Abstract

Soils are under increasing utilization pressure, and soil governance is an important element to maintain soil functions and prevent the degradation of soil quality. However, scientific studies about soil governance are rare. In this paper, we focus on the governance mechanism of land rent. Here, a major theoretical assumption is that landowners have higher incentives to maintain soil quality than leaseholders. By using data for German arable land at the county level, we contrast theoretical assumptions about the relationships between landowners, leaseholders and soil quality with empirical evidence based on correlations between arable land rent prices, rent proportions and yield potential. The main finding is that the empirical data contradict the theoretical assumptions to a large degree, i.e., no clear relationship could be discerned between the three parameters of arable land soil quality, rent price and rent proportion. We discuss possible explanations for the revealed contradictions based on the state of research and highlight the need for future research to better understand the potential of arable land tenancy as a governance mechanism for sustainable soil management.

1. Introduction

A globally increasing population and a demand for biomass-based food, feed, energy and fiber is causing the intensified use of soils and requires corresponding actions of soil governance [1]. The current utilization pressure on soils might endanger their quality, i.e., their capacity to maintain their various functions and contributions to ecosystem services such as biomass production, nutrient provisioning and cycling, carbon storage, filtering and storage of clean water, providing habitats for biological activity, and climate regulation [2]. Because of this multifunctional and site-specific nature, soil quality is a complex phenomenon, for which no standardized assessment procedure yet exists [3]. Yield potential is a proxy for the inherent capacity of soil to produce biomass and is taken as an indicator for soil quality [4]. Soil degradation is a combination of processes that reduce soil quality and may thereby impede the achievement of societal targets such as those determined in the United Nation’s Sustainable Development Goals [5]. Thus, there is a quest for sustainable intensification practices for soil management, which integrates the achievement of the highest productivity levels with the maintenance of soil functions [6,7]. Consequently, sustainable soil governance requires policies and regulations that support this quest [8]. In general, soil-related governance is far less understood than the governance of other natural resources such as water, air or biodiversity [9]. In addition, there is a general knowledge gap about the linkages between soil quality, soil/agricultural management and soil governance [10]. Therefore, complementary to our empirical study, we discuss propositions for more comprehensive research activities in the field of soil quality linked to management and governance.

Soil management in Europe is regulated by governance structures at several organizational levels through different mechanisms such as obligatory or voluntary policy instruments. At the European Union (EU) level, for example, policy instruments such as the agri-environmental measures of the Common Agricultural Policy (CAP) aim to compensate farmers for income loss associated with soil conservation management practices [11,12,13]. However, the proposal for a legally stronger binding Soil Framework Directive for the EU was rejected because some member states feared high costs for its implementation [14]. Thus, there is currently no European legislation that focuses exclusively on legally binding soil conservation regulations. At the national level, the German Federal Soil Protection Act aims to secure soil fertility [15]. However, similar to the agri-environmental measures of the CAP, most of the sustainable land use and soil conservation measures refrain from obligatory policy instruments and only apply incentive-based and awareness-raising instruments. Incentive-based and awareness-raising instruments aim to encourage farmers to implement additional soil protection measures on a voluntary basis [16,17]. For example, additional soil protection measures include the integration of additional crops that have the potential to improve soil quality through their root system, into the rotation scheme.

Farmers are assumed to have intrinsic reasons to protect soil quality because it secures their benefits arising from soil use. However, such an assumption might not be warranted when looking at the manifold forms of ownership and use rights on agricultural land that is often regulated through tenancy as a form of governance mechanism between private individuals. For example, leaseholders might have much less incentives to protect soils than landowners because the former may expect to stop using the land in the near future and thus aim for benefit maximization at the expense of soil quality. In this case, landowners have the opportunity to prevent such behavior by fixing obligatory soil protection measures in lease contracts that in turn might reduce rent prices to compensate for investments in soil quality [18]. Thus, property rights and tenure systems play a crucial role in the efficiency of soil protection governance. Germany, with a comparatively high land proportion of approximately 60% [19,20], is a prime location for investigating landowner and tenure relationships as governance mechanisms. Furthermore, Germany has a highly technologized agricultural system and faces demands for the highest level of productivity while preventing soil degradation. In this context, we focus on arable soils because soil degradation is more of a key issue here in contrast to, e.g., grassland.

Our objective is to investigate the influence of tenancy as a soil governance mechanism on soil quality by examining the relationship between landowners and leaseholders based on contrasting theoretical assumptions with empirical analysis, i.e., correlations between arable land rent prices, rent proportions and yield potential, the latter being used as an indicator for soil quality [4].

2. Theory of Land Price, Tenure and Soil Quality

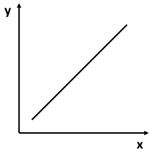

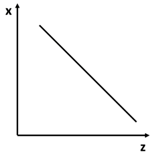

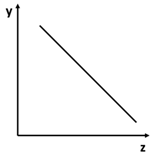

Major theoretical assumptions about soil governance and economic behavior of farmers are rooted in the theory of rent by Ricardo [21] and in owner-tenant-relationships hypotheses [22,23]. We explain these theoretical assumptions from the perspective of soil governance through tenancy and connect them to the analytical dimensions of yield potential, rent price, and rent proportion (Table 1). Yield potential is used as an indicator for soil quality and represents the production function of soils [4] (compare Section 3). Yield potential estimates for arable land in Germany are available through the German Federal Institute for Geosciences and Natural Resources [24]. The arable land rent price represents the monetary value of arable land benefiting landowners in return for making assets available to a leaseholder. Leaseholders aim to exceed the costs for the rented land by agricultural production. Arable land rent proportion represents the rate of land leased to tenants in contrast to arable land being under ownership.

Table 1.

Theoretical relationships between arable land yield potential, rent price, and rent proportion.

The theoretical background characterizing the relationship between arable land yield potential, rent price and rent proportion is as follows. First, following Ricardo [21], the rent for arable land arises because of the fertility of the soils that determines the productivity of the land. The difference between superior and inferior soils determine the rent price. Although subsequent researchers based the determination of rent prices on different underlying assumptions [25,26], the support for neoclassical rent theory is still strong and influences the scientific debate [27,28]. For example, farmland values are determined by expected returns that are demonstrated via land rents [29]. In addition, rent price formation is a complex process and depends on many factors. For example, rent is defined in standardized land values (taking into account productivity characteristics, soil characteristics, size, location, cultivation opportunities) or the demand and supply ratio of land, environmental factors, the presence of investors or governmental regulations influencing rent market processes and prices [30]. Since our research interest focuses on tenancy, the major theoretical assumptions would be that the higher the yield potential of soils, the higher the rent price because tenants or leaseholders can generate higher-quality products and returns from soils that exhibit a higher quality based on well-performing soil functions (Table 1A).

Second, the relationship between landowner and tenant is mainly described on the basis of classical-economic profit maximization approaches [31]. A number of studies have identified soil management differences between landowner and leaseholder [32,33,34]. The following perception prevails: land managed by its owner, who aims to secure high sale and option values of his property, is used in a more sustainable way compared to land tenure, where incentives are set up to invest in short-term production and less in long-term sustainable management strategy. It is often concluded that such a behavior is the consequence of insecure land tenure [17,35,36]. With the increasing trend of land tenure operations on farms in Europe, the problem of land tenure insecurity will remain, causing a decrease in the application of soil conservation measures [17,33,37]. From the perspective of soil management, this would mean that the higher the rent proportion (more land is managed by leaseholders), the lower the yield potential because leaseholders have lower incentives than landowners to invest in soils. This again would result in lower yields (Table 1B). This assumption needs to consider a dynamic relationship because the effect of leaseholder management on yield potential is time delayed.

Third, we apply a simple “supply and demand” assumption to assess the relationship between rent price and rent proportion. Within the natural limitations of a given amount of land, the relationship between rent price and rent proportion depends on a number of factors. For example, demographic, economic, regulatory and technological drivers influence the availability of land that is for rent and therefore influence the degree of rent proportion [27,38]. From the perspective of classic economic theory, the availability of land (e.g., scarcity or abundance) influences the rent price [21]. Thus, we assume that the lower the amount of land available for rent (rent proportion) is, the higher the rent price because leaseholders compete for renting land. In addition, the assumption that land leaseholders have lower incentives to apply soil-protecting measures than land owners would imply that a high rent proportion might result in an overall decrease in soil quality (Table 1C).

3. Materials and Methods

In this paper, we used data about arable land yield potential, arable land rent proportion and arable land rent price as indicators for soil quality and soil governance through tenancy agreements to test the abovementioned theoretical assumptions. We used the yield potential estimates for arable land in Germany of the German Federal Institute for Geosciences and Natural Resources [24]. They are based on the Müncheberger Soil Quality Rating (MSQR), which is a visual procedure for yield potential estimation, taking soil structure and soil degradation threats into account [4]. It integrates eight basic soil indicators with 13 hazard indicators into a rating of soil quality on an ordinal scale of 0 to 102, with higher values indicating higher yield potential. The eight soil indicators are: Substrate, A-horizon depth, topsoil structure, subsoil structure, rooting depth, profile available water, wetness and ponding, slope, and relief. The 13 hazard indicators are: Contamination, salinization, sodification, acidification, low total nutrient status, shallow soil depth above hard rock, drought, flooding and extreme waterlogging, steep slope, rock and surface, high percentage of coarse texture fragments, unsuitable soil thermal regime, and miscellaneous hazards (e.g., exposure to wind and water erosion) [4]. The procedure is an up-to-date, internationally acknowledged and applied method to assess soil quality [3]. Because of its focus on soil structure and soil degradation characteristics, most (albeit not all) of the indicators are sensitive to improper agricultural soil management, which makes it particularly useful for the scope of this study. Overall, the MSQR compiles parameters on a uniform basis that can be spatially processed. We combined the yield potential data with arable land rent price and rent proportion data. The source of both data sets is the German Statistical Agency of the Federal States, which provided German-wide data from the Agricultural Census in 2010 [20]. In Germany, the rent prices and the rent proportion rate increased constantly during the last decades, with significant differences between East Germany (former GDR) and West Germany (former BRD) [19,20]. Because of this situation, we analyzed the data for Germany in total as well as for East and West Germany separately. For all three indicators, we were able to access data on a uniform basis at the county level and therefore focus our empirical analysis at this level.

3.1. Data Acquisition: Arable Land Rent Proportion, Rent Price and Yield Potential

The most relevant source for data on arable land rent proportion and arable land rent price is the Agricultural Census for Germany from 2010. It comprises data from the main Land Use Survey, the Survey on Agricultural Production Methods, and the Agricultural Structure Survey. It is commonly used for German and EU administrative purposes at different political and administrative levels and includes data with spatial information on Federal State-level, NUTS2- and NUTS3-level (the abbreviation NUTS is explained in the next paragraph) per farm operating business (according to a threshold of 5 ha or more and based on the locality of the operating business). The Agricultural Census comprises (based on uniform table formats) data on land use, livestock, labor forces, acquisition of agricultural production methods and “further survey characteristics” that constitute the legal form, place of farm operating business, owner and tenancy information, land under tenure and rent prices for arable land [18]. Comparisons with previous Agricultural Census data are difficult because of changes in data collection processes and definitions such as the size of farm operating business considered in the statistics [20].

For the purpose of this analysis, the smallest but nation-wide uniformly assessed spatial unit for Germany is the statistical unit NUTS-3 (county level). The “Nomenclature des Unités territoriales statistiques—NUTS” represents statistical regions within the EU and facilitates the supranational statistical comparison of such regions. NUTS-3 regions represent the statistically (based on the population) smallest regions. In Germany, NUTS-3 regions represent counties and corporate cities and number 402 in total [39,40]. To ensure a nation-wide uniform analysis of data based on the Agricultural Census from 2010, data were requested from the Statistical Agency of Germany. Statistical data from all federal states of Germany were requested with a response rate of 15 out of 16 (federal state statistical offices). After a data preparation and cleansing process, 389 out of 402 NUTS-3 regions were used for further analysis. In addition to four corporate city regions, the data for six NUTS-3 regions from one federal state were not available. For the purpose of our analysis, data on arable land rent proportion at the NUTS-3-level could not be derived directly from the acquisition, but data on rent prices could be derived directly for NUTS-3 regions.

Aside from the statistical data sources used to assess arable land rent proportion and arable land rent price, spatial data on the arable land yield potential was assessed with the aim to visualize the linkage and spatial distribution of those three variables. Here, two basic types of spatial datasets form the basis for the visualization, shapefiles and a raster dataset. The shapefiles mostly represent administrative borders. The raster dataset comprises data on arable land yield potential that is available for arable land in Germany at a scale of 1:1,000,000 (BÜK 1000) [24,41].

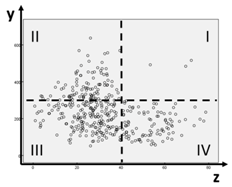

The arable land rent price as well as the arable land rent proportion were calculated and visualized for NUTS-3 regions, which reflects the highest spatial resolution that can be acquired at the national scale for these data. Rent proportion and rent price data were not normally distributed and thus were classified for the spatial visualization based on Jenks (natural breaks), which is a common and suggested method given an uneven distribution (Figure 1a,b). The method orientates itself on natural data gaps and classifies the data in such a way that variations within classes are as low as possible while differences between classes are as large as possible [42]. For arable land yield potential, the mean value has been visualized for NUTS-3 regions. Heterogeneities within those regions can therefore not be visualized. Figure 1c represents the frequency distribution and the breaks within the arable land yield potential data based on the classification of the BGR [24] (Table 2), reflecting heterogeneities among the raster data set of almost 2 million points for Germany.

Figure 1.

Frequency distribution of arable land rent prices (a), rent proportion (b) and yield potential (c).

Table 2.

Classification of the agricultural yield potential ratings according to the BGR [24].

3.2. Data Calculation and Visulization: Arable Land Rent Proportion, Rent Price and Yield Potential

The arable land rent proportion was determined by the share of rented arable land out of the total arable land (in %) at the county level (=NUTS-3 regions) from the Agricultural Census of 2010. Arable land rent prices were directly taken from the Agricultural Census for NUTS-3 regions. The calculated values for arable land rent proportion and rent prices as well as the average arable land yield potential for NUTS-3 regions were correlated with each other. The three variables were tested for normality in their distribution using the “Kolmogorov-Smirnov-Test”, and the Spearman rank correlation rs was chosen as none of the variables are normally distributed (Figure 1a–c). In this method, the correlations are based on the rank of the values that are ranked beforehand [43]. The scatter plots provide a visual representation of the characteristics of the cases and support the identification of patterns and the description of correlations. They are not intended as an analysis in inferential statistical terms.

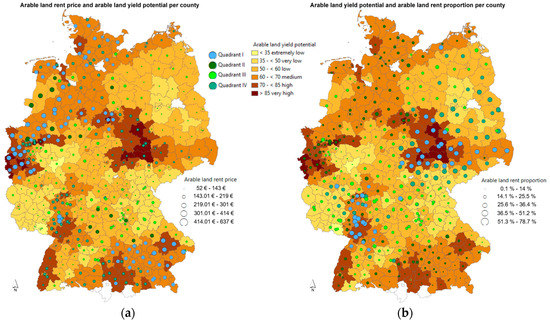

For the visualization of the data in a spatial map, the raster dataset was transformed into a vector dataset. The vector dataset allows for the attachment of the NUTS-3 information on arable land rent proportion, rent prices for arable land, and the average (mean) value for the arable land yield potential. The classification of the arable land yield potential (Table 2) guides the map of arable land yield potential of German soils by the BGR [24] (Figure 5).

During data processing, data for some NUTS-3 regions were removed and therefore do not appear in the map nor were they considered for the statistical analysis. The data set used therefore only includes data comprising information on arable land rent proportion and price. Where the arable land yield potential is not visualized (Figure 5), no arable land is determined by the MSQR. In these cases, the dominant land use type might be, for example, grassland.

4. Results

We have structured the results into three parts that describe the empirical findings of the relationships between the three variables, namely, the arable land rent price, arable land proportion and arable land yield potential. For each relationship, we interpret the results from the perspective of the theoretical assumptions presented in Section 2.

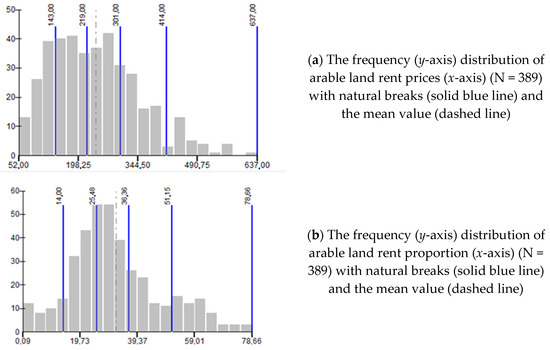

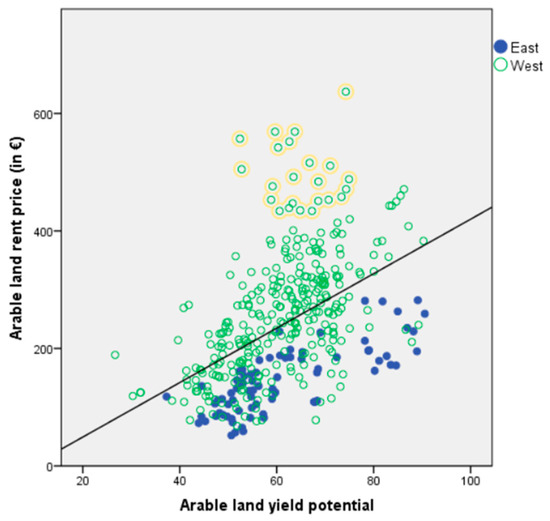

4.1. Arable Land Yield Potential and Rent Price

There is a weak positive correlation between arable land yield potential and rent price in Germany (rs 0.235, Figure 2). This result supports the theoretical assumption only to a limited degree. A group of 23 cases (marked yellow in Figure 2) with rent prices between 400 and 600 € (aggregated at county level in 2010) has a solid effect on the weak correlation (rs excluding these cases: 0.303, N = 366). These outliers are counties located in the northwestern part of Germany on the border with The Netherlands (compare the map in Figure 5). These counties have a high density of livestock that increases the application of large amounts of farm manure. This group of outliers appears in the West German data points potentially explaining the correlation of rs 0.274 in an otherwise quite evenly spread data cloud. In contrast to West Germany, East Germany shows a stronger correlation (rs 0.585) that again concurs strongly with the theoretical assumption that high yield potential causes high rent prices. We discuss possible explanations for the limited agreement of empirical findings with the theoretical predictions between arable land yield potential and rent prices below in Section 5.1.

Figure 2.

Correlation of arable land rent prices and yield potential in counties within Germany (N = 389); West Germany (N = 311); East Germany (N = 78).

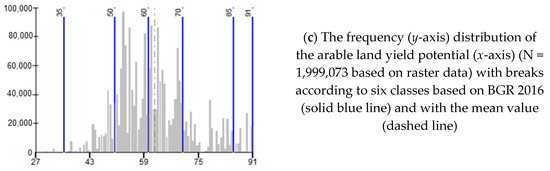

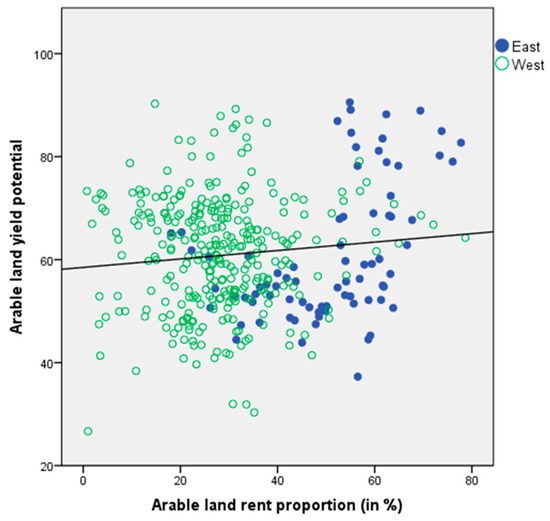

4.2. Arable Land Yield Potential and Rent Proportion

There is no correlation between arable land yield potential and rent proportion in Germany (rs 0.012, Figure 3). The scatter plot shows an evenly spread data cloud without clear groups of outliers. This also applies to the data from West Germany (rs 0.002). In contrast to West Germany, East Germany shows a weak correlation (rs 0.211). While the West German data show indifferent results, the East German data slightly contradict the theoretical assumption that high values of rent proportion cause a decrease in soil quality and yield potential. We discuss the possible reasons for the mismatch between the theoretical assumptions and empirical findings of the relationship between rent proportion and yield potential below in Section 5.2.

Figure 3.

Correlation of arable land rent proportion and yield potential in counties within Germany (N = 389); West Germany (N = 311); East Germany (N = 78).

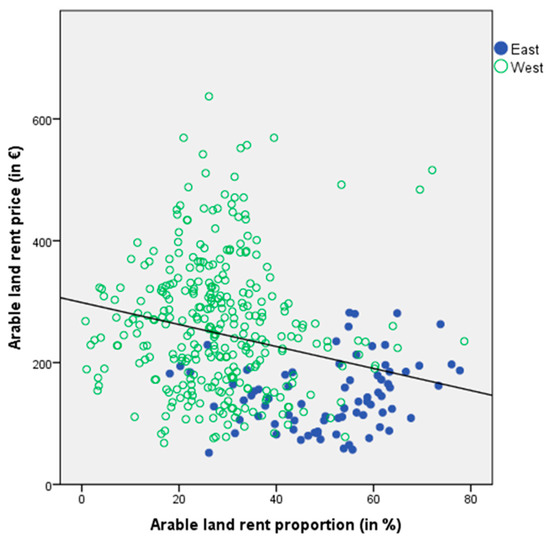

4.3. Arable Land Rent Proportion and Rent Prices

There is a very weak correlation between the arable land rent price and rent proportion in Germany (rs 0.065, Figure 4). The scatter plot shows an evenly spread data cloud. The data make an even stronger case for the different degrees of correlations for West Germany (rs 0.001) and East Germany (rs 0.038). In all cases, we see no strong empirical evidence supporting the theoretical assumption that a high level of rent proportion decreases the rent price. We discuss possible explanations for the limited agreement between empirical findings and the theoretical predictions of arable land rent prices and rent proportion below in Section 5.3.

Figure 4.

Correlation of arable land rent proportion and rent prices in counties within Germany (N = 389); West Germany (N = 311); East Germany (N = 78).

5. Discussion

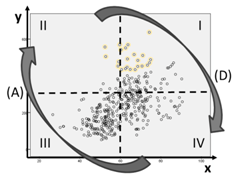

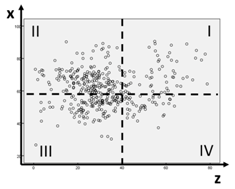

We have divided the XY diagrams of all three combinations of arable land rent price, rent proportion and yield potential into four quadrants in order to more easily discuss possible explanations to the empirical findings (Table 3) and connect them to the spatial visualization of all three variables at the end of the discussion (Figure 5).

Table 3.

XY diagrams of the relationships between arable land yield potential, rent prices, and rent proportion divided in four quadrants.

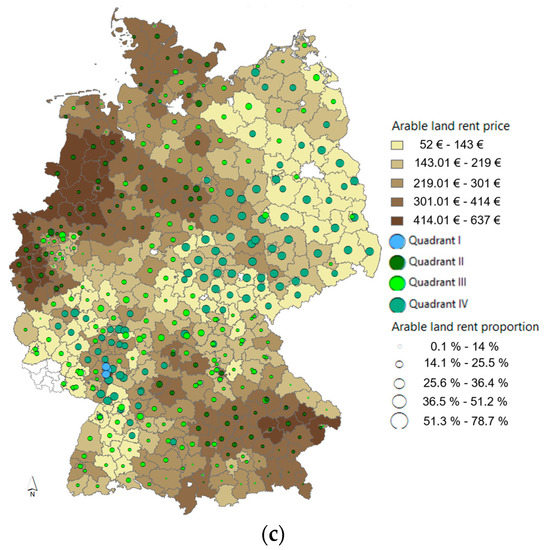

Figure 5.

Maps of arable land rent prices and yield potential (a), arable land rent proportion and yield potential (b), and arable land rent proportion and rent price (c). Quadrants I-IV refer to Table 3. Rent prices and rent proportion are aggregated data for the year 2010. Yield potential is represented on an ordinal scale between 0 and 102 (see Chapter 3 for details).

5.1. Arable Land Yield Potental and Rent Price

Table 3A visualizes the relationship between arable land yield potential and rent price. The quadrants I and III represent theoretically expected relationships: arable lands with high yield potential have high rent prices (I), and arable lands with low yield potential have low rent prices (III). Quadrants II and IV represent relationships that are contrary to the theory: arable land with low yield potential have high rent prices (II), and arable land with high yield potential have low rent prices (IV). The empirical analysis revealed a weak positive correlation between yield potential and rent price (rs 0.235). Given the complex process of rent price formation, as indicated in the introduction, a number of possible explanations exist. Other than soil- and yield potential-related factors, the rent price is influenced by availability of land, distance to markets, compensation area for the application of farm manure, cultivation opportunities or competition on land markets [30,44] or non-agricultural attributes such as natural amenities [45]. A further potential explanation could be governmental interventions such as agricultural subsidies [46]. Focusing on the relationship between landowner and tenant, low rent prices for arable land with high yield potential might internalize costs for measures aimed at maintaining or increasing soil quality, e.g., fixed in lease contracts. However, there exists a research gap with respect to the relationship between tenancy agreements and soil governance mechanism. Viewing the relationship between both indicators, the theoretical assumption focuses on how the yield potential of arable land affects rent prices (A). However, the rent price might also explain the degree of yield potential (D) because low rent prices internalizing costly soil protection measures according to lease contract conditions increases the soil quality and, thus, the yield potential.

5.2. Arable Land Yield Potential and Rent Proportion

Table 3B visualizes the relationship between arable land rent proportion and yield potential. Quadrants II and IV represent the theoretically expected relationships: a low rent proportion exists on arable lands with high yield potential (II), and a high rent proportion exists on arable lands with low yield potential (IV). We observed a smaller number of cases present in Quadrant IV. A reason could be that non-productive arable land is not economically worthwhile for leaseholders [27]. The leaseholders’ influence on soil quality in such cases is therefore restricted. Quadrants I and III represent cases that are contrary to the theory: a low rent proportion exists on arable land with low yield potential (III), and a high rent proportion exists on arable land with high yield potential (I). The empirical analysis revealed no correlation and many cases deviated from the theoretical assumptions stated about the relationship between arable land proportion and yield potential. Quadrant III represents a large number of cases where arable land with lower yield potential is not rented out to leaseholders. Similar to the situation in Quadrant IV, a reason could be that non-productive arable land is economically worthless to leaseholders and thus tend to be operated by landowners. Furthermore, the quality of soils and their productivity varies naturally regardless of the influence of owner or tenant operations. The data reveal no differentiation between the original soil quality status and the observed soil degradation process in determining the yield potential. It should be noted that the yield potential is averaged per county.

Possible explanations for cases in Quadrant I are rather intricate. First, many cases are East German counties, where before unification, cooperatives collectively managed arable land and large areas of arable land were state-owned. For more than 20 years, a privatization agency, i.e., the Land Utilization and Administration Company (BVVG), has been steadily selling areas of formerly state-owned arable land in East Germany on behalf of the German Federal Ministry of Finance, and this activity significantly affects the price formation in agricultural land markets [47]. Moreover, before contracts of sales are finally concluded, the arable land is leased out to tenants and, thus, explains the higher level of rent proportion in East Germany [19]. In addition, the farm size in East Germany is relatively large, and the larger the farm size is, the higher the rent proportion of arable land [48]. Second, the characteristics of soils might explain cases with high rent proportion and high yield potential. Soil resilience is the capacity of soils to cope with disturbances and to prevent significant changes in their functions [49]. This capacity maintains the soil’s functional integrity until a particular tipping point or threshold is reached, which would then start a process of degradation. The time factor is crucial here because leaseholders can manage soils in an unsustainable way for some time until degradation and lower yields occur. Thus, arable soils usually have a high ecological resilience and can buffer impacts of tillage, harvest, agro-chemical applications before decrease of soil functional performance is detectable [49]. Third, the design of lease contracts might influence the way that leaseholders manage their soils. For example, a fixation of soil protection measures in tenancy agreements, enforced by landowners, might explain why arable land with high rent proportion have high yield potentials. Furthermore, a high level of rent security, i.e., long-term lease contracts or preferential lease rights, for leaseholders provide incentives for sustainable management of soils. A legally binding minimum term length, however, is not established in Germany [33]. Thus, establishing rent security is left to the contracting parties, where landowners have a high decision-making power in most cases. From the perspective of tenancy agreements, we call for further research about (a) the influence of the form of ownership on soil resilience over time, which should be directly connected to (b) the degree of detailed fixation of soil protection measures and rent security in lease contracts.

5.3. Arable Land Rent Proportion and Rent Price

Table 3C visualizes the relationship between arable land rent proportion and rent price. Quadrants II and IV represent theoretically expected relationships: a low rent proportion of arable lands is linked to high rent prices (II), and a high rent proportion of arable lands is linked to low rent prices (IV). Quadrants I and III are contrary to the theory: a low rent proportion coincides with low rent price (III), and high rent proportion coincides with high rent prices (I). Our empirical analysis revealed a very weak to no correlation. Although the almost empty quadrant I supports the theoretical assumptions, a high number of cases in Quadrant III deviate from the theory about the relationship between arable land rent proportion and rent price. The three cases in Quadrant I represent very specific urban-type counties with low levels of arable land. Possible explanations for the high number of cases in Quadrant III are a low demand for or supply of leased arable land [27]. Additionally, the abovementioned explanations of rent price fixation or internalized costs of soil protection or other issues in lease contracts might determine the correlation between low rent proportion and rent price. Another reason might be the isolated location of arable lands in counties with large areas of forests or mountainous regions that decrease the value of arable land for potential leaseholders, thereby enhancing farm operation by landowners. From the perspective of tenancy agreements, central research gaps concur with the abovementioned research needs, i.e., to clarify the details in the fixation of soil protection measures in lease contracts and its influence on rent price formation [50]. This is of crucial relevance for agricultural systems with high arable land rent proportions, such as those in Germany.

6. Conclusions

The empirical analysis of arable land rent prices, rent proportion and yield potential reveals limited compliance and, in many cases, noncompliance of data with theory. This is due to a complex set of explanatory factors influencing rent price formation processes, the degree of rent proportion, and soil quality. From the perspective of tenancy as a governance mechanism, we suggest that an analysis of the particular designs of soil management measures incorporated in lease contracts in conjunction with the degree of soil quality would help to identify particular governance instruments for sustainable soil management. For example, rent security and preferential rights for new lease contracts are instruments that provide incentives for tenants to invest in soil conservation. Other crucial factors for such an analysis are the particular characteristics of soils that change over time and their capacity to resist disturbances by soil management measures over a particular timeframe (ecological resilience). For example, identifying the tipping points between different degrees of soil quality with respect to particular soil management practices would help to improve the design of precautionary measures in lease contracts. Furthermore, the effects of particular soil conservation designs in tenancy agreements on rent price development and the degree of rent proportion could be the subject of future research. For example, we propose investigating the internalization of soil conservation costs in rent prices. In addition, in this study, yield potential data were aggregated to county level and spatial heterogeneity within the county area was not accounted for. In heterogeneous landscapes, this confines the explanatory power for an assessment of specific relationships between land rent characteristics and soil quality. Nevertheless, the county-level analysis in this paper serves to identify the divergent and complementary cases for further detailed analysis of complex landowner and leaseholder relationships and their influence on the protection of soil quality. This could be the starting point for urgently needed research on tenancy as a soil governance mechanism or tool to enhance soil management towards sustainability.

Author Contributions

All authors contributed substantially to the work reported. K.H. and K.D. conceived and designed the study; N.L. collected and analyzed the data. K.D., K.H. and N.L. interpreted the data. K.D. and N.L. wrote the manuscript. K.H. revised the manuscript.

Funding

This research and the open access publication costs was funded by the German Federal Ministry of Education and Research (BMBF) in the framework of the funding measure “Soil as a Sustainable Resource for the Bioeconomy—BonaRes”, project “BonaRes (Module B): BonaRes Centre for Soil Research, subproject B” (grant number 031A608B).

Acknowledgments

The authors thank Kevin Urbasch (Leibniz Centre for Agricultural Landscape Research e.V., Müncheberg) for his support in data analysis and visualization. The German Statistical Agency of the Federal States of Brandenburg and Berlin and the Leibniz Centre for Agricultural Landscape Research e.V., Müncheberg kindly provided the data. The authors also thank two reviewers for their valuable comments on an earlier version of this manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Schulte, R.; Creamer, R.; Donnellan, T.; Farrelly, N.; Fealy, R.; O’Donoghue, C.; O’Huallachain, D. Functional land management: A framework for managing soil-based ecosystem services for the sustainable intensification of agriculture. Environ. Sci. Policy 2014, 38, 45–58. [Google Scholar] [CrossRef]

- Schwilch, G.; Bernet, L.; Fleskens, L.; Giannakis, E.; Leventon, J.; Maranon, T.; Mills, J.; Short, C.; Stolte, J.; Delden, H.; et al. Operationalizing ecosystem services for the mitigation of soil threats: A proposed framework. Ecol. Indic. 2016, 67, 586–597. [Google Scholar] [CrossRef] [Green Version]

- Bünemann, E.K.; Bongiorno, G.; Bai, Z.; Creamer, R.E.; De Deyn, G.; de Goede, R.; Fleskens, L.; Geissen, V.; Kuyper, T.W.; Mäder, P.; et al. Soil quality—A critical review. Soil Biol. Biochem. 2018, 120, 105–125. [Google Scholar] [CrossRef]

- Mueller, L.; Schindler, U.; Mirschel, W.; Shepherd, T.G.; Ball, B.C.; Helming, K.; Rogasik, J.; Eulenstein, F.; Wiggering, H. Assessing the productivity functions of soils—A review. Agron. Sustain. Dev. 2010, 30, 601–614. [Google Scholar] [CrossRef]

- Keesstra, S.D.; Bouma, J.; Wallinga, J.; Tittonell, P.; Smith, P.; Cerdà, A.; Montanarella, L.; Quinton, J.N.; Pachepsky, Y.; van der Putten, W.H.; et al. The significance of soils and soil science towards realization of the United Nations Sustainable Development Goals. SOIL 2016, 2, 111–128. [Google Scholar] [CrossRef] [Green Version]

- Garnett, T.; Appleby, M.C.; Balmford, A.; Bateman, I.J.; Benton, T.G.; Bloomer, P.; Burlingame, B.; Dawkins, M.; Dolan, L.; Fraser, D.; et al. Sustainable Intensification in Agriculture: Premises and Policies. Science 2013, 341, 33–34. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Rockström, J.; Williams, J.; Daily, G.; Noble, A.; Matthews, N.; Gordon, L.; Wetterstrand, H.; DeClerck, F.; Shah, M.; Steduto, P.; et al. Sustainable intensification of agriculture for human prosperity and global sustainability. Ambio 2017, 46, 4–17. [Google Scholar] [CrossRef] [PubMed]

- Weigelt, J.; Müller, A.; Janetschek, H.; Töpfer, K. Land and soil governance towards a transformational post-2015 Development Agenda: An overview. Curr. Opin. Environ. Sustain. 2015, 15, 57–65. [Google Scholar] [CrossRef]

- Jurges, N.; Hansjürgens, B. Soil governance in the transition towards a sustainable bioeconomy—A review. J. Clean. Prod. 2018, 170, 1628–1639. [Google Scholar] [CrossRef]

- Helming, K.; Daedlow, K.; Paul, C.; Techen, A.; Bartke, S.; Bartkowski, B.; Kaiser, D.B.; Wollschläger, U.; Vogel, H.-J. Managing soil functions for a sustainable bioeconomy—Assessment framework and state of the art. Land Degrad. Dev. 2018, 1–15. [Google Scholar] [CrossRef]

- Brunotte, J.; Schmidt, W.; Brandhuber, R.; Bach, M.; Honecker, H.; Bug, J.; Ebach, C.; Schrader, S.; Weyer, T.; Vorderbrügge, T. Gute Fachliche Praxis—Bodenbewirtschaftung und Bodenschutz; Aid Infodienst Ernährung, Landwirtschaft: Verbraucherschutz, Germany, 2013; p. 116. ISBN 10 3830810555. [Google Scholar]

- Paleari, S. Is the European Union protecting soil? A critical analysis of Community environmental policy and law. Land Use Policy 2017, 64, 163–173. [Google Scholar] [CrossRef]

- Vrebos, D.; Bampa, F.; Creamer, R.E.; Gardi, C.; Ghaley, B.B.; Jones, A.; Rutgers, M.; Sanden, T.; Staes, J.; Meire, P. The impact of policy instruments on soil multifunctionality in the European Union. Sustainability 2017, 9, 407. [Google Scholar] [CrossRef]

- Glæsner, N.; Helming, K.; de Vries, W. Do current European policies prevent soil threats and support soil functions? Sustainability 2014, 6, 9538–9563. [Google Scholar] [CrossRef]

- Severin, K. Bodenfruchtbarkeit sichern. In B&B Agrar Die Zeitschrift für Bildung und Beratung; Federal Ministry of Food and Agriculture Germany: Bonn, Germany, 2015; Volume 4, pp. 12–13. [Google Scholar]

- Haber, W.; Brückmann, W. Nachhaltiges Landmanagement, Differenzierte Landnutzung und Klimaschutz. Kurzfassung für Entscheidungsträger; Universitätsverlag der TU Berlin: Berlin, Germany, 2013; p. 54. [Google Scholar]

- Sklenicka, P. Classification of farmland ownership fragmentation as a cause of land degradation: A review on typology, consequences, and remedies. Land Use Policy 2016, 57, 694–701. [Google Scholar] [CrossRef]

- Davis, I. How landlords are getting down to earth. Farmers Weekly 2016, 165, 20–22. [Google Scholar]

- Habermann, H.; Ernst, C. Entwicklungen und Bestimmungsgründe der Landpachtpreise in Deutschland. In Berichte über Landwirtschaft, Zeitschrift für Agrarpolitik und Landwirtschaft; Federal Ministry of Food, Agriculture and Consumer Protection Germany (pub.), Kohlhammer Verlag: Stuttgart, Germany, 2010; Volume 88, pp. 57–83. [Google Scholar]

- Destatis (German Federal Statistical Office). Land- und Forstwirtschaft, Fischerei. In Eigentums- und Pachtverhältnisse Landwirtschaftszählung 2010; Destatis: Wiesbaden, Germany, 2011; p. 125. [Google Scholar]

- Ricardo, D. On the Principles of Political Economy and Taxation, 3rd ed.; John Murray: London, UK, 1821. [Google Scholar]

- Nowak, P.J.; Korsching, P.F. Social and institutional factors affecting the adoption and maintenance of agricultural BMPs. In Agricultural Management and Water Quality, 1st ed.; Schaller, F.W., Bailey, G.W., Eds.; Iowa State University Press: Ames, IA, USA, 1983; pp. 349–373. [Google Scholar]

- Schertz, L.; Wunderlich, G. The structure of farming and landownership in the future: Implications for soil conservation. In Soil Conservation Policies, Institutions, and Incentives; Halcrow, H., Heady, E., Cotner, M., Eds.; North Central Research Committee lll, Natural Resource Use and Environmental Policy by the Soil Conservation Society of America: Ankeny, IA, USA, 1982. [Google Scholar]

- BGR (Bundesanstalt für Geowissenschaften und Rohstoffe). Ackerbauliches Ertragspotential der Böden in Deutschland. Bewertet nach dem Müncheberger Soil Quality Rating—Final Rating (1:1.000.000) auf Basis der BÜK1000N. 2016. Available online: https://www.bgr.bund.de/DE/Themen/Boden/Ressourcenbewertung/Ertragspotential/Ertragspotential_node.html (accessed on 3 November 2016).

- Backhaus, J.G. Henry George’s ingenious tax: A contemporary restatement—Special issue: Commemorating the 100th anniversary of the death of Henry George. Am. J. Econ. Soc. 1997, 56, 453–474. [Google Scholar] [CrossRef]

- Brooke, G.T.F. Uncertainty, Profit and Entrepreneurial Action. J. Hist. Econ. Thought 2010, 32, 221–235. [Google Scholar] [CrossRef]

- Bert, F.; North, M.; Rovere, S.; Tatara, E.; Macal, C.; Podestá, G. Simulating agricultural land markets by combining agent-based models with traditional economics concepts: The case of the Argentine Pampas. Environ. Model. Softw. 2015, 71, 97–110. [Google Scholar] [CrossRef]

- Czyzewski, B.; Matuszczak, A. A new land rent theory for sustainable agriculture. Land Use Policy 2016, 55, 222–229. [Google Scholar] [CrossRef]

- Burt, O.R. Econometric modeling of the capitalization formula for farmland prices. Am. J. Agric. Econ. 1986, 68, 10–26. [Google Scholar] [CrossRef]

- Hüttel, S.; Odening, M.; Balmann, A. Agricultural land markets—Recent Developments and Determinants. Ger. J. Agric. Econ. 2013, 62, 69–70. [Google Scholar]

- Braido, L.H.B. Evidence on the incentive properties of share contracts. J. Law Econ. 2008, 51, 327–349. [Google Scholar] [CrossRef]

- Soule, M.J.; Tegene, A.; Wiebe, K.D. Land tenure and the adoption of conservation practices. Am. J. Agric. Econ. 2000, 82, 993–1005. [Google Scholar] [CrossRef]

- Myyrä, S.; Ketoja, E.; Yli-Halla, M.; Pietola, K. Land improvements under land tenure insecurity: The case of pH and phosphate in Finland. Land Econ. 2005, 81, 557–569. [Google Scholar] [CrossRef]

- Theobald, T.; Daedlow, K.; Kern, J. Assessing farm structural factors for phosphorous availability in agricultural land in Northeast Germany. Soil Use Manag. 2015, 31, 350–357. [Google Scholar] [CrossRef]

- Fraser, E.D.G. Land tenure and agricultural management: Soil conservation on rented and owned fields in southwest British Columbia. Agric. Hum. Values 2004, 21, 73–79. [Google Scholar] [CrossRef]

- Lichtenberg, E. Tenants, landlords, and soil conservation. Am. J. Agric. Econ. 2007, 89, 294–307. [Google Scholar] [CrossRef]

- Sklenicka, P.; Molnarova, K.J.; Salek, M.; Simova, P.; Vlasak, J.; Sekac, P.; Janovska, V. Owner or tenant: Who adopts better soil conservation practices? Land Use Policy 2015, 47, 253–261. [Google Scholar] [CrossRef]

- Swinnen, J.; Vranken, L.; Stanley, V. Emerging challenges of land rental markets. Europe and Central Asia. In Chief Economist’s Regional Working Paper Series; The World Bank: Washington, DC, USA, 2006. [Google Scholar]

- Destatis (German Federal Statistical Office). NUTS-Klassifikationen. Die Einteilung der Europäischen Union in EU-Regionen. 2018. Available online: https://www.destatis.de/Europa/DE/MethodenMetadaten/Klassifikationen/UebersichtKlassifikationen_NUTS.html (accessed on 23 May 2018).

- Maurer, T. Erfolgsfaktoren von Genossenschaftsbanken. Eine Analyse auf Basis von Jahresabschlüssen und Regionalen Wirtschaftsdaten. Ph.D. Thesis, Technische Universität Chemnitz, Chemnitz, Germany, 8 December 2015. [Google Scholar]

- Richter, R.; Hennings, V.; Müller, L. Anwendung des Müncheberger Soil Quality Ratings (SQR) auf bodenkundliche Grundlagenkarten; der Jahrestagung, D.G.B., Kommission, V., Eds.; Böden-Eine Endliche Ressource: Bonn, Germany, 2009. [Google Scholar]

- Leiner, C. Einführung in GIS und digitale Kartografie. Universität Kassel. 2014. Available online: http://docplayer.org/14450081-Einfuehrung-in-gis-und-digitale-kartografie-lehrmaterial-zum-kurs-aufgabe-2-01-dezember-2014-auswertung-die-kursteilnehmer-und-ihre-wohnorte.html (accessed on 9 March 2017).

- Brosius, F. SPSS 11, 1st ed.; Moderne Industrie Buch Verlag: Bonn, Germany, 2002; p. 988. ISBN1 10 3826609220. ISBN2 13 978-3826609220. [Google Scholar]

- Huang, H.; Miller, G.Y.; Sherrick, B.J.; Gomez, M.I. Factors influencing Illinois farmland values. Am. J. Agric. Econ. 2006, 88, 458–470. [Google Scholar] [CrossRef]

- Delbecq, B.A.; Kuethe, T.H.; Borchers, A.M. Identifying the extent of the urban fringe and its impact on agricultural land values. Land Econ. 2014, 90, 587–600. [Google Scholar] [CrossRef]

- Latruffe, L.; Le Mouël, C. Capitalization of government support in agricultural land prices: What do we know? J. Econ. Surv. 2009, 23, 659–691. [Google Scholar] [CrossRef]

- Hüttel, S.; Wildermann, L.; Croonenbroeck, C. How do institutional market players matter in farmland pricing? Land Use Policy 2016, 59, 154–167. [Google Scholar] [CrossRef]

- Ciaian, P.; d’Artis, K.; Swinnen, J.; van Herck, K.; Vranken, L. Key Issues and Developments in Farmland Rental Markets in EU Member States and Candidate Countries; Factor Market Working Paper; Centre for European Policy Studies (CEPS): Brussels, Belgium, 2012; No. 13. [Google Scholar]

- Ludwig, M.; Wilmes, P.; Schrader, S. Measuring soil sustainability via soil science. Sci. Total Environ. 2018, 626, 1484–1493. [Google Scholar] [CrossRef] [PubMed]

- Kuethe, T.H.; Bigelow, D.P. Bargaining Power in Farmland Rental Markets. AgEcon Conference Paper Record Identifier. 2018. Available online: http://ageconsearch.umn.edu/record/274113 (accessed on 11 July 2018).

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).