Designing Solar Power Purchase Agreement of Rooftop PVs with Battery Energy Storage Systems under the Behind-the-Meter Scheme

Abstract

:1. Introduction

- (1)

- A novel optimization model for designing SPPA discount rates on TOU tariff with demand charges and operation modes of the BESS for rooftop PVs with BESS under the BTMS.

- (2)

- Implementation case studies of the proposed methodology with the tariff structure in Thailand to evaluate the sensitivity analysis of the installed capacity of rooftop PVs, battery capacity, and rate of excess energy.

2. Background Knowledge

2.1. Battery Energy Storage Systems

2.1.1. Battery Capacity

2.1.2. Charged and Discharged Power

2.1.3. State of Charge

2.1.4. Lifetime of Battery

2.2. Rooftop PVs with BESS

2.3. TOU Tariff with Demand Charges

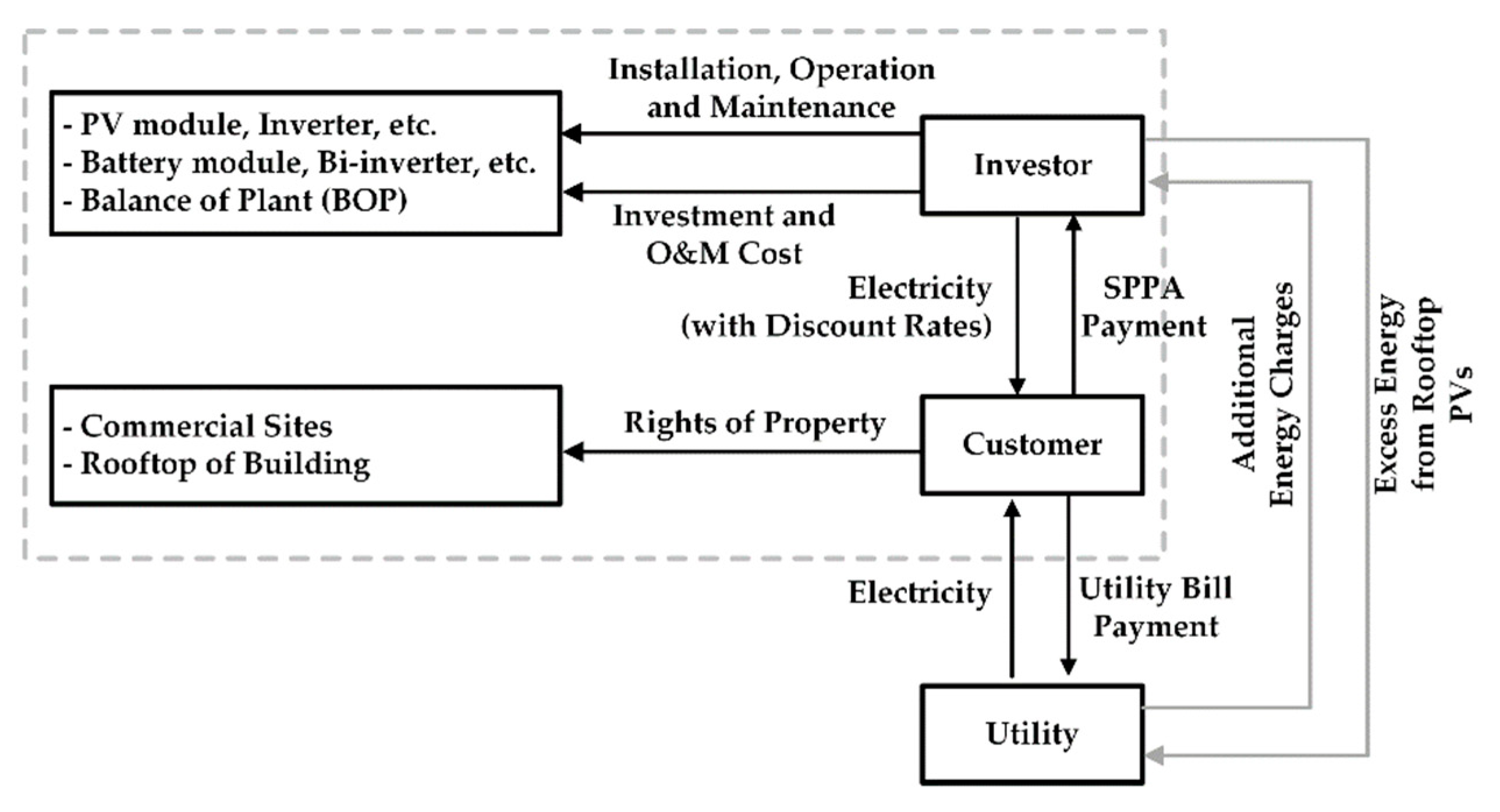

2.4. Behind-the-Meter Scheme

3. Modeling of Cost and Revenue

3.1. Total Project Cost

3.2. Solar Power Purchase Agreement

4. Proposed Methodology

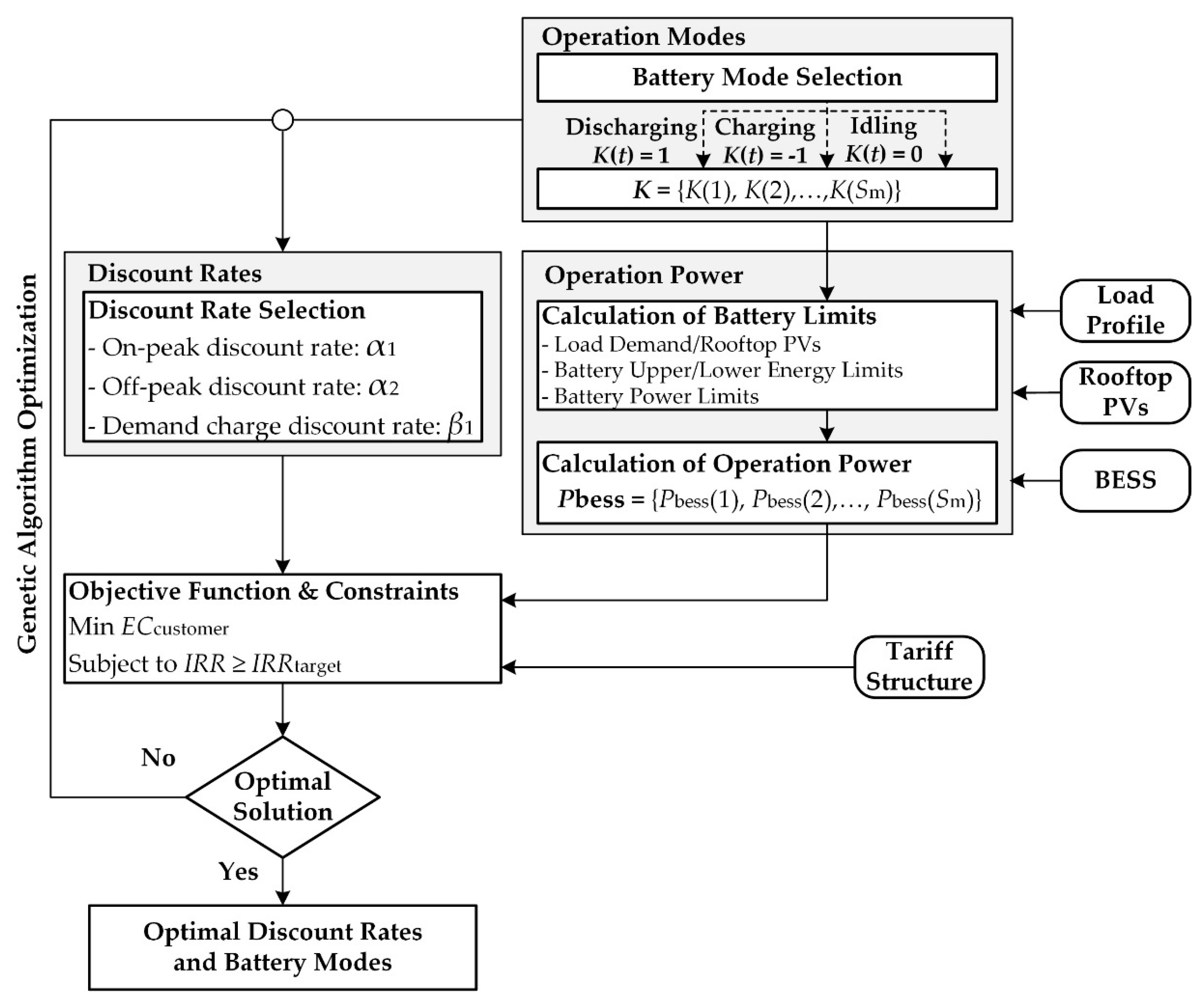

4.1. Operation Modes of Battery Energy Storage Systems

4.2. Solar Power Purchase Agreement with Behind-the-Meter Scheme

4.2.1. Electricity Charges of the Customers

4.2.2. Revenue of the Investors

4.3. Discount Rate and Operation Mode Optimization

5. Simulation Results and Discussion

5.1. Problem Description

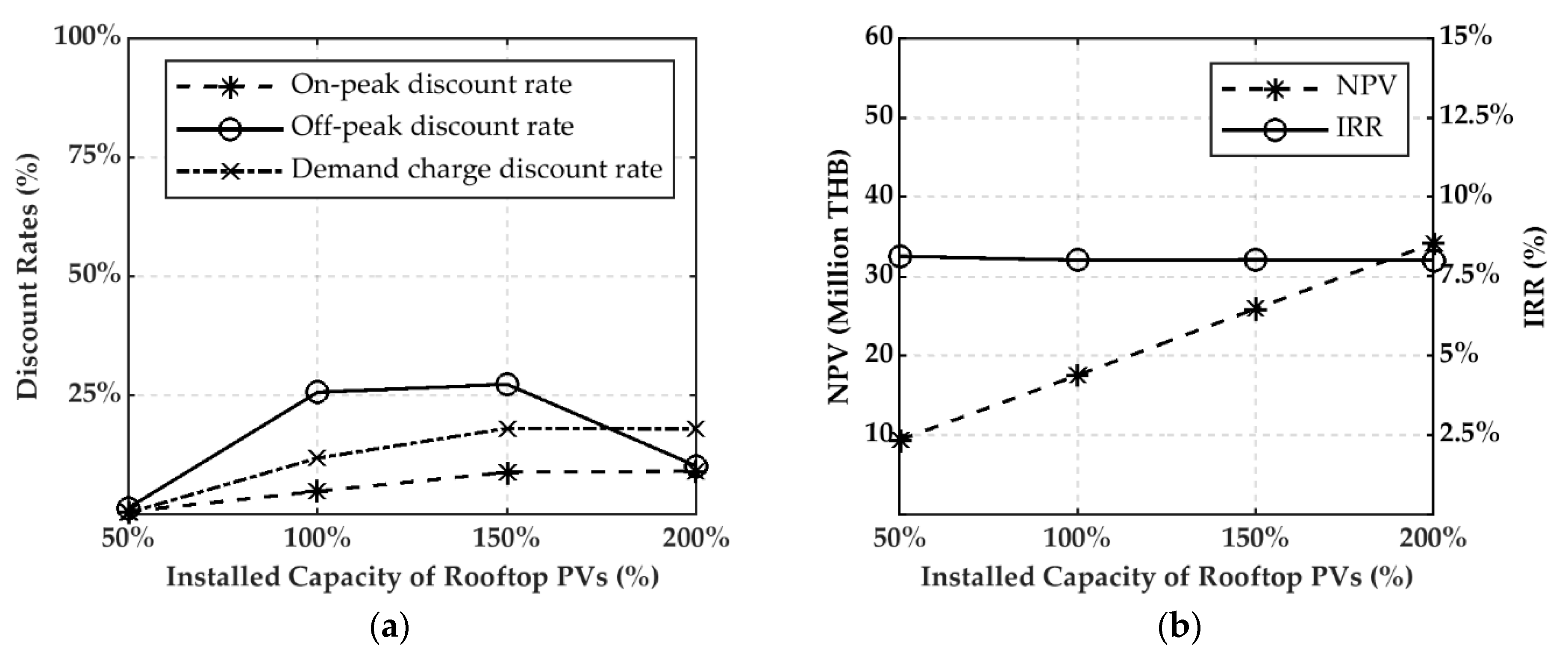

5.2. Scenario I: Installed Capacity of Rooftop PVs

5.3. Scenario II: Battery Capacity

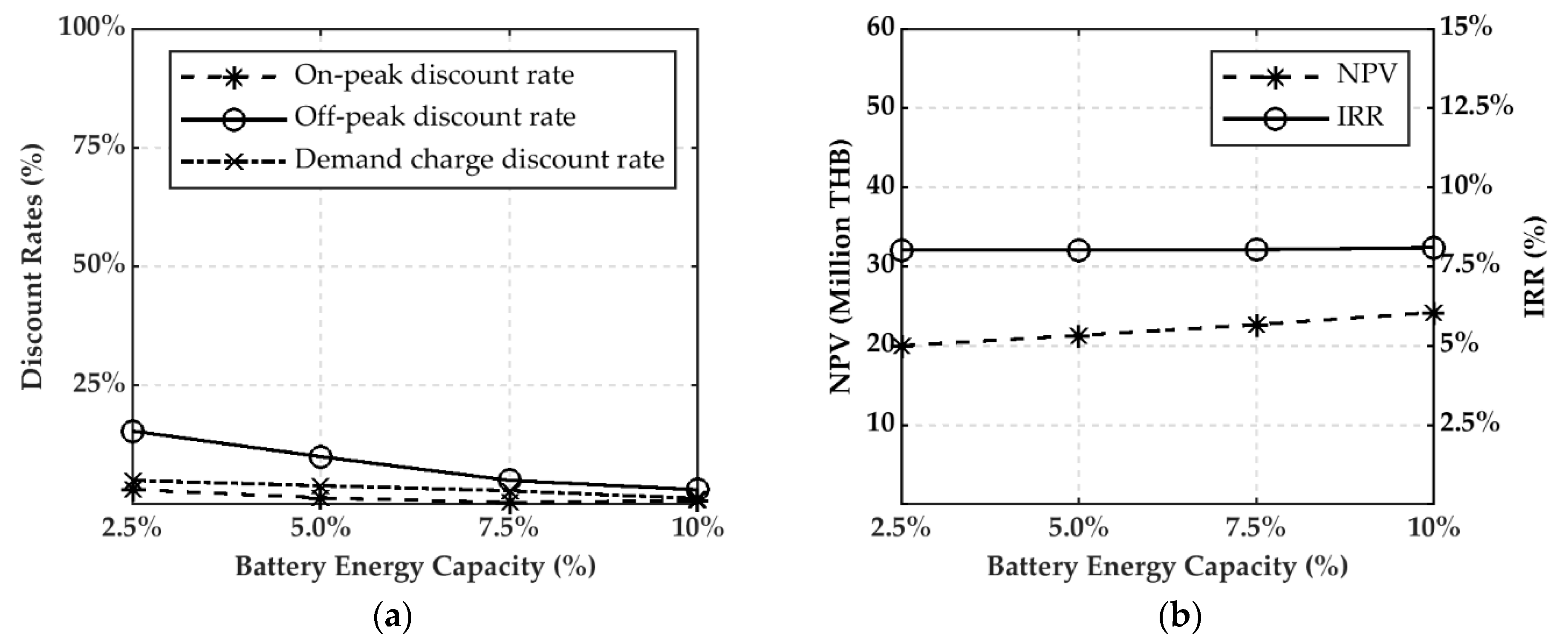

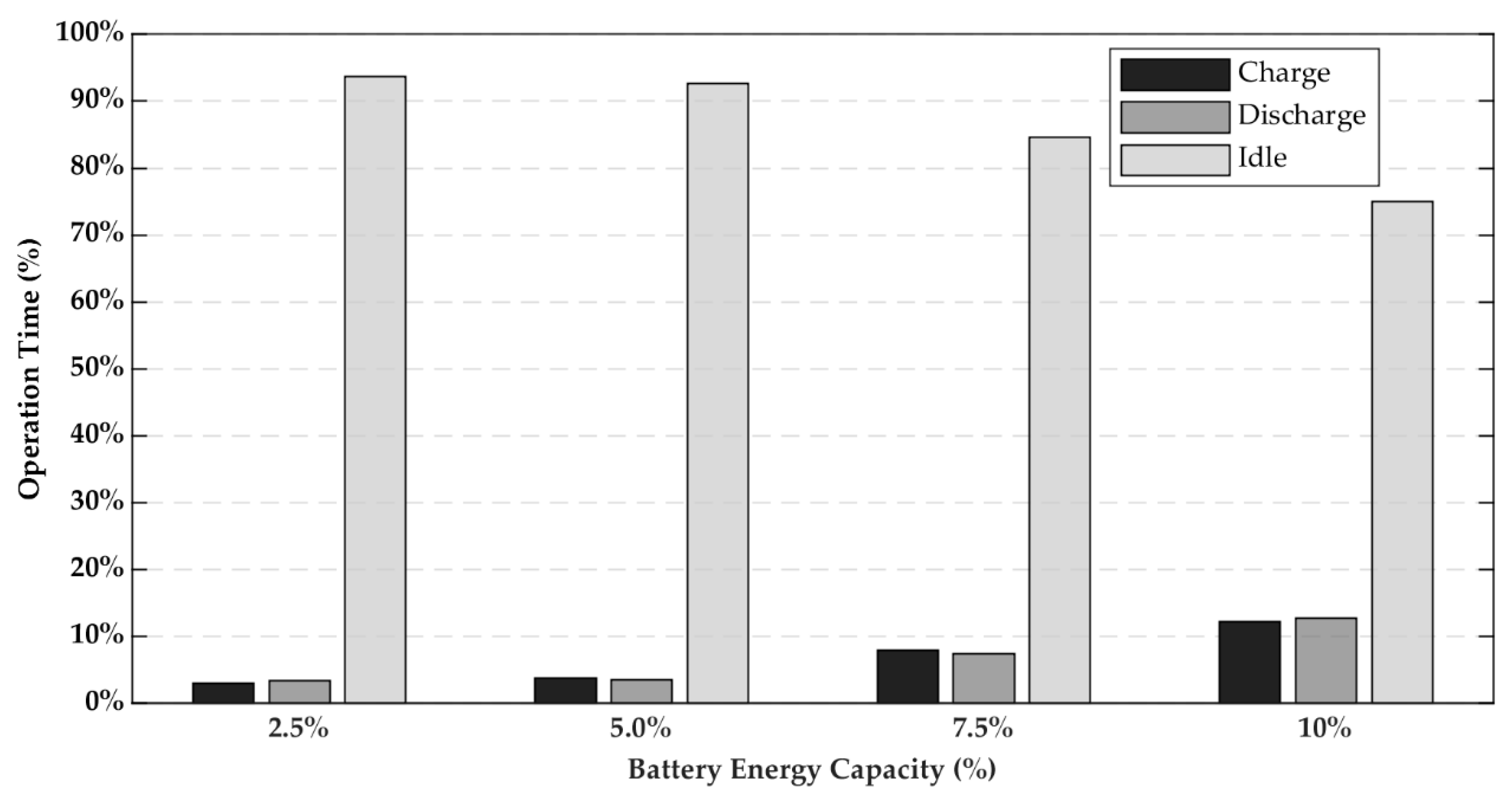

5.3.1. Battery Energy Capacity

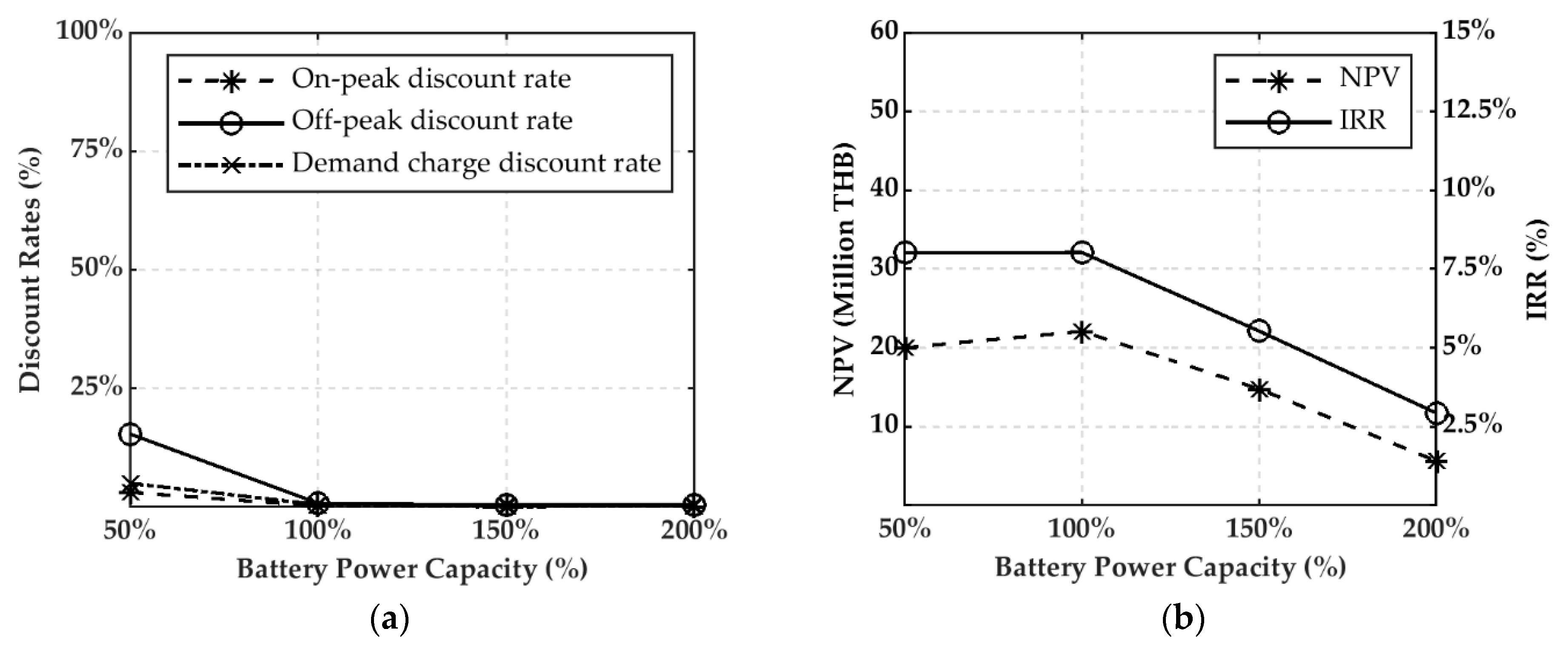

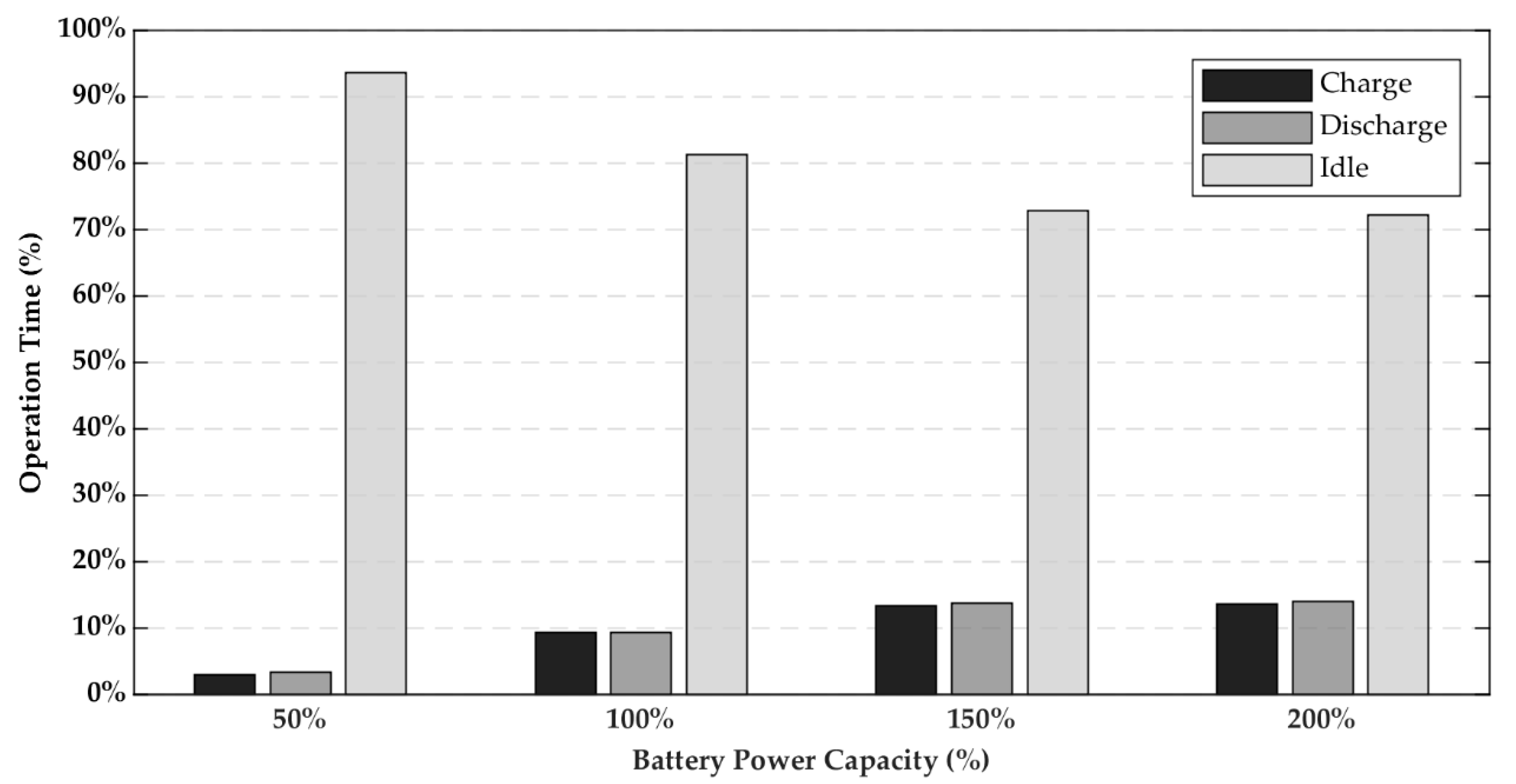

5.3.2. Battery Power Capacity

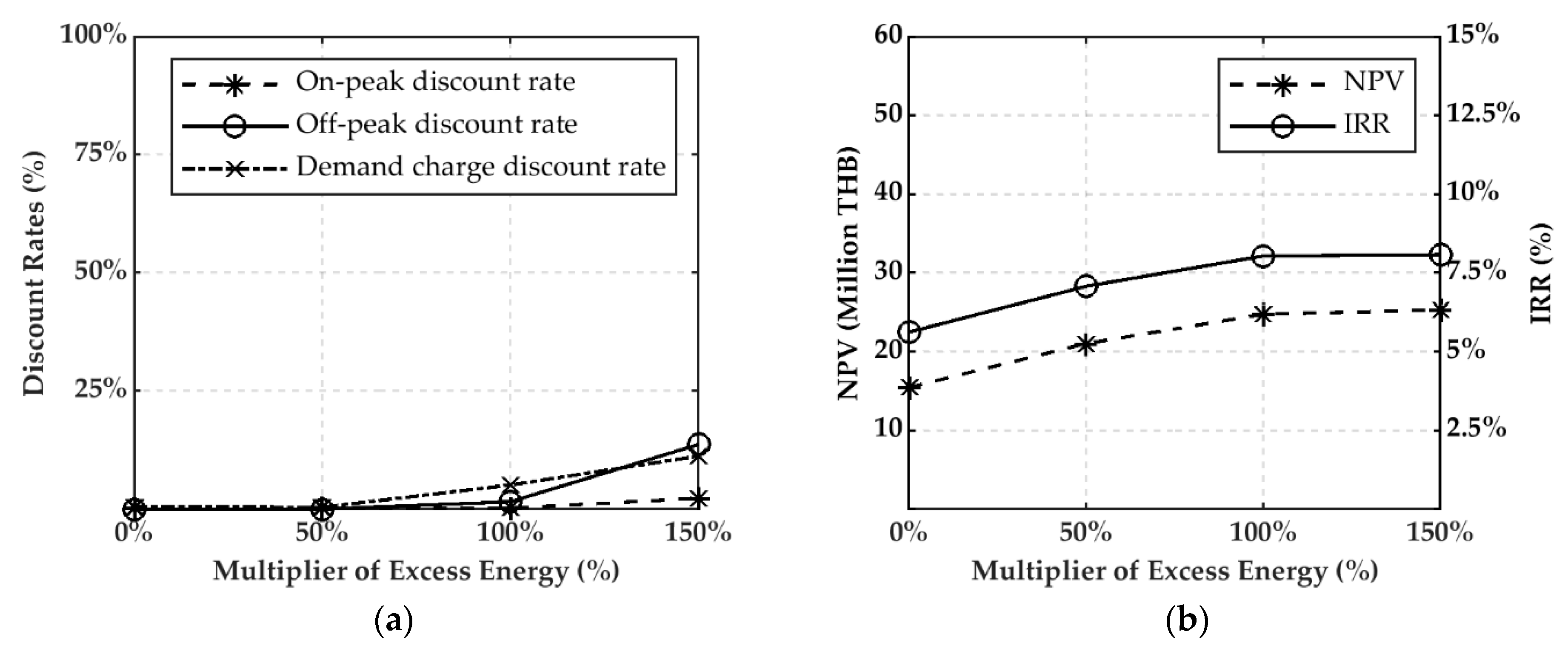

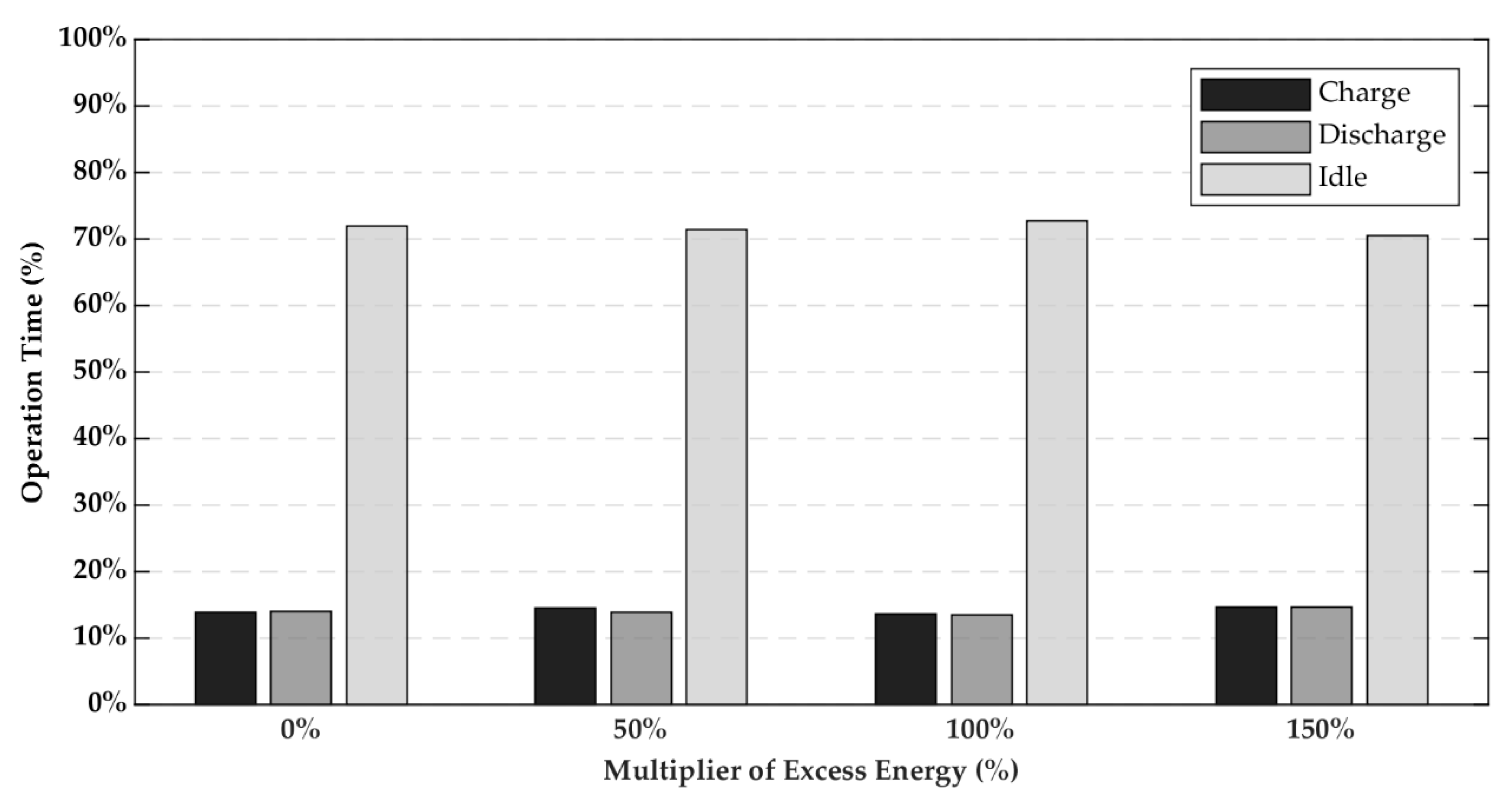

5.4. Scenario III: Rate of Excess Energy

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Time Window of Interest | |

| t | Time (1st hour = 1, 2nd hour = 2, …) |

| tpeak | Time of peak output power from grid |

| m | Month (1st month = 1, 2nd month = 2, …) |

| y | Year (1st year = 1, 2nd year = 2, …) |

| Δt | Length of the time interval (h) |

| Y | Lifetime of the project (y) |

| Number of on-peak time intervals in month m | |

| Number of off-peak time intervals in month m | |

| Sy | Number of time intervals in year y |

| Rooftop PVs with Battery Energy Storage Systems and Load | |

| Ppv(t) | AC output power from rooftop PVs at time t (kW) |

| Pg(t) | Output power from the utility’s grid at time t (kW) |

| Pl(t) | Load consumption at time t (kW) |

| Pbess(t) | Output power from battery energy storage systems at time t (kW) |

| Cbess(t)η | Stored energy in battery energy storage systems at time t (kWh) |

| ηbi-inverter | Bi-directional inverter efficiency (%) |

| ηrt | Battery round-trip efficiency (%) |

| Cnom,dc | Battery nominal energy capacity (kWh) |

| Pnom,dc | Battery nominal power capacity (kW) |

| Maximum charged power at time t (kW) | |

| Maximum discharged power at time t (kW) | |

| φ | Energy to power ratio |

| σ(t) | State of charge at time t (%) |

| σmax | Maximum state of charge (%) |

| σmin | Minimum state of charge (%) |

| L(t) | Battery degradation coefficient at time t |

| Lop(t) | Operating degradation coefficient at time t |

| Lself(t) | Self-degradation coefficient at time t |

| Ncount(t) | Number of used cycles |

| Ntotal | Total life cycles of BESS (Cycles) |

| TOU Tariff with Demand Charges | |

| γ | Multiplier of excess energy (%) |

| ron | On-peak energy rate (THB/kWh) |

| roff | Off-peak energy rate (THB/kWh) |

| rdemand | Demand charge rate (THB/kW) |

| On-peak rate of excess energy (THB/kWh) | |

| Off-peak rate of excess energy (THB/kWh) | |

| Ron(m) | On-peak energy charges at month m (THB) |

| Roff(m) | Off-peak energy charges at month m (THB) |

| Rdemand(m) | Demand charges at month m (THB) |

| Rtotal(m) | Total electricity charges at month m (THB) |

| Solar Power Purchase Agreement | |

| SPPA on-peak energy rate (THB/kWh) | |

| SPPA off-peak energy rate (THB/kWh) | |

| SPPA demand charge rate (THB/kW) | |

| α1 | On-peak discount rate |

| α2 | Off-peak discount rate |

| β1 | Demand charge discount rate |

| Financial Assumptions | |

| Interest rate (%) | |

| IRR | Internal rate of return (%) |

| IRRtarget | Target rate of return (%) |

| cop | Rate of operating cost (%) |

| cpv | Unit cost of rooftop PVs (THB/kW) |

| Total cost of rooftop PVs (THB) | |

| ceic | Energy installation cost (THB/kWh) |

| cpic | Power installation cost (THB/kW) |

| Total cost of battery energy storage systems (THB) | |

References

- REN21. Renewables 2019 Global Status Report; REN21 Secretariat: Paris, France, 2019; Available online: https://ren21.net/gsr-2019/ (accessed on 27 July 2020).

- IRENA. Innovation Landscape Brief: Behind-the-Meter Batteries; IRENA: Abu Dhabi, UAE, 2019. [Google Scholar]

- Tongsopit, S.; Moungchareon, S.; Aksornkij, A.; Potisat, T. Business models and financing options for a rapid scale-up of rooftop solar power systems in Thailand. Energy Policy 2016, 95, 447–457. [Google Scholar] [CrossRef] [Green Version]

- Reid, E.; Dingenen, S. Bird & Bird & Corporate PPAs: An International Perspective. 2019. Available online: https://www.twobirds.com/en/news/articles/2018/global/bird-and-bird-and-corporate-ppas-an-international-perspective (accessed on 27 July 2020).

- BNEF. Global Trends I Renewable Energy Investment 2019; Frankfurt School—UNEP Collaborating Centre for Climate & Sustainable Energy Finance: Bonn, Germany, 2019. [Google Scholar]

- NREL. Using Power Purchase for Solar Deployment at Universities 2016. Available online: https://www.nrel.gov/docs/gen/fy16/65567.pdf (accessed on 27 July 2020).

- Sandia National Laboratories. DOE/EPRI 2015 Electricity Storage Handbook in Collaboration with NRECA; Sandia National Laboratories: Albuquerque, New Mexico; Livermore, CA, USA, 2015. [Google Scholar]

- Wong, L.A.; Ramachandaramurthy, V.K.; Taylor, P.; Ekanayake, J.B.; Walker, S.L.; Padmanaban, S. Review on the optimal placement, sizing and control of an energy storage system in the distribution network. J. Energy Storage 2019, 21, 489–504. [Google Scholar] [CrossRef]

- Chaianong, A.; Tongsopit, S.; Bangviwat, A.; Menke, C. Bill saving analysis of rooftop PV customers and policy implications for Thailand. Renew. Energy 2019, 131, 422–434. [Google Scholar] [CrossRef]

- Darghouth, N.R.; Barbose, G.; Wiser, R. The impact of rate design and net metering on the bill savings from distributed PV for residential customers in California. Energy Policy 2011, 39, 5243–5253. [Google Scholar] [CrossRef] [Green Version]

- Poullikkas, A. A comparative assessment of net metering and feed in tariff schemes for residential PV systems. Sustain. Energy Technol. Assess. 2013, 3, 1–8. [Google Scholar] [CrossRef]

- Watts, D.; Valdés, M.F.; Jara, D.; Watson, A. Potential residential PV development in Chile: The effect of Net Metering and Net Billing schemes for grid-connected PV systems. Renew. Sustain. Energy Rev. 2015, 41, 1037–1051. [Google Scholar] [CrossRef]

- Cucchiella, F.; D’Adamo, I.; Gastaldi, M.; Stornelli, V. Solar Photovoltaic Panels Combined with Energy Storage in a Residential Building: An Economic Analysis. Sustainability 2018, 10, 3117. [Google Scholar] [CrossRef] [Green Version]

- Naumann, M.; Karl, R.C.; Truong, C.N.; Jossen, A.; Hesse, H.C. Lithium-ion Battery Cost Analysis in PV-household Application. Energy Procedia 2015, 73, 37–47. [Google Scholar] [CrossRef] [Green Version]

- Jo, B.-K.; Jung, S.; Jang, G. Feasibility Analysis of Behind-the-Meter Energy Storage System According to Public Policy on an Electricity Charge Discount Program. Sustainability 2019, 11, 186. [Google Scholar] [CrossRef] [Green Version]

- Neubauer, J.; Simpson, M. Deployment of Behind-The-Meter Energy Storage for Demand Charge Reduction; Office of Scientific and Technical Information (OSTI): Golden, CO, USA, 2015. [Google Scholar]

- Park, A.; Lappas, P. Evaluating demand charge reduction for commercial-scale solar PV coupled with battery storage. Renew. Energy 2017, 108, 523–532. [Google Scholar] [CrossRef]

- Hayat, M.A.; Shahnia, F.; Shafiullah, G.M. Economic Viability of Roof Leasing for Rooftop Photovoltaic Systems from a Leasing Company’s Perspective. In Proceedings of the 2018 IEEE 7th World Conference on Photovoltaic Energy Conversion (WCPEC) (A Joint Conference of 45th IEEE PVSC, 28th PVSEC & 34th EU PVSEC, Waikoloa Village, HI, USA, 10–15 June 2018); IEEE: Waikoloa Village, HI, USA, 2018. [Google Scholar]

- Hong, T.; Yoo, H.; Kim, J.; Koo, C.; Jeong, K.; Lee, M.; Ji, C.; Jeong, J. A model for determining the optimal lease payment in the solar lease business for residences and third-party companies—With focus on the region and on multi-family housing complexes. Renew. Sustain. Energy Rev. 2018, 82, 824–836. [Google Scholar] [CrossRef]

- Yoon, Y.; Kim, Y.-H. Charge scheduling of an energy storage system under time-of-use pricing and a demand charge. Sci. World J. 2014, 2014, 937329. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Pena-Bello, A.; Burer, M.; Patel, M.K.; Parra, D. Optimizing PV and grid charging in combined applications to improve the profitability of residential batteries. J. Energy Storage 2017, 13, 58–72. [Google Scholar] [CrossRef]

- Moiteaux, A. Analysis of Grid-Connected Battery Energy Storage and Photovoltaic Systems for Behind-the-Meter Applications: Case Study for a Commercial Building in Sweden. Available online: https://www.diva-portal.org/smash/record.jsf?pid=diva2%3A1070752&dswid=-3229 (accessed on 27 July 2020).

- Henri, G.; Lu, N.; Carrejo, C. Design of a novel mode-based energy storage controller for residential PV systems. In Proceedings of the 2017 IEEE PES Innovative Smart Grid Technologies Conference Europe (ISGT-Europe), 26–29 September 2017; IEEE: Torino, Italy, 2017. [Google Scholar]

- Nguyen, T.A.; Byrne, R.H. Maximizing the cost-savings for time-of-use and net-metering customers using behind-the-meter energy storage systems. In Proceedings of the 2017 North American Power Symposium (NAPS), Morgantown, WV, USA, 17–19 September 2017; IEEE: Morgantown, WV, USA, 2017. [Google Scholar]

- Ratnam, E.L.; Weller, S.R.; Kellett, C.M. Scheduling residential battery storage with solar PV: Assessing the benefits of net metering. Appl. Energy 2015, 155, 881–891. [Google Scholar] [CrossRef]

- Hesse, H.; Martins, R.; Musilek, P.; Naumann, M.; Truong, C.; Jossen, A. Economic Optimization of Component Sizing for Residential Battery Storage Systems. Energies 2017, 10, 835. [Google Scholar] [CrossRef]

- Prapanukool, C.C. Surachai, Optimal Battery Capacity for Residential Rooftop PVs with Consideration of Net-Metering Scheme Compensation Period. Int. J. Renew. Energy Res. 2019, 9, 1724–1732. [Google Scholar]

- Zhou, L.; Zhang, Y.; Lin, X.; Li, C.; Cai, Z.; Yang, P. Optimal Sizing of PV and BESS for a Smart Household Considering Different Price Mechanisms. IEEE Access 2018, 6, 41050–41059. [Google Scholar] [CrossRef]

- Gomez-Gonzalez, M.; Hernandez, J.C.; Vera, D.; Jurado, F. Optimal sizing and power schedule in PV household-prosumers for improving PV self-consumption and providing frequency containment reserve. Energy 2020, 191, 116554. [Google Scholar] [CrossRef]

- Dai, Q.; Liu, J.; Wei, Q. Optimal Photovoltaic/Battery Energy Storage/Electric Vehicle Charging Station Design Based on Multi-Agent Particle Swarm Optimization Algorithm. Sustainability 2019, 11, 1973. [Google Scholar] [CrossRef] [Green Version]

- Yao, L.; Damiran, Z.; Lim, W.H. Optimal Charging and Discharging Scheduling for Electric Vehicles in a Parking Station with Photovoltaic System and Energy Storage System. Energies 2017, 10, 550. [Google Scholar] [CrossRef]

- Hejazi, H.A.; Araghi, A.R.; Vahidi, B.; Hosseinian, S.H.; Abedi, M.; Mohsenian-Rad, H. Independent distributed generation planning to profit both utility and DG investors. IEEE Trans. Power Syst. 2013, 28, 1170–1178. [Google Scholar] [CrossRef]

- Xu, B. Degradation-Limiting Optimization of Battery Energy Storage Systems Operations. Master’s Thesis, ETH Zurich, Zurich, Switzerland, September 2013. [Google Scholar]

- Riffonneau, Y.; Bacha, S.; Barruel, F.; Ploix, S. Optimal Power Flow Management for Grid Connected PV Systems with Batteries. IEEE Trans. Sustain. Energy 2011, 2, 309–320. [Google Scholar] [CrossRef]

- IRENA. Electricity Storage and Renewables: Costs and Markets to 2030; International Renewable Energy Agency: Abu Dhabi, UAE, 2017. [Google Scholar]

- Ardani, K.; O’Shaughnessy, E.; Fu, R.; McClurg, C.; Huneycutt, J.; Margolis, R. Installed Cost Benchmarks and Deployment Barriers for Residential Solar Photovoltaics with Energy Storage: Q1 2016; Office of Scientific and Technical Information (OSTI): Golden, CO, USA, 2016. [Google Scholar]

- MEA. Electricity Tariffs. Available online: http://www.mea.or.th/en/profile/109/111 (accessed on 15 October 2017).

- Zinaman, O.R.; Bowen, T.; Aznar, A.Y. An Overview of Behind-the-Meter Solar-Plus-Storage Regulatory Design: Approaches and Case Studies to Inform. International Applications; Office of Scientific and Technical Information (OSTI): Golden, CO, USA, 2020. [Google Scholar]

- Couture, T.D.; Jacobs, D.; Rickerson, W.; Healey, V. Next Generation of Renewable Electricity Policy: How Rapid Change Is Breaking Down Conventional Policy Categories; Office of Scientific and Technical Information (OSTI): Golden, CO, USA, 2015. [Google Scholar]

- Masson, G.; Briano, J.I.; Baez, M.J. Review and Analysis of PV Self-Consumption Policies. 2016. Available online: http://www.vindogsol.dk/assets/iea-pvps---self-consumption-policies---2016.pdf (accessed on 27 July 2020).

- Curry, C. Lithium-Ion Battery Costs and Market: Squeezed Margins Seek Technology Improvements & New Business Models. BNEF. 2017. Available online: https://data.bloomberglp.com/bnef/sites/14/2017/07/BNEF-Lithium-ion-battery-costs-and-market.pdf (accessed on 27 July 2020).

| Parameters | Scenario I | Scenario II | Scenario III |

|---|---|---|---|

| Battery Energy Storage Systems: | |||

| Battery Energy Capacity (%) | 1% | Varying | 7.5% |

| Battery Power Capacity (%) | 10% | Varying | 100% |

| Depth of discharge (%) | 20% | 20% | 20% |

| Life Cycles (Full cycles) | 6000 | 6000 | 6000 |

| Round-trip efficiency (%) | 90% | 90% | 90% |

| Bi-directional inverter efficiency (%) | 90% | 90% | 90% |

| Self-discharge per month (%) | 0.002% | 0.002% | 0.002% |

| Financial parameters: | |||

| Financial discount rate (%) | 5% | 5% | 5% |

| Project Life (y) | 8 | 8 | 8 |

| Rate of operation cost (%) | 1% | 1% | 1% |

| Target internal rate of return (%) | 12% | 12% | 12% |

| Energy installation cost of the BESS (THB/kWh) | 9265 | 9265 | 9265 |

| Power installation cost of the BESS (THB/kW) | 13,576 | 13,576 | 13,576 |

| Total investment cost of rooftop PVs (THB/kWdc) | 55,000 | 55,000 | 55,000 |

| Load: | |||

| Daily load consumption (kWh) | 23,849 | 23,849 | 23,849 |

| Peak demand (kW) | 1290 | 1290 | 1290 |

| Rooftop PVs: | |||

| PV inverter efficiency (%) | 90% | 90% | 90% |

| Installed capacity of rooftop PVs (%) | Varying | 100% | 100% |

| PV module annual degradation (% per year) | 0.6% | 0.6% | 0.6% |

| Tariff rate: | |||

| Demand charges (THB/kW) | 132.93 | 132.93 | 132.93 |

| On-peak energy charges (THB/kWh) | 4.1839 | 4.1839 | 4.1839 |

| Off-peak energy charges (THB/kWh) | 2.6037 | 2.6037 | 2.6037 |

| Rate of excess energy (%) | 100% | 100% | Varying |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Prapanukool, C.; Chaitusaney, S. Designing Solar Power Purchase Agreement of Rooftop PVs with Battery Energy Storage Systems under the Behind-the-Meter Scheme. Energies 2020, 13, 4438. https://doi.org/10.3390/en13174438

Prapanukool C, Chaitusaney S. Designing Solar Power Purchase Agreement of Rooftop PVs with Battery Energy Storage Systems under the Behind-the-Meter Scheme. Energies. 2020; 13(17):4438. https://doi.org/10.3390/en13174438

Chicago/Turabian StylePrapanukool, Chawin, and Surachai Chaitusaney. 2020. "Designing Solar Power Purchase Agreement of Rooftop PVs with Battery Energy Storage Systems under the Behind-the-Meter Scheme" Energies 13, no. 17: 4438. https://doi.org/10.3390/en13174438