7.1. Methodology

Until now, we have gained an impression about the premium and the accompanying risk of the flexible certificate by analyzing the performance of the strategies. However, the final price of the certificate must also be an acceptable price for potential buyers. In the following, we take the perspective of potential buyers and analyze the maximum price they are willing to pay under different conditions. We refer to this price as the limit price.

As discussed, potential demand for the certificate is from electricity price optimizers, owners of electricity storage systems, or consumers who basically want to transfer their forecasting risk. As an alternative to buying the flexible certificate, these buyers could trade at the day-ahead auction (given access to this market). For the following analysis, we consider a consumer with a demand for a given electricity volume that can be flexibly disposed to m hours. With the certificate and known prices, the consumer can buy electricity for the cheapest m hours. Without the certificate, the consumer forecasts prices and buys at the day-ahead market for the forecast cheapest m hours. When forecasts are not accurate, the chosen hours may afterwards turn out to be suboptimal. Thus, the alternative without the certificate comes with the opportunity cost of not achieving the best prices. This opportunity cost constitutes the willingness to pay a premium for the certificate, that is, the limit price.

We estimate limit prices for the certificate by quantifying the opportunity costs as outlined. To this end, we run an historical simulation.

If potential buyers could make accurate forecasts, they would always choose the

m most-favorable contracts. Accordingly, they would have no reason to buy the flexible certificate, since they would bear no forecast risk. Thus, the certificate becomes valuable if the forecasts of the possible buyer are not exact. For this reason, the quality of the price forecasts is of great importance for the price that a buyer is willing to pay for the flexible certificate. The higher the forecast error, the more likely it is that bids will not be placed for the most favorable contracts. In this context, it is well known from the literature that the forecasting of day-ahead auction prices is complex, and actual forecasting errors are correlated with each other. This is because new information can become available between the forecast and the actual auction, usually affecting several consecutive contracts. However, our simulation is not concerned with exact prices, nor with the systematic error that can be made in a forecast. For example, if the forecast for the contract between 00–01 h is EUR 30, which would represent the most favorable contract of the day, it would be irrelevant if it actually ended up costing EUR 50, as long as it continued to be the lowest-priced contract. Accordingly, our simulation is only concerned with the idiosyncratic error, which generally cannot be covered by the forecast either way. We therefore assume that the forecast price of a contract,

, is independent and normally distributed around the actual price

; that is

where

represents the idiosyncratic part of the forecast error.

We run historical simulations with

= 100,000 runs for

. According to the empirical findings on day-ahead price forecasts (see

Section 1.2), a forecast error set to

is very conservative, while

seems not to be unrealistic.

In each simulation, we first draw a random historical day and the corresponding 24 realized day-ahead auction prices. We then assume that the daily historical price distributions of the day-ahead auction are also estimators for the future. We simulate the forecast prices according to Equation (

5). The buyer then selects the

m most-favorable contracts (at equal volumes) based on the forecast prices (with simulated forecast error). A comparison with the actually realized prices shows whether the buyer has selected the

m most-favorable contracts or if opportunity costs occur. Analogous to

Section 4, all consumers are price-takers; in particular, trading has no impact on the prices of the day-ahead auction.

Buying the flexible certificate would eliminate any price risk for the buyer. To analyze their willingness to pay for this risk reduction, we distinguish between risk-neutral and risk/loss-averse buyers. The risk-neutral demand would be based exclusively on the expected value of the simulation with respect to the opportunity costs. The risk/loss-averse buyer would be willing to pay an extra amount for risk elimination.

The limit price for the risk-neutral agent is therefore the expected difference between the average price of the m selected contracts and the actual m most-favorable contracts.

In practice, decision-makers tend to be risk-averse, i.e., they prefer certain outcomes over risky outcomes with identical expected value. Furthermore, behavioral economics has also found most decision-makers to be loss-averse, i.e., they weigh potential losses higher than profits of the same amount. For the risk/loss-averse agent, the limit price (for the certain alternative) would thus be higher than for the risk-neutral agent. We consider a loss relative to this certain alternative as the flexible certificate at a (limit) price

. Defining the corresponding profit from self-trading,

, it is positive if the average price obtained for the

m selected contracts is lower than the price of the certificate (

), and it is negative (loss) if choosing the certificate would have been the more favorable alternative. According to the prospect theory, which has become a standard in behavioral economics, the decision-maker values an outcome based on a value function [

44]:

with

and

.

The simulation runs yield values for the alternative of not buying the certificate and finally an expected value . The limit price is implicitly defined by . The potential buyer would, therefore, just be indifferent between the flexible certificates and trading himself for this price.

This method considers the risk for a single trading day. One might argue that buyers also trade on many successive days, so losses and gains cancel out, and the long-term risk might be considerably smaller. However, real decision-makers have often been found to neglect future prospects [

45], for example, because of cognitive biases such as mental accounting (e.g., [

46,

47]). Thus, an analysis based on a single trading day is not too unrealistic. In the end, the two cases of a risk-neutral and a myopic risk- and loss-averse buyer represent two different sides of the actual spectrum of real decision-makers.

7.2. Results

In this section, we discuss the resulting limit prices, while in

Section 7.3, we relate them to the strategy premiums of the supplier. From the perspective of the buyer, we differentiate between two possible acquisition options. If there are no restrictions on the purchase of the electricity, a buyer will want to purchase the most-favorable contracts on one day, regardless of exactly when the delivery occurs. Then, contracts can be arbitrary (A), distributed over the entire day. A common restriction for many buyers will be that the most-favorable contracts must be consecutive (C) in time, since an electricity-intensive process may not be able to be interrupted. This reduces the quantity of combinations that can be purchased. As an illustrative example, a buyer may need electricity for two hours. In the arbitrary case, they will choose the two hours with the lowest contract prices. In the consecutive case, there is the additional restriction that the two hours must be successive; thus, the choice is between the pairs 00–02, 01–03, etc. The arbitrary case contains any possible combination, so the resulting limit prices can be considered as an upper bound. Constraints reduce the number of combinations and, thus, also the limit price.

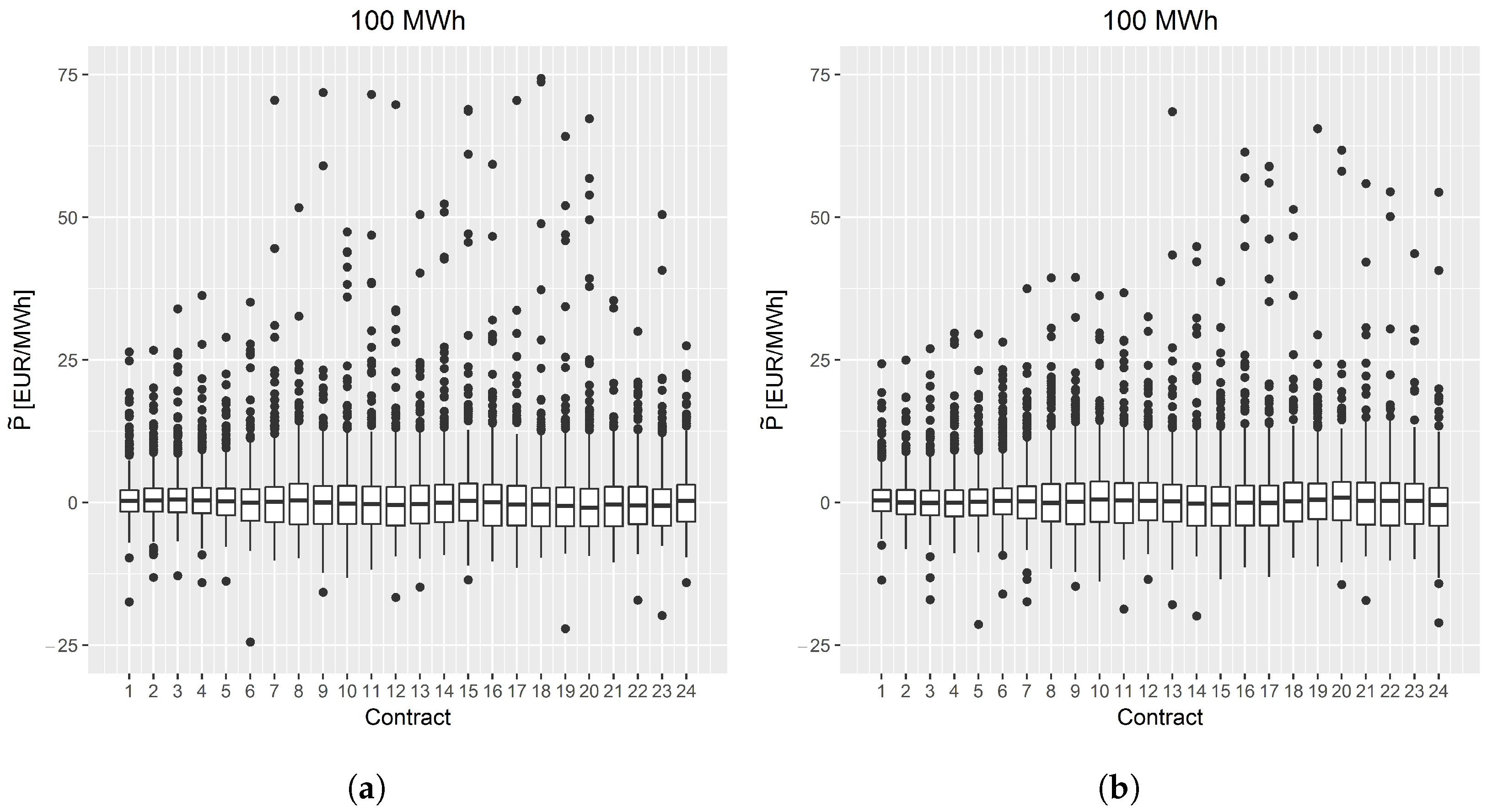

Figure 9 shows the determined limit prices of the simulation study for a risk-neutral (

Figure 9a) and risk/loss-averse (

Figure 9b) buyer for different forecast errors

.

The limit prices depend on the specific demands of a possible buyer. For example, a risk-neutral buyer with rather high inaccuracy in his idiosyncratic forecast error ( = 5) would be willing to pay a premium of about 1.80 EUR per MWh for exactly one contract. This premium is reduced if there is a smaller forecast error. Regardless of the forecast error, the price limit reaches a maximum when exactly one contract is required, and it decreases with each additional contract. Furthermore, the limit price is smaller in the case of consecutive (C) contracts. Naturally, the risk/loss-averse buyer is willing to pay a higher limit price in all settings. Under the given assumptions, the curves are shifted upwards for the risk/loss-averse by up to about 50%. With even higher levels of risk/loss aversion, limit prices would continue to rise.

The limit price analysis is necessarily based on several assumptions, such as the buyer purchasing all contracts with the same volume, and that the historical daily distributions of the prices of the day-ahead auctions are also estimators for the future. Regarding the volumes, it is conceivable that the most-favorable contract(s) set would be purchased at higher volumes. As this would result in higher limit prices, the values shown for identical volumes can be seen as lower bounds. On the other hand, further restrictions in the choice of contracts would reduce the potential for optimization and, thus, the limit price for the flexible certificate.

7.3. Relation to Strategy Premiums

As shown, the limit price for a risk-neutral buyer needing exactly one hourly contract is 1.80 EUR per MWh for reasonable estimation errors. While it is still higher for risk-averse agents, this limit price drops substantially when more hourly contracts are required, in particular with further restrictions (consecutive case). These limit prices have to be discussed in light of the strategy premiums of the supplier and, thus, the premium at which he can offer the flexible certificate.

In

Section 5, we stressed Strategy III with

and

as the best trade-off between average performance and risk. For a volume of 100 MWh to be bought (or sold) on the intraday market, the average strategy premium is

(

) EUR per MWh. However, as discussed, these strategy premiums only apply to that part of the overall volume that is not bought at the day-ahead auction. For example, if 80% of the required volume is already acquired, the actual premium is only one fifth of the base premium (see Equation (

1)).

For the base premium

, the strategy premium

can be applied. Alternatively, the supplier can price an add-on for risk. We therefore also consider the 90% quantile of the strategy premium as an extremely risk-averse choice.

Figure 10 illustrates the relationship of the final premium

P and the base premium

depending on the volume that is assumed to be acquired at the day-ahead auction (for an intraday volume of 100 MWh).

The premiums are compared with the limit prices of potential buyers. The figure also shows these limit prices (horizontal lines) based on the analysis of the previous section for different buyers: (i) risk/loss-averse, one contract, and forecast error ; (ii) risk-neutral, one contract, and forecast error ; (iii) risk-neutral, one contract, and forecast error ; and (iv) risk-neutral, eight contracts arbitrarily, and forecast error . With the average strategy premium as the base premium , the actual premium P would already meet the price limits of some buyers, even if no volume is bought on the day-ahead market, and it falls below most limit prices with small shares on the day-ahead market. However, the choice of the possibly appropriate 90% quantile as the base premium appears to be too aggressive for many buyers. It can only be offset by a good forecast of the demanded volume, that is, a large share of the day-ahead market volume. For example, when 90% (900 MWh) of the total volume is bought on the day-ahead market, the premium is attractive for the exemplary buyers (i) and (ii). In summary, we consider the profitability of the flexible electricity certificate to be positive, even with risk-neutrality of the potential buyers.

Of course, this analysis is based on a number of assumptions and uncertainties in all relevant factors: the demand of the buyers, the quality of the price forecasts, the strategy premiums on the intraday market, the volumes on the day-ahead market, and the potential turnover of the flexible certificate. All these factors can impact a possible premium P. Nevertheless, the analysis shows that the certificate can be offered at acceptable prices for a wide range of potential buyers.