Joint Emission Reduction Strategy in Green Supply Chain under Environmental Regulation

Abstract

:1. Introduction

- (1)

- How do the players in the supply chain make pricing decisions, green level decisions and advertising decisions concerning supply chain structure, environmental regulation, and supply chain contract?

- (2)

- How does the environmental regulation impact the green level of the product and the advertising effort?

- (3)

- Can the environmental regulation and the cost-revenue-sharing contract effectively improve the performance of the joint emission strategy?

2. Literature Review

2.1. Sustainable Supply Chain Management

2.2. Environmental Regulation

2.3. Supply Chain Coordination

3. Problem Notations and Assumptions

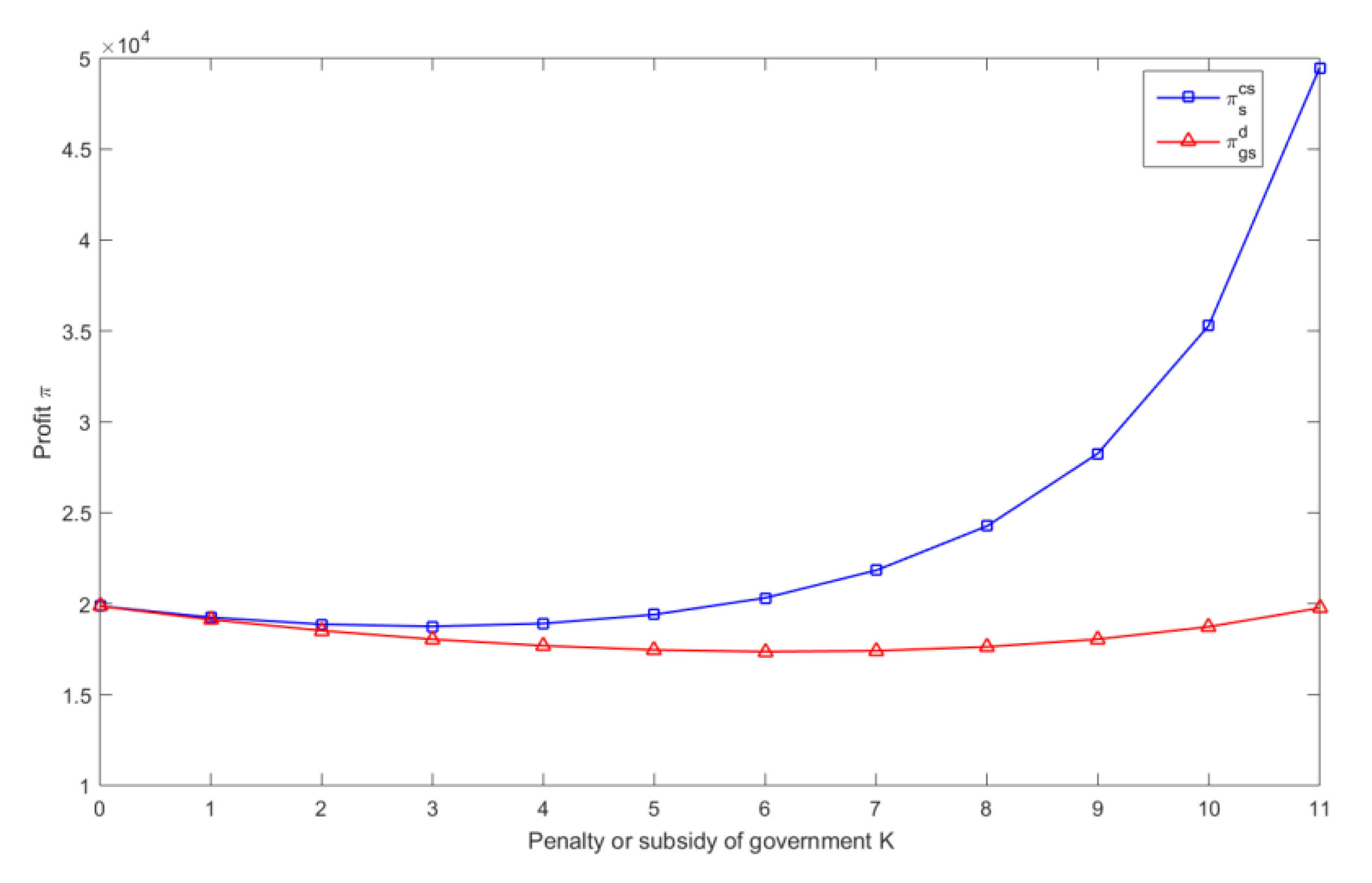

4. Model Solutions and Discussions

4.1. Centralized Decision Model

4.1.1. Without Environmental Regulation

4.1.2. With Environmental Regulation

- (1)

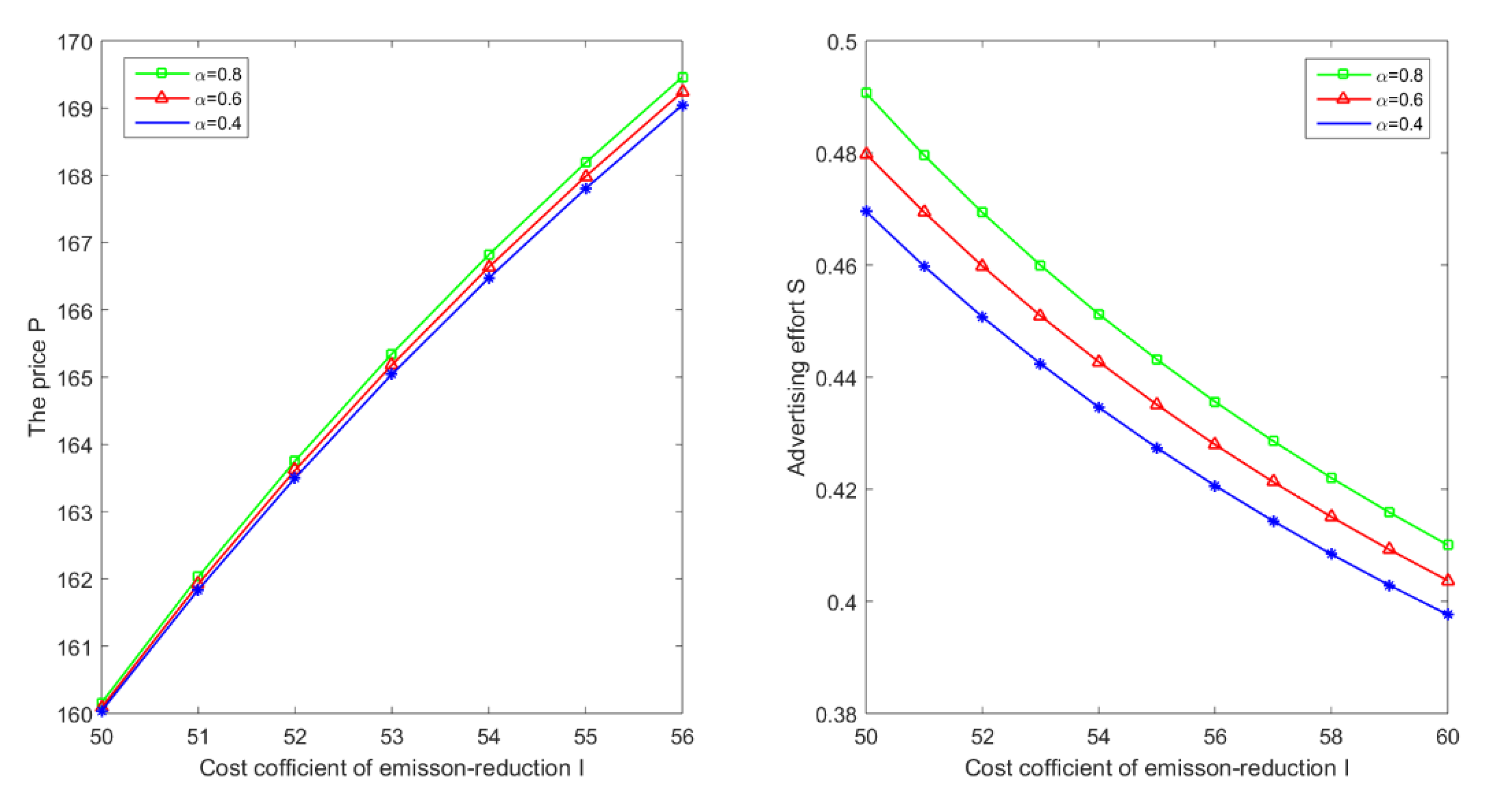

- The optimal green level of product increase in if ;

- (2)

- The optimal advertising effort of retailer decrease in if ; where

4.2. Decentralized Decision Model

4.2.1. Without Environmental Regulation

4.2.2. With Environmental Regulation

- (1)

- ;

- (2)

- , where ;

- (3)

- , where .

- (1)

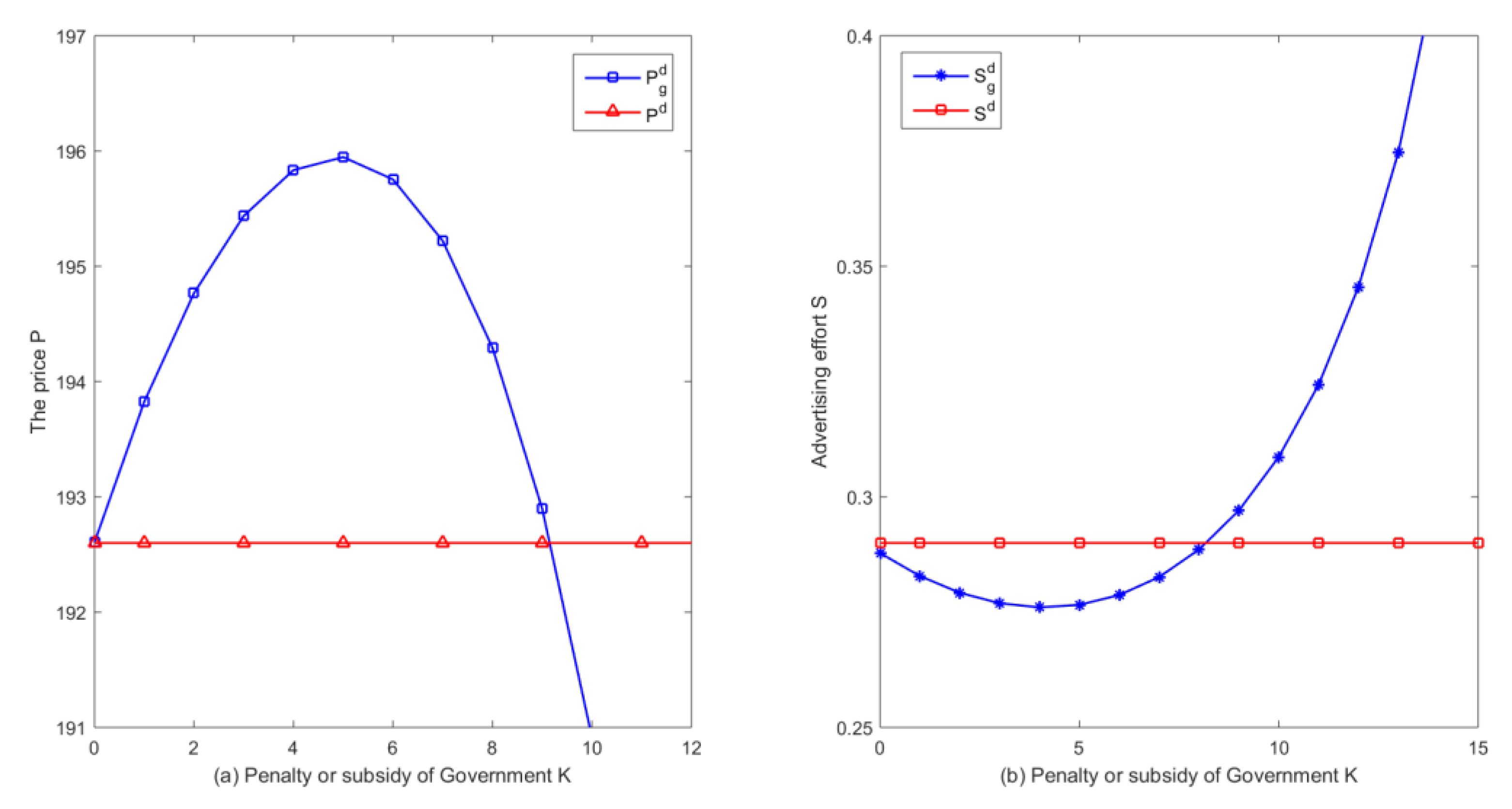

- For , then ;

- (2)

- There are that make the following corollary true. for , for , for and for , where is constrained to in which , , , and, .

- (1)

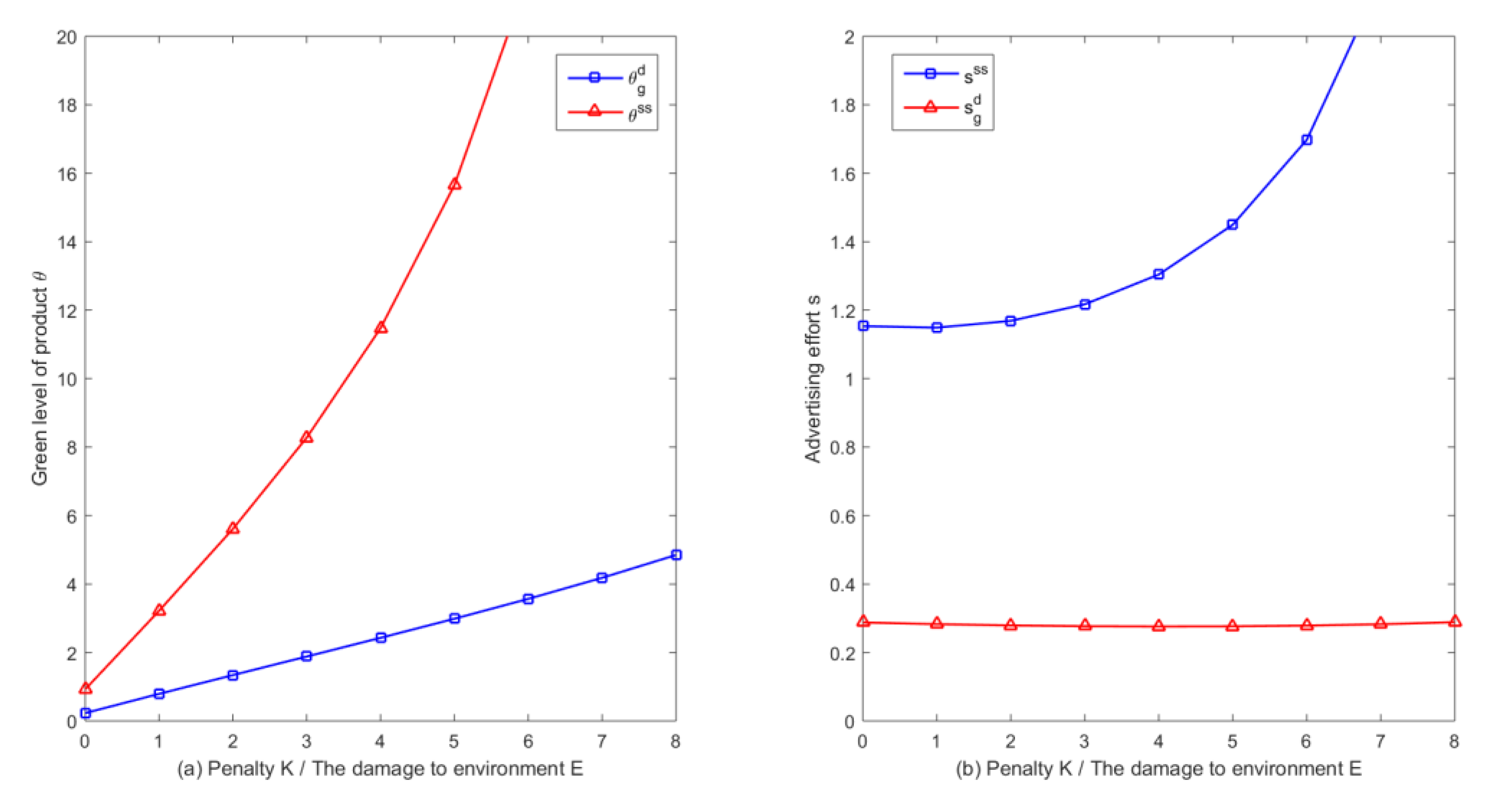

- Whether the manufacturer and retailer can provide socially optimal green efforts under environmental regulation?

- (2)

- If not, under what condition are the manufacturer and the retailer willing to provide socially optimal green efforts?

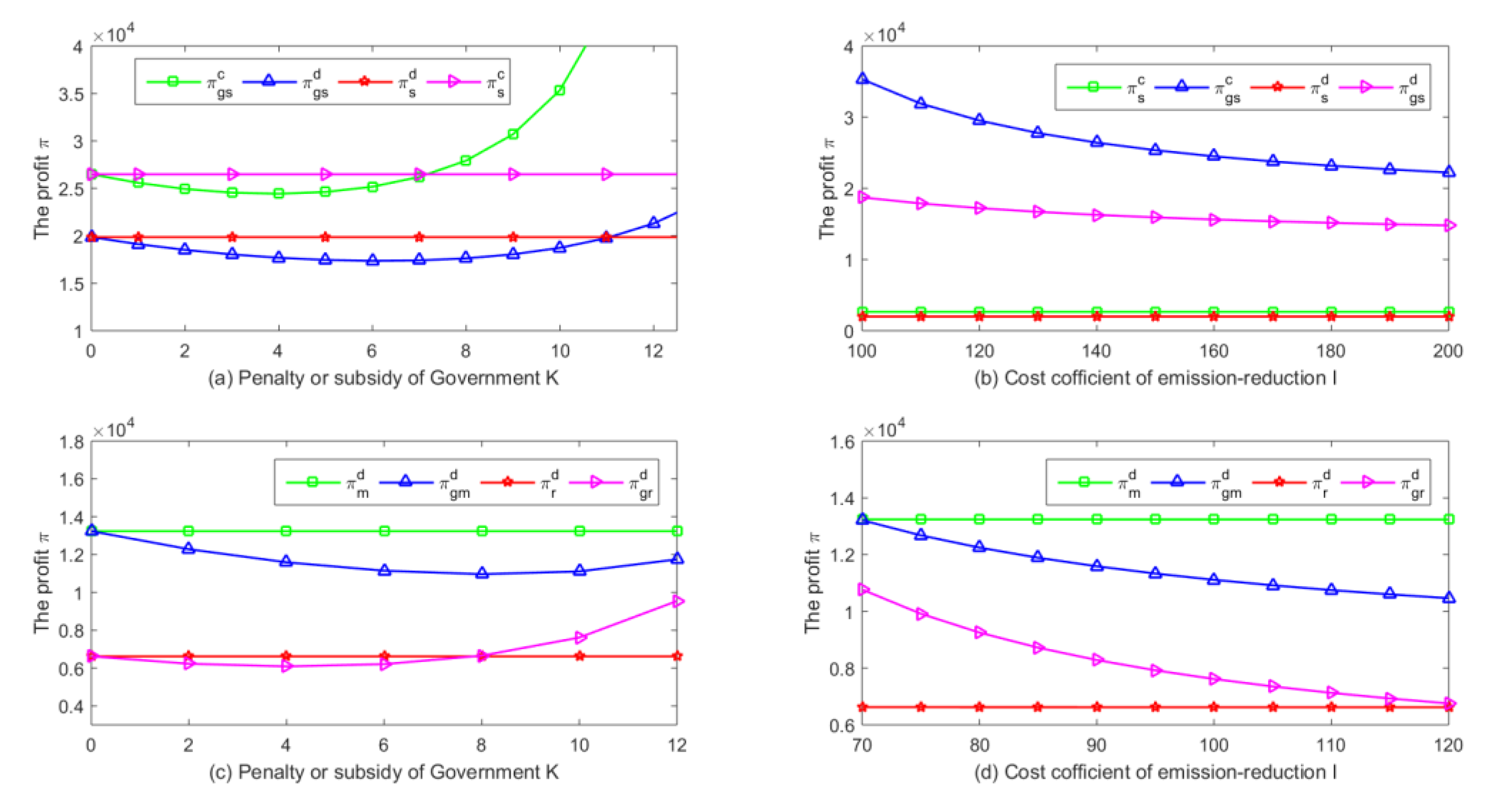

5. Emission Reduction Cost-Revenue-Sharing Contract

6. Conclusions and Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- Yang, L.; Zhang, Q.; Ji, J. Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. Int. J. Prod. Econ. 2017, 191, 286–297. [Google Scholar] [CrossRef]

- Ma, P.; Zhang, C.; Hong, X.; Xu, H. Pricing decisions for substitutable products with green manufacturing in a competitive supply chain. J. Clean. Prod. 2018, 183, 618–640. [Google Scholar] [CrossRef] [Green Version]

- Kumar, V.; Holt, D.; Ghobadian, A.; Garza-Reyes, J.A. Developing green supply chain management taxonomy-based decision support system. Int. J. Prod. Res. 2015, 53, 6372–6389. [Google Scholar] [CrossRef] [Green Version]

- Cohen, M.A.; Cui, S.; Gao, F. The effect of government support on green product design and environmental impact. SSRN Electr. J. 2019. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J.; Swami, S. Product greening and pricing strategies of firms under green sensitive consumer demand and environmental regulations. Ann. Oper. Res. 2018, 1–30. [Google Scholar] [CrossRef]

- Wang, Y.; Hou, G. A duopoly game with heterogeneous green supply chains in optimal price and market stability with consumer green preference. J. Clean. Prod. 2020, 255, 120161. [Google Scholar] [CrossRef]

- Zhou, Y.; Ye, X. Differential game model of joint emission reduction strategies and contract design in a dual-channel supply chain. J. Clean. Prod. 2018, 190, 592–607. [Google Scholar] [CrossRef]

- Hong, Z.; Guo, X. Green product supply chain contracts considering environmental responsibilities. Omega 2019, 83, 155–166. [Google Scholar] [CrossRef]

- Tao, Z. Two-Stage Supply-Chain Optimization Considering Consumer Low-Carbon Awareness under Cap-and-Trade Regulation. Sustainability 2019, 11, 5727. [Google Scholar] [CrossRef] [Green Version]

- Yang, L.; Ji, J.; Wang, M.; Wang, Z. The manufacturer’s joint decisions of channel selections and carbon emission reductions under the cap-and-trade regulation. J. Clean. Prod. 2018, 193, 506–523. [Google Scholar] [CrossRef]

- Drumwright, M.E. Socially responsible organizational buying: Environmental concern as a noneconomic buying criterion. J. Mark. 1994, 58, 1–19. [Google Scholar] [CrossRef]

- Hsu, C.-C.; Tan, K.-C.; Mohamad Zailani, S.H. Strategic orientations, sustainable supply chain initiatives, and reverse logistics: Empirical evidence from an emerging market. Int. J. Oper. Prod. Manag. 2016, 36, 86–110. [Google Scholar] [CrossRef]

- Govindan, K.; Soleimani, H.; Kannan, D. Reverse logistics and closed-loop supply chain: A comprehensive review to explore the future. Eur. J. Oper. Res. 2015, 24, 603–626. [Google Scholar] [CrossRef] [Green Version]

- Winkler, H. Closed-loop production systems—A sustainable supply chain approach. CIRP J. Manuf. Sci. Technol. 2011, 4, 243–246. [Google Scholar] [CrossRef]

- Devika, K.; Jafarian, A.; Nourbakhsh, V. Designing a sustainable closed-loop supply chain network based on triple bottom line approach: A comparison of metaheuristics hybridization techniques. Eur. J. Oper. Res. 2014, 235, 594–615. [Google Scholar] [CrossRef]

- Govindan, K.; Popiuc, M.N. Reverse supply chain coordination by revenue sharing contract: A case for the personal computers industry. Eur. J. Oper. Res. 2014, 233, 326–336. [Google Scholar] [CrossRef]

- Ji, J.; Zhang, Z.; Yang, L. Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J. Clean. Prod. 2017, 141, 852–867. [Google Scholar] [CrossRef]

- Hong, Z.; Wang, H.; Yu, Y. Green product pricing with non-green product reference. Transp. Res. Part E Logist. Transp. Rev. 2018, 115, 1–15. [Google Scholar] [CrossRef]

- Raitasuo, P.; Kuula, M.; Ruiz-Torres, A.J.; Finne, M. Linking green supply chain management skills and environmental performance. In Operations Management and Sustainability; Springer: Berlin, Germany, 2019; pp. 273–291. [Google Scholar]

- Narimissa, O.; Kangarani-Farahani, A.; Molla-Alizadeh-Zavardehi, S. Drivers and barriers for implementation and improvement of Sustainable Supply Chain Management. Sustain. Dev. 2020, 28, 247–258. [Google Scholar] [CrossRef]

- Brandenburg, M.; Govindan, K.; Sarkis, J.; Seuring, S. Quantitative models for sustainable supply chain management: Developments and directions. Eur. J. Oper. Res. 2014, 233, 299–312. [Google Scholar] [CrossRef]

- Golicic, S.L.; Smith, C.D. A meta-analysis of environmentally sustainable supply chain management practices and firm performance. J. Supply Chain Manag. 2013, 49, 78–95. [Google Scholar] [CrossRef]

- Wolf, J. The relationship between sustainable supply chain management, stakeholder pressure and corporate sustainability performance. J. Bus. Ethics 2014, 119, 317–328. [Google Scholar] [CrossRef]

- Beske, P.; Land, A.; Seuring, S. Sustainable supply chain management practices and dynamic capabilities in the food industry: A critical analysis of the literature. Int. J. Prod. Econ. 2014, 152, 131–143. [Google Scholar] [CrossRef]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef] [Green Version]

- Zimon, D.; Tyan, J.; Sroufe, R. Implementing Sustainable Supply Chain Management: Reactive, Cooperative, and Dynamic Models. Sustainability 2019, 11, 7227. [Google Scholar] [CrossRef] [Green Version]

- Koberg, E.; Longoni, A. A systematic review of sustainable supply chain management in global supply chains. J. Clean. Prod. 2019, 207, 1084–1098. [Google Scholar] [CrossRef]

- Rauscher, M. Environmental regulation and the location of polluting industries. Int. Tax Public Finance 1995, 2, 229–244. [Google Scholar] [CrossRef] [Green Version]

- Gersbach, H.; Requate, T. Emission taxes and optimal refunding schemes. J. Public Econ. 2004, 88, 713–725. [Google Scholar] [CrossRef]

- Holland, S.P. Emissions taxes versus intensity standards: Second-best environmental policies with incomplete regulation. J. Environ. Econ. Manag. 2012, 63, 375–387. [Google Scholar] [CrossRef] [Green Version]

- Chen, C. Design for the environment: A quality-based model for green product development. Manag. Sci. 2001, 47, 250–263. [Google Scholar] [CrossRef]

- Krass, D.; Nedorezov, T.; Ovchinnikov, A. Environmental taxes and the choice of green technology. Prod. Oper. Manag. 2013, 22, 1035–1055. [Google Scholar] [CrossRef]

- Moner-Colonques, R.; Rubio, S.J. The strategic use of innovation to influence environmental policy: Taxes versus standards. BE J. Econ. Anal. Policy 2016, 16, 973–1000. [Google Scholar] [CrossRef]

- Subramanian, R.; Gupta, S.; Talbot, B. Product design and supply chain coordination under extended producer responsibility. Prod. Oper. Manag. 2009, 18, 259–277. [Google Scholar] [CrossRef]

- Gouda, S.K.; Jonnalagedda, S.; Saranga, H. Design for the environment: Impact of regulatory policies on product development. Eur. J. Oper. Res. 2016, 248, 558–570. [Google Scholar] [CrossRef]

- Martín-Herrán, G.; Rubio, S.J. Second-best taxation for a polluting monopoly with abatement investment. Energy Econ. 2018, 73, 178–193. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, W.; He, P.; Xu, X. Production and pricing problems in make-to-order supply chain with cap-and-trade regulation. Omega 2017, 66, 248–257. [Google Scholar] [CrossRef]

- Hariga, M.; As’ ad, R.; Shamayleh, A. Integrated economic and environmental models for a multi stage cold supply chain under carbon tax regulation. J. Clean. Prod. 2017, 166, 1357–1371. [Google Scholar] [CrossRef]

- Chen, Y.J.; Sheu, J.-B. Environmental-regulation pricing strategies for green supply chain management. Transp. Res. Part E Logist. Transp. Rev. 2009, 45, 667–677. [Google Scholar] [CrossRef] [Green Version]

- Fahimnia, B.; Sarkis, J.; Choudhary, A.; Eshragh, A. Tactical supply chain planning under a carbon tax policy scheme: A case study. Int. J. Prod. Econ. 2015, 164, 206–215. [Google Scholar] [CrossRef] [Green Version]

- Xu, C.; Zhao, D.; Yuan, B.; He, L. Differential game model on joint carbon emission reduction and low-carbon promotion in supply chains. J. Manag. Sci. China 2016, 19, 53–65. [Google Scholar]

- Wang, S.; Wan, L.; Li, T.; Luo, B.; Wang, C. Exploring the effect of cap-and-trade mechanism on firm’s production planning and emission reduction strategy. J. Clean. Prod. 2018, 172, 591–601. [Google Scholar] [CrossRef]

- Xu, L.; Wang, C. Sustainable manufacturing in a closed-loop supply chain considering emission reduction and remanufacturing. Resour. Conserv. Recycl. 2018, 131, 297–304. [Google Scholar] [CrossRef]

- Xu, J.; Chen, Y.; Bai, Q. A two-echelon sustainable supply chain coordination under cap-and-trade regulation. J. Clean. Prod. 2016, 135, 42–56. [Google Scholar] [CrossRef]

- Zhang, J.; Gou, Q.; Liang, L.; Huang, Z. Supply chain coordination through cooperative advertising with reference price effect. Omega 2013, 41, 345–353. [Google Scholar] [CrossRef]

- Song, H.; Gao, X. Green supply chain game model and analysis under revenue-sharing contract. J. Clean. Prod. 2018, 170, 183–192. [Google Scholar] [CrossRef]

- Aslani, A.; Heydari, J. Transshipment contract for coordination of a green dual-channel supply chain under channel disruption. J. Clean. Prod. 2019, 223, 596–609. [Google Scholar] [CrossRef]

- Xue, W.; Hu, Y.; Chen, Z. The value of buyback contract under price competition. Int. J. Prod. Res. 2019, 57, 2679–2694. [Google Scholar] [CrossRef]

- Chauhan, C.; Singh, A. Modeling green supply chain coordination: Current research and future prospects. Benchmarking Int. J. 2018, 25, 3767–3788. [Google Scholar] [CrossRef]

- Cao, E.; Yu, M. Trade credit financing and coordination for an emission-dependent supply chain. Comput. Ind. Eng. 2018, 119, 50–62. [Google Scholar] [CrossRef]

- Wang, Q.; Zhao, D.; He, L. Contracting emission reduction for supply chains considering market low-carbon preference. J. Clean. Prod. 2016, 120, 72–84. [Google Scholar] [CrossRef]

- Erickson, G.M. A differential game model of the marketing-operations interface. Eur. J. Oper. Res. 2011, 211, 394–402. [Google Scholar] [CrossRef]

- Zhang, J.; Kevin Chiang, W.Y.; Liang, L. Strategic pricing with reference effects in a competitive supply chain. Omega 2014, 44, 126–135. [Google Scholar] [CrossRef]

- Swami, S.; Shah, J. Channel coordination in green supply chain management. J. Oper. Res. Soc. 2013, 64, 336–351. [Google Scholar] [CrossRef]

- Drozdenko, R.; Jensen, M.; Coelho, D. Pricing of green products: Premiums paid, consumer characteristics and incentives. Int. J. Bus. Mark. Decis. Sci. 2011, 4, 106–116. [Google Scholar]

- Xue, J.; Gong, R.; Zhao, L.; Ji, X.; Xu, Y. A Green Supply-Chain Decision Model for Energy-Saving Products That Accounts for Government Subsidies. Sustainability 2019, 11, 2209. [Google Scholar] [CrossRef] [Green Version]

- Han, Q.; Wang, Y. Decision and Coordination in a Low-Carbon E-Supply Chain Considering the Manufacturer’s Carbon Emission Reduction Behavior. Sustainability 2018, 10, 1686. [Google Scholar] [CrossRef] [Green Version]

- Wu, C.-H. Price and service competition between new and remanufactured products in a two-echelon supply chain. Int. J. Prod. Econ. 2012, 140, 496–507. [Google Scholar] [CrossRef]

- Xing, G.; Xia, B.; Guo, J. Sustainable Cooperation in the Green Supply Chain under Financial Constraints. Sustainability 2019, 11, 5977. [Google Scholar] [CrossRef] [Green Version]

- Giri, B.C.; Mondal, C.; Maiti, T. Analysing a closed-loop supply chain with selling price, warranty period and green sensitive consumer demand under revenue sharing contract. J. Clean. Prod. 2018, 190, 822–837. [Google Scholar] [CrossRef]

- Bhaskaran, S.R.; Krishnan, V. Effort, Revenue, and Cost Sharing Mechanisms for Collaborative New Product Development. Manag. Sci. 2009, 55, 1152–1169. [Google Scholar] [CrossRef] [Green Version]

- Goldberg, P.K. The effects of the corporate average fuel efficiency standards in the US. J. Ind. Econ. 1998, 46, 1–33. [Google Scholar] [CrossRef]

- Dong, L.; Narasimhan, C.; Zhu, K. Product Line Pricing in a Supply Chain. Manag. Sci. 2009, 55, 1704–1717. [Google Scholar] [CrossRef]

- Liu, Z.; Nishi, T. Government Regulations on Closed-Loop Supply Chain with Evolutionarily Stable Strategy. Sustainability 2019, 11, 5030. [Google Scholar] [CrossRef] [Green Version]

- Xu, L.; Wang, C.; Zhao, J. Decision and coordination in the dual-channel supply chain considering cap-and-trade regulation. J. Clean. Prod. 2018, 197, 551–561. [Google Scholar] [CrossRef]

- Dellarocas, C. Double Marginalization in Performance-Based Advertising: Implications and Solutions. Manag. Sci. 2012, 58, 1178–1195. [Google Scholar] [CrossRef] [Green Version]

- Li, X.; Li, Y.; Cai, X. Double marginalization and coordination in the supply chain with uncertain supply. Eur. J. Oper. Res. 2013, 226, 228–236. [Google Scholar] [CrossRef]

| Parameters | |

|---|---|

| Penalty or subsidy of government for per unit deviation from the standard | |

| Green level standard | |

| Unit production cost (not including emission reduction cost) | |

| Cost coefficient of emission reduction | |

| Potential demand for the product | |

| Consumers’ demand sensitivity of the green level | |

| Consumers’ demand sensitivity of advertising effort | |

| Demand sensitivity of the price | |

| Cost coefficient of advertising effort | |

| Decision variables | |

| Green level of the product | |

| The wholesale price of the product | |

| The unit selling price of the product | |

| Advertising effort of the retailer | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, W.; Xiao, J.; Cai, L. Joint Emission Reduction Strategy in Green Supply Chain under Environmental Regulation. Sustainability 2020, 12, 3440. https://doi.org/10.3390/su12083440

Zhang W, Xiao J, Cai L. Joint Emission Reduction Strategy in Green Supply Chain under Environmental Regulation. Sustainability. 2020; 12(8):3440. https://doi.org/10.3390/su12083440

Chicago/Turabian StyleZhang, Wensi, Jing Xiao, and Lingfei Cai. 2020. "Joint Emission Reduction Strategy in Green Supply Chain under Environmental Regulation" Sustainability 12, no. 8: 3440. https://doi.org/10.3390/su12083440