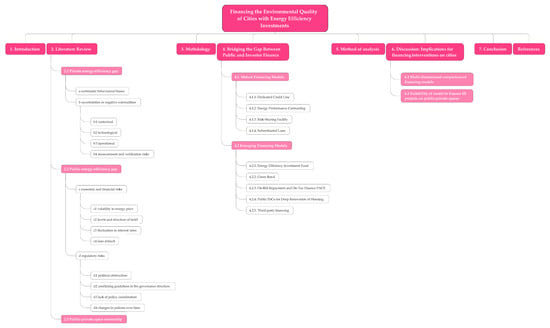

Financing the (Environmental) Quality of Cities with Energy Efficiency Investments

Abstract

:1. Introduction

2. Literature Review

- private gap,

- public gap.

2.1. Private Energy-Efficiency Gap

2.2. Public Energy-Efficiency Gap

2.3. Public–Private Space Ownership

3. Methodology

4. Bridging the Gap between Public and Investor Finance

4.1. Mature Financing Models

4.1.1. Dedicated Credit Line

4.1.2. Energy Performance Contracting

4.1.3. Risk-Sharing Facility

4.1.4. Subordinated Loan

4.2. Emerging Financing Models

4.2.1. Energy Efficiency Investment Fund

4.2.2. Green Bond

4.2.3. On-Bill Repayment and On-Tax Finance (PACE)

4.2.4. Public ESCo for Deep Renovation of Housing

4.2.5. Third-Party Financing

5. Method of Analysis

- (a)

- (b)

- (c)

- The author has reviewed the results of the survey to check the internal validity of the scores, i.e., appropriateness in scaling, completeness in the answers, and the apparent coherence within the categories. Different experts should score the indicators in a similar way. The goal is to minimize errors and biases in case study.

- (d)

- In case of internal or reliability inconsistency, clarifications have been requested to the Institution at Section 4. or a third-party expert has provided an independent evaluation.

6. Discussion: Implications for Financing Interventions on Cities

6.1. Multidimensional Comparison of Financing Models

6.2. Suitability of Model to Finance EE Projects on Public–Private Spaces

7. Conclusions

- The trend towards private ownership status to the detriment of the public one in investments.

- Besides the barriers already considered, the ways and means to access EEF can disadvantage smaller or less proactive public administrations.

- In leveraging private funding, local governments may struggle to get the investment levels required to finance their measures at reasonable costs.

- Financial institutions are reluctant to invest in new domains, especially if the returns are not clearly envisaged in a business model, and the renovation of open spaces is among them.

- finance the mutual regeneration of buildings and of open spaces,

- assist local administrations in leveraging resources,

- manage the constraints coming from the Stability Pact for administrations affected by structural problems or distortions,

- improve the administrations’ creditworthiness,

- collect upfront capital for projects with long return-on-investment period.

Supplementary Materials

Funding

Acknowledgments

Conflicts of Interest

References

- Cao, X.; Dai, X.; Liu, J. Building energy-consumption status worldwide and the state-of-the-art technologies for zero-energy buildings during the past decade. Energy Build. 2016, 128, 198–213. [Google Scholar] [CrossRef]

- Foxon, T.J. Energy and Economic Growth: Why We Need a New Pathway to Prosperity; Routledge: New York, NY, USA; London, UK, 2017. [Google Scholar]

- Intergovernmental Panel on Climate Change (IPCC). Special Report on the Impacts of Global Warming of 1.5 °C Above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; IPCC: Geneva, Switzerland, 2018. [Google Scholar]

- European Environment Agency. The European Environment State and Outlook 2020; European Environment Agency: Copenhagen, Denmark, 2020. [Google Scholar]

- Santamouris, M.; Synnefa, A.; Karlessi, T. Using advanced cool materials in the urban built environment to mitigate heat islands and improve thermal comfort conditions. Sol. Energy 2011, 85, 3085–3102. [Google Scholar] [CrossRef]

- Falasca, S.; Ciancio, V.; Salata, F.; Golasi, I.; Rosso, F.; Curci, G. High albedo materials to counteract heat waves in cities: An assessment of meteorology, buildings energy needs and pedestrian thermal comfort. Build. Environ. 2019, 163, 106242. [Google Scholar] [CrossRef]

- Gudipudi, R.; Lüdeke, M.K.; Rybski, D.; Kropp, J.P. Benchmarking urban eco-efficiency and urbanites’ perception. Cities 2018, 74, 109–118. [Google Scholar] [CrossRef]

- Brown, D.; Sorrell, S.; Kivimaa, P. Worth the risk? An evaluation of alternative finance mechanisms for residential retrofit. Energy Policy 2019, 128, 418–430. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research and Applications: Design and Methods; Sage Publications: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Hirst, E.; Brown, M.A. Closing the efficiency gap: Barriers to the efficient use of energy. Resour. Conserv. Recycl. 1990, 3, 267–281. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Stavins, R.N. The energy-efficiency gap: What does it mean? Energy Policy 1994, 22, 804–810. [Google Scholar] [CrossRef]

- Weber, L. Some reflections on barriers to the efficient use of energy. Energy Policy 1997, 25, 833–835. [Google Scholar] [CrossRef]

- Allcott, H.; Greenstone, M. Is there an energy efficiency gap? J. Econ. Perspect. 2012, 26, 3–28. [Google Scholar] [CrossRef]

- Carmona, M. Contemporary public space, part two: Classification. J. Urban Des. 2010, 15, 157–173. [Google Scholar] [CrossRef]

- Gerarden, T.D.; Newell, R.G.; Stavins, R.N. Assessing the energy-efficiency gap. J. Econ. Lit. 2017, 55, 1486–1525. [Google Scholar] [CrossRef] [Green Version]

- Van Raaij, W.F.; Verhallen, T.M.M. Patterns of residential energy behavior. J. Econ. Psychol. 1983, 4, 85–106. [Google Scholar] [CrossRef] [Green Version]

- Lee, Y.S.; Malkawi, A.M. Simulating multiple occupant behaviors in buildings: An agent-based modeling approach. Energy Build. 2014, 69, 407–416. [Google Scholar] [CrossRef]

- Haldi, F.; Calì, D.; Andersen, R.K.; Wesseling, M.; Müller, D. Modelling diversity in building occupant behaviour: A novel statistical approach. J. Build. Perform. Simul. 2017, 10, 527–544. [Google Scholar] [CrossRef]

- Haas, R.; Auer, H.; Biermayr, P. The impact of consumer behavior on residential energy demand for space heating. Energy Build. 1998, 27, 195–205. [Google Scholar] [CrossRef]

- Hens, H.; Parijs, W.; Deurinck, M. Energy consumption for heating and rebound effects. Energy Build. 2010, 42, 105–110. [Google Scholar] [CrossRef] [Green Version]

- Torregrossa, M. Energy-efficiency investment with special regard to the retrofitting of buildings in Europe. In Europe’s Energy Transformation in the Austerity Trap; Galgoczi, B., Ed.; European Trade Union Institute (ETUI): Brussels, Belgium, 2015. [Google Scholar]

- Webber, P.; Gouldson, A.; Kerr, N. The impacts of household retrofit and domestic energy efficiency schemes: A large scale, ex post evaluation. Energy Policy 2015, 84, 35–43. [Google Scholar] [CrossRef] [Green Version]

- Mills, E.; Kromer, S.; Weiss, G.; Mathew, P.A. From volatility to value: Analysing and managing financial and performance risk in energy savings projects. Energy Policy 2006, 34, 188–199. [Google Scholar] [CrossRef]

- Dunphy, N.P.; Henry, A.M.M. Characterisation of the Multi-dimensional Performance Risks Associated with Building Energy Retrofits. In Proceedings of the SCP Meets Industry Proceedings of the 15th European Roundtable on Sustainable Consumption and Production, Bregenz, Austria, 2–4 May 2012; pp. 164–170. [Google Scholar]

- Zou, P.X.; Wagle, D.; Alam, M. Strategies for minimizing building energy performance gaps between the design intend and the reality. Energy Build. 2019, 191, 31–41. [Google Scholar] [CrossRef]

- Shove, E. Gaps, barriers and conceptual chasms: Theories of technology transfer and energy in buildings. Energy Policy 1998, 26, 1105–1112. [Google Scholar] [CrossRef]

- Galvin, R. Thermal upgrades of existing homes in Germany: The building code, subsidies, and economic efficiency. Energy Build. 2010, 42, 834–844. [Google Scholar] [CrossRef] [Green Version]

- Griffiths, J. ‘Leveraging’ Private Sector Finance: How Does It Work and What Are the Risks; Bretton Woods Project: London, UK, 2012. [Google Scholar]

- Hoicka, C.E.; Parker, P.; Andrey, J. Residential energy efficiency retrofits: How program design affects participation and outcomes. Energy Policy 2014, 65, 594–607. [Google Scholar] [CrossRef]

- Wade, J.; Eyre, N. Energy Efficiency Evaluation: The Evidence for Real Energy Savings from Energy Efficiency Programmes in the Household Sector; A Report by the UKERC Technology & Policy Assessment Function; UKERC: London, UK, 2015. [Google Scholar]

- Caputo, P.; Pasetti, G. Boosting the energy renovation rate of the private building stock in Italy: Policies and innovative GIS-based tools. Sustain. Cities Soc. 2017, 34, 394–404. [Google Scholar] [CrossRef]

- Kerr, N.; Winskel, M. Household investment in home energy retrofit: A review of the evidence on effective public policy design for privately owned homes. Renew. Sustain. Energy Rev. 2020, 123, 109778. [Google Scholar] [CrossRef]

- CABE—Commission for Architecture and the Built Environment. Paying for Parks Eight Models for Funding Urban Green Spaces; CABE: London, UK, 2006. [Google Scholar]

- Erickson, D. MetroGreen: Connecting Open Space in North American Cities; Island Press: Washington, DC, USA, 2012. [Google Scholar]

- Kats, G. Greening Our Built World: Costs, Benefits, and Strategies; Island Press: Washington, DC, USA, 2013. [Google Scholar]

- Merk, O.; Saussier, S.; Staropoli, C.; Slack, E.; Kim, J.H. Financing Green Urban Infrastructure; OECD Regional Development Working Papers 2012/10; OECD Publishing: Paris, France, 2012. [Google Scholar]

- Łaszkiewicz, M.C.; Andersson, E. Deliverable D4.3 Report on the Potential for Integrating Monetary and Non-Monetary Valuation of Urban Ecosystem Services. GREEN SURGE FP7 European Project. 2017. Available online: https://www.researchgate.net/publication/327261445_REPORT_ON_THE_POTENTIAL_FOR_INTEGRATING_MONETARY_AND_NON-MONETARY_VALUA-TION_OF_URBAN_ECOSYSTEM_SERVICES (accessed on 30 June 2020).

- Hoverter, S.P. Adapting to Urban Heat: A Tool Kit for Local Governments; Georgetown Climate Center: Washington, DC, USA, 2012. [Google Scholar]

- Chapin, R. Pocket Neighborhoods: Creating Small-Scale Community in a Large-Scale World; Taunton Press: Newtoown, CT, USA, 2011. [Google Scholar]

- Colding, J.; Barthel, S. The potential of ‘Urban Green Commons’ in the resilience building of cities. Ecol. Econ. 2013, 86, 156–166. [Google Scholar] [CrossRef]

- Frazier, A.E.; Bagchi-Sen, S. Developing open space networks in shrinking cities. Appl. Geogr. 2015, 59, 1–9. [Google Scholar] [CrossRef]

- Rutt, R.L.; Gulsrud, N.M. Green justice in the city: A new agenda for urban green space research in Europe. Urban For. Urban Green. 2016, 19, 123–127. [Google Scholar] [CrossRef]

- Kabisch, N.; Korn, H.; Stadler, J.; Bonn, A. Nature-Based Solutions to Climate Change Adaptation in Urban Areas: Linkages between Science, Policy and Practice; Springer Nature: London, UK, 2017. [Google Scholar]

- Barberis, N.C. Thirty years of prospect theory in economics: A review and assessment. J. Econ. Perspect. 2013, 27, 173–196. [Google Scholar] [CrossRef] [Green Version]

- Thompson, P.B. Evaluating energy efficiency investments: Accounting for risk in the discounting process. Energy Policy 1997, 25, 989–996. [Google Scholar] [CrossRef]

- Stevens, D.; Fuerst, F.; Adan, H.; Brounen, D.; Kavarnou, D.; Singh, R. Risks and Uncertainties Associated with Residential Energy Efficiency Investments; SSRN Scholarly Paper ID 3254854; Social Science Research Network: Rochester, NY, USA, 2018. [Google Scholar]

- Cochran, S.J.; Mansur, I.; Odusami, B. Equity market implied volatility and energy prices: A double threshold GARCH approach. Energy Econ. 2015, 50, 264–272. [Google Scholar] [CrossRef]

- Joskow, P.L.; Wolfram, C.D. Dynamic pricing of electricity. Am. Econ. Rev. 2012, 102, 381–385. [Google Scholar] [CrossRef] [Green Version]

- Muller, N.Z.; Mendelsohn, R. Efficient pollution regulation: Getting the prices right. Am. Econ. Rev. 2009, 99, 1714–1739. [Google Scholar] [CrossRef]

- Graff Zivin, J.S.; Kotchen, M.J.; Mansur, E.T. Spatial and temporal heterogeneity of marginal emissions: Implications for electric cars and other electricity-shifting policies. J. Econ. Behav. Organ. 2014, 107, 248–268. [Google Scholar] [CrossRef] [Green Version]

- Golove, W.H.; Eto, J.H. Market Barriers to Energy Efficiency: A Critical Reappraisal of the Rationale for Public Policies to Promote Energy Efficiency; Technical Report LBL-38059; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 1996. [Google Scholar]

- Ruderman, H.; Levine, M.D.; McMahon, J.E. The behavior of the market for energy efficiency in residential appliances including heating and cooling equipment. Energy J. 1987, 8, 101–124. [Google Scholar] [CrossRef] [Green Version]

- Kaza, N.; Quercia, R.G.; Tian, C.Y. Home energy efficiency and mortgage risks. Cityscape 2014, 16, 279–298. [Google Scholar]

- An, X.; Pivo, G. Green buildings in commercial mortgage-backed securities: The effects of LEED and energy star certification on default risk and loan terms. Real Estate Econ. 2020, 48, 7–42. [Google Scholar] [CrossRef]

- Giraudet, L.G. Energy efficiency as a credence good: A review of informational barriers to energy savings in the building sector. Energy Econ. 2020, 80, 104698. [Google Scholar] [CrossRef]

- Langlois-Bertrand, S.; Benhaddadi, M.; Jegen, M.; Pineau, P.O. Political-institutional barriers to energy efficiency. Energy Strategy Rev. 2015, 8, 30–38. [Google Scholar] [CrossRef] [Green Version]

- Blumberga, A.; Cilinskis, E.; Gravelsins, A.; Svarckopfa, A.; Blumberga, D. Analysis of regulatory instruments promoting building energy efficiency. Energy Procedia 2018, 147, 258–267. [Google Scholar] [CrossRef]

- IEA-RETD. Business Models for Renewable Energy in the Built Environment; Routledge: New York, NY, USA, 2013. [Google Scholar]

- Næss-Schmidt, H.; Hansen, M.; Danielsson, C. Multiple Benefits of Investing in Energy Efficient Renovation of Buildings; Copenhagen Economics: Copenhagen, Denmark, 2012. [Google Scholar]

- Kohn, M. Brave New Neighborhoods: The Privatization of Public Space; Routledge: New York, NY, USA; London, UK, 2004. [Google Scholar]

- Nissen, S. Urban transformation from public and private space to spaces of hybrid character. Sociol. Časopis Czech Sociol. Rev. 2008, 44, 1129–1149. [Google Scholar] [CrossRef]

- Lippert, R.K.; Steckle, R. Conquering condos from within: Condo-isation as urban governance and knowledge. Urban Stud. 2016, 53, 132–148. [Google Scholar] [CrossRef]

- Yin, R.K. The case study crisis: Some answers. Adm. Sci. Q. 1981, 26, 58–65. [Google Scholar] [CrossRef] [Green Version]

- De Marco, A.; Mangano, G.; Michelucci, F.V.; Zenezini, G. Using the private finance initiative for energy efficiency projects at the urban scale. Int. J. Energy Sect. Manag. 2016, 10, 99–117. [Google Scholar] [CrossRef] [Green Version]

- Lam, P.T.; Yang, W. Factors influencing the consideration of Public-Private Partnerships (PPP) for smart city projects: Evidence from Hong Kong. Cities 2020, 99, 102606. [Google Scholar] [CrossRef]

- Novikova, A.; Stelmakh, K.; Klinge, A.; Juergens, I.; Hessling, M. Financing Models for Energy Efficiency in Public Buildings and Street Lighting in Germany and Neighbouring Countries. In Improving Energy Efficiency in Commercial Buildings and Smart Communities; Springer: Cham, Switzerland, 2020; pp. 165–194. [Google Scholar]

- Marshall, S. The kind of art urban design is. J. Urban Des. 2016, 21, 399–423. [Google Scholar] [CrossRef]

- Caneparo, L. An agenda for education: On the relationship between architectural design education, technology of architecture and information technology. In Design Studio Pedagogy: Horizons for the Future; Urban International Press: Gateshead, UK, 2007; pp. 345–346. [Google Scholar]

- EEFIG. Energy Efficiency—The First Fuel for the EU Economy: How to Drive New Finance for Energy Efficiency Investments; European Union: Brussels, Belgium, 2015. [Google Scholar]

- Economidou, M.; Todeschi, V.; Bertoldi, P. Accelerating Energy Renovation Investments in Buildings; Publications Office of the European Union: Luxembourg, 2019. [Google Scholar]

- Rydin, Y.; Guy, S.; Goodier, C.; Chmutina, K.; Devine-Wright, P.; Wiersma, B. The financial entanglements of local energy projects. Geoforum 2015, 59, 1–11. [Google Scholar] [CrossRef] [Green Version]

- IEA. Joint Public-Private Approaches for Energy Efficiency Finance. Policies to Scale-Up Private Sector Investment; IEA Publications: Paris, France, 2011. [Google Scholar]

- Halcoussis, D.; Lowenberg, A.D. The effects of the fossil fuel divestment campaign on stock returns. N. Am. J. Econ. Financ. 2019, 47, 669–674. [Google Scholar] [CrossRef]

- BMWi—Bundesministerium für Wirtschaft und Energie. Ein Gutes Stück Arbeit. Mehr Aus Energie Machen. Nationaler Aktionsplan Energieeffizienz; BMWi: Berlin, Germany, 2014. [Google Scholar]

- Michelsen, C.; Neuhoff, K.; Schopp, A. Using equity capital to unlock investment in building energy efficiency? Diw Econ. Bull. 2015, 5, 259–265. [Google Scholar]

- Chandler, J. Energy efficiency in the United Kingdom: The failure of the green deal. Renew. Energy L Pol’y Rev. 2015, 6, 191–195. [Google Scholar]

- Rosenow, J.; Eyre, N. A post mortem of the Green Deal: Austerity, energy efficiency, and failure in British energy policy. Energy Res. Soc. Sci. 2016, 21, 141–144. [Google Scholar] [CrossRef]

- Bertoldi, P.; Rezessy, S.; Vine, E. Energy service companies in European countries: Current status and a strategy to foster their development. Energy Policy 2006, 34, 1818–1832. [Google Scholar] [CrossRef]

- Bullier, A.; Milin, C. Dispositifs de financement alternatifs pour la rénovation énergétique du bâtiment. Les Cah. De Glob. Chance 2014, 35, 12–23. [Google Scholar]

- Eichhammer, W.; Reuter, M. Grant Agreement n. H2020 Energy/69607 ODYSSEE-MURE a Decision Support Tool for Energy Efficiency Policy Evaluation; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- Reuter, M.; Patel, M.K.; Eichhammer, W.; Lapillonne, B.; Pollier, K. A comprehensive indicator set for measuring multiple benefits of energy efficiency. Energy Policy 2020, 139, 111284. [Google Scholar] [CrossRef]

- MURE Database on Energy Efficiency Policies. Available online: http://www.measures-odyssee-mure.eu/ (accessed on 30 June 2020).

- Energy Efficiency Database of the International Energy Agency. Available online: https://www.iea.org/policies (accessed on 30 June 2020).

- Incubators of Public Spaces Research Project. Available online: https://jpi-urbaneurope.eu/project/incubators/ (accessed on 30 June 2020).

- Incubators of Public Spaces Online Interactive Visual Synopsis of Interventions. Available online: https://polytechnic-egrid.polito.it/viewer.php (accessed on 30 June 2020).

- Loga, T.; Stein, B.; Diefenbach, N. TABULA building typologies in 20 European countries—Making energy-related features of residential building stocks comparable. Energy Build. 2016, 132, 4–12. [Google Scholar] [CrossRef]

- Cappa, F.; Rosso, F.; Giustiniano, L.; Porfiri, M. Nudging and citizen science: The effectiveness of feedback in energy-demand management. J. Environ. Manag. 2020, 269, 110759. [Google Scholar] [CrossRef]

- González-Ruiz, J.D.; Botero-Botero, S.; Duque-Grisales, E. Financial eco-innovation as a mechanism for fostering the development of sustainable infrastructure systems. Sustainability 2018, 10, 4463. [Google Scholar] [CrossRef] [Green Version]

- Coderre, F.; Mathieu, A.; St-Laurent, N. Comparison of the quality of qualitative data obtained through telephone, postal and email surveys. Int. J. Mark. Res. 2004, 46, 349–357. [Google Scholar] [CrossRef]

- Brough, P. (Ed.) Advanced Research Methods for Applied Psychology: Design, Analysis and Reporting; Routledge: Oxon, UK, 2018. [Google Scholar]

| Space Ownership: | Instances: | ||

|---|---|---|---|

| Private Public | 1 | private | home |

| 2 | private, co-owned | condominium grounds, fences, landscaped and rooftop areas, parking places, corridors, and stairs | |

| 3 | private, with open or controlled access | shops, shopping malls, theatres, plazas at the entrance of high-rises, | |

| 4 | private/public, public property sale with political and administrative spin-off | gated communities, where developers, inhabitants organise according to local tasks and self-defined governance | |

| 5 | public, commodification of quasi-public property | underground, railways | |

| 6 | public, transfer of rights of use and of maintenance | redevelopment of parks and public greens | |

| 7 | public, privately managed, e.g., installation of signs of private character | pedestrian areas, business improvement districts | |

| 8 | public | city streets, plazas, parks |

| Benefits | Gaps |

|---|---|

| Below market interest rates Integrate aid mechanisms Recover funds for further EE projects Fill loan EE market gaps | Homeowners’ behavioural biases to take on or increase debt Homeowners’ behavioural biases on borrowing from banks Financial institutions’ biases on value of EE projects Energy poverty unwilling to credit means EE projects fragmentation makes credit delivery unattractive to financial institutions |

| Benefits | Gaps |

|---|---|

| Recover funds for further EE projects ESCos involvement ease the integration with and bundling of credits for financial institutions | Homeowners’ behavioural biases on value of EE projects Financial institutions’ biases on value of EE projects Gaps for ESCos due to EE market maturity Energy poverties unwilling to save or invest on EE |

| Benefits | Gaps |

|---|---|

| Reduce risks on upfront capital Reduce financial costs on EE investments Independent from the ownership of the loan EE projects ease of access to credit | Gap on levels and structure of energy billing Gap on insolvency on energy bills Gap on appraising homeowners’ credit eligibility and default |

| Benefits | Gaps |

|---|---|

| Homeowners’ ease of access to credit Reduce risks on upfront capital Below market interest rates Recover funds for further EE projects EE projects bundling makes credit delivery attractive to financial institutions | Gap in levels and structure of energy billing Gap in insolvency on energy bills Gap in appraising homeowners’ credit eligibility and default |

| Benefits | Gaps |

|---|---|

| EE projects bundling makes credit delivery attractive to financial institutions Suitable to focus on specific EE projects funding Investors willingness to environmental consciousness | Above Dedicated Credit Line interest rates Unsuitable to large-scale uptake rates Gaps on investors biases on EE projects Gaps on volatility in energy price Gaps on fluctuation in interest rates and investment return |

| Benefits | Gaps |

|---|---|

| Reduce cost on upfront capital EE projects bundling makes credit delivery attractive to financial institutions Suitable to focus on specific EE projects funding Amortised over long periods of time | Return on investment over long periods of time Gap on structure and transparency of fund-raising Above Dedicated Credit Line interest rates Gaps on investors biases on EE projects Gaps on volatility in energy price Gaps on fluctuation in interest rates and investment return |

| Benefits | Gaps |

|---|---|

| Reduce cost on upfront capital Ease of repayment Homeowners’ credit eligibility Amortised over long periods of time Associated to the property, not to the homeowner Offered with technical assistance on the measures | Return on investment over long periods of time Gap on structure and transparency of fund-raising Above Dedicated Credit Line interest rates Gaps in investors behavioural biases on EE projects Gap in homeowners’ insolvency on energy bills Gaps in volatility in energy price Gaps in fluctuation in interest rates and investment return Gaps in transferring the property without the loan Gaps in regulations on house and taxation policies Gaps on regulatory transparency |

| Benefits | Gaps |

|---|---|

| Trig high-performance energy renovation projects, e.g., zero energy or passive Below market interest rates Reduce cost on upfront capital Amortised over long periods of time Financial offer packed with technical assistance on measures EE projects bundling makes credit delivery attractive to financial institutions | Return on investment over long periods of time Gaps in volatility of energy price Gaps in fluctuation in interest rates and investment return Gaps in regulations on house and taxation policies Gaps on regulatory transparency Homeowners’ behavioural biases to take or increase debit Energy poverty unwilling to credit means |

| Benefits | Gaps |

|---|---|

| Ease of implementation by financial institutions ESCos in charge of paperwork and technical procedures, and filling the request [to the bank] ESCos involvement ease the integration with and bundling of credits for financial institutions Rapid evaluation and delivery of credit ESCos projects bundling makes credit delivery attractive to financial institutions | Return on investment over long periods of time Gaps on volatility in energy price Gaps on fluctuation in interest rates and investment return Gaps on trigging zero energy/passive renovations Gaps on scaling-up projects at regional/national levels |

| Category | Indicator | Score |

|---|---|---|

| (a) systematic behavioural biases | (a) systematic behavioural biases | −2: very low −1: low 0: neutral 1: high 2: very high |

| (b) uncertainties or negative externalities | (b) uncertainties or negative externalities | |

| (c) economic and financial risks | (c1) volatility in energy price | |

| (c2) levels and structure of tariff | ||

| (c3) fluctuation in interest rates | ||

| (c4) loan default | ||

| (d) regulatory risks | (d) regulatory risks |

| Financing Model | 4.1.1. Dedicated Credit Line | 4.1.2. Energy Performance Contracting | 4.1.3. Risk-Sharing Facility | 4.1.4. Subordinated Loan | 4.2.1. Energy Efficiency Investment Fund | 4.2.2. Green Bond | 4.2.3. On-Bill Repayment and On-Tax Finance | 4.2.4. Public ESCo for Deep Renovation of Housing | 4.2.5. Third-Party Financing | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Case study | KfW | Eco-loan at zero rate | Energy Saving Partnership | CEEF | Risk Sharing Facility | ELENA EEEF | ADEME | NAPE | PACE | PACE | UK Green Deal | Energies POSIT’IF | City of Berlin | MEEF |

| Suitable for Space ownership | 1–8 | 1–5 | 1–3 | 1–8 | 1–7 | 1–8 | 1–4 | 1–8 | 1–3 | |||||

| (a) systematic behavioural biases | 2 | 1 | 1 | 1 | 2 | 2 | 1 | −1 | 1 | |||||

| (b) uncertainties or negative externalities | −1 | 2 | −1 | −1 | −1 | −2 | −1 | 0 | 2 | |||||

| (c1) volatility in energy price | −2 | 2 | −2 | −2 | −2 | −2 | −2 | −1 | 1 | |||||

| (c2) levels and structure of tariff | 1 | 2 | 2 | 1 | 1 | 1 | 2 | 1 | 2 | |||||

| (c3) fluctuation in interest rates | −1 | 1 | 1 | 1 | 2 | 2 | 2 | 1 | 2 | |||||

| (c4) loan default | 1 | −2 | −2 | −1 | 1 | 1 | 1 | 1 | 1 | |||||

| (d) regulatory risks | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 2 | |||||

| 4.1.1. Dedicated Credit Line | 4.1.2. Energy Performance Contracting | 4.1.3. Risk-Sharing Facility | 4.1.4. Subordinated Loan | 4.2.1. Energy Efficiency Investment Fund | 4.2.2. Green Bond | 4.2.3. On-Bill Repayment and On-Tax Finance PACE | 4.2.4. Public ESCo for Deep Renovation of Housing | 4.2.5. Third-Party Financing | |

|---|---|---|---|---|---|---|---|---|---|

| 1 private | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 2 private co-owned | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 3 private with open or controlled access | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 4 private/public | 0 | 1 | 0 | 1 | 1 | 1 | 0 | 0 | 0 |

| 5 public commodification | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 6 public transfer of rights | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 7 public privately managed | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| 8 public | 1 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Caneparo, L. Financing the (Environmental) Quality of Cities with Energy Efficiency Investments. Sustainability 2020, 12, 8809. https://doi.org/10.3390/su12218809

Caneparo L. Financing the (Environmental) Quality of Cities with Energy Efficiency Investments. Sustainability. 2020; 12(21):8809. https://doi.org/10.3390/su12218809

Chicago/Turabian StyleCaneparo, Luca. 2020. "Financing the (Environmental) Quality of Cities with Energy Efficiency Investments" Sustainability 12, no. 21: 8809. https://doi.org/10.3390/su12218809