1. Introduction

Due to the growing penetration of distributed energy resources (DERs), including photovoltaic panels (PVs), electric vehicles (EVs), and thermostatically controlled loads (TCLs), power systems are benefiting an increasing control flexibility, not only from the supply side, but also from the demand side. Worldwide EV integration level is assumed to grow up to 20 million by 2020 [

1]. Hence, the usage of EV batteries to support a power system has a significant potential [

2]. Several types of batteries are used as energy storage for EVs, for example lithium-ion, lead acid and nickel metal hydride batteries. Battery market analysis based on efficiency, cost, durability, performance, power and energy can be found in [

3,

4,

5].

EV flexibilities are combined by aggregators to participate in corresponding markets and to provide bids. An aggregator aims to satisfy the driving needs of its fleet of EVs at the lowest possible cost [

2,

6]. In addition, the aggregator has an economic incentive to participate in different market places targeting higher revenue [

7,

8,

9,

10]. Because they can increase or decrease their power output quite fast, EV aggregators can maximize their profit while at the same time providing reserve power. In references [

11,

12,

13,

14,

15,

16], the authors study the potential of using EVs as a flexible power providers for real-time balancing market and system reserves.

The grid-to-vehicle (G2V) problem of bidding regulation and spinning reserves is investigated in [

12]. The vehicle-to-grid (V2G) interaction with the grid as a flexibility source for real-time balancing market is modeled in [

13,

15,

16]. However, using the batteries as storage devices for grid purposes reduces their lifetime [

15,

17], and therefore, EV owners must be compensated for the lost utility of their batteries.

Optimal bidding strategies are particularly relevant to EV aggregators, since they have the possibility to store energy and choose the best time to charge/discharge the electric power according to the market conditions. When prices are high, electric power is discharged and sold, whereas when prices are low, the electric power is charged to meet the driving needs of the aggregator’s fleet of EVs. Thus, modeling of market price uncertainties is an important feature to be considered when developing a bidding strategy. The optimal bidding problem of EVs is studied in [

18], taking into consideration uncertain market price and nonlinear charging curve.

Two approaches can be emphasized for modeling uncertainty in a coordinated bidding problem to address the uncertain nature of market conditions and fleet characteristics: (a) risk management and (b) stochastic programming. The EV aggregator needs to prepare its bid function considering the volatility of the electricity prices. For that purpose, ref. [

19] proposes two-stage stochastic optimization of EV participation in electricity markets incorporating VaR risk measure. To manage short-term volatility in market prices the conditional value at risk (CVaR) as a hedging instrument is incorporated in EV aggregation models [

14,

20]. The authors in [

21] apply the concept of CVaR on an hourly basis for controlling the risk of hydropower producer’s hourly profit. In [

21], it is illustrated that hourly bid functions derived from an hourly CVaR include more accurate information on the short-term price risk as compared to the bid functions derived from the daily CVaR.

The existing literature on bidding strategies for EV aggregators that uses stochastic programming can be categorized as (1) day-ahead market bidding and (2) day-ahead and balancing markets bidding. Optimal bidding strategies for participation of an EV aggregator in the day-ahead electricity market are modeled in [

9,

10].

Imbalances between volumes discharged/charged and volumes dispatched in the day-ahead market are settled in the balancing market, where market players submit their bids to increase or decrease the generation/consumption. Two-stage stochastic optimal bidding models of an EV aggregator for trading in day-ahead energy and regulation markets are presented in [

11,

13,

14,

15,

17]. The reference [

22] presents planning and operation models for an EV sharing community in day-ahead and regulating markets. A game theoretic approach is developed in [

23] for analyzing the competition among the EV aggregators acting in day-ahead energy and ancillary services markets with variable wind energy.

In addition, adjustments in the actual discharge/charge can also be done by trading energy in the intra-day market, which allows for trading physical electricity between the participants. In previous studies [

9,

10,

11,

12,

13,

14,

15,

16,

17,

18,

19,

20,

21,

22,

23], optimal bidding strategies for an EV aggregator have been developed. However these studies do not include participation of the aggregator in the intra-day market. Worldwide, significant increase of RES integration in the power system causes highly volatile day-ahead, intra-day and real-time market prices. Consequently, the intra-day market becomes a potentially promising market platform for a flexible market actor to participate in. Therefore, coordinated bidding is highly attractive for an EV aggregators who are able to engage in sequential day-ahead, intra-day and real-time markets and thereby increase their profit.

For a small market participant (a price-taker EV aggregator), whose decisions have no impact on the market outcomes, the bidding process is subject to uncertainty in day-ahead, intra-day, real-time market prices and the availability of the aggregator’s fleet of EVs.

This paper is the extension of the work in [

16], and develops a stochastic, dynamically updated two-stage multi-period optimal bidding strategy for a risk-averse EV aggregator who participates in the day-ahead, intra-day and real-time markets. The model addresses the uncertain nature of market conditions and fleet characteristics. A Markov-based Holt winter (HW) model is used to predict electricity prices in all three market places. The uncertainty in day-ahead, intra-day and real-time market prices is represented by a set of scenarios, generated by a forecasting tool (based on the historical data) and reduced by the backward-reduction algorithm. Unlike previous two-stage stochastic formulations in [

11,

14,

16,

19], this model accounts dynamically for the clearing nature of the intra-day and real-time markets while deriving optimal bids for day-ahead, intra-day and real-time markets. In addition, the hourly version of CVaR (T-CVaR) is incorporated in the coordination to hedge against short-term market price volatility. The rolling planning is employed to update the scenario trees of intra-day and real-time prices within the day of planning. Finally, the developed model enables the aggregator to manage both stationary storages and EVs. The main contributions of the paper are:

Development of a two-stage SD-MILP optimal coordinated bidding model for an aggregator who manages numerous storage units (stationary and EVs) and trades electric power in three-settlement markets, taking into account uncertainties in market price and fleet characteristics, as well as existing market rules. This model can be used for market exchange irrespective of (1) production or consumption technology and (2) mobile or stationary storage unit.

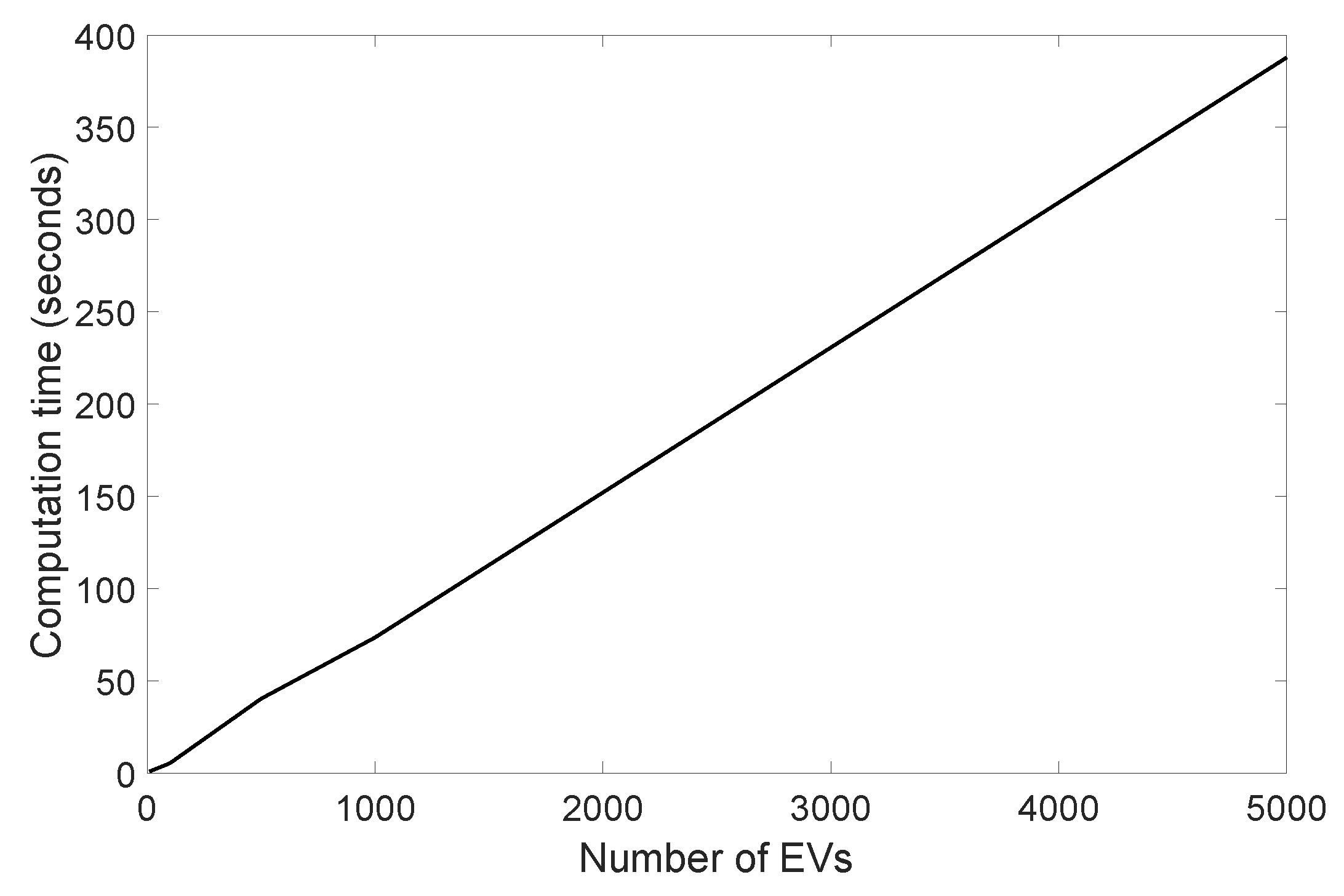

Derivation of optimal coordinated charge (discharge) bids for day-ahead, intra-day and real-time markets with reasonable computation time using scenario-reduction techniques.

Uncertainty modeling in all three market prices as well as of EV mobility parameters.

Incorporation of the hourly CVaR (T-CVaR) to focus on the lower tails of the profits on hourly bases.

The paper is structured as follows.

Section 2 introduces the general decision-making procedure of an EV aggregator participating in three-settlement markets.

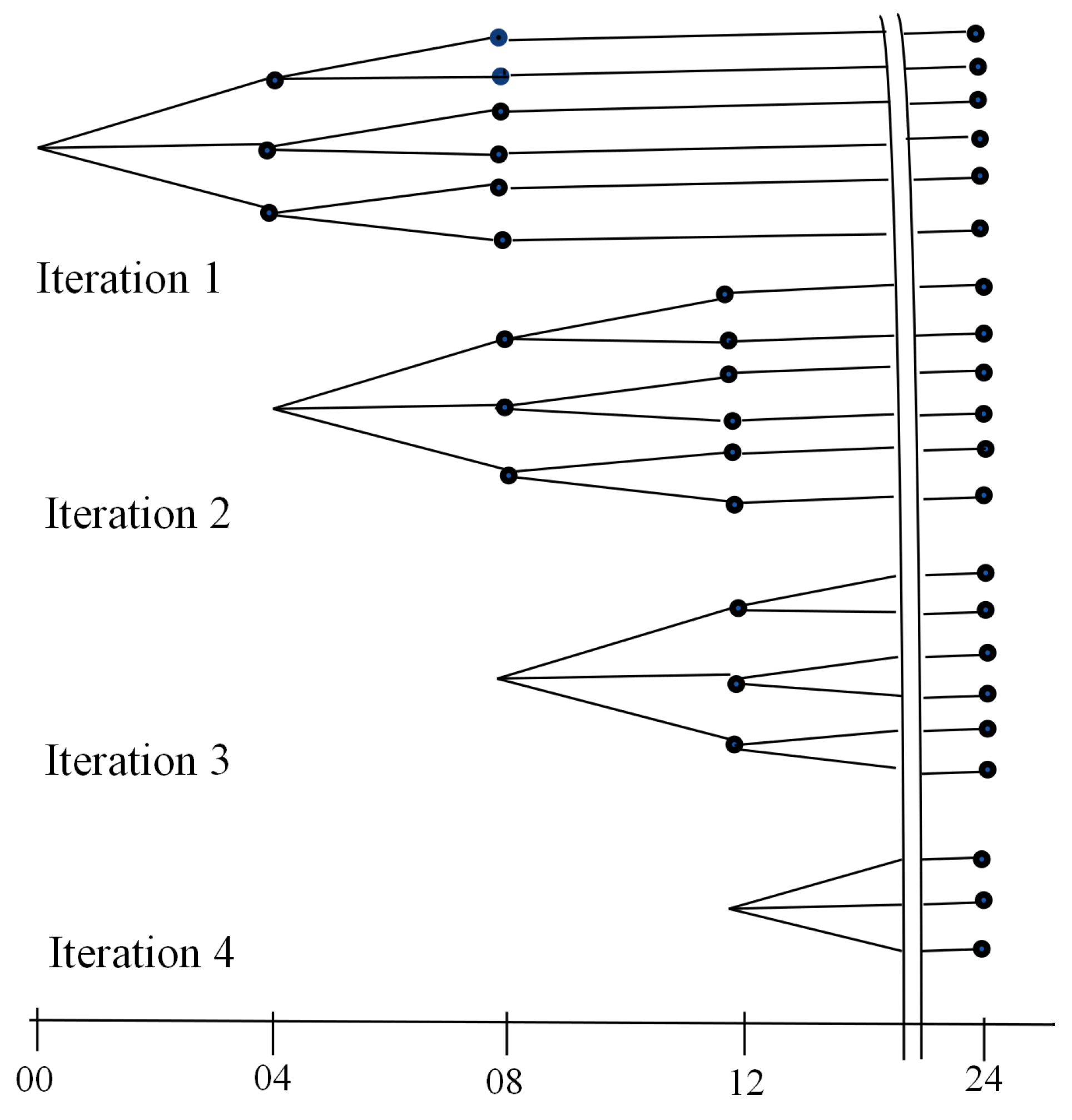

Section 3 explains the uncertainty modeling related to market prices and EV availability as well as the concept of rolling planning.

Section 4 describes the two-stage dynamically updated stochastic mathematical model formulation of an aggregator, who manages a big number of energy storage units.

Section 5 provides the case-study results and

Section 6 concludes the paper.

4. Mathematical Problem Formulation

The current bidding problem formulation of an EV aggregator is an extension of the model presented in [

16], where the trading possibilities in intra-day market are ignored and the optimization is risk-neutral.

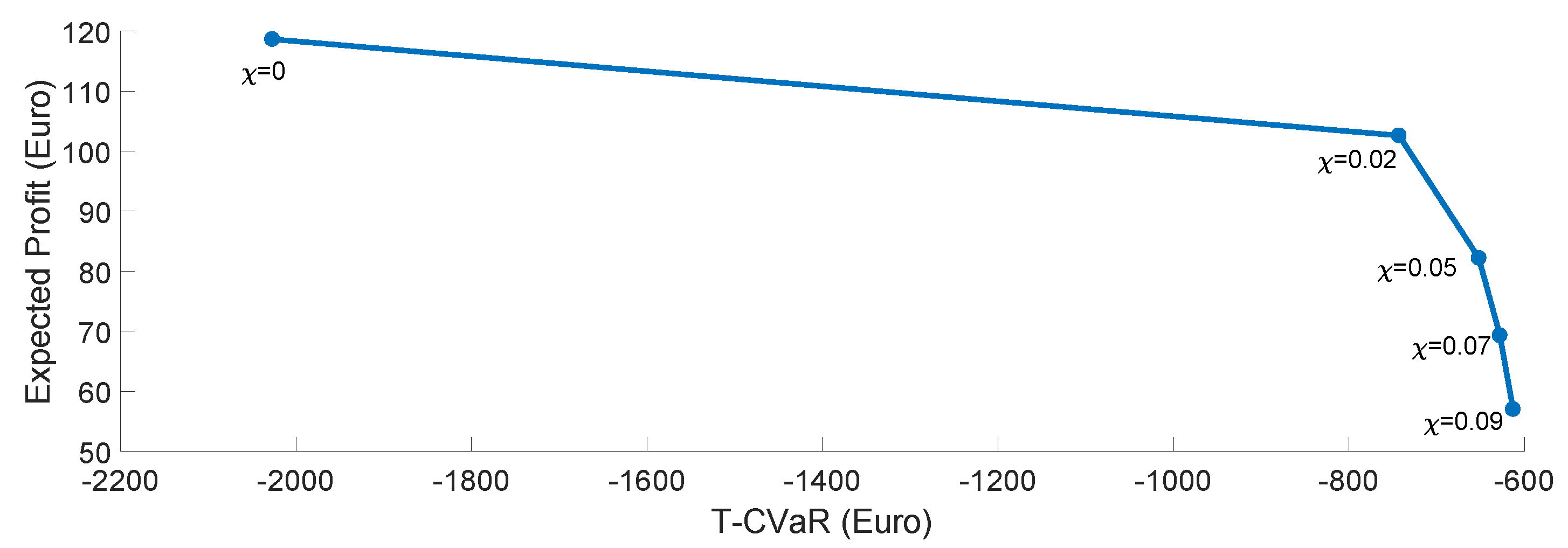

A profit-maximizing risk-averse aggregator is assumed, who participates in day-ahead, intra-day and real-time markets. The aggregator maximizes its expected profit while minimizing its exposure to market price risk. The profits in different hours might have different statistical behavior due to the fact that the market prices can be functions of fundamentally different drivers for different trading hours within the planning day. The time-dependent conditional value at risk (T-CVaR) is proposed to manage the lower tail of profit distribution in each hour in Equations (

3)–(

5). Equation (

3) aims at maximizing hourly CVaR subject to Equations (

4) and (

5). Here, constraints (

4) and (

5) set conditions on the hourly risk measure. According to Equation (

4),

if the profit for scenario

s and hour

t is greater than

.

is defined by the difference between

and the relative profit for all other scenarios and hours.

For a given confidence level , the defines the expected value of profits less than -quantile of distributed profit in hour t.

Two-Stage Stochastic Optimal Strategy of an EV Aggregator

The stochastic optimization problem stated in Equation (

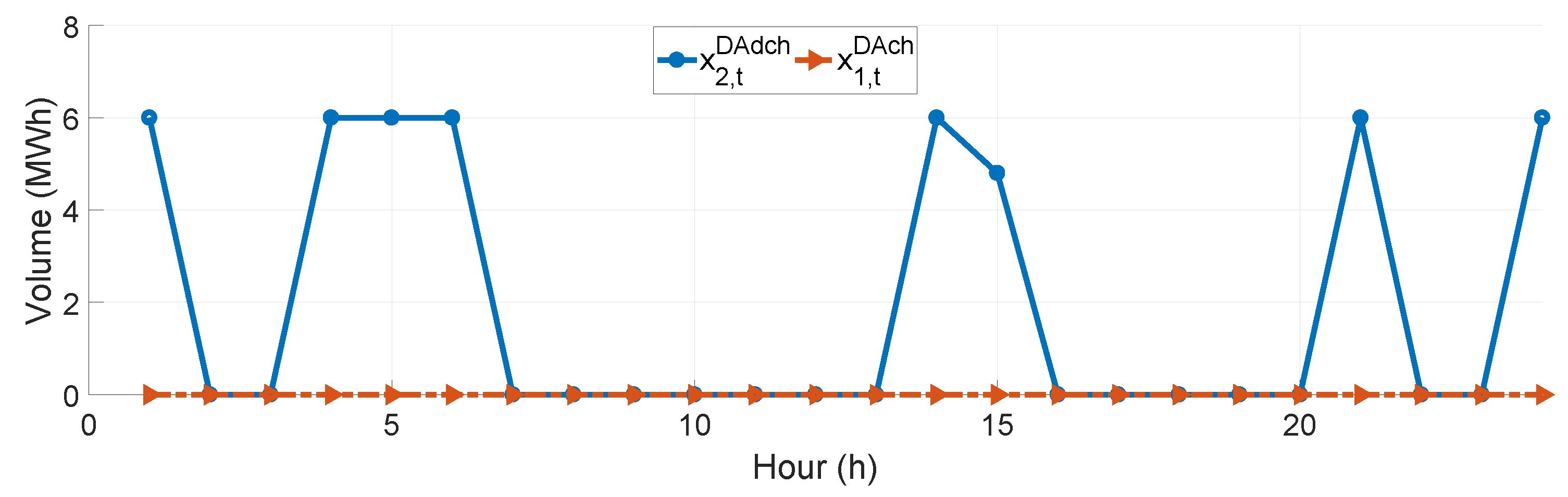

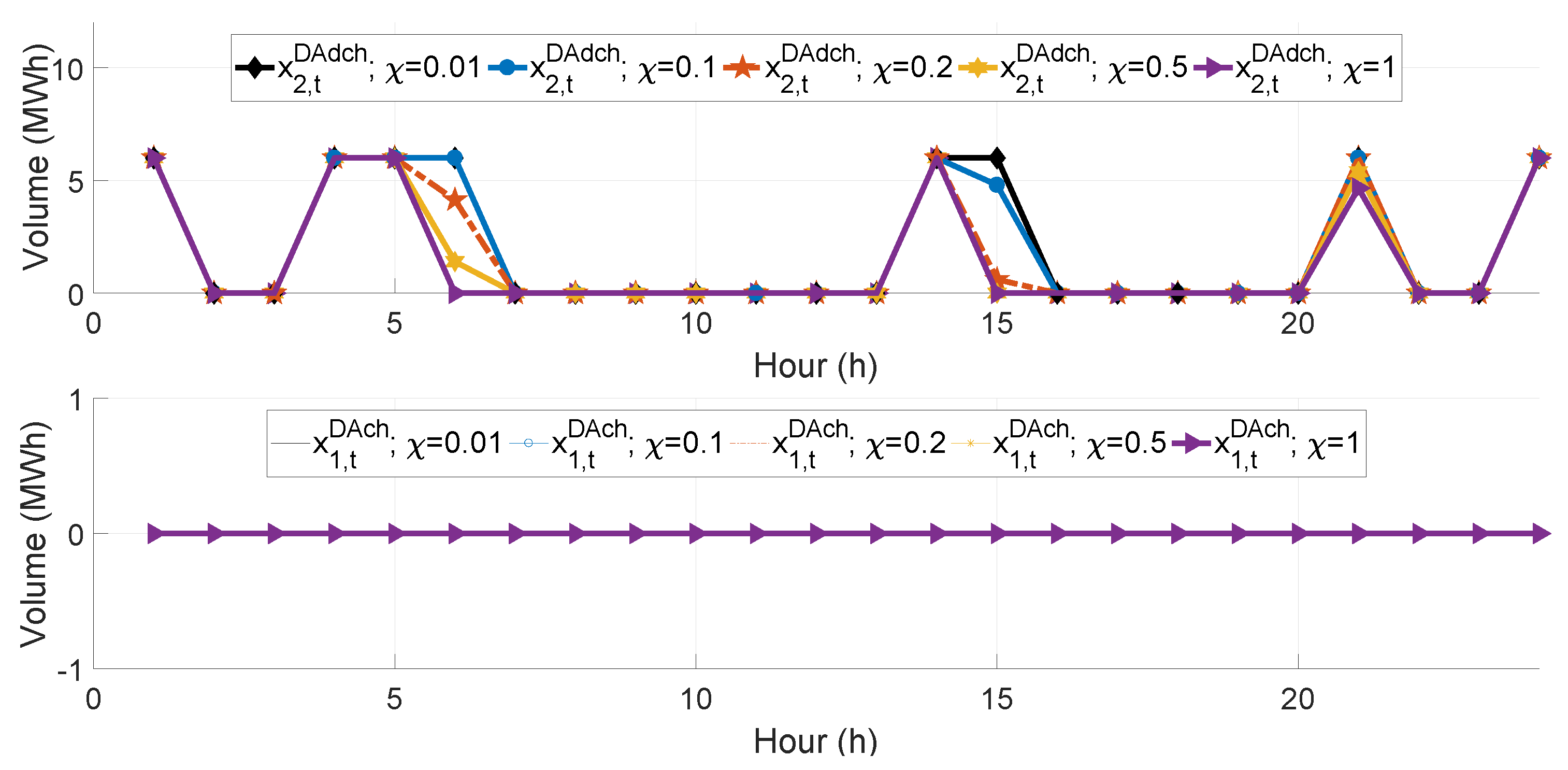

6) aims at the maximization of scenario-weighted expected profits from day-ahead energy trading, intra-day and real-time power exchange, while minimizing its exposure to market price risk. Hourly resolution is assumed for day-ahead, intra-day and real-time markets.

where

,

and

are potential profits

from day-ahead, intra-day and real-time markets expressed as in (

7), (8) and (

9) correspondingly.

Equations (

7)–(

9) express the aggregator’s revenue minus cost while providing optimal discharge/charge bids in day-ahead, intra-day and real-time markets, respectively.

The equations in (

10) provide the aggregated charge/discharge bids in three market places. The aggregator’s cost in all three markets while providing charging/discharging optimal bids includes the aggregator’s agreement with the EV owner set out in Equations (

11)–(

13). Here

is the degradation cost modeled as in [

15] and set out in (

14).

To derive the step-function bidding curve for hour

t of the day-ahead market, the parameters

,

, ...,

are first fixed at

I arbitrary price levels. Then the unknown variables

,

, ...,

of the step function are derived as follows:

Using binary variable

and a large enough constant

, (

15) can be reformulated as constraints (

16)–(

18):

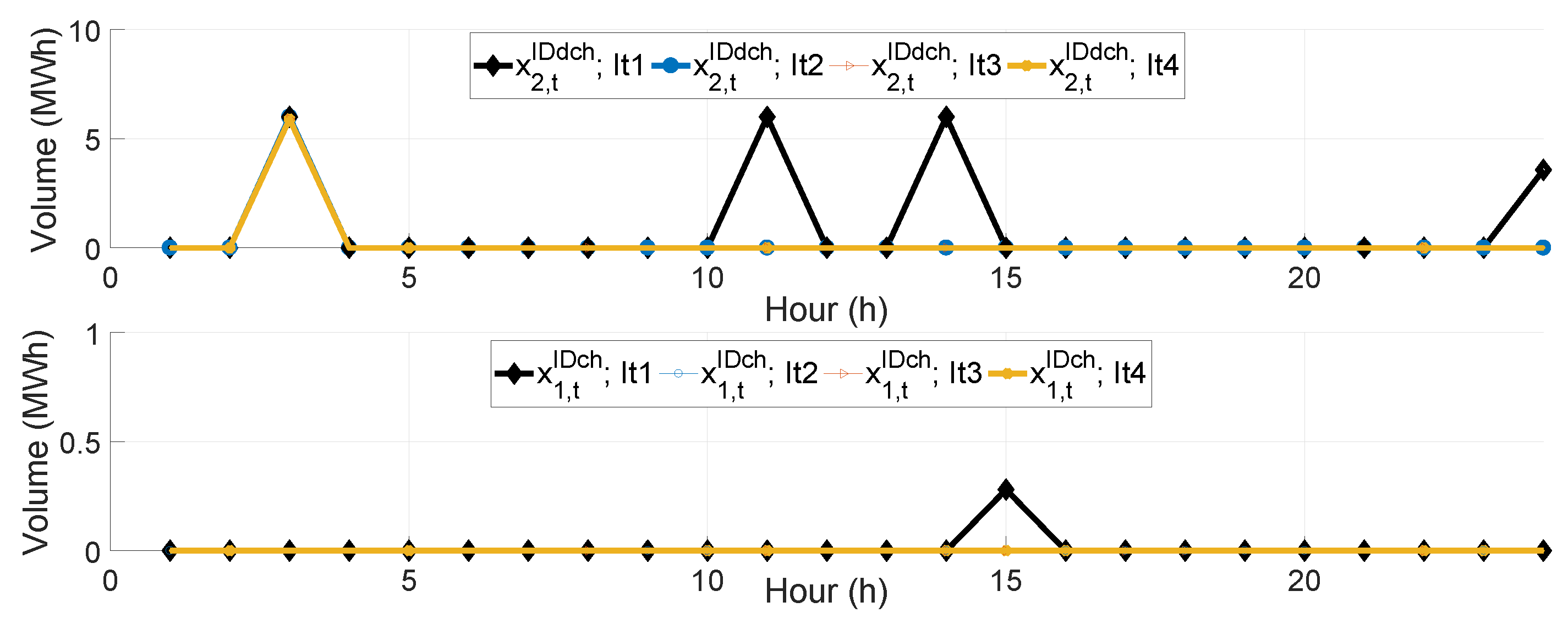

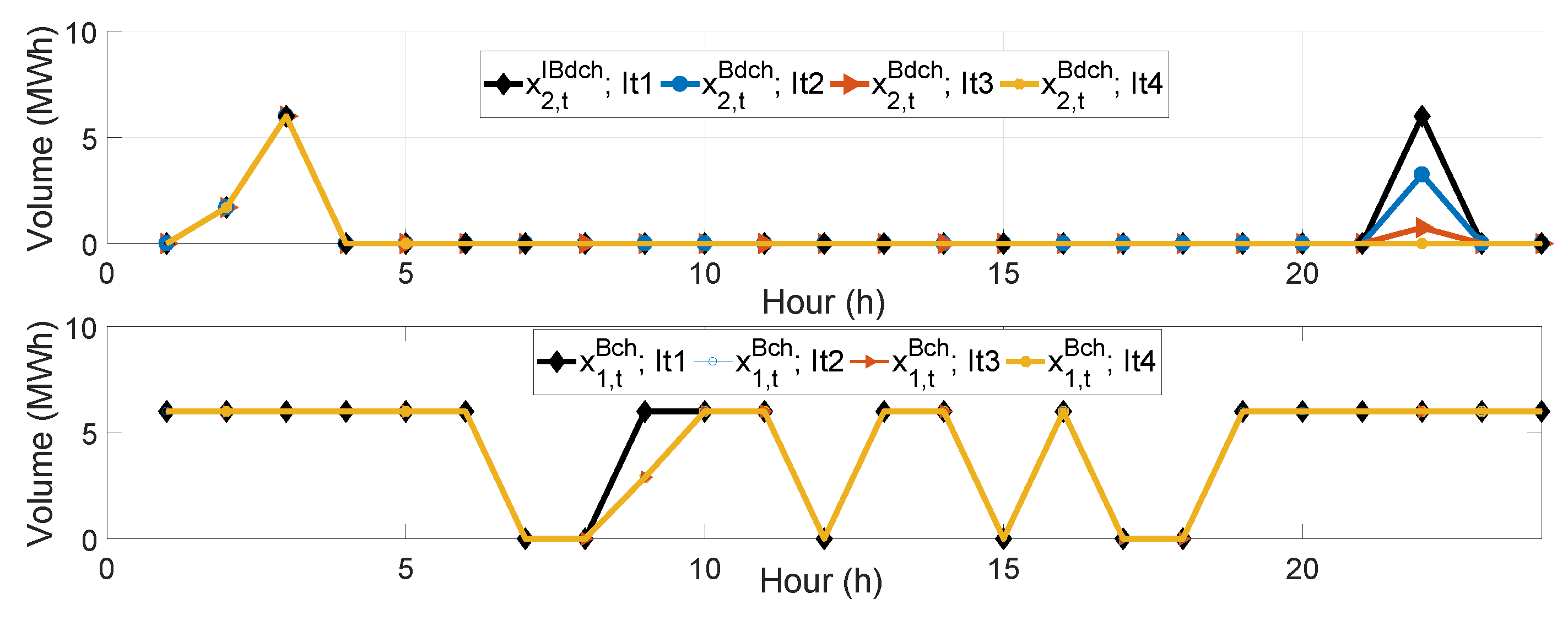

The selling and buying bids to intra-day market are expressed in (

19).

In the similar way, using binary variables

and a large enough constant

, we have:

Similarly, the up- and down-regulating bids to real-time market are expressed in (

23).

Again using binary variables

and a large enough constant

(

23) can be reformulated as:

Constants , and must be tuned carefully to avoid introducing extra bounds or ill-conditioning in the optimization problem.

The state of charge balance constraint

can be modeled in the following way [

14]:

Constraint (

27) states that for each hour the new content of the storage is equal to its old content plus energy inflow minus energy outflow. Equation (

27) allows modeling of both stationary and mobile (EV) storages. For stationary storages,

availability matrix entities are always 1. For EVs the availability matrix element for hour

t and scenario

s is either 0 or 1 depending on whether the EV is available or on a journey. The storage level is bounded by its minimum and maximum levels (

28).

The constraint (

29) prevents discharging/charging in the periods of unavailability, while the constraint (

30) states the end SoC condition.

Finally, constraints (

31) and (

32) impose the conditions of risk measure.

In Equation (

31),

is 0 if the profit in scenario

s and time

t is greater than

. Otherwise,

is equal to the difference of

and the corresponding profit.

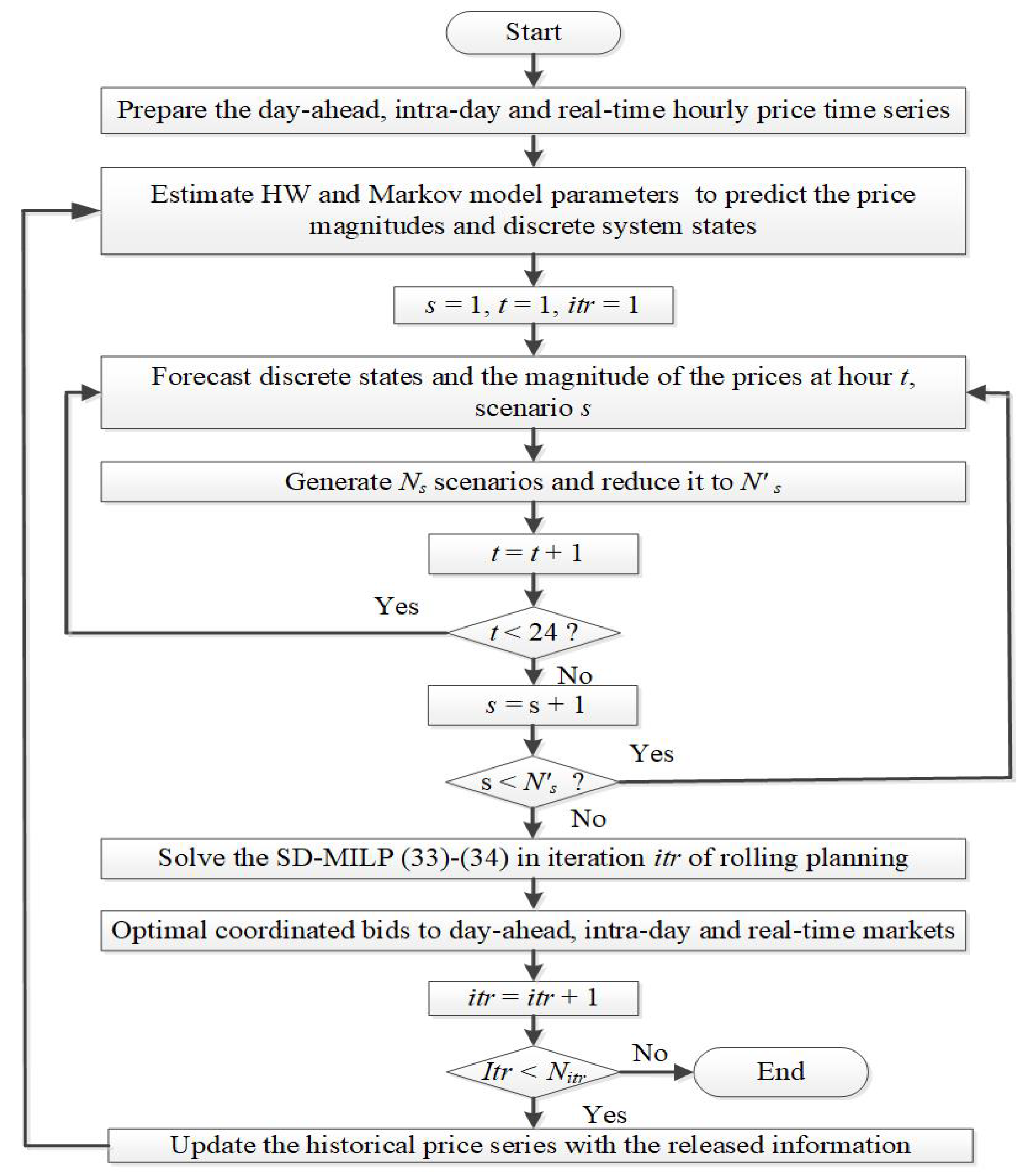

With the concept of rolling planning dynamically updated, the stochastic two-stage optimal bidding strategy for deriving the coordinated bidding curves in day-ahead, intra-day and real-time markets is defined in Equations (33) and (34).

where

=

is the set of decision variables.

The whole framework of deriving the optimal coordinated bids for three-settlement markets is presented in

Figure 3.