Regional Economic Resilience of the Old Industrial Bases in China—A Case Study of Liaoning Province

Abstract

:1. Introduction

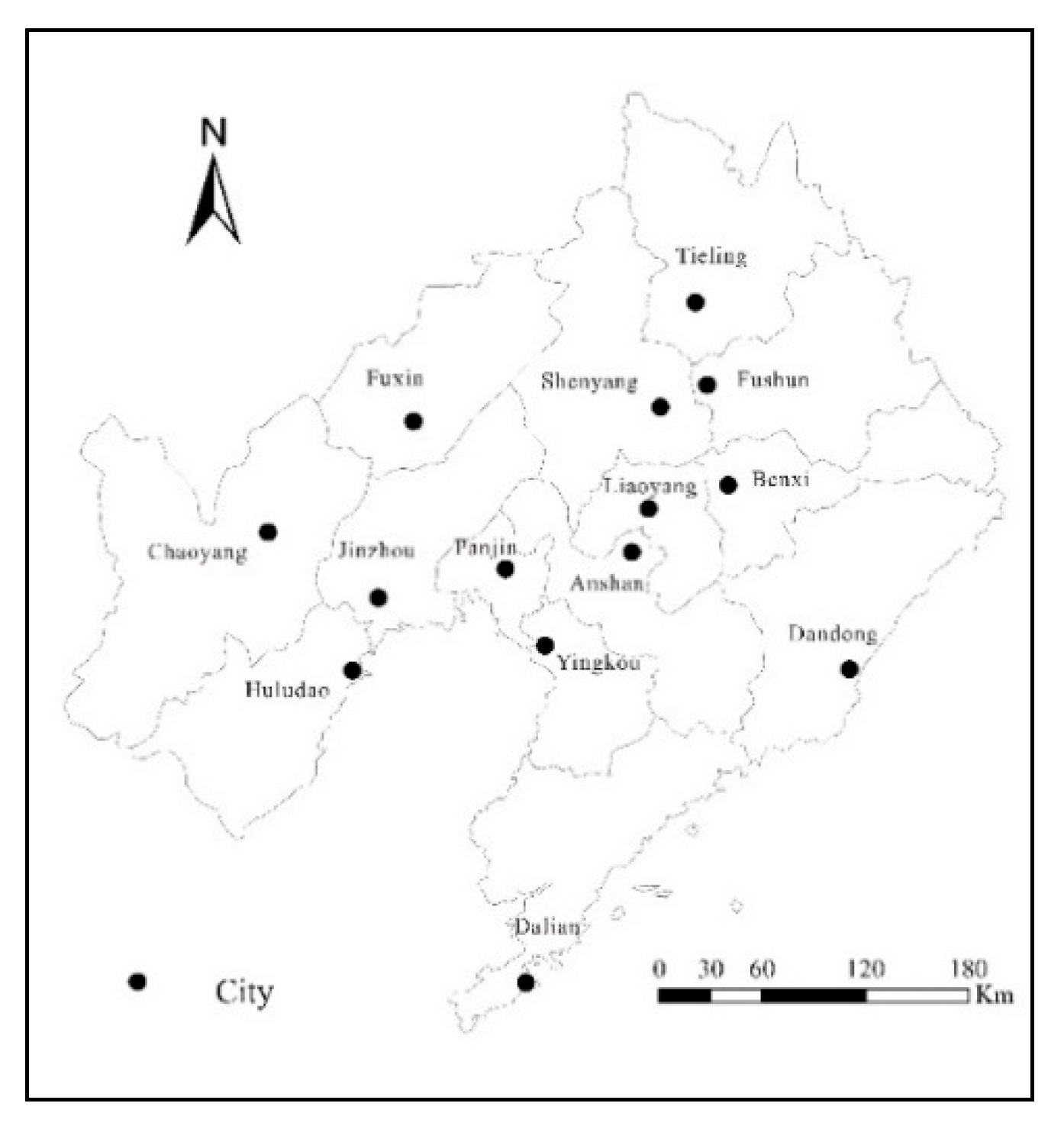

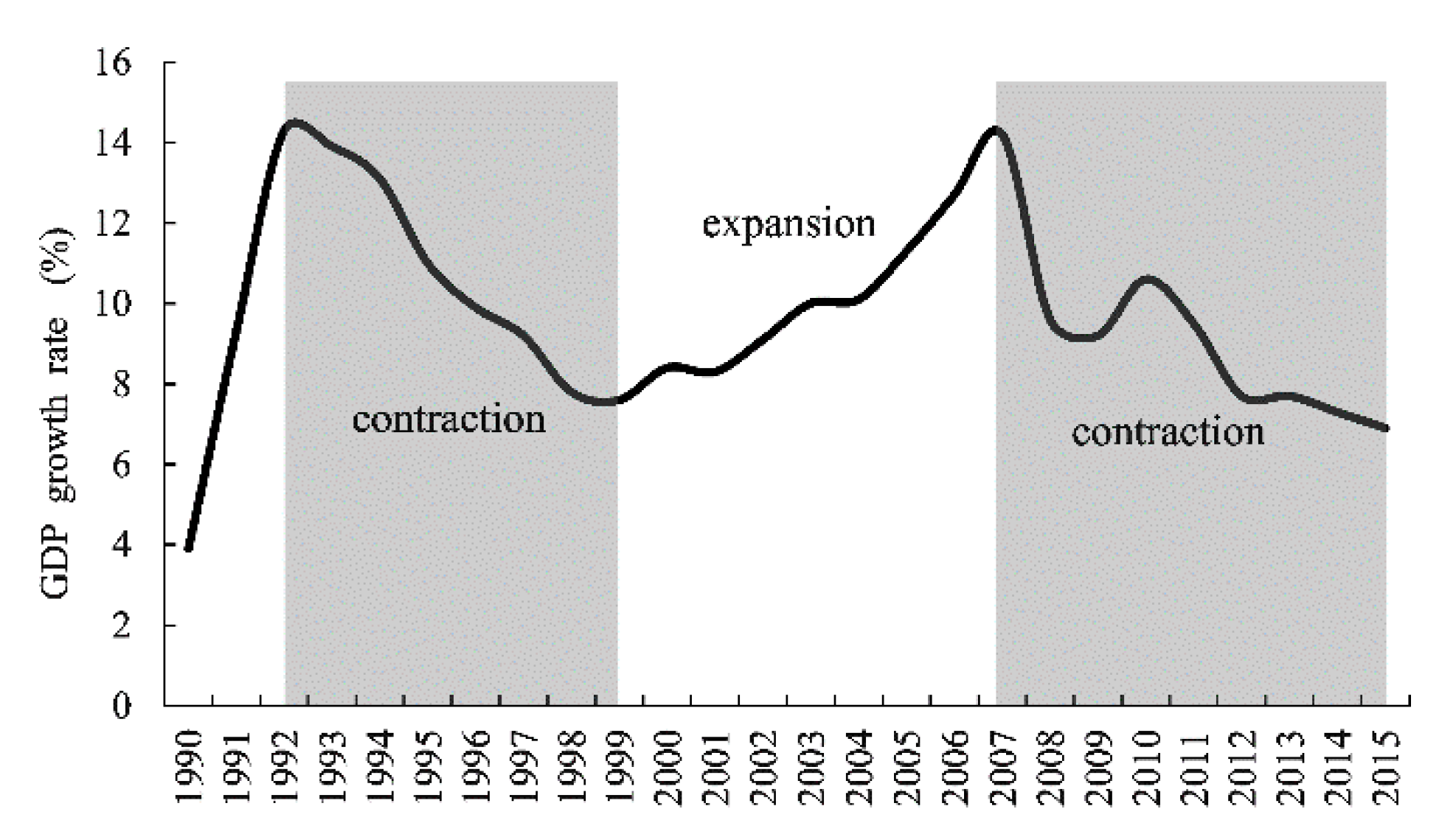

2. Study Area and Major Recessionary Shocks

3. Measuring Regional Economic Resilience of Liaoning Province

3.1. Measuring Resistance and Recoverability

3.2. Results of Regional Economic Resilience Measurements

4. Determinants of Regional Economic Resilience in Liaoning Province

4.1. Determining Factors of Regional Economic Resilience

4.2. Analysis Model of Determinants of Regional Economic Resilience

4.2.1. Spatial Autocorrelation Moran Index

4.2.2. Spatial Econometric Model

4.3. Estimation Results

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Simmie, J.; Martin, R. The economic resilience of regions: Towards an evolutionary approach. Camb. J. Reg. Econ. Soc. 2010, 3, 27–43. [Google Scholar] [CrossRef]

- Eraydin, A. Attributes and characteristics of regional resilience: Defining and measuring the resilience of Turkish regions. Reg. Stud. 2016, 50, 600–614. [Google Scholar] [CrossRef]

- Martin, R. Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr. 2011, 12, 1–32. [Google Scholar] [CrossRef]

- Boschma, R. Towards an evolutionary perspective on regional resilience. Reg. Stud. 2015, 49, 733–751. [Google Scholar] [CrossRef]

- Hu, X.; Hassink, R. Exploring adaptation and adaptability in uneven economic resilience: A tale of two Chinese mining regions. Camb. J. Reg. Econ. Soc. 2017, 10, 527–541. [Google Scholar] [CrossRef]

- Tan, J.; Lo, K.; Qiu, F.; Liu, W.; Li, J.; Zhang, P. Regional Economic Resilience: Resistance and Recoverability of Resource-Based Cities during Economic Crises in Northeast China. Sustainability 2017, 9, 2136. [Google Scholar] [CrossRef]

- Guan, H.; Liu, W.; Zhang, P.; Lo, K.; Li, J.; Li, L. Analyzing Industrial Structure Evolution of Old Industrial Cities Using Evolutionary Resilience Theory: A Case Study in Shenyang of China. Chin. Geogr. Sci. 2018, 28, 516–528. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P.; Gardiner, B.; Tyler, P. How regions react to recessions: Resilience and the role of economic structure. Reg. Stud. 2016, 50, 561–585. [Google Scholar] [CrossRef]

- Reggiani, A.; De Graaff, T.; Nijkamp, P. Resilience: An evolutionary approach to spatial economic systems. Netw. Spat. Econ. 2002, 2, 211–229. [Google Scholar] [CrossRef]

- Reggiani, A. Network resilience for transport security: Some methodological considerations. Transp. Policy 2013, 28, 63–68. [Google Scholar] [CrossRef]

- Martin, R.; Sunley, P. On the notion of regional economic resilience: Conceptualization and explanation. J. Econ. Geogra. 2015, 15, 1–42. [Google Scholar] [CrossRef]

- Holling, C. Resilience and stability of ecological systems. Ann. Rev. Ecol. Syst. 1973, 4, 1–23. [Google Scholar] [CrossRef]

- Cerra, V.; Saxena, S.C. Growth dynamics: The myth of economic recovery. Am. Econ. Rev. 2008, 98, 439–457. [Google Scholar] [CrossRef]

- Cerra, V.; Panizza, U.; Saxena, S.C. International evidence on recovery from recessions. Contemp. Econ. Policy 2013, 31, 424–439. [Google Scholar] [CrossRef]

- Fingleton, B.; Garretsen, H.; Martin, R. Recessionary shocks and regional employment: Evidence on the resilience of UK regions. J. Reg. Sci. 2012, 52, 109–133. [Google Scholar] [CrossRef]

- Doran, J.; Fingleton, B. Employment resilience in Europe and the 2008 economic crisis: Insights from micro-level data. Reg. Stud. 2016, 50, 644–656. [Google Scholar] [CrossRef]

- Bristow, G. Resilient regions: Re-‘place’ing regional competitiveness. Camb. J. Reg. Econ. Soc. 2010, 3, 153–167. [Google Scholar] [CrossRef]

- Modica, M.; Reggiani, A. Spatial economic resilience: Overview and perspectives. Netw. Spat. Econ. 2015, 15, 211–233. [Google Scholar] [CrossRef]

- Davies, S. Regional resilience in the 2008–2010 downturn: Comparative evidence from European countries. Camb. J. Reg. Econ. Soc. 2011, 4, 369–382. [Google Scholar] [CrossRef]

- Di, C. Recessions, recoveries and regional resilience: Evidence on Italy. Camb. J. Reg. Econ. Soc. 2015, 8, 273–291. [Google Scholar]

- Cellini, R.; Torrisi, G. Regional resilience in Italy: A very long-run analysis. Reg. Stud. 2014, 48, 1779–1796. [Google Scholar] [CrossRef]

- Brakman, S.; Garretsen, H.; Marrewijk, C. Regional resilience across Europe: On urbanisation and the initial impact of the Great Recession. Reg. Stud. 2015, 8, 225–240. [Google Scholar] [CrossRef]

- Chapple, K.; Lester, T. The resilient regional labour market? The US case. Reg. Stud. 2010, 3, 85–104. [Google Scholar] [CrossRef] [Green Version]

- Angulo, A.; Mur, J.; Trívez, F. Measuring resilience to economic shocks: An application to Spain. Ann. Reg. Sci. 2018, 60, 349–373. [Google Scholar] [CrossRef]

- Giannakis, E.; Bruggeman, A. Determinants of regional resilience to economic crisis: A European perspective. Eur. Plan. Stud. 2017, 25, 1394–1415. [Google Scholar] [CrossRef]

- Di, C. Testing and explaining economic resilience with an application to Italian regions. Pap. Reg. Sci. 2017, 96, 93–113. [Google Scholar]

- Sagan, I.; Masik, G. Economic resilience. The case study of Pomorskie region. Raumforsch. Raumordn. 2014, 72, 153–164. [Google Scholar] [CrossRef]

- Hassink, R. Regional resilience: A promising concept to explain differences in regional economic adaptability? Camb. J. Reg. Econ. Soc. 2010, 3, 45–58. [Google Scholar] [CrossRef]

- Zhao, Q. Industrialization and urbanization and its paths’ selection of Liaoning traditional industrial base. Econ. Geogr. 2005, 25, 329–332. [Google Scholar]

- Zhang, P. Regional Development Report of Northeast China 2008; Science Press: Beijing, China, 2008. [Google Scholar]

- Yang, D.; Zhao, Z. Investment explanation of stagnation of economic growth in Northeast China. Northeast Asia Forum. 2015, 24, 94–107, 128. [Google Scholar]

- Bao, Z.; Li, X. Industrial Economy History of Liaoning Province; Social Sciences Academic Press: Beijing, China, 2014. [Google Scholar]

- Jin, F.; Wang, J.; Yang, Y.; Ma, L.; Qi, Y. The paths and solutions of innovation development in Northeast China. Sci. Geogr. Sin. 2016, 36, 1285–1292. [Google Scholar]

- Holm, J.; Østergaard, C. Regional employment growth, shocks and regional industrial resilience: A quantitative analysis of the Danish ICT sector. Reg. Stud. 2015, 49, 95–112. [Google Scholar] [CrossRef]

- Mazzola, F.; Cascio, I.; Epifanio, R.; Giacomo, G. Territorial capital and growth over the Great Recession: A local analysis for Italy. Ann. Reg. Sci. 2018, 60, 411–441. [Google Scholar] [CrossRef]

- Petrakos, G.; Psycharis, Y. The spatial aspects of economic crisis in Greece. Camb. J. Reg. Econ. Soc. 2015, 9, 137–152. [Google Scholar] [CrossRef] [Green Version]

- Palaskas, T.; Psycharis, Y.; Rovolis, A.; Stoforos, C. The asymmetrical impact of the economic crisis on unemployment and welfare in Greek urban economies. J. Econ. Geogr. 2015, 15, 973–1007. [Google Scholar] [CrossRef]

- Anselin, L.; Florax, R. New Directions in Spatial Econometrics; Springer: Berlin, Germany, 1995. [Google Scholar]

- Qi, W.; Liu, S.; Jin, F. Calculation and spatial evolution of population loss in Northeast China. Sci. Geogr. Sin. 2017, 37, 1795–1804. [Google Scholar]

- Research group on development and strategy of science and technology of China. In Annual Report of Regional Innovation Capability of China 2015; Science Publishing House: Beijing, China, 2015.

- Angulo, A.; Mur, J.; Trívez, F. Measure of the resilience to Spanish economic crisis: The role of specialization. Econ. Bus. Lett. 2014, 3, 263–275. [Google Scholar] [CrossRef]

- Kakderi, C.; Tasopoulou, A. Regional economic resilience: The role of national and regional policies. Eur. Plan. Stud. 2017, 25, 1435–1453. [Google Scholar] [CrossRef]

| Variable | Description | Min | Max | Mean |

|---|---|---|---|---|

| Regional economic resilience | Resistance and recoverability index | −0.6547 | 0.4531 | −0.1441 |

| Economic development level (GDP) | Gross domestic product/city population (Log of the number) | 7.3165 | 10.8519 | 9.0248 |

| Governance arrangement (GOV) | Public finance expenditure/city population (Log of the number) | 5.2652 | 8.6927 | 6.7745 |

| Financial environment (FDI) | Amount of foreign direct investment actually utilized/GDP (Ratio) | 0.0002 | 0.1180 | 0.0271 |

| Innovation ability (INO) | Employment in scientific research and technical services/city population (Ratio) | 0.0006 | 0.0131 | 0.0020 |

| Labor market (UMP) | Unemployment rate (Ratio) | 0.0200 | 0.0850 | 0.0374 |

| Industrial structure (IND) | Proportion of secondary industry (Ratio) | 0.2980 | 0.7151 | 0.4879 |

| Economic diversity (HHI) | Herfindahl–Hirschman index | 0.1053 | 0.4129 | 0.2302 |

| Resistance 1992–1999 | Recoverability 1999–2007 | Resistance 2007–2015 | |

|---|---|---|---|

| Moran’s I | 0.28 ** | −0.27 * | −0.11 |

| p value | 0.02 | 0.09 | 0.45 |

| OLS 1992–2015 | SLM 1992–2015 | SEM 1992–2015 | SEM 1992–1999 | SEM 1999–2007 | OLS 2007–2015 | |

|---|---|---|---|---|---|---|

| Constant | 0.831 | −5.704 *** | 3.846 *** | −2.776 | ||

| GDP | −0.101 | −1.234 ** | −1.340 *** | 1.303 *** | −0.251 * | −0.364 |

| GOV | 0.070 | 0.982 ** | 1.021 *** | −0.864 ** | −0.261 | 0.882 |

| FDI | 2.162 | 1.938 | 2.033 | 0.175 | 5.614 *** | −0.068 |

| INO | −7.281 | 33.325 | 67.854 *** | −21.107 | −0.801 | −91.147 |

| UMP | −5.847 | −0.059 | −3.427 | 1.025 | −7.732 ** | −7.325 |

| IND | −0.287 | −1.176 | −2.638 *** | −1.509 ** | −0.034 | 0.524 |

| HHI | −1.000 | −1.503 | −2.541 *** | 1.689 | 1.559 *** | −3.770 |

| ρ/λ | 0.105 | −1.246 *** | −0.416 | −4.464 *** | ||

| R2 | 0.189 | 0.465 | 0.335 | 0.738 | 0.617 | 0.359 |

| LogL | 0.174 | 7.346 | 17.809 | 7.854 | 16.174 | 5.981 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, L.; Zhang, P.; Li, X. Regional Economic Resilience of the Old Industrial Bases in China—A Case Study of Liaoning Province. Sustainability 2019, 11, 723. https://doi.org/10.3390/su11030723

Li L, Zhang P, Li X. Regional Economic Resilience of the Old Industrial Bases in China—A Case Study of Liaoning Province. Sustainability. 2019; 11(3):723. https://doi.org/10.3390/su11030723

Chicago/Turabian StyleLi, Liangang, Pingyu Zhang, and Xin Li. 2019. "Regional Economic Resilience of the Old Industrial Bases in China—A Case Study of Liaoning Province" Sustainability 11, no. 3: 723. https://doi.org/10.3390/su11030723