Telecoupled Food Trade Affects Pericoupled Trade and Intracoupled Production

Abstract

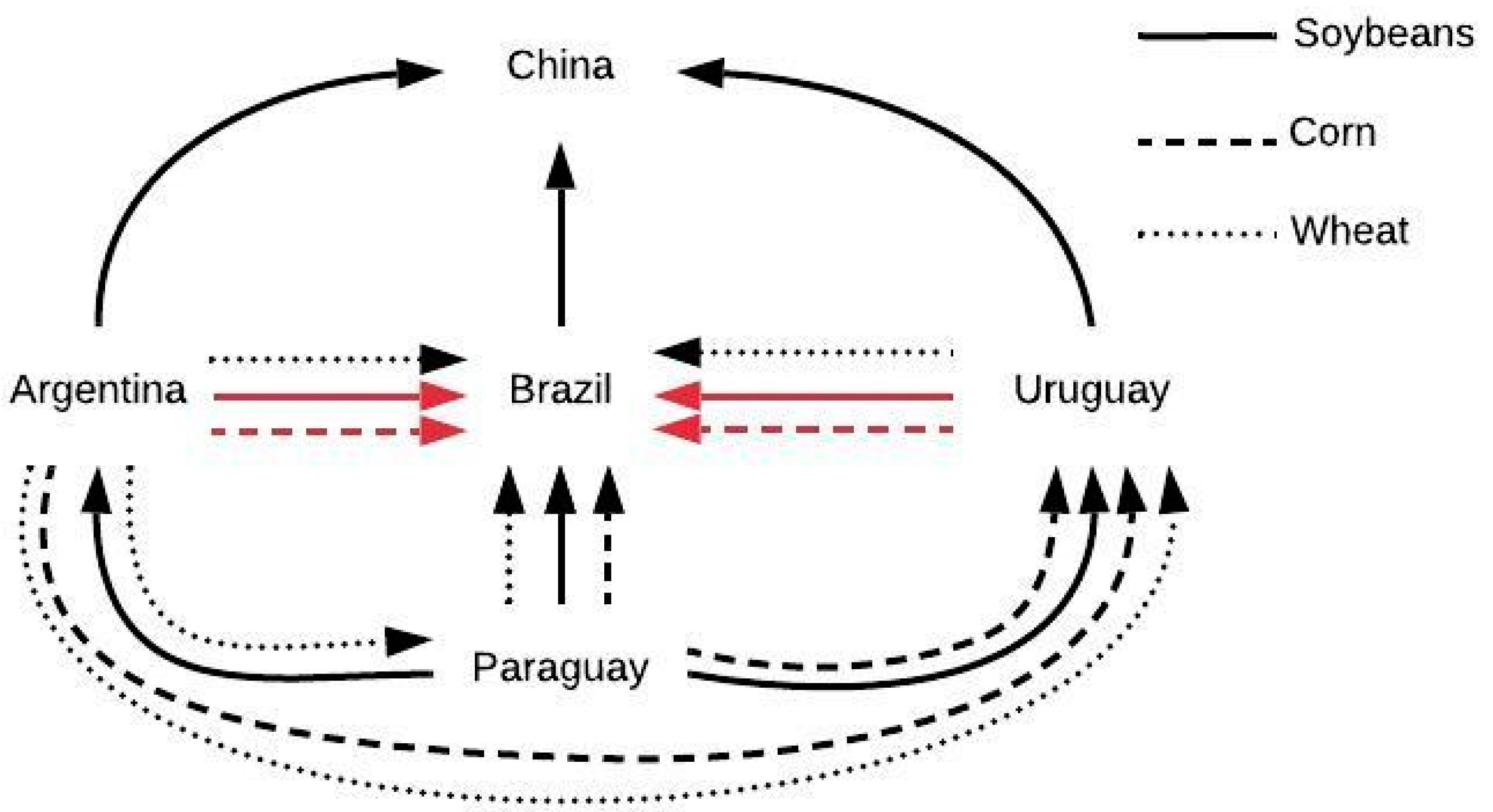

:1. Introduction

2. Materials and Methods

2.1. Conceptual Framework

2.2. Relevant Theories

2.3. Data Collection

2.4. Data Analysis

3. Results

3.1. Trend Analysis

3.1.1. Overview

3.1.2. Argentina

3.1.3. Uruguay

3.1.4. Paraguay

3.2. Differences in Trade Between the Pre- and Post-Period Trends

3.2.1. Overview

3.2.2. Argentina

3.2.3. Uruguay

3.2.4. Paraguay

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

References

- Wood, S.A.; Smith, M.R.; Franzo, J.; Remans, R.; DeFries, R. Trade and the equitability of global food nutrient distribution. Nat. Sustain. 2018, 1, 34–37. [Google Scholar] [CrossRef] [Green Version]

- Lensen, M.; Moran, D.; Kanemoto, K.; Foran, B.; Lobefaro, L.; Geschke, A. International trade drives biodiversity threats in developing nations. Nature 2012, 486, 109–112. [Google Scholar] [CrossRef] [PubMed]

- Dalin, C.; Wada, Y.; Kastner, T.; Puma, M.J. Groundwater depletion embedded in international food trade. Nature 2017, 543, 700–704. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chaudhary, A.; Katsner, T. Land use biodiversity impacts embodied in international food trade. Glob. Environ. Chang. 2016, 38, 195–204. [Google Scholar] [CrossRef]

- Moran, D.; Kanemoto, K. Identifying species threat hotspots from global supply chains. Nat. Ecol. Evol. 2017, 1. [Google Scholar] [CrossRef]

- MacDonald, G.K.; Brauman, K.A.; Sun, S.; Carlson, K.M.; Cassidy, E.S.; Gerber, J.S.; West, P.C. Rethinking agricultural trade relationships in an era of globalization. BiosSciences 2015, 65, 275–289. [Google Scholar] [CrossRef]

- Crist, E.; Moran, C.; Engelman, R. The interaction of human population, food production, and biodiversity protection. Science 2017, 356, 260–264. [Google Scholar] [CrossRef]

- DeFries, R.; Rudel, T.K.; Uriarte, M.; Hansen, M. Deforestation driven by urban population growth and agricultural trade in the twenty-first century. Nat. Geosci. 2010, 3, 178–181. [Google Scholar] [CrossRef]

- Lambin, E.F.; Meyfroidt, P. Global land use change, economic globalization, and the looming land scarcity. Proc. Natl. Acad. Sci. USA 2011, 108, 3465–3472. [Google Scholar] [CrossRef] [Green Version]

- Foley, J.A.; Ramankutty, K.A.; Brauman, K.A.; Cassidy, E.S.; Gerber, J.S.; Johnston, M.; Mueller, N.D.; O’Connell, C.; Ray, D.K.; West, P.C.; et al. Solutions for a cultivated planet. Nature 2011, 478, 337–342. [Google Scholar] [CrossRef] [Green Version]

- Liu, J.; Hull, V.; Batistella, M.; DeFries, R.; Dietz, T.; Fu, F.; Hertel, T.W.; Izaurralde, E.F.; Lambin, S.L.; Li, S.; et al. Framing sustainability in a telecoupled world. Ecol. Soc. 2013, 18, 26. [Google Scholar] [CrossRef]

- Sun, J.; Mooney, H.; Wu, W.; Tang, H.; Tong, Y.; Xu, Z.; Huang, B.; Cheng, Y.; Yang, X.; Wei, D.; et al. Importing food damages domestic environment: Evidence from global soybean trade. Proc. Natl. Acad. Sci. USA 2018, 115, 5415–5419. [Google Scholar] [CrossRef] [Green Version]

- Sun, J.; Tong, Y.; Liu, J. Telecoupled land-use changes in distant countries. J. Integr. Agric. 2017, 16, 368–376. [Google Scholar] [CrossRef]

- Reenberg, A.; Fener, N.A. Globalizing land use transistions: The soybean acceleraition. J. Geogr. 2011, 111, 85–92. [Google Scholar]

- Martinelli, A.L.; Batistella, M.; Silva, F.R.; Moran, E. Soy Expansion and Socioeconomic Development in Municipalities of Brazil. Land 2017, 6, 62. [Google Scholar] [CrossRef]

- Schaffer-Smith, D.; Tomscha, S.A.; Jarvis, K.J.; Maguire, D.Y.; Treglia, M.L.; Liu, J. Network analysis as a tool for quantifying the dynamics of metacoupled systems: An example using global soybean trade. Ecol. Soc. 2018, 23. [Google Scholar] [CrossRef]

- Sun, J.; Wu, W.; Tang, H.; Liu, J. Spatiotemporal patterns of non-genetically modified crops in the era of expansion of genetically modified food. Sci. Rep. 2015, 5, 14180. [Google Scholar] [CrossRef] [Green Version]

- Gasparri, N.I.; Kuemmerle, T.; Meyfroidt, P.; de Waroux, Y.l.P.; Kreft, H. The Emerging Soybean Production Frontier in Southern Africa: Conservation Challenges and the Role of South-South Telecouplings. Conserv. Lett. 2016, 9, 21–31. [Google Scholar] [CrossRef]

- Bo, X.; Yi, F.; Li, Y. What do China’s rising meat demand and industrialization of the livestock sector mean for its vegetable oil market? China Agric. Econ. Rev. 2017, 9, 303–316. [Google Scholar]

- UN International Statistics Division. 2018. Available online: https://comtrade.un.org/data/ (accessed on 13 May 2019).

- Bicudo da Silva, R.F.; Batistella, M.; Dou, Y.; Moran, E.F.; Torres, S.M.; Liu, J. The Sino-Brazilian Telecoupled Soybean System and Cascading Effects for the Exporting Country. Land 2017, 6, 53. [Google Scholar] [CrossRef]

- Dou, Y.; Bicudo da Silva, R.F.; Yang, H.; Liu, J. Spillover effect offsets the conservation effort in the Amazon. J. Geogr. Sci. 2018, 28, 1715–1732. [Google Scholar] [CrossRef] [Green Version]

- Li, A.S. Argentina and China: The Soybean Trade and Its Consequences; Law School International Immersion Program Papers; University of Chicago Law School Chicago Unbound: Chicago, IL, USA, 2016. [Google Scholar]

- Peine, E.K. Trading on Pork and Beans: Agribusiness and the Construction of the Brazil-China-Soy-Pork Commodity Complex. In The Ethics and Economics of Agrifood Competition; James, J.H.S., Ed.; Springer: Dordrecht, The Netherlands, 2013; pp. 193–210. [Google Scholar]

- Jordan, G.; Navin, R.; Oliver, T.C. Increasing expansion of large-scale crop production onto deforested land in sub-Andean South America. Environ. Res. Lett. 2018, 13, 084021. [Google Scholar] [Green Version]

- FAS. Vietnam’s Soybean and Soybean Meal Imports Continue to Grow in 2017; USDA Forgein Agriculutral Service: Washington, DC, USA, 2017. [Google Scholar]

- FAS. EU-27 Soybean Imports from the United States Still Impeded; USDA Forgein Agricultural Service: Washington, DC, USA, 2009. [Google Scholar]

- Westcott, P.; Trostle, R. USDA Agriculutral Projections to 2023; USDA Economic Research Service: Washington, DC, USA, 2014. [Google Scholar]

- Cargill. Growing a New Soy Industry in Uruguay. Available online: http://150.cargill.com/150/en/URUGUAYAN-SOY.jsp (accessed on 15 December 2018).

- Dutch Soy Coalition. Soy in Paraguay; Dutch Soy Coalition: Washington, DC, USA, 2009. [Google Scholar]

- Liu, J. Integration across a metacoupled world. Ecol. Soc. 2017, 22. [Google Scholar] [CrossRef]

- Felter, C.; Renwick, D. Mercosur: South America’s Fractious Trade Bloc. Available online: https://www.cfr.org/backgrounder/mercosur-south-americas-fractious-trade-bloc (accessed on 2 January 2019).

- Reeder, J.; Torene, J.; Jabara, C.; Babula, R. Regional Trade Agreements: Effects of the Andean and Mercosur Pacts on the Venezuelan Soybean Trade and U.S. Exports; U.S. International Trade Commission: Washington, DC, USA, 2005. [Google Scholar]

- Williman, K. Soybean Trade Telecouplings and Land Use Change in Uruguay: Connecting the Provincial to the Global. Master’s Thesis, Stockholm University, Stockholm, Sweden, 2015. [Google Scholar]

- Wallace, J.M.; Gutzler, D.S. Teleconnections in the Geopotential Height Field during the Northern Hemisphere Winter. Am. Meteorol. Soc. 1981, 109, 784–812. [Google Scholar] [CrossRef]

- Sassen, S. Globalization and Its Discontents: Essays on the New Mobility of People and Money; The New Press: New York, NY, USA, 1999. [Google Scholar]

- Liu, J.; Herzberger, A.; Kapsar, K.; Carlson, A.; Connor, T. What is Telecoupling? In Telecoupling: Exploring Land-Use Change in a Globalised World (Palgrave Studies in Natural Resource Management); Friis, C., Nielsen, J.Ø., Eds.; Palgrave Macmillan: Basingstoke, UK, 2019; pp. 19–48. [Google Scholar]

- Levin, S.A. Ecosystems and the biosphere as complex adaptive systems. Ecosystems 1998, 1, 431–436. [Google Scholar] [CrossRef]

- Holland, J.H. Complex Adaptive Systems. Daedalus 1992, 121, 17–30. [Google Scholar]

- Narlikar, A. New powers in the club: The challenges of global trade governance. Int. Affairs 2010, 86, 717–728. [Google Scholar] [CrossRef]

- Food and Agriculture Organization of the United Nations. FAOSTAT Statistical Database. Available online: http://www.fao.org/faostat/en/#home (accessed on 13 May 2019).

- Peter, D.; Silva, P. ARIMA vs. ARIMAX—Which approach is better to analyze and forecast macroeconomic time series? In Proceedings of the 30th International Conference Mathematical Methods in Economics, Karviná, Czech Republic, 11–13 September 2012. [Google Scholar]

- Hyndman, R.J.; Athanasopoulos, G. Forecasting: Principles and Practice; OTexts: Chula Vista, CA, USA, 2014. [Google Scholar]

- Williams, B.M.; Hoel, L.A. Modeling and Forecasting Vehicular Traffic Flow as a Seasonal ARIMA Process: Theoretical Basis and Empirical Results. J. Transp. Eng. 2003. [Google Scholar] [CrossRef]

- Trapletti, A.; Hornik, K. ggplot2: Time Series Analysis and Computational Finance; Springer: New York, NY, USA, 2018. [Google Scholar]

- Wickham, H. ggplot2: Elegant Graphics for Data Analysis; Springer: New York, NY, USA, 2016. [Google Scholar]

- Lin, Y. Post-crisis China impact on trade integration and manufacturing competitiveness between Argentina and Brazil. J. Chin. Econ. Bus. Stud. 2018, 16, 147–170. [Google Scholar] [CrossRef] [Green Version]

- Deese, W.; Reeder, J. Export taxes on agricultural products: Recent history and economic modeling of soybean export taxes in Argentina. Commission. J. Int. Commer. Econ. 2007, 1, 185. [Google Scholar]

- de Ridder, M.; ten Haaf, P.; Olah, N.; Bolscher, H. Soy Supply Security for The Netherlands; The Hague Centre for Strategic Studies, The Netherlands Organization for Applied Scientifc Research: The Hague, The Netherlands, 2015. [Google Scholar]

- Wright, B. Global Biofuels: Key to the Puzzle of Grain Market Behavior. J. Econ. Perspect. 2014, 28, 73–98. [Google Scholar] [CrossRef] [Green Version]

- Villoria, N.B.; Hertel, T.W. Geography Matters: International Trade Patterns and the Indirect Land Use Effects of Biofuels. Am. J. Agric. Econ. 2011, 93, 919–935. [Google Scholar] [CrossRef] [Green Version]

- Babcock, B.A.; Carriquiry, M. Prospects for Corn Ethanol in Argentina; IOWA State University: Ames, IA, USA, 2012. [Google Scholar]

- Vieira, L. Argentina’s Export Tax to Drive Dorn Acres Lower; Successful Farming: Des Moines, IA, USA, 2018. [Google Scholar]

- Liu, J.; Mooney, H.; Hull, V.; Davis, S.J.; Gaskell, J.; Hertel, T.; Lubchenco, J.; Seto, K.C.; Gleick, P.; Kremen, C.; et al. Systems integration for global sustainability. Science 2015, 347. [Google Scholar] [CrossRef]

- Bronstein, H.; Desantis, D. INTERVIEW-Paraguay Soybeans Flow to China Regardless of Politics; Reuters: Canary Wharf, UK, 2018. [Google Scholar]

- Solidaridad. Promoting Sustainability amoung Soy Family Farmers in Paraguay; The Sustainable Trade Initiative: Utrecht, The Netherlands, 2016. [Google Scholar]

- Bronstein, H.; Desantis, D. Paraguay Soybean Exports to Top Argentina’s for First Time; Reuters: Canary Wharf, UK, 2018. [Google Scholar]

- Brazier, J. Case Study: Paraguay’s Cursed Green Gold; South America Monthly Insight: San Francisco, CA, USA, 2017. [Google Scholar]

- Nickson, R.A. Brazil and Paraguay: A Protectorate in the making? In Brazil and Spanish America: Relationships and Comparisons; Insititue of Latin America Studies, University of London: London, UK, 2019. [Google Scholar]

- Lagarde, M. How to do (or not to do) … Assessing the impact of a policy change with routine longitudinal data. Health Policy Plan. 2011, 27, 76–83. [Google Scholar] [CrossRef] [PubMed]

- Carlson, A.; Zaehringer, J.; Garrett, R.; Felipe Bicudo Silva, R.; Furumo, P.; Raya Rey, A.; Torres, A.; Gon Chung, M.; Li, Y.; Liu, J. Toward Rigorous Telecoupling Causal Attribution: A Systematic Review and Typology. Sustainability 2018, 10, 4426. [Google Scholar] [CrossRef]

- Boulding, K. The Economics of Peace; Prentice-Hall Inc.: New York, NY, USA, 1945; Volume 278. [Google Scholar]

| Brazil’s Soybean Imports | ||||

| Argentina | Paraguay | Uruguay | USA | |

| Pre-Period | 129,079 | 177,765 | 33,016 | 187,397 |

| 2016 | 670 | 381,448 | 0 | 0 |

| Percent Change | −99.5% | 114.6% | −100% | −100% |

| Brazil’s Corn Imports | ||||

| Argentina | Paraguay | Uruguay | USA | |

| Pre-Period | 811,167 | 80,831 | 5188 | 123,894 |

| 2016 | 1,436,245 | 1,465,053 | 0 | 532 |

| Percent Change | 77% | 1712% | −100% | −99.5% |

| Brazil’s Wheat Imports | ||||

| Argentina | Paraguay | Uruguay | USA | |

| Pre-Period | 1,074,906 | 14,544 | 47,287 | 173,355 |

| 2016 | 3,950,036 | 956,125 | 577,415 | 1,226,210 |

| Percent Change | 268 | 6474% | 1121% | 607% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Herzberger, A.; Chung, M.G.; Kapsar, K.; Frank, K.A.; Liu, J. Telecoupled Food Trade Affects Pericoupled Trade and Intracoupled Production. Sustainability 2019, 11, 2908. https://doi.org/10.3390/su11102908

Herzberger A, Chung MG, Kapsar K, Frank KA, Liu J. Telecoupled Food Trade Affects Pericoupled Trade and Intracoupled Production. Sustainability. 2019; 11(10):2908. https://doi.org/10.3390/su11102908

Chicago/Turabian StyleHerzberger, Anna, Min Gon Chung, Kelly Kapsar, Kenneth A. Frank, and Jianguo Liu. 2019. "Telecoupled Food Trade Affects Pericoupled Trade and Intracoupled Production" Sustainability 11, no. 10: 2908. https://doi.org/10.3390/su11102908