Valuing Expansions of the Electricity Transmission Network under Uncertainty: The Binodal Case

Abstract

:1. Introduction

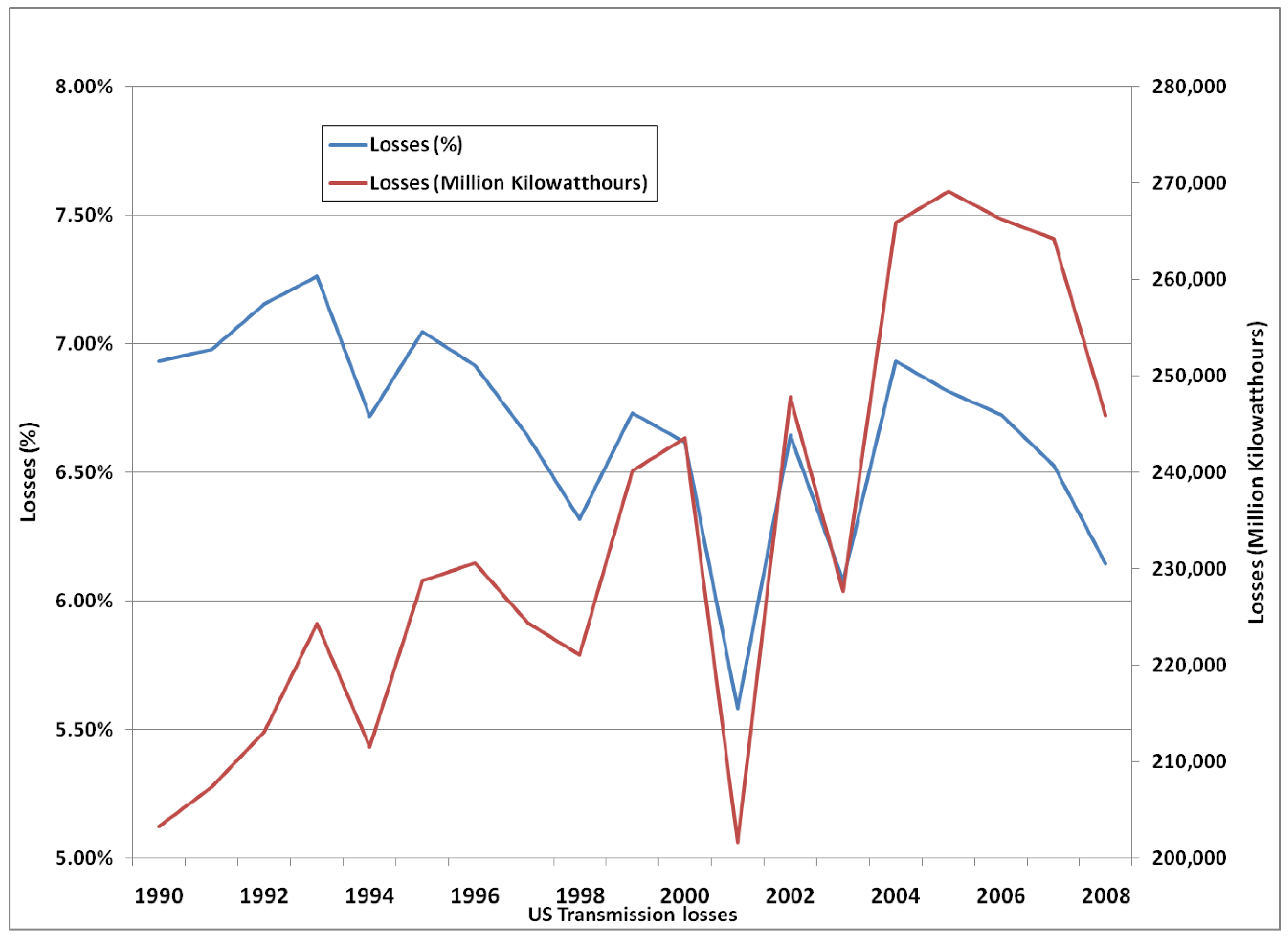

2. Some Background

2.1. The Physical Environment

2.2. The Economic Environment

3. The Basic Setup

3.1. Some Features of the Model to Be Developed

- ·

- We assume a stochastic behavior for the price of coal, natural gas, and carbon emission allowances. They evolve according to some parameters whose values are estimated from observed market prices.

- ·

- Each component of the network (generation unit, transmission line) has a certain probability of being out of service at any time (e.g., plants can be unavailable because of adverse weather conditions like high winds and low temperatures). So outages occur stochastically according to some rate.

- ·

- Given commodity prices and components availability, at any time the supply curve of generators is determined (the merit order), which is ordered from lower to higher bid price of electricity. The model must allow for the possibility that, on some occasions, the cheapest-to-run units be coal-fired plants while at some other times that role fall on natural gas combined cycles [25]. It depends on the stochastic evolution of prices along each path generated by Monte Carlo simulation(this numerical method will be adopted for solving this type of problem).

- ·

- At any time there is a stochastic demand at each node. This load is going to be correlated with the loads at adjacent nodes (e.g., because both are more or less affected by common factors such as outdoor temperature or sun light).

- ·

- From the intersection of supply and demand curves the (marginal) price of electricity results. In the case of a network under uniform pricing, this would be the price charged by all generators.

- ·

- At every time demand and supply must be balanced, and the Laws of Physics must apply in the network.

- ·

- We adopt the DC load flow model, so we do not model the impact of reactive power on the system. It provides an approximate solution for a network carrying AC power [15, Appendix D].

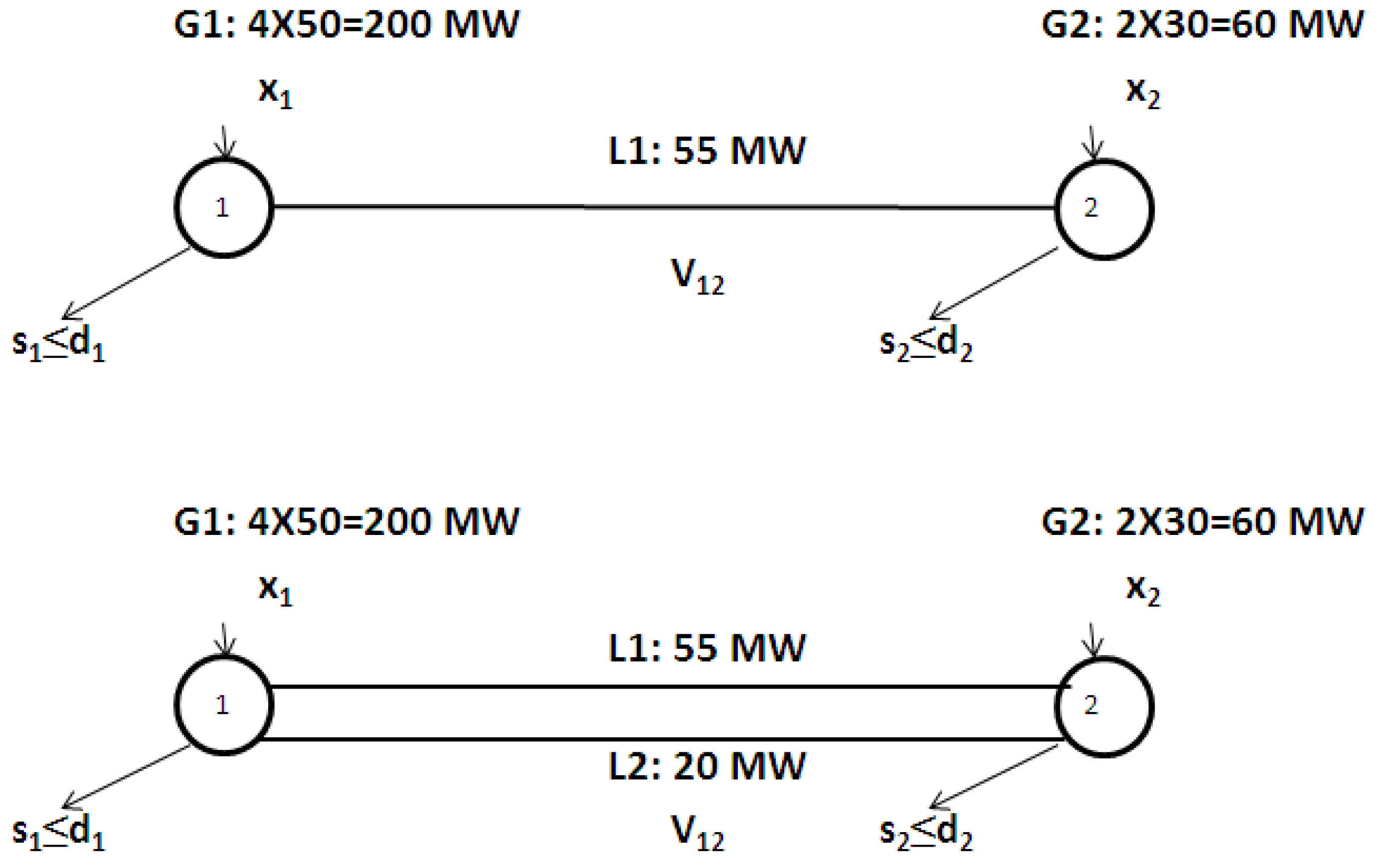

3.2. A Simple Transmission Model

| Node #1 | Node #2 | Line L1 | |

|---|---|---|---|

| Effective Generation | - | ||

| Maximum Generation | - | ||

| Availability {0,1} | |||

| Load Served | - | ||

| Load Demanded | - | ||

| Line capacity | - | - | |

| Trans. Losses | - | - |

4. The Stochastic Model

4.1. Future Loads

4.2. Commodity Prices

- (a)

- Natural gas price:

- (b)

- Coal price:

- (c)

- As for the emission allowance price, we adopt a non-stationary process:

5. Estimation of the Underlying Parameters

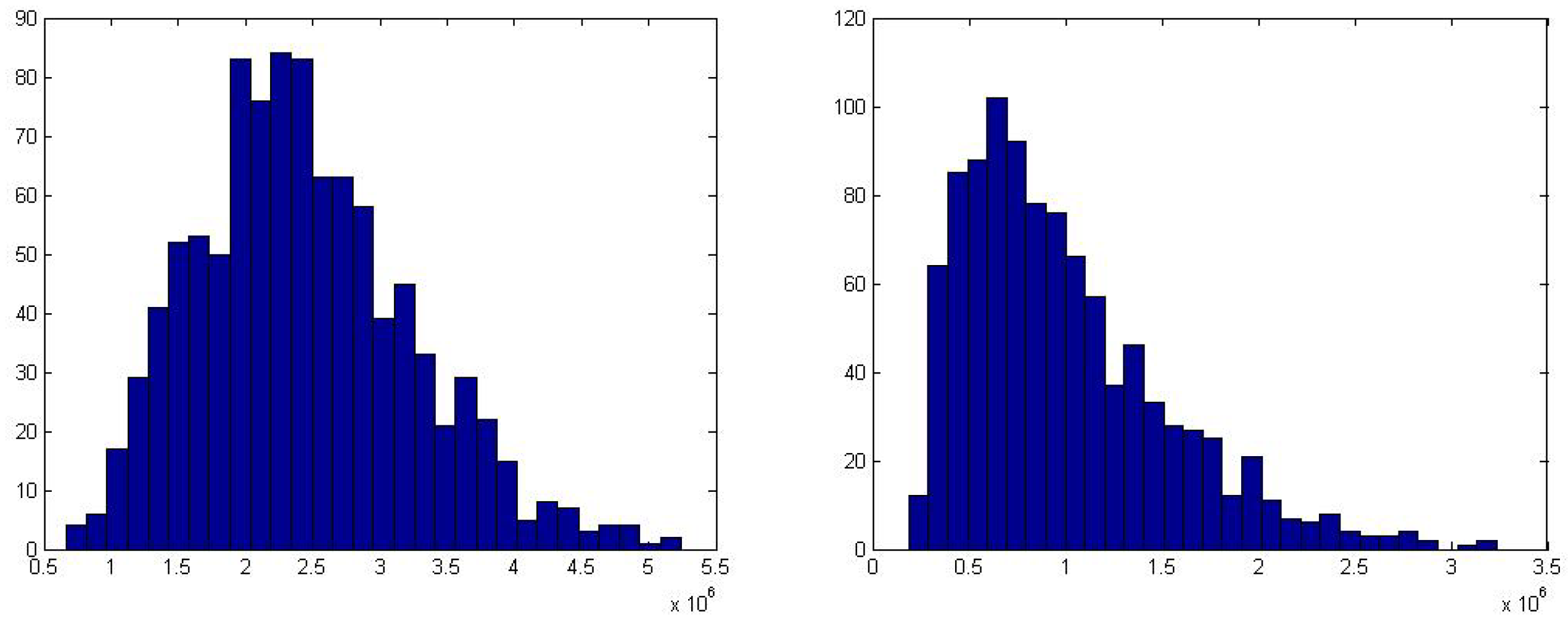

5.1. Drift and Volatility of the Demand

| Coefficient | Estimate | Std. Dev. | t-statistic | p-value |

|---|---|---|---|---|

| 0.0176115 | 0.00365603 | 4.817 | 0.0002 |

5.2. Estimation of the Price Processes

| Parameter | Value | Parameter | Value | Parameter | Value | Parameter | Value |

|---|---|---|---|---|---|---|---|

| 105.27 | 25.04 | −21.7 3.29 | 74.7898 | ||||

| 0.69 | 0.85 | 0.054 | 7.2419 | ||||

| 0.4144 | 0.6356 | 0.20 | 13.18 |

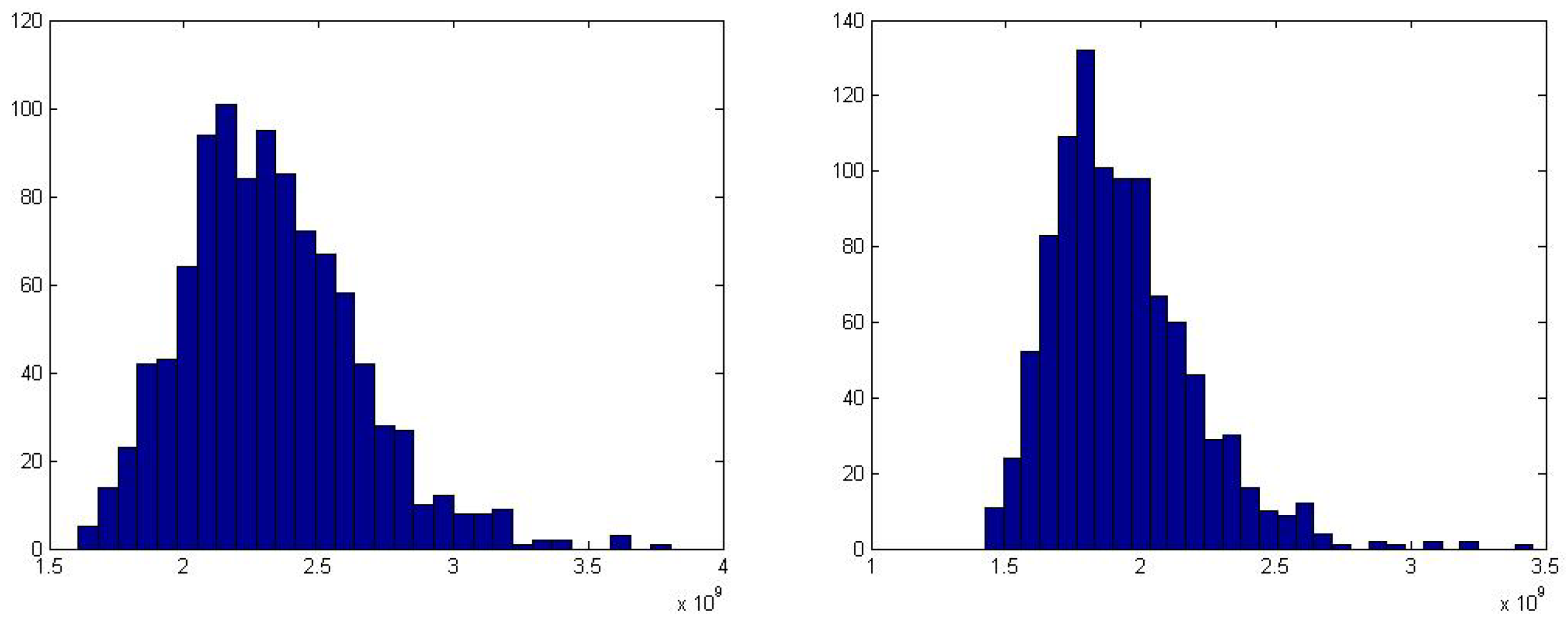

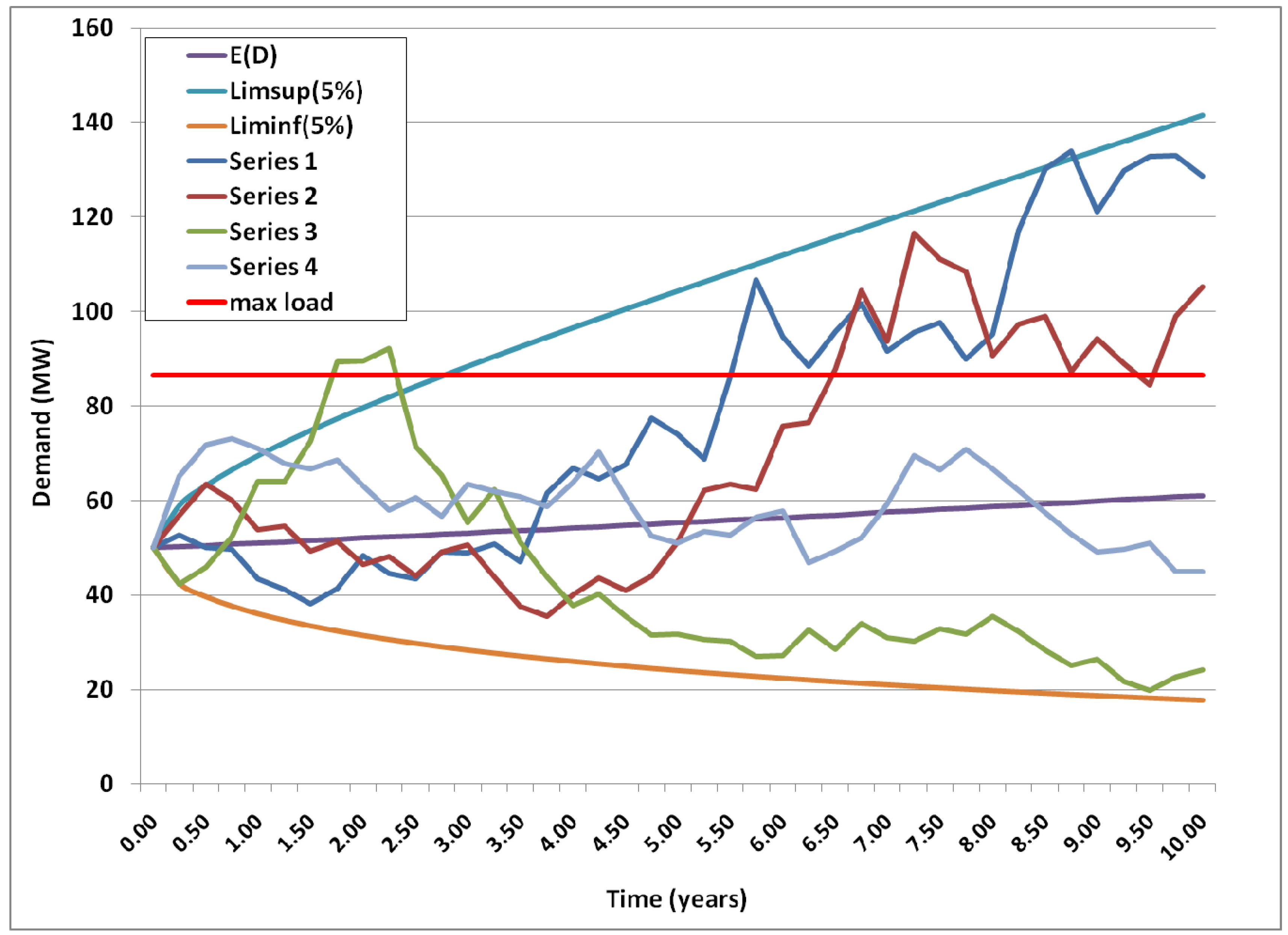

6. Monte Carlo Simulation

7. Certainty and Uncertainty with a Single Transmission Line (L1)

7.1. The Base Case: No Growth in Loads and Only L1 under Certainty

| No Volatility | Base Case | |

|---|---|---|

| Coal generation (GWh) | 493.63 | 493.27 |

| Gas generation (GWh) | 1201.64 | 1199.63 |

| Load (GWh) | 1785.44 | 1786.04 |

| Unserved load (GWh) | 118.83 | 121.69 |

| Transmission (GWh) | 466.60 | 464.59 |

| Emissions (KtCO2) | 1000.61 | 1000.46 |

| Allowance costs (M€) | 15.88 | 15.84 |

| Present cost (M€) | 115.14 | 116.06 |

7.2. Impact of Higher Demand Volatitlity

| Base Case (σ = 1.55%) | σ = 3.1% | |

|---|---|---|

| Coal generation (GWh) | 493.27 | 491.63 |

| Gas generation (GWh) | 1199.63 | 1193.46 |

| Load (GWh) | 1786.04 | 1786.49 |

| Unserved load (GWh) | 121.69 | 129.57 |

| Transmission (GWh) | 464.59 | 458.56 |

| Emissions (KtCO2) | 1000.46 | 996.34 |

| Allowance costs (M€) | 15.84 | 15.74 |

| Present cost (M€) | 116.06 | 118.45 |

7.3. Impact of Higher Demand Growth Rate

| Base Case (α = 1.74%) | α = 3.49% | |

|---|---|---|

| Coal generation (GWh) | 493.27 | 494.91 |

| Gas generation (GWh) | 1199.63 | 1341.73 |

| Load (GWh) | 1786.04 | 2163.30 |

| Unserved load (GWh) | 121.69 | 354.47 |

| Transmission (GWh) | 464.59 | 452.68 |

| Emissions (KtCO2) | 1000.46 | 1054.50 |

| Allowance costs (M€) | 15.84 | 16.75 |

| Present cost (M€) | 116.06 | 193.30 |

7.4. Effect of a Higher Initial Allowance Price

| Base Case A0 = 13.18 | A0 = 26.36 | |

|---|---|---|

| Coal generation (GWh) | 493.27 | 485.70 |

| Gas generation (GWh) | 1199.63 | 1206.98 |

| Load (GWh) | 1786.04 | 1786.04 |

| Unserved load (GWh) | 121.69 | 122.36 |

| Transmission (GWh) | 464.59 | 471.94 |

| Emissions (KtCO2) | 1000.46 | 994.57 |

| Allowance costs (M€) | 15.84 | 31.32 |

| Present cost (M€) | 116.06 | 131.81 |

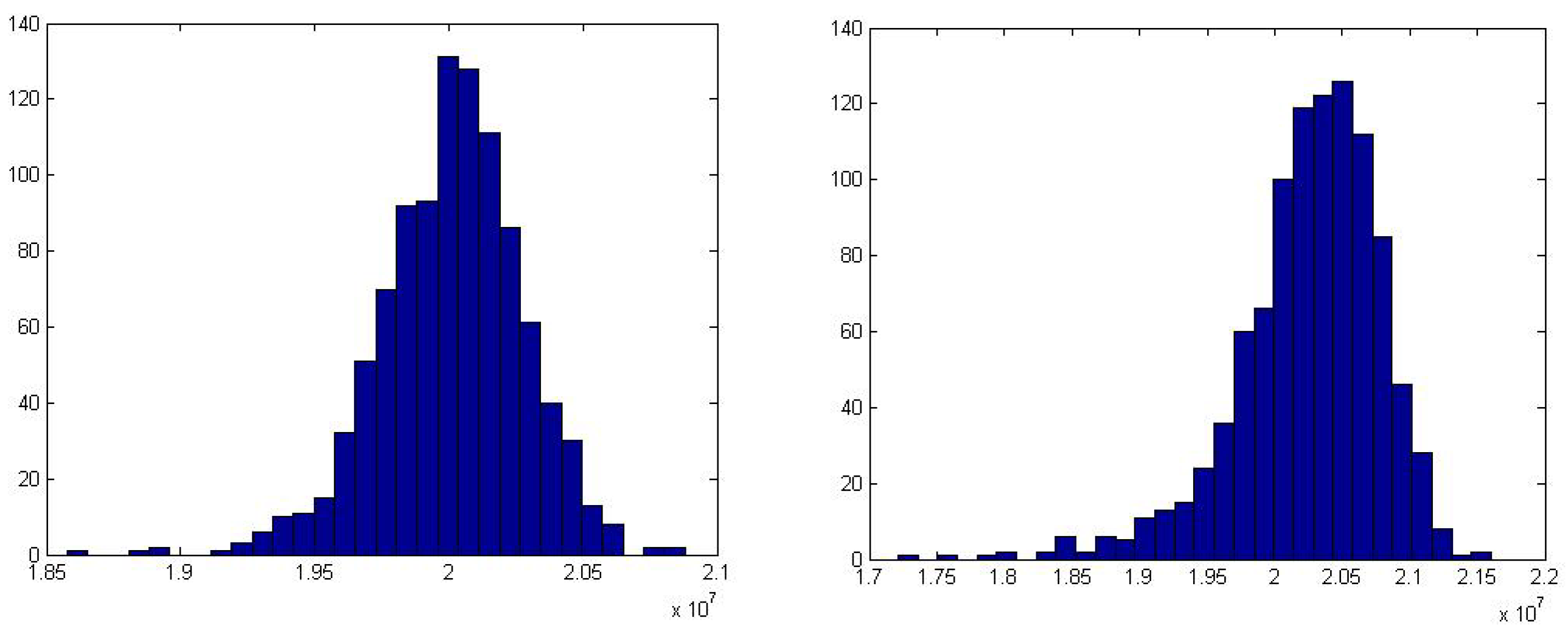

8. Expansion of the Transmission Network

8.1. The Case with Full Certainty

| Coal generation (GWh) | 493.63 | 473.57 |

| Gas generation (GWh) | 1201.64 | 1301.98 |

| Load (GWh) | 1785.44 | 1785.44 |

| Unserved load (GWh) | 118.83 | 44.73 |

| Transmission (GWh) | 466.60 | 566.95 |

| Emissions (KtCO2) | 1000.61 | 1015.68 |

| Allowance costs (M€) | 15.88 | 16.05 |

| Present cost (M€) | 115.14 | 95.23 |

8.2. Expansion in the Base Case

| Coal generation (GWh) | 493.27 | 471.69 |

| Gas generation (GWh) | 1199.63 | 1299.32 |

| Load (GWh) | 1786.04 | 1786.04 |

| Unserved load (GWh) | 121.69 | 49.71 |

| Transmission (GWh) | 464.59 | 564.28 |

| Emissions (KtCO2) | 1000.46 | 1012.57 |

| Allowance costs (M€) | 15.84 | 15.95 |

| Present cost (M€) | 116.06 | 96.51 |

8.3. Expansion under Higher Demand Volatility

| Coal generation (GWh) | 491.63 | 467.31 |

| Gas generation (GWh) | 1193.46 | 1291.60 |

| Load (GWh) | 1786.49 | 1786.49 |

| Unserved load (GWh) | 129.57 | 61.78 |

| Transmission (GWh) | 458.56 | 556.70 |

| Emissions (KtCO2) | 996.34 | 1004.77 |

| Allowance costs (M€) | 15.74 | 15.75 |

| Present cost (M€) | 118.45 | 99.61 |

8.4. Expansion under Higher Demand Growth

| Coal generation (GWh) | 494.91 | 483.27 |

| Gas generation (GWh) | 1341.73 | 1452.84 |

| Load (GWh) | 2163.30 | 2163.30 |

| Unserved load (GWh) | 354.47 | 261.82 |

| Transmission (GWh) | 452.68 | 563.79 |

| Emissions (KtCO2) | 1054.50 | 1082.09 |

| Allowance costs (M€) | 16.75 | 17.19 |

| Present cost (M€) | 193.30 | 166.25 |

8.5. Expansion under Higher Allowance Price

| Coal generation (GWh) | 485.70 | 429.76 |

| Gas generation (GWh) | 1206.98 | 1343.30 |

| Load (GWh) | 1786.04 | 1786.04 |

| Unserved load (GWh) | 122.36 | 50.36 |

| Transmission (GWh) | 471.94 | 608.26 |

| Emissions (KtCO2) | 994.57 | 981.12 |

| Allowance costs (M€) | 31.32 | 30.82 |

| Present cost (M€) | 131.81 | 112.16 |

| L1 | L1 + L2 | |||

|---|---|---|---|---|

| Average | 90% Percentile | Average | 90% Percentile | |

| No load volatility | 2,376,500 | 2,441,589 | 894,570 | 958,389 |

| Base case | 2,433,759 | 3,561,563 | 994,179 | 1,747,684 |

| Double load volat. | 2,591,459 | 4,854,215 | 1,235,570 | 2,793,873 |

| Double load growth | 7,089,456 | 8,678,301 | 5,236,445 | 6,943,400 |

| Double CO2 price | 2,447,227 | 3,588,797 | 1,007,142 | 1,765,800 |

9. Concluding Remarks

Acknowledgements

Appendix A. Estimation of the Long-Term Fixed Margin

Appendix B. Load and Risk of Unserved Load

| 50 | 0.03 | 0.20 | 67.49 | 91.11 | 156.38 | 2.53 |

| 50 | 0.02 | 0.20 | 61.07 | 74.59 | 141.50 | 2.78 |

| 50 | 0.01 | 0.20 | 55.26 | 61.07 | 128.04 | 3.10 |

| 50 | 0.03 | 0.10 | 67.49 | 91.11 | 108.00 | 5.92 |

| 50 | 0.02 | 0.10 | 61.07 | 74.59 | 97.73 | 7.17 |

| 50 | 0.01 | 0.10 | 55.26 | 61.07 | 88.43 | 9.30 |

| 30 | 0.03 | 0.20 | 40.50 | 54.66 | 93.83 | 8.72 |

| 30 | 0.02 | 0.20 | 36.64 | 44.75 | 84.90 | 10.36 |

| 30 | 0.01 | 0.20 | 33.16 | 36.64 | 76.82 | 13.08 |

| 30 | 0.03 | 0.10 | 40.50 | 54.66 | 64.80 | 16.02 |

| 30 | 0.02 | 0.10 | 36.64 | 44.75 | 58.64 | 20.70 |

| 30 | 0.01 | 0.10 | 33.16 | 36.64 | 53.06 | 30.40 |

References and Notes

- Intergovernmental Panel on Climate Change (IPCC). Fourth Assessment Report. Climate Change 2007: Mitigation and Climate Change; IPCC: Geneva, Switzerland, 2007. [Google Scholar]

- Covarrubias, A.J. Expansion planning for electric power systems. IAEA Bull. 1979, 21, 55–64. [Google Scholar]

- Deb, R.K. Transmission investment valuations: Weighing project benefits. Electr. J. 2004, 17, 55–67. [Google Scholar] [CrossRef]

- Buygi, M.O.; Balzer, G.; Shanechi, H.M.; Shahidehpour, M. Market-based transmission expansion planning. IEEE Trans. Power Syst. 2004, 19, 2060–2067. [Google Scholar] [CrossRef]

- Dixit, A.K.; Pindyck, R.S. Investment under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Trigeorgis, L. Real Options: Managerial Flexibility and Strategy in Resource Allocation; The MIT Press: Cambridge, MA, USA, 1996. [Google Scholar]

- Bohn, R.E.; Caramanis, M.C.; Schweppe, F.C. Optimal pricing in electrical networks over space and time. Rand J. Econ. 1984, 15, 360–376. [Google Scholar] [CrossRef]

- Kurlinski, R.E. Valuing Transmission: Reliability, Congestion, and Uncertainty; USAEE WP 08-004; Carnegie Mellon University: Pittsburgh, PA, USA, 2008. [Google Scholar]

- Blanco, G.A.; Olsina, F.G.; Ojeda, O.A.; Garcés, F.F. Transmission Expansion Planning under Uncertainty. In Presented at the IEEE Bucharest Power Tech Conference, Bucharest, Romania, 28 June–2 July 2009.

- García, R.C.; Contreras, J.; Correia, P.F.; Muñoz, J.I. Transmission assets investment timing using net present value curves. Energy Policy 2010, 38, 598–605. [Google Scholar] [CrossRef]

- Stoft, S. Power System Economics; IEEE Press & Wiley-Interscience: Piscataway, NJ, USA, 2002. [Google Scholar]

- Schmalensee, R. The MIT Future of the Electric Grid Study. Available online: http://web.mit.edu/ceepr/www/about/Sept%202011/Schmalensee.pdf (accessed on 24 September 2011).

- Direct current DC is conceptually much simpler since it flows in only one direction.

- At present, each of the ten North American Reliability Council (NERC) regions must maintain enough excess generating capacity online or quickly available to continue supplying system load if a large generating unit or transmission line fails [48].

- Schweppe, F.S.; Caramanis, M.C.; Tabors, R.D.; Bohn, R.E. Spot Pricing of Electricity; Kluwer Academic Publishers: Dordrecht, The Netherlands, 1988. [Google Scholar]

- Electric Power Research Institute (EPRI). Scoping Study on Trends in the Economic Value of Electricity Reliability to the U.S. Economy. EPRI: Palo Alto, CA, USA, 2001. Available online: http://eetd.lbl.gov/ea/ems/reports/47911.pdf (accessed on 21 July 2011). [Google Scholar]

- The inverse of efficiency is the so-called heat rate, which is the ratio between heat input into the plant (Btu/hr) and electrical power output (kW).

- In practice, economic dispatch is recalculated every five to ten minutes. The economic dispatch problem is related to the unit commitment problem. The latter considers longer time scales; it specifies the daily on/off schedule of generators. The economic dispatch is a subproblem of unit commitment [15].

- Sauma, E.E.; Oren, S.S. Do generation firms in restructured electricity markets have incentives to support social-welfare-improving transmission investments? Energy Econ. 2009, 31, 676–689. [Google Scholar] [CrossRef]

- Leuthold, F.; Weigt, H.; von Hirschhausen, C. Efficient pricing for European electricity networks—The theory of nodal pricing applied to feeding-in wind in Germany. Util. Policy 2008, 16, 284–291. [Google Scholar] [CrossRef]

- See for example [24, Chapter 4].

- This looks like an unduly short period of time; the physical and economic life may well run from 30 to 50 years [49]. Boyle et al. [50] also consider a time horizon of 20 years, the same as in Ojeda et al. [51]. In the PJM interconnection, instead, the cost-effectiveness of an upgrade is estimated over a 10 year window. The Dutch electricity regulator does not take costs and benefits after 25 years into account [52]. The reasons are that the technical life of (underground) HVDC cables is uncertain and that economic models become ever less detailed and reliable.

- The model allows addressing this issue but our main concern here is the alleged shortfall of investments in transmission.

- Skantze, P.L.; Ilić, M.D. Valuation, Hedging, and Speculation in Competitive Electricity Markets: A Fundamental Approach; Kluwer Academic Publishers: Dordrecht, The Netherlands, 2001. [Google Scholar]

- More generally, the model accounts for the possibility that electricity flows in one direction at some times and the other way round at others.

- Blumsack, S.; Lave, L.B.; Ilić, M. A quantitative analysis of the relationship between gestion and reliability in electric power networks. Energy J. 2007, 28, 73–100. [Google Scholar] [CrossRef]

- Intergovernmental Panel on Climate Change (IPCC). Guidelines for National Greenhouse Gas Inventories; IPCC: Geneva, Switzerland, 2006. [Google Scholar]

- This corresponds to 15.311 kgC/GJ, since one ton of carbon is carried on 3.67 tons of CO2.

- Typically the efficiency of power generation is not constant. Instead, it drops off as load level is reduced [53]. This can be modeled by means of a quadratic equation of the form a + bx − cx2, where x goes from 0 to 100 per cent. The values of a, b, and c differ from one power technology to another.

- Abadie, L.M.; Chamorro, J.M.; González-Eguino, M. Optimal Abandonment of EU Coal-fired Stations. Energy J. 2011, 32, 175–207. [Google Scholar] [CrossRef]

- Bresesti et al. [54] assume 2,000 €/MWh while Blumsack et al. [26] opt for a VOLL equal to $1,000 $/MWh–interrupted; Kurlinski [8] adopts this same amount. Blanco et al. [9] instead consider a lower value, 700 $/MWh. A still lower VOLL$ of 500 €/MWh is assumed in [55]. At the other end of the spectrum, de Nooij [52] takes 8.6 €/kWh, Ojeda et al. [51] 10 €/kWh, while Leahy and Tol [56] estimate the VOLL at the Republic of Ireland of 18 €/kWh.

- See Reference [57].

- The interest rate corresponds to the rate of German government bonds in November 2009. On the other hand, we transform ARA coal prices from $/tonne to €/tonne using an exchange rate of 1.4934 $/€ (the rate on 27 November 2009, when the 15-year interest rates of the euro and the dollar were at similar levels). In a further step, we transform €/tonne into €/MWh considering 29.31 GJ/tonne and using the equivalence 1 GJ = 0.27777 MWh.

- de Neufville, R.; Scholtes, S. Flexibility in Engineering Design; The MIT Press: Cambridge, MA, USA, 2011; Engineering Systems Series. [Google Scholar]

- Jäckel, P. Monte Carlo Methods in Finance; Wiley Finance: Hoboken, NJ, USA, 2002. [Google Scholar]

- Rosellón, J.; Weigt, H. A dynamic incentive mechanism for transmission expansion in electricity networks: Theory, modeling, and application. Energy J. 2011, 32, 119–148. [Google Scholar] [CrossRef]

- Increasing network reliability by adding new AC transmission lines can in some instances increase congestion [26]. The magnitude of the relationship between congestion and reliability is ultimately an empirical question. First they consider a Bridgestone network; later on, they move to the IEEE 118-bus test network. They find that the relationship is a function of both the network topology and the level of demand. Therefore, the implicit distinction between “economic” investments (which relieve congestion) and “system” investments (which promote reliability) is not only meaningless, but in many cases wrong. This can certainly be an issue in networks more complex than ours.

- If, in addition to GHG emissions, other environmental damages are encompassed (SO2, NOx, ...) then the objective function could include a third term with an additional cost per tonne emitted.

- Regarding the costs of transmission lines, Blanco et al. [9] assume they have a fixed component (90,000 $/km) and a variable component (800 $/MW km); Rosellón and Weigt [36] choose a value of 100 €/km/MW; see also [51], Table 1.

- See Reference [58]. See also Shell: The Energy Security Challenge, 2010. Available online: http://www.shelldialogues.com/ec (accessed on 20 July 2011).

- Pérez-Arriaga, I.; Rubio, F.J.; Puerta, J.F. Marginal pricing of transmission services: An analysis of cost recovery. IEEE Trans. Power Syst. 1995, 10, 546–553. [Google Scholar] [CrossRef]

- See also Reference [59].

- Léautier, T.O. Transmission constraints and imperfect markets for power. J. Regul. Econ. 2001, 19, 27–54. [Google Scholar] [CrossRef]

- Rosellón, J. Different approaches towards electricity transmission expansion. Rev. Netw. Econ. 2003, 2, 238–269. [Google Scholar] [CrossRef]

- Valuation of transmission investments must consider the fundamental dynamics and integration of transmission networks with electricity markets.

- Hogan, W. Transmission Congestion: The Nodal-Zonal Debate Revisited; Harvard University, John F. Kennedy School of Government, Center for Bussiness and Government: Cambridge, MA, USA, 1999. [Google Scholar]

- Editorial: An end to gridlock? Nature 2010, 468, 599. [CrossRef]

- Baer, W.S.; Fulton, B.; Mahnovski, S. Estimating the Benefits of the GridWise Initiative. Phase I Report; RAND Science and Technology: Santa Monica, CA, USA, 2004. [Google Scholar]

- Consortium of Electric Reliability Technology Solutions. Economic Evaluation of Transmission Interconnection in a Restructured Market; Consultant Report 700-04-007 for the California Energy Commission: Sacramento, CA, USA, 2004. [Google Scholar]

- Boyle, G.; Guthrie, G.; Meade, R. Real Options and Transmission Investment: The New Zealand Grid Investment Test; New Zealand Institute for the Study of Competition and Regulation (ISCR): Wellington, New Zealand, 2006. [Google Scholar]

- Ojeda, O.A.; Olsina, F.; Garcés, F. Simulation of the long-term dynamic of a market-based transmission interconnection. Energy Policy 2009, 37, 2889–2899. [Google Scholar] [CrossRef]

- de Nooij, M. Social cost-benefit analysis of electricity interconnector investment: A critical appraisal. Energy Policy 2011, 39, 3096–3105. [Google Scholar] [CrossRef]

- Connors, S.; Martin, K.; Adams, M.; Kern, E. Future Electricity Supplies: Redifining Efficiency from a Systems Perspective; MIT Laboratory for Energy and the Environment: Cambridge, MA, USA, 2004; LFEE-WP-04-005. [Google Scholar]

- Bresesti, P.; Calisti, R.; Cazzol, M.V.; Gatti, A.; Provenzano, D.; Vaiani, A.; Vailati, R. The benefits of transmission in the competitive electricity markets. Energy 2009, 34, 274–280. [Google Scholar] [CrossRef]

- Blanco, G.A.; Olsina, F.G.; Garcés, F.; Rehtanz, C. Real option valuation of FACTS investments based on the Least Square Monte Carlo method. IEEE Trans. Power Syst. 2011, 26, 1389–1398. [Google Scholar] [CrossRef]

- Leahy, E.; Tol, R.S.J. An estimate of the value of lost load for Ireland. Energy Policy 2011, 39, 1514–1520. [Google Scholar] [CrossRef]

- Çetin, U.; Verschuere, M. Pricing and hedging in carbon emission markets. Int. J. Theor. Appl. Financ. 2009, 12, 949–967. [Google Scholar] [CrossRef]

- Arnold, S.; Markandya, A.; Hunt, A. Estimating Historical Energy Security Costs; Centre for European Policy Studies: Brussels, Belgium, 2009. [Google Scholar]

- Rubio-Odériz, J.; Pérez-Arriaga, I. Marginal pricing of transmission services: A comparative analysis of network cost allocation methods. IEEE Trans. Power Syst. 2000, 15, 448–454. [Google Scholar] [CrossRef]

© 2011 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Abadie, L.M.; Chamorro, J.M. Valuing Expansions of the Electricity Transmission Network under Uncertainty: The Binodal Case. Energies 2011, 4, 1696-1727. https://doi.org/10.3390/en4101696

Abadie LM, Chamorro JM. Valuing Expansions of the Electricity Transmission Network under Uncertainty: The Binodal Case. Energies. 2011; 4(10):1696-1727. https://doi.org/10.3390/en4101696

Chicago/Turabian StyleAbadie, Luis M., and José M. Chamorro. 2011. "Valuing Expansions of the Electricity Transmission Network under Uncertainty: The Binodal Case" Energies 4, no. 10: 1696-1727. https://doi.org/10.3390/en4101696