An Analysis on the Influence of R&D Fiscal and Tax Subsidies on Regional Innovation Efficiency: Empirical Evidence from China

Abstract

:1. Introduction

2. Literature Review

2.1. Research on Efficiency of Regional Innovation in China

2.2. Research on the Influence of R&D Financial Subsidies on Regional Innovation Efficiency

3. Materials and Methods

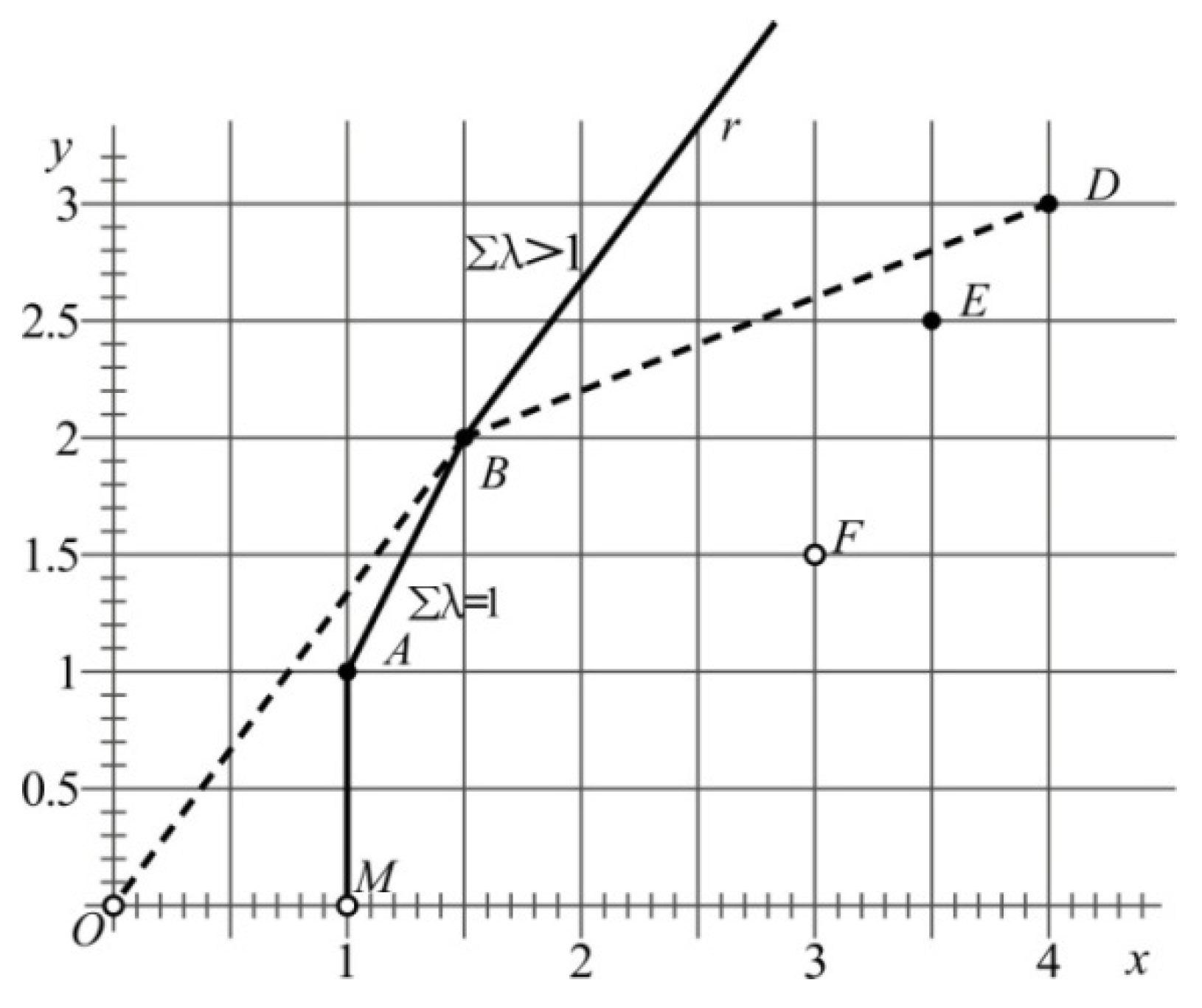

3.1. DEA Tobit Model

3.1.1. Decomposition of Regional Innovation Efficiency

3.1.2. Tobit Regression Model

3.2. Malmquist Exponential Decomposition

4. Results and Discussion

4.1. Evaluation of Regional Innovation Efficiency

4.1.1. Evaluation Index and Data Sources

4.1.2. Efficiency Evaluation

4.1.3. Malmquist Index Change Analysis

4.1.4. Returns to Scale Analysis

4.1.5. Projection Analysis

4.2. Regression of R&D Fiscal and Tax Policy Model

4.2.1. Variable Selection and Model Establishment

4.2.2. Empirical Results

5. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Solow, R.M. A contribution to the theory of economic growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Lundvall, B. National systems of innovation: Toward a theory of innovation and interactive learning. In Anthem Other Canon Economics; Anthem Press: London, UK; New York, NY, USA, 2010; Volume 2, p. 388. [Google Scholar]

- Wallsten, S.J. The effects of government-industry R&D programs on private R&D: The case of the small business innovation research program. RAND J. Econ. 2000, 31, 82–100. [Google Scholar] [CrossRef]

- Sharma, S.; Thoms, V.J. Inter-Country R&D Efficiency Analysis: Application of Data Envelopment Analysis. Scientometrics 2008, 76, 483–501. [Google Scholar]

- Parida, V.; Westerberg, M.; Frishammar, J. Inbound open innovation activities in high-tech SMEs: The impact on innovation performance. J. Small Bus. Manag. 2012, 50, 283–309. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.; Chen, K.H.; Fu, X.L. Scientific effects of Triple Helix interactions among research institutes, industries and universities. Technovation 2019, 86, 33–47. [Google Scholar] [CrossRef]

- Li, X.B. An empirical analysis of the effect of institutional factors on regional innovation performance. J. Quant. Tech. Econ. 2007, 24, 13–24. [Google Scholar]

- Cheng, D.P.; Gan, S.M. Research on high-tech industry input-output efficiency in Yangtze River economic belt: Resources and Environment in the Yangtze Basin. CNKI J. 2017, 26, 325–332. [Google Scholar]

- Fischlein, M.; Smith, T.M. Revisiting renewable portfolio standard effectiveness: Policy design and outcome specification matter. Policy Sci. 2013, 46, 277–310. [Google Scholar] [CrossRef]

- Joskow, P.L. Comparing the costs of intermittent and dispatchable electricity generating technologies. Am. Econ. Rev. 2011, 101, 238–241. [Google Scholar] [CrossRef] [Green Version]

- Liu, F.C.; Simon, D.F.; Sun, Y.T.; Cao, C. China’s innovation policies: Evolution, institution and structure, and trajectory. Res. Policy 2011, 40, 917–931. [Google Scholar] [CrossRef]

- Liu, S.Z.; Guan, J.C. The evaluation on the innovating performance of regional innovation systems. Chin. J. Manag. Sci. 2002, 1, 75–78. [Google Scholar]

- Shi, F. Research on regional innovation efficiency: Based on Chinese provincial panel data and DEA method. Technol. Econ. 2010, 5, 42–47. [Google Scholar]

- Zhao, S.K.; Yu, H.Q.; Gong, S.L. The innovation efficiency of hi-tech enterprises in Jilin Province based on DEA method. Sci. Res. Manag. 2013, 34, 36–43+104. [Google Scholar]

- Yu, X.F.; Li, Z.W.; Chi, R.Y.; Shi, M.W. Technological innovation efficiency of different regions in China: Status quo and causes. Sci. Res. Manag. 2005, 2, 258–264. [Google Scholar]

- Bai, J.H.; Li, J. Government R&D funding and enterprise technology innovation: An empirical analysis from the perspective of efficiency. J. Financ. Res. 2011, 6, 181–193. [Google Scholar]

- Fan, F.; Huan, L.A.; Wang, S. Can regional collaborative innovation improve innovation efficiency? An empirical study of Chinese cities. Growth Chang. 2020, 51, 440–463. [Google Scholar] [CrossRef]

- Qian, L.; Wang, W.P.; Xiao, R.Q. Ownership, technology gap and innovation efficiency of high-tech enterprises. Sci. Technol. Prog. Policy 2019, 12, 1058–1114. [Google Scholar]

- Wu, Y.B. Which type of ownership is the most innovative enterprise in China? J. World Econ. 2012, 6, 3–29. [Google Scholar]

- Chen, Z.; Xu, W.; Lee, S.H. R&D Performances in High-Tech Firms in China. Asian Econ. Pap. 2017, 16, 193–208. [Google Scholar]

- Chen, K.; Kou, M.; Fu, X. Evaluation of multi-period regional R&D efficiency: An application of dynamic DEA to China’s regional R&D systems. Omega 2018, 74, 103–114. [Google Scholar]

- Hall, B.H.; Reenen, J.V. How effective are fiscal incentives for R&D? A review of the evidence. Res. Policy 2000, 29, 449–469. [Google Scholar] [CrossRef]

- Rothstein, B. Government Quality, Governance Capacity and Corruption, Social Trust and Inequality; Jiang, X.H., Ed.; Translator; Xinhua Publishing House: Beijing, China, 2012. [Google Scholar]

- Fukuyama, F. What is governance? Governance 2013, 26, 347–368. [Google Scholar] [CrossRef]

- Szczygielski, K.; Grabowski, W.; Pamukcu, M.T.; Tandogan, V.S. Does government support for private innovation matter? Firm-level from evidence from two catching-up countries. Res. Policy 2017, 46, 219–237. [Google Scholar] [CrossRef]

- Jin, H.; Bing, F.; Wu, Y.R.; Wang, L.B. Do government grants promote innovation efficiency in China’s high-tech industries? Technovation 2016, 57–58, 4–13. [Google Scholar] [CrossRef]

- Barca, F.; Mccann, P.; Rodriguez, P.A. The case for regional development intervention: Place-based versus place-neutral approaches. J. Reg. Sci. 2012, 52, 134–152. [Google Scholar] [CrossRef]

- Rodriguez, P.A. Do institutions matter for regional development? Reg. Stud. 2013, 47, 1034–1047. [Google Scholar] [CrossRef] [Green Version]

- West, J. Regional Innovation Monitor: Governance, Policies, and Perspectives in European Regions; Enterprise and Industry Directorate-General. Project No. 0932; European Commission: Brussels, Belgium, 2012.

- Mauro, P. Corruption and the composition of government expenditure. J. Public Econ. 1998, 69, 263–279. [Google Scholar] [CrossRef]

- Freeman, C. Technology policy and economic performance. In R&D Management; Trevor, M., Ed.; Pinter Publishers: London, UK, 1989; Volume 2, p. 34. [Google Scholar]

- Porter, M.E. Competitive Advantage of Nations: Creating and Sustaining Superior Performance, 5th ed.; Simon and Schuster: New York, NY, USA, 2011. [Google Scholar]

- Pang, L.X.; Guan, J.C. The effects of government financial policies on high-tech firm’s innovation and growth. Stud. Sci. 2018, 12, 2259–2269. [Google Scholar]

- Li, P.; Wang, C.H. The optimal level of public direct subsidies to business R&D and the targeted project select: A threshold regression analysis based on the industrial heterogeneity. Rev. Ind. Econ. 2010, 9, 37–53. [Google Scholar]

- Li, L.; Chen, J.; Gao, H.L.; Xie, L. The certification effect of government R&D subsidies on innovative entrepreneurial firm’s access to bank finance: Evidence from China. Small Bus. Econ. 2019, 52, 241–259. [Google Scholar]

- Guellec, D.; Van Pottelsberghe, B. The impact of public R&D expenditure on business R&D. Econ. Innov. New Technol. 2003, 12, 225–243. [Google Scholar] [CrossRef]

- Kang, Z.Y. Does Chinese government subsidies promote the quality of enterprise patents? Stud. Sci. 2018, 36, 69–80. [Google Scholar]

- Yang, T.T.; Luo, L.H.; Xu, B.T. The technical innovation effect of government subsidy: “Quantity change” or “Quality change”. China Soft Sci. 2018, 10, 52–61. [Google Scholar]

- Jian, G.; Richard, C.M. Effects of government financial incentives on firm’s innovation performance in China. Res. Policy 2015, 44, 273–282. [Google Scholar] [CrossRef]

- An, T.L.; Zhou, S.D.; Pi, J.C. The stimulating effects of R&D subsidies on independent innovation of Chinese enterprises. Econ. Res. J. 2009, 10, 87–98. [Google Scholar]

- Yu, F.F. Government R&D subsidies, political relations and technological SMEs innovation transformation. iBusiness 2013, 5, 104–109. [Google Scholar]

- Gorg, H.; Strobl, E. The effect of R&D subsidies on private R&D. Economica 2007, 74, 215–234. [Google Scholar]

- Feng, Z.; Chen, K.H.; Dai, X.Y. Does the weighted tax deduction for R&D costs promote firm’s innovative capability?—The full perspective of innovation chain. Sci. Res. Manag. 2019, 10, 73–86. [Google Scholar]

- Li, Y.L. Preferential tax policy and innovation efficiency of high-tech industry. J. Quant. Tech. Econ. 2018, 1, 60–76. [Google Scholar]

- Wang, Z.; Wang, L.H. Low-carbon economy development under the carbon emission trading scheme (ETS)—An analysis based on undesired DEA and DID models. J. Southwest. Univ. 2019, 5, 85–95. [Google Scholar]

- Czarnitzki, D.; Hanel, P.; Rosa, J.M. Evaluating the impact of R&D tax credits on innovation: A micro-econometric study on Canadian firms. Res. Policy 2011, 40, 217–229. [Google Scholar]

- Li, W.A.; Li, H.B.; Li, H.C. Innovation incentives or tax shield?—A study of the tax preferences of high-tech enterprises. Sci. Res. Manag. 2016, 37, 61–70. [Google Scholar] [CrossRef]

- Zheng, C.M.; Li, P. The influence of government subsidy and tax preference on innovation performance of enterprises. Sci. Technol. Prog. Policy 2015, 16, 83–87. [Google Scholar]

- Warda, J. Measuring the Attractiveness Of R&D Tax Incentives: Canada and Major Industrial Countries; Report Prepared for TAITC, OIS and Statistics Canada 88F0006XFB; Statistics Canada: Ottawa, ON, Canada, 1999.

- Brown, J.R.; Martinsson, G.; Petersen, C. What promotes R&D? Comparative evidence from around the world. Res. Policy 2017, 46, 447–462. [Google Scholar] [CrossRef] [Green Version]

- Tobin, J. Estimation of relationships for limited dependent variables. Econometrica 1958, 1, 24–36. [Google Scholar] [CrossRef] [Green Version]

- Heckman, J. Shadow price, market wages, and labor supply. Econometrica 1974, 4, 679–694. [Google Scholar] [CrossRef]

- Fare, R.; Grosskopf, S.; Norris, M.; Zhang, Z. Productivity growth, technical progress, and efficiency change in industrialized countries. Am. Econ. Rev. 1994, 84, 66–83. [Google Scholar]

- Liu, Z.Y.; Zhang, J.K. Analysis on innovation efficiency of the different capital type enterprises in high-tech industries—Based on the three-stage DEA model. R&D Manag. 2013, 25, 45–51. [Google Scholar]

- Chen, K.H.; Guan, J.C. Measuring China’s regional innovation systems: Application of network data envelopment analysis (DEA). Reg. Stud. 2012, 46, 355–377. [Google Scholar] [CrossRef]

- Zhu, P.F.; Xu, W.M. On the impact of government’s S&T incentive policy on the R&D input and its patent output of large and medium-sized industrial enterprises in Shanghai. Econ. Res. J. 2003, 6, 45–52. [Google Scholar]

- Doh, S.; Kim, B. Government support for SME innovations in the regional industries: The case of government financial support program in South Korea. Res. Policy 2014, 43, 1557–1569. [Google Scholar] [CrossRef]

- Zheng, R. Evaluation on different approaches of R&D tax incentives. Financ. Trade Econ. 2006, 9, 3–8. [Google Scholar]

- Harmaakorpi, V.; Rinkinen, S. Regional development platforms as incubators of business ecosystems. Case study: The Lahti urban region, Finland. Growth Chang. 2020, 51, 626–645. [Google Scholar] [CrossRef] [Green Version]

- Feng, M.H.; Qu, W.; Li, M.L. Does tax incentives induce R&D investment in firms? Stud. Sci. 2015, 33, 665–673. [Google Scholar]

- Chen, Z.; Liu, Z.; Serrato, J.C.; Xu, D. Notching R&D Investment with Corporate Income Tax Cuts in China. Am. Econ. Rev. 2021, 111, 2065–2100. [Google Scholar]

- Watkins, A.; Papaioannou, T.; Mugwagwa, J.; Kale, D. National innovation systems and the intermediary role of industry associations in building institutional capacities for innovation in developing countries: A critical review of the literature. Res. Policy 2015, 44, 1407–1418. [Google Scholar] [CrossRef]

- Xian, W.; Li, G.B. Government support, R&D management and technological innovation efficiency. Manag. World 2014, 4, 71–80. [Google Scholar]

| Investment Category | Definition | Unit |

|---|---|---|

| Input | R&D expenditure of regional innovation system | 100 million yuan |

| R&D innovation system full-time equivalent personnel | 1000 person/year | |

| Science and technology appropriation of local finance | 100 million yuan | |

| Output | Amount of invention patent authorization | Items |

| The sales revenue of new products in high-tech industry | 100 million yuan | |

| Scientific and technical papers published in Chinese Journals | Number of articles | |

| The contract amount of technology introduction | 100 million yuan |

| DMU | TE | PE | SE | DEA Effective Years |

|---|---|---|---|---|

| Beijing | 1.000 | 1.000 | 1.000 | 15 |

| Tianjin | 0.932 | 0.944 | 0.987 | 11 |

| Hebei | 0.411 | 0.440 | 0.937 | 0 |

| Shanxi | 0.544 | 0.582 | 0.931 | 1 |

| Inner Mongolia | 0.323 | 0.391 | 0.820 | 0 |

| Liaoning | 0.556 | 0.570 | 0.974 | 0 |

| Jilin | 0.973 | 0.981 | 0.992 | 11 |

| Heilongjiang | 0.891 | 0.937 | 0.953 | 7 |

| Shanghai | 0.891 | 0.970 | 0.921 | 10 |

| Jiangsu | 0.805 | 0.848 | 0.954 | 6 |

| Zhejiang | 0.732 | 0.750 | 0.978 | 0 |

| Anhui | 0.781 | 0.842 | 0.931 | 3 |

| Fujian | 0.804 | 0.818 | 0.982 | 4 |

| Jiangxi | 0.433 | 0.503 | 0.867 | 0 |

| Shandong | 0.549 | 0.558 | 0.985 | 0 |

| Henan | 0.460 | 0.479 | 0.961 | 0 |

| Hubei | 0.837 | 0.842 | 0.992 | 6 |

| Hunan | 0.835 | 0.849 | 0.984 | 4 |

| Guangdong | 0.875 | 1.000 | 0.875 | 10 |

| Guangxi | 0.555 | 0.582 | 0.949 | 3 |

| Hainan | 0.918 | 1.000 | 0.918 | 12 |

| Chongqing | 0.806 | 0.821 | 0.971 | 9 |

| Sichuan | 0.696 | 0.716 | 0.973 | 0 |

| Guizhou | 0.678 | 0.761 | 0.902 | 1 |

| Yunnan | 0.680 | 0.790 | 0.873 | 2 |

| Shaanxi | 0.906 | 0.922 | 0.979 | 11 |

| Gansu | 0.978 | 1.000 | 0.978 | 12 |

| Qinghai | 0.334 | 0.860 | 0.419 | 0 |

| Ningxia | 0.464 | 0.747 | 0.619 | 1 |

| Xinjiang | 0.454 | 0.529 | 0.857 | 0 |

| Country | 0.972 | 1.000 | 0.972 | 3 |

| Eastern Area | 1.000 | 1.000 | 1.000 | 15 |

| Central Area | 0.974 | 0.993 | 0.981 | 11 |

| Western Area | 0.897 | 0.920 | 0.972 | 8 |

| Northeast Area | 1.000 | 1.000 | 1.000 | 15 |

| Year | EC | PEC | SEC | TC |

|---|---|---|---|---|

| 2002 | 1.031 | 1.015 | 1.020 | 1.256 |

| 2003 | 0.986 | 0.984 | 1.004 | 1.086 |

| 2004 | 1.048 | 1.017 | 1.033 | 1.012 |

| 2005 | 1.013 | 1.012 | 1.001 | 0.973 |

| 2006 | 0.969 | 1.012 | 0.956 | 1.005 |

| 2007 | 1.022 | 0.994 | 1.029 | 1.036 |

| 2008 | 0.986 | 1.006 | 0.980 | 1.044 |

| 2009 | 1.006 | 1.021 | 0.987 | 1.049 |

| 2010 | 0.985 | 0.998 | 0.987 | 1.041 |

| 2011 | 1.015 | 1.006 | 1.010 | 1.046 |

| 2012 | 1.032 | 1.040 | 0.997 | 0.956 |

| 2013 | 1.076 | 1.033 | 1.041 | 0.953 |

| 2014 | 1.007 | 0.998 | 1.010 | 1.177 |

| 2015 | 0.991 | 0.991 | 1.000 | 1.062 |

| 2016 | 0.969 | 0.989 | 0.980 | 0.998 |

| Year | Region | EC | PEC | SEC | TC |

|---|---|---|---|---|---|

| 2002–2006 | Country | 1.002 | 1 | 1.002 | 1.010 |

| Eastern Area | 1 | 1 | 1 | 1 | |

| Central Area | 1 | 1 | 1 | 1.031 | |

| Western Area | 1.009 | 1.006 | 1.008 | 1.052 | |

| Northeast Area | 1 | 1 | 1 | 1.005 | |

| 2007–2011 | Country | 1.004 | 1 | 1.004 | 1.006 |

| Eastern Area | 1 | 1 | 1 | 1 | |

| Central Area | 1 | 1 | 1 | 1.009 | |

| Western Area | 1.032 | 1.025 | 1.006 | 1.015 | |

| Northeast Area | 1 | 1 | 1 | 1.008 | |

| 2012–2016 | Country | 0.996 | 1 | 0.996 | 1.018 |

| Eastern Area | 1 | 1 | 1 | 1 | |

| Central Area | 0.986 | 0.987 | 0.999 | 1.032 | |

| Western Area | 1 | 1 | 1 | 1.002 | |

| Northeast Area | 1 | 1 | 1 | 1.003 |

| Year | IRS | DRS | CRS |

|---|---|---|---|

| 2002–2006 | AH, FJ, HE, HA, JS, JX, LN, QH, SD, SN, SC, CQ | GD, GX, GZ, IN, NX, SX, XJ, YN, ZJ | BJ, GS, HI, HL, HB, HN, JL, SH, TJ |

| 2007–2011 | AH, FJ, GX, HE, HA, JX, LN, IN, NX, QH, SD, SX, SC, XJ, ZJ | GZ, YN | BJ, GS, GD, HI, HL, HB, HN, JL, JS, SN, SH, TJ, CQ |

| 2012–2016 | FJ, GZ, HE, HA, HN, JX, LN, IN, NX, QH, SD, SX, SC, XJ, YN, ZJ | HB, SH, TJ | AH, BJ, GS, GD, GX, HI, HL, JL, JS, SN, CQ |

| Province | TE | Benchmark | Province | TE | Benchmark |

|---|---|---|---|---|---|

| Beijing | 1 | 1 | Henan | 0.491 | 1(0.161) |

| Tianjin | 0.848 | 19(0.056); 22(1.232) | Hubei | 0.714 | 1(0.055); 22(0.402); 26(0.592) |

| Hebei | 0.431 | 1(0.099); 19(0.005) | Hunan | 0.762 | 1(0.066); 22(0.679); 26(0.154) |

| Shanxi | 0.439 | 1(0.061) | Guangdong | 1 | 19 |

| Inner Mongolia | 0.227 | 1(0.021); 19(0.001) | Guangxi | 1 | 20 |

| Liaoning | 0.556 | 1(0.080); 22(0.129); 26(0.406) | Hainan | 1 | 21 |

| Jilin | 1 | 7 | Chongqing | 1 | 22 |

| Heilongjiang | 1 | 8 | Sichuan | 0.868 | 1(0.163); 22(0.565); 26(0.088) |

| Shanghai | 0.713 | 1(0.348); 22(1.154) | Guizhou | 0.708 | 1(0.012); 12(0.082); 20(0.076) |

| Jiangsu | 1 | 10 | Yunnan | 0.561 | 1(0.055) |

| Zhejiang | 0.831 | 1(0.403); 12(0.409); 19(0.103) | Shaanxi | 1 | 26 |

| Anhui | 1 | 12 | Gansu | 1 | 27 |

| Fujian | 0.719 | 1(0.078); 19(0.094) | Qinghai | 0.374 | 1(0.005); 22(0.003) |

| Jiangxi | 0.488 | 22(0.305); 26(0.073) | Ningxia | 0.531 | 1(0.010); 22(0.020) |

| Shandong | 0.669 | 1(0.352); 19(0.103) | Xinjiang | 0.441 | 1(0.024) |

| Province. | Input Adjustment (%) | Output Adjustment (%) | |||||

|---|---|---|---|---|---|---|---|

| Beijing | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Tianjin | 27.839 | 9.823 | 7.926 | 51.011 | 0 | 0 | 187.661 |

| Hebei | 48.808 | 72.439 | 49.575 | 0 | 0 | 15.939 | 121.888 |

| Shanxi | 39.400 | 67.891 | 61.014 | 0 | 125.604 | 12.182 | 66.345 |

| Inner Mongolia | 71.583 | 85.474 | 74.771 | 0 | 0 | 7.507 | 76.597 |

| Liaoning | 39.285 | 29.383 | 64.552 | 0 | 20.917 | 0 | 0 |

| Jilin | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Heilongjiang | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Shanghai | 17.650 | 10.316 | 58.283 | 0 | 53.320 | 5.494 | 0 |

| Jiangsu | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Zhejiang | 0 | 39.693 | 10.876 | 0 | 0 | 85.269 | 16.057 |

| Anhui | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Fujian | 23.217 | 47.486 | 13.528 | 0 | 0 | 4.790 | 11.607 |

| Jiangxi | 42.757 | 45.467 | 65.364 | 8.478 | 0 | 0 | 586.023 |

| Shandong | 43.141 | 51.460 | 4.762 | 0 | 0 | 52.253 | 106.627 |

| Henan | 34.129 | 74.295 | 44.136 | 0 | 67.647 | 32.022 | 668.869 |

| Hubei | 17.777 | 32.003 | 35.925 | 0 | 0 | 0 | 67.606 |

| Hunan | 11.442 | 36.380 | 23.475 | 0 | 0 | 0 | 544.294 |

| Guangdong | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Guangxi | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Hainan | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Chongqing | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sichuan | 10.107 | 29.414 | 0 | 0 | 0 | 8.620 | 389.074 |

| Guizhou | 0 | 29.209 | 58.538 | 0 | 0 | 48.974 | 6.571 |

| Yunnan | 2.923 | 59.549 | 69.139 | 0 | 109.933 | 7.245 | 615.325 |

| Shaanxi | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Gansu | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Qinghai | 38.257 | 68.456 | 81.001 | 0 | 81.510 | 46.035 | 0 |

| Ningxia | 11.236 | 58.735 | 70.641 | 0 | 31.098 | 149.175 | 0 |

| Xinjiang | 19.081 | 64.060 | 84.662 | 0 | 305.339 | 0.154 | 57.558 |

| Variable Symbol | Variable Name | Definition | Unit |

|---|---|---|---|

| Gov | Government funding | Government funding in internal R&D expenditure | 100 million yuan |

| Pri | Enterprise funding | Enterprise funding in internal R&D expenditure | 100 million yuan |

| Tax | Tax relief | Government’s additional deduction policy | 100 million yuan |

| Inf | Regional infrastructure | Business total of posts and telecommunications/GDP | % |

| GDP | Regional economic development level | Total GDP | 100 million yuan |

| H | Talent number and intensity | R&D person/Enterprises number | Person/quantity |

| High-tech | Enterprise technology scale | High-tech industry main business income/Enterprises number | 100 million yuan/quantity |

| Chance | Technology chance | R&D expenditure/High-tech industry main business income | % |

| Variable Symbol | Model (1) | Model (2) | Model (3) |

|---|---|---|---|

| Gov | 0.154 *** (0.058) | 0.132 ** (0.060) | 0.132 ** (0.060) |

| Pri | −0.024 (0.053) | −0.187 *** (0.059) | −0.169 *** (0.062) |

| Tax | −0.027 | −0.020 | |

| (0.025) | (0.024) | ||

| Inf | −0.003 | −0.003 | |

| (0.002) | (0.002) | ||

| GDP | 0.236 ** | 0.241 ** | |

| (0.105) | (0.106) | ||

| H | −0.256 *** | −0.251 *** | |

| (0.054) | (0.055) | ||

| High−tech | 0.153 *** | 0.153 *** | |

| (0.043) | (0.043) | ||

| Chance | 0.002 *** | 0.002 *** | |

| (0.001) | (0.001) | ||

| _cons | −0.761 *** | −0.718 | −0.842 |

| (0.152) | (0.826) | (0.841) | |

| sigma_u | 0.296 *** | 0.289 *** | 0.290 *** |

| (0.042) | (0.042) | (0.042) | |

| sigma_e | 0.159 *** | 0.147 *** | 0.146 *** |

| (0.008) | (0.007) | (0.007) | |

| AIC | −88.730 | −116.100 | −114.800 |

| BIC | −67.840 | −81.320 | −76.530 |

| Observations | 240 | 240 | 240 |

| Variable Symbol | Model (4) | Model (5) | Model (6) |

|---|---|---|---|

| Gov | 0.264 *** | 0.308 *** | 0.270 *** |

| (0.057) | (0.060) | (0.063) | |

| Pri | −0.260 *** | −0.320 *** | −0.409 *** |

| (0.066) | (0.074) | (0.084) | |

| Tax | 0.0129 | −0.026 | −0.007 |

| (0.024) | (0.024) | (0.024) | |

| Inf | −0.009 *** | −0.009 *** | −0.006 ** |

| (0.002) | (0.003) | (0.003) | |

| GDP | 0.142 | 0.228 * | 0.397 *** |

| (0.108) | (0.119) | (0.137) | |

| H | −0.300 *** | −0.236 *** | −0.144 ** |

| (0.059) | (0.064) | (0.069) | |

| High−tech | 0.098 ** | 0.078 | 0.043 |

| (0.043) | (0.051) | (0.054) | |

| Chance | 0.001 ** | 0.001 | −0.000 |

| (0.001) | (0.001) | (0.001) | |

| _cons | 0.296 | −0.517 | −1.880 * |

| (0.867) | (0.927) | (1.041) | |

| sigma_u | 0.273 *** | 0.277 *** | 0.302 *** |

| (0.037) | (0.038) | (0.043) | |

| sigma_e | 0.135 *** | 0.130 *** | 0.117 *** |

| (0.007) | (0.008) | (0.008) | |

| AIC | −122.300 | −101.700 | −89.590 |

| BIC | −85.460 | −66.620 | −56.480 |

| Observations | 210 | 180 | 150 |

| Variable Symbol | Model (7) | Model (8) | Model (9) | Model (10) |

|---|---|---|---|---|

| Gov | 0.223 *** | 0.339 *** | 0.300 ** | −0.439 *** |

| (0.087) | (0.120) | (0.127) | (0.123) | |

| pri | 0.112 | 0.436 *** | −0.471 *** | −0.598 *** |

| (0.092) | (0.148) | (0.120) | (0.146) | |

| Tax | 0.024 | −0.164 *** | 0.039 | 0.026 *** |

| (0.049) | (0.051) | (0.043) | (0.021) | |

| Inf | −0.129 *** | −0.070 | −0.001 | 0.121 ** |

| (0.060) | (0.059) | (0.004) | (0.048) | |

| GDP | −0.407 *** | −0.423 * | 0.409 ** | 0.222 |

| (0.148) | (0.250) | (0.205) | (0.224) | |

| H | 0.246 | 0.504 ** | −0.155 | −0.663 *** |

| (0.244) | (0.211) | (0.111) | (0.214) | |

| High−tech | −0.587 ** | −0.760 *** | 0.335 *** | 0.966 *** |

| (0.246) | (0.224) | (0.063) | (0.256) | |

| Chance | −0.636 *** | −0.593** | 0.002 *** | 0.837 *** |

| (0.246) | (0.253) | (0.001) | (0.238) | |

| _cons | 3.008 *** | −0.076 | −2.174 | 2.231 * |

| (1.094) | (1.918) | (1.613) | (1.140) | |

| sigma_u | 0.132 *** | 0.153 *** | 0.348 *** | 0.000 |

| (0.048) | (0.052) | (0.083) | (0.010) | |

| sigma_e | 0.136 *** | 0.089 *** | 0.154 *** | 0.049 *** |

| (0.011) | (0.010) | (0.013) | (0.007) | |

| AIC | −107.380 | −120.400 | −88.290 | −93.100 |

| BIC | −74.230 | −81.860 | −58.200 | −63.330 |

| Observations | 240 | 240 | 240 | 240 |

| Variable Symbol | Model (11) |

|---|---|

| Gov | 0.158 ** (0.069) |

| Pri | −0.149 ** (0.066) |

| eTax | −0.081 |

| (0.160) | |

| _cons | −0.808 |

| (0.820) | |

| control variable | YES |

| sigma_u | 0.279 *** |

| (0.042) | |

| sigma_e | 0.150 *** |

| (0.007) | |

| AIC | −108.200 |

| BIC | −73.390 |

| Observations | 240 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, W.; Bai, Y. An Analysis on the Influence of R&D Fiscal and Tax Subsidies on Regional Innovation Efficiency: Empirical Evidence from China. Sustainability 2021, 13, 12707. https://doi.org/10.3390/su132212707

Liu W, Bai Y. An Analysis on the Influence of R&D Fiscal and Tax Subsidies on Regional Innovation Efficiency: Empirical Evidence from China. Sustainability. 2021; 13(22):12707. https://doi.org/10.3390/su132212707

Chicago/Turabian StyleLiu, Weijiang, and Yue Bai. 2021. "An Analysis on the Influence of R&D Fiscal and Tax Subsidies on Regional Innovation Efficiency: Empirical Evidence from China" Sustainability 13, no. 22: 12707. https://doi.org/10.3390/su132212707