Multi-Stakeholder Decision Support Based on Multicriteria Assessment: Application to Industrial Waste Heat Recovery for a District Heating Network in Grenoble, France

Abstract

:1. Introduction

2. Materials and Method

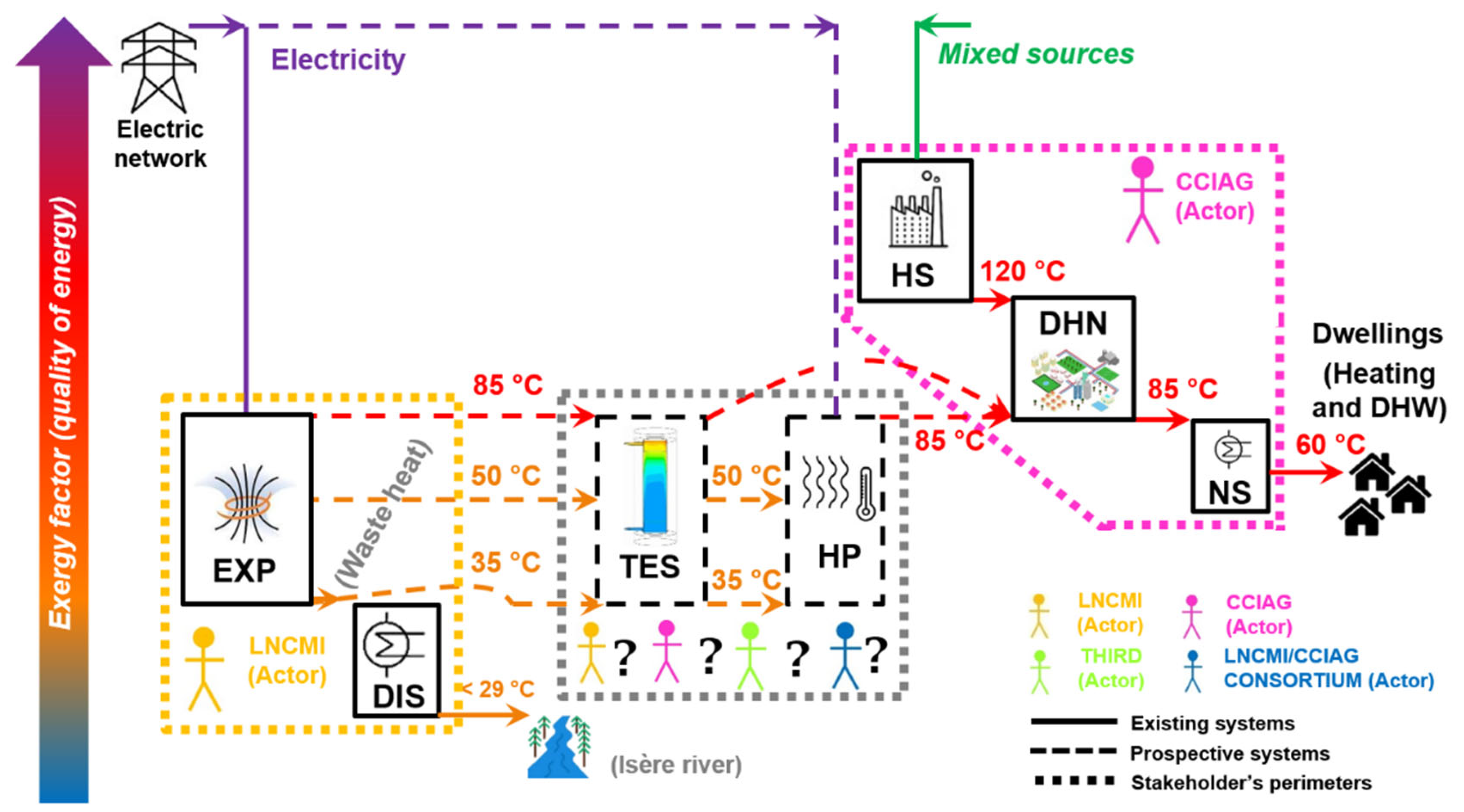

2.1. System Description and Ownership Scenarios

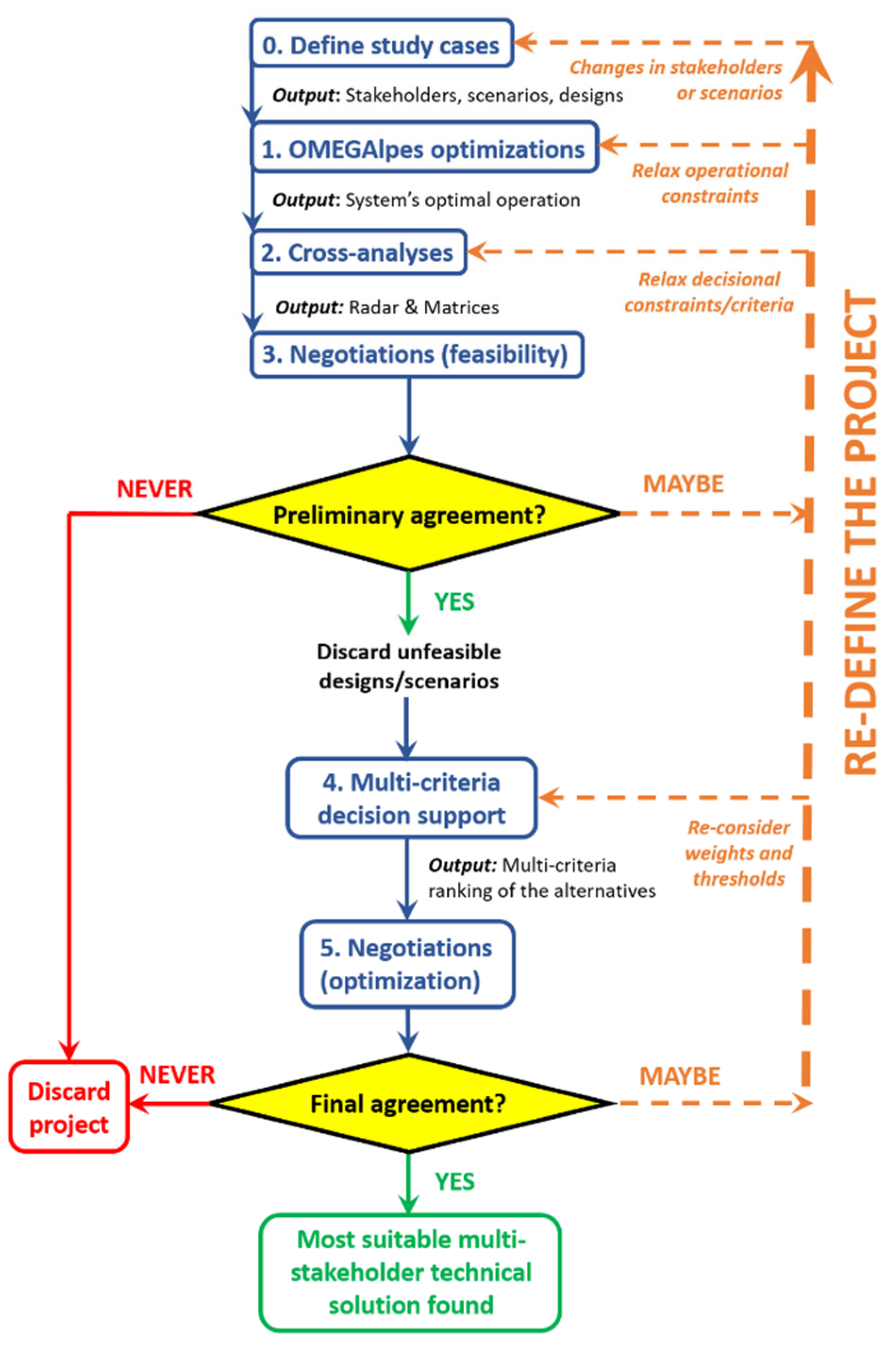

2.2. Calculation Procedure and Simulation/Optimization Tools

- Optimize the technical system’s yearly management. This was performed with an open-source tool called OMEGAlpes (v.0.4.0), which stands for “Optimization Model Generation as Linear Programming for Energy Systems” ([41,42]). This tool applies mixed-integer linear programming (MILP) to find the optimal management of energy flows in a study case. This optimization was applied to the 15 possible designs of the waste heat recovery system.

- Apply multi-stakeholder and multi-criteria analysis. This was performed with the multi-stakeholder energy, exergy, economic, and exergoeconomic models presented in the next subsections. These models were applied to the results yielded by OMEGAlpes in the previous step. The analysis gives the system’s performance in terms of 4 indicators for each stakeholder, for each possible design.

- Relax stakeholders’ constraints and repeat step 2. Some of the stakeholders may relax some of their constraints in order to facilitate the project’s feasibility. Those relaxations are detailed in Section 2.3.2. Only decisional or economic relaxations were considered. Thus, it was not necessary to repeat step 1, since OMEGAlpes accounts for technical or operational constraints that were not modified.

- Generate the matrices and the radar chart. This was performed to identify the feasible designs without relaxations, along with the most promising designs after the relaxations were applied. The results presented in this article were selected for the sake of illustrating the method.

- Analyze the negotiation possibilities. Reflections based on the matrices and radar chart inspired an iterative procedure for the conception of these kinds of projects, through cooperation between the stakeholders. That procedure is presented in Section 3.4.

2.3. Models

2.3.1. Energy, Exergy, Economic, and Exergoeconomic Models

- Potential and kinetic energy are neglected.

- Temperature levels of the units remain constant throughout the year.

- Pressure, temperature, and heat losses across the pipelines are neglected.

- Perfect stratification is assumed in the thermal storage unit.

- The initial and final states of charge of the thermal energy storage are the same.

- Heat losses across the different components of the heat pump are neglected.

- The heat production process by the heat supplier has a constant exergy efficiency.

- Potential and kinetic exergy are neglected.

- The heat production process by the heat supplier has a constant exergetic efficiency.

2.3.2. Multi-Stakeholder Model

Perimeter-Dependent Performance Indicators

Stakeholder’s Tolerance and Relaxation Possibilities

- Tolerance, understood as a stakeholder’s capacity to accept a design that is inferior to the optimal design that they would prefer, from the standpoint of a specific criterion.

- Relaxation, understood as a stakeholder’s capacity to decrease or eventually drop a constraint of theirs, potentially increasing the project’s feasibility for themselves and for other stakeholders.

3. Results and Discussion

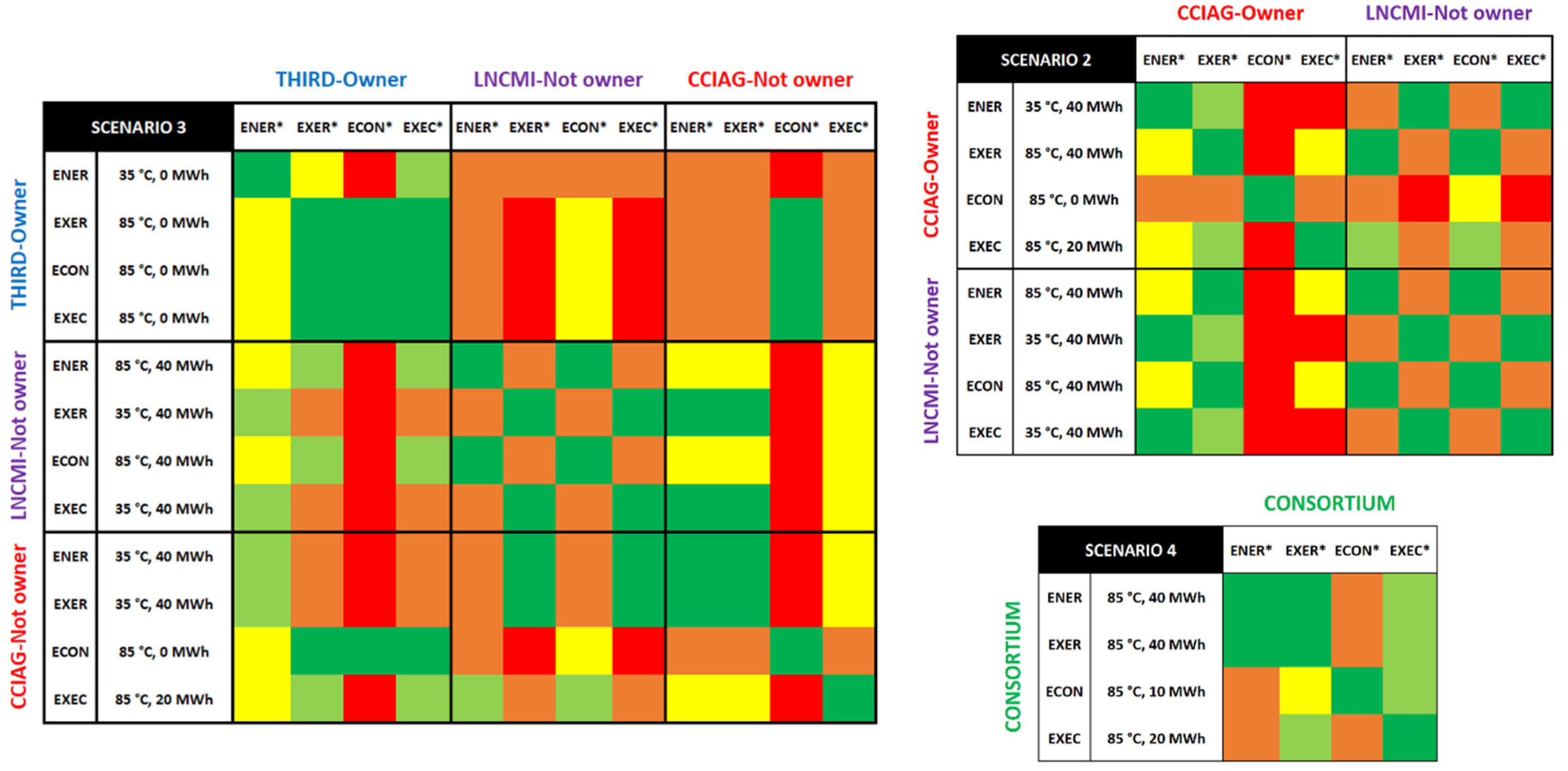

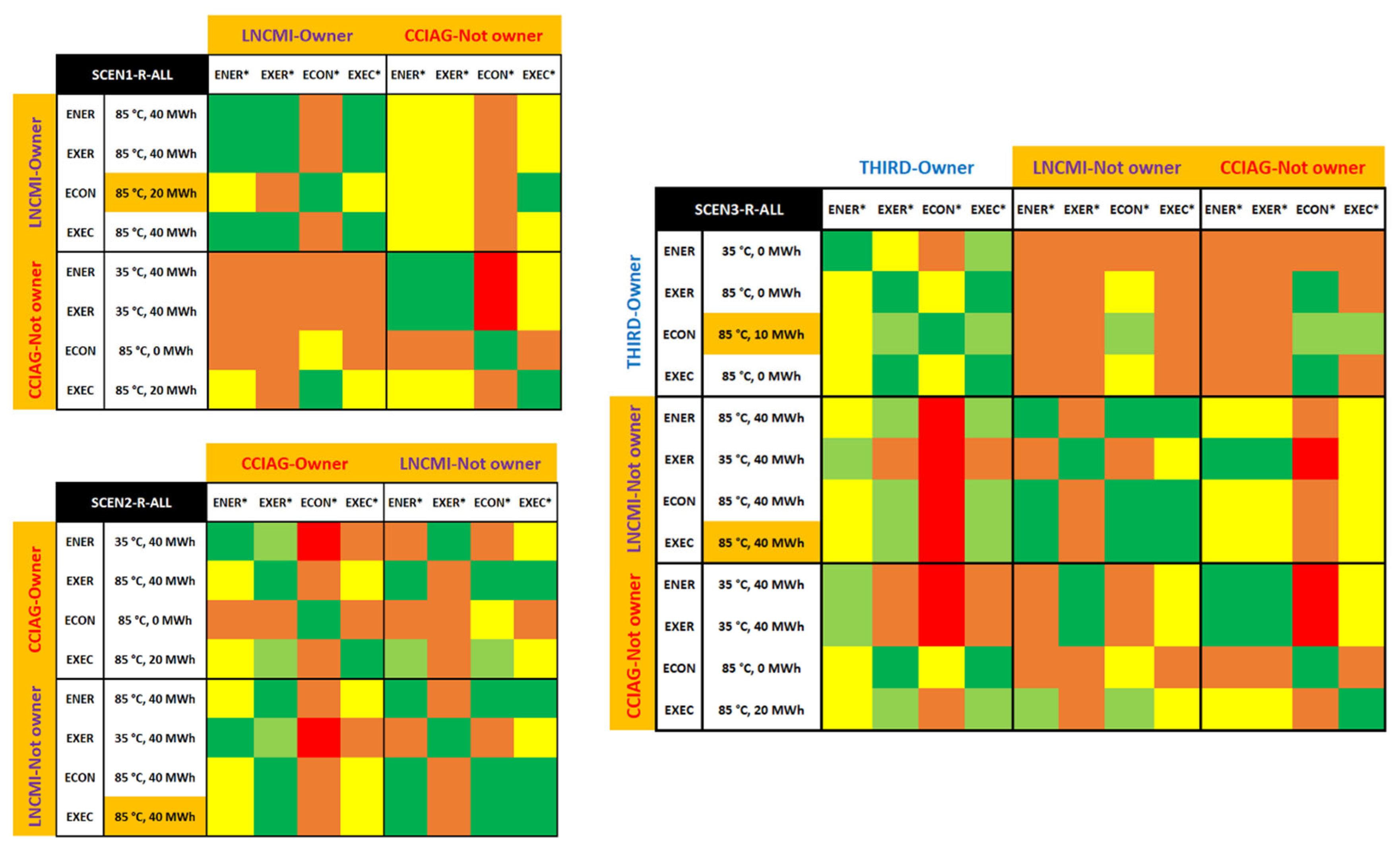

3.1. Stakeholder–Stakeholder Interactions (Cross-Analysis Matrix)

3.2. Relative Optimality (Multicriteria Radar)

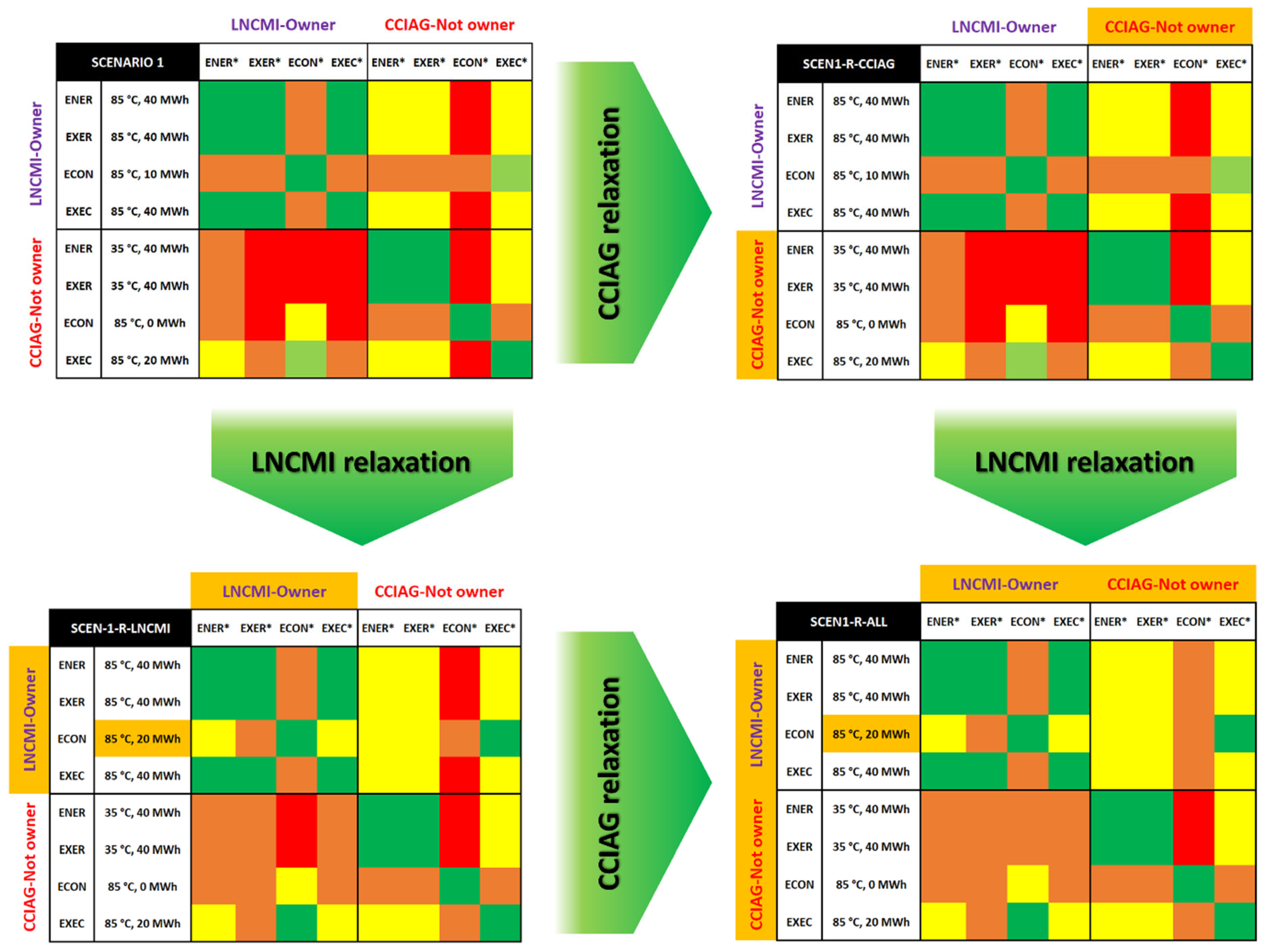

3.3. Effects of Stakeholders’ Flexibility

3.4. Toward an Iterative Decision Procedure

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ch | Chemical | in | Inlet |

| chrg | Heat charge of the thermal storage unit | ini | Initial |

| CI | Capital investment | L | Losses |

| cooling | Magnet’s cooling process | magnets | LNCMI’s high-intensity magnets |

| CF | Coverage factor | max | Maximal |

| COM | Costs of operation and maintenance | min | Minimal |

| COP | Coefficient of performance | mono | Mono-criterion |

| D | Destruction | multi | Multi-criterion |

| dchg | Heat discharge of the thermal storage unit | NPV | Net present value |

| DHN | District heating network | OM | Operation and maintenance |

| DISS | Dissipation | out | Outlet |

| ECON | Economic criterion | P | Product |

| ENER | Energetic criterion | PEC | Purchased equipment cost |

| EXER | Exergetic criterion | piping | Overall pipeline layout |

| EXEC | Exergo-economic criterion | RACF | Recovery and coverage factor |

| elec | Electrical | REF | Reference scenario |

| ex | Exergetic | RF | Recovery factor |

| exo | Exogenous | SST | Network sub-stations |

| F | Fuel | TES | Thermal energy storage |

| f | Final | TCI | Total capital investment |

| GLOB | Global | use | Useful exergy destruction |

| HP | Heat pump | wh | Waste heat |

| HS | Heat supplier | WHRS | Waste heat recovery system |

Appendix A. Detailed Results for Each Technical Solution per Criteria and Scenario

| Scenario | Stakeholder | Criterion | 35 °C—Reference | 35 °C—0 MWh | 35 °C—10 MWh | 35 °C—20 MWh | 35 °C—30 MWh | 35 °C—40 MWh | 50 °C—0 MWh | 50 °C—10 MWh | 50 °C—20 MWh | 50 °C—30 MWh | 50 °C—40 MWh | 85 °C—0 MWh | 85 °C—10 MWh | 85 °C—20 MWh | 85 °C—30 MWh | 85 °C—40 MWh |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SCENARIO 1 | LNCMI [OWNER] | ENER | 0.00 | 0.20 | 0.33 | 0.38 | 0.41 | 0.42 | 0.22 | 0.36 | 0.42 | 0.45 | 0.46 | 0.30 | 0.45 | 0.51 | 0.54 | 0.55 |

| EXER | 7.59 | 8.23 | 8.68 | 8.84 | 8.92 | 8.96 | 8.24 | 8.30 | 8.32 | 8.34 | 8.34 | 8.09 | 7.50 | 7.26 | 7.15 | 7.10 | ||

| ECON | 0.00 | 0.02 | −0.61 | −1.91 | −3.40 | −4.98 | 1.12 | 0.99 | −0.14 | −1.56 | −3.10 | 2.81 | 3.53 | 2.95 | 1.63 | 0.13 | ||

| EXEC | 0.99 | 1.05 | 1.17 | 1.25 | 1.33 | 1.40 | 1.08 | 1.13 | 1.18 | 1.23 | 1.28 | 1.08 | 0.98 | 0.95 | 0.93 | 0.92 | ||

| CCIAG [NOT OWNER] | ENER | 0.00 | 0.23 | 0.39 | 0.45 | 0.48 | 0.49 | 0.23 | 0.37 | 0.43 | 0.45 | 0.47 | 0.23 | 0.35 | 0.40 | 0.42 | 0.43 | |

| EXER | 29.8 | 23.2 | 18.7 | 17.1 | 16.2 | 15.8 | 23.4 | 19.2 | 17.7 | 16.9 | 16.5 | 23.1 | 19.8 | 18.5 | 17.9 | 17.6 | ||

| ECON | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.13 | 0.00 | 0.00 | 0.00 | 0.00 | 0.65 | 0.29 | 0.00 | 0.00 | 0.00 | ||

| EXEC | 1.86 | 1.57 | 1.38 | 1.35 | 1.37 | 1.40 | 1.54 | 1.37 | 1.34 | 1.36 | 1.40 | 1.48 | 1.35 | 1.33 | 1.36 | 1.41 | ||

| SCENARIO 2 | LNCMI [NOT OWNER] | ENER | 0.00 | 0.20 | 0.33 | 0.38 | 0.41 | 0.42 | 0.22 | 0.36 | 0.42 | 0.45 | 0.46 | 0.30 | 0.45 | 0.51 | 0.54 | 0.55 |

| EXER | 7.59 | 7.28 | 7.06 | 6.98 | 6.94 | 6.91 | 7.61 | 7.27 | 7.14 | 7.08 | 7.04 | 8.09 | 7.50 | 7.26 | 7.15 | 7.10 | ||

| ECON | 0.00 | 0.60 | 1.02 | 1.17 | 1.25 | 1.29 | 0.99 | 1.63 | 1.88 | 2.00 | 2.07 | 2.16 | 3.24 | 3.68 | 3.87 | 3.97 | ||

| EXEC | 0.99 | 0.93 | 0.90 | 0.88 | 0.88 | 0.87 | 0.99 | 0.94 | 0.92 | 0.91 | 0.90 | 1.08 | 0.98 | 0.95 | 0.93 | 0.92 | ||

| CCIAG [OWNER] | ENER | 0.00 | 0.23 | 0.39 | 0.45 | 0.48 | 0.49 | 0.23 | 0.37 | 0.43 | 0.45 | 0.47 | 0.23 | 0.35 | 0.40 | 0.42 | 0.43 | |

| EXER | 29.8 | 24.2 | 20.3 | 18.9 | 18.2 | 17.9 | 24.0 | 20.3 | 18.8 | 18.2 | 17.8 | 23.1 | 19.8 | 18.5 | 17.9 | 17.6 | ||

| ECON | 0.00 | −0.58 | −1.63 | −3.08 | −4.65 | −6.28 | 0.26 | −0.63 | −2.01 | −3.56 | −5.16 | 1.30 | 0.57 | −0.73 | −2.24 | −3.84 | ||

| EXEC | 1.86 | 1.69 | 1.65 | 1.72 | 1.82 | 1.93 | 1.62 | 1.56 | 1.60 | 1.69 | 1.78 | 1.48 | 1.35 | 1.34 | 1.36 | 1.41 | ||

| SCENARIO 3 | LNCMI [NOT OWNER] | ENER | 0.00 | 0.20 | 0.33 | 0.38 | 0.41 | 0.42 | 0.22 | 0.36 | 0.42 | 0.45 | 0.46 | 0.30 | 0.45 | 0.51 | 0.54 | 0.55 |

| EXER | 7.59 | 7.28 | 7.06 | 6.98 | 6.94 | 6.91 | 7.61 | 7.27 | 7.14 | 7.08 | 7.04 | 8.09 | 7.50 | 7.26 | 7.15 | 7.10 | ||

| ECON | 0.00 | 0.60 | 1.02 | 1.17 | 1.25 | 1.29 | 0.99 | 1.63 | 1.88 | 2.00 | 2.07 | 2.16 | 3.24 | 3.68 | 3.87 | 3.97 | ||

| EXEC | 0.99 | 0.93 | 0.90 | 0.88 | 0.88 | 0.87 | 0.99 | 0.94 | 0.92 | 0.91 | 0.90 | 1.08 | 0.98 | 0.95 | 0.93 | 0.92 | ||

| CCIAG [NOT OWNER] | ENER | 0.00 | 0.23 | 0.39 | 0.45 | 0.48 | 0.49 | 0.23 | 0.37 | 0.43 | 0.45 | 0.47 | 0.23 | 0.35 | 0.40 | 0.42 | 0.43 | |

| EXER | 29.8 | 23.2 | 18.7 | 17.1 | 16.2 | 15.8 | 23.4 | 19.2 | 17.7 | 16.9 | 16.5 | 23.1 | 19.8 | 18.5 | 17.9 | 17.6 | ||

| ECON | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.13 | 0.00 | 0.00 | 0.00 | 0.00 | 0.65 | 0.29 | 0.00 | 0.00 | 0.00 | ||

| EXEC | 1.86 | 1.57 | 1.38 | 1.35 | 1.37 | 1.40 | 1.54 | 1.37 | 1.34 | 1.36 | 1.40 | 1.48 | 1.35 | 1.33 | 1.36 | 1.41 | ||

| THIRD [OWNER] | ENER | 0.00 | 1.50 | 1.50 | 1.49 | 1.49 | 1.49 | 1.30 | 1.30 | 1.30 | 1.30 | 1.30 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | |

| EXER | 2.05 | 0.96 | 1.62 | 1.86 | 1.98 | 2.05 | 0.62 | 1.03 | 1.18 | 1.26 | 1.30 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | ||

| ECON | 0.00 | −0.58 | −1.63 | −3.08 | −4.65 | −6.28 | 0.13 | −0.63 | −2.01 | −3.56 | −5.16 | 0.65 | 0.29 | −0.73 | −2.24 | −3.84 | ||

| EXEC | 525 | 122 | 272 | 369 | 450 | 525 | 83.1 | 189 | 261 | 324 | 381 | 0.00 | 0.20 | 0.44 | 0.71 | 0.98 | ||

| SCENARIO 4 | CONSORTIUM [OWNER] | ENER | 0.00 | 0.05 | 0.13 | 0.17 | 0.19 | 0.21 | 0.05 | 0.13 | 0.18 | 0.20 | 0.22 | 0.07 | 0.16 | 0.20 | 0.23 | 0.24 |

| EXER | 37.4 | 31.5 | 27.4 | 25.9 | 25.2 | 24.8 | 31.6 | 27.6 | 26.0 | 25.2 | 24.8 | 31.2 | 27.3 | 25.7 | 25.0 | 24.7 | ||

| ECON | 0.00 | 0.02 | −0.61 | −1.91 | −3.40 | −4.98 | 1.25 | 0.99 | −0.14 | −1.56 | −3.10 | 3.47 | 3.82 | 2.95 | 1.63 | 0.13 | ||

| EXEC | 2.84 | 2.62 | 2.55 | 2.60 | 2.69 | 2.80 | 2.62 | 2.50 | 2.52 | 2.59 | 2.68 | 2.56 | 2.34 | 2.28 | 2.29 | 2.33 |

| Scenario | Stakeholder | Criterion | 35 °C—Reference | 35 °C—0 MWh | 35 °C—10 MWh | 35 °C—20 MWh | 35 °C—30 MWh | 35 °C—40 MWh | 50 °C—0 MWh | 50 °C—10 MWh | 50 °C—20 MWh | 50 °C—30 MWh | 50 °C—40 MWh | 85 °C—0 MWh | 85 °C—10 MWh | 85 °C—20 MWh | 85 °C—30 MWh | 85 °C—40 MWh |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SCENARIO 1 | LNCMI [OWNER] | ENER | 0.00 | 0.20 | 0.33 | 0.38 | 0.41 | 0.42 | 0.22 | 0.36 | 0.42 | 0.45 | 0.46 | 0.30 | 0.45 | 0.51 | 0.54 | 0.55 |

| EXER | 7.59 | 8.23 | 8.68 | 8.84 | 8.92 | 8.96 | 8.24 | 8.30 | 8.32 | 8.34 | 8.34 | 8.09 | 7.50 | 7.26 | 7.15 | 7.10 | ||

| ECON | 0.00 | 0.40 | 0.20 | −0.98 | −2.42 | −3.97 | 1.11 | 1.29 | 0.74 | −0.62 | −2.13 | 2.52 | 3.08 | 2.81 | 2.22 | 1.02 | ||

| EXEC | 0.85 | 0.93 | 1.06 | 1.15 | 1.22 | 1.29 | 0.91 | 0.98 | 1.04 | 1.09 | 1.14 | 0.86 | 0.81 | 0.79 | 0.78 | 0.78 | ||

| CCIAG [NOT OWNER] | ENER | 0.00 | 0.23 | 0.39 | 0.45 | 0.48 | 0.49 | 0.23 | 0.37 | 0.43 | 0.45 | 0.47 | 0.23 | 0.35 | 0.40 | 0.42 | 0.43 | |

| EXER | 29.8 | 23.2 | 18.7 | 17.1 | 16.2 | 15.8 | 23.4 | 19.2 | 17.7 | 16.9 | 16.5 | 23.1 | 19.8 | 18.5 | 17.9 | 17.6 | ||

| ECON | 0.00 | −0.38 | −0.81 | −0.92 | −0.98 | −1.02 | 0.14 | −0.29 | −0.88 | −0.94 | −0.97 | 0.95 | 0.73 | 0.14 | −0.59 | −0.89 | ||

| EXEC | 1.86 | 1.55 | 1.36 | 1.33 | 1.34 | 1.38 | 1.52 | 1.34 | 1.31 | 1.32 | 1.36 | 1.44 | 1.29 | 1.26 | 1.29 | 1.33 | ||

| SCENARIO 2 | LNCMI [NOT OWNER] | ENER | 0.00 | 0.20 | 0.33 | 0.38 | 0.41 | 0.42 | 0.22 | 0.36 | 0.42 | 0.45 | 0.46 | 0.30 | 0.45 | 0.51 | 0.54 | 0.55 |

| EXER | 7.59 | 7.28 | 7.06 | 6.98 | 6.94 | 6.91 | 7.61 | 7.27 | 7.14 | 7.08 | 7.04 | 8.09 | 7.50 | 7.26 | 7.15 | 7.10 | ||

| ECON | 0.00 | 0.30 | 0.51 | 0.59 | 0.63 | 0.65 | 0.50 | 0.81 | 0.94 | 1.00 | 1.03 | 1.08 | 1.62 | 1.84 | 1.94 | 1.99 | ||

| EXEC | 0.85 | 0.83 | 0.81 | 0.80 | 0.80 | 0.79 | 0.84 | 0.81 | 0.80 | 0.80 | 0.80 | 0.86 | 0.81 | 0.79 | 0.78 | 0.78 | ||

| CCIAG [OWNER] | ENER | 0.00 | 0.23 | 0.39 | 0.45 | 0.48 | 0.49 | 0.23 | 0.37 | 0.43 | 0.45 | 0.47 | 0.23 | 0.35 | 0.40 | 0.42 | 0.43 | |

| EXER | 29.8 | 24.2 | 20.3 | 18.9 | 18.2 | 17.9 | 24.0 | 20.3 | 18.8 | 18.2 | 17.8 | 23.1 | 19.8 | 18.5 | 17.9 | 17.6 | ||

| ECON | 0.00 | 2.82 | 1.98 | 0.60 | −0.93 | −2.53 | 3.85 | 3.28 | 2.02 | 0.54 | −1.03 | 5.48 | 5.30 | 4.21 | 2.80 | 1.24 | ||

| EXEC | 1.86 | 1.66 | 1.61 | 1.68 | 1.77 | 1.88 | 1.59 | 1.50 | 1.54 | 1.62 | 1.71 | 1.44 | 1.29 | 1.26 | 1.29 | 1.33 | ||

| SCENARIO 3 | LNCMI [NOT OWNER] | ENER | 0.00 | 0.20 | 0.33 | 0.38 | 0.41 | 0.42 | 0.22 | 0.36 | 0.42 | 0.45 | 0.46 | 0.30 | 0.45 | 0.51 | 0.54 | 0.55 |

| EXER | 7.59 | 7.28 | 7.06 | 6.98 | 6.94 | 6.91 | 7.61 | 7.27 | 7.14 | 7.08 | 7.04 | 8.09 | 7.50 | 7.26 | 7.15 | 7.10 | ||

| ECON | 0.00 | 0.30 | 0.51 | 0.59 | 0.63 | 0.65 | 0.50 | 0.81 | 0.94 | 1.00 | 1.03 | 1.08 | 1.62 | 1.84 | 1.94 | 1.99 | ||

| EXEC | 0.85 | 0.83 | 0.81 | 0.80 | 0.80 | 0.79 | 0.84 | 0.81 | 0.80 | 0.80 | 0.80 | 0.86 | 0.81 | 0.79 | 0.78 | 0.78 | ||

| CCIAG [NOT OWNER] | ENER | 0.00 | 0.23 | 0.39 | 0.45 | 0.48 | 0.49 | 0.23 | 0.37 | 0.43 | 0.45 | 0.47 | 0.23 | 0.35 | 0.40 | 0.42 | 0.43 | |

| EXER | 29.8 | 23.2 | 18.7 | 17.1 | 16.2 | 15.8 | 23.4 | 19.2 | 17.7 | 16.9 | 16.5 | 23.1 | 19.8 | 18.5 | 17.9 | 17.6 | ||

| ECON | 0.00 | −0.38 | −0.81 | −0.92 | −0.98 | −1.02 | 0.14 | −0.29 | −0.88 | −0.94 | −0.97 | 0.95 | 0.73 | 0.14 | −0.59 | −0.89 | ||

| EXEC | 1.86 | 1.55 | 1.36 | 1.33 | 1.34 | 1.38 | 1.52 | 1.34 | 1.31 | 1.32 | 1.36 | 1.44 | 1.29 | 1.26 | 1.29 | 1.33 | ||

| THIRD [OWNER] | ENER | 0.00 | 1.50 | 1.50 | 1.49 | 1.49 | 1.49 | 1.30 | 1.30 | 1.30 | 1.30 | 1.30 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | |

| EXER | 2.05 | 0.96 | 1.62 | 1.86 | 1.98 | 2.05 | 0.62 | 1.03 | 1.18 | 1.26 | 1.30 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01 | ||

| ECON | 0.00 | 0.10 | −0.31 | −1.57 | −3.04 | −4.61 | 0.61 | 0.47 | −0.19 | −1.62 | −3.16 | 1.43 | 1.46 | 0.97 | 0.28 | −0.97 | ||

| EXEC | 499 | 110 | 251 | 345 | 425 | 499 | 67.8 | 163 | 232 | 292 | 349 | 0.00 | 0.10 | 0.22 | 0.35 | 0.49 | ||

| SCENARIO 4 | CONSORTIUM [OWNER] | ENER | 0.00 | 0.05 | 0.13 | 0.17 | 0.19 | 0.21 | 0.05 | 0.13 | 0.18 | 0.20 | 0.22 | 0.07 | 0.16 | 0.20 | 0.23 | 0.24 |

| EXER | 37.4 | 31.5 | 27.4 | 25.9 | 25.2 | 24.8 | 31.6 | 27.6 | 26.0 | 25.2 | 24.8 | 31.2 | 27.3 | 25.7 | 25.0 | 24.7 | ||

| ECON | 0.00 | 0.50 | 0.20 | −0.98 | −2.42 | −3.97 | 1.72 | 1.76 | 0.74 | −0.62 | −2.13 | 3.95 | 4.54 | 3.78 | 2.50 | 1.02 | ||

| EXEC | 2.71 | 2.49 | 2.42 | 2.48 | 2.57 | 2.67 | 2.43 | 2.32 | 2.34 | 2.42 | 2.51 | 2.30 | 2.10 | 2.06 | 2.07 | 2.11 |

References

- Lichtenegger, K.; Leitner, A.; Märzinger, T.; Mair, C.; Moser, A.; Wöss, D.; Schmidl, C.; Pröll, T. Decentralized heating grid operation: A comparison of centralized and agent-based optimization. Sustain. Energy Grids Netw. 2020, 21, 100300. [Google Scholar] [CrossRef]

- Lund, H.; Werner, S.; Wiltshire, R.; Svendsen, S.; Thorsen, J.E.; Hvelplund, F.; Vad Mathiesen, B.; Mathiesen, B.V. 4th Generation District Heating (4GDH). Energy 2014, 68, 1–11. [Google Scholar] [CrossRef]

- Broberg, S.; Backlund, S.; Karlsson, M.; Thollander, P. Industrial excess heat deliveries to Swedish district heating networks: Drop it like it’s hot. Energy Policy 2012, 51, 332–339. [Google Scholar] [CrossRef]

- Haas, J.; Nowak, W.; Palma-Behnke, R. Multi-objective planning of energy storage technologies for a fully renewable system: Implications for the main stakeholders in Chile. Energy Policy 2018, 126, 494–506. [Google Scholar] [CrossRef]

- Yao, R.; Hu, Y.; Varga, L. Applications of Agent-Based Methods in Multi-Energy Systems—A Systematic Literature Review. Energies 2023, 16, 2456. [Google Scholar] [CrossRef]

- Gährs, S.; Knoefel, J. Stakeholder demands and regulatory framework for community energy storage with a focus on Germany. Energy Policy 2020, 144, 111678. [Google Scholar] [CrossRef]

- Wang, G.; Blondeau, J. Multi-Objective Optimal Integration of Solar Heating and Heat Storage into Existing Fossil Fuel-Based Heat and Power Production Systems. Energies 2022, 15, 1942. [Google Scholar] [CrossRef]

- Battini, F.; Pernigotto, G.; Morandi, F.; Gasparella, A.; Kämpf, J.H. Assessment of Subsidization Strategies for Multi-Objective Optimization of Energy Efficiency Measures for Building Renovation at District Scale. Energies 2023, 16, 5780. [Google Scholar] [CrossRef]

- Alavijeh, N.M.; Steen, D.; Norwood, Z.; Tuan, L.A.; Agathokleous, C. Cost-Effectiveness of Carbon Emission Abatement Strategies for a Local Multi-Energy System—A Case Study of Chalmers University of Technology Campus. Energies 2020, 13, 1626. [Google Scholar] [CrossRef]

- Li, M.; Feng, Y.; Zhou, M.; Mu, H.; Li, L.; Wang, Y. Economic and Environmental Optimization for Distributed Energy System Integrated with District Energy Network. Energies 2019, 12, 1844. [Google Scholar] [CrossRef]

- Ye, B.; Zhou, M.; Yan, D.; Li, Y. Multi-Objective Decision-Making for Hybrid Renewable Energy Systems for Cities: A Case Study of Xiongan New District in China. Energies 2020, 13, 6223. [Google Scholar] [CrossRef]

- Schmeling, L.; Schönfeldt, P.; Klement, P.; Wehkamp, S.; Hanke, B.; Agert, C. Development of a Decision-Making Framework for Distributed Energy Systems in a German District. Energies 2020, 13, 552. [Google Scholar] [CrossRef]

- Thomsen, J.; Saad Hussein, N.; Senkpiel, C.; Hartmann, N.; Schlegl, T. An optimized energy system planning and operation on distribution grid level—The Decentralized Market Agent as a novel approach. Sustain. Energy Grids Netw. 2017, 12, 40–56. [Google Scholar] [CrossRef]

- Lichtenegger, K.; Wöss, D.; Halmdienst, C.; Höftberger, E.; Schmidl, C.; Pröll, T. Intelligent heat networks: First results of an energy-information-cost-model. Sustain. Energy Grids Netw. 2017, 11, 1–12. [Google Scholar] [CrossRef]

- Hinker, J.; Hemkendreis, C.; Drewing, E.; März, S.; Hidalgo Rodríguez, D.I.; Myrzik, J.M.A. A novel conceptual model facilitating the derivation of agent-based models for analyzing socio-technical optimality gaps in the energy domain. Energy 2017, 137, 1219–1230. [Google Scholar] [CrossRef]

- Miró, L.; Brueckner, S.; McKenna, R.; Cabeza, L.F. Methodologies to estimate industrial waste heat potential by transferring key figures: A case study for Spain. Appl. Energy 2016, 169, 866–873. [Google Scholar] [CrossRef]

- Bolwig, S.; Bolkesjø, T.F.; Klitkou, A.; Lund, P.D.; Bergaentzlé, C.; Borch, K.; Olsen, O.J.; Kirkerud, J.G.; Chen, Y.K.; Gunkel, P.A.; et al. Climate-friendly but socially rejected energy-transition pathways: The integration of techno-economic and socio-technical approaches in the Nordic-Baltic region. Energy Res. Soc. Sci. 2020, 67, 101559. [Google Scholar] [CrossRef]

- Martin, N.; Rice, J. Improving Australia’s renewable energy project policy and planning: A multiple stakeholder analysis. Energy Policy 2015, 84, 128–141. [Google Scholar] [CrossRef]

- Heuninckx, S.; Boveldt, G.T.; Macharis, C.; Coosemans, T. Stakeholder objectives for joining an energy community: Flemish case studies. Energy Policy 2022, 162, 112808. [Google Scholar] [CrossRef]

- Sanderink, L.; Nasiritousi, N. How institutional interactions can strengthen effectiveness: The case of multi-stakeholder partnerships for renewable energy. Energy Policy 2020, 141, 111447. [Google Scholar] [CrossRef]

- Dashti, R.; Yousefi, S.; Parsa Moghaddam, M. Comprehensive efficiency evaluation model for electrical distribution system considering social and urban factors. Energy 2013, 60, 53–61. [Google Scholar] [CrossRef]

- Jano-Ito, M.A.; Crawford-Brown, D. Investment decisions considering economic, environmental and social factors: An actors’ perspective for the electricity sector of Mexico. Energy 2017, 121, 92–106. [Google Scholar] [CrossRef]

- Farías, I.; Bender, T. Urban Assemblages: How Actor-Network Theory Changes Urban Studies; Routledge: London, UK; New York, NY, USA, 2010; ISBN 978-0-415-48662-0. [Google Scholar] [CrossRef]

- Hampikian, Z. De la Distribution Aux Synergies? Circulations Locales d’énergie et Transformations des Processus de Mise en Réseau de la Ville; Université Paris-Est: Créteil, France, 2017. [Google Scholar]

- Wehkamp, S.; Schmeling, L.; Vorspel, L.; Roelcke, F.; Windmeier, K.-L. District Energy Systems: Challenges and New Tools for Planning and Evaluation. Energies 2020, 13, 2967. [Google Scholar] [CrossRef]

- Ha, Y.H.; Kumar, S.S. Investigating decentralized renewable energy systems under different governance approaches in Nepal and Indonesia: How does governance fail? Energy Res. Soc. Sci. 2021, 80, 102214. [Google Scholar] [CrossRef]

- Reda, F.; Ruggiero, S.; Auvinen, K.; Temmes, A. Towards low-carbon district heating: Investigating the socio-technical challenges of the urban energy transition. Smart Energy 2021, 4, 100054. [Google Scholar] [CrossRef]

- Simeoni, P.; Ciotti, G.; Cottes, M.; Meneghetti, A. Integrating industrial waste heat recovery into sustainable smart energy systems. Energy 2019, 175, 941–951. [Google Scholar] [CrossRef]

- Lund, R.; Ilic, D.D.; Trygg, L. Socioeconomic potential for introducing large-scale heat pumps in district heating in Denmark. J. Clean. Prod. 2016, 139, 219–229. [Google Scholar] [CrossRef]

- Taylor, P.C.; Abeysekera, M.; Bian, Y.; Ćetenović, D.; Deakin, M.; Ehsan, A.; Levi, V.; Li, F.; Oduro, R.; Preece, R.; et al. An interdisciplinary research perspective on the future of multi-vector energy networks. Int. J. Electr. Power Energy Syst. 2021, 135, 107492. [Google Scholar] [CrossRef]

- Höfer, T.; Madlener, R. A participatory stakeholder process for evaluating sustainable energy transition scenarios. Energy Policy 2020, 139, 111277. [Google Scholar] [CrossRef]

- Turcksin, L.; Macharis, C.; Lebeau, K.; Boureima, F.; Van Mierlo, J.; Bram, S.; De Ruyck, J.; Mertens, L.; Jossart, J.M.; Gorissen, L.; et al. A multi-actor multi-criteria framework to assess the stakeholder support for different biofuel options: The case of Belgium. Energy Policy 2011, 39, 200–214. [Google Scholar] [CrossRef]

- Hettinga, S.; Nijkamp, P.; Scholten, H. A multi-stakeholder decision support system for local neighbourhood energy planning. Energy Policy 2018, 116, 277–288. [Google Scholar] [CrossRef]

- Fitó, J.; Ramousse, J.; Hodencq, S.; Morriet, L.; Wurtz, F.; Debizet, G. Analyse technico-économique multi-acteurs de la conception d’un système de valorisation de chaleur fatale sur réseau de chaleur. In Proceedings of the Communautés Énergétiques, Autoproduction, Autoconsommation: Cadrages, Pratiques et Outils, Paris, France, 15–16 June 2020. [Google Scholar]

- Tabourdeau, A.; Debizet, G. Concilier ressources in situ et grands réseaux: Une lecture des proximités par la notion de nœud socio-énergétique. Flux 2017, 109–110, 87–101. [Google Scholar] [CrossRef]

- Fitó, J.; Hodencq, S.; Ramousse, J.; Wurtz, F.; Stutz, B.; Debray, F.; Vincent, B. Energy- and exergy-based optimal designs of a low-temperature industrial waste heat recovery system in district heating. Energy Convers. Manag. 2020, 211, 112753. [Google Scholar] [CrossRef]

- Morriet, L.; Pajot, C.; Delinchant, B.; Marechal, Y.; Wurtz, F.; Debray, F.; Vincent, B. Optimisation multi-acteurs appliquée à la valorisation de chaleur fatale d’un acteur industriel flexible. In Proceedings of the Conférence Francophone de l’International Building Performance Simulation Association (IBPSA), Bordeaux, France, 15–16 May 2018. [Google Scholar]

- Hodencq, S.; Debray, F.; Trophime, C.; Vincent, B.; Stutz, B.; Delinchant, B.; Wurtz, F.; Pajot, C.; Morriet, L.; Bentivoglio, F.; et al. Thermohydraulics of High Field Magnets: From microns to urban community scale. In Proceedings of the 24ème Congrès Français de Mécanique, Brest, France, 26–30 August 2019. [Google Scholar]

- Morriet, L.; Debizet, G.; Wurtz, F. Multi-actor modelling for MILP energy systems optimisation: Application to collective self-consumption. In Building Simulation; 2015; Available online: https://hal.science/hal-02285965/ (accessed on 11 February 2022).

- Debizet, G.; Pappalardo, M.; Wurtz, F. Local Energy Communities: Emergence, Places, Organizations, Decision Tools, 1st ed.; Routledge: London, UK, 2022; ISBN 9781003257547. [Google Scholar] [CrossRef]

- Pajot, C.; Morriet, L.; Hodencq, S.; Delinchant, B.; Maréchal, Y.; Wurtz, F.; Reinbold, V. An Optimization Modeler as an Efficient Tool for Design and Operation for City Energy Stakeholders and Decision Makers. (HAL Id: Hal-02285954). In Proceedings of the 16th IBPSA International Conference, Rome, Italy, 2–4 September 2019. [Google Scholar]

- Pajot, C. OMEGAlpes: Outil D’aide à la Décision Pour Une Planification Energétique Multi-Fluides Optimale à L’échelle Des Quartiers. Doctoral Thesis, Université de Grenoble, Saint-Martin-d’Hères, France, 2019. [Google Scholar]

- Fitó, J.; Ramousse, J.; Hodencq, S.; Wurtz, F. Energy, exergy, economic and exergoeconomic (4E) multicriteria analysis of an industrial waste heat valorization system through district heating. Sustain. Energy Technol. Assess. 2020, 42, 100894. [Google Scholar] [CrossRef]

- Pons, M. On the reference state for exergy when ambient temperature fluctuates. Int. J. Thermodyn. 2009, 12, 113–121. [Google Scholar]

- Pajot, C.; Delinchant, B.; Marechal, Y.; Wurtz, F.; Debray, F.; Vincent, B. Valorisation optimale de chaleur fatale d’un site à forte consommation électrique. In Proceedings of the Conférence des Jeunes Chercheurs en Génie Electrique (JCGE), Oléron, France, 30 May–1 June 2017. [Google Scholar]

- Pajot, C.; Delinchant, B.; Maréchal, Y.; Wurtz, F.; Robin, S.; Vincent, B.; Debray, F.; Nguyen, Q. Data-Driven Modeling of Building Consumption Profile for Optimal Flexibility: Application to Energy Intensive Industry. In Proceedings of the Building Simulation Conference, Rome, Italy, 2–4 September 2019; Available online: https://hal.science/hal-02364669/ (accessed on 14 April 2022).

- Greco, S.; Ehrgott, M.; Figueira, J. Multiple Criteria Decision Analysis; Springer: Catania, Italy, 2016. [Google Scholar]

| Scenario | Stakeholder | Socio-Energetic Node |

|---|---|---|

| 1 | LNCMI (Owner) | EXP + DISS + TES + HP |

| CCIAG (Not owner) | CDCH + RES + SST | |

| 2 | CCIAG (Owner) | HS + NTW + SST + TES + HP |

| LNCMI (Not owner) | EXP + DISS | |

| 3 | THIRD (Owner) | TES + HP |

| LNCMI (Not owner) | EXP + DISS | |

| CCIAG (Not owner) | HS + NTW + SST | |

| 4 | CONSORTIUM (Owner) | EXP + DISS + TES + HP + HS + NTW + SST |

| Stakeholder | Criterion | Indicator (Owner) | Indicator (Not Owner) |

|---|---|---|---|

| LNCMI | ENER | ||

| EXER | |||

| EXEC | |||

| ECON | |||

| CCIAG | ENER | ||

| EXER | |||

| EXEC | |||

| ECON | |||

| THIRD | ENER | N/A | |

| EXER | N/A | ||

| EXEC | N/A | ||

| ECON | N/A | ||

| CONSORTIUM | ENER | N/A | |

| EXER | N/A | ||

| EXEC | N/A | ||

| ECON | N/A | ||

| Stakeholder | Criterion | Tolerance | NO-GO | Relaxation | ||

|---|---|---|---|---|---|---|

| Light | Moderate | Heavy | ||||

| LNCMI | ENER | <5% | <10% | >10% | N/A | N/A |

| EXER | <10% | <25% | >25% | if Δ(ExD) > 0 | Disregard NO-GO | |

| ECON | <25% | <50% | >50% | if NPV < 0 | Cut C_WH by 50% | |

| EXEC | <10% | <25% | >25% | if Δ(CD) > 0 | Disregard NO-GO | |

| CCIAG | ENER | <10% | <25% | >25% | N/A | N/A |

| EXER | <10% | <25% | >25% | if Δ(ExD) > 0 | Disregard NO-GO | |

| ECON | <5% | <10% | >10% | if NPV < 0 | Disregard Z_NETW by 50% | |

| EXEC | <10% | <25% | >25% | if Δ(CD) > 0 | Disregard NO-GO | |

| THIRD | ENER | <25% | <50% | >50% | N/A | N/A |

| EXER | <25% | <50% | >50% | N/A | N/A | |

| ECON | <5% | <10% | >10% | if NPV < 0 | N/A | |

| EXEC | <25% | <50% | >50% | N/A | N/A | |

| CONSORTIUM | ENER | <5% | <10% | >10% | N/A | N/A |

| EXER | <10% | <25% | >25% | if Δ(ExD) > 0 | Disregard NO-GO | |

| ECON | <5% | <10% | >10% | if NPV < 0 | N/A | |

| EXEC | <10% | <25% | >25% | if Δ(CD) > 0 | Disregard NO-GO | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fitó, J.; Ramousse, J. Multi-Stakeholder Decision Support Based on Multicriteria Assessment: Application to Industrial Waste Heat Recovery for a District Heating Network in Grenoble, France. Energies 2024, 17, 2009. https://doi.org/10.3390/en17092009

Fitó J, Ramousse J. Multi-Stakeholder Decision Support Based on Multicriteria Assessment: Application to Industrial Waste Heat Recovery for a District Heating Network in Grenoble, France. Energies. 2024; 17(9):2009. https://doi.org/10.3390/en17092009

Chicago/Turabian StyleFitó, Jaume, and Julien Ramousse. 2024. "Multi-Stakeholder Decision Support Based on Multicriteria Assessment: Application to Industrial Waste Heat Recovery for a District Heating Network in Grenoble, France" Energies 17, no. 9: 2009. https://doi.org/10.3390/en17092009