2.1. Costs and Benefits of Green Building and Affordable Housing

The US Green Building Council (USGBC) defines green building as a comprehensive approach to planning, design, construction, operations, and, ultimately, end-of-life recycling or renewal of structures with several central considerations, including energy use, water use, indoor environmental quality, material selection and the building’s effects on its site [

12]. There are several green building rating programs that encourage the development of green buildings and energy-efficient products and appliances in the US, of which LEED and EnergyStar are often cited as the two most prominent. USGBC, a private, membership-based, non-profit organization, developed LEED in 1999, and the Environmental Protection Agency and the Department of Energy jointly developed EnergyStar in 1992, extended it to buildings in 1995, and initiated the EnergyStar labeling program for buildings in 1999 [

12]. In a parallel effort, and at the regional level, Greater Atlanta Home Builders Association and Southface established EarthCraft jointly in 1999, which was extended to Virginia in 2006 as EarthCraft VA, and named Viridiant since 2018, whose certification standards are similar to or higher than EarthCraft’s [

13]. To become certified, an EarthCraft project must meet or exceed the local International Energy Conservation Code (IECC), requirements for the energy code for energy and water efficiency, and meet certain required standards and optional points in a series of categories, determining Certified, Gold, or Platinum levels of certification (i.e., the expected levels of environmental performance). An analysis of LEED and Energy Star-certified properties suggests several trends over the first decade after the programs’ inception: increases in the rate of adoption, improvements in certification standards, decreases in the share of buildings certified at the lowest level, growth of the share of private, versus public, developers [

14]. Previous research has compared the costs and benefits of green buildings to those of conventional buildings (e.g., in terms of energy and water efficiency, indoor environmental quality, health and productivity), using a variety of indicators, but construction costs and price premiums are among the most concrete indicators to reflect total costs and total benefits for the purpose of policy and planning [

15].

During the last decade, a growing body of empirical research has tracked the economic performance of green buildings, based on reported construction costs, rent, sale prices, and occupancy rates. So far, there is little evidence on the magnitude of upfront green construction cost premiums in the residential sector in the US, and available studies in the commercial sector provide no conclusive answers. Two recent reviews, covering a variety of geographies, building types, and rating systems, Refs. [

16] and [

17], reported that the majority of incremental costs for all levels of certification fall within the range of −0.4–21% and −0.4–11%, respectively. Large-sample statistical studies of new constructions, however, have reported narrower ranges. For instance, Refs. [

18] and [

19] did not find a statistically significant upfront cost premium from an analysis of the actual cost of green buildings when compared to conventional ones. Based on anecdotal evidence from homebuilders, EarthCraft reports an upfront cost premium of 0.5–3%, which is consistent with a hypothesis by Ref. [

20], suggesting that entry-level certification standards and costs are often kept loose and low to attract stakeholders with low willingness to pay for environmental labels [

21]. In addition to the impacts of confounding variables that could explain the variability of results (e.g., stage of involvement with the program, choice of program and the magnitude of its requirements, builders’ level of experience, building characteristics, the choice of research methodology), some variability is attributed to the nature of green building programs (e.g., the availability of optional easy or hard credits, and interactions of project-specific issues and program credits) [

22].

Although empirical cost estimates are often based on industry reports, more comparable systematic studies have emerged on estimated rents and sale price premiums of green certification on office properties in the US, based on commercial real estate databases [

23,

24,

25,

26,

27,

28]. According to these studies, average sale price premiums for EnergyStar and for LEED-certified buildings could fall between 5.1–31% and 11.7–28.4%, respectively. In some cases, results are not statistically significant, and contrasting results have been found on the incremental premiums associated with different levels of certification. In the residential sector, there is comparatively less research available on both construction costs and price premiums. In a study of three US metropolitan areas between 2005 and 2011, [

29], found 2% and 4–9% sale price premiums associated with single-family units with EnergyStar and local green building certifications, respectively. Ref. [

11] found EnergyStar certified single-family dwellings in California transacted at an average premium of 4.7% between 2005 and 2012, with higher premiums for GreenPointRated and LEED certifications, although these differences were insignificant. Ref. [

30] estimated a sale price premium of 8.3% for EarthCraft certified houses in Atlanta. Using American Community Survey 2007 data, Ref. [

31] estimated that energy efficiency codes IECC 2003-06 resulted in an increase of 23.25% in house rents. Based on contingent valuation analysis, Ref. [

32] estimated that the aggregate stated willingness to pay for green features was 9.3%. A general conclusion from the past analyses is that green buildings can have small upfront cost premiums, but price premiums often offset the cost of certification.

The US Department of Housing and Urban Development (HUD) broadly defines affordable housing as “housing for which the occupant(s) is/are paying no more than 30% of his or her income for gross housing costs, including

utilities” [

33,

34]. While helpful, this definition combines all the potential reasons for lack of affordability (e.g., housing prices, housing quality, household income, household choices, public policies), thus, making affordability difficult to understand [

35]. A voluntary inclusionary housing program—used interchangeably with an affordable housing program—places a rent or price control on a percentage of new developments to keep its units affordable to very low-, low-, or moderate-income households for a pre-determined period of time, and in return, offers economic or zoning benefits to builders to offset the imposed costs [

36]. Many program-specific studies on the costs and benefits of affordable housing have explored diverse effects of housing conditions (e.g., affordability, stability, quality, location) on program participants (e.g., residential mobility, residents’ satisfaction, health outcomes, labor market outcomes, educational outcomes, criminal offenses, parenting behavior, etc.) and stakeholders (e.g., origin communities, host communities, taxpayers, and government agencies) but the most common method has been quantifying the value impact of locating near affordable housing properties [

37,

38,

39]. A general conclusion from existing value impact analyses is that conventional affordable housing properties can have negative but small spillover effects, which should be addressed by planning and policy instruments [

40]. However, there is also evidence that the construction of well-maintained affordable housing properties can appreciate property values in neighborhoods containing abandoned or physically deteriorating housing units [

41].

Since the inception of green building rating systems in the early 2000s, state and local governments have provided incentives to promote the integration of green building with affordable housing [

42]. Many researchers have seen the integration of environmental principles into traditionally single-purpose policy sectors, such as affordable housing, as a goal of governance to reduce policy conflicts and inefficiencies [

43,

44]. As affordable housing advocates increasingly demand the inclusion of affordable housing in locations beyond central cities, this integration could make affordable housing developments more acceptable for host neighborhoods in the suburbs, and more cost-effective for low-income occupants on a life-cycle basis, thus helping to achieve multiple policy goals [

39,

45,

46]. Nonetheless, costs and benefits of green affordable housing have rarely been investigated, despite the fact that low-income households are often exposed to low quality housing conditions and thus bear disproportionate costs of energy, transport, healthcare, safety, etc. [

6,

47]. Except for a few recent studies in the EU, available evidence on green building cost premiums is from the gray literature on the commercial sector, thus leaving little information for public and private entities considering green building certifications in the housing sector [

8,

17].

2.2. Incentivizing the Supply of Green Affordable Housing

Focused on quantifying the relationships between local characteristics and the market penetration of green buildings, a number of previous studies have recognized the importance of economic, political, environmental, and social composition of urban areas to the market penetration of green building [

48]. For instance, Ref. [

49] concluded that some industry types (e.g., the financial services industry) are more likely than others to choose to locate in green buildings, thus, cities with a high concentration of those industries are more likely to have a higher number of green buildings per capita. The work of Ref. [

7] concluded that large, growing, and wealthy cities with a highly educated workforce are more likely to have a higher adoption of green buildings. Financial benefits of green buildings and features (e.g., solar panels, green roofs, etc.) increase where more energy savings can be achieved due to the scarcity of water reserves (i.e., higher water costs) or frequency of heating or cooling degree days [

11,

50]. Such economic, political, environmental, and social drivers could help to explain the reasons behind the slow market penetration of green buildings, despite documented tangible benefits. Therefore, municipal policy measures—whether regulatory policies or incentives—should be seen as a small fraction of all drivers of green building [

51,

52].

Besides findings on the effective real-world performance and economic viability of green buildings, states and local governments have increasingly developed policies and programs that require or encourage public–private partnerships to internalize life-cycle externalities associated with conventional buildings (e.g., construction waste, water run-off, energy inefficiency) [

53,

54,

55,

56]. These policy instruments include a blend of energy price increases (e.g., by introducing an ecological tax), mandatory energy-efficiency standards, and incentives for new construction and rehabilitation projects [

57]. Mandatory green building standards often apply to publicly owned or funded projects, and voluntary economic instruments (e.g., loans, tax-based incentives, soft-cost assistance, technical assistance, information provision) and zoning instruments (e.g., height and/or density incentives, parking incentives, flexible lot sizes) influence the incorporation of green standards in both public and private sectors [

58]. Assuming other drivers of green building are, to some extent, present, the goal of an incentive is to help local builders to supply an efficient quantity of green affordable housing when the free market fails to provide a socially optimal level of such benefits for the society. Previous research considers a variety of factors that could lead to underinvestment in green building, including but not limited to, split incentives, information asymmetries, risk aversion, skill shortages, and analytical failures [

7,

59,

60].

The rationale for inclusionary housing programs (i.e., incentivizing private developers to incorporate affordable housing into market-driven developments) is the historic shortage of housing units for low-income households [

61]. Underinvestment in affordable housing has been historically exacerbated by local opposition from host neighborhoods to equitable affordable housing siting. For instance, in a survey of 74 not-for-profit and for-profit developers, Ref. [

62] found that 70% of developers experienced local opposition to affordable housing developments, leading to construction delays, delays in leasing or selling units, denied building permits, reduction in the number of units, changes in project location, or cancellation of the entire development. The positive externalities graph (

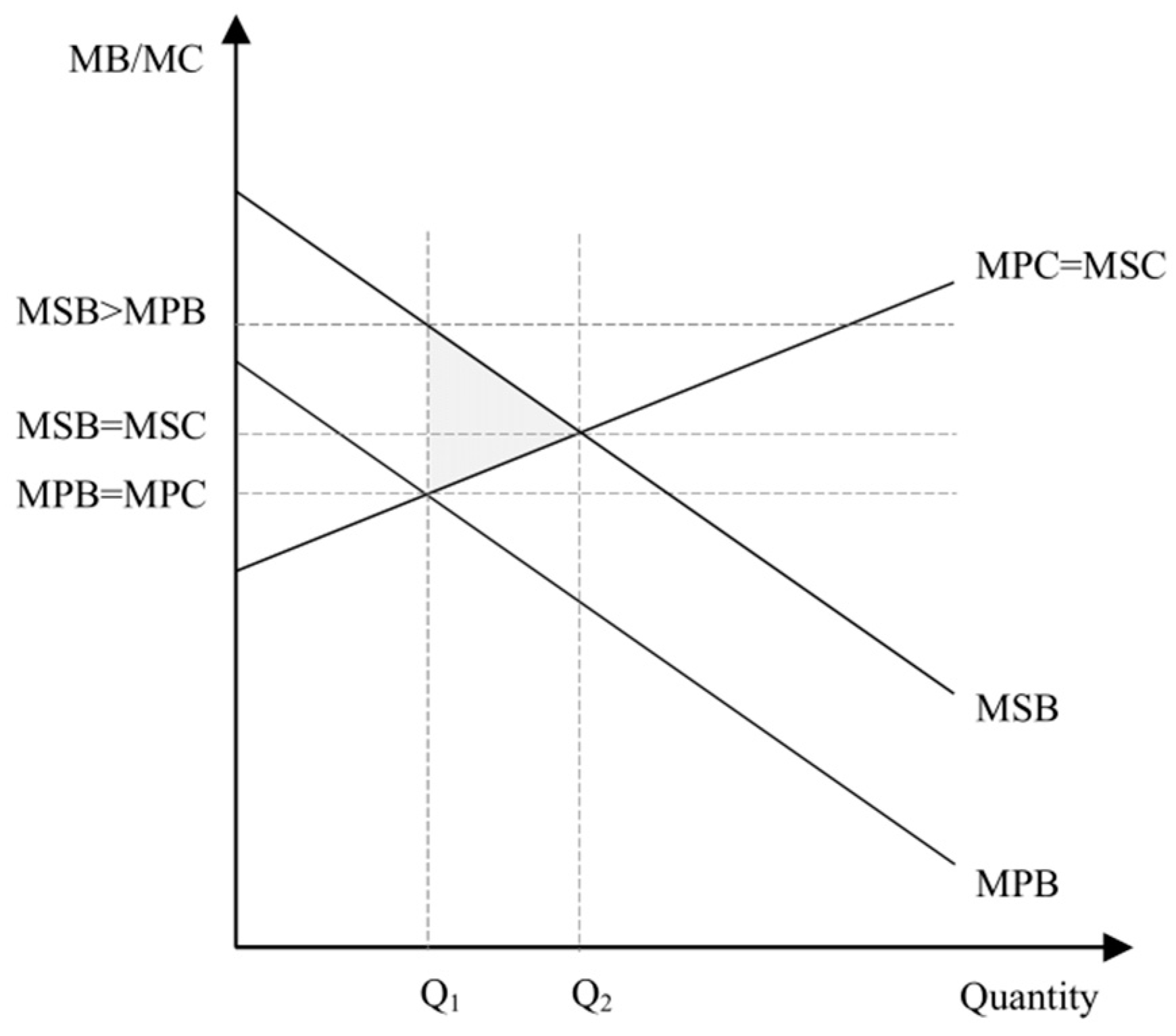

Figure 1) illustrates the effect of introducing a per square foot incentive correcting the under-provision of green affordable housing in free market. A supply incentive would increase the free market supply quantity (Q

1) toward a socially optimal level (Q

2), where the marginal private/social cost of production (MPC/MSC) is equal to the marginal social benefit of consumption (MSB). The upward shift in the marginal private benefit (MPB) curve creates the triangular grey area, which represents the quantity of positive externality known as welfare gain. Marginal private cost (MPC), also known as marginal cost of production, is the change in the producer’s total cost, resulting from the production of an additional unit, and marginal private cost (MPC) could be considered equal to marginal social cost (MSC), as there is no external cost from the production of green housing relative to conventional housing.

While aiming for socially efficient green affordable housing, incentives are often linked to other urban planning goals, to further address market failures in environmental sustainability and economic development. For instance, urban planners strategically use density incentive programs to direct development to areas with locational and temporal priorities and common challenges. In addition, green building programs could provide opportunities to fund or realize long-term community benefits (e.g., open space preservation, historic preservation, pedestrian and bicycle connectivity, compliance with urban design guidelines) in new construction projects. These programs could work towards a more efficient use of existing infrastructure (e.g., higher transit ridership, reduction in road construction) and penalize goods with negative externalities (e.g., congestion, pollution) [

60]. Incentives, however, have limited power to induce general growth and increase affordability by reducing housing prices in markets with a low price-elasticity of supply or demand. In fact, any changes in supply (e.g., associated with regulations, approval delays or growth management) or demand (e.g., associated with changes in income, demographics, mortgage mechanisms) might not be feasible without major regulatory reforms [

63,

64,

65].

Figure 2 illustrates such inefficient markets. On the left graph, S

1, D

1, Q

1, and P

0 are supply curve (marginal cost), demand curve (marginal benefit), supply quantity, and equilibrium price in the existing housing market, respectively. The introduction of a per-square-foot subsidy would create a new equilibrium, in which Q

2, P

p, and P

c are the new supply quantity, the unit price for firms, and the unit price for costumers, respectively. The right graph represents a market with a low-price elasticity of supply, in which introducing the same amount of subsidy (P

p − P

c = P′

p − P′

c) would have a little impact on supply quantity (Q′

2), while giving more benefits to producers than consumers. Similar mechanisms are in place for introducing new residential energy efficiency policies that depend on the price elasticity of demand for energy [

57]. For guidance and more information, see Ref. [

66].

The integration of environmental principles in an affordable housing program requires innovative policymakers to monetize and evaluate the private and public costs and benefits of the program, based on local demographic and housing market data. The extant literature suggests that certified offices and houses have higher rents and/or prices that can come from energy efficiency, water efficiency, improved air quality, and occupant productivity. Nonetheless, evaluation of public benefits (i.e., positive externalities, such as eco-system protection, and waste and carbon dioxide emission reduction) associated with green building against environmental damages caused by conventional buildings has been documented with insufficient attention and consensus in the literature [

17,

67]. Simulation-based life-cycle analyses have provided valuable insight into the environmental impacts of green buildings [

68], but little, if any, research has been performed to date to analyze the spillover effects of green buildings, e.g., in terms of the impact of the presence or density of green buildings on prices of nearby non-green buildings. Such analyses would have provided more details on price dynamics and the social benefits of green buildings, and consequences for local sustainability and climate change policy [

69]. The need for monetary analyses is reinforced by the fact that construction cost data, performance data (e.g., energy use, water use) and outcome data (e.g., on health, pollution, congestion) are generally confidential, limited, or simply unavailable, and engineering simulation studies could be hard to compare or have restricted generalizability, due to heterogeneities involved in the operation stage. Monetizing all the impacts of green affordable housing could reduce uncertainties associated with forecasts, and allow policy analysts to obtain systematic and context-driven conclusions about the social benefits of such programs, based on cost benefit analysis [

70,

71].

The current analysis aims to address the lack of attention in the existing literature to the residential sector in smaller urban areas, through a cost analysis of EarthCraft VA certified LIHTC developments, a price analysis of market-rate EarthCraft VA certified single-family houses, and an analysis of spillover effects associated with market-rate certified houses and affordable non-certified houses in Montgomery County, VA. As previous research [

50,

51,

72,

73,

74] has documented large associations between the presence of density incentives and a higher production of green residential buildings in a state or county, we apply our findings on costs and prices to the design of a county-wide voluntary density incentive program, to explore how much additional floor area could compensate local builders for investment in the construction of green affordable housing units in for-sale and for-rent scenarios.