Non-Parametric Model for Evaluating the Performance of Chinese Commercial Banks’ Product Innovation

Abstract

:1. Introduction

2. Literature Review

3. Methodology

3.1. Input and Output Variables

3.2. Models for the Evaluation of Commercial Banks’ Product Innovation Performance

3.3. Models for the Estimation of Product Innovation Target Income

| Nomenclatures | |

| CNY | Chinese Yuan |

| DEA | Data Envelopment Analysis |

| DMU | Decision-Making Unit |

| FCM | Fixed Correlation Model |

| VCM | Variable Correlation Model |

| RII | The Ratio of Product Innovation Target Income Increase to Actual Income |

4. Empirical Analysis

4.1. Sampling and Data Source

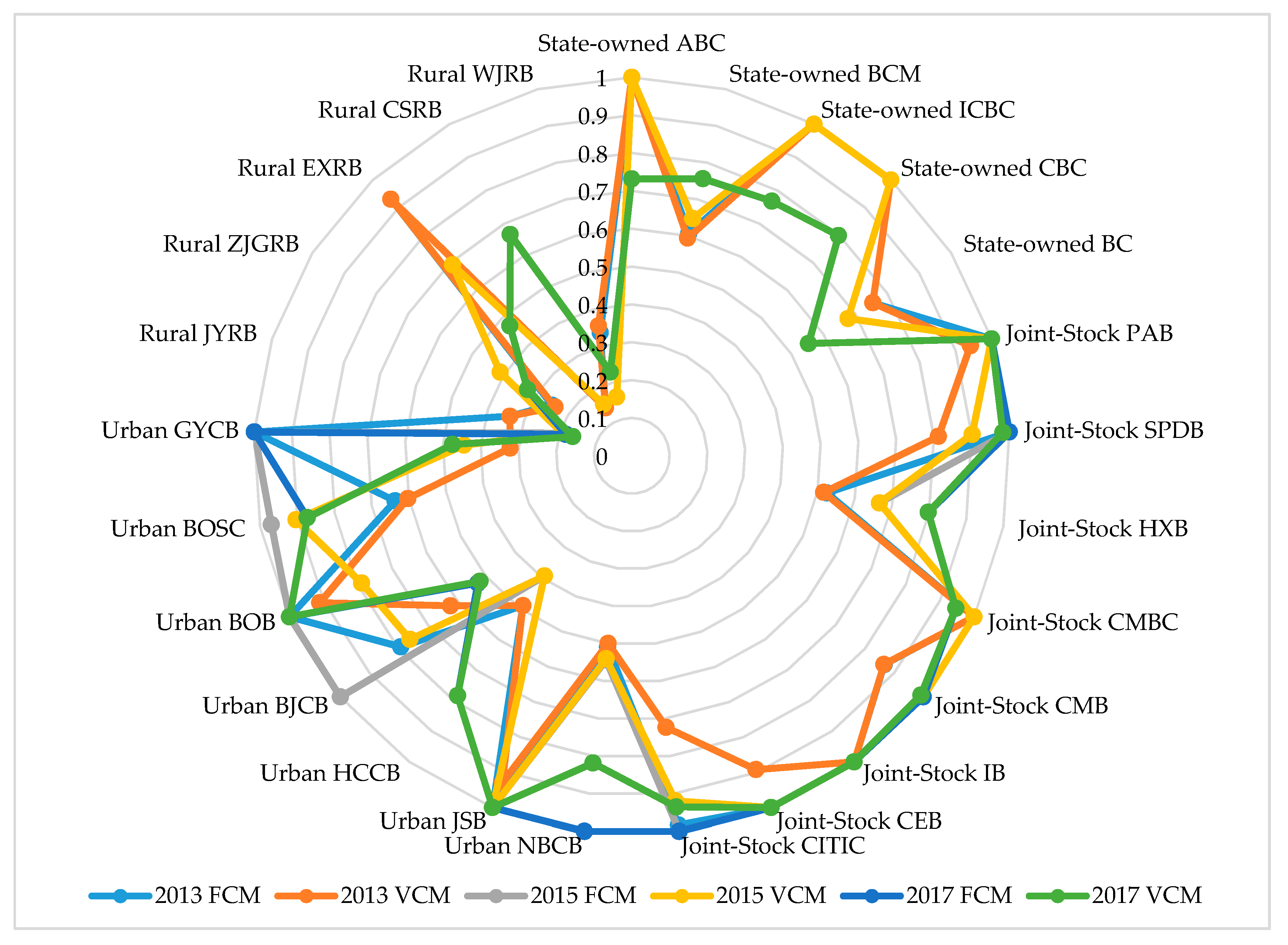

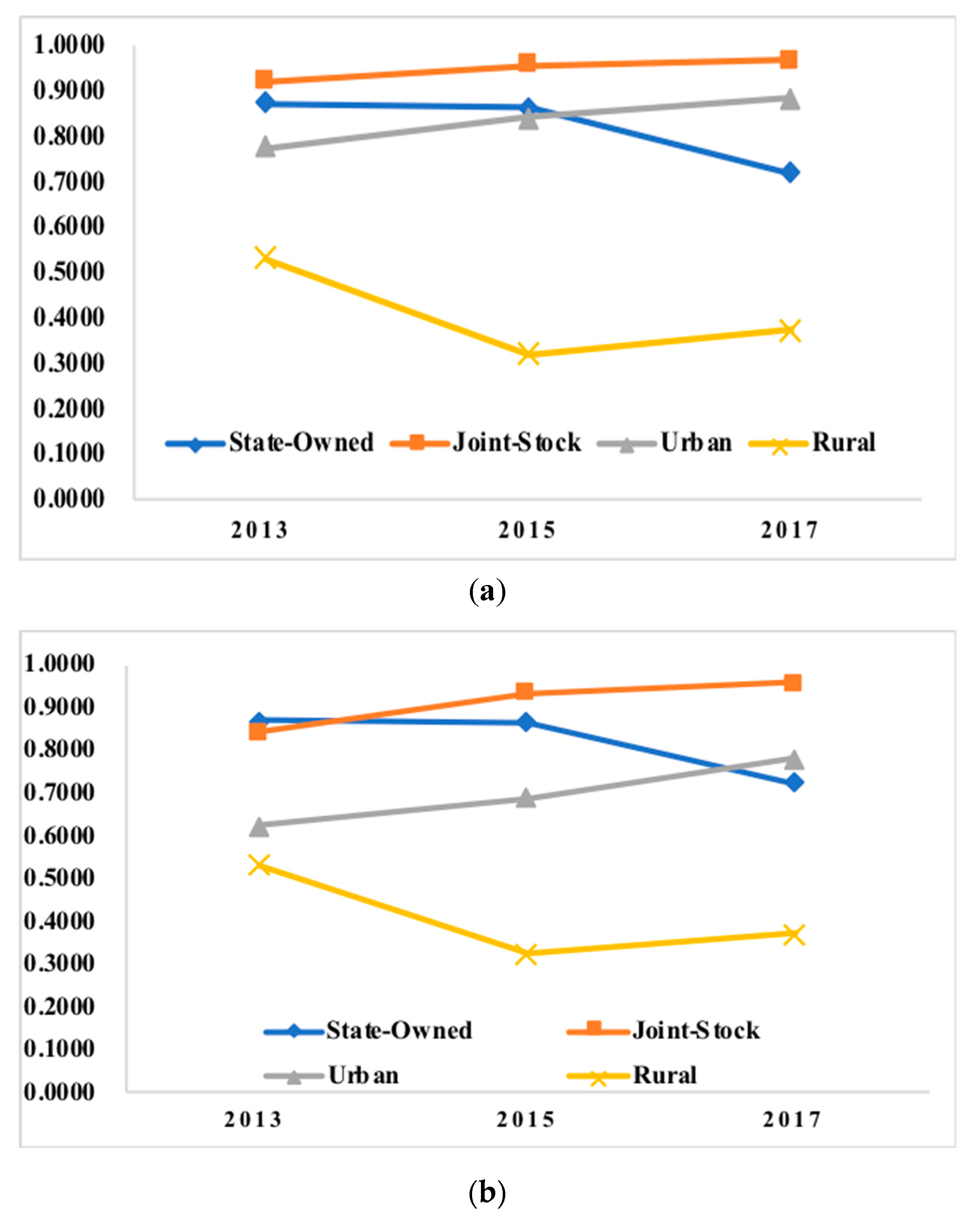

4.2. Product Innovation Performance Analysis

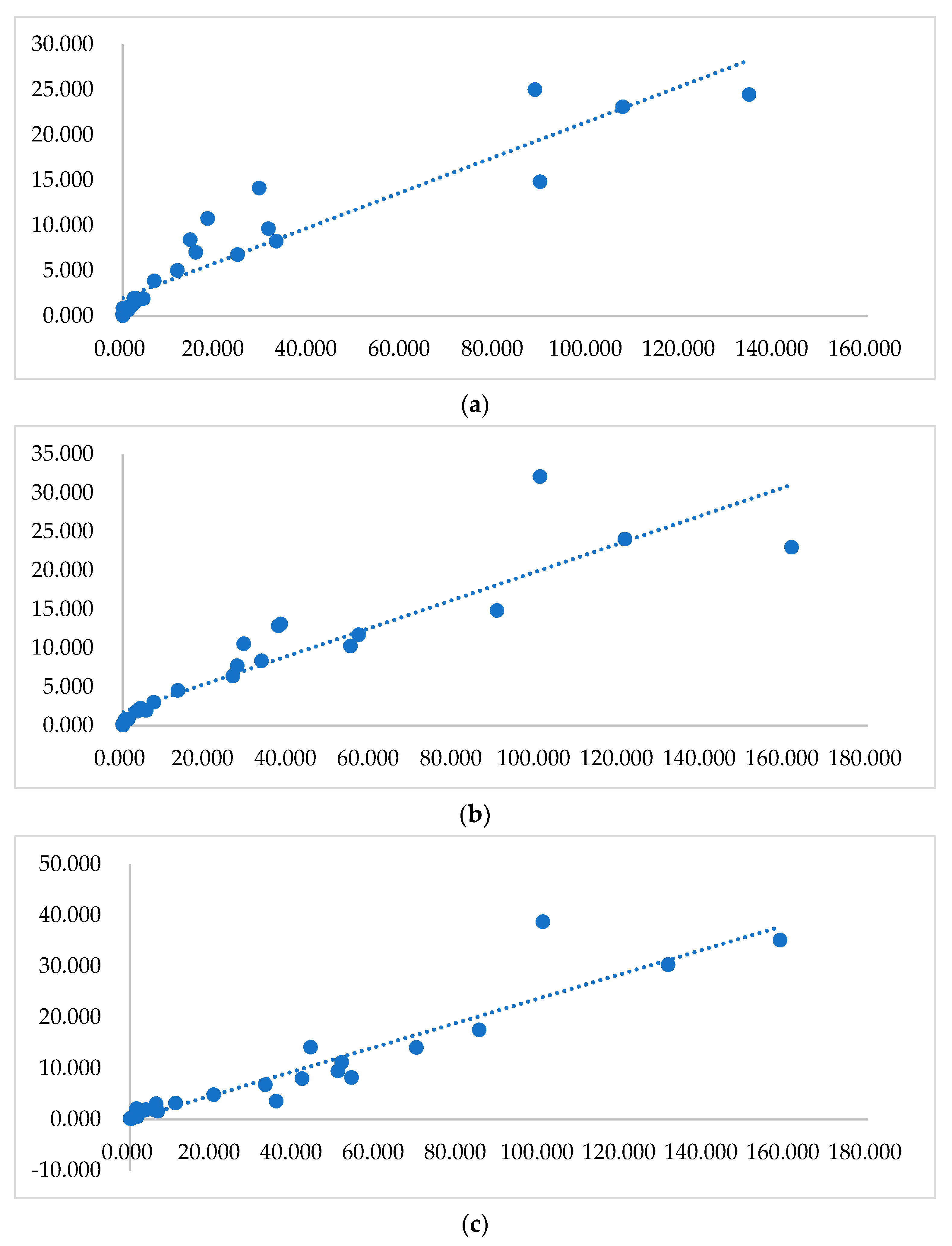

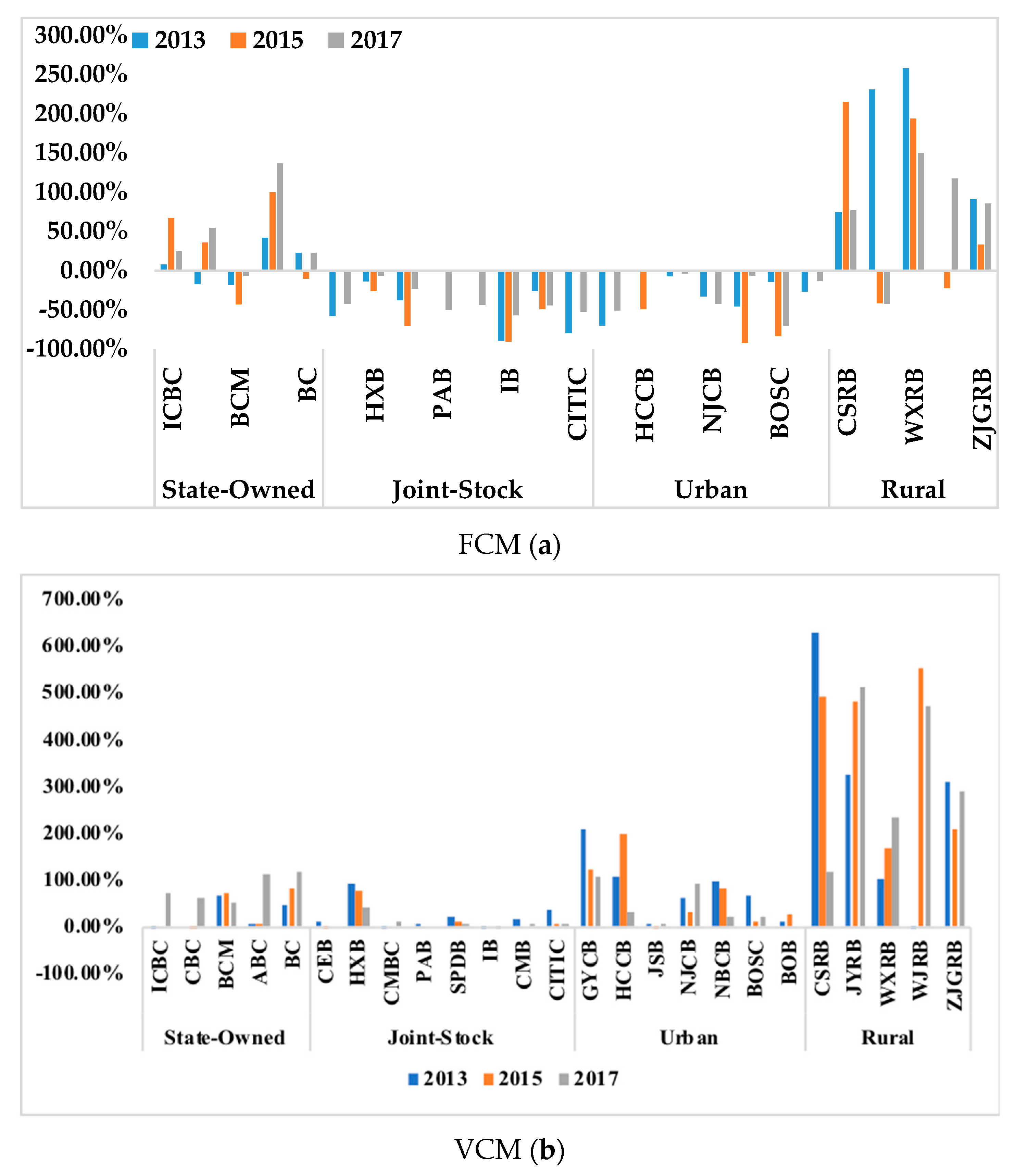

4.3. Analyzing the Target Income of Commercial Banks’ Product Innovation

4.4. Findings and Discussions

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Norden, L.; Silva Buston, C.; Wagner, W. Financial innovation and bank behavior: Evidence from credit markets. Soc. Sci. Electron. Publ. 2014, 43, 130–145. [Google Scholar] [CrossRef]

- Wang, F.; Huang, M.; Shou, Z. Business expansion and firm efficiency in the commercial banking industry: Evidence from the US and China. Asia Pac. J. Manag. 2015, 32, 551–569. [Google Scholar] [CrossRef]

- Zhao, J.H.; Min, D.; Mathematics, D.O.; University, L.N. Empirical analysis on the influence factors of commerical bank’s intermediary business Innovation—A case of CCB. Technol. Dev. Enterp. 2015, 22, 27. [Google Scholar]

- Roberts, P.W.; Amit, R. The Dynamics of Innovative Activity and Competitive Advantage: The Case of Australian Retail Banking, 1981 to 1995. Organ. Sci. 2003, 14, 107–122. [Google Scholar] [CrossRef]

- Lerner, J.; Tufano, P. The Consequences of Financial Innovation: A Counterfactual Research Agenda. NBER Work. Pap. 2011, 3, 41–85. [Google Scholar]

- Lepetit, L.; Nys, E.; Rous, P.; Tarazi, A. The Provision of Services, Interest Margins and Loan Pricing in European Banking. Ssrn Electron. J. 2006. [Google Scholar] [CrossRef] [Green Version]

- Zhu, J.; Price, C.C.; Zhu, J.; Hillier, F.S. Data Envelopment Analysis: A Handbook of empirical Studies and Applications; Springer: Berlin, Germany, 2015; Volume 238, pp. 267–280. [Google Scholar]

- Xie, L.; Chen, C.L.; Yu, Y.H. Dynamic Assessment of Environmental Efficiency in Chinese Industry: A Multiple DEA Model with a Gini Criterion Approach. Sustainability 2019, 11, 2294. [Google Scholar] [CrossRef] [Green Version]

- Yang, W.X.; Li, L.G. Analysis of Total Factor Efficiency of Water Resource and Energy in China: A Study Based on DEA-SBM Model. Sustainability 2017, 9, 1316. [Google Scholar] [CrossRef] [Green Version]

- Calmès, C.; Théoret, R. The impact of off-balance-sheet activities on banks returns: An application of the ARCH-M to Canadian data. J. Bank. Financ. 2010, 34, 1719–1728. [Google Scholar] [CrossRef]

- Aktan, B.; Chan, S.-G.; Zikovic, S.; Evrim-Mandaci, P. Off-Balance Sheet Activities Impact on Commercial Banks Performance: An Emerging Market Perspective. Econ. Res. 2013, 26, 117–132. [Google Scholar] [CrossRef] [Green Version]

- Chateau, J.P.D. Marking-to-model credit and operational risks of loan commitments: A Basel-2 advanced internal ratings-based approach. Int. Rev. Financ. Anal. 2009, 18, 260–270. [Google Scholar] [CrossRef]

- Vlontzos, G.; Niavis, S.; Manos, B. A DEA approach for estimating the agricultural energy and environmental efficiency of EU countries. Renew. Sustain. Energy Rev. 2014, 40, 91–96. [Google Scholar] [CrossRef]

- Cai, H.; Liang, L.; Tang, J.; Wang, Q.; Wei, L.; Xie, J. An Empirical Study on the Efficiency and Influencing Factors of the Photovoltaic Industry in China and an Analysis of Its Influencing Factors. Sustainability 2019, 11, 6693. [Google Scholar] [CrossRef] [Green Version]

- Wang, K.; Huang, W.; Wu, J.; Liu, Y.-N. Efficiency measures of the Chinese commercial banking system using an additive two-stage DEA. Omega 2014, 44, 5–20. [Google Scholar] [CrossRef]

- Liu, W.; Zhou, Z.; Ma, C.; Liu, D.; Shen, W. Two-stage DEA models with undesirable input-intermediate-outputs. Omega 2015, 56, 74–87. [Google Scholar] [CrossRef]

- Ohsato, S.; Takahashi, M. Management Efficiency in Japanese Regional Banks: A Network DEA. Procedia Soc. Behav. Sci. 2015, 172, 511–518. [Google Scholar] [CrossRef] [Green Version]

- Bian, Y.; He, P.; Xu, H. Estimation of potential energy saving and carbon dioxide emission reduction in China based on an extended non-radial DEA approach. Energy Policy 2013, 63, 962–971. [Google Scholar] [CrossRef]

- Gattoufi, S.; Amin, G.R.; Emrouznejad, A. A new inverse DEA method for merging banks. IMA J. Manag. Math. 2014, 25, 73–87. [Google Scholar] [CrossRef] [Green Version]

- Wei, Q.; Zhang, J.; Zhang, X. An inverse DEA model for inputs/outputs estimate. Eur. J. Oper. Res. 2000, 121, 151–163. [Google Scholar] [CrossRef]

- Fukuyama, H.; Matousek, R. Modelling bank performance: A network DEA approach. Eur. J. Oper. Res. 2017, 259, 721–732. [Google Scholar] [CrossRef]

- Wenqiang, Y.; Jihui, G.; Hua, L. The Internal Driving Force of Commercial Bank Transformation and Upgrading—Based on the Perspective of Innovation Efficiency. Financ. Forum 2017, 22, 13. [Google Scholar]

- Lyu, X. The Evaluation of the Innovation Capability of A-Share Listed Banks under the Impact of Internet Banking: Based on Generalized DEA Model of Panel Data. J. Account. Econ. 2016, 23, 253–271. [Google Scholar]

- Rossignoli, B.; Arnaboldi, F. Financial innovation: Theoretical issues and empirical evidence in Italy and in the UK. Int. Rev. Econ. 2009, 56, 275–301. [Google Scholar] [CrossRef]

- Wen, L. Research on the Relationship between Internet Finance and Commercial Bank’s Innovation Performance—Based on the Analysis of MOA Theory. Financ. Theory Pract. 2017, 38, 6. [Google Scholar]

- Zeng, W.; Chen, S.; Zhou, Z.B. The Impact of Financial Supervision on Commercial Bank’s Product Innovation-the Research Based on Two-stage DEA Model. Chin. J. Manag. Sci. 2016, 24, 1–7. [Google Scholar]

- Linyun, C.; Sitai, Y. Research on Intermediary Business and Business Performance of Commercial Banks. Times Financ. 2017, 38, 2. [Google Scholar]

- Mottaleb, K.A.; Sonobe, T. What determines the performance of small enterprises in developing countries? Evidence from the handloom industry in Bangladesh. Int. J. Bus. Glob. 2013, 10, 39–55. [Google Scholar] [CrossRef] [Green Version]

- Heffernan, S.A.; Fu, X.; Fu, M. The Determinants of Financial Innovation. Soc. Sci. Electron. Publ. 2009. [Google Scholar] [CrossRef]

- Yang, H.L.; Pollitt, M. The necessity of distinguishing weak and strong disposability among undesirable outputs in DEA: Environmental performance of Chinese coal-fired power plants. Energy Policy 2010, 38, 4440–4444. [Google Scholar] [CrossRef]

- Fare, R.; Grosskopf, S.; Pasurka, C. Effects on relative efficiency in electric power generation due to environmental controls. Resour. Energy 1986, 8, 167–184. [Google Scholar] [CrossRef]

| Bank Type | Bank Name |

|---|---|

| State-Owned | Industrial and Commercial Bank of China (ICBC), Agricultural Bank of China (ABC), Bank of China (BC), China Construction Bank (CBC), Bank of Communications (BCM) |

| Joint-Stock | China Merchants Bank (CMB), Shanghai Pudong Development Bank (SPDB), China CITIC Bank (CITIC), China Everbright Bank (CEB), Huaxia Bank (HXB), China Minsheng Bank (CMBC), China Guangfa Bank (CGB), Industrial Bank (IB), Ping An Bank (PAB), China Zheshang Bank (CZB), Evergrowing Bank Bank (EB), China Bohai Bank (CBB) |

| Urban | Bank of Ningbo (NBCB), Bank of Jiangsu (JSB), Bank of Hangzhou (HCCB), Bank of Nanjing (NJCN), Bank of Beijing (BOB), Bank of Shanghai (BOSC), Bank of Guiyang (GYCB) |

| Rural | Jiangyin Rural Commercial Bank (JYRB), Rural Commercial Bank of Zhangjiagang (ZJGRB), Wuxi Rural Commercial Bank (WXRB), Changshu Rural Commercial Bank (CSRB), Wujiang Rural Commercial Bank (WJRB) |

| Year | Parameter | Fixed Assets | No. of Employees Holding Bachelor’s Degree and above | Handling Charge and Commission Expense | Handling Charge and Commission Income | Anticipated Non-Performing Loans |

|---|---|---|---|---|---|---|

| Unit | 109 CNY | 103 | 109 CNY | 109 CNY | 109 CNY | |

| 2013 | Minimum | 0.335 | 0.703 | 0.001 | 0.050 | 0.019 |

| Maximum | 158.968 | 221.393 | 12.224 | 134.550 | 24.998 | |

| Average | 29.937 | 49.639 | 1.769 | 24.815 | 6.815 | |

| Standard Deviation | 52.467 | 74.346 | 2.879 | 38.035 | 7.932 | |

| 2015 | Minimum | 0.418 | 0.772 | 0.010 | 0.067 | 0.043 |

| Maximum | 195.401 | 249.961 | 18.279 | 161.670 | 32.100 | |

| Average | 37.834 | 55.985 | 2.628 | 32.851 | 7.700 | |

| Standard Deviation | 62.940 | 82.489 | 4.182 | 43.414 | 8.611 | |

| 2017 | Minimum | 0.626 | 1.080 | 0.023 | 0.077 | 0.079 |

| Maximum | 216.156 | 276.062 | 19.041 | 158.666 | 38.706 | |

| Average | 44.253 | 61.245 | 3.930 | 36.659 | 8.656 | |

| Standard Deviation | 69.497 | 88.953 | 5.175 | 43.816 | 11.065 |

| Type | DMU | 2013 | 2015 | 2017 | |||

|---|---|---|---|---|---|---|---|

| State-Owned | ICBC | 10.618 | 29.982 | 108.126 | 130.000 | 39.200 | 74.244 |

| CBC | −18.387 | 0.000 | 43.102 | 69.999 | 71.054 | 84.468 | |

| BCM | −5.300 | 20.112 | −16.441 | 17.588 | −2.966 | 23.977 | |

| ABC | 37.603 | 50.003 | 90.386 | 100.001 | 116.235 | 126.221 | |

| BC | 19.887 | 42.935 | −10.462 | 42.791 | 22.661 | 59.785 | |

| Joint-Stock | CEB | −9.070 | 1.907 | 0.000 | 0.000 | −13.895 | 0.000 |

| HXB | −0.946 | 6.422 | −3.479 | 10.308 | −1.333 | 8.886 | |

| CMBC | −12.470 | 0.002 | −38.745 | 0.000 | −12.337 | 5.689 | |

| PAB | 0.000 | 0.737 | 0.000 | 0.000 | −17.763 | 0.000 | |

| SPDB | 0.000 | 3.366 | 0.000 | 3.201 | −22.272 | 0.886 | |

| IB | −22.065 | 0.004 | −30.398 | 0.000 | −23.944 | 0.002 | |

| CMB | −8.156 | 4.895 | −27.989 | 0.000 | −30.845 | 0.563 | |

| CITIC | −14.538 | 7.005 | 0.000 | 3.292 | −27.074 | 3.566 | |

| Urban | BOB | −3.125 | 0.434 | 0.000 | 0.918 | −5.661 | 0.000 |

| GYCB | 0.000 | 0.246 | −0.713 | 2.881 | 0.000 | 1.771 | |

| HCCB | −0.088 | 1.333 | 0.000 | 0.000 | −0.062 | 0.579 | |

| JSB | −0.803 | 0.188 | 0.000 | 1.078 | −2.571 | 0.000 | |

| NJCB | −0.567 | 0.755 | −4.055 | 3.737 | −0.245 | 3.646 | |

| NBCB | −0.253 | 1.797 | −4.837 | 0.617 | −4.450 | 1.415 | |

| BOSC | −0.670 | 1.642 | 0.000 | 2.022 | −0.886 | 1.403 | |

| Rural | CSRB | 0.050 | 0.226 | 0.228 | 0.522 | 0.367 | 0.560 |

| JYRB | 0.170 | 0.241 | −0.028 | 0.121 | −0.032 | 0.092 | |

| WXRB | 0.276 | 0.312 | 0.356 | 0.413 | 0.294 | 0.464 | |

| WJRB | −0.016 | 0.002 | 0.016 | 0.089 | 0.112 | 0.355 | |

| ZJGRB | 0.046 | 0.157 | 0.034 | 0.215 | 0.120 | 0.410 | |

| Type | 2013 | 2015 | 2017 | Average | |

|---|---|---|---|---|---|

| F C M | State-Owned | 7.43% | 29.78% | 46.18% | 27.79% |

| Joint-Stock | −37.95% | −29.46% | −39.81% | −35.74% | |

| Urban | −28.03% | −32.09% | −26.52% | −28.88% | |

| Rural | 130.76% | 75.47% | 77.46% | 94.57% | |

| V C M | State-Owned | 23.37% | 30.84% | 84.49% | 46.23% |

| Joint-Stock | 23.61% | 12.05% | 7.93% | 14.53% | |

| Urban | 80.15% | 67.96% | 39.76% | 62.62% | |

| Rural | 274.52% | 381.80% | 326.43% | 327.58% | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shao, L.; You, J.; Xu, T.; Shao, Y. Non-Parametric Model for Evaluating the Performance of Chinese Commercial Banks’ Product Innovation. Sustainability 2020, 12, 1523. https://doi.org/10.3390/su12041523

Shao L, You J, Xu T, Shao Y. Non-Parametric Model for Evaluating the Performance of Chinese Commercial Banks’ Product Innovation. Sustainability. 2020; 12(4):1523. https://doi.org/10.3390/su12041523

Chicago/Turabian StyleShao, Luning, Jianxin You, Tao Xu, and Yilei Shao. 2020. "Non-Parametric Model for Evaluating the Performance of Chinese Commercial Banks’ Product Innovation" Sustainability 12, no. 4: 1523. https://doi.org/10.3390/su12041523