8.1. Scenario A

The amount of surplus baseload electricity for 2017 of each capacity factor is converted to hydrogen and then allocated according to the pre-defined demand for each pathway (

Table 7). Accordingly, the total hydrogen produced is approximately 170, 193, and 227 kilo-tonnes (kt), respectively. For each capacity factor, the hydrogen amount is allocated to the four PtG pathways mentioned earlier.

Figure 6 illustrates hydrogen allocation percentage for each PtG pathway for each capacity factor.

Furthermore,

Table 7 shows the amount of carbon offset by producing hydrogen via the PtG technology instead of the conventional methods. The highest carbon reduction occurs in the case of utilizing hydrogen as mobility fuel instead of gasoline, about 2,215,916 tonnes of CO

2 might be reduced.

Table 7 also shows PtG pathways economy considering scenario A allocation for each pathway for the three capacity factors. Wherein the pathways’ costs are represented by the overall capital exposures (CAPEX) and the overall annual operational expenses (OPEX); and the pathways’ profitability are expressed by NPV, PBP, and IRR. In fact, CAPEX value is strongly dependent on the type and the number of technologies for each pathway, electrolyzers in particular, because the capital cost of the electrolysis equipment is high.

For scenario A, hydrogen allocation is constrained by each PtG pathway demand illustrated by

Table 5. Therefore, hydrogen amount for each pathway will be constant at three capacity factors except for the PtG pathway Power-to-Gas to Renewable Gas which has relatively flexible demand.

The pathway PtG to mobility fuel has the highest CAPEX, about 4.6 billion dollars, since it requires 1610 electrolyzers—considering the maximum surplus electricity generation—compared to other pathways. Further, OPEX is changing since the HOEP range (refer to

Table 4) is different for each capacity factor. For the three capacity factors, the pathway shows an acceptable economic validity, in which NPV is positive, the average payback period is 5 years, and an IRR of 19%.

PtG to industry, the second pathway, has the lowest overall CAPEX and OPEX among the other pathways. However, with a PBP of more than 10 years the project investment costs will not be recovered sooner although the IRR indicates a positive possibility of money gain up to 4%. Moreover, the negative NPV indicates that the total income is less than the costs and the reason might be because of the hydrogen is sold at the same price as hydrogen produced through steam methane reforming (2.69

$/kg H

2 [

37]), which is low compared to hydrogen as mobility fuel (10

$/kg H

2 [

36]). For this particular case, selling hydrogen at least at 4

$/kg makes the project profitable with a positive NPV of

$45,456,997, payback time of 9 years, and 10% IRR. Such projects should be part of government incentives to encourage clean energy utilization.

The third and fourth pathways, PtG to pipeline for use as HENG and PtG to RNG, show un-acceptable economic validity with highly negative NPVs and PBPs that reach more than 100 years. This might be because HENG and RNG are sold at a very low price (10

$ per MWh [

38]) compared to their extremely high production costs. For this current study, the prices that make PtG to pipeline for use as HENG and PtG to RNG profitable business cases start from 0.358 and 0.191

$/MWh, respectively, which are high prices compared to the current natural gas price range.

Generally, this result ties with a previous German case study by Schiebahn et al. (2015) [

15], wherein the production costs of injecting hydrogen or renewable natural gas into the natural gas grid are several times higher than conventional natural gas production cost. Hence, large-scale implementation of such projects is currently uneconomic [

15]. Although injecting RNG would not pose any risks to distribution pipelines or end-user appliances compared to hydrogen injection, this technology has some main drawbacks that need to be overcome. First is low overall process efficiency (40%–63%) because it involves multiple energy conversion steps, which boosts the energy loses [

12]. The second problem is that the CO

2 methanation requires an enormous amount of carbon dioxide. For example, in this study, CO

2 source is assumed to be from Ontario’s biogas farms in which the total annual biogas production is 118.98 million cubic meter [

49], accordingly 55 kilo-tonnes of CO

2 (40% concentration of CO

2 in the biogas). What is required, however, in the case of 67% availability, equals around 281 kilo-tonnes of CO

2; that is, requirements exceed CO

2 availability. Albeit, CO

2 could be captured from other sources like the cement industry, but that is an expensive option.

In addition, the realization of hydrogen injection into the natural gas grid to be used as HENG requires re-specifying composition and gas quality standers along with transmission and distribution pipeline tolerances for high hydrogen concentration. Further, some other concerns need to be addressed regarding HENG blend, namely those related to process control, safety, and public acceptance [

19]. It is neither possible nor legal to blend hydrogen in high concentration with natural gas (more than 20 vol% H

2) because that will result in natural gas composition change, which affects consumer devices [

50].

Conversely, the high-efficiency of fuel cell vehicles tolerates hydrogen cost competitiveness compared to gasoline, making the use of hydrogen as a green fuel for automobiles an economically sound, commercial case. Though for this pathway to be implemented, hydrogen infrastructure would need to be built from scratch, and a collaboration among industry, governments, and the public would be required for cost-effective conversion to renewable energy [

15].

Producing hydrogen via electrolysis has always been seen as an ideal means in industry, especially if it is generated from renewable sources. Even though the electrolytic hydrogen is an excellent solution for industrial greenhouse gases reduction, it is still inherently expensive and not continually efficient. Therefore, adoption of a large-scale plant that produces hydrogen via PtG technology is currently not bankable because cost matters, especially if there are cheaper alternatives available [

51].

8.3. Scenario C

In this scenario, hydrogen produced via PtG technology is utilized entirely for the pathway PtG to industry, at three production capacities 67%, 80%, and 96% (

Table 9). Utilizing Ontario’s surplus electricity to produce hydrogen via the PtG technology could supply 82%, 93%, and 110% of industrial demand at the three capacity factors, respectively. By implementing this PtG energy stream, up to 3131 kilo-tonnes of CO

2 could be offset, as

Table 9 illustrates. Nevertheless, hydrogen production through PtG is still costly compared to other available cheaper alternatives, namely hydrogen produced via steam methane reforming. The economic validity indicators (NPV, PBP, and IRR) show some improvement by increasing hydrogen production capacity, but they are not indicating any positive gain feedback. To increase this pathway’s profitability, hydrogen could be sold at a higher price; however, in this case, hydrogen would not be a favorable option for stockholders. For this particular case, selling hydrogen at least at 10

$/kg makes the project profitable with a positive NPV of

$1,259,846,895, payback time of 9 years, and 9% IRR. Such projects should be part of government incentives to encourage clean energy utilization.

8.5. Scenario E

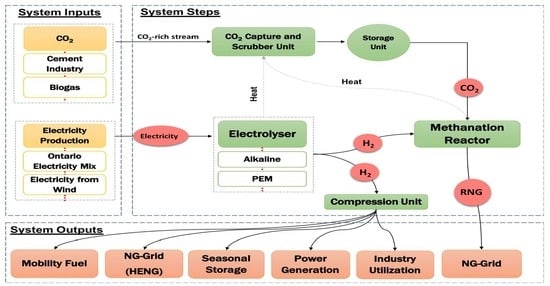

In this scenario, the amount of hydrogen produced via PtG technology is entirely combined with CO

2 from biogas digestion plant for RNG synthesis.

Table 11 shows the selected three capacity factors for hydrogen production, the amount of CO

2 offset, the economic cost, as well as the profitability indicators. RNG produced in the reaction of methanation could be a 12%, 14%, and 16% additive by volume into the natural gas grid at three capacity factors, respectively. Regarding the methanation reaction an enormous amount of carbon dioxide is required; Ontario’s biogas digesters are unlikely to be able to supply this carbon dioxide because of resource limitations. Therefore, other more expensive options may be considered, for instance, utilizing CO

2 captured from the cement industry. On one hand, methanation could eliminate up to 997,080 tonnes of carbon dioxide from the atmosphere in the case of 96% electrolysis availability. On the other hand, the cost of RNG production is exceedingly high because it demands multiple processes, namely water electrolysis, CO

2 separation, and CH

4 synthesis. This PtG pathway shows low profitability potential as

Table 11 illustrates, with a negative NPV and a payback period exceeding 100 years. In this case, IRR is undefined because there is no interest rate small enough that makes NPV equal zero. For this current study, the selling price that makes this PtG pathway a profitable business case starts from 341

$/MWh, which is relatively high price compared to the current natural gas price range.