1. Introduction

R&D portfolio management facilitates decision-making on project selection and the prioritization and allocation of resources for project progression [

1,

2,

3]. Decision-making on R&D portfolio management is based on an economic valuation of firm R&D projects. Therefore, valuation of R&D projects is a critical factor for enhancing a firm’s efficiency and towing its growth, which means that it can be a tool of sustainable management. Various methods of R&D project valuation have been introduced so far.

Previous studies on the valuation of R&D projects are largely divided into two categories: one is the discounted cash flow (DCF) analysis, often called the expected net present value or risk-adjusted net present value [

4], and the other is the real options valuation (ROV) analysis, which adopts the financial option pricing method.

In particular, the ROV can be a strategic device to capitalize on upside potential and mitigate downside risks [

5]. The risk is an especially key issue for managers and investors. The ROV is useful for the risk analysis of various projects with managerial flexibility [

6,

7]. The ROV has highlighted sustainable management to properly realign the firm’s strategies according to risks from uncertainties related with the business environment [

8,

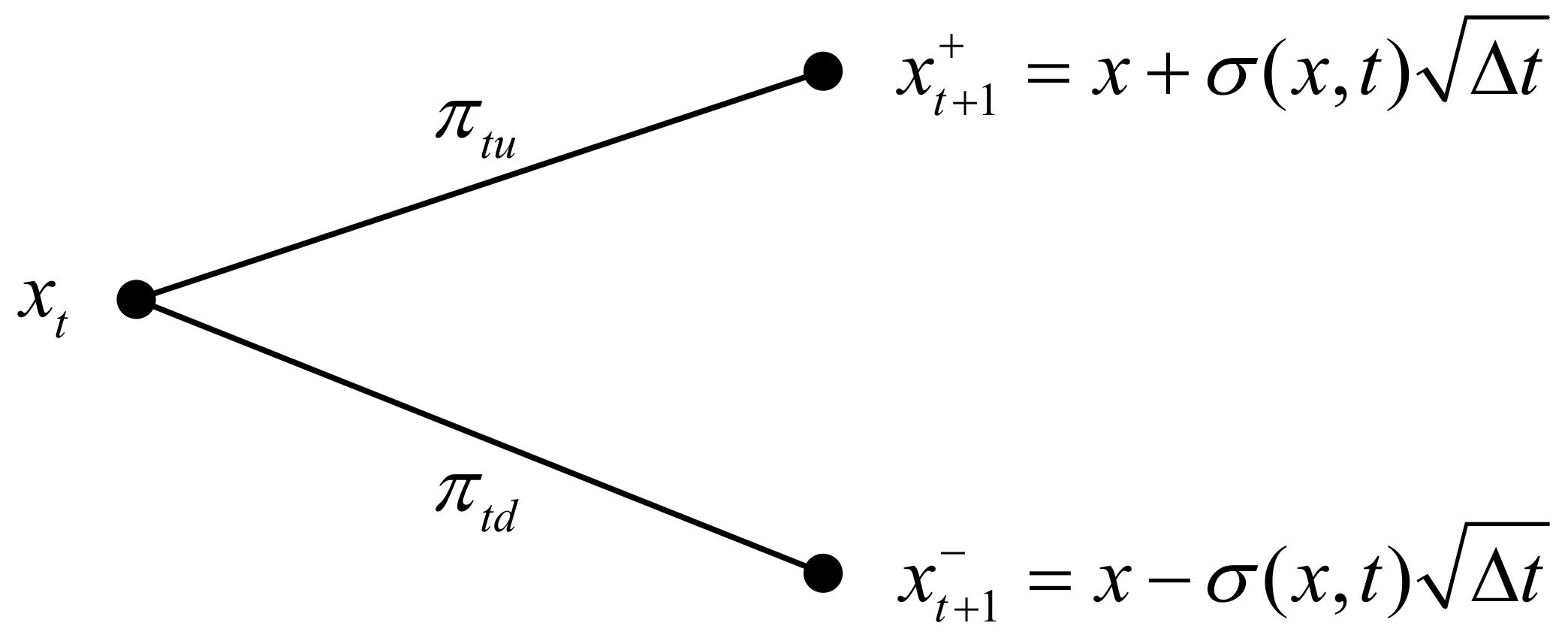

9]. Scholars proposed a binomial lattice model [

10,

11,

12], option models compounding Geske’s and the fuzzy model [

13,

14], the Monte Carlo simulation (MCS) approach with general stochastic processes and assumption of sales of a drug governed by a mean-reverting stochastic process [

15,

16,

17], and the mean-reverting binomial lattice model [

18] for the valuation of R&D projects in various industries.

However, most ROV models proposed in previous studies assume that model parameters such as market volatility and risk-free interest rates are constant throughout the project period, but this assumption should be considered as time-varying parameters. The valuation result of the ROV is likely to go wrong unless its underlying assumptions are consistent with reality [

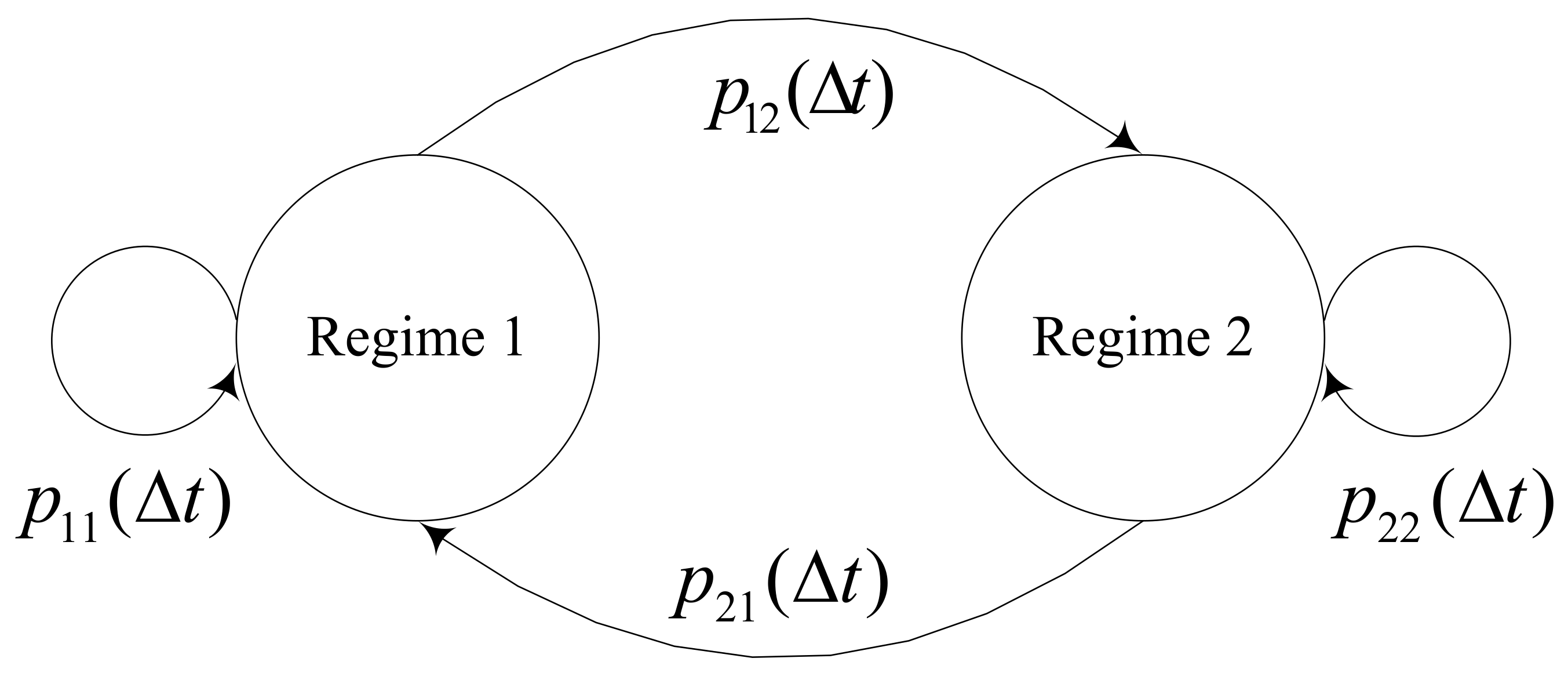

19]. Few studies have proposed a more realistic ROV model to encourage the decision making of the firm. To this fashion, Markov regime switching may be a useful approach to accommodate the time-varying aspect of parameters in ROV models [

20,

21,

22]. Therefore, we suggest the valuation method with mean-reverting binomial lattice model under Markov regime switching. Then, this study compares valuation results from the proposed model with those from conventional DCF and previous ROV models and performs a sensitivity analysis regarding the major parameters of the model.

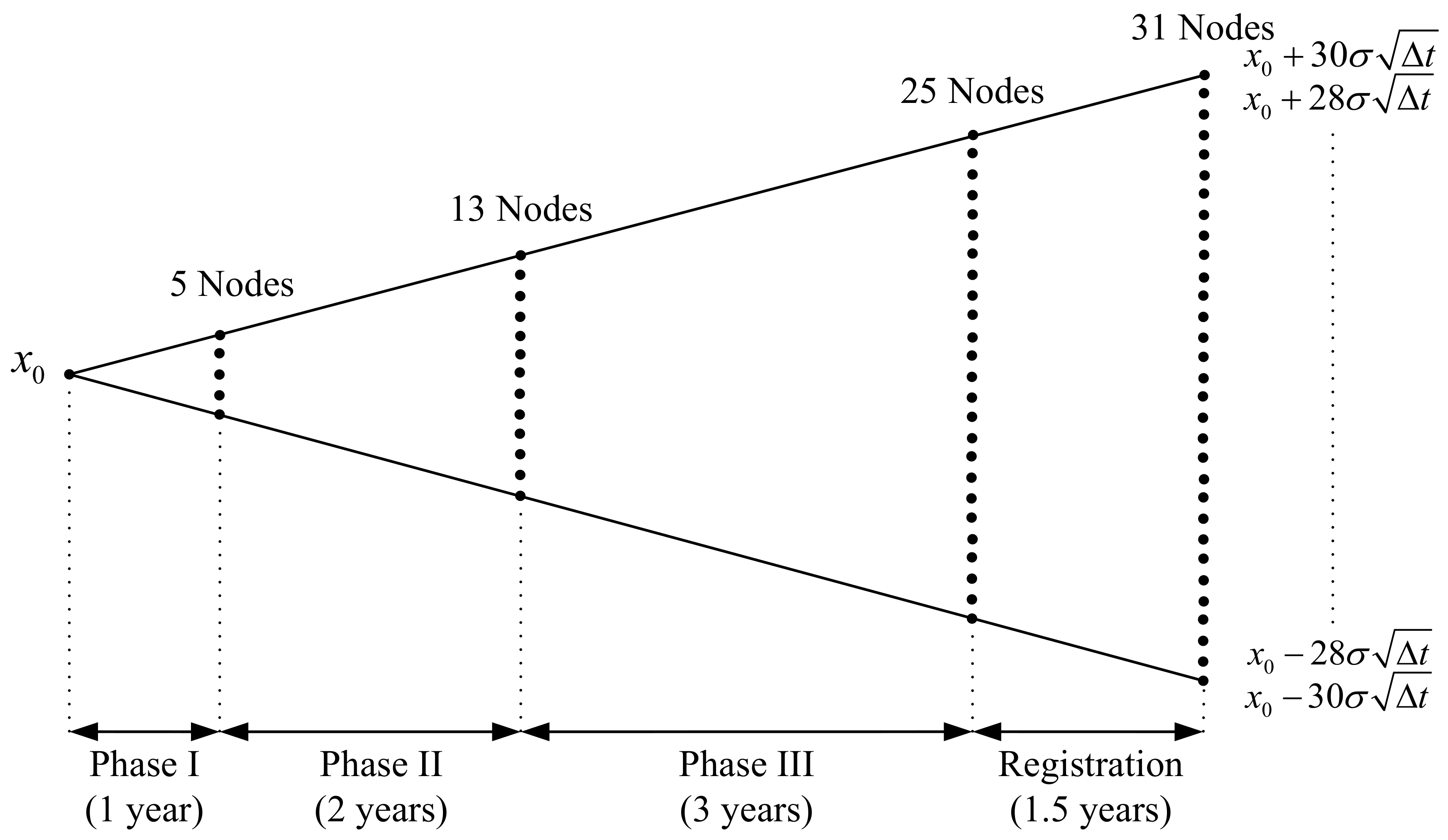

The focus of this study is the valuation of R&D projects in the pharmaceutical industry. Pharmaceutical R&D projects have characteristics of the long period of the R&D process and tremendous R&D investment, thus a high uncertainty of R&D success. Generally, it takes approximately 10 to 12 years to develop a new drug from discovery to commercialization [

23], and the total R&D budget for a new drug often exceeds

$1 billion USD [

24]. These features make an accurate valuation of pharmaceutical R&D projects considering risks critical for a firm’s decision makers related to its sustainable development.

Previous studies on the valuation of pharmaceutical R&D projects are largely divided into two categories: one is DCF analysis, often called the expected net present value or risk-adjusted net present value [

4], and the other is ROV analysis, which adopts the financial option pricing method. In particular, ROV has highlighted dealing with managerial flexibility around issues such as economically motivated abandonment, expansion, and contraction of R&D investments. It also considers the uncertainty of market potential [

8,

9]. Kellogg and Charnes [

10], Bogdan and Villiger [

11], and Hauschild and Reimsbach [

12] proposed a binomial lattice model for the evaluation of a clinical drug development project. Cassimon et al. [

13] and Wang and Hwang [

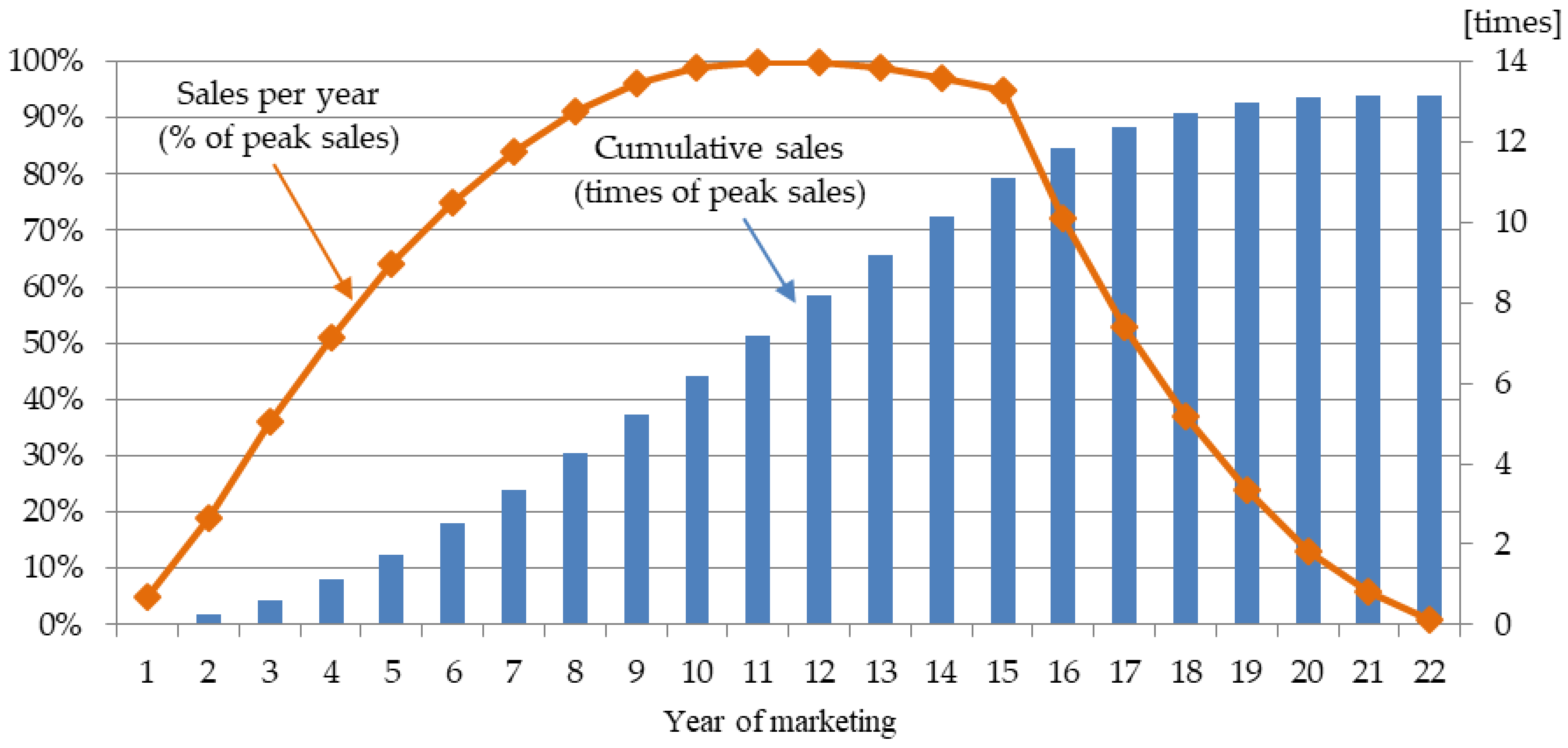

14] suggested a generalized version of Geske’s compound option model and the fuzzy compound option model to evaluate a new drug development project. They considered each phase of drug development as a compound option and solved the model with the partial differential equation approach, which was quite complex. They also assumed that the cash flow from sales of a drug is governed by a geometric Brownian motion (GBM), which is rather unrealistic. A mean-reverting process is the most often-used assumption concerning the cash flow of a project in ROV models [

18,

25,

26]. Myers and Howe [

15] and Schwartz [

16] proposed an MCS approach, which can easily model general stochastic processes. Willigers and Hansen [

17] strengthened the MCS approach by adding the assumption that the logarithm of sales of a drug is governed by a mean-reverting stochastic process, which is closer to reality. However, the MCS approach is computationally intensive and complex compared to a lattice-based model.

Our proposed real option valuation model in this study contributes to helping decision makers consider the changes of economic environment and the adequate future cash flows estimation of R&D projects. Most ROV models previously proposed in the pharmaceutical industry assume that model parameters such as market volatility and risk-free interest rates are constant throughout the project development period, but this assumption is somewhat unrealistic considering the long span of pharmaceutical R&D projects. The valuation result of the ROV is likely to go wrong unless its underlying assumptions are consistent with reality [

19]. We propose a new real option valuation model which simultaneously employs mean-reverting stochastic process and time-varying parameters based on a binomial lattice approach. The mean-reversion assumption and a regime switching technique can more realistically capture the characteristics of R&D projects and the structural changes of economic conditions [

17,

27]. Additionally, as Mun [

28] indicated, a lattice-based approach is relatively intuitive and can therefore be accepted easily. Therefore, this study contributes to the effective decision making of pharmaceutical companies, to find more accurate and intuitive valuations of R&D projects.

The rest of this study is organized into four sections. In

Section 2, we introduce the process of drug development and risks involved, and we then present our proposed economic valuation model. We describe data and assumptions used in the valuation in

Section 3, which is followed by the presentation of valuation results and discussions in

Section 4. Finally, in

Section 5, we conclude the study with the implications, limitations, and future research of the study.

4. Results and Discussion

Table 4 shows the project valuation results by the proposed MRBL-MRS and five other methods: conventional DCF, BL-GBM, MCS-GBM, BL-MRP, and MCS-MRP. In Monte Carlo simulation methods, we ran 50,000 paths to compute project values and calculated the average value of all paths. All six methods valued the development projects in the direction one may expect compared to the value of Project 1: increase and decrease of peak sales resulted in higher and lower values, respectively, and increased development risk and launch costs resulted in lower values of the study projects. That is, Project 2 has the same condition as Project 1 and only the peak sales value is larger. Therefore, the valuation results of Project 2 are larger in all methods. On the other hand, Project 3 has a lower peak sales value, Project 4 has a lower success rate, and Project 5 has a higher launch cost than Project 1. Therefore, the valuation results of Project 3, 4, and 5 are all lower than Project 1 in all six valuation methods. These results show that all six methods are consistent.

Valuation results of ROV are consistently higher than the valuation by the conventional DCF because ROV-based methods allow a decision maker to abandon the project at a decision node, while the DCF-based method does not. This abandonment occurs when the value of the project at the node drops below zero or does not reach the payoff level the decision maker expects from the project.

The valuation methods with the underlying assumption that a GBM governs sales distribution—both binomial lattice and Monte Carlo simulation—yielded conspicuously larger values than those of DCF and other ROV methods with a mean-reverting process across all projects. The differences ranged from

$40.2 M to

$245.8 M. For Project 1, MCS-GBM’s result is greater than DCF’s result by more than 63%. Although ROV captures managerial flexibility, the results of MCS-GBM are unrealistically larger than those of DCF. However, for MCS-MRP, the results are closer to those of DCF. Although there are some differences among the results in relative terms across the projects, they range from just

$4.3 M to

$26.9 M. These are quite small in absolute terms when compared with the differences between DCF and MCS-GBM. The same difference pattern also exists among DCF, BL-GBM, and BL-MRP. This finding reconfirms the argument of Schwartz [

32] and Bastian-Pinto, Brandão and Hahn [

33]. These researchers state that GBM can generate extremely great or small cash flows, but the mean-reverting process reverts to a long-term equilibrium level which is typically assumed as the long-term mean. Therefore, the mean-reverting process is more realistic to model the cash flows of a developed drug in the market than GBM.

For Project 3, DCF yields a negative NPV value, but MCS-GBM and MCS-MRP yield positive values, $39.4 M and $3.5 M. Because MCS abandons economically unprofitable projects, it presents greater project values than DCF. This has a significant implication for management as managerial decision-making can be affected by valuation methods. Comparing the results between MCS and BL shows that if the stochastic process of cash flows is same, the results are similar to each other. However, for Project 3, while MCS-MRP yields $3.5 M, BL-MRP yields only $2.6 M. This means that MCS-MRP captures flexibility more largely than BL-MRP.

Column 7 shows the result of the valuation assuming that the R&D project starts in regime 1, and column 8 shows the result of it assuming that it starts in regime 2. The results in regime 2 of MRBL-MRS are greater than those in regime 1 across all projects. The differences range from $4.4 M to $28.0 M. This difference is due to the fact that the two regimes reflect different economic conditions. The difference of parameters between regime 1 and 2 resulted in the difference between Column 7 and Column 8. In our case study, the volatility of regime 2 is greater than that of regime 1. This difference had a critical influence on the difference in project values. From these results, it is revealed that MRBL-MRS captures risks caused by the uncertainty of the economic environment, which is represented by regime switching. This means that using the MRBL-MRS ROV model proposed in this paper, the decision maker can make different managerial decisions according to the current economic condition and expected changes in the future. Therefore, MRBL-MRS is a more flexible model than previous ROV models.

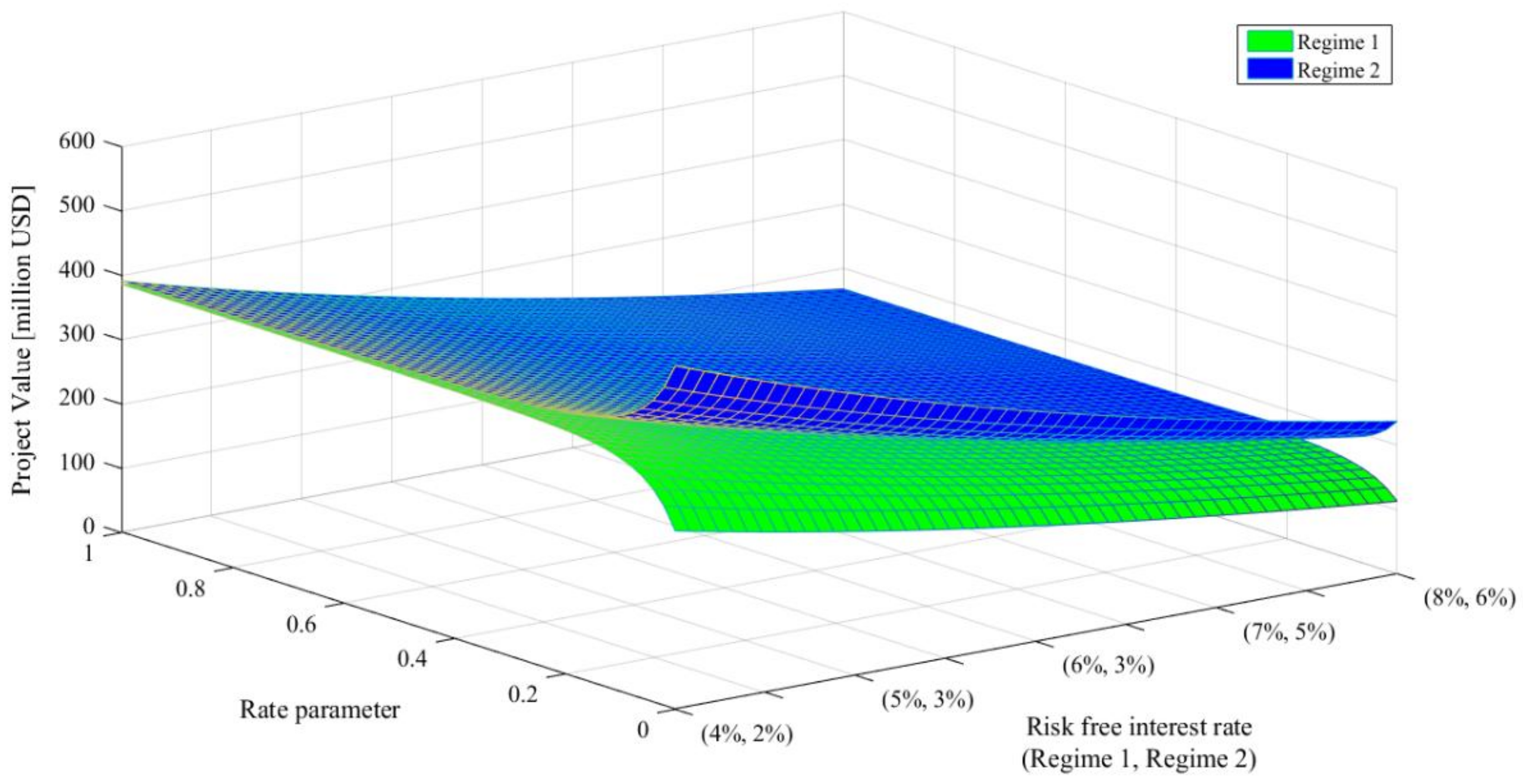

Further, we evaluated Project 1 with MRBL-MRS according to different values of the rate parameter and risk-free interest rate. The results are shown in

Table 5 and

Figure 5. Rate parameter determines the probability of transition between regime 1 and regime 2. Rate parameter takes a value between 0 and 1. If it is close to 1, the transition probability is high, that is, the economic environment is likely to change. On the other hand, if the parameter value is close to 0, it means that the possibility of changing the economic environment is lowered. A risk-free interest rate affects the ROV as a risk-free discount rate. Thus, higher interest rates have an effect of lowering the resulting value. We varied rate parameter from 0.00 to 1.00 and risk-free interest rates for regimes 1 and 2 from (

= 4%,

= 2%) to (

= 7%,

= 5%). Other parameter values remain unchanged. Columns 2, 4, 6, and 8 of

Table 5 present the project values in regime 1 for different speed of reversion values and columns 3, 5, 7, and 9 present those in regime 2. As the risk-free interest rate increases, the project value decreases and the value difference between regimes 1 and 2 also decreases. This is because as risk-free interest rate grows, the effect of discounting increases. Low 3 to 11 gives the project values for different values of rate parameters. As the rate parameter grows bigger, the transition probability from regime 1 to regime 2 increases. Thus, the project values in regime 1 increase, but those in regime 2 decrease. That is, when the rate parameter increases, the project values in regimes 1 and 2 converge. This means that the effect of regime switching by the Markov process is low for low values of the rate parameter, and it gradually increases as the rate parameter increases. You can see this characteristic in

Figure 5. Therefore, when the transition probabilities between regimes are high, it is not important to the valuation result in which regime the project development starts. However, when the transition probability is low, it significantly affects the valuation results. Thus, management can decide to invest or wait, considering the current regime condition and the transition probability.

5. Conclusions

Effective management of the R&D portfolio is critical for a company’s R&D productivity, innovation, and financial performance, and furthers the firm’s sustainability or survival. An accurate valuation of R&D projects is an essential step towards R&D portfolio management. A real options approach for the valuation of R&D projects has an advantage to deal with various risks, and contributes to a firm’s strategic decision making for sustainable management. Therefore, ROV models have been considered an essential valuation method for decision making in R&D projects. However, current ROV models do not simultaneously adopt mean-reverting stochastic process and time-varying parameters. Therefore, this study proposed a valuation method with the mean-reverting binomial lattice model under Markov regime switching which can consider the market risks by applying time-varying parameters, such as volatility and risk-free interest rates.

We focused on the effective and sustainable management of the R&D portfolio in a pharmaceutical company, which is required risk management in the R&D stage, due to the long R&D period and huge R&D expenditure [

23]. In this study, five clinical development projects of pharmaceutical companies were evaluated with the suggested model and compared with the valuation results of conventional DCF and other ROV models. The MRBL-MRS model suggested in this study represented more effective values than DCF, but corrected overestimated values by GBM. In addition, the results revealed that MRBL-MRS is an applicable and more flexible model that reflects changes of economic environment with a reflection of switching economic regimes compared to models that do not consider regime changing. Therefore, in practice, the method on the valuation of R&D projects proposed in this study can assist project managers of pharmaceutical companies in making effective decision making in R&D projects.

R&D project managers in pharmaceutical companies often face the difficulty of selecting an appropriate portfolio of R&D projects. The MRBL-MRS model suggested in this study captured risks caused by the uncertainty of the economic environment. In other words, it means that the MRBL-MRS model can provide more accurate information for decision making on portfolio selection for pharmaceutical R&D project managers by adapting mean reverting process and time-varying parameters resulting from changes of economic environment. Therefore, they can make different managerial decision according to the current economic condition and expected changes in the future.

Despite these contributions, this study has several limitations and future research is suggested. First, this study obtained the volatility, speed of sales reversion, and long-term mean of peak sales of a drug using Arca Pharmaceutical Index data, but the index does not fully represent the peak sales of a drug. Thus, future research is required to obtain a more accurate estimation of the parameters by using actual drug sales data or other complementary data. Second, this study only considered an option to abandon the project. Therefore, future research should consider other options in the real world for pharmaceutical R&D project valuation. In particular, the open innovation strategy by license agreements between small biotechnology firms and large pharmaceutical companies has become a popular business model in the pharmaceutical industry. Thus, licensing out or in options in pharmaceutical R&D project management should be considered in a future model. Third, this study employed a simple mean-reverting process. It was limited due to the fact that it did not describe exogeneous shocks despite providing a more realistic R&D project value than GBM. Therefore, future study should consider alternative stochastic processes, such as a mean-reverting jump diffusion process, for economic and technical exogeneous shocks during R&D periods.