Ushering in a New Dawn: Demand-Side Local Flexibility Platform Governance and Design in the Finnish Energy Markets

Abstract

:1. Introduction

“Either you become a platform, or you will be killed by one” [1]

2. Theoretical Background

2.1. Local Flexibility Marketplaces

2.2. Platform Governance

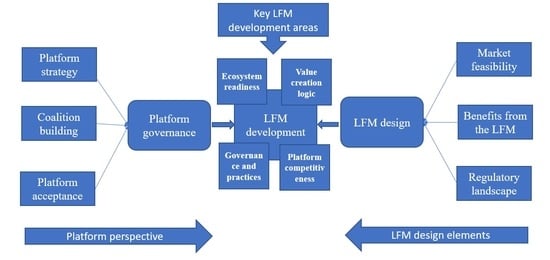

2.3. Theoretical Framework

3. Methods

4. Findings

4.1. LFM Design

4.1.1. Market Feasibility

‘already in our current processes… we are (going to) smaller sizes, the minimum size, which is often something that the smaller market players would like to have. That should you have five megawatts, why cannot it be one megawatt, to be able to offer something.’

‘(The) platform needs to somehow to control who is buying and from whom, because if you have a resource that (part of an aggregation) can be valuable for the TSO…but the same resource can be a single resource valuable for the DSO…(then) the platform has to manage how and who eventually buys it.’

‘If somebody else (an aggregator) is trading my energy…then I might give my data (from the Datahub) to the aggregator, so they have more information to work on. So, they could see my address and, what kind of heating I have and, if I have a battery and solar panels, and how my consumption was going last year, that kind of information can be given to some other party with a click of a button, so then the Datahub gives access to some other party (LFM).’

4.1.2. LFM Benefit

‘We do not like that the DSO will purchase (flexibility through) contracts with one participant only. That will be inefficient. And that is why if there is a platform to provide services to different DSOs, for example, it will be a more open and market-based solution.’

4.1.3. Regulatory Landscape

‘All of the networks are now facing huge problems with the existing regulation, so they are quite reluctant to make collaborative efforts because all of their focus is on rebuilding the network because of the Network Electricity Act.’

4.2. Platform Governance

4.2.1. Platform Strategy

4.2.2. Platform Acceptance

4.2.3. Coalition Building

‘If somebody gets hurt, this somebody will do everything to prevent flexibility from happening. And if this somebody is an electricity sales company, that has a relatively strong, grip of the customer and has very good channels of communicating with the customer and so forth’.

‘if the aggregators are playing, so that that the seller of the initial energy is going to pay the bill, then they are not welcome. But if the aggregators, for example, if they would take the balance responsible for themselves, then why not.’

5. Discussion

5.1. Ecosystem Readiness

5.2. Platform Architecture and Governance

5.3. Value Creation Logic

5.4. Platform Competitiveness

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Fenwick, M.; McCahery, J.; Vermeulen, E. The end of ‘corporate’ governance: Hello platform governance. Eur. Bus. Organ. Law Rev. 2019, 20, 171–199. [Google Scholar] [CrossRef] [Green Version]

- Treffers, D.; Faaij, A.; Spakman, J.; Seebregts, A. Exploring the possibilities for setting up sustainable energy systems for the long term: Two visions for the Dutch energy system in 2050. Energy Policy 2005, 33, 1723–1743. [Google Scholar] [CrossRef]

- Bevilacqua, M.; Ciarapica, F.; Diamantini, C.; Potena, D. Big data analytics methodologies applied at energy management in the industrial sector: A case study. Int. J. RF Technol. Res. Appl. 2017, 8, 105–122. [Google Scholar] [CrossRef]

- Emmerick, P.; Hülemeier, A.; Jendryczko, D.; Baumann, M.J.; Weil, M.; Baur, D. Public acceptance of emerging energy technologies in the context of the German energy transition. Energy Policy 2020, 142, 111516. [Google Scholar] [CrossRef]

- Ramos, A.; Jonghe, C.D.; Gomez, V.; Belmans, R. Realizing the smart grid’s potential: Defining local markets for flexibility. Util. Policy 2016, 40, 26–35. [Google Scholar] [CrossRef]

- Solomon, B.D.; Krishna, K. The coming sustainable energy transition: History, strategies, and outlook. Energy Policy 2011, 39, 7422–7431. [Google Scholar] [CrossRef]

- USEF Foundation. USEF: The Framework Explained; USEF: Lexington, KY, USA, 2015. [Google Scholar]

- Schittekatte, T.; Meeus, L. Flexibility markets: Q&A with project pioneers. Util. Policy 2020, 63, 101017. [Google Scholar]

- Hadush, S.Y.; Meeus, L. DSO-TSO Cooperation Issues and Solutions for Distribution Grid Congestion Management. Energy Policy 2018, 120, 610–621. [Google Scholar] [CrossRef] [Green Version]

- INTERRFACE Report. TSO-DSO-Consumer INTERFACE aRchitecture to Provide Innovative Grid Services for an Efficient Power System; CORDIS: Luxembourg, 2019. [Google Scholar]

- Lind, L.; Avila, J.P.C. Deliverable D1.1. Market and Regulatory Analysis: Analysis of Current Market and Regulatory Framework in the Involved Areas. CoordiNet. 2019. Available online: https://www.iit.comillas.edu/docs/IIT-19-051I.pdf (accessed on 7 March 2021).

- Ottesen, S.; Haug, M.; Nygörd, S. A Framework for Offering Short-Term Demand-Side Flexibility to a Flexibility Marketplace. Energies 2020, 13, 3612. [Google Scholar] [CrossRef]

- Villar, J.; Bessa, R.; Matos, M. Flexibility products and markets: Literature review. Electr. Power Syst. Res. 2018, 154, 329–340. [Google Scholar] [CrossRef]

- Tushar, W.; Saha, T.K.; Yuen, C.; Morstyn, T.; McCulloch, M.D.; Poor, V.H.; Wood, K.L. A motivational game-theoretic approach for peer-to-peer energy trading in the smart grid. Appl. Energy 2019, 243, 10–20. [Google Scholar] [CrossRef]

- Minniti, S.; Nguyen, P.; Vo, T.H.; Haque, N. Development of grid-flexibility services from aggregators clustering algorithm for deploying flexible DERs. In Proceedings of the IEEE Conference on Industrial and Commercial Power Systems in Europe 2018, Palermo, Italy, 12–15 June 2018. [Google Scholar]

- Lampropoulos, I.; Broek, M.; Hoofd, E.; Sark, W. A system based perspective to the deployment of flexibility through aggregator companies in the Netherlands. Energy Policy 2018, 118, 534–551. [Google Scholar] [CrossRef]

- Olivella-Rosell, P.; Lloret-Gallego, P.; Munné-Collado, Í.; Villafafila-Robles, R.; Sumper, A.; Ottessen, S.Ø.; Rajasekharan, J.; Bremdal, B.A. Local Flexibility Market Design for Aggregators Providing Multiple Flexibility Services at Distribution Network Level. Energies 2018, 11, 822. [Google Scholar] [CrossRef] [Green Version]

- Olivella-Rosell, P.; Bullich-Massagué, E.; Aragüés-Peñalba, M.; Sumper, A.; Ottesen, S.Ø.; Vidal-Clos, J.-A.; Villafáfila-Robles, R. Optimization problem for meeting distribution system operator requests in local flexibility markets with distributed energy resources. Appl. Energy 2017, 210, 881–895. [Google Scholar] [CrossRef]

- Roby, H.; Dibb, S. Future pathways to mainstreaming community energy. Energy Policy 2019, 135, 111020. [Google Scholar] [CrossRef]

- De Vries, G.W.; Boon, W.P.; Peine, A. User-led innovation in civic energy communities. Environ. Innov. Soc. Transit. 2016, 19, 51–56. [Google Scholar] [CrossRef]

- McGovern, G.; Klenke, T. A process approach to mainstreaming civic energy. Energies 2018, 11, 2914. [Google Scholar] [CrossRef] [Green Version]

- Boscan, L.; Poudineh, R. Flexibility-Enabling Contracts in Electricity Markets; Oxford Institute for Energy Studies: Oxford, UK, 2016. [Google Scholar]

- Wåge, D.; Bremdal, B.; Crawford, G. Platform-based business models in the future energy market. In Proceedings of the CIRED Workshop 2018, Ljublijana, Slovenia, 7–8 June 2018. [Google Scholar]

- Giordano, V.; Gianluca, F. A business case for Smart Grid technologies: A systemic perspective. Energy Policy 2012, 40, 252–259. [Google Scholar] [CrossRef]

- Kotilainen, K.; Sommarberg, M.; Järventausta, P.; Aalto, P. Prosumer centric digital energy ecosystem framework. In Proceedings of the 8th International Conference on Management of Digital EcoSystems 2016, Biarritz, France, 1–4 November 2016; pp. 47–51. [Google Scholar]

- Gawer, A. Platforms, Markets, and Innovation; Edward Elgar: Cheltenham, UK, 2009. [Google Scholar]

- Kenny, M.; Zysman, J. The next phase in the digital revolution: Intelligent tools, platforms, growth, employment. Commun. ACM 2018, 61, 54–63. [Google Scholar]

- Venkatraman, N.; Henderson, J.C. Real strategies for virtual organizing. Sloan Manag. Rev. 1998, 40, 33–48. [Google Scholar]

- Wonglimpiyarat, J. The use of strategies in managing technological innovation. Eur. J. Innov. Manag. 2004, 7, 229–250. [Google Scholar] [CrossRef]

- Satu, P.; Saastamoinen, H.; Hakkarainen, E.; Similä, L.; Pasonen, R.; Ikäheimo, J.; Rämä, M.; Tuovinen, M.; Horsmanheimo, S. Increasing flexibility of Finnish energy systems—A review of potential technologies and means. Sustain. Cities Soc. 2018, 43, 509–523. [Google Scholar]

- Tiwana, A.; Konsynski, B.; Bush, A. Platform evolution: Coevolution of platform architecture, governance, and environmental dynamics. Inf. Syst. Res. 2010, 21, 675–687. [Google Scholar] [CrossRef] [Green Version]

- Parker, G.G.; Van Alstyne, M.W.; Choudary, S.P. Platform Revolution: How Networked Markets Are Transforming the Economy and How to Make Them Work for You; WW Norton Company, Inc.: New York, NY, USA, 2016. [Google Scholar]

- Gawer, A.; Henderson, R. Platform Owner Entry and Innovation in Complementary Markets: Evidence from Intel. J. Econ. Manag. Strategy 2007, 16, 1–34. [Google Scholar] [CrossRef]

- Katona, Z.; Zubcsek, P.P.; Sarvary, M. Network effects and personal influences: The diffusion of an online social network. J. Mark. Res. 2011, 48, 425–443. [Google Scholar] [CrossRef] [Green Version]

- Mäkinen, S.; Kanniainen, J.; Peltola, I. Investigating the adoption of free beta applications in a platform-based business ecosystem. Prod. Innov. Manag. 2014, 31, 451–465. [Google Scholar] [CrossRef]

- EURELETRIC. Flexibility and Aggregation Requirements for Their Interaction in the Market; EURELETRIC: Brussels, Belgium, 2014. [Google Scholar]

- Jin, X.; Wu, Q.; Jia, H. Local flexibility markets: Literature review on concepts models and clearing methods. Appl. Energy 2020, 261, 114387. [Google Scholar] [CrossRef] [Green Version]

- Bouloumpasis, I.; Steen, D.; Tuan, L.A. Congestion management using local flexibility markets: Recent development and challenges. In Proceedings of the 2019 IEEE PES Innovative Grid Technologies Europe, Bucharest, Romania, 29 September–2 October 2019. [Google Scholar]

- CEER. DSO Procedures of Procurement of Flexibility; C19-DS-55-05; CEER: Brussels, Belgium, 2020. [Google Scholar]

- Esmat, A.; Usaola, J.; Moreno, A.M. A decentralized local flexibility market considering the uncertainty of demand. Energies 2018, 11, 2078. [Google Scholar] [CrossRef] [Green Version]

- Kim, J. The platform business model and business ecosystem: Quality management and revenue structures. Eur. Plan. Stud. 2015, 24, 2113–2132. [Google Scholar] [CrossRef]

- Gawer, A.; Cusumano, M.A. Industry platforms and ecosystem innovation. J. Prod. Innov. Manag. 2014, 31, 417–433. [Google Scholar] [CrossRef] [Green Version]

- Furstenau, D.; Auschra, C.; Klein, S.; Gersch, M. A process perspective on platform design and management: Evidence from a digital platform in health care. Electron. Mark. 2019, 29, 581–596. [Google Scholar] [CrossRef]

- Euchner, J. Ecosystem innovation. Res. Technol. Manag. 2016, 59, 9–10. [Google Scholar] [CrossRef]

- Anton, S.G.; Afloarei-Nucu, A.E. The effect of financial development on renewable energy consumption. A panel data approach. Renew. Energy 2020, 147, 330–338. [Google Scholar] [CrossRef]

- Adner, R.; Euchner, J. Innovation Ecosystems. Res. Technol. Manag. 2014, 57, 10–14. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef] [Green Version]

- Tura, N.; Kutvonen, A.; Ritala, P. Platform design framework: Conceptualisation and application. Technol. Anal. Strateg. Manag. 2018, 30, 881–894. [Google Scholar] [CrossRef]

- Patton, E.; Appelbum, S.E. The case for case studies in management research. Manag. Res. News 2003, 26, 60–66. [Google Scholar] [CrossRef] [Green Version]

- Yin, R.K. Qualitative Research from Start to Finish, 2nd ed.; Guilford: New York, NY, USA, 2015; p. 46. [Google Scholar]

- Yin, R.K. Case Study Research: Design and Methods, 4th ed.; Sage: Thousand Oaks, CA, USA, 2009; p. 4. [Google Scholar]

- Patton, M.Q. Qualitative Evaluation and Research Methods, 2nd ed.; Sage: Newbury Park, CA, USA, 1990; pp. 184–185, 387–403. [Google Scholar]

- Saunders, M.; Lewis, P.; Thornhill, A.; Bristow, A. Research Methods for Business Students, 6th ed.; Pearson: Harlow, UK, 2012; pp. 374–375. [Google Scholar]

- Gioia, D.A.; Corley, K.G.; Hamilton, A.L. Seeking qualitative rigor in inductive research: Notes on the Gioia methodology. Organ. Res. Methods 2012, 16, 15–31. [Google Scholar] [CrossRef]

- Energy Authority. National Report 2019 to the Agency for the Cooperation of Energy Regulators and to the European Commission. National Report. Finland. 2020. Available online: https://energiavirasto.fi/documents/11120570/13026619/National+Report+2020+Finland.pdf/7fb2df66-cf5e-ecf5-22a2-635077b6297a/National+Report+2020+Finland.pdf?t=1594791637682 (accessed on 4 February 2021).

- Caillaud, B.; Jullien, B. Chicken & egg: Competition among intermediation service providers. RAND J. Econ. 2003, 34, 309–328. [Google Scholar]

| Interviews | Date | Duration | Interview Type | Organization Type | Interviewee Position |

|---|---|---|---|---|---|

| A | 5.9.2019 | 101 min | Face to face | Industrial actor/Energy services | Development Director |

| B | 28.1.2020 | 67 min | Face to face | TSO | Corporate Advisor |

| C | 29.1.2020 | 69 min | Face to face | TSO | Specialist |

| D | 30.1.2020 | 57 min | Face to face | Retailer/BRP | Head of Unit, Risk Management |

| E | 30.1.2020 12.2.2020 | 70 min 81 min | Online Face to face | Retailer/DSO | Business Director |

| F | 29.1.2020 | 58 min | Face to face | Industrual actor/BRP | VP, Energy Markets |

| G | 11.2.2020 | 55 min | Face to face | Energy Regulator | Deputy Director-General |

| H | 11.2.2020 | 61 min | Online | Energy industry interest group | Experts |

| I | 12.2.2020 | 54 min | Online | Aggregator | Operations manager |

| Case | Date | Location | Interview Type | Duration | Type | Interviewee Position |

|---|---|---|---|---|---|---|

| 1 | 10.2.2020 | Netherlands | Online | 52 min | Interview | Business Consultant, Smart energy |

| 2 | 17.2.2020 | UK | Online | 36 min | Interview | Project Manager |

| 3 | 21.2.2020 | Norway | Online | 30 min | Interview | Senior Consultant |

| 4 | 5.3.2020 | Germany | Online | 31 min | Interview | Analyst |

| Focus | Design Components | Principal Findings |

|---|---|---|

| LFM design | Market feasibility | Ensuring liquidity is paramount. The entry barrier needs to be low for direct users. Aggregators are needed to activate the LFM. Discerning the flexibility needs between TSO and DSOs. Datahub increases the possibility for demand response. The supply-side should be prioritized in generating the network effect. |

| LFM benefit | Create new values for flexibility. Can enable localized trading. Incentivizing customers to lower overall consumption. Countering high spot prices. Sharing monitory savings with customers. Offering a market-based flexibility solution to the DSOs. Can instigate DSO cost savings. | |

| Regulatory landscape | The current regulatory setup is geared towards centralized generation. Legislation is geared towards network investment. Specific TSO regulations are restrictive. OPEX vs. CAPEX situation is relevant for flexibility usage. No significant regulatory barrier towards aggregation. CEP emerges as a significant factor in defining DSO roles. Sandbox regulations can be restrictive. |

| Focus | Governance Dimensions | Principal Findings |

|---|---|---|

| Platform governance | Platform strategy | The network situation must be considered. The installation cost of the flexibility gadgets remains high. Demand response-friendly smart meters by 2025. Little willingness to lower the 100 KW market participation threshold. Market-based pricing is preferred. |

| Platform acceptance | Profitable participation for the market participants. Forecasting and real-time information feature important for BRPs. Reliable delivery is needed from the supply side. Ease of use and a user-friendly reporting process. Automated bidding makes it easier to reach prosumers. Ensuring platform transparency. Penalties should be equal for all parties. B2B vs. B2C communication should be designed separately. Double taxation for prosumers in certain situations. | |

| Coalition building | Coordination with DERs is still a challenge. Stakeholder coordination (TSO-DSO; DSO-DSO; DSO-Aggregator). Convincing the end customers remains a challenge. New marketplace acceptability. Designing retailer-aggregator value chain. Balance responsibility for independent aggregators. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rahman, N.; Rabetino, R.; Rajala, A.; Partanen, J. Ushering in a New Dawn: Demand-Side Local Flexibility Platform Governance and Design in the Finnish Energy Markets. Energies 2021, 14, 4405. https://doi.org/10.3390/en14154405

Rahman N, Rabetino R, Rajala A, Partanen J. Ushering in a New Dawn: Demand-Side Local Flexibility Platform Governance and Design in the Finnish Energy Markets. Energies. 2021; 14(15):4405. https://doi.org/10.3390/en14154405

Chicago/Turabian StyleRahman, Nayeem, Rodrigo Rabetino, Arto Rajala, and Jukka Partanen. 2021. "Ushering in a New Dawn: Demand-Side Local Flexibility Platform Governance and Design in the Finnish Energy Markets" Energies 14, no. 15: 4405. https://doi.org/10.3390/en14154405