Research on Trading Optimization Model of Virtual Power Plant in Medium- and Long-Term Market

Abstract

:1. Introduction

2. Virtual Power Plant and China’s Medium- and Long-Term Power Market

2.1. Power Market Modes

2.1.1. Centralized Power Market

2.1.2. Decentralized Power Market

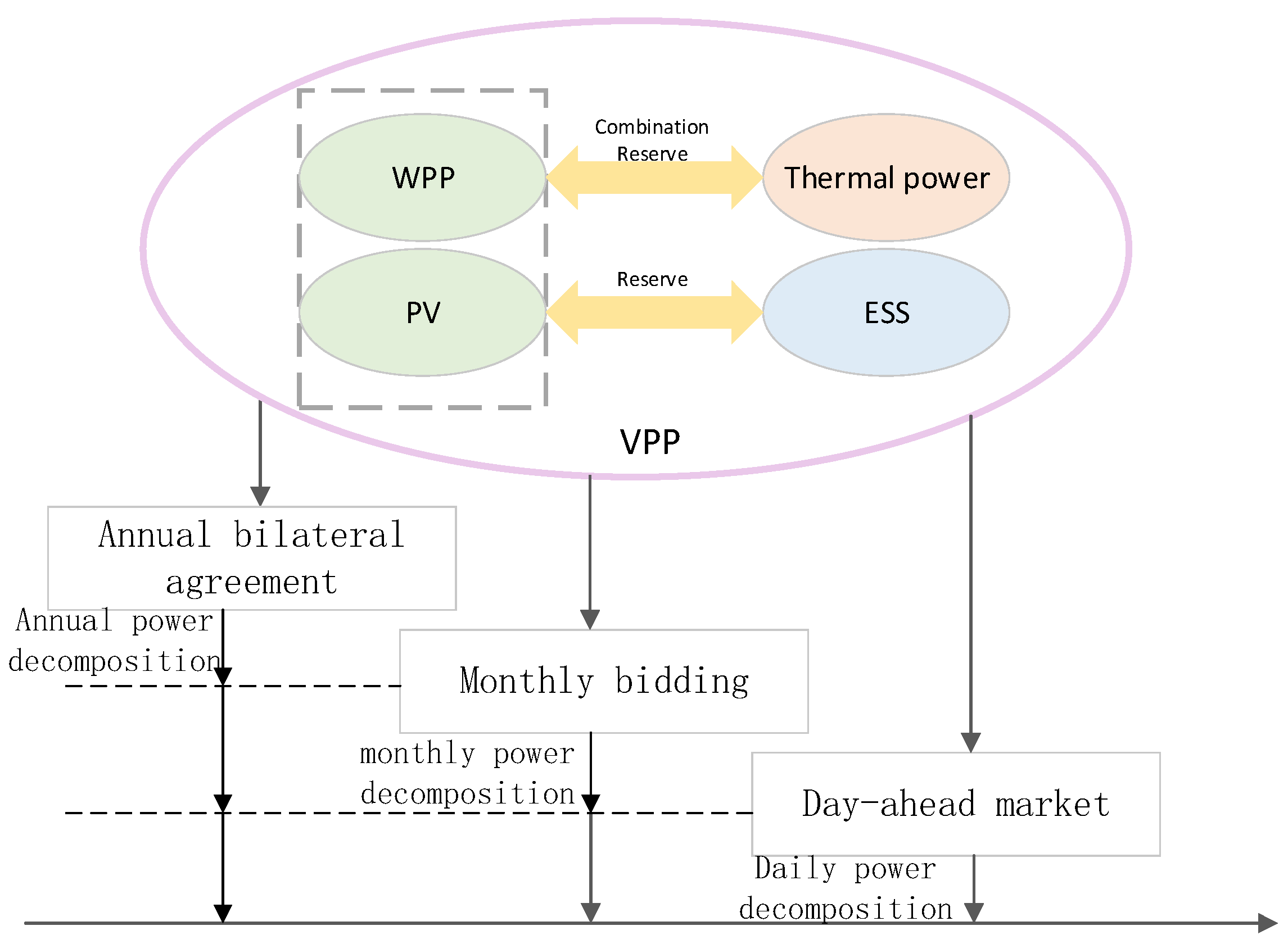

2.2. Structure of Virtual Power Plant

- (1)

- Distributed renewable energy generators

- (2)

- Distributed fuel generators

- (3)

- Energy storage system

- (4)

- Demand response

3. Optimization Analysis of Virtual Power Plant Participating in Medium- and Long-Term Power Market Transaction

3.1. Contract Transaction Mechanism in Medium- and Long-Term Market

3.2. Revenue Analysis of Virtual Power Plant in Medium- and Long-Term Market

3.2.1. Contract Power Decomposition

3.2.2. Deviation Assessment Cost

3.3. Revenue Analysis of Virtual Power Plant Considering CFD

4. Analysis of Medium- and Long-Term Contract Transaction of Virtual Power Plant Considering Renewable Energy Derivatives

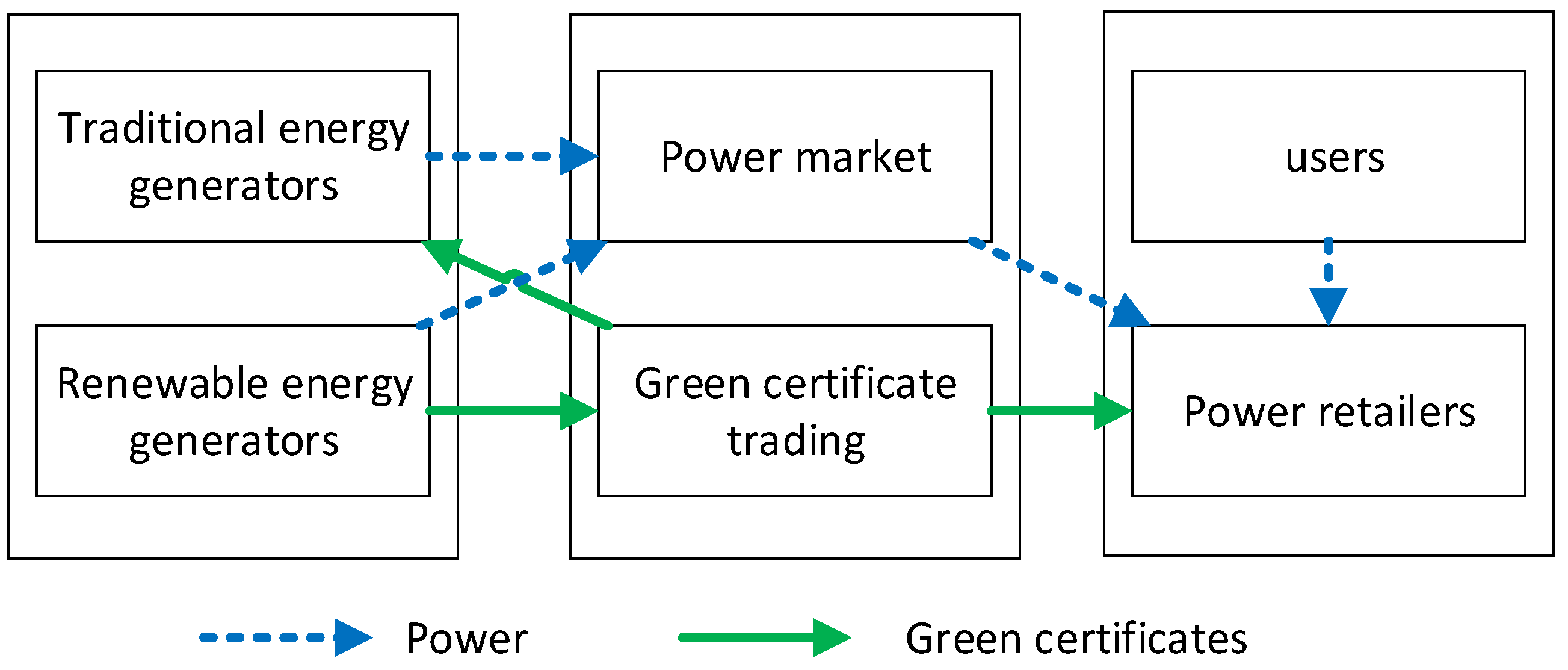

4.1. Analysis on the Impact of Renewable Energy Quota System and Green Certificate Mechanism

4.2. Medium- and Long-Term Contract Transaction of VPP Considering Renewable Energy Derivatives

4.2.1. Objective Function

4.2.2. Constraint Condition

- (1)

- System operation balance constraints

- (2)

- Medium- and long-term market contract transaction constraints

- (3)

- WPP, PV, ESS and MT output constraints

- (4)

- Reserve constraints

- (5)

- Green certificate market constraint

5. Case Study

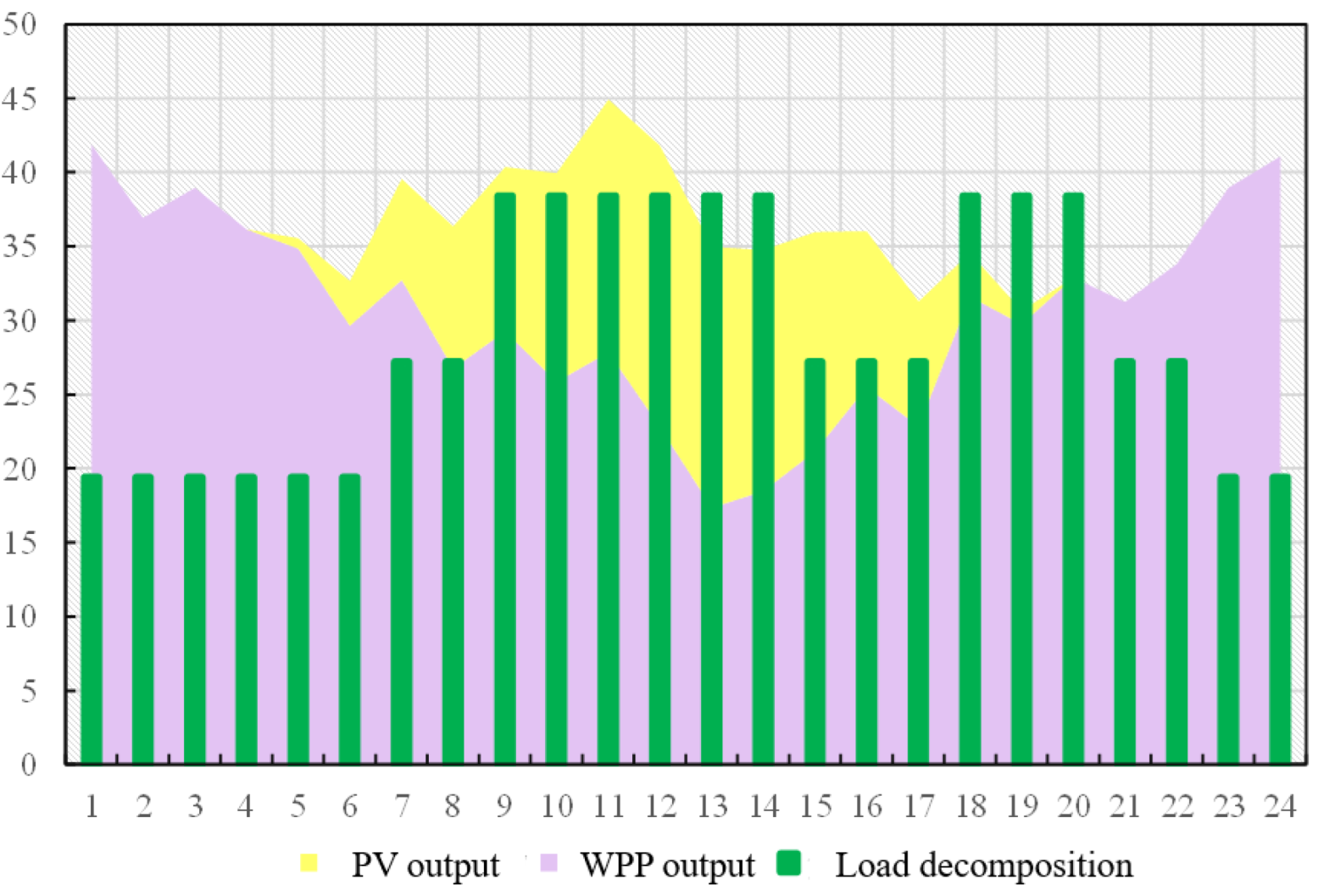

5.1. Basic Data

5.2. Scenarios Setting and Result Analysis

- (1)

- Normal output scenario

- (2)

- Insufficient output scenario

- (3)

- No output scenario

6. Conclusions

- The fixed-price contract in the decentralized power market can provide effective economic guarantee for the VPP under the conventional output of renewable energy and considering deviations.

- In extreme scenarios, CFD can help VPP avoid more risk losses in centralized power market, but it cannot completely avoid all price risks.

- CFD will have better advantages in the development of spot market, especially for renewable energy aggregators.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ge, R.; Chen, L.; Wang, T.; Liu, D. Optimiazation and Design of Construction Route for Electricity Market in China. Automat. Electr. Power Syst. 2017, 41, 10–15. [Google Scholar]

- Jin, L.; Chen, C.; Wang, X.; Yu, J.; Long, H. Research on information disclosure strategies of electricity retailers under new electricity reform in China. Sci. Total Environ. 2020, 710, 136382. [Google Scholar] [CrossRef] [PubMed]

- Jo, S.H.; Woo, J.; Byun, G.S.; Jeong, J.-H.; Jeong, H. Study on the Integral Compensator Using Supercapacitor for Energy Harvesting in Low-Power Sections of Solar Energy. Energie 2021, 14, 2262. [Google Scholar] [CrossRef]

- Zhao, F. Simulation and Implementation of Medium—And Long-Term Trading Algorithm in a Provincial Electricity Market. Master’s Thesis, Dalian University of Technology, Dalian, China, 2019. [Google Scholar]

- Guo, H.; Chen, Q.; Zhong, H.; Yang, W.; Zhang, W.; Xia, Q. Spot Market Mechanism Design and Path Planning Based on Standard Curve for Financial Delivery. Autom. Electr. Power Syst. 2017, 41, 1–8. [Google Scholar]

- Zhao, S.; Hu, L.; Tian, J.; Xu, C. Contract Power Decomposition Model of Multi-energy Power System based on Mid-long Term Wind Power and Photovoltaic Forecasting. Electr. Power Autom. Equip. 2019, 39, 13–19. [Google Scholar]

- Miao, S.; Luo, B.; Shen, J.; Cheng, C.; Li, G.; Sun, Y. Short-term Multi-objective Hydro-thermal Generation Dispatch considering Electricity Market Transition and Mid- and Long-term Contract Decomposition. Power Syst. Technol. 2018, 42, 2221–2231. [Google Scholar]

- Nie, Z.; Gao, F.; Wu, J.; Guan, X.; Liu, K. Contract for difference energy decomposition model for maximizing social benefit in electricity market. In Proceedings of the World Congresson Intelligent Controland Automation, Guilin, China, 12–15 June 2016; pp. 2449–2454. [Google Scholar]

- Sun, L. Research on Optimal Dispatching of Virtual Power Plant under Electricity Market Environment. Master’s Thesis, Dalian University of Technology, Dalian, China, 2020. [Google Scholar]

- Wu, D.; Lu, J.; Li, G.; Yu, H.; Cheng, C. Compensation Method of Thermal Auxiliary Service under Electricity Market Environment with High Proportion of Clean Energy. South. Power Syst. Technol. 2018, 12, 78–85. [Google Scholar]

- Zhang, G. Bidding Strategy and Coordinated Dispatch of Virtual Power Plant with Multiple Distributed Energy Resources. Ph.D. Thesis, Shanghai Jiao Tong University, Shanghai, China, 2019. [Google Scholar]

- Pal, P.; Krishnamoorthy, P.A.; Rukmani, D.K.; Antony, S.J.; Ocheme, S.; Subramanian, C.; Elavarasan, R.M.; Das, N.; Hasanieri, H.N. Optimal Dispatch Strategy of Virtual Power Plant for Day-Ahead Market Framework. Appl. Sci. 2021, 11, 3814. [Google Scholar] [CrossRef]

- Yu, X.; Li, G.; Cheng, C. Research and Application of Continuous Bidirectional Trading Mechanism in Yunnan Electricity Market. Energies 2019, 37, 4663. [Google Scholar] [CrossRef] [Green Version]

- Wei, X.; Yang, D.; Ye, B. Operation Mode of Virtual Power Plant in Energy Internet and its Enlightenment. Electr. Power Construct. 2016, 37, 1–9. [Google Scholar]

- Dong, F.; Ding, X.; Shi, L. Wind Power Pricing Game Strategy under the China’s Market Trading Mechanism. Energies 2019, 12, 3456. [Google Scholar] [CrossRef] [Green Version]

- Kildegaard, A. Green certificate markets, the risk of over-investment, and the role of long-term contracts. Energy Policy 2008, 36, 3413–3421. [Google Scholar] [CrossRef]

- Huang, Q. The Theoretical Analysis of Green Certificates Policy or Renewable Energy. J. Zhejiang Bus. Technol. Inst. 2011, 10, 34–39. [Google Scholar]

- National Energy Administration. Notice on Establishing and Improving the Guarantee Mechanism for Renewable Energy Power Consumption; National Energy Administration: Beijing, China, 2019.

- Shuai, D.; Wang, C.; Liang, J.; Dong, X.; Liang, H. Multi-objective Optimal Day-ahead Dispatch of Integrated Energy System Considering Power-to-gas Operation Cost. Automat. Electr. Power Syst. 2018, 42, 8–15. [Google Scholar]

| Units | Maximum Output (MW) | Minimum Output (MW) | Climbing Speed (MW/h) | Unit Parameters | ||

|---|---|---|---|---|---|---|

| a | b | c | ||||

| MT | 40 | 6.5 | 1.5 | 0 | 0.3725 | 0.0218 |

| WPP | 25 | 0 | 8 | 0 | 0 | 0 |

| PV | 14 | 0 | 3.2 | 0 | 0 | 0 |

| Units | Feed-In Tariff (MWh) | Contract Agreed Price (MWh) | Punishing Cost (MWh) |

|---|---|---|---|

| MT | 296 | 278.2 | - |

| WPP | 300 | 0 | 176 |

| PV | 487 | 0 | 243 |

| Green certificate | 176 | 164 | - |

| VPP | - | 442.2 | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, Y.; Wu, J.; De, G. Research on Trading Optimization Model of Virtual Power Plant in Medium- and Long-Term Market. Energies 2022, 15, 759. https://doi.org/10.3390/en15030759

Wu Y, Wu J, De G. Research on Trading Optimization Model of Virtual Power Plant in Medium- and Long-Term Market. Energies. 2022; 15(3):759. https://doi.org/10.3390/en15030759

Chicago/Turabian StyleWu, Yungao, Jing Wu, and Gejirifu De. 2022. "Research on Trading Optimization Model of Virtual Power Plant in Medium- and Long-Term Market" Energies 15, no. 3: 759. https://doi.org/10.3390/en15030759