Application of Game Theory to Conflict Management in a Construction Contract

Abstract

:1. Introduction

- entities cooperation [5],

- setting a portfolio of orders,

- building a market entry strategy for a new entity, product or service (technology),

- mediation between contractors,

- wage negotiations with employees,

- simulating the course of the "price war" between sellers of construction production, enforcing obligations of the parties to the contract [16],

- simulating the course of the conflict resolved in court,

- determining the level, scope, and type of construction production affected by the market situation [20],

- During the preparation and submission of tender offers, the contractors are obliged to verify the project documentation or the functional and operational program (FOP), to identify their defects, to examine the area of planned construction in regard to provision of utilities and to geological and geotechnical conditions.

- During project execution, after the contract is signed, the selected contractor is obliged to remove the identified defects of the project documentation or the FOP and to complete additional works.

- During the final inspection the following causes of conflict can be identified: making the acceptance of works by the investor affected by the circumstances beyond the contractor’s control or unrelated to the construction process (e.g., delivery and launch of the production line by another supplier, service provider).

Introductory Example

2. The Cause of Conflict between the GC and the IN—Description and Structure of the Research Problem

- value of the signed contract for construction works: 55 million,

- total time of investment completion: 500 workdays,

- value of the additional works completed by the GC: 1.5 million,

- amount of contractual penalties for failing to meet the deadline: 2.0 million,

- cost of profits lost: 2.0 million.

3. Game Model Proposition

3.1. Assumptions for the Constructed Game Model

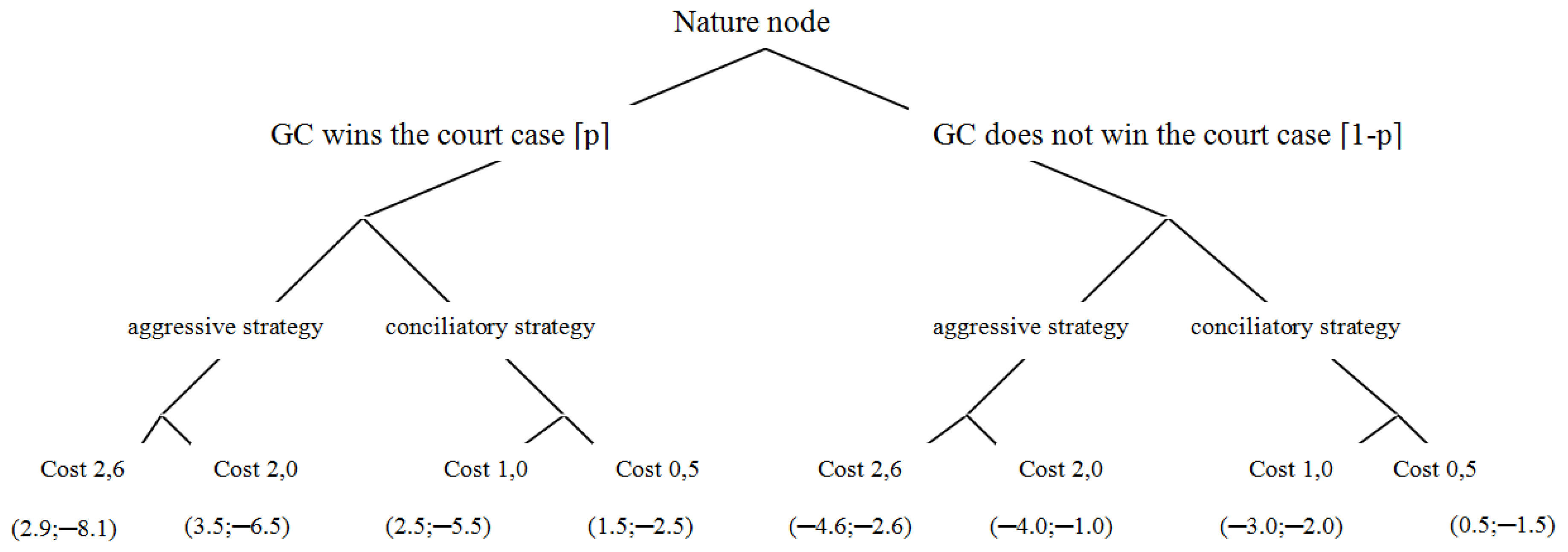

- The aggressive strategy means taking a decisive action and actively searching for the opponent’s weaknesses. Its disadvantage is the considerable resources needed to prove the case in court (evidence e.g., numerous witnesses, expert opinions). It is assumed that the cost of long-term litigation is 2.6 million.

- The conciliatory strategy means demonstrating readiness for dialogue and searching for rational compromise. The conciliatory strategy of the winning side results in smaller benefits than the aggressive one. Its advantage is significantly shorter litigation. It is assumed that the total cost of litigation is 0.5 million.

- In the case of taking asymmetric actions (one of the players applies aggressive strategy, the other conciliatory) the cost of litigation varies for both sides. It is assumed that for the aggressive player it will be 2.0 million, and for the conciliatory 1.0 million.

- S—the strategy space,

- Ω—the action space,

- J—the vector of objective functions associated to players,

- M—the set of players.

A Formal Description of the Game

- data acquisition,

- analysis and description of the conflict origin,

- establishing assumptions for the game model,

- determining the preliminary rules and the game conditions,

- determining the strategies that can be applied by each player, game states and payoff amounts,

- calculation of the payoff amount for the two game states (court case won/lost by the GC); the same probability distribution of the court decision being favorable/unfavorable for the GC is assumed (50%—the GC won, 50%—the IN lost, 50%—the IN won, 50%—the GC lost), not considering specific circumstances and evidence affecting the court decision.

- estimating the minimum probability of favorable circumstances at which it is beneficial to apply a specific strategy.

- collecting and interpreting new information,

- entering new information,

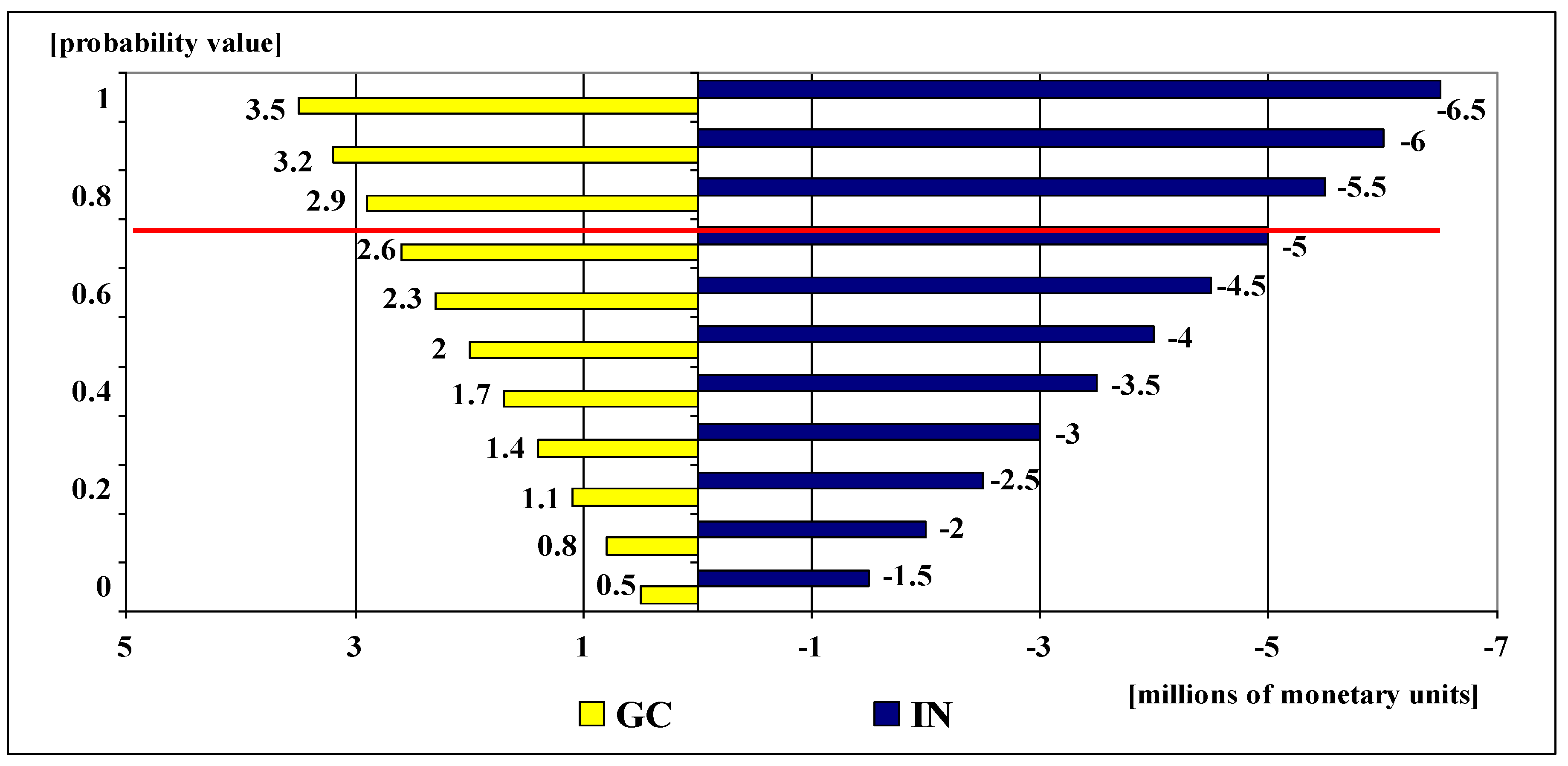

- probability distinction of a court judgment favorable for the GC—probability analysis in the range from 0.0 (the GC loses the court case) to 1.0 (the GC wins the court case), considering new circumstances and evidence favorable for the GC,

- determining the scope of changes in the expected payoffs for both players depending on the variable probability value of a given game state (calculation of the payoff values for different cases),

- analysis and interpretation of the results obtained in the aspect of taking a rational decision by the GC.

3.2. Game States

3.3. Payoff Tables for Two Game States

3.3.1. Game State 1

3.3.2. Game State 2

3.4. Payoff Analysis for Two Game States

3.5. Expected Payoffs for Players for the New Probability Distribution

3.6. Border Value of Probability, Model Analysis, Simulations

- —probability border value is understood as the minimal probability of circumstances favorable for the contractor, in which it pays off to apply the aggressive strategy.

- —the payoff for the GC when the aggressive strategy is used for game state 1,

- —the payoff for the GC when the aggressive strategy is used for game state 2,

- —the payoff for the GC when the conciliatory strategy is used for game state 1,

- —the payoff for the GC when the conciliatory strategy is used for game state 2.

4. Conclusions and Recommendations

Author Contributions

Conflicts of Interest

References

- Zavadskas, E.K.; Turskis, Z.; Tamošaitienė, J. Contractor selection of construction in a competitive environment. J. Bus. Econ. Manag. 2008, 9, 181–187. [Google Scholar] [CrossRef]

- Tamošaitiene, J.; Turskis, Z.; Zavadskas, E.K. Modeling of Contractor Selection Taking into Account Different Risk Level. In Proceedings of the 25th ISARC, Vilnius, Lituania, 26–29 June 2008; pp. 676–681. [Google Scholar] [CrossRef]

- Osborne, M.J. An Introduction to Game Theory, 1st ed.; Oxford University Press: New York, NY, USA, 2003; ISBN 978-0-19-512895-6. [Google Scholar]

- Osborne, M.J.; Rubinstein, A. A Course in Game Theory, 1st ed.; The MIT Press: Cambridge, MA, USA, 1994; ISBN 978-0-262-65040-3. [Google Scholar]

- Halac, M. Relationship Building: Conflict and Project Choice over Time. J. Law Econ. Organ. 2014, 30, 683–708. [Google Scholar] [CrossRef]

- Yang, Y.; Wang, M. Analysis on the interests of construction parties in project management model based on the game theory. In Proceedings of the 2009 Chinese Control and Decision Conference, Shanghai, China, 16–18 December 2009; pp. 4512–4516. [Google Scholar] [CrossRef]

- Anderson, L.L., Jr.; Polkinghorn, B. Managing conflict in construction megaprojects: Leadership and third-party principles. Confl. Resolut. Q. 2008, 26, 167–198. [Google Scholar] [CrossRef]

- Zavadskas, E.K. Game Theory in Building Technology and Management; Vilnius: Technika, Lithuanian, 2004. [Google Scholar]

- Ibadov, N. Determination of the Risk Factors Impact on the Construction Projects Implementation Using Fuzzy Sets Theory. Acta Phys. Pol. A 2016, 130, 107–111. [Google Scholar] [CrossRef]

- Barough, A.S.; Shoubi, M.V.; Skardi, M.J.E. Application of Game Theory Approach in Solving the Construction Project Conflicts. Procedia Soc. Behav. Sci. 2012, 58, 1586–1593. [Google Scholar] [CrossRef] [Green Version]

- Wu, G.; Wang, H.; Chang, R. A Decision Model Assessing the Owner and Contractor’s Conflict Behaviors in Construction Projects. Available online: https://www.hindawi.com/journals/ace/2018/1347914/ (accessed on 2 November 2018).

- Wu, G.; Liu, C.; Zhao, X.; Zuo, J. Investigating the relationship between communication-conflict interaction and project success among construction project teams. Int. J. Proj. Manag. 2017, 35, 1466–1482. [Google Scholar] [CrossRef]

- Puck, J.; Pregernig, U. The effect of task conflict and cooperation on performance of teams: Are the results similar for different task types? Eur. Manag. J. 2014, 32, 870–878. [Google Scholar] [CrossRef]

- Mateo, S.C.; Ramón, J. The use of Game Theory to solve conflicts in the project management and construction industry. Int. J. Inf. Syst. Proj. 2015, 3, 43–58. [Google Scholar] [CrossRef]

- Yiu, T.W.; Cheung, S.O. Behavioral Transition: A Framework for the Construction Conflict–Tension Relationship. IEEE Trans. Eng. Manag. 2007, 54, 498–505. [Google Scholar] [CrossRef]

- Yuan, H.; Ma, H. Game Analysis in the Construction Claim Negotiations. Procedia Eng. 2012, 28, 586–593. [Google Scholar] [CrossRef] [Green Version]

- Sacks, R.; Harel, M. An economic game theory model of subcontractor resource allocation behavior. Constr. Manag. Econ. 2006, 24, 869–881. [Google Scholar] [CrossRef]

- Motchenkova, E. Determination of optimal penalties for antitrust violations in a dynamic setting. Eur. J. Oper. Res. 2008, 189, 269–291. [Google Scholar] [CrossRef] [Green Version]

- Brockman, J.L. Interpersonal Conflict in Construction: Cost, Cause, and Consequence. J. Constr. Eng. Manag. 2014, 140, 4013050. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Peldschus, F. Application of Games Theory in Preparation for Building Production; Vilnius Engineering Civil Institute: Vilnius, Lithuania, 1986. [Google Scholar]

- Hwang, B.-G.; Zhao, X.; Yu, G.S. Risk identification and allocation in underground rail construction joint ventures: contractors’ perspective. J. Civ. Eng. Manag. 2016, 22, 758–767. [Google Scholar] [CrossRef]

- Reneke, J.A. A game theory formulation of decision making under conditions of uncertainty and risk. Nonlinear Anal. Theory Methods Appl. 2009, 71, e1239–e1246. [Google Scholar] [CrossRef]

- Tomczak, M.; Jaśkowski, P. Application of type-2 interval fuzzy sets to contractor qualification process. KSCE J. Civ. Eng. 2018, 22, 2702–2713. [Google Scholar] [CrossRef]

- Apollo, M.; Kembłowski, M.W. Modelowanie ryzyka inwestycyjnego przy użyciu OOBN. Mater. Bud. 2016, 48–49. [Google Scholar] [CrossRef]

- Kapliński, O.; Tamošaitiene, J. Game theory applications in construction engineering and management. Ukio Technologinis ir Ekonominis Vystymas 2010, 16, 348–363. [Google Scholar] [CrossRef] [Green Version]

- Peldschus, F.; Zavadskas, E.K.; Turskis, Z.; Tamosaitiene, J. Sustainable assessment of construction site by applying game theory. Inzinerine Ekon. Eng. Econ. 2010, 3, 223–236. [Google Scholar]

- Peldschus, F. Multi-attribute decisions in construction. Transform. Bus. Econ. 2008, 7, 163–165. [Google Scholar]

- Peldschus, F. Experience of the game theory application in construction management. Technol. Econ. Dev. Econ. 2008, 14, 531–545. [Google Scholar] [CrossRef]

- Podvezko, V. Book review: Game theory in building technology and management. Bus. Econ. Manag. 2008, 9, 237–239. [Google Scholar] [CrossRef]

- Homburg, C.; Scherpereel, P. How should the cost of joint risk capital be allocated for performance measurement? Eur. J. Oper. Res. 2008, 187, 208–227. [Google Scholar] [CrossRef]

- Su, B.B.; Chang, H.; Chen, Y.-Z.; He, D.R. A game theory model of urban public traffic networks. Phys. Stat. Mech. Appl. 2007, 379, 291–297. [Google Scholar] [CrossRef]

- Sun, L.-J.; Gao, Z.-Y. An equilibrium model for urban transit assignment based on game theory. Eur. J. Oper. Res. 2007, 1, 305–314. [Google Scholar] [CrossRef]

- Meszek, W. The analysis of property value increase as a result of infrastructural investment projects. Int. J. Environ. Pollut. 2008, 35, 345. [Google Scholar] [CrossRef]

- Grzyl, B.; Miszewska-Urbańska, E.; Siemaszko, A. Safety of investment process parties in the aspect of construction work contract. Zesz. Nauk. Wyższa Szk. Oficer. Wojsk Lądowych Im Gen T Kościuszki 2017, Nr 4. [Google Scholar] [CrossRef]

- Grzyl, B.; Apollo, M. Umowa o roboty budowlane w aspekcie podziału ryzyka stron. Inżynieria Morska i Geotechnika 2015, 838–843. [Google Scholar] [CrossRef]

- Kembłowski, M.W.; Grzyl, B.; Siemaszko, A. Game Theory Analysis of Bidding for a Construction Contract. IOP Conf. Ser. Mater. Sci. Eng. 2017, 245. [Google Scholar] [CrossRef]

- Anysz, H.; Ibadov, N. Neuro-fuzzy predictions of construction site completion dates. Tech. Trans. 2017, 6. [Google Scholar] [CrossRef] [Green Version]

- Juszczyk, M.; Kozik, R.; Leśniak, A.; Plebankiewicz, E.; Zima, K. Errors in the Preparation of Design Documentation in Public Procurement in Poland. Procedia Eng. 2014, 85, 283–292. [Google Scholar] [CrossRef] [Green Version]

- Leśniak, A.; Plebankiewicz, E. Modeling the Decision-Making Process Concerning Participation in Construction Bidding. J. Manag. Eng. 2015, 31, 4014032. [Google Scholar] [CrossRef]

- Antoniou, F.; Aretoulis, G.N.; Konstantinidis, D.; Kalfakakou, G.P. Engineers’ Perception of Contract Types’ Performance for Highway Construction Projects. Int. J. Appl. Behav. Econ. IJABE 2013, 2, 1–24. [Google Scholar] [CrossRef]

- Ianole, R. Applied Behavioral Economics Research and Trends; IGI Global: Hershey, PA, USA, 2001; ISBN 978-1-5225-1826-6. [Google Scholar]

- Shi, Q.; Zhu, J.; Li, Q. Cooperative Evolutionary Game and Applications in Construction Supplier Tendency. Available online: https://www.hindawi.com/journals/complexity/2018/8401813/ (accessed on 8 March 2019).

- Jide, S.; Xincheng, W.; Liangfa, S. Research on the mobility behavior of Chinese construction workers based on evolutionary game theory. Econ. Res.-Ekon. Istraživanja 2018, 31, 1–14. [Google Scholar] [CrossRef]

- Kembłowski, M.W.; Grzyl, B.; Siemaszko, A. Game Theory Analysis of Bidding for a Construction Contract. In IOP Conference Series: Materials Science and Engineering; IOP Publishing: Bristol, England, 2017; Volume 245, p. 062047. [Google Scholar]

- Hargreaves-Heap, S.; Varoufakis, Y. Game Theory: A Critical Introduction, 2nd ed.; Routledge: London, UK; New York, NY, USA, 2004; ISBN 978-0-415-25095-5. [Google Scholar]

| Player 1 | Strong | Fight | Not |

| Fight | 1, −2 | 2, −1 | |

| Not | −1, 2 | 0, 0 | |

| Player 2 | Weak | Fight | Not |

| Fight | −2, 1 | 2, −1 | |

| Not | −1, 2 | 0, 0 |

Player 1—Investor (IN)  Player 2—General Conractor (GC)  | Aggressive Strategy | Conciliatory Strategy |

|---|---|---|

| Aggressive Strategy | (−2.6; −2.6) | (−2.0; −1.0) |

| Conciliatory Strategy | (−1.0; −2.0) | (−0.5; −0.5) |

Player 1—Investor (IN)  Player 2—General Contractor (GC)  | Aggressive Strategy | Conciliatory Strategy | ||

|---|---|---|---|---|

| Aggressive Strategy | 5.5 − 2.6 = 2.9 | −5.5 − 2.6 = −8.1 | 5.5 − 2.0 = 3.5 | −5.5 − 1.0 = −6.5 |

| (2.9; −8.1) | (3.5; −6.5) | |||

| Conciliatory Strategy | 3.5 − 1.0 = 2.5 | −3.5 − 2.0 = −5.5 | 2.0 − 0.5 = 1.5 | −2.0 − 0.5 = −2.5 |

| (2.5; −5.5) | (1.5; −2.5) | |||

Player 1—Investor (IN)  Player 2—General Contractor (GC)  | Aggressive Strategy | Conciliatory Strategy | |||

|---|---|---|---|---|---|

| Aggressive Strategy | −2.0 − 2.6 = −4.6 | 0 − 2.6 = −2.6 | −2.0 − 2.0 = −4.0 | 0 − 1.0 = −1.0 | |

| (−4.6; −2.6) | (−4.0; −1.0) | ||||

| Conciliatory Strategy | −2.0 − 1.0 = −3.0 | 0 − 2.0 = −2.0 | 1 − 0.5 = 0.5 | −1.0 − 0.5 = −1.5 | |

| (−3.0; −2.0) | (0.5; −1.5) | ||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Grzyl, B.; Apollo, M.; Kristowski, A. Application of Game Theory to Conflict Management in a Construction Contract. Sustainability 2019, 11, 1983. https://doi.org/10.3390/su11071983

Grzyl B, Apollo M, Kristowski A. Application of Game Theory to Conflict Management in a Construction Contract. Sustainability. 2019; 11(7):1983. https://doi.org/10.3390/su11071983

Chicago/Turabian StyleGrzyl, Beata, Magdalena Apollo, and Adam Kristowski. 2019. "Application of Game Theory to Conflict Management in a Construction Contract" Sustainability 11, no. 7: 1983. https://doi.org/10.3390/su11071983