The Causal Nexus between Oil Prices, Interest Rates, and Unemployment in Norway Using Wavelet Methods

Abstract

:1. Introduction

2. Theory and Evidence

2.1. Theoretical Background

2.1.1. Transmission Channels

2.1.2. Time Horizons

2.2. Empirical Evidence

3. Preliminaries

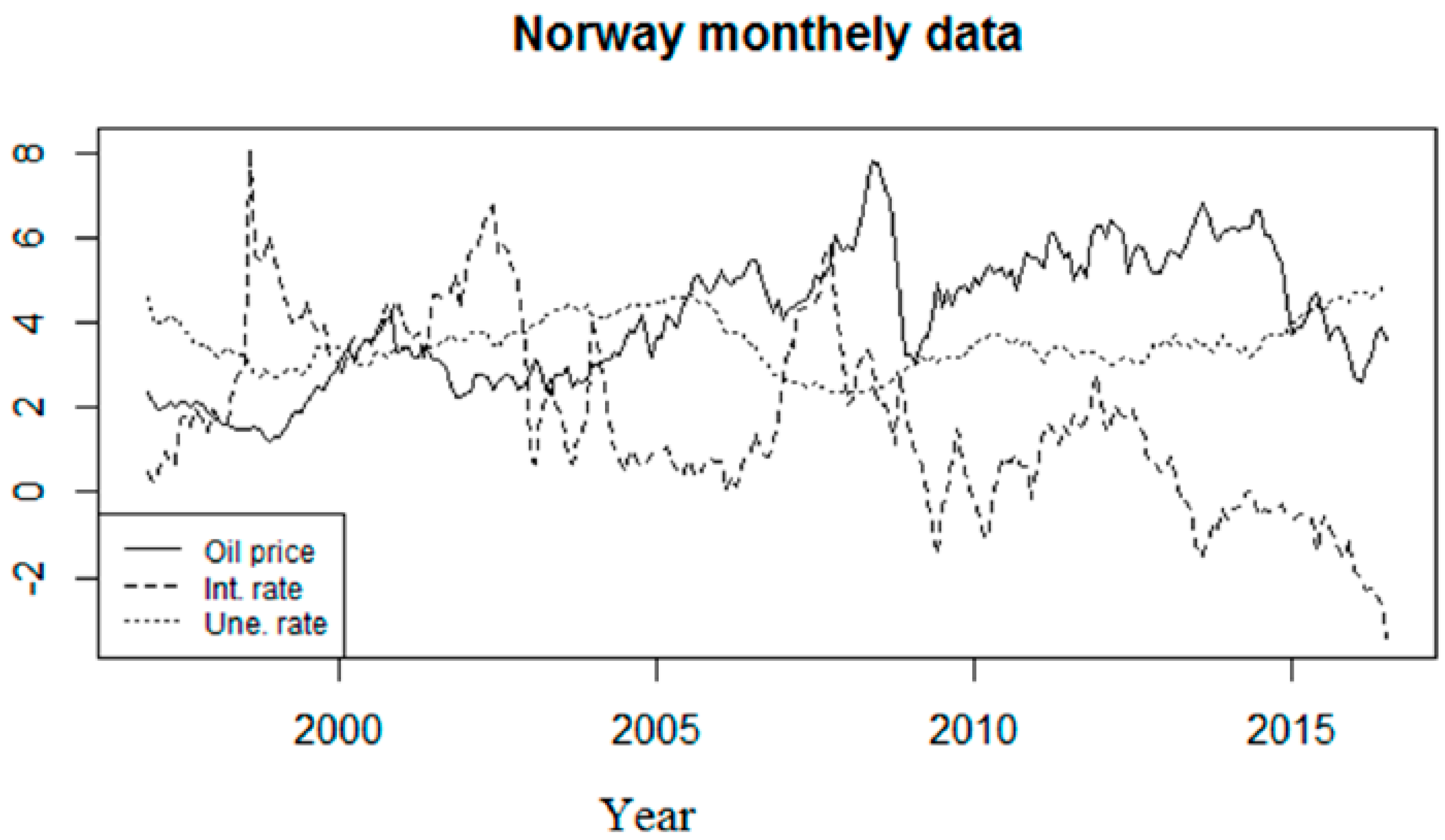

3.1. Some Stylised Facts

3.2. Methodology and Estimation Results

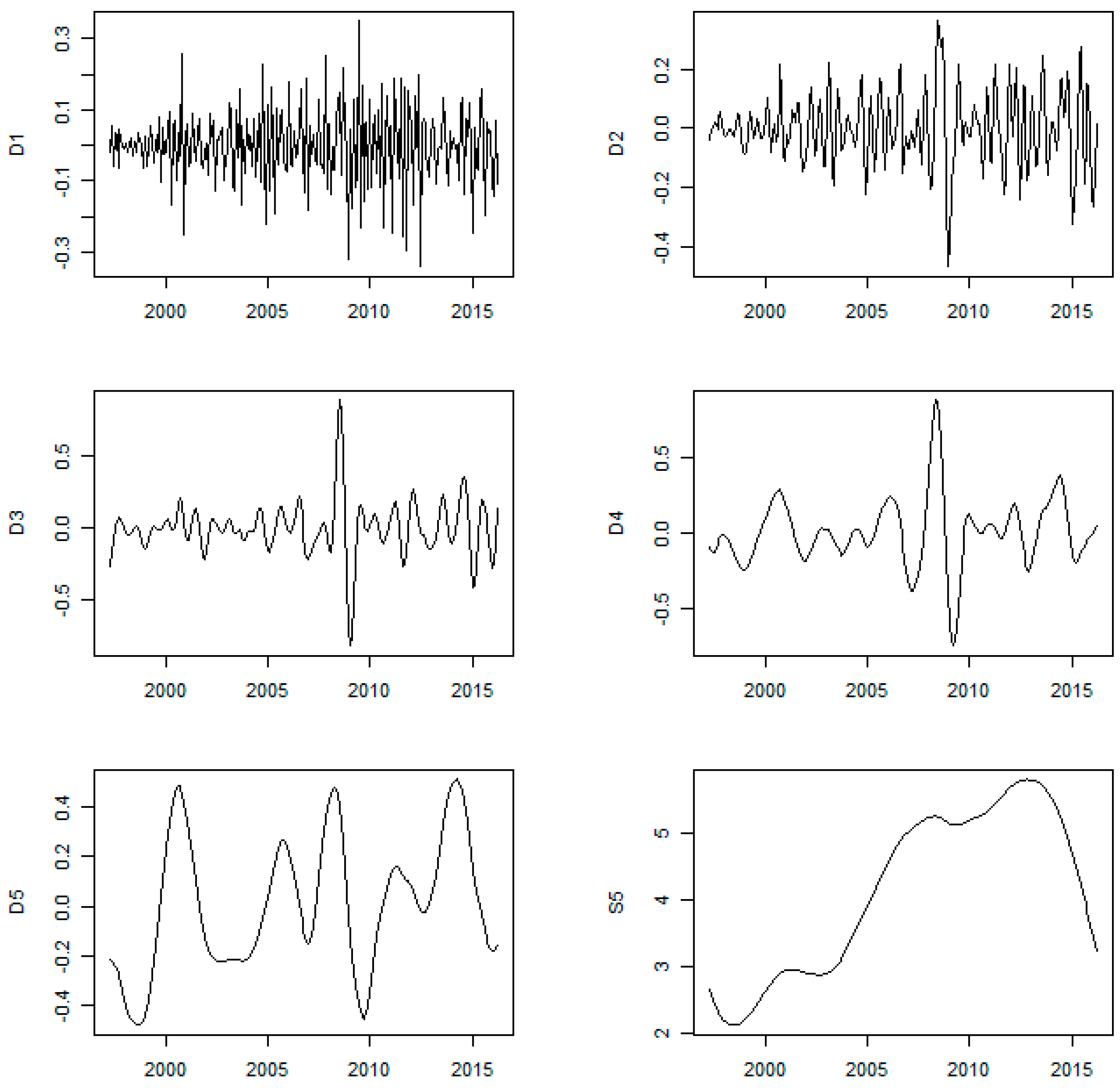

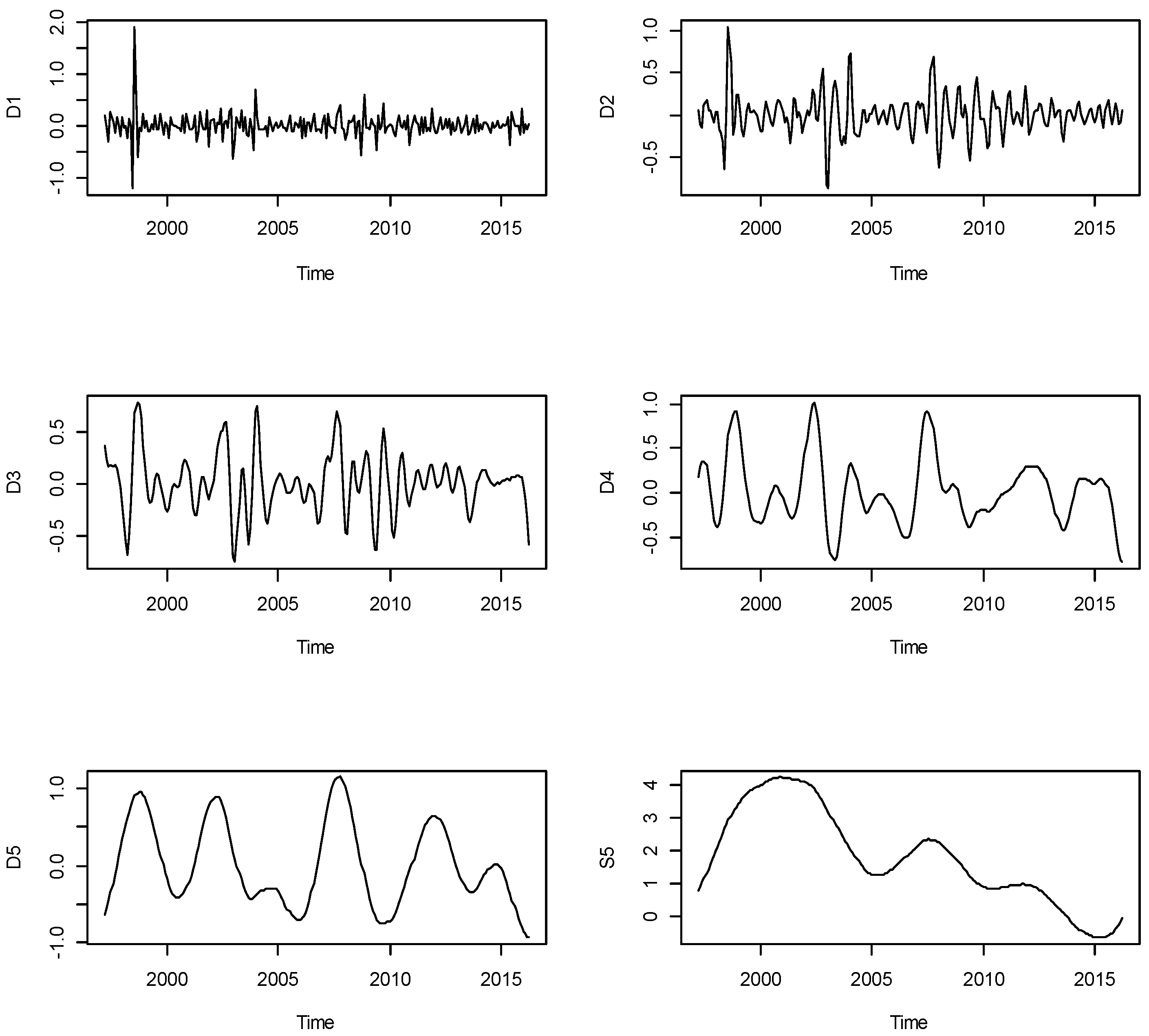

3.2.1. Wavelet Decomposition

3.2.2. Toda–Yamamoto (TY) Procedure and Granger Causality Test

- (1)

- Identify maximal order of integration d of all the series. Augmented Dickey-Fuller (ADF) unit root tests based on the procedure in Enders [34] are applied in this identification.

- (2)

- Using the three original data in levels, a vector autoregressive model (VAR) model is built. Using certain selection criteria such as final prediction error (FPE), Akaike information criterion (AIC), or Schwarz information criterion (SIC), specify a well-behaved kth optimal lag order VAR in levels (not in the difference series).

- (3)

- Diagnose the VAR model by checking residual serial correlation applying Lagrange multiplier (LM)-test and ensure that all the inverse roots of the characteristic AR polynomial must lie inside the unit circle.

- (4)

- Finally, a Wald test is conducted on the first k parameters of augmented VAR (k + d) model as follows:

4. Estimation Results

4.1. Causality Test

4.2. Impulse Response Function

5. Conclusions and Policy Implications

Author Contributions

Funding

Conflicts of Interest

References

- Carruth, A.; Hooker, M.; Oswald, A. Unemployment equilibria and input prices: Theory and evidence from the United States. Rev. Econ. Stat. 1998, 80, 621–628. [Google Scholar] [CrossRef]

- Mork, K.A. Oil and the Macroeconomy when Prices Go Up and Down: An Extension of Hamilton’s Results. J. Polit. Econ. 1989, 97, 740–744. [Google Scholar] [CrossRef]

- Kilian, L. A Comparison of the Effects of Exogenous Oil Supply Shocks on Output and Inflation in the G7 Countries. J. Eur. Econ. Assoc. 2008, 6, 78–121. [Google Scholar] [CrossRef]

- Doğrul, H.G.; Soytas, U. Relationship between oil prices, interest rate, and unemployment: Evidence from an emerging market. Energy Econ. 2010, 32, 1523–1528. [Google Scholar] [CrossRef]

- Rasche, R.H.; Tatom, J.A. Energy price shocks, aggregate supply and monetary policy: The theory and the international evidence. Carnegie Rochester Conf. Ser. Public Policy 1981, 14, 9–93. [Google Scholar] [CrossRef]

- Bruno, M.; Sachs, J. Input Price Shocks and the Slowdown in Economic Growth: The Case of U.K. Manufacturing. Rev. Econ. Stud. 1982, 49, 679–705. [Google Scholar] [CrossRef]

- Jorgenson, D.W. The Role of Energy in Productivity Growth. Energy J. 1984, 5, 11–26. [Google Scholar] [CrossRef]

- Hamilton, J.D. A Neoclassical Model of Unemployment and the Business Cycle. J. Polit. Econ. 1988, 96, 593–617. [Google Scholar] [CrossRef]

- Rotemberg, J.J.; Woodford, M. Imperfect competition and the effects of energy price increases on economic activity. J. Money Credit Bank. 1996, 28, 549–577. [Google Scholar] [CrossRef]

- Shapiro, C.; Stiglitz, J.E. Equilibrium unemployment as a worker discipline device. Am. Econ. Rev. 1984, 74, 433–444. [Google Scholar]

- Blanchard, O. Designing Labor Market Institutions, Central Banking, Analysis, and Economic Policies Book Series, 1st ed.; Jorge, R., Andrea Tokman, R., Norman, L., Klaus, S.-H., Eds.; Labor Markets and Institutions, Central Bank of Chile: Santiago, Chile, 2005; Volume 8, pp. 367–381. [Google Scholar]

- Pindyck, R.S.; Rotemberg, J.J. Dynamic factor demands and the effects of energy price shocks. Am. Econ. Rev. 1983, 73, 1066–1079. [Google Scholar]

- Kim, I.M.; Loungani, A. The role of energy in real business cycle models. J. Monet. Econ. 1992, 29, 173–189. [Google Scholar] [CrossRef]

- Atkeson, A.; Kehoe, P. Putty Clay Capital and Energy; Working Paper No. 4833; National Bureau of Economic Research: Cambridge, MA, USA, 1994. [Google Scholar]

- Burbidge, J.; Harrison, A. Testing for the Effects of Oil-Price Rises Using Vector Autoregression. Int. Econ. Rev. 1984, 25, 459–484. [Google Scholar] [CrossRef]

- Hooker, M. What happened to the oil price-macroeconomy relationship? J. Monet. Econ. 1996, 38, 195–213. [Google Scholar] [CrossRef]

- Lee, K.; Ni, S. On the Dynamic Effects of Oil Price Shocks: A Study Using Industry Level Data. J. Monet. Econ. 2002, 49, 823–852. [Google Scholar] [CrossRef]

- Ferderer, J.P. Oil Price Volatility and the Macroeconomy. J. Macroecon. 1996, 18, 1–16. [Google Scholar] [CrossRef]

- Hamilton, J.D. This is what happened to the oil price-macroeconomy relationship. J. Monet. Econ. 1996, 38, 215–222. [Google Scholar] [CrossRef]

- Hamilton, J.D. Oil and the Macroeconomy since World War II. J. Polit. Econ. 1983, 9, 228–248. [Google Scholar] [CrossRef]

- Gisser, M.; Goodwin, T.H. Crude Oil and the Macroeconomy: Tests of Some Popular Notions. J. Money Credit Bank. 1986, 18, 95–103. [Google Scholar] [CrossRef]

- Loungani, P. Oil Price Shocks and the Dispersion Hypothesis. Rev. Econ. Stat. 1986, 68, 536–539. [Google Scholar] [CrossRef]

- Davis, S.J.; Haltiwanger, J. Sectoral Job Creation and Destruction Response to Oil Price Changes. J. Monet. Econ. 2001, 48, 465–512. [Google Scholar] [CrossRef]

- Keane, M.P.; Prasad, E.S. The Employment and Wage Effects of Oil Price Changes: A Sectoral Analysis. Rev. Econ. Stat. 1996, 78, 389–399. [Google Scholar] [CrossRef]

- Uri, N.D. Crude oil price volatility and unemployment in the United States. Fuel Energy Abstr. 1996, 37, 91. [Google Scholar] [CrossRef]

- Mork, K.; Olsen, O.; Mysen, H. Macroeconomic Responses to Oil Price Increases and Decreases in Seven OECD Countries. Energy J. 1994, 15, 19–36. [Google Scholar]

- Jimenez-Rodriguez, R.; Sanchez, M. Oil price shocks and real GDP growth: Empirical evidence for some OECD countries. Appl. Econ. 2005, 37, 201–228. [Google Scholar] [CrossRef]

- Ramsey, J.B.; Lampart, C. Decomposition of Economic Relationships by Timescale Using Wavelets. Macroecon. Dyn. 1998, 2, 49–71. [Google Scholar]

- Vidakovic, B. Statistical Modelling by Wavelets; Wiley: Hoboken, NJ, USA, 1999. [Google Scholar]

- Percival, D.B.; Walden, A.T. Wavelet Methods for Time Series Analysis; Cambridge University Press: Cambridge, UK, 2006. [Google Scholar]

- Gençay, R.; Selçuk, F.; Whitcher, B. An Introduction to Wavelets and Other Filtering Methods in Finance and Economic; Academic Press: San Diego, CA, USA, 2001. [Google Scholar]

- Li, Y.; Shukur, G. Testing for unit roots in panel data using Wavelet ratio method. Comput. Econ. 2013, 41, 59–69. [Google Scholar] [CrossRef]

- Toda, H.Y.; Yamamoto, T. Statistical inference in vector autoregression with possibly integrated processes. J. Econ. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Enders, W. Applied Econometric Time Series; Wiley: Hoboken, NJ, USA, 2010. [Google Scholar]

- Haar, A. Zur Theorie der orthogonalen Funktionensysteme. Math. Ann. 1910, 69, 331–371. (In German) [Google Scholar] [CrossRef]

- Percival, D.B.; Sardy, S.; Davison, A.C. Wavestrapping time series: Adaptive Wavelet-based bootstrapping. In Nonlinear and Nonstationary Signal Processing; Fitzgerald, W.J., Smith, R.L., Walden, A.T., Young, P.C., Eds.; Cambridge University Press: Cambridge, UK, 2000; pp. 442–471. [Google Scholar]

| From | To | S5 * | D5 | D4 | D3 | D2 + D1 |

|---|---|---|---|---|---|---|

| (Interpretations of the Wavelet Scale Notations above) | ||||||

| 32 Months and Longer | 16–32 Month (4–8 Quarter) Cycle | 8–16 Month (2–4 Quarter) Cycle | 4–8 Month (Around Two Quarters) Cycle | 1–3 Month (One Quarter) Cycle | ||

| Oprice | IntR | 0.014 | 0.000 | 0.412 | 0.129 | 0.9566 |

| Oprice | UnEmp | 0.083 | 0.002 | 0.412 | 0.129 | 0.9566 |

| IntR | Oprice | 0.220 | 0.227 | 0.038 | 0.713 | 0.7745 |

| IntR | UnEmp | 0.000 | 0.111 | 0.045 | 0.713 | 0.7745 |

| UnEmp | Oprice | 0.082 | 0.977 | 0.290 | 0.310 | 0.6572 |

| UnEmp | IntR | 0.012 | 0.001 | 0.001 | 0.001 | 0.6572 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim Karlsson, H.; Li, Y.; Shukur, G. The Causal Nexus between Oil Prices, Interest Rates, and Unemployment in Norway Using Wavelet Methods. Sustainability 2018, 10, 2792. https://doi.org/10.3390/su10082792

Kim Karlsson H, Li Y, Shukur G. The Causal Nexus between Oil Prices, Interest Rates, and Unemployment in Norway Using Wavelet Methods. Sustainability. 2018; 10(8):2792. https://doi.org/10.3390/su10082792

Chicago/Turabian StyleKim Karlsson, Hyunjoo, Yushu Li, and Ghazi Shukur. 2018. "The Causal Nexus between Oil Prices, Interest Rates, and Unemployment in Norway Using Wavelet Methods" Sustainability 10, no. 8: 2792. https://doi.org/10.3390/su10082792