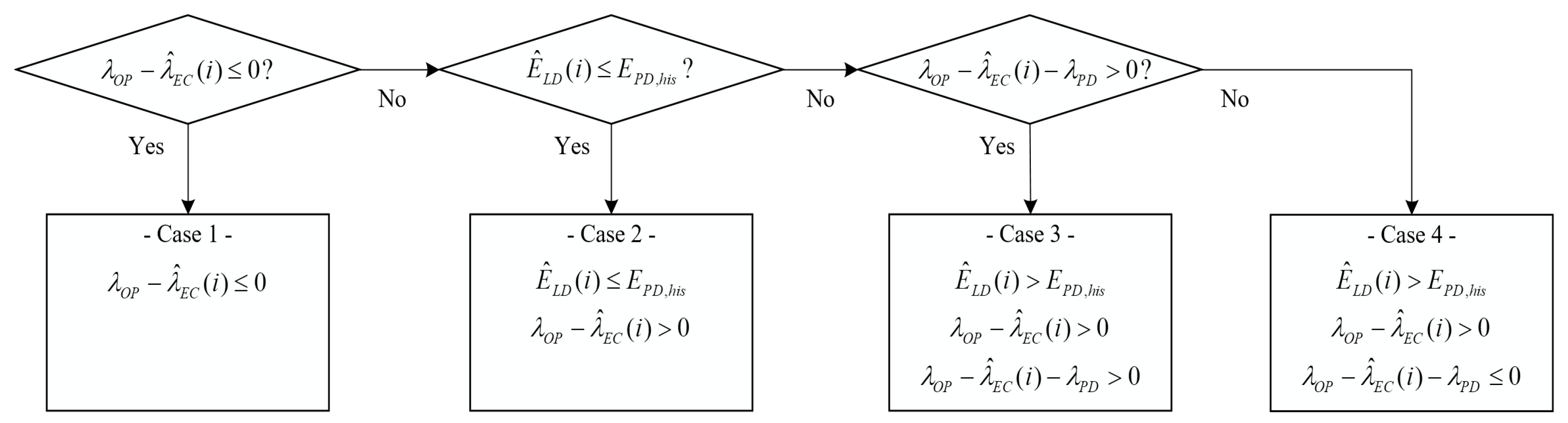

3.4. Determination Method for the Active Power Reference

3.5. Overall Process of the Proposed Method

4. Results from Case Study and Field Tests

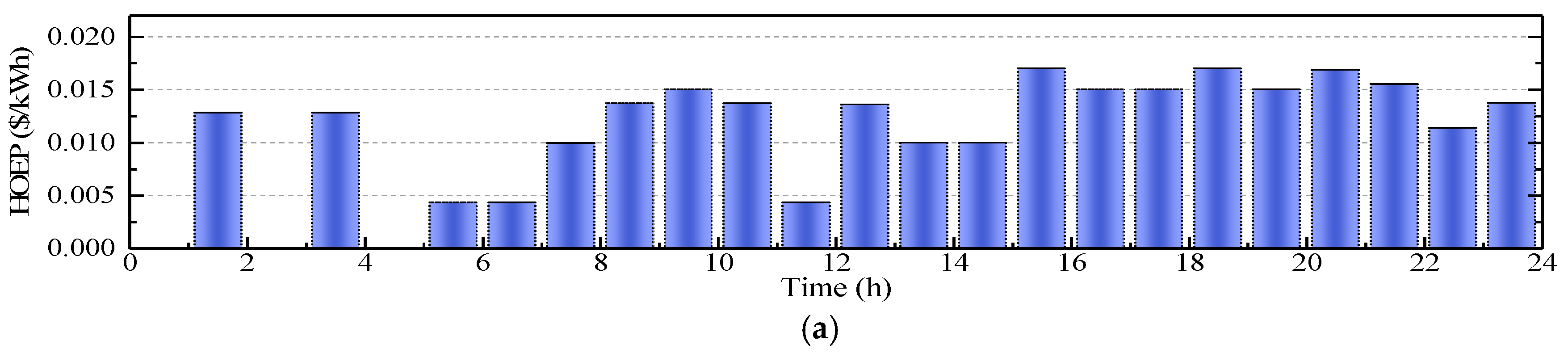

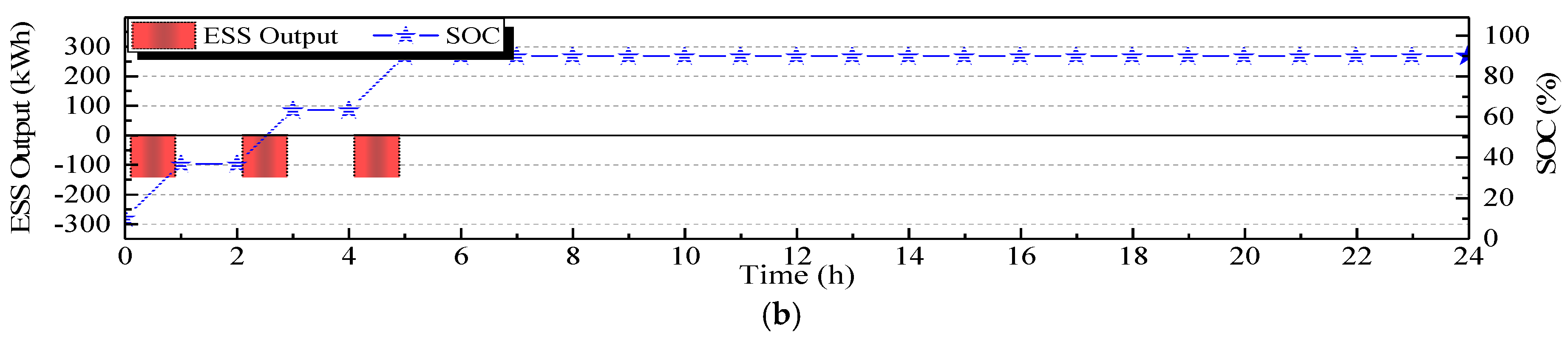

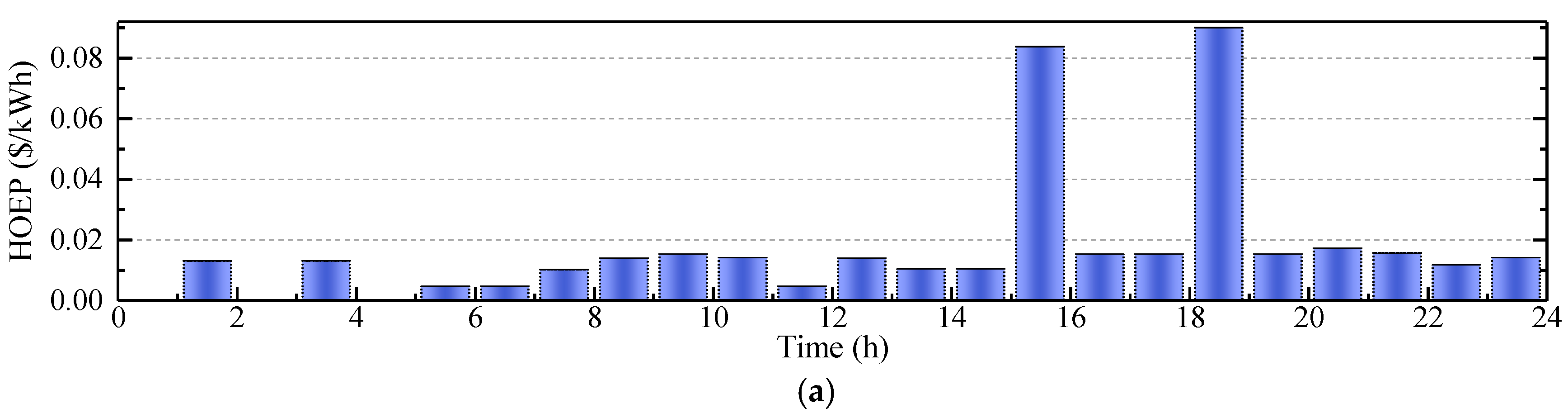

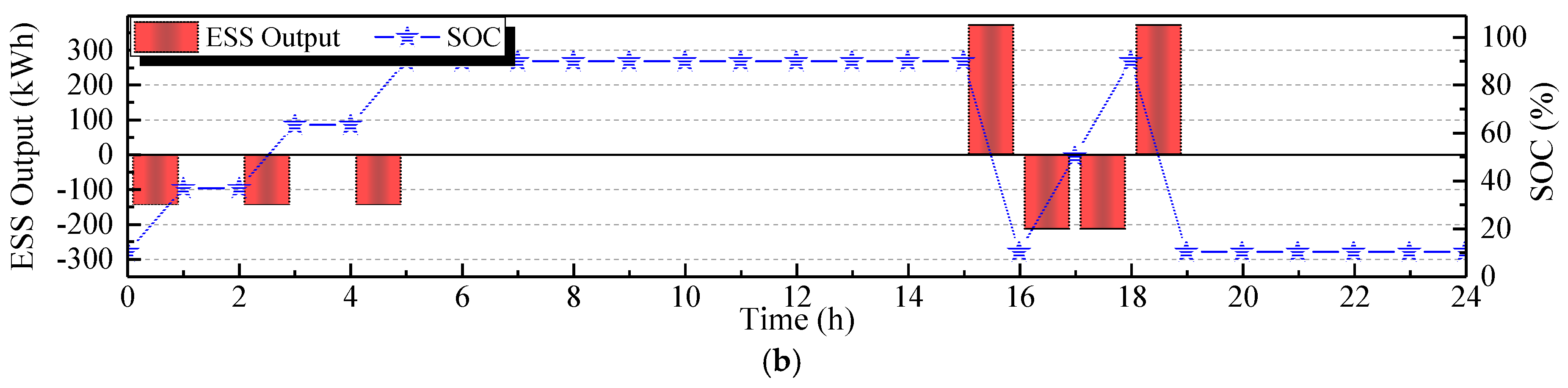

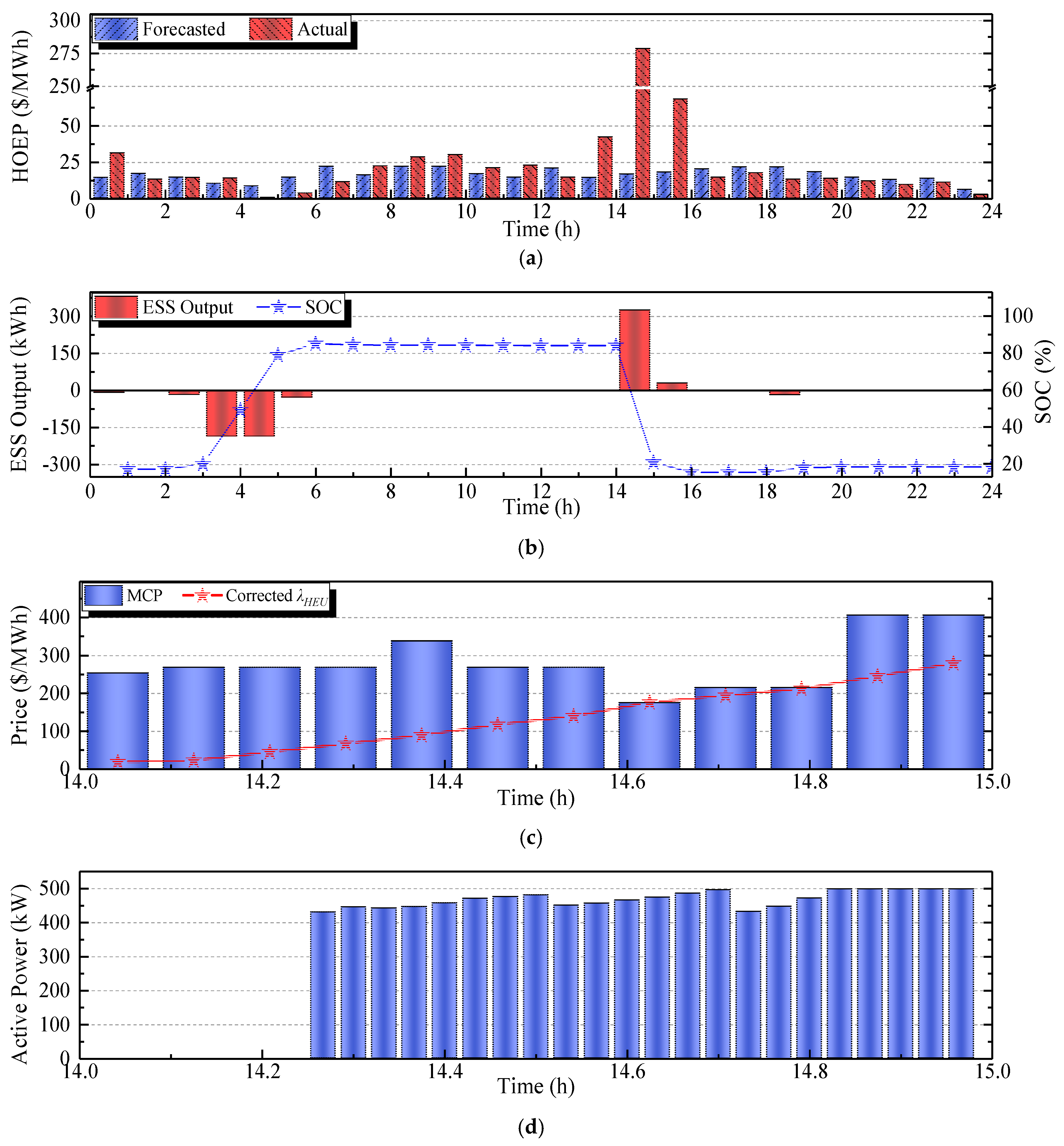

4.1. Results from Case Study

4.2. Major Results of the Field Test

5. Conclusions

- The OPCC can be reduced by using the proposed method. It should be noted that it is hard to reduce the OPCC with conventional methods as the OPCC has not been previously considered in them.

- The proposed method can enable the ESS cope with unpredicted events, e.g., the ESS can be discharged in the time intervals where the actual price is high even though the price forecasted by the IESO is low.

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Acronyms | |

| ESS | Energy storage system |

| EUC | Electricity usage cost |

| FC | Fixed cost |

| GA | Global adjustment |

| HEUC | Hourly electricity usage cost |

| HOEP | Hourly Ontario energy price |

| ICI | Industrial conservation initiative |

| IESO | Independent electricity system operator |

| LDC | Local distribution company |

| LP | Linear programing |

| MCP | Market clearing price |

| MEUC | Monthly electricity usage cost |

| OPCC | Ontario peak contribution cost |

| PDC | Peak demand cost |

| SM | Spot market |

| SOC | State-of-charge |

| Variables | |

| Total system-wide GA costs for the billing month, $ | |

| Total system-wide GA costs for the last adjustment period, $ | |

| Hourly electricity usage cost, $ | |

| Monthly electricity usage cost, $ | |

| Ontario peak contribution cost, $ | |

| Energy output of an ESS, kWh | |

| Already-discharged energy for the current time interval, kWh | |

| Maximum energy output of an ESS in an hour, kWh | |

| Modified maximum output of an ESS in an hour, kWh | |

| Minimum energy output of an ESS in an hour, kWh | |

| Energy consumption of a load, kWh | |

| Ontario demand, kW | |

| Recorded Ontario demand given by the IESO, kW | |

| Previous peak demand of a customer in the current month, kW | |

| Five-minute average Ontario demand record given by the IESO, kW | |

| Rated capacity of an ESS, kWh | |

| Minimum value of the current top five peak demands, kW | |

| User-defined minimum threshold demand for the OPCC, kW | |

| Sum of the top five Ontario peak demands for the last adjustment period, kW | |

| Scheduled output energy of an ESS, kWh | |

| Discharging energy of an ESS, kWh | |

| Charging energy of an ESS, kWh | |

| n × 1 vector whose elements are equal to one | |

| Optimal energy discharged from the energy stored in the ESS, kWh | |

| Forecasted consumption of a load, kWh | |

| Ontario demand forecasted by the IESO, kW | |

| Current time interval | |

| Index of an hour-long time interval | |

| n × n identity matrix | |

| Current minute | |

| Number of time intervals remaining for the day | |

| Number of announced MCPs for the current time interval | |

| Number of five-minute average Ontario demand records announced for the current time interval | |

| n × 1 zero vector | |

| Set of time intervals included in a billing month | |

| SOC at the end of a time interval | |

| Maximum operational limit of the SOC | |

| Minimum operational limit of the SOC | |

| Set of the top five Ontario peak hours for the last base period | |

| n × n upper triangular matrix whose nonzero values are equal to one | |

| Target time interval whose final SOC should be identical to the maximum SOC | |

| Increase in the hourly electricity usage cost, $ | |

| Increase in the monthly electricity usage cost, $ | |

| Increase in the Ontario peak contribution cost, $ | |

| Increase in the operating cost, $ | |

| Threshold reduction factor | |

| Charging efficiency | |

| Discharging efficiency | |

| Hourly electricity usage price, $/kWh | |

| Market clearing price, $/kWh | |

| Monthly electricity usage price, $/kWh | |

| Operating cost of an ESS, $/kWh | |

| Peak demand price, $/kW | |

| Price of the electricity costs excepting the PDC, $/kWh | |

| Expected hourly electricity usage price, $/kWh | |

| HOEP forecasted by the IESO, $/kWh | |

| Expected price of the OPCC, $/kW | |

| Price of the OPCC, $/kW |

Appendix A. Sufficient Condition Guaranteeing That Either and Is Zero

| Case | Optimal Solution | |||

|---|---|---|---|---|

| # | ||||

| 1 | > 0 | > 0 | 0 | |

| 2 | = 0 | 0 | 0 | |

| 3 | < 0 | 0 | ||

| 4 | = 0 | all | Infinite number of solutions | |

| 5 | < 0 | > 0 | ||

| 6 | = 0 | |||

| 7 | < 0 | |||

Appendix B. Determination of Modified Maximum Output of the ESS

Appendix C. Proof that Equation (37) Guarantees that Either or Is Zero

Appendix D. Simulation Results for Basic Functions

References

- Mercier, P.; Cherkaoui, R.; Oudalov, A. Optimizing a battery energy storage system for frequency control application in an isolated power system. IEEE Trans. Power Syst. 2009, 24, 1469–1477. [Google Scholar] [CrossRef]

- Beaudin, M.; Zareipour, H.; Schellenberglabe, A.; Rosehart, W. Energy storage for mitigating the variability of renewable electricity sources: An updated review. Energy Sustain. Dev. 2010, 14, 302–314. [Google Scholar] [CrossRef]

- Sahay, K.; Dwivedi, B. Supercapacitors energy storage system for power quality improvement: An overview. J. Energy Sources 2009, 10, 1–8. [Google Scholar]

- Lee, T.Y. Operating schedule of battery energy storage system in a time-of-use rate industrial user with wind turbine generators: A multipass iteration particle swarm optimization approach. IEEE Trans. Energy Conver. 2007, 22, 774–782. [Google Scholar] [CrossRef]

- Chacra, F.A.; Bastard, P.; Fleury, G.; Clavreul, R. Impact of energy storage costs on economical performance in a distribution substation. IEEE Trans. Power Syst. 2005, 24, 684–691. [Google Scholar] [CrossRef]

- Adamek, F.; Arnold, M.; Andersson, G. On decisive storage parameters for minimizing energy supply costs in multicarrier energy systems. IEEE Trans. Sustain. Energy 2014, 5, 102–109. [Google Scholar] [CrossRef]

- Wang, Y.; Lin, X.; Pedram, M. A near-optimal model-based control algorithm for households equipped with residential photovoltaic power generation and energy storage systems. IEEE Trans. Sustain. Energy 2016, 7, 77–86. [Google Scholar] [CrossRef]

- Chen, C.; Duan, S.; Cai, T.; Liu, B.; Hu, G. Smart energy management system for optimal microgrid economic operation. IET Renew. Power Gener. 2011, 5, 258–267. [Google Scholar] [CrossRef]

- Mahmoodi, M.; Shamsi, P.; Fahimi, B. Economic dispatch of a hybrid microgrid with distributed energy storage. IEEE Trans. Smart Grid 2015, 6, 2607–2614. [Google Scholar] [CrossRef]

- Khani, H.; Zadeh, M.R.D.; Seethapathy, R. Large-scale energy storage deployment in ontario utilizing time-of-use and wholesale electricity prices: An economic analysis. In Proceedings of the Cigre Canada Conference, Toronto, ON, Canada, 22–24 September 2014; pp. 1–8. [Google Scholar]

- Khani, H.; Zadeh, M.R.D. Online adaptive real-time optimal dispatch of privately owned energy storage systems using public-domain electricity market prices. IEEE Trans. Power Syst. 2015, 30, 930–938. [Google Scholar] [CrossRef]

- Khani, H.; Varma, R.K.; Zadeh, M.R.D.; Hajimiragha, A.H. A real-time multistep optimization-based model for scheduling of storage-based large-scale electricity consumers in a wholesale market. IEEE Trans. Sustain. Energy 2017, 8, 836–845. [Google Scholar] [CrossRef]

- Xu, Y.; Tong, L. On the operation and value of storage in consumer demand response. In Proceedings of the 53rd IEEE Conference Decision Control (CDC), Los Angeles, CA, USA, 15–17 December 2014; pp. 205–210. [Google Scholar]

- Mokrian, P.; Stephen, M. A stochastic programming framework for the valuation of electricity storage. In Proceedings of the 26th USAEE/IAEE North America Conference, Ann Arbor, MI, USA, 24–27 September 2006; pp. 24–27. [Google Scholar]

- Qin, J.; Sevlian, R.; Varodayan, D.; Rajagopal, R. Optimal electric energy storage operation. In Proceedings of the IEEE PES GM, San Diego, CA, USA, 22–26 July 2012; pp. 1–6. [Google Scholar]

- Erdinc, O.; Paterakis, N.G.; Mendes, T.D.P.; Bakirtzis, A.G.; Catalao, J.P.S. Smart household operation considering bi-directional EV and ESS utilization by real-time pricing-based DR. IEEE Trans. Smart Grid 2015, 6, 1281–1291. [Google Scholar] [CrossRef]

- Van de Ven, P.M.; Hegde, N.; Massoulie, L.; Salonidis, T. Optimal control of end-user energy storage. IEEE Trans. Smart Grid 2013, 4, 789–797. [Google Scholar] [CrossRef]

- Lujano-Rojas, J.M.; Dufo-López, R.; Bernal-Agustín, J.L.; Catalão, J.P.S. Optimizing daily operation of battery energy storage systems under real-time pricing schemes. IEEE Trans. Smart Grid 2017, 8, 316–330. [Google Scholar] [CrossRef]

- Yoon, Y.; Kim, Y.-H. Effective scheduling of residential energy storage systems under dynamic pricing. Renew. Energy 2016, 87, 936–945. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Y. Optimal energy management of wind-battery hybrid power system with two-scale dynamic programming. IEEE Trans. Sustain. Energy 2013, 4, 765–773. [Google Scholar] [CrossRef]

- Nguyen, M.Y.; Nguyen, D.H.; Yoon, Y.T. A new battery energy storage charging/discharging scheme for wind power producers in realtime markets. Energies 2012, 5, 5439–5452. [Google Scholar] [CrossRef]

- Telaretti, E.; Ippolito, M.; Dusonchet, L. A simple operating strategy of small-scale battery energy storages for energy arbitrage under dynamic pricing tariffs. Energies 2016, 9, 1–20. [Google Scholar] [CrossRef]

- Ontario Energy Report. ONTARIO ENERGY REPORT Q4 2017. Available online: https://www.ontarioenergyreport.ca/pdfs/6210_IESO_2017Q4OER_Electricity_EN.pdf (accessed on 20 September 2018).

- Power Stream Website. Rates & Support Programs. Available online: https://www.powerstream.ca/customers/rates-support-programs.html (accessed on 18 January 2018).

- Independent Electricity System Operator (IESO). Understanding Global Adjustment. Available online: http://ieso.ca/-/media/files/ieso/document-library/global-adjustment/understanding-global-adjustment.pdf (accessed on 18 January 2018).

- Independent Electricity System Operator (IESO). Industrial Conservation Initiative Backgrounder September 2017. Available online: http://ieso.ca/-/media/files/ieso/document-library/global-adjustment/ici-backgrounder.pdf (accessed on 4 September 2018).

- Independent Electricity System Operator (IESO). Price. Available online: http://ieso.ca/-/media/files/ieso/uploaded/chart/price_multiday.xml (accessed on 20 July 2018).

- Independent Electricity System Operator (IESO). Demand. Available online: http://ieso.ca/-/media/files/ieso/uploaded/chart/ontario_demand_multiday.xml (accessed on 20 July 2018).

- Independent Electricity System Operator (IESO). Peak Tracker. Available online: http://ieso.ca/-/media/files/ieso/power-data/peak-tracker.xml (accessed on 20 July 2018).

- Independent Electricity System Operator (IESO). Top Ten Ontario Demand Peaks Archive. Available online: http://ieso.ca/-/media/files/ieso/settlements/top-ten-ontario-demand-peaks-archive.xlsx (accessed on 23 January 2018).

- Independent Electricity System Operator (IESO). Global Adjustment Components and Costs. Available online: http://ieso.ca/en/sector-participants/settlements/global-adjustment-components-and-costs (accessed on 23 January 2018).

- Paragon Decision Technology. AIMMS Optimization Modeling. Available online: https://download.aimms.com/aimms/download/manuals/AIMMS3_OM.pdf (accessed on 18 January 2018).

| Price | ||||

|---|---|---|---|---|

| Value | 0.012 $/kWh | 7.3 $/kW | 112.3 $/kW | 0.03 $/kWh |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hwang, P.-I.; Kwon, S.-C.; Yun, S.-Y. Schedule-Based Operation Method Using Market Data for an Energy Storage System of a Customer in the Ontario Electricity Market. Energies 2018, 11, 2683. https://doi.org/10.3390/en11102683

Hwang P-I, Kwon S-C, Yun S-Y. Schedule-Based Operation Method Using Market Data for an Energy Storage System of a Customer in the Ontario Electricity Market. Energies. 2018; 11(10):2683. https://doi.org/10.3390/en11102683

Chicago/Turabian StyleHwang, Pyeong-Ik, Seong-Chul Kwon, and Sang-Yun Yun. 2018. "Schedule-Based Operation Method Using Market Data for an Energy Storage System of a Customer in the Ontario Electricity Market" Energies 11, no. 10: 2683. https://doi.org/10.3390/en11102683