Value of a Flexible Forest Harvest Decision with Short Period Forest Carbon Offsets: Application of a Binomial Option Model

Abstract

:1. Introduction

2. Materials and Methods

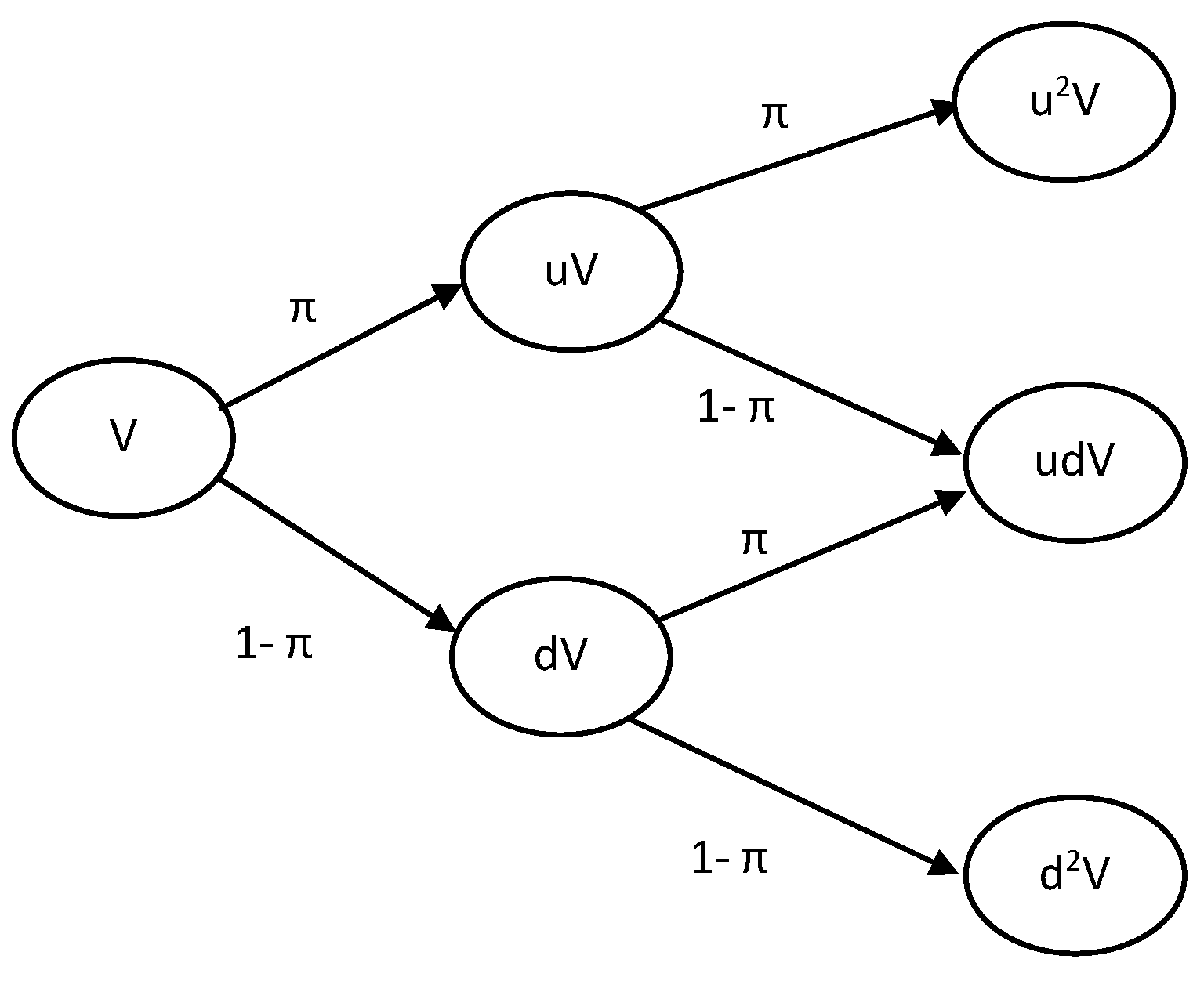

2.1. Binomial Option Model

2.2. Model Application

2.3. Forest Management Scenarios and Economic Data

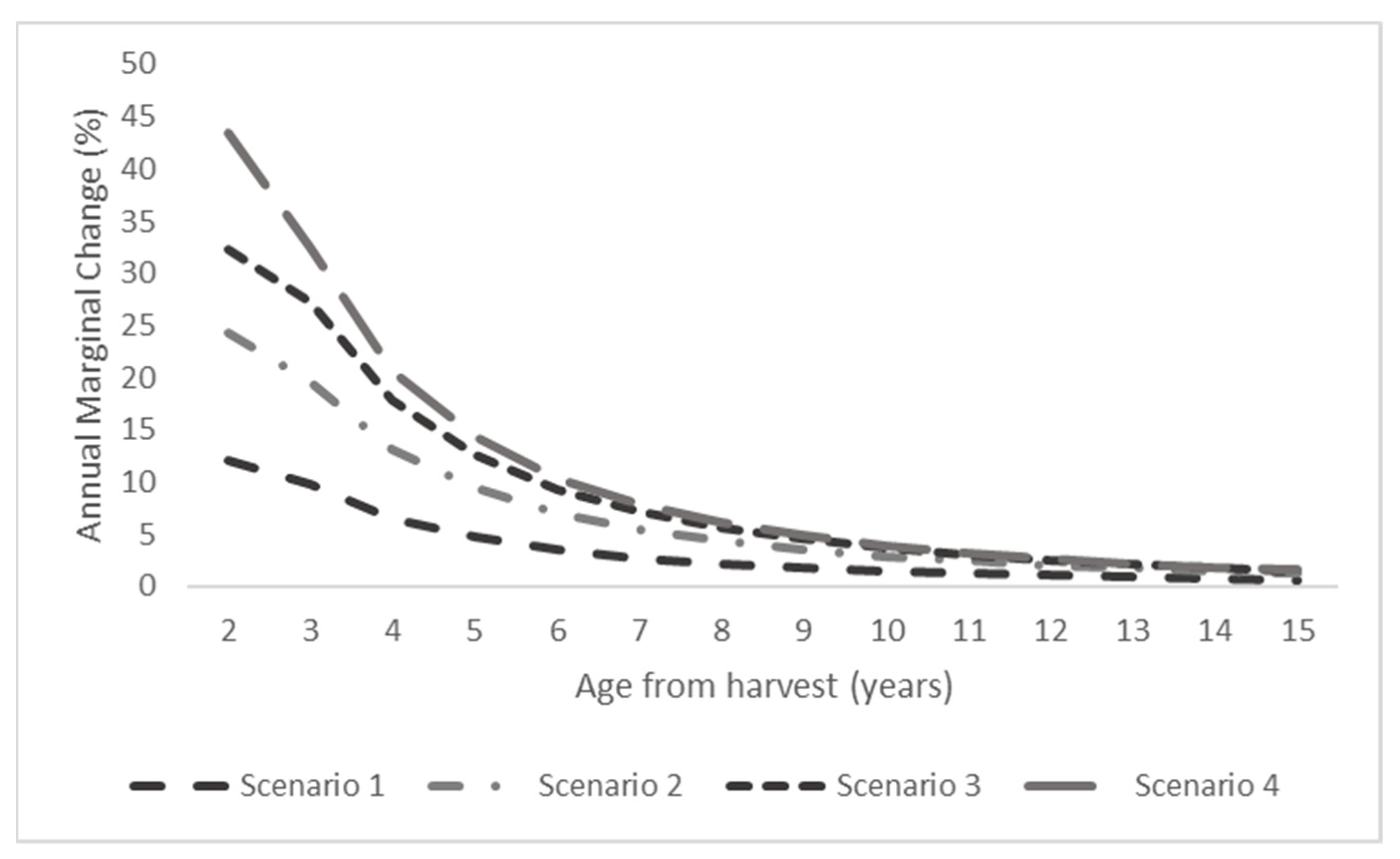

2.4. Key Parameter Estimates

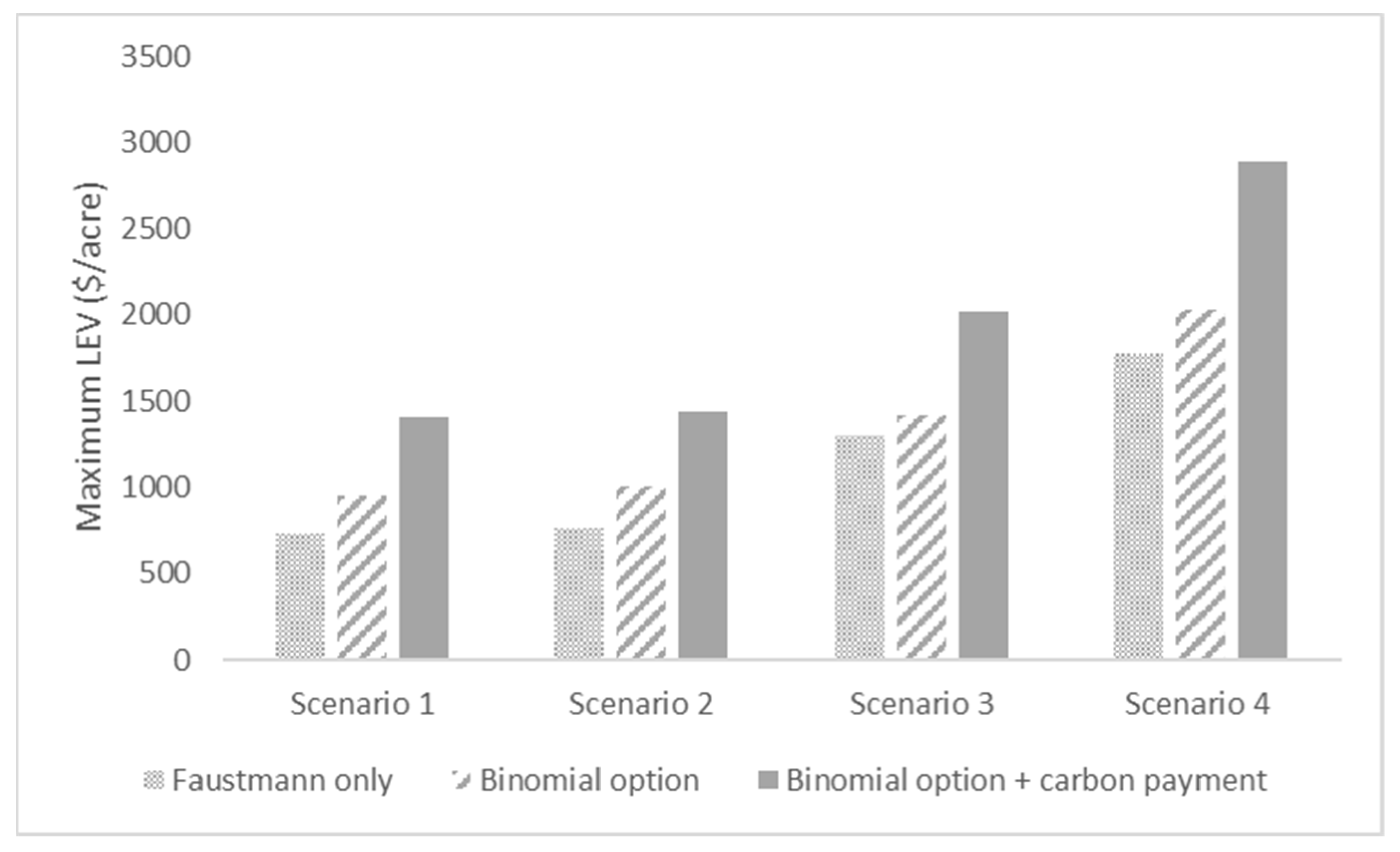

3. Results

4. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Yoshimoto, A.; Shoji, I. Searching for an optimal rotation age for forest stand management under stochastic log prices. Eur. J. Oper. Res. 1998, 105, 100–112. [Google Scholar] [CrossRef]

- Dixit, A.K.; Pindyck, R.S. The options approach to capital investment. In Real Options and Investment under Uncertainty-Classical Readings and Recent Contributions; MIT Press: Cambridge, UK, 1995; p. 6. [Google Scholar]

- Thomson, T.A. Optimal forest rotation when stumpage prices follow a diffusion process. Land Econ. 1992, 68, 329–342. [Google Scholar] [CrossRef]

- Gong, P.; Löfgren, K.-G. Market and welfare implications of adaptive harvest strategy. J. For. Econ. 2007, 13, 217–243. [Google Scholar]

- Susaeta, A.; Alavalapati, J.R.; Carter, D.R. Modeling impacts of bioenergy markets on nonindustrial private forest management in the southeastern United States. Nat. Resour. Model. 2009, 22, 345–369. [Google Scholar] [CrossRef]

- Manley, B.; Niquidet, K. What is the relevance of option pricing for forest valuation in New Zealand? For. Policy Econ. 2010, 12, 299–307. [Google Scholar] [CrossRef]

- Hildebrandt, P.; Knoke, T. Investment decisions under uncertainty—A methodological review on forest science studies. For. Policy Econ. 2011, 13, 1–15. [Google Scholar] [CrossRef]

- Plantinga, A.J. The optimal timber rotation: An option value approach. For. Sci. 1998, 44, 192–202. [Google Scholar]

- Gong, P.; Löfgren, K.-G. Modeling forest harvest decisions: Advances and challenges. Int. Rev. Environ. Resour. Econ. 2009, 3, 195–216. [Google Scholar] [CrossRef]

- Ekholm, T. Optimal forest rotation under carbon pricing and forest damage risk. For. Policy Econ. 2020, 115, 102131. [Google Scholar] [CrossRef] [Green Version]

- Duku-Kaakyire, A.; Nanang, D.M. Application of real options theory to forestry investment analysis. For. Policy Econ. 2004, 6, 539–552. [Google Scholar] [CrossRef]

- Luehrman, T.A. Investment Opportunities as Real Options: Getting Started on the Numbers. Harv. Bus. Rev. 1998, 76, 51–67. [Google Scholar]

- Clarke, H.R.; Reed, W.J. The tree-cutting problem in a stochastic environment: The case of age-dependent growth. J. Econ. Dyn. Control. 1989, 13, 569–595. [Google Scholar] [CrossRef]

- Morck, R.; Schwartz, E.; Stangeland, D. The valuation of forestry resources under stochastic prices and inventories. J. Financ. Quant. Anal. 1989, 24, 473–487. [Google Scholar] [CrossRef]

- Cox, J.C.; Ross, S.A.; Rubinstein, M. Option pricing: A simplified approach. J. Financ. Econ. 1979, 7, 229–263. [Google Scholar] [CrossRef]

- Haight, R.G.; Holmes, T.P. Stochastic price models and optimal tree cutting: Results for loblolly pine. Nat. Resour. Model. 1991, 5, 423–443. [Google Scholar] [CrossRef]

- Yin, R.; Newman, D.H. The effect of catastrophic risk on forest investment decisions. J. Environ. Econ. Manag. 1996, 31, 186–197. [Google Scholar] [CrossRef]

- Gjolberg, O.; Guttormsen, A.G. Real options in the forest: What if prices are mean-reverting? For. Policy Econ. 2002, 4, 13–20. [Google Scholar] [CrossRef]

- Insley, M. A real options approach to the valuation of a forestry investment. J. Environ. Econ. Manag. 2002, 44, 471–492. [Google Scholar] [CrossRef]

- Malchow-Møller, N.; Strange, N.; Thorsen, B.J. Real-options aspects of adjacency constraints. For. Policy Econ. 2004, 6, 261–270. [Google Scholar] [CrossRef]

- Saphores, J.-D. Harvesting a renewable resource under uncertainty. J. Econ. Dyn. Control. 2003, 28, 509–529. [Google Scholar] [CrossRef] [Green Version]

- Jacobsen, J.B.; Thorsen, B.J. A Danish example of optimal thinning strategies in mixed-species forest under changing growth conditions caused by climate change. For. Ecol. Manag. 2003, 180, 375–388. [Google Scholar] [CrossRef]

- Rocha, K.; Moreira, A.R.; Reis, E.J.; Carvalho, L. The market value of forest concessions in the Brazilian Amazon: A real option approach. For. Policy Econ. 2006, 8, 149–160. [Google Scholar] [CrossRef]

- Mei, B.; Clutter, M.L. Evaluating timberland investment opportunities in the United States: A real options analysis. For. Sci. 2015, 61, 328–335. [Google Scholar] [CrossRef]

- Kerchner, C.D.; Keeton, W.S. California’s regulatory forest carbon market: Viability for northeast landowners. For. Policy Econ. 2015, 50, 70–81. [Google Scholar] [CrossRef]

- Foley, T.G.; Richter, D.d.; Galik, C.S. Extending rotation age for carbon sequestration: A cross-protocol comparison of North American forest offsets. For. Ecol. Manag. 2009, 259, 201–209. [Google Scholar] [CrossRef]

- Englin, J.; Callaway, J.M. Global climate change and optimal forest management. Nat. Resour. Model. 1993, 7, 191–202. [Google Scholar] [CrossRef]

- Van Kooten, G.C.; Binkley, C.S.; Delcourt, G. Effect of carbon taxes and subsidies on optimal forest rotation age and supply of carbon services. Am. J. Agric. Econ. 1995, 77, 365–374. [Google Scholar] [CrossRef] [Green Version]

- Stainback, G.A.; Alavalapati, J.R. Restoring longleaf pine through silvopasture practices: An economic analysis. For. Policy Econ. 2004, 6, 371–378. [Google Scholar] [CrossRef]

- Sohngen, B.; Mendelsohn, R. An optimal control model of forest carbon sequestration. Am. J. Agric. Econ. 2003, 85, 448–457. [Google Scholar] [CrossRef]

- Olschewski, R.; Benítez, P.C. Optimizing joint production of timber and carbon sequestration of afforestation projects. J. For. Econ. 2010, 16, 1–10. [Google Scholar] [CrossRef]

- Nepal, P.; Grala, R.K.; Grebner, D.L. Financial feasibility of increasing carbon sequestration in harvested wood products in Mississippi. For. Policy Econ. 2012, 14, 99–106. [Google Scholar] [CrossRef]

- Chladná, Z. Determination of optimal rotation period under stochastic wood and carbon prices. For. Policy Econ. 2007, 9, 1031–1045. [Google Scholar] [CrossRef]

- Guthrie, G.; Kumareswaran, D. Carbon subsidies, taxes and optimal forest management. Environ. Resour. Econ. 2009, 43, 275–293. [Google Scholar] [CrossRef]

- Tee, J.; Scarpa, R.; Marsh, D.; Guthrie, G. Forest valuation under the New Zealand emissions trading scheme: A real options binomial tree with stochastic carbon and timber prices. Land Econ. 2014, 90, 44–60. [Google Scholar] [CrossRef]

- An, H. Forest Carbon Sequestration And Optimal Harvesting Decision Considering Southern Pine Beetle (Spb) Disturbance: A Real Option Approach. J. Rural. Dev./Nongchon-Gyeongje 2017, 40, 1–33. [Google Scholar]

- Yoo, S.; Cho, Y.-s.; Park, H. An optimal management strategy of carbon forestry with a stochastic price. Sustainability 2018, 10, 3290. [Google Scholar] [CrossRef] [Green Version]

- Wear, D.N.; Greis, J.G. The Southern Forest Futures Project: Technical Report; Gen. Tech. Rep. SRS-GTR-178; USDA-Forest Service, Southern Research Station: Asheville, NC, USA, 2013; Volume 178, 542p. [Google Scholar]

- Oswalt, S.N.; Smith, W.B.; Miles, P.D.; Pugh, S.A. Forest Resources of the United States, 2017: A Technical Document Supporting the Forest Service 2020 RPA Assessment; Gen. Tech. Rep. WO-97; US Department of Agriculture, Forest Service, Washington Office: Washington, DC, USA, 2019; pp. 1–223. [Google Scholar]

- Newell, R.G.; Stavins, R.N. Climate change and forest sinks: Factors affecting the costs of carbon sequestration. J. Environ. Econ. Manag. 2000, 40, 211–235. [Google Scholar] [CrossRef] [Green Version]

- Lubowski, R.N.; Plantinga, A.J.; Stavins, R.N. What drives land-use change in the United States? A national analysis of landowner decisions. Land Econ. 2008, 84, 529–550. [Google Scholar] [CrossRef]

- Ahn, S.; Plantinga, A.J.; Alig, R.J. Determinants and projections of land use in the South Central United States. South. J. Appl. For. 2002, 26, 78–84. [Google Scholar] [CrossRef] [Green Version]

- Rossi, D.; Baker, J.S.; Abt, R.C. Quantifying Additionality Thresholds for Forest Carbon Offsets in Southern Pine Pulpwood Markets. In Proceedings of the 2022 Agricultural & Applied Economics Association Annual Meeting, Anaheim, CA, USA, 31 July–2 August 2022. [Google Scholar]

- Faustmann, M. Calculation of the Value which Forest Land and Immature Stands Possess for Forestry. J. For. Econ. 1995, 1, 89–114. [Google Scholar]

- Rendleman, R.J. Two-state option pricing. J. Financ. 1979, 34, 1093–1110. [Google Scholar] [CrossRef]

- Dwivedi, P.; Alavalapati, J.R.; Susaeta, A.; Stainback, A. Impact of carbon value on the profitability of slash pine plantations in the southern United States: An integrated life cycle and Faustmann analysis. Can. J. For. Res. 2009, 39, 990–1000. [Google Scholar] [CrossRef]

- Hartman, R. The harvesting decision when a standing forest has value. Econ. Inq. 1976, 14, 52–58. [Google Scholar] [CrossRef]

- Gonzalez-Benecke, C.A.; Martin, T.A.; Cropper, W.P., Jr.; Bracho, R. Forest management effects on in situ and ex situ slash pine forest carbon balance. For. Ecol. Manag. 2010, 260, 795–805. [Google Scholar] [CrossRef]

- Timber Mart-South Market News Quarterly; 4th Quarter; TimberMart-South: Athens, GA, USA, 2017.

- Schwartz, E.S. The stochastic behavior of commodity prices: Implications for valuation and hedging. J. Financ. 1997, 52, 923–973. [Google Scholar] [CrossRef]

- Holmgaard, A.B. Pricing of Contingent Interest Rate Claims, Foundations and Application of the Hull-White Extended Vasicek Term Structure Model. Master’s Thesis, Copenhagen Business School, Copenhagen, Denmark, 2013. [Google Scholar]

- Koirala, U.; Athearn, K.; Adams, D.C. The Effects of Non-Timber Ecosystem Services on Economically Optimal Forest Management. In Proceedings of the Society of American Foresters National Meeting, Portland, OR, USA, 3–7 October 2018. [Google Scholar]

- Susaeta, A.; Soto, J.R.; Adams, D.C.; Allen, D.L. Economic sustainability of payments for water yield in slash pine plantations in Florida. Water 2016, 8, 382. [Google Scholar] [CrossRef]

- Moeller, J.C.; Susaeta, A.; Deegen, P.; Sharma, A. Optimal Forest Management of Pure and Mixed Forest Plantations in the Southeastern United States. Res. Sq. 2022; preprint. [Google Scholar] [CrossRef]

- Khanal, P.N.; Grebner, D.L.; Munn, I.A.; Grado, S.C.; Grala, R.K.; Henderson, J.E. Evaluating non-industrial private forest landowner willingness to manage for forest carbon sequestration in the southern United States. For. Policy Econ. 2017, 75, 112–119. [Google Scholar] [CrossRef] [Green Version]

- Susaeta, A.; Carter, D.R.; Chang, S.J.; Adams, D.C. A generalized Reed model with application to wildfire risk in even-aged Southern United States pine plantations. For. Policy Econ. 2016, 67, 60–69. [Google Scholar] [CrossRef]

| Scenarios | TPA | Management Practices |

|---|---|---|

| Scenario 1 | 400 | No thinning; initial weed control; prescribed fire every 5 years starting age 10 |

| Scenario 2 | 600 | No thinning; initial weed control; prescribed fire every 5 years starting age 10 |

| Scenario 3 | 700 | Artificial regeneration; thinning at age 12, 20; fertilization at age 3, 13, 21; initial weed control only |

| Scenario 4 | 900 | Artificial regeneration; thinning at age 10, 15, 20; fertilization at age 3, 11, 16, 21; initial weed control only |

| Costs/Revenues | Amount | Sources |

|---|---|---|

| Costs | ||

| Site preparation | $158/acre | [52] |

| Planting | $0.1/seedling | |

| Initial weed control | $55/acre | |

| Fertilization at age 3 (Urea only) | $37/acre | |

| Other fertilization (Urea + DAP) | $83/acre | |

| Cruising and marking | $21/acre | |

| Prescribed burning | $30/acre | |

| Annual management costs | $5/acre/year | |

| Annual taxes | $4/acre/year | |

| Aggregator’s fee | 10% of annual total carbon revenue | [32] |

| Verification fee | $0.25/tCO2e/year | |

| Transaction fee | $0.20/tCO2e/year | |

| Revenues | ||

| Sawtimber stumpage price | $31/m3 | [49] |

| Chip-n-saw stumpage price | $24/m3 | |

| Pulpwood stumpage price | $16/m3 | |

| Carbon price | $18/tCO2e | [54] |

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | |

|---|---|---|---|---|

| Investment value | $769 | $823 | $1122 | $1548 |

| Investment cost | $327 | $351 | $329 | $345 |

| Risk-free rate (ρ) | 4% | 4% | 4% | 4% |

| Rotation age (years) | 23 | 24 | 27 | 28 |

| Option time (years) | 15 | 15 | 15 | 15 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Koirala, U.; Adams, D.C.; Susaeta, A.; Akande, E. Value of a Flexible Forest Harvest Decision with Short Period Forest Carbon Offsets: Application of a Binomial Option Model. Forests 2022, 13, 1785. https://doi.org/10.3390/f13111785

Koirala U, Adams DC, Susaeta A, Akande E. Value of a Flexible Forest Harvest Decision with Short Period Forest Carbon Offsets: Application of a Binomial Option Model. Forests. 2022; 13(11):1785. https://doi.org/10.3390/f13111785

Chicago/Turabian StyleKoirala, Unmesh, Damian C. Adams, Andres Susaeta, and Emmanuel Akande. 2022. "Value of a Flexible Forest Harvest Decision with Short Period Forest Carbon Offsets: Application of a Binomial Option Model" Forests 13, no. 11: 1785. https://doi.org/10.3390/f13111785