Increasing the Benefit from Cost-Minimizing Loads via Centralized Adjustments

Abstract

:1. Introduction

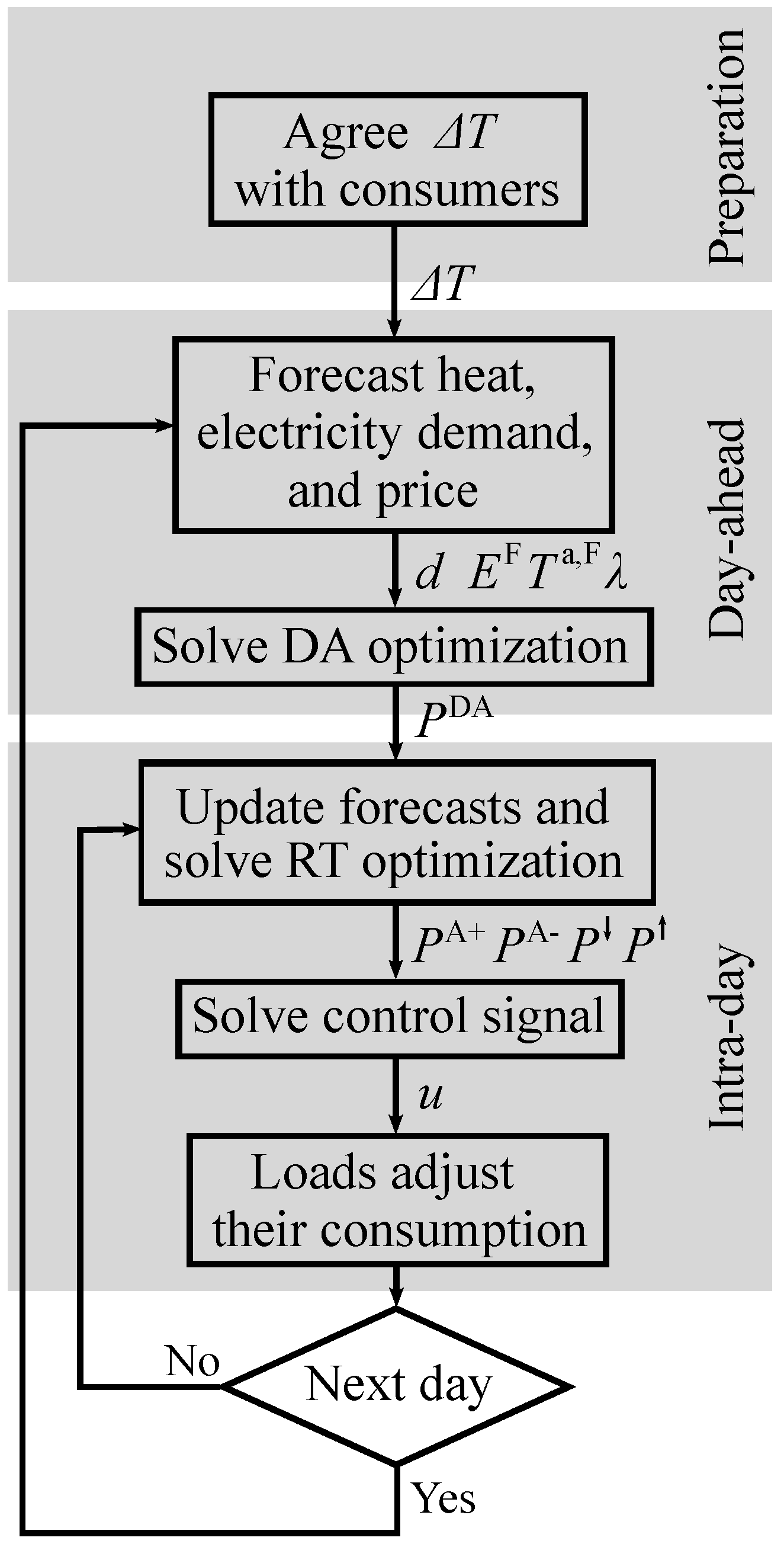

2. General Framework

2.1. Market Environment

2.2. Aggregator and Consumers

2.3. Control Strategy

3. Problem Formulation

3.1. Local Optimization

3.2. Aggregators’ Decision-Making

4. Simulations

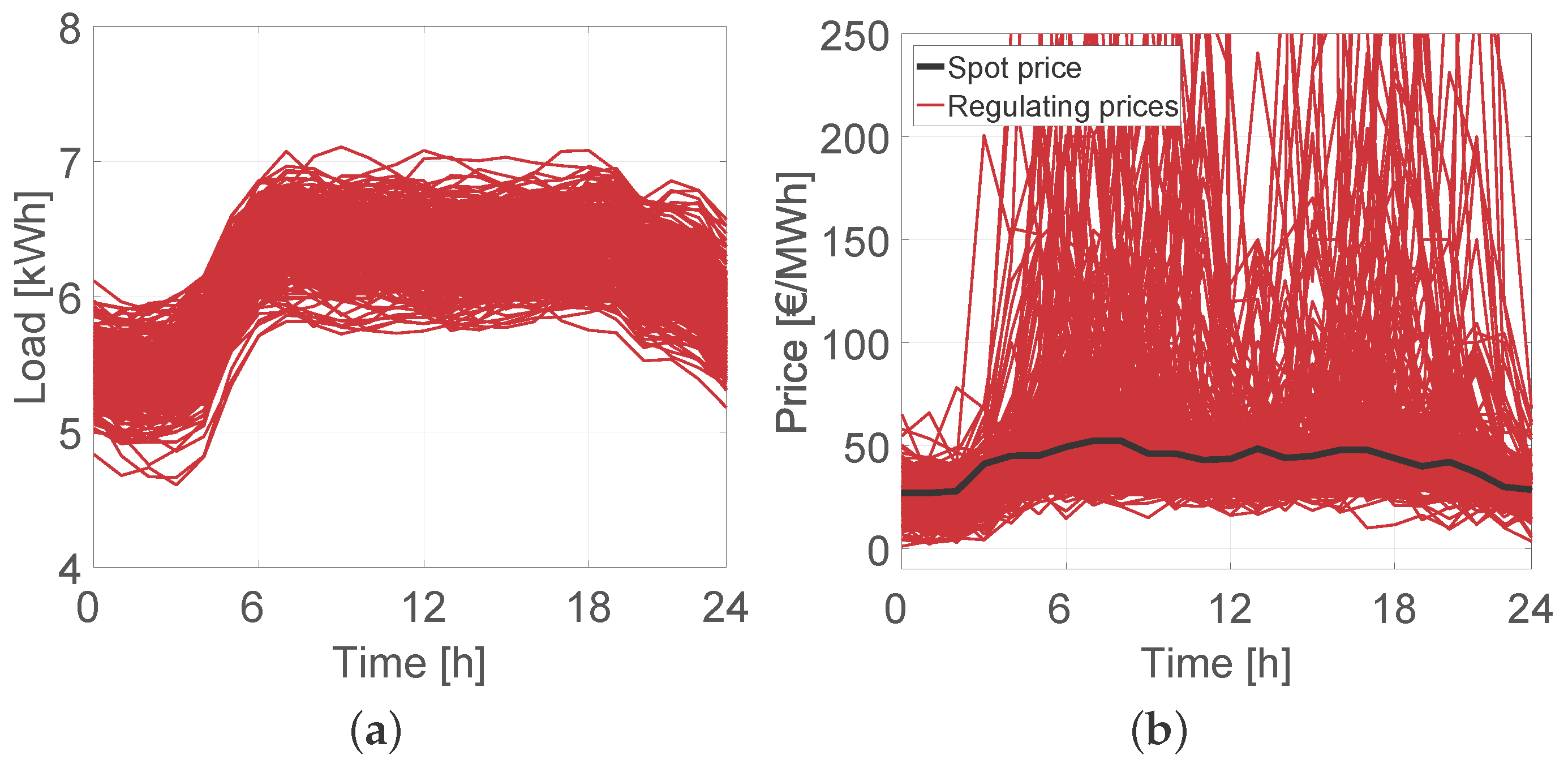

4.1. Simulation Setup

- Base: Loads optimize locally but they cannot be centrally controlled. However, the aggregator is able to bid in the DA market but without the heating load flexibility.

- Base+RT: RT optimization and control are possible but the flexibility is not considered in the DA optimization.

- DA+RT: The DA optimization is solved with the heating load flexibility and the operation is updated by solving the RT optimization. The aggregator is also able to control the loads.

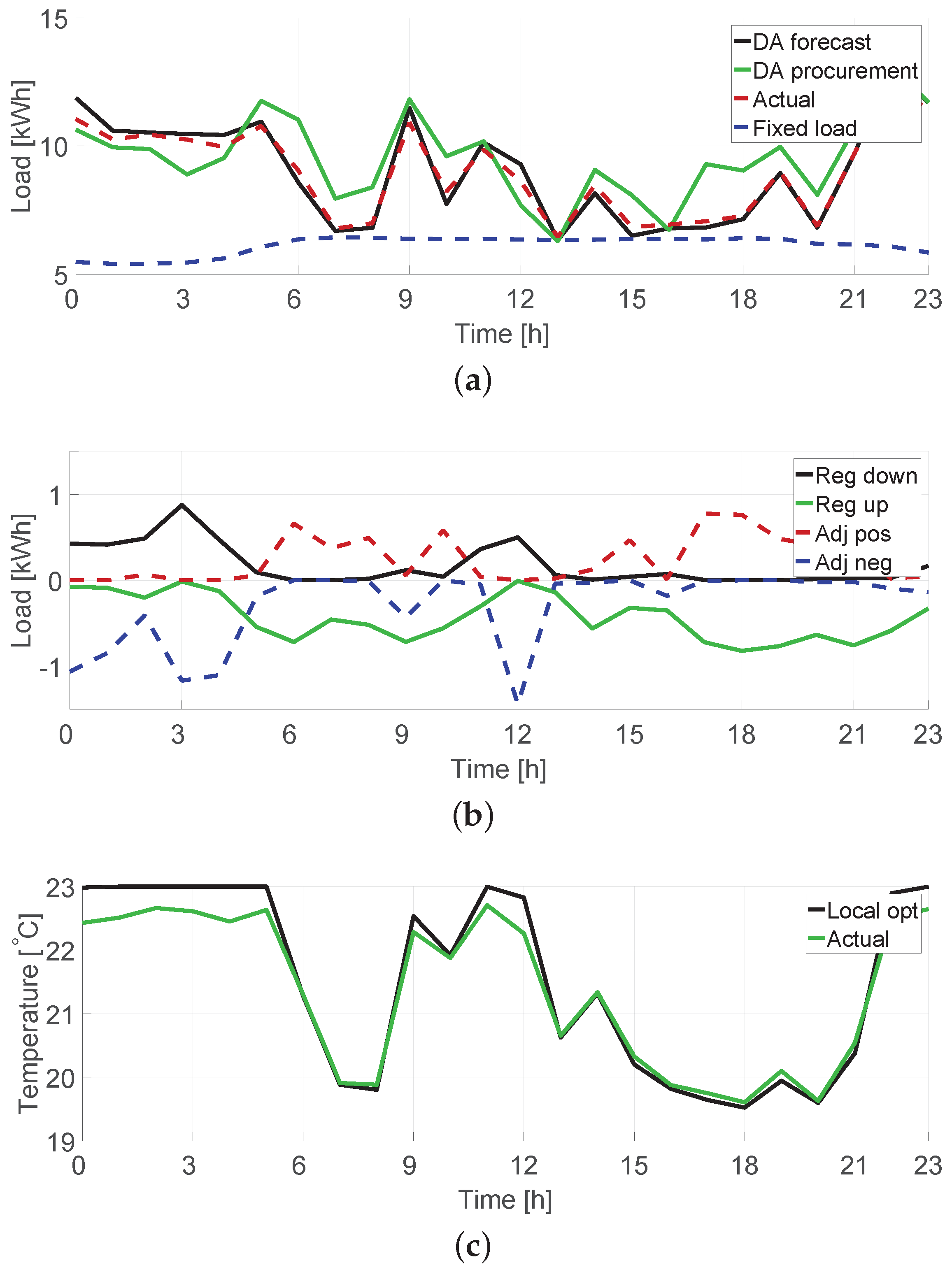

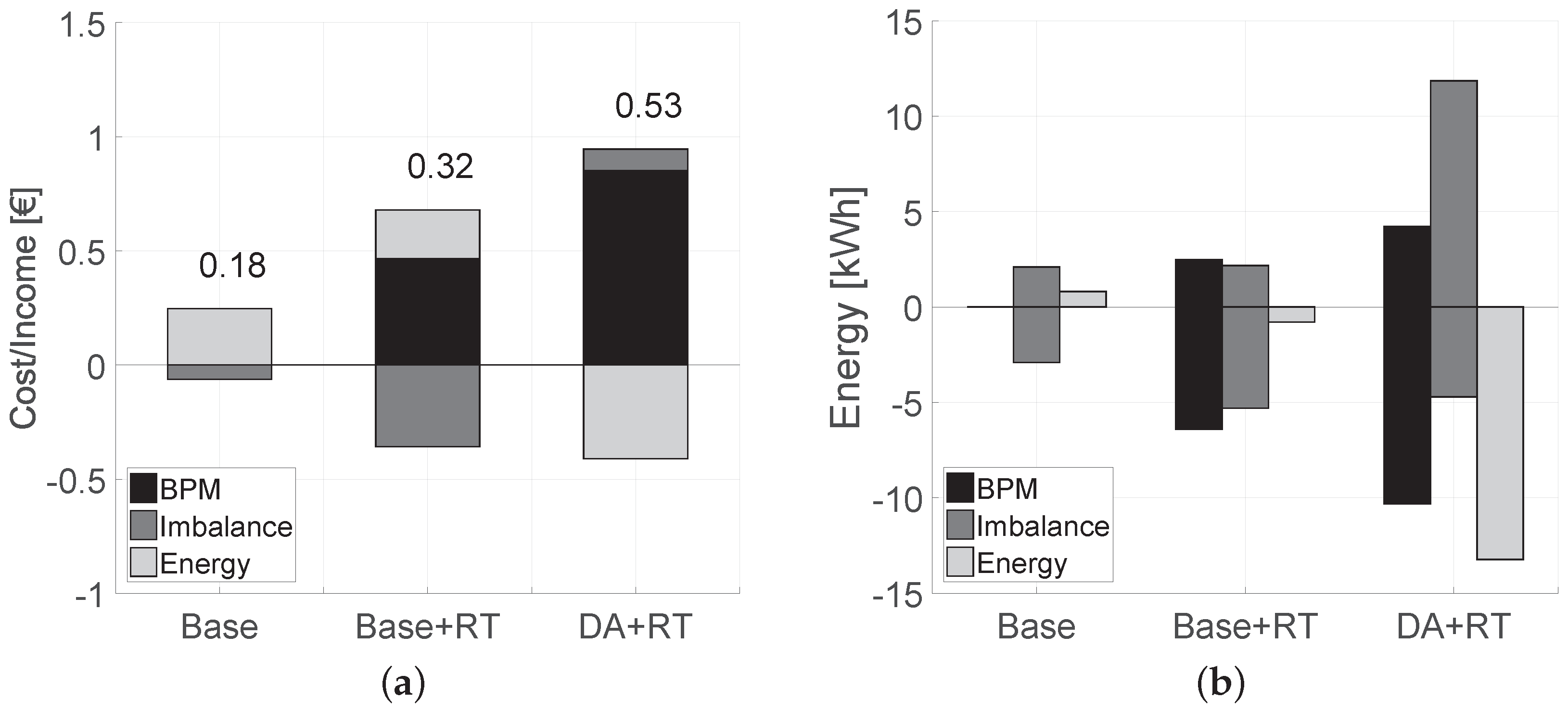

4.2. Results

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

Indices and sets

| i | Index of heating load model |

| k | Time step index |

| l | Index of averaging block |

| s | Scenario index |

| θ | Set of building model parameters |

Parameters and Constants

| A1–A4 | Building model parameters |

| B1–B3 | Building model parameters |

| β+, β− | Weighting factors of imbalance power trade |

| ΔT | Allowed temperature band for control |

| ΔTL | Allowed temperature deviation from set-point |

| d | Fixed electricity consumption |

Maximum heating power | |

| EF | Heating load forecast |

| H↑, H↓ | Indicates direction of regulation |

| K | Length of optimization period |

| Kb | Length of averaging period |

| λ | DA market price, spot price |

| λ↑, λ↓ | Up/downregulating prices |

| λS+, λS− | Prices of positive/negative imbalance power |

| m | Margin in consumer tariff |

| ρ | Probability of a scenario |

| S | Number of scenarios |

| Ta,F | Forecast of indoor temperature evolution set-point |

| Tset | Indoor temperature |

Variables (non-negative)

| ΔE+ | Increase in heating power |

| E | Heating power |

| EA | Heating power after adjustments |

| ER | Real-time heating power |

| PDA | Day-ahead procurement |

| P↑, P↓ | Up/downregulating power, regulating power bids |

| PA+, PA− | Positive/negative heating load adjustment |

| PR: | Real-time electricity consumption |

| PS+, PS− | Positive/negative imbalance power |

| Ta, Tm | Indoor and building mass temperatures |

| u | Generic control signal |

References

- Siano, P. Demand response and smart grids—A survey. Renew. Sustain. Energy Rev. 2014, 30, 461–478. [Google Scholar] [CrossRef]

- Beaudin, M.; Zareipour, H. Home energy management systems: A review of modelling and complexity. Renew. Sustain. Energy Rev. 2015, 45, 318–335. [Google Scholar] [CrossRef]

- Yang, S.; Zeng, D.; Ding, H.; Yao, J.; Wang, K.; Li, Y. Multi-objective demand response model considering the probabilistic characteristic of price elastic load. Energies 2016, 9, 80. [Google Scholar] [CrossRef]

- Weckx, S.; D’Hulst, R.; Driesen, J. Primary and secondary frequency support by a multi-agent demand control system. IEEE Trans. Power Syst. 2015, 30, 1394–1404. [Google Scholar] [CrossRef]

- Alahäivälä, A.; Ali, M.; Lehtonen, M.; Jokisalo, J. An intra-hour control strategy for aggregated electric storage space heating load. Int. J. Electr. Power Enery Syst. 2015, 73, 7–15. [Google Scholar] [CrossRef]

- Sarker, M.R.; Ortega-Vazquez, M.A.; Kirschen, D.S. Optimal coordination and scheduling of demand response via monetary incentives. IEEE Trans. Smart Grid 2015, 6, 1341–1352. [Google Scholar] [CrossRef]

- Fan, W.; Liu, N.; Zhang, J.; Lei, J. Online air-conditioning energy management under coalitional game framework in smart community. Energies 2016, 9, 689. [Google Scholar] [CrossRef]

- Corradi, O.; Ochsenfeld, H.; Madsen, H.; Pinson, P. Controlling electricity consumption by forecasting its response to varying prices. IEEE Trans. Power Syst. 2013, 28, 421–429. [Google Scholar] [CrossRef]

- Zugno, M.; Morales, J.M.; Pinson, P.; Madsen, H. A bilevel model for electricity retailers’ participation in a demand response market environment. Energy Econ. 2013, 36, 182–197. [Google Scholar] [CrossRef]

- Nord Pool. Nord Pool Spot. Available online: www.nordpoolspot.com (accessed on 7 April 2016).

- Finnish Energy. Consumption and Network Losses of Electricity. Available online: energia.fi/en/statistics-and-publications/electricity-statistics/electricity-consumption/consumption-and-network-l (accessed on 1 November 2016).

- Fingrid Oyj. Balancing Power Market. Available online: www.fingrid.fi/en/electricity-market/reserves/acquiring/market/Pages/default.aspx (accessed on 1 November 2016).

- Fingrid Oyj. Electricity Market and Balance Service. Available online: www.fingrid.fi/en (accessed on 7 April 2016).

- Ali, M.; Safdarian, A.; Lehtonen, M. Demand response potential of residential HVAC loads considering users preferences. In Proceedings of the IEEE PES Innovative Smart Grid Technologies Europe, Istanbul, Turkey, 12–15 October 2014.

- Alahäivälä, A.; Ekström, J.; Jokisalo, J.; Lehtonen, M. A framework for the assessment of electric heating load flexibility contribution to mitigate severe wind power ramp effects. Electr. Pow. Syst. Res. 2017, 142, 268–278. [Google Scholar] [CrossRef]

- Conejo, A.J.; Carrión, M.; Morales, J.M. Decision Making Under Uncertainty in Electricity Markets; Springer: New York, NY, USA, 2010. [Google Scholar]

- Ministry of the Environment. Decree for the Energy Certificate (176/2013). Available online: www.finlex.fi/data/sdliite/liite/6186.pdf (accessed on 7 April 2016). (In Finnish)

- Ministry of the Environment. C3: Finnish Code of Building Regulations (Thermal Insulation in a Building); Ministry of the Environment: Helsinki, Finland, 2010. (In Finnish)

- Alimohammadisagvand, B.; Alam, S.; Ali, M.; Degefa, M.; Jokisalo, J.; Sirén, K. Influence of energy demand response actions on thermal comfort and energy cost in electrically heated residential houses. Indoor Built Environ. 2015. [Google Scholar] [CrossRef]

- Official Statistics of Finland (OSF). Electrically Heated Detached Houses by the Year of Construction and Construction Material in Finland; Official Statistics of Finland: Helsinki, Finland, 2013. [Google Scholar]

- Koivisto, M.; Degefa, M.; Ali, M.; Ekström, J.; Millar, J.; Lehtonen, M. Statistical modeling of aggregated electricity consumption and distributed wind generation in distribution systems using AMR data. Electr. Power Syst. Res. 2015, 129, 217–226. [Google Scholar] [CrossRef]

- Koivisto, M.; Seppänen, J.; Mellin, I.; Ekström, J.; Millar, J.; Mammarella, I.; Komppula, M.; Lehtonen, M. Wind speed modeling using a vector autoregressive process with a time-dependent intercept term. Int. J. Electr. Power Enery Syst. 2016, 77, 91–99. [Google Scholar] [CrossRef]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alahäivälä, A.; Lehtonen, M. Increasing the Benefit from Cost-Minimizing Loads via Centralized Adjustments. Energies 2016, 9, 983. https://doi.org/10.3390/en9120983

Alahäivälä A, Lehtonen M. Increasing the Benefit from Cost-Minimizing Loads via Centralized Adjustments. Energies. 2016; 9(12):983. https://doi.org/10.3390/en9120983

Chicago/Turabian StyleAlahäivälä, Antti, and Matti Lehtonen. 2016. "Increasing the Benefit from Cost-Minimizing Loads via Centralized Adjustments" Energies 9, no. 12: 983. https://doi.org/10.3390/en9120983

APA StyleAlahäivälä, A., & Lehtonen, M. (2016). Increasing the Benefit from Cost-Minimizing Loads via Centralized Adjustments. Energies, 9(12), 983. https://doi.org/10.3390/en9120983