Quantifying the Effects of Biomass Market Conditions and Policy Incentives on Economically Feasible Sites to Establish Dedicated Energy Crops

Abstract

:1. Introduction

2. Experimental Section

2.1. Model Description

2.2. Baseline Scenario

2.3. Alternative Scenarios

2.3.1. Scenario I—Discount Rates

2.3.2. Scenario II—Biomass Prices

2.3.3. Scenario III—Tax Incentives

2.3.4. Scenario IV—Carbon Offset Payments

2.3.5. Scenario V—Inclusion of Agricultural Lands

3. Results

3.1. Baseline Scenario

3.2. Alternative Scenarios

3.2.1. Scenario I—Discount Rates

| Discount Rate (%) | Break-Even Biomass Amount (t·year−1) | Economically Feasible Area (ha) |

|---|---|---|

| 3 | 2.6–4.3 | 17,269 |

| 4 | 3.1–5.1 | 13,397 |

| 5 | 3.7–6.0 | 942 |

| 6 | 4.3–7.0 | 18 |

| 7 | 5.0–8.2 | 0 |

3.2.2. Scenario II—Biomass Prices

| Biomass Price ($·t−1) | Break-Even Biomass Amount (t·year−1) | Economically Feasible Area (ha) |

|---|---|---|

| 35 | 4.5–8.3 | 0 |

| 40 | 3.7–6.0 | 942 |

| 45 | 3.2–4.7 | 13,903 |

| 50 | 2.7–3.8 | 17,272 |

| 55 | 2.4–3.2 | 17,274 |

3.2.3. Scenario III—Tax Incentives

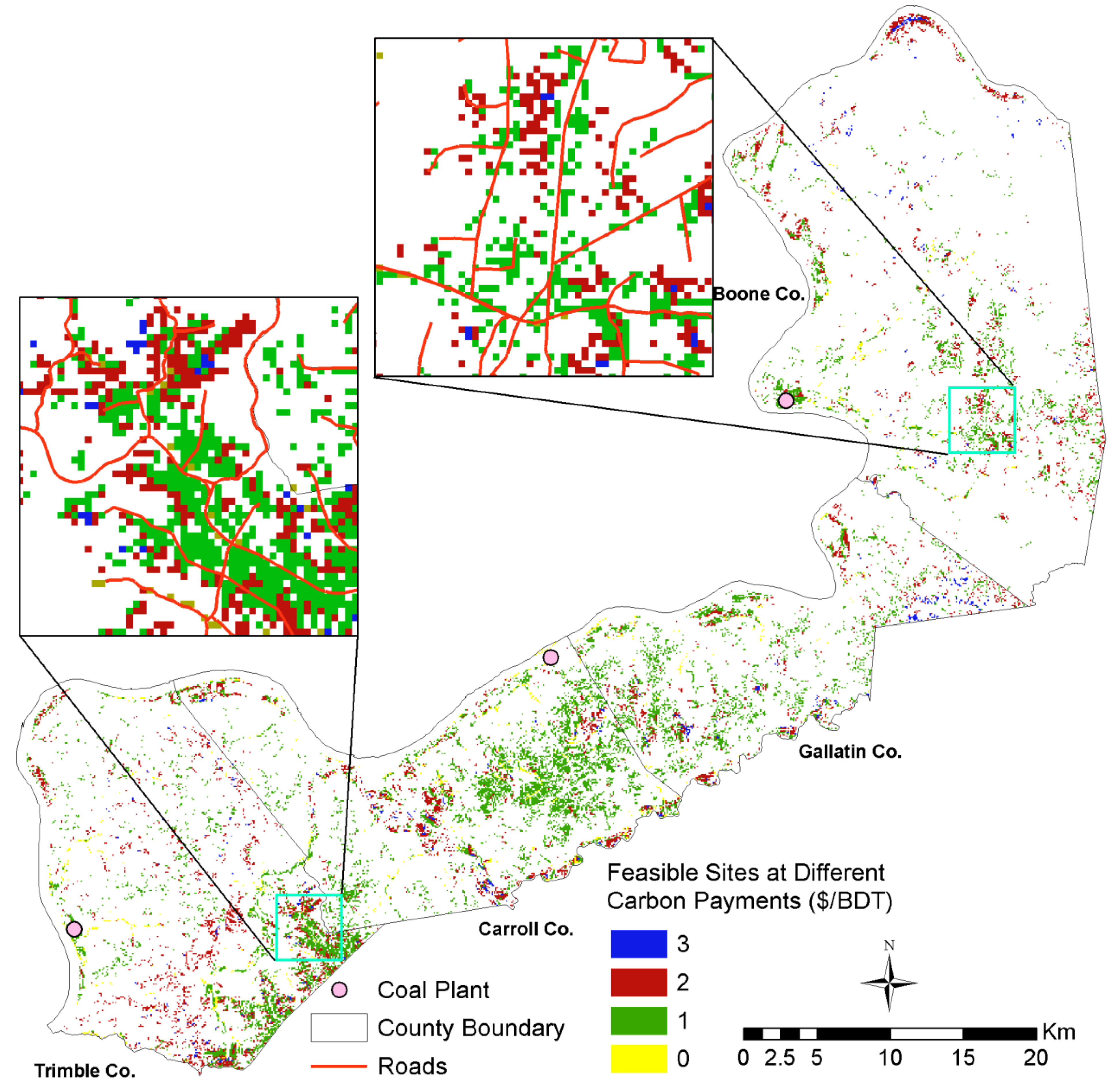

3.2.4. Scenario IV—Carbon Offset Payment

| Carbon Offset Payment ($·t−1) | Break-Even Biomass Amount (t·year−1) | Economically Feasible Area (ha) |

|---|---|---|

| 0 | 3.7–6.0 | 942 |

| 1 | 3.3–5.0 | 11,260 |

| 2 | 3.0–4.3 | 16,615 |

| 3 | 2.7–3.8 | 17,274 |

| 4 | 2.5–3.4 | 17,274 |

3.2.5. Scenario V—Inclusion of Agricultural Lands

3.2.6. Combined Effects

| Biomass Price ($·t−1) | Carbon Payment ($·t−1) | ||||

|---|---|---|---|---|---|

| 0 | 1 | 2 | 3 | 4 | |

| 35 | 0 | 279 | 5301 | 14,486 | 17,255 |

| 40 | 942 | 11,260 | 16,615 | 17,274 | 17,274 |

| 45 | 13,906 | 17,240 | 17,274 | 17,274 | 17,274 |

| 50 | 17,272 | 17,274 | 17,274 | 17,274 | 17,274 |

| 55 | 17,274 | 17,274 | 17,274 | 17,274 | 17,274 |

| Biomass Price ($·t−1) | Carbon Payment $·t−1) | ||||

|---|---|---|---|---|---|

| 0 | 1 | 2 | 3 | 4 | |

| 35 | 46 | 929 | 11,590 | 16,850 | 17,274 |

| 40 | 4167 | 14,281 | 17,254 | 17,274 | 17,274 |

| 45 | 16,537 | 17,274 | 17,274 | 17,274 | 17,274 |

| 50 | 17,274 | 17,274 | 17,274 | 17,274 | 17,274 |

| 55 | 17,274 | 17,274 | 17,274 | 17,274 | 17,274 |

4. Discussion

5. Conclusions

Author Contributions

Conflicts of Interest

References

- He, L.; English, B.C.; Daniel, G.; Hodges, D.G. Woody biomass potential for energy feedstock in United States. J. For. Econ. 2014, 20, 174–191. [Google Scholar] [CrossRef]

- Jeffers, R.F.; Jacobson, J.J.; Searcy, E.M. Dynamic analysis of policy drivers for bioenergy commodity. Energy Policy 2013, 52, 249–263. [Google Scholar] [CrossRef]

- Hinchee, M.; Rottmann, W.; Mullinax, L.; Zhang, C.; Chang, S.; Cunningham, M.; Pearson, L.; Nehra, N. Short-rotation woody crops for bioenergy and biofuels applications. Vitro Cell. Dev. Biol. Plant 2009, 45, 619–629. [Google Scholar] [CrossRef] [PubMed]

- Blanco-Canqui, H. Energy crops and their implication on soil and environment. Agron. J. 2010, 102, 403–419. [Google Scholar] [CrossRef]

- Perlack, R.D.; Wright, L.L.; Turhollow, A.F.; Graham, R.L.; Stokes, B.J.; Erbach, D.C. Biomass as Feedstock for a Bioenergy and Bioproducts Industry: The Technical Feasibility of a Billion-Ton Annual Supply; Oak Ridge National Laboratory: Oak Ridge, TN, USA; US Department of Energy and US Department of Agriculture: Washington, DC, USA, 2005. Available online: http://oai.dtic.mil/oai/oai?verb=getRecord&metadataPrefix=html&identifier=ADA436753 (accessed on 2 October 2015).

- US Department of Energy. US Billion-Ton Update: Biomass Supply for a Bioenergy and Bioproducts Industry; Oak Ridge National Laboratory: Oak Ridge, TN, USA, 2011; p. 227. [Google Scholar]

- Jose, S.; Bhaskar, T. Biomass and Biofuels—Advanced Biorefineries for Sustainable Production and Distribution; CRC Press, Taylor & Francis Group: Boca Raton, FL, USA, 2015; p. 367. [Google Scholar]

- Jessup, R.W. Development and status of dedicated energy crops in the United States. Vitro Cell. Dev. Biol. Plant. 2009, 45, 282–290. [Google Scholar] [CrossRef]

- Tyndall, J.C.; Shulte, L.A.; Hall, R.B. Expanding the US cornbelt biomass portfolio: Forester perceptions of the potential for woody biomass. Small-Scale For. 2011, 10, 287–303. [Google Scholar] [CrossRef]

- Leitch, Z.J.; Lhotka, J.M.; Stainback, G.A.; Stringer, J.W. Private landowner intent to supply woody feedstock for bioenergy production. Biomass Bioenergy 2013, 56, 127–136. [Google Scholar] [CrossRef]

- Tyner, W.E.; Taheripour, F. Advanced biofuels: Economic uncertainties, policy options, and land use impacts. Plants Bioenergy 2013, 4, 35–48. [Google Scholar]

- Environmental Protection Agency & National Renewable Energy Laboratory. State Bioenergy primer: Information and Resource for States on Issues, Opportunities and Options for Advancing Bioenergy. Available online: http://www.epa.gov/statelocalclimate/documents/pdf/bioenergy.pdf (accessed on 15 July 2015).

- Hallmann, F.W.; Amacher, G.S. Forest bioenergy adoption for a risk-averse landowener under uncertain merging biomass market. Nat. Resour. Model. 2012, 25, 482–510. [Google Scholar] [CrossRef]

- Chamberlain, J.F.; Miller, S.A. Policy incentives for switchgrass production using valuation of non-market ecosystem services. Energy Policy 2012, 48, 526–536. [Google Scholar] [CrossRef]

- Luo, Y.; Miller, S. A game theory analysis of market incentives for US switchgrass ethanol. Ecol. Econ. 2013, 93, 42–56. [Google Scholar] [CrossRef]

- Shivan, G.C.; Mehmood, S.R. Factors influencing nonindustrial private forest landowners’ policy preference for promoting bioenergy. For. Policy Econ. 2010, 12, 581–588. [Google Scholar] [CrossRef]

- Alexander, P.; Moran, D.; Smith, P.; Hastings, A.; Wang, S.; Sünnenberg, G.; Lovett, A.; Tallis, M.J.; Casella, E.; Taylor, G.; et al. Estimating UK perennial energy crop supply using farm scale models with spatially disaggregated data. Glob. Chang. Biol. Bioenergy 2014, 6, 142–155. [Google Scholar] [CrossRef] [Green Version]

- Alexander, P.; Moran, D.; Rounsevell, M.D.A. Evaluating potential policies for the UK perennial energy crop market to achieve carbon abatement and deliver a source of low carbon electricity. Biomass Bioenergy 2015. [Google Scholar] [CrossRef]

- Rizzo, D.; Martin, L.; Wohlfahrt, J. Miscanthus spatial location as seen by farmers: A machine learning approach to model real criteria. Biomass Bioenergy 2014, 66, 348–363. [Google Scholar] [CrossRef]

- Elobeid, A.; Tokgoz, S.; Dodder, R.; Johnson, T.; Kaplan, O.; Kurkalova, L.; Secchi, S. Integration of agricultural and energy system models for biofuel assessment. Environ. Model. Softw. 2013, 48, 1–16. [Google Scholar] [CrossRef]

- Egbendewe-Mondzozo, A.; Swinton, S.M.; Izaurralde, R.; Manowitz, D.H.; Zhang, X. Biomass Supply from Alternative Cellulosic Crops and Crop Residues: A Preliminary Spatial Bioeconomic Modeling Approach; Staff Paper; Department of Agricultural, Food, and Resource Economics: Washington, DC, USA; Michigan State University: East Lansing, MI, USA, 2010. Available online: http://ageconsearch.umn.edu/bitstream/98277/1/StaffPaper2010–07.pdf (accessed on 2 October 2015).

- Khanna, M.; Dhungana, B.; Clifton-Brown, J. Costs of producing miscanthus and switchgrass for bioenergy in Illinois. Biomass Bioenergy 2008, 32, 482–493. [Google Scholar] [CrossRef]

- Zubaryeva, A.; Zaccarelli, N.; del Giudice, C.; Zurlini, G. Spatially explicit assessment of local biomass availability for distributed biogas production via anaerobic co-digestion—Mediterranean case study. Renew. Energy 2012, 39, 261–270. [Google Scholar] [CrossRef]

- Goerndt, M.E.; Aguilar, F.X.; Miles, P.; Shifley, S.; Song, N.; Stelzer, H. Regional assessment of woody biomass physical availability as an energy feedstock for combined combustion in the US northern region. J. For. 2012, 110, 138–148. [Google Scholar] [CrossRef]

- Calvert, K.; Mabee, W. Spatial analysis of biomass resources within a socio-ecologically heterogeneous region: Identifying opportunities for a mixed feedstock stream. ISPRS Int. J. Geo-Inf. 2014, 3, 209–232. [Google Scholar] [CrossRef]

- Nepal, S.; Contreras, M.; Lhotka, J.M.; Stainback, A. A spatially explicit model to identify suitable sites to establish dedicated woody energy crops. Biomass Bioenergy 2014, 71, 245–255. [Google Scholar] [CrossRef]

- Fowells, H.A. Silvics of Forest Trees of the United States; US Department of Agriculture, Forest Service, Agriculture Handbook 271; US Department of Agriculture, Forest Service: Washington, DC, USA, 1965; pp. 569–572.

- Kormanik, P.P. Sweetgum: Liquidambar Styraciflua. In Silvics of North America, Volume 2: Hardwoods; US Department of Agriculture, Forest Service, Agriculture Handbook 654; Burns, R.M., Honkala, B.H., Eds.; Department of Agriculture, Forest Service: Washington, DC, USA, 1990. [Google Scholar]

- Scott, D.A.; Burger, J.A.; Kaczmarek, D.J.; Kane, M.B. Growth and nutrition response of young sweetgum plantations to repeated nitrogen fertilization on two site types. Biomass Bioenergy 2004, 27, 313–325. [Google Scholar] [CrossRef]

- Davis, A.A.; Trettin, C.C. Sycamore and sweetgum plantation productivity on former agricultural land in South Carolina. Biomass Bioenergy 2006, 30, 769–777. [Google Scholar] [CrossRef]

- Kaczmarek, D.J.; Wachelka, B.C.; Wright, J.; Steele, V.; Aubrey, D.P.; Coyle, D.R.; Coleman, M.D. Development of high-yielding sweetgum (Liquidambar styraciflua L.) plantation systems for bioenergy production in the southeastern United States. In Proceedings of the 9th Biennial Short Rotation Woody Crops Operations Working Group Conference, Oak Ridge, TN, USA, 5–8 November 2012.

- Jetton, R.M.; Robison, D.J. Effects of Artificial Defoliation on Growth and Biomass Accumulation in Short-Rotation Sweetgum (Liquidambar styraciflua) in North Carolina. J. Insect Sci. 2014, 14, 107–121. [Google Scholar] [CrossRef] [PubMed]

- Kline, K.L.; Coleman, M.D. Woody energy crops in the southern United States: Two centuries of practitioner experience. Biomass Bioenergy 2010, 34, 1655–1666. [Google Scholar] [CrossRef]

- National Agricultural Statistics Services, US Department of Agriculture. CropScape—Cropland Data Layer. Available online: http://nassgeodata.gmu.edu/CropScape/ (accessed on 13 May 2015).

- Kentucky Geography Network. Kentucky Geoportal. Available online: http://kygisserver.ky.gov/geoportal/catalog/main/home.page (accessed on 13 May 2015).

- Abrahamson, L.P.; Volk, T.A.; Smart, L.B.; Cameron, K.D. Shrub Willow Biomass Producer’s Handbook; College of Environmental Science and Forestry, State University of New York: Syracuse, NY, USA, 2010; p. 27. [Google Scholar]

- Kentucky Department of Revenue. 2011–2014 Quadrennial Recommended Agricultural Assessment Guidelines. Available online: http://revenue.ky.gov/NR/rdonlyres/1F10DE44-9317-4A79-8589-7E31CDD60B8E/0/20112014_RecommendedAgGuidelineFINAL.pdf (accessed on 15 July 2015).

- Baker, J.B.; Broadfoot, W.M. A Practical Field Method of Site Evaluation for Commercially Important Southern Hardwoods; General Technical Report SO-26; US Department of Agriculture, Forest Service, Southern Forest Experiment Station: New Orleans, LA, USA, 1979; p. 51.

- Soil Survey Geographic Database. Soil Survey Staff, Natural Resources Conservation Service, US Department of Agriculture. Web Soil Survey. Available online: http://websoilsurvey.nrcs.usda.gov/ (accessed on 13 May 2015).

- Ortiz, D.S.; Curtright, A.E.; Samaras, C.; Litovitz, A.; Burger, N. Near-Term Opportunities for Integrating Biomass into the US; Electric Supply: Technical Considerations; The RAND Corporation: Pittsburgh, PA, USA, 2011. [Google Scholar]

- Khanna, M.; Chen, X.; Huang, H.; Önal, H. Supply of cellulosic biofuel feedstocks and regional production pattern. Am. J. Agric. Econ. 2011, 93, 473–480. [Google Scholar] [CrossRef]

- Nesbit, T.S.; Alavalapati, J.R.; Dwivedi, P.; Marinescu, M.V. Economics of ethanol production using feedstock from slash pine (Pinus elliottii) plantations in the southern United States. South. J. Appl. For. 2011, 35, 61–66. [Google Scholar]

- Dwivedi, P.; Robert, B.; Stainback, A.; Carter, D.R. Impact of payments for carbon sequestrated in wood products and avoided carbon emissions on the profitability of NIPF landowners in the US South. Ecol. Econ. 2012, 78, 63–69. [Google Scholar] [CrossRef]

- Skog, K.; Barbour, J.; Buford, M.; Dykstra, D.; Lebow, P.; Miles, P.; Perlack, B.; Stokes, B. Forest-based biomass supply curves for the United States. J. Sustain. For. 2013, 32, 14–27. [Google Scholar] [CrossRef]

- Jones, G.; Loeffler, D.; Butler, E.; Hummel, S.; Chung, W. The financial feasibility of delivering forest treatment residues to bioenergy facilities over a range of diesel fuel and delivered biomass prices. Biomass Bioenergy 2013, 48, 171–180. [Google Scholar] [CrossRef]

- White, E.M. Woody Biomass for Bioenergy and Biofuels in the United States—A Briefing Paper; General Technical Report PNW-GTR-825; US Department of Agriculture, Forest Service, Pacific Northwest Research Station: Portland, OR, USA, 2010; p. 45.

- Database of State Incentives for Renewables & Efficiency. Available online: http://programs.dsireusa.org/system/program (accessed on 11 March 2015).

- John, S.; Watson, A. Establishing a Green Energy Crop Market in the Decatur Area; Report of the Upper Sangamom Watershed Farm Power Project; The Agricultural Watershed Institute: Decatur, IL, USA, 2007; p. 93. Available online: http://www.agwatershed.org/PDFs/Biomass_Report_Aug07.pdf (accessed on 15 July 2015).

- Intercontinental Exchange. CCX historical price and volume. Available online: https://www.theice.com/CCXProtocols.shtml (accessed on 18 February 2015).

- Regional Greenhouse Gas Initiative. CO2 Allowance Sold at $3.00 at 22nd RGGI Auction. News Release December 6, 2013. Available online: http://rggi.org/docs/Auctions/22/PR120613_Auction22.pdf (accessed on 15 July 2014).

- US Environmental Protection Agency. Metrics for Expressing Greenhouse Emissions: Carbon Equivalents and Carbon Dioxide Equivalents; EPA420-F-05-002; US Environmental Protection Agency: Washington, DC, USA, 2005.

- IPCC National Greenhouse Gas Inventories Programme. Good Practice Guidance for Land Use, Land-Use Change and Forestry; Institute for Global Environmental Strategies: Kanagawa, Japan, 2003; Available online: http://www.ipcc-nggip.iges.or.jp/public/gpglulucf/gpglulucf_files/GPG_LULUCF_FULL.pdf (accessed on 18 February 2014).

- Myneni, R.B.; Dong, J.; Tucker, C.J.; Kaufmann, R.K.; Kauppi, P.E.; Liski, J.; Zhou, L.; Alexeyev, V.; Hughes, M.K. A large carbon sink in the woody biomass of Northern forests. Proc. Natl. Acad. Sci. 2001, 98, 14787–14789. [Google Scholar] [CrossRef] [PubMed]

- Shrestha, P.; Stainback, G.A.; Dwivedi, P.; Lhotka, J.M. Economic and life-cycle analysis of forest carbon sequestration and wood-based bioenergy offsets in the central hardwood region of United States. J. Sustain. For. 2015, 34, 214–232. [Google Scholar] [CrossRef]

- Lemoine, D.M.; Plevin, R.J.; Cohn, A.S.; Jones, A.D.; Brandt, A.R.; Vergara, S.E.; Kammen, D.M. The climate impacts of systems depend on market and regulatory policy contexts. Environ. Sci. Technol. 2010, 44, 7347–7350. [Google Scholar] [CrossRef] [PubMed]

- Johnson, R.; Ramseur, J.L.; Gorte, R.W.; Stubbs, M. Potential implications of a carbon offset programs to farmers and landowners. CRS Report for Congress. 2010. Available online: http://nationalaglawcenter.org/wp-content/uploads/assets/crs/R41086.pdf (accessed on 15 July 2015).

- Kentucky Energy and Environment Cabinet. Kentucky Coal Facts: 2013. Available online: http://energy.ky.gov/Pages/CoalFacts.aspx (accessed on 15 July 2015).

- Cherubini, F.; Bird, N.D.; Cowie, A.; Jungmeier, G.; Schalamadinger, B.; Woess-Gallasch, S. Energy- and greenhouse gas-based LCA of biofuel and bioenergy systems: Key issues, ranges and recommendations. Resour. Conserv. Recycl. 2009, 53, 434–447. [Google Scholar] [CrossRef]

- Sebastian, F.; Royo, J.; Gomez, M. Cofiring versus biomass-fired power plants: GHG (Greehouse Gases) emissions savings comparisons by means of LAC (Life Cycle Assessment) methodology. Energy 2011, 36, 2029–2037. [Google Scholar] [CrossRef]

- Basu, P.; Butler, J.; Leon, M.A. Biomass co-firing options on the emission reduction and electricity generation costs in coal-fired power plants. Renew. Energy 2011, 36, 282–288. [Google Scholar] [CrossRef]

- Sherrington, C.; Bartley, J.; Moran, D. Farm-level constraints on the domestic supply of perennial energy crops in the UK. Energy Policy 2008, 36, 2504–2512. [Google Scholar] [CrossRef]

- Shastri, Y.; Rodríguez, L.; Hansen, A.; Ting, K.C. Agent-based analysis of biomass feedstock production dynamics. Bioenergy Res. 2011, 4, 258–275. [Google Scholar] [CrossRef]

- Glithero, N.J.; Wilson, P.; Ramsden, S.J. Prospects for arable farm uptake of Short Rotation Coppice willow and miscanthus in England. Appl. Energy 2013, 107, 209–218. [Google Scholar] [CrossRef] [PubMed]

- Catron, J.; Stainback, G.A.; Dwivedi, P.; Lhotka, J.M. Bioenergy development in Kentucky: A SWOT-ANP analysis. For. Policy Econ. 2013, 28, 38–43. [Google Scholar] [CrossRef]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nepal, S.; Contreras, M.A.; Stainback, G.A.; Lhotka, J.M. Quantifying the Effects of Biomass Market Conditions and Policy Incentives on Economically Feasible Sites to Establish Dedicated Energy Crops. Forests 2015, 6, 4168-4190. https://doi.org/10.3390/f6114168

Nepal S, Contreras MA, Stainback GA, Lhotka JM. Quantifying the Effects of Biomass Market Conditions and Policy Incentives on Economically Feasible Sites to Establish Dedicated Energy Crops. Forests. 2015; 6(11):4168-4190. https://doi.org/10.3390/f6114168

Chicago/Turabian StyleNepal, Sandhya, Marco A. Contreras, George A. Stainback, and John M. Lhotka. 2015. "Quantifying the Effects of Biomass Market Conditions and Policy Incentives on Economically Feasible Sites to Establish Dedicated Energy Crops" Forests 6, no. 11: 4168-4190. https://doi.org/10.3390/f6114168