Modeling the Risk of Extreme Value Dependence in Chinese Regional Carbon Emission Markets

Abstract

:1. Introduction

2. Literature Review

3. Models and Methodology

3.1. AR-GARCH Model

3.2. Extreme Value Theory (EVT)

3.3. Copula Function

4. Data and Empirical Analysis

4.1. Data

4.2. Empirical Analysis

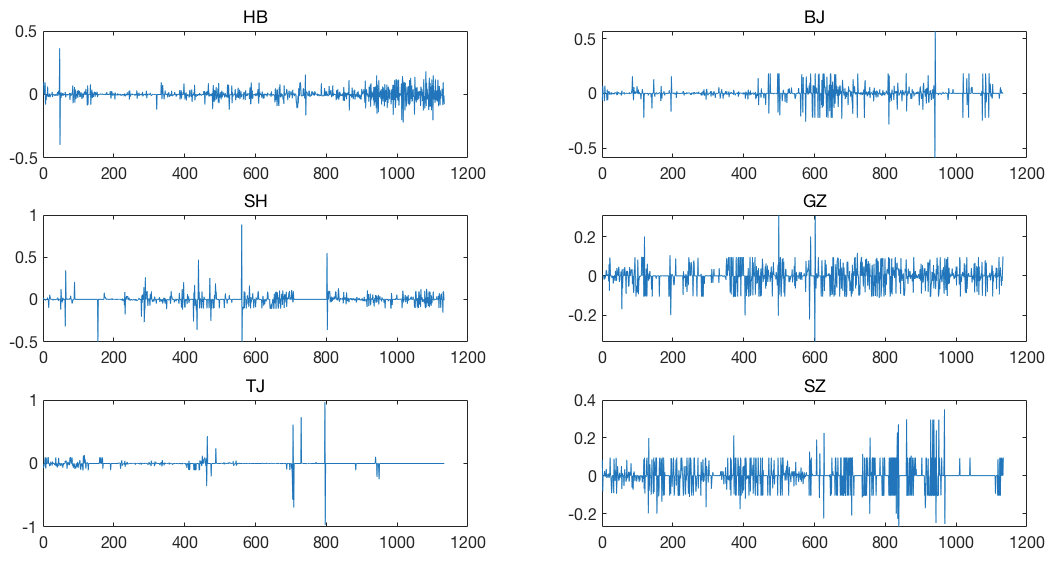

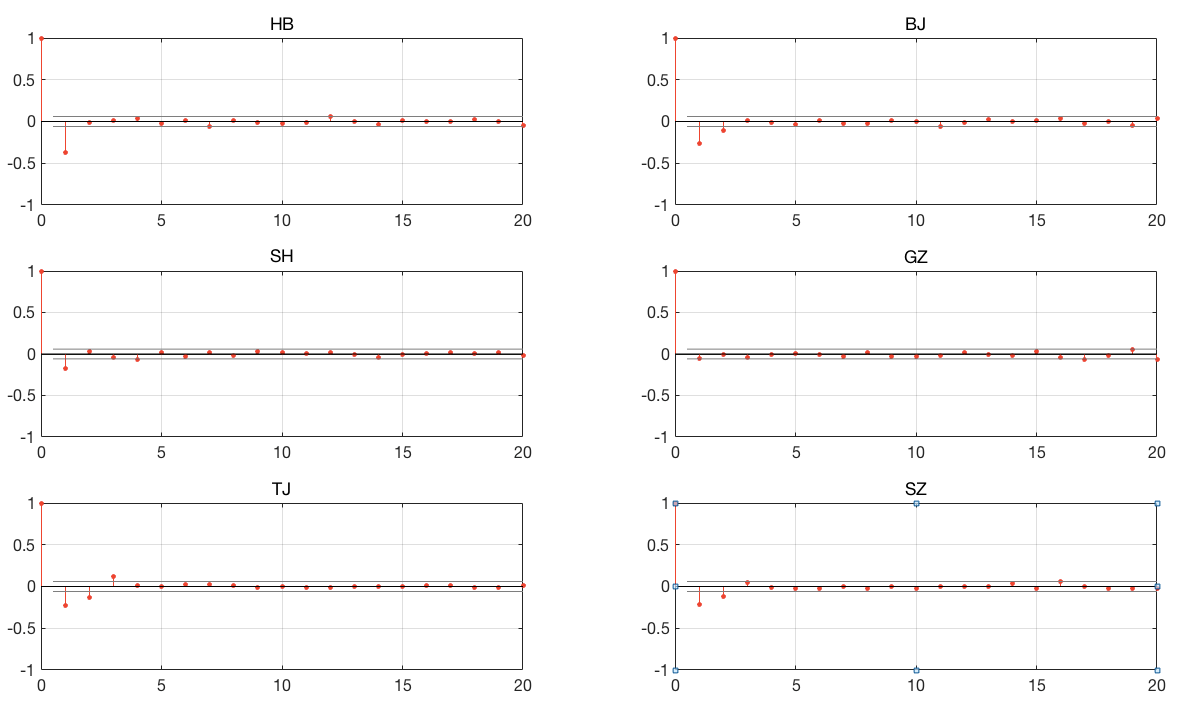

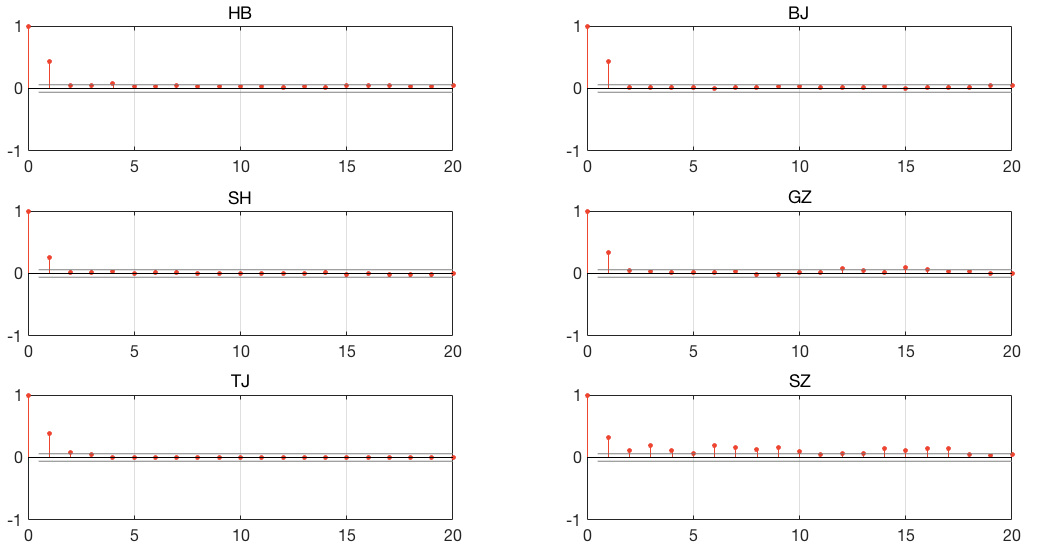

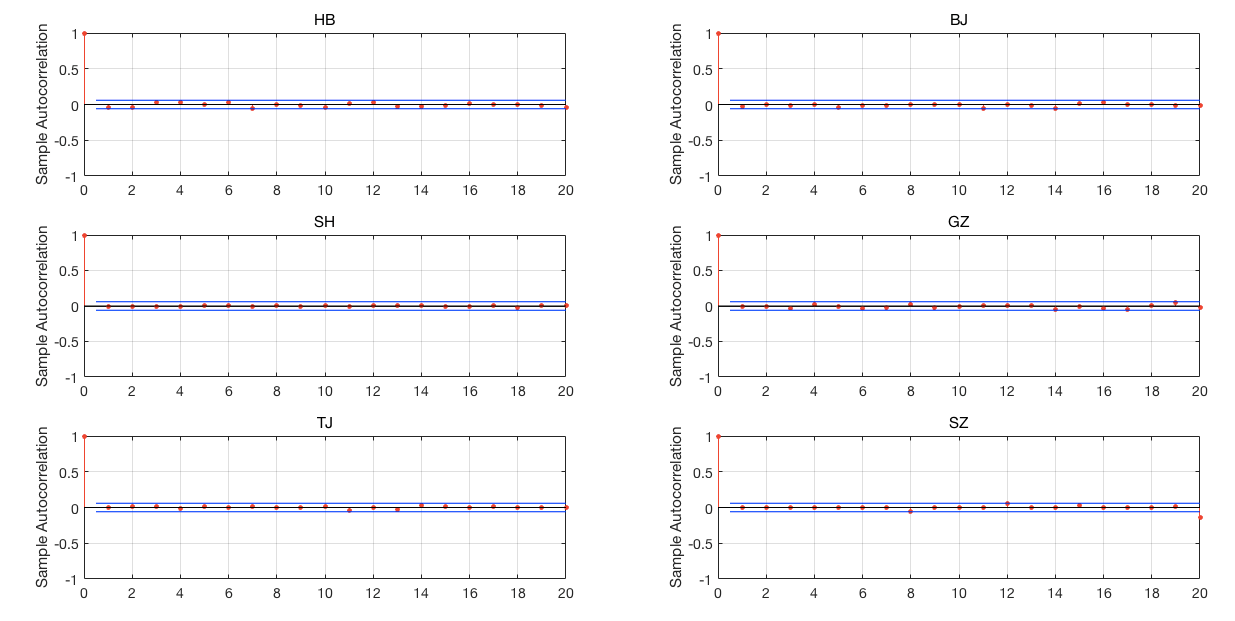

4.2.1. Autocorrelation Analysis

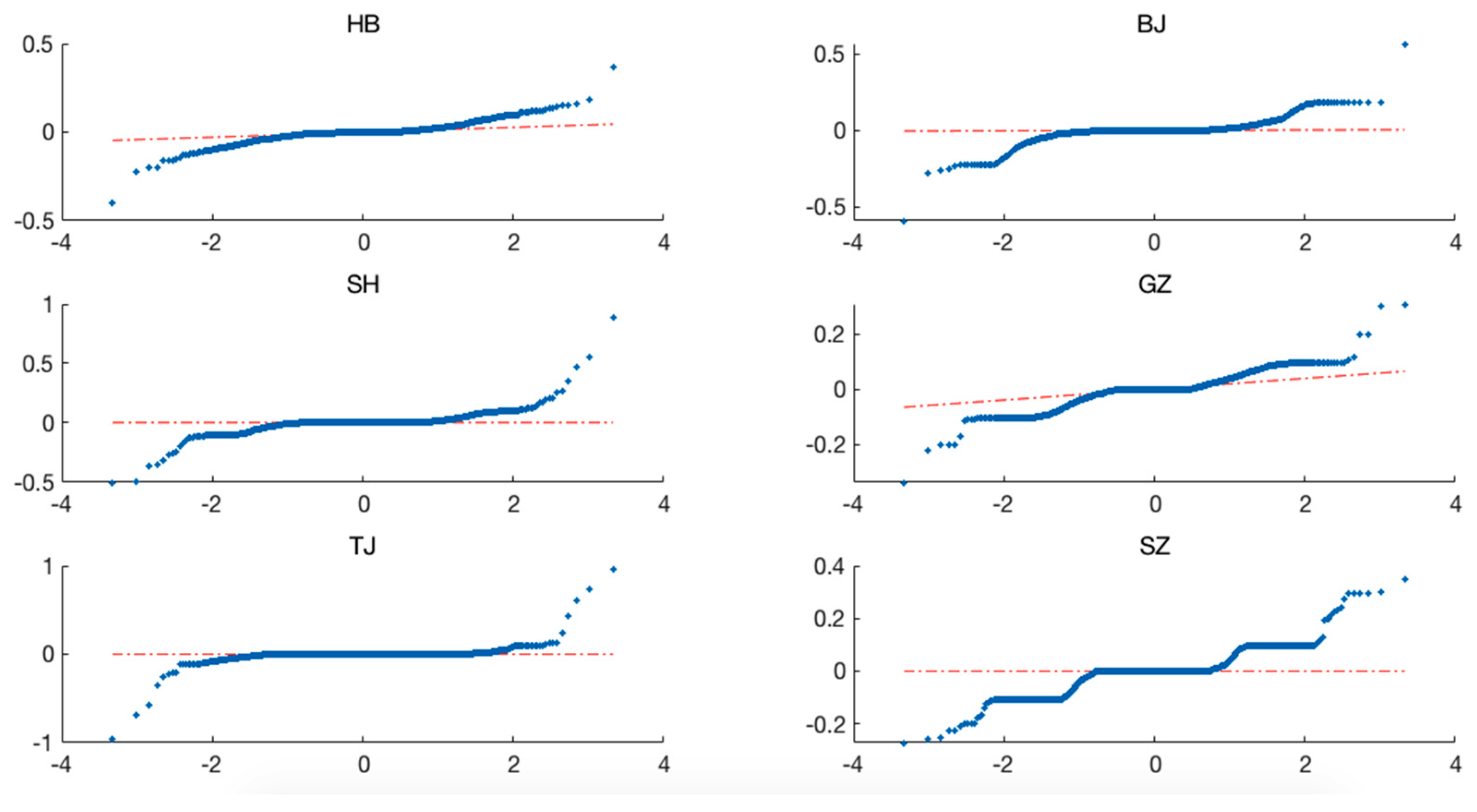

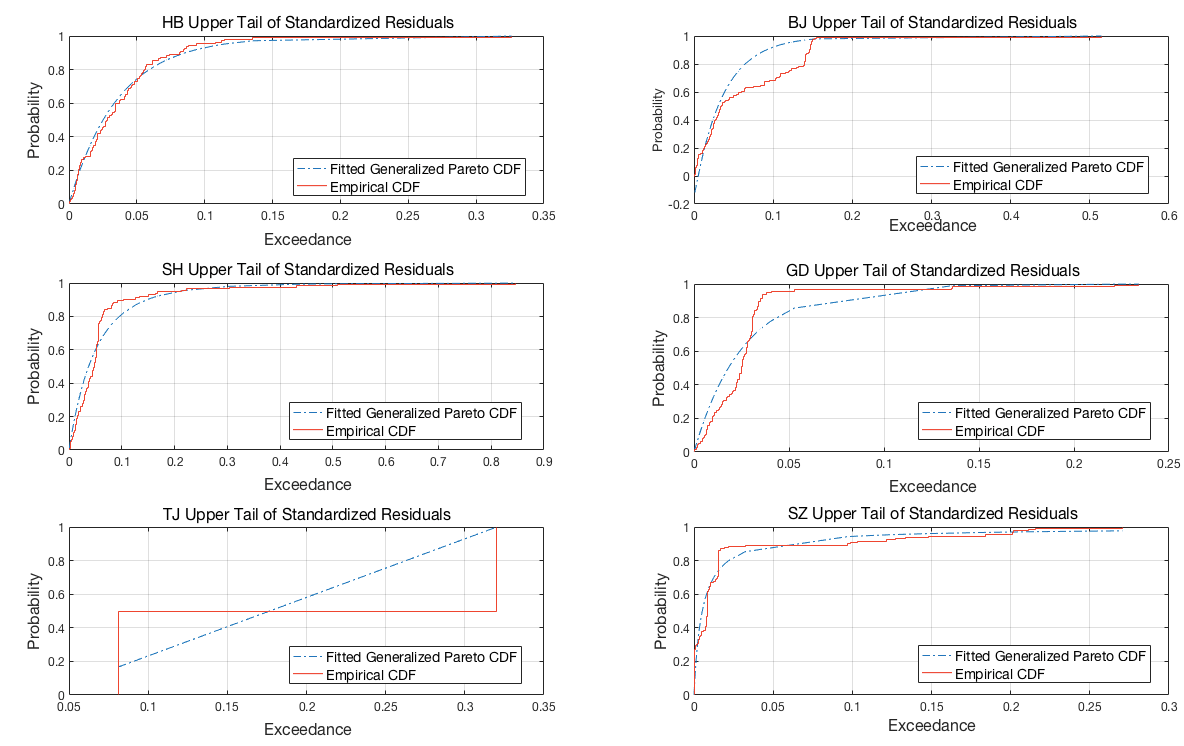

4.2.2. Evaluation of EVT Model

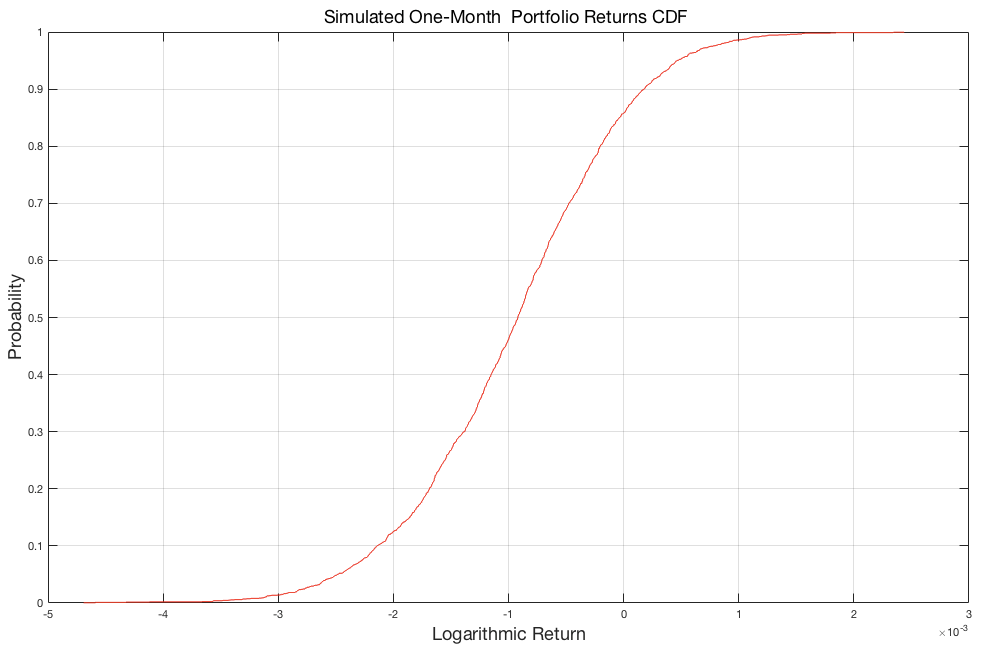

4.2.3. VaR Calculation

5. Discussion

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Christoffersen, P.F. Copyright-elements of financial risk management. In Elements of Financial Risk Management; Christoffersen, P., Ed.; Elsevier: Amsterdam, The Netherlands, 2012; pp. 3–20. [Google Scholar]

- Deng, M.Z.; Zhang, W.X. Recognition and analysis of potential risks in China’s carbon emission trading markets. Adv. Clim. Chang. Res. 2019, 10, 30–46. [Google Scholar] [CrossRef]

- Subramaniam, N.; Wahyuni, D.; Cooper, B.J.; Leung, P.; Wines, G. Integration of carbon risks and opportunities in enterprise risk management systems: Evidence from Australian firms. J. Clean. Prod. 2015, 96, 407–417. [Google Scholar] [CrossRef]

- Chu, W.; Chai, S.; Chen, X.; Du, M. Does the Impact of Carbon Price Determinants Change with the Different Quantiles of Carbon Prices? Evidence from China ETS Pilots. Sustainability 2020, 12, 5581. [Google Scholar] [CrossRef]

- Grubb, M.; Neuhoff, K. Allocation and competitiveness in the EU emissions trading scheme: Policy overview. Clim. Policy 2006, 6, 7–30. [Google Scholar] [CrossRef]

- Mo, J.L.; Zhu, L.; Fan, Y. The impact of the EU ETS on the corporate value of European electricity corporations. Energy 2012, 45, 3–11. [Google Scholar] [CrossRef]

- Zhao, F.; Liu, F.; Hao, H.; Liu, Z. Carbon Emission Reduction Strategy for Energy Users in China. Sustainability 2020, 12, 6498. [Google Scholar] [CrossRef]

- Abadie, L.M.; Chamorro, J.M. European CO2 prices and carbon capture investments. Energy Econ. 2008, 30, 2992–3015. [Google Scholar]

- Hartman, P.; Straetmans, S.; De Vries, C.G. Asset market linkages in crisis periods. Rev. Econ. Stat. 2004, 86, 313–326. [Google Scholar] [CrossRef] [Green Version]

- McNeil, A.J.; Frey, R.; Embrechts, P. Quantitative Risk Management: Concepts, Techniques and Tools; Princeton University Press: Princeton, NY, USA, 2005. [Google Scholar]

- Longin, F.; Solnik, B. Extreme correlation of international equity markets. J. Financ. 2001, 56, 649–676. [Google Scholar]

- Longin, F.; Pagliardi, G. Tail relation between return and volume in the US stock market: An analysis based on extreme value theory. Econ. Lett. 2016, 145, 252–254. [Google Scholar] [CrossRef]

- Liu, G.Q.; Wei, Y.; Chen, Y.F.; Yu, J.; Hu, Y. Forecasting the value-at-risk of Chinese stock market using the HARQ model and extreme value theory. Phys. A Stat. Mech. Appl. 2018, 499, 288–297. [Google Scholar] [CrossRef]

- Sobreira, N.; Louro, R. Evaluation of volatility models for forecasting Value-at-Risk and Expected Shortfall in the Portuguese stock market. Financ. Res. Lett. 2020, 32, 101098. [Google Scholar] [CrossRef]

- Longin, F. From VaR to stress testing: The extreme value approach. J. Bank. Financ. 2000, 24, 1097–1130. [Google Scholar] [CrossRef]

- Angelidis, T.; Benos, A.; Degiannakis, S. The use of GARCH models in VaR estimation. Stat. Methodol. 2004, 1, 105–128. [Google Scholar] [CrossRef] [Green Version]

- Biage, M. Analysis of shares frequency components on daily value-at-risk in emerging and developed markets. Phys. A Stat. Mech. Appl. 2019, 532, 121798. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Nguyen, K.D.; Sousa, M.R. What explains the short-term dynamics of the prices of CO2 emissions? Energy Econ. 2014, 46, 122–135. [Google Scholar] [CrossRef]

- Sklar, A. Fonctions de Répartition à n Dimensions et leurs Marges. Publ. l’Institut Stat. l’Université Paris 1959, 8, 229–231. [Google Scholar]

- Wang, Z.; Chen, X.; Jin, Y.; Zhou, Y. Estimating risk of foreign exchange portfolio: Using VaR and CVaR based on GARCH-EVT-Copula model. Phys. A Stat. Mech. Appl. 2010, 389, 4918–4928. [Google Scholar] [CrossRef]

- Berger, T. Forecasting value-at-risk using time varying copulas and EVT return distributions. Int. Econ. 2013, 133, 93–106. [Google Scholar] [CrossRef]

- Hussain, S.I.; Li, S. The dependence structure between Chinese and other major stock markets using extreme values and copulas. Int. Rev. Econ. Financ. 2017, 56, 421–437. [Google Scholar] [CrossRef]

- Herrera, R.; González, S.; Clements, A. Mutual excitation between OECD stock and oil markets: A conditional intensity extreme value approach. N. Am. J. Econ. Financ. 2018, 46, 70–88. [Google Scholar] [CrossRef]

- Jiang, J.J.; Ye, B. Value-at-Risk Estimation of Carbon Spot Market Based on the Combined GARCH-EVT-VaR Model. Adv. Mater. Res. 2014, 1065, 3250–3253. [Google Scholar] [CrossRef]

- Bedford, T.; Cooke, R.M. Probability density decomposition for conditionally dependent random variables modeled by vines. Ann. Math. Artif. Intell. 2001, 32, 245–268. [Google Scholar] [CrossRef]

- Bedford, T.; Cooke, R.M. Vines-A new graphical model for dependent random variables. Ann. Stat. 2002, 30, 1031–1068. [Google Scholar] [CrossRef]

- Dißmann, J.; Brechmann, E.C.; Czado, C.; Kurowicka, D. Selecting and estimating regular vine copula and application to financial returns. Comput. Stat. Data Anal. 2013, 59, 52–69. [Google Scholar] [CrossRef] [Green Version]

- Koliai, L. Extreme risk modeling: An EVT-Pair-copulas approach for financial stress tests. J. Bank. Financ. 2016, 70, 1–22. [Google Scholar] [CrossRef]

- Feng, Z.; Wei, Y.; Wang, K. Estimating risk for the carbon market via extreme value theory: An empirical analysis of the EU ETS. Appl. Energy 2012, 99, 97–108. [Google Scholar] [CrossRef]

- Philip, D.; Shi, Y. Optimal hedging in carbon emission markets using Markov regime switching models. J. Int. Financ. Mark. Inst. Money 2016, 43, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Boyce, J.K. Carbon pricing: Effectiveness and equity. Ecol. Econ. 2018, 150, 52–61. [Google Scholar] [CrossRef]

- Jiao, L.; Liao, Y.; Zhou, Q. Predicting carbon market risk using information from macroeconomic fundamentals. Energy Econ. 2018, 73, 212–227. [Google Scholar] [CrossRef]

- Zhu, J.M.; Wu, P.; Chen, H.Y.; Liu, J.P.; Zhou, L.G. Carbon price forecasting with variational mode decomposition and optimal combined model. Phys. A Stat. Mech. Appl. 2018, 519, 140–158. [Google Scholar]

- Chang, K.; Pei, P.; Zhang, C.; Wu, X. Exploring the price dynamics of CO2 emission allowances in China’s emissions trading scheme pilots. Energy Econ. 2017, 67, 213–223. [Google Scholar]

- Yin, Y.; Jiang, Z.; Liu, Y.; Yu, Z. Factors Affecting Carbon Emission Trading Price: Evidence from China. Emerg. Mark. Financ. Trade 2019, 55, 3433–3451. [Google Scholar]

- Dai, Y.; Li, N.; Gu, R.; Zhu, X. Can China’s Carbon Emissions Trading Rights Mechanism Transform its Manufacturing Industry? Based on the Perspective of Enterprise Behavior. Sustainability 2018, 10, 2421. [Google Scholar]

- Ramazan, G.; Faruk, S.; Ulugülyaǧci, A. High volatility, thick tails and extreme value theory in value-at-risk estimation. Insur. Math. Econ. 2003, 33, 337–356. [Google Scholar]

- Bollerslev, T. Generalized autoregressive conditional heteroscedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar]

- Gazola, L.; Fernandes, C.; Pizzinga, A. The log-periodic-AR(1)-GARCH(1,1) model for financial crashes. Eur. Phys. J. B 2008, 61, 355–362. [Google Scholar]

- Richard, P.; Kabin, K. GARCH (1,1) model of the financial market with the Minkowski metric. Ztschrift Nat. A 2018, 73, 669–684. [Google Scholar]

- Mika, M.; Pentti, S. Stability of nonlinear AR-GARCH models. J. Time Ser. Anal. 2008, 29, 453–475. [Google Scholar]

- Peng-Cheng, M.A.; Sha-Sha, W.U.; Zhen-Fang, H. SHIBOR Rate Fluctuations Based on AR(1)-GARCH(1,1) Model. J. Hebei North Univ. Nat. Sci. Ed. 2012, 28, 1–5. [Google Scholar]

- Scarrott, C.; MacDonald, A. A reviewof extreme value threshold estimation and uncertainty quantification. Stat. J. 2012, 10, 33–60. [Google Scholar]

- DuMouchel, W.H. Estimating the table index α in order to measure tail thickness: A critique. Ann. Stat. 1983, 11, 1019–1031. [Google Scholar] [CrossRef]

- Boyer, B.H.; Gibson, M.S.; Loretan, M. Pitfalls in Tests for Changes in Correlations. 1997. Available online: https://ssrn.com/abstract=58460 (accessed on 18 July 2020).

- Patton, A.J. Skewness, Asymmetric Dependence, and Portfolios; London School of Economics & Political Science: London, UK, 2002; Working paper of London School of Economics & Political Science. [Google Scholar]

- Cuculescu, I.; Theodorescu, R. Extreme value attractors for star unimodal copulas. Comptes Rendus Math. 2002, 334, 689–692. [Google Scholar] [CrossRef]

- Hürlimann, W. Hutchinson-Lai’s conjecture for bivariate extreme value copulas. Stat. Probab. Lett. 2003, 61, 191–198. [Google Scholar] [CrossRef]

- Rosenberg, J.V.; Schuermann, T. A general approach to integrated risk management with skewed, fat-tailed risks. J. Financ. Econ. 2004, 79, 569–614. [Google Scholar] [CrossRef] [Green Version]

- Vermillion, S. Lessons from China’s Carbon markets for U.S. climate change policy. William Mary Environ. Law Policy Rev. 2015, 39, 457–482. [Google Scholar]

- Zhang, D.; Zhang, Q.; Qi, S.; Huang, J.; Karplus, V.; Zhang, X. Integrity of firms’ emissions reporting in China’s early carbon markets. Nat. Clim. Chang. 2019, 9, 164–169. [Google Scholar] [CrossRef]

| HB | BJ | SH | GZ | TJ | SZ | |

|---|---|---|---|---|---|---|

| Mean | −0.0004 | 0 | 0 | −0.0012 | −0.0012 | −0.0005 |

| Std. | 0.043 | 0.0581 | 0.063 | 0.0515 | 0.0646 | 0.0634 |

| Kurtosis | 16.8556 | 25.3499 | 55.4872 | 7.6041 | 131.0534 | 7.2871 |

| Skewness | −0.3211 | −0.6705 | 2.1326 | −0.1766 | 0.3916 | 0.3409 |

| Jarque-Box | 9082.4 | 23666 | 130910 | 1006.6 | 77414 | 889.5997 |

| Freedom | Maximum Simulated Loss | Maximum Simulated Revenue | VaR | ||

|---|---|---|---|---|---|

| 90% | 95% | 99% | |||

| 23.1829 | 0.4689% | 0.2437% | −0.2141% | −0.2486% | −0.3116% |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qiu, H.; Hu, G.; Yang, Y.; Zhang, J.; Zhang, T. Modeling the Risk of Extreme Value Dependence in Chinese Regional Carbon Emission Markets. Sustainability 2020, 12, 7911. https://doi.org/10.3390/su12197911

Qiu H, Hu G, Yang Y, Zhang J, Zhang T. Modeling the Risk of Extreme Value Dependence in Chinese Regional Carbon Emission Markets. Sustainability. 2020; 12(19):7911. https://doi.org/10.3390/su12197911

Chicago/Turabian StyleQiu, Hong, Genhua Hu, Yuhong Yang, Jeffrey Zhang, and Ting Zhang. 2020. "Modeling the Risk of Extreme Value Dependence in Chinese Regional Carbon Emission Markets" Sustainability 12, no. 19: 7911. https://doi.org/10.3390/su12197911