Key Issues and Technical Applications in the Study of Power Markets as the System Adapts to the New Power System in China

Abstract

:1. Introduction

- 1

- What are the hot topics in primary studies regarding the construction and operation of power markets, and how do these topics interconnect with each other?

- 2

- What are the key issues in the study of power markets as the system seeks to adapt to the NPS, which will feature a high proportion of new energy?

- 3

- What is the basic paradigm for the study of power markets that would be suitable for the NPS?

- 4

- Which theoretical basis can help simulate the power market to further research into power market mechanisms under the NPS?

- 5

- From which dimensions should simulation modeling be established and how should researchers set related parameters?

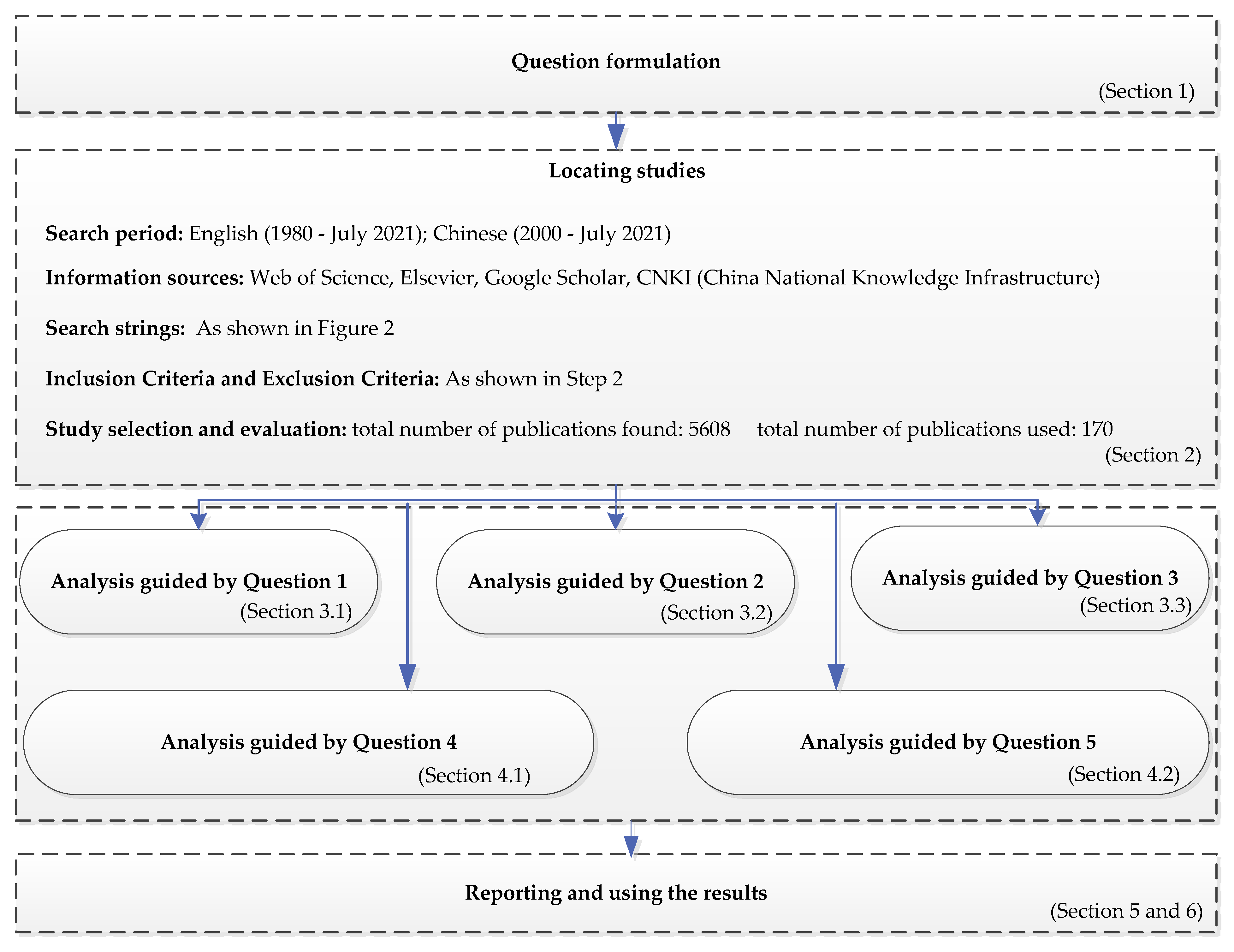

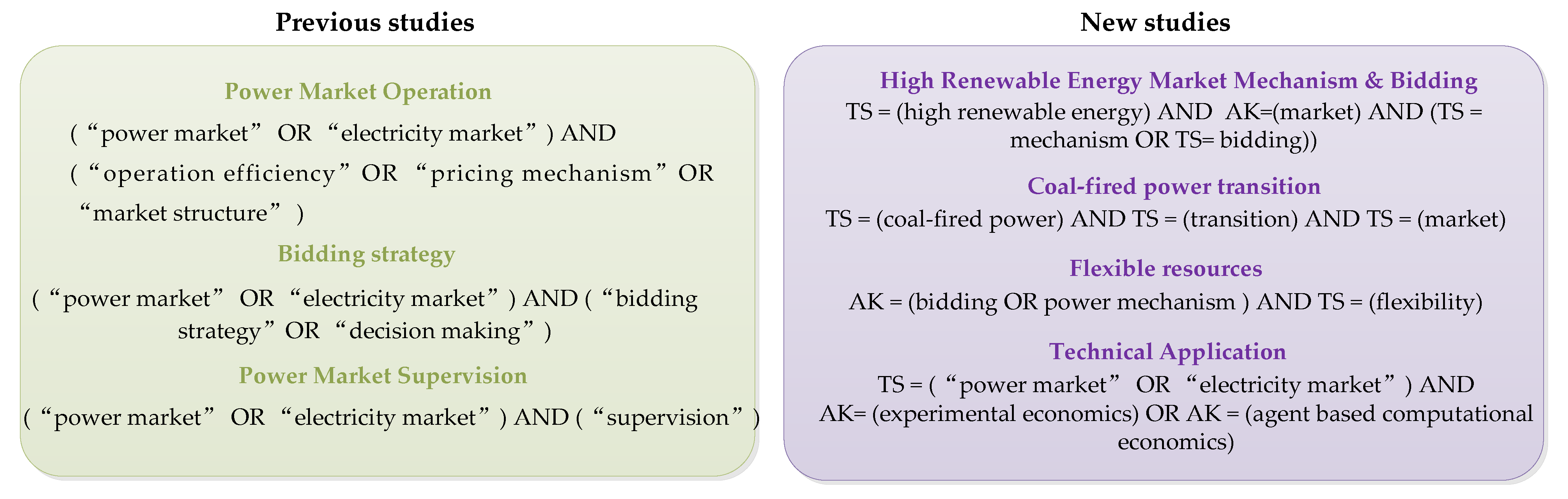

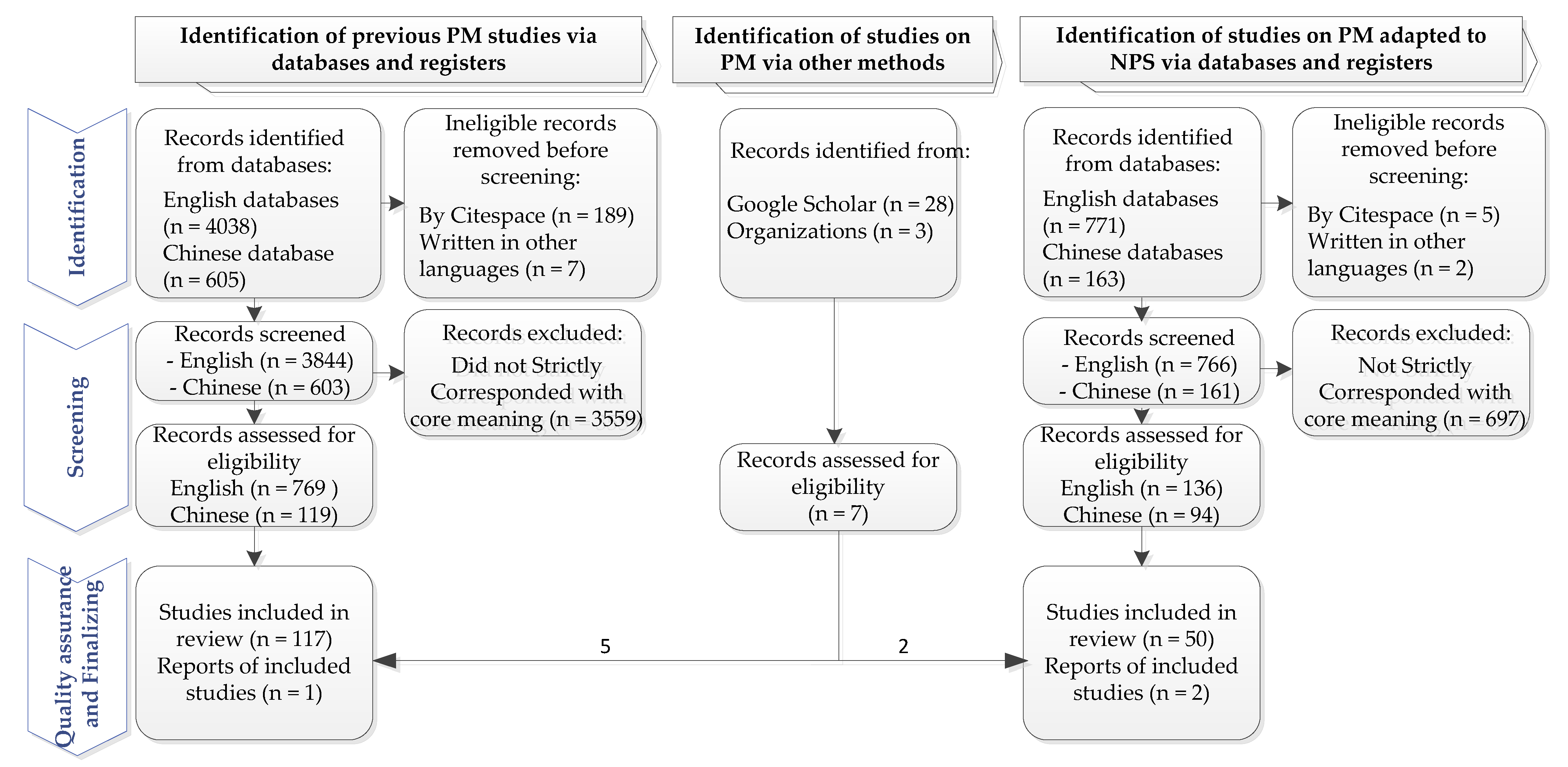

2. Methodology

- Papers should be in social sciences, business and economics, energy, or relative fields.

- The title or subject must be strictly matched with the search strings. For example, papers that focused on storage efficiency in the power market [14] could be found when we searched for “power market operation efficiency”. Alternatively, articles that used experimental methods with neural networks [15] could also be found when we searched for “experimental economics”. These kinds of articles should be excluded.

- Papers or reports must be written in English or Chinese. Literature in other languages was excluded in this review.

- English articles must be published between 1980 and 2021 (access in July 2021) and Chinese articles must be published between 2000 and 2021.

- Articles must have at least one keyword in the title or abstract, or cover the topic in the full article.

3. Key Issues and the Basic Paradigm of Research into New Power Systems in the Power Market

3.1. General Issues in the Study of Power Markets

3.1.1. Operational Efficiency of the Power Market

3.1.2. Bidding Strategy of Market Participants

3.1.3. Power Market Regulation

3.2. Key Issues in the Study of Power Markets as the System Adapts to the New Power System

3.2.1. Mechanisms and Strategies for Renewable Energy Producers Participating in the Power Market

3.2.2. The Survival and Transformation of Coal-Fired Power Units

3.2.3. Value Realization and Supporting Mechanism for Flexible Resources

3.3. Basic Paradigm for the Study of Power Markets under the New Situation

4. The Theoretical Basis and Technical Applications of Power Market Simulations to Help Markets Adapt to the New Power System

4.1. The Theoretical Basis of Power Market Simulation

4.1.1. Principles and Applications of Experimental Economics

4.1.2. Principles and Applications of Agent-Based Computational Economics

4.2. Simulation Applications and Parameter Settings for the Power Market as It Adapts to the NPS

4.2.1. Parameter Settings for the Modeling and Simulation of Power Systems

4.2.2. Parameter Settings to Simulate the Rules and Conditions of the Power Market

4.2.3. Market Participant Characteristic Parameters

5. Discussion

6. Conclusions and Implications

- The general issues of power market research were summarized in terms of market operation, bidding strategies of market players, and market supervision. The quantitative analysis shows that China’s previous power market studies paid more attention to the market mechanism design and operation supervision. However, bidding strategies were discussed more than power market supervision in other countries.

- Key issues related to research on the power market were picked out for further study as the market adapts to the new power system, which features a high proportion of new energy. These issues include market mechanisms to promote the participation of new energy, flexible resource value discovery and supporting mechanisms, as well as the survival of thermal power units. The systematic review indicates that the mechanism and strategies for a new energy-dominated power market were not fully considered in previous studies. Moreover, for the survival of coal-fired power plants in this new environment, most studies focused on the phase out issues rather than the market mechanisms and strategies relating to their transformation. In addition, research on flexible market products is still rare, although more attention is being paid to this issue [174].

- A basic paradigm for the study of power markets that is suitable for the new power system was established, which provides the basic direction for power market research under the new situation.

- The theoretical basis of power market simulation was presented in our paper. Meanwhile, the applications of experimental economics and agent-based computational economics in the study of power markets were reviewed. The quantitative analysis shows that although the current studies can provide a point of reference for the study of power markets, there are few pieces of literature on the new power market with the application of EE and ACE. More research is needed in the future to adapt to the construction of the NPS.

- Specific parameter settings were recommended for simulating power market transactions, which can serve as a theoretical basis and practical guidance for other researchers to better study the power market.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wang, D.; Zhang, Z.; Yang, X.; Zhang, Y.; Li, Y.; Zhao, Y. Multi-Scenario Simulation on the Impact of China’s Electricity Bidding Policy Based on Complex Networks Model. Energy Policy 2021, 158, 112573. [Google Scholar] [CrossRef]

- Huo, T.; Xu, L.; Feng, W.; Cai, W.; Liu, B. Dynamic Scenario Simulations of Carbon Emission Peak in China’s City-Scale Urban Residential Building Sector through 2050. Energy Policy 2021, 159, 112612. [Google Scholar] [CrossRef]

- China News. China’s Renewable Energy Power Generation Capacity Reached 2.2 Trillion KWh in 2020. Available online: https://www.chinanewsweb.com/index.php/2021/03/30/chinas-renewable-energy-generation-will-reach-2-2-trillion-kilowatt-hours-by-2020 (accessed on 15 August 2021).

- Ma, L.; Fan, M.; Qu, H.; Li, J.; Zhao, Z.; Wu, C.; Chen, K. Construction path and key problems of China’s power market. Electric Power 2020, 53, 1–9. [Google Scholar]

- Chen, H. Causes and Countermeasures of “unbalanced funds” in power market. China Electr. Power Enterp. Manag. 2020, 25, 27–30. [Google Scholar]

- Zhao, Z.; Gu, W.; Chen, Y.; Li, X.; Jiang, Y.; Gao, D.; Duan, R.; Wu, Y. Analysis of unbalanced capital in power market under dual track system. Electr. Power 2020, 53, 47–54. [Google Scholar]

- Chen, Q.; Yang, J.; Huang, Y.; Lu, E.; Wang, Y. Review on Market Power Monitoring and Mitigation Mechanisms in Foreign Electricity Markets. South. Power Syst. Technol. 2018, 12, 9–15+63. [Google Scholar]

- Deng, S.; Xu, K.; Liu, L. Review on the Reasons for Formation and Inhibition Mechanism of Market Power in the Electricity Market. Telecom Power Technol. 2018, 35, 129–131. [Google Scholar]

- Wu, T.; Ding, Y.; Shang, N.; Bao, M.; Song, Y. Joint decomposition algorithm of medium and long-term contract electricity of multi class units considering market power test. Autom. Electr. Power Syst. 2021, 45, 72–81. [Google Scholar]

- Zhang, Q.; Wang, X.; Wang, J.; Feng, C.; Liu, L. Review on demand response research in power market. Autom. Electr. Power Syst. 2008, 3, 97–106. [Google Scholar]

- Xiao, Y.; Wang, X.; Wang, X.; Bie, Z. Review on Electricity Market Towards High Proportion of Renewable Energy. Proc. CSEE 2018, 38, 663–674. [Google Scholar]

- Keele, S. Guidelines for Performing Systematic Literature Reviews in Software Engineering; EBSE Technical Report: Durham, UK, 2007. [Google Scholar]

- PRISMA-P Group; Moher, D.; Shamseer, L.; Clarke, M.; Ghersi, D.; Liberati, A.; Petticrew, M.; Shekelle, P.; Stewart, L.A. Preferred Reporting Items for Systematic Review and Meta-Analysis Protocols (PRISMA-P) 2015 Statement. Syst. Rev. 2015, 4, 1–9. [Google Scholar] [CrossRef] [Green Version]

- Shrestha, T.K.; Karki, R. Impact of Market-Driven Energy Storage System Operation on the Operational Adequacy of Wind Integrated Power Systems. J. Energy Storage 2020, 32, 101792. [Google Scholar] [CrossRef]

- Bigdeli, N.; Afshar, K.; Fotuhi-Firuzabad, M. Bidding Strategy in Pay-as-Bid Markets Based on Supplier-Market Interaction Analysis. Energy Convers. Manag. 2010, 51, 2419–2430. [Google Scholar] [CrossRef]

- Chen, C. Searching for Intellectual Turning Points: Progressive Knowledge Domain Visualization. Proc. Natl. Acad. Sci. USA 2004, 101, 5303–5310. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chen, Y.; Qin, Z. Review of Research on Electricity Market Reform. Electrotech. Electr. 2019, 4, 1–6+12. [Google Scholar]

- Newbery, D. Electricity Liberalization in Britain and the Evolution of Market Design. In Electricity Market Reform; Elsevier: Amsterdam, The Netherlands, 2006; pp. 109–143. [Google Scholar]

- Marshall, L.; Bruce, A.; MacGill, I. Assessing Wholesale Competition in the Australian National Electricity Market. Energy Policy 2021, 149, 112066. [Google Scholar] [CrossRef]

- Borenstein, S.; Bushnell, J.B.; Wolak, F.A. Measuring Market Inefficiencies in California’s Restructured Wholesale Electricity Market. Am. Econ. Rev. 2002, 92, 1376–1405. [Google Scholar] [CrossRef] [Green Version]

- Daglish, T.; de Bragança, G.G.F.; Owen, S.; Romano, T. Pricing Effects of the Electricity Market Reform in Brazil. Energy Econ. 2021, 105197. [Google Scholar] [CrossRef]

- Bertram, G. Weak Regulation, Rising Margins, and Asset Revaluations. In Evolution of Global Electricity Markets; Elsevier: Amsterdam, The Netherlands, 2013; pp. 645–677. [Google Scholar]

- Keles, D.; Bublitz, A.; Zimmermann, F.; Genoese, M.; Fichtner, W. Analysis of Design Options for the Electricity Market: The German Case. Appl. Energy 2016, 183, 884–901. [Google Scholar] [CrossRef]

- Nilsson, M. Red Light for Green Paper: The EU Policy on Energy Efficiency. Energy Policy 2007, 35, 540–547. [Google Scholar] [CrossRef]

- Pérez-Díaz, J.I.; Wilhelmi, J.R.; Arévalo, L.A. Optimal Short-Term Operation Schedule of a Hydropower Plant in a Competitive Electricity Market. Energy Convers. Manag. 2010, 51, 2955–2966. [Google Scholar] [CrossRef]

- Xu, D. Research on Operation Efficiency of Power Market; Zhejiang University: Hangzhou, China, 2003. [Google Scholar]

- Luan, F. Research on Theory and Application of Economic Efficiency Evaluation of Power Market; North China Electric Power University: Beijing, China, 2007. [Google Scholar]

- Wang, W.; Shao, S.; Li, L.; Tang, H.; Zhao, Y.; Xia, Q. Power market efficiency theory and its evaluation method. Power Grid Technol. 2009, 33, 66–71. [Google Scholar]

- Ren, Y.; Liu, S.; Bie, Z. Regional Marginal Price Mechanism in the China Northwest Power Grid. In Proceedings of the 2019 IEEE 8th International Conference on Advanced Power System Automation and Protection (APAP), Xi’an, China, 21 October 2019; pp. 1115–1119. [Google Scholar]

- Daneshi, H.; Srivastava, A.K. ERCOT Electricity Market: Transition from Zonal to Nodal Market Operation. In Proceedings of the 2011 IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 24–28 July 2011; pp. 1–7. [Google Scholar]

- Höschle, H.; De Jonghe, C.; Le Cadre, H.; Belmans, R. Electricity Markets for Energy, Flexibility and Availability—Impact of Capacity Mechanisms on the Remuneration of Generation Technologies. Energy Econ. 2017, 66, 372–383. [Google Scholar] [CrossRef]

- BOWRING, J. Capacity Markets in PJM. Econ. Energy Environ. Policy 2013, 2, 47–64. [Google Scholar] [CrossRef] [Green Version]

- Bowring, J.E. The evolution of the PJM capacity market: Does it address the revenue sufficiency problem? In Evolution of Global Electricity Markets; Elsevier: Amsterdam, The Netherlands, 2013; pp. 227–264. [Google Scholar]

- Hobbs, B.F.; Hu, M.-C.; Inon, J.G.; Stoft, S.E.; Bhavaraju, M.P. A Dynamic Analysis of a Demand Curve-Based Capacity Market Proposal: The PJM Reliability Pricing Model. IEEE Trans. Power Syst. 2007, 22, 3–14. [Google Scholar] [CrossRef]

- Song, X.; Zhai, X.; Chen, W.; Xue, J.; Wang, P. Study on Three-Part Pricing Method of Pumped Storage Power Station in China Considering Peak Load Regulation Auxiliary Service. IOP Publ. 2021, 675, 012110. [Google Scholar] [CrossRef]

- Wang, J.; Zhong, H.; Yang, Z.; Lai, X.; Xia, Q.; Kang, C. Incentive Mechanism for Clearing Energy and Reserve Markets in Multi-Area Power Systems. IEEE Trans. Sustain. Energy 2020, 11, 2470–2482. [Google Scholar] [CrossRef]

- Wang, J.; Zhong, H.; Wu, C.; Du, E.; Xia, Q.; Kang, C. Incentivizing Distributed Energy Resource Aggregation in Energy and Capacity Markets: An Energy Sharing Scheme and Mechanism Design. Appl. Energy 2019, 252, 113471. [Google Scholar] [CrossRef]

- Wolak, F.; Patrick, R. The Impact of Market Rules and Market Structure on the Price Determination Process in the England and Wales Electricity Market; National Bureau of Economic Research: Cambridge, MA, USA, 2001; p. w8248. [Google Scholar]

- Tirole, J. The Theory of Industrial Organization; MIT Press: Cambridge, MA, USA, 1988. [Google Scholar]

- Landes, W.M.; Posner, R.A. Market Power in Antitrust Cases. Harv. Law Rev. 1981, 94, 937. [Google Scholar] [CrossRef]

- Visudhiphan, P.; Ilic, M.D. Dependence of Generation Market Power on the Demand/Supply Ratio: Analysis and Modeling. In Proceedings of the 2000 IEEE Power Engineering Society Winter Meeting. Conference Proceedings (Cat. No.00CH37077), Singapore, 23–27 January 2000; Volume 2, pp. 1115–1122. [Google Scholar]

- Gan, D.; Bourcier, D.V. Locational Market Power Screening and Congestion Management: Experience and Suggestions. IEEE Trans. Power Syst. 2002, 17, 180–185. [Google Scholar] [CrossRef]

- Rahimi, A.F.; Sheffrin, A.Y. Effective Market Monitoring in Deregulated Electricity Markets. IEEE Trans. Power Syst. 2003, 18, 486–493. [Google Scholar] [CrossRef]

- Goncalves, M.J.D.; Vale, Z.A. Evaluation of Transmission Congestion Impact in Market Power. In Proceedings of the 2003 IEEE Bologna Power Tech Conference Proceedings, Bologna, Italy, 23–26 June 2003; Volume 4, pp. 438–443. [Google Scholar]

- Bompard, E.; Ma, Y.C.; Napoli, R.; Jiang, C.W. Assessing the Market Power Due to the Network Constraints in Competitive Electricity Markets. Electr. Power Syst. Res. 2006, 76, 953–961. [Google Scholar] [CrossRef]

- Moreira e Silva, R.; Terra, L.D.B. Market Power under Transmission Congestion Constraints. In Proceedings of the PowerTech Budapest 99. Abstract Records. (Cat. No.99EX376), Budapest, Hungary, 29 August–2 September 1999; p. 82. [Google Scholar]

- Li, H.; Wang, B.; Guo, S. Evaluation on Market Power of Generation Companies in Regional Electricity Market Based on Principal Component Analysis. Mod. Electr. Power 2011, 28, 85–89. [Google Scholar]

- Yang, T.; Fu, S.; Wang, B. Analysis of market power in power market based on Game Theory. J. Shandong Electr. Power Coll. 2011, 14, 13–18. [Google Scholar]

- Zhang, Z.; Guo, X.; Wang, F. Analysis of financial transmission rights and market power based on oligopoly competition model. Autom. Electr. Power Syst. 2011, 35, 30–33+59. [Google Scholar]

- Zhang, F.; Wen, F.; Yan, H.; Yu, Z.; Zhong, Z.; Hunag, J. Analysis of reactive power market power based on agent simulation. Autom. Electr. Power Syst. 2009, 33, 18–24. [Google Scholar]

- Ambrosius, M.; Grimm, V.; Sölch, C.; Zöttl, G. Investment Incentives for Flexible Demand Options under Different Market Designs. Energy Policy 2018, 118, 372–389. [Google Scholar] [CrossRef]

- Richstein, J.C.; Hosseinioun, S.S. Industrial Demand Response: How Network Tariffs and Regulation (Do Not) Impact Flexibility Provision in Electricity Markets and Reserves. Appl. Energy 2020, 278, 115431. [Google Scholar] [CrossRef]

- Spees, K.; Lave, L.B. Demand Response and Electricity Market Efficiency. Electr. J. 2007, 20, 69–85. [Google Scholar] [CrossRef]

- Wang, J.; Zhong, H.; Ma, Z.; Xia, Q.; Kang, C. Review and Prospect of Integrated Demand Response in the Multi-Energy System. Appl. Energy 2017, 202, 772–782. [Google Scholar] [CrossRef]

- Grimm, V.; Rückel, B.; Sölch, C.; Zöttl, G. The Impact of Market Design on Transmission and Generation Investment in Electricity Markets. Energy Econ. 2021, 93, 104934. [Google Scholar] [CrossRef]

- Tómasson, E.; Hesamzadeh, M.R.; Söder, L.; Biggar, D.R. An Incentive Mechanism for Generation Capacity Investment in a Price-Capped Wholesale Power Market. Electr. Power Syst. Res. 2020, 189, 106708. [Google Scholar] [CrossRef]

- Barazza, E.; Strachan, N. The Co-Evolution of Climate Policy and Investments in Electricity Markets: Simulating Agent Dynamics in UK, German and Italian Electricity Sectors. Energy Res. Soc. Sci. 2020, 65, 101458. [Google Scholar] [CrossRef]

- Feng, T.; Li, R.; Zhang, H.; Gong, X.; Yang, Y. Induction Mechanism and Optimization of Tradable Green Certificates and Carbon Emission Trading Acting on Electricity Market in China. Resour. Conserv. Recycl. 2021, 169, 105487. [Google Scholar] [CrossRef]

- Kraan, O.; Kramer, G.J.; Nikolic, I.; Chappin, E.; Koning, V. Why Fully Liberalised Electricity Markets Will Fail to Meet Deep Decarbonisation Targets Even with Strong Carbon Pricing. Energy Policy 2019, 131, 99–110. [Google Scholar] [CrossRef]

- Sarfati, M.; Hesamzadeh, M.R.; Holmberg, P. Production Efficiency of Nodal and Zonal Pricing in Imperfectly Competitive Electricity Markets. Energy Strategy Rev. 2019, 24, 193–206. [Google Scholar] [CrossRef]

- U.S. Department of Energy. Benefits of Demand Response in Electricity Markets and Recommendations for Achieving Them; U.S. Department of Energy: Washington, DC, USA, 2006. [Google Scholar]

- Davarzani, S.; Pisica, I.; Taylor, G.A.; Munisami, K.J. Residential Demand Response Strategies and Applications in Active Distribution Network Management. Renew. Sustain. Energy Rev. 2021, 138, 110567. [Google Scholar] [CrossRef]

- Pallonetto, F.; De Rosa, M.; D’Ettorre, F.; Finn, D.P. On the Assessment and Control Optimisation of Demand Response Programs in Residential Buildings. Renew. Sustain. Energy Rev. 2020, 127, 109861. [Google Scholar] [CrossRef]

- Lu, X.; Li, K.; Xu, H.; Wang, F.; Zhou, Z.; Zhang, Y. Fundamentals and Business Model for Resource Aggregator of Demand Response in Electricity Markets. Energy 2020, 204, 117885. [Google Scholar] [CrossRef]

- Yang, S.; Liu, J.; Yao, J.; Ding, H.; Wang, K.; Li, Y. Multi time scale coordinated flexible load interactive response scheduling model and strategy. Proc. CSEE 2014, 34, 3664–3673. [Google Scholar]

- Yuan, B.; Yang, Q.; Yan, W. Demand response under real-time price for domestic energy system. J. Mech. Electr. Eng. 2015, 32, 857–862. [Google Scholar]

- Jiang, T.; Li, Y.; Ju, P.; Yang, Y.; Zhao, J. Overview of Modeling Method for Flexible Load and its Control. Smart Power 2020, 48, 1–8. [Google Scholar]

- Lund, H.; Münster, E.; Tambjerg, L.H. EnergyPlan: Computer Model for Energy System Analysis: Version 6; Technology, Environment and Society, Department of Development and Planning, Aalborg University: Aalborg, Denmark, 2004. [Google Scholar]

- He, G.; Avrin, A.-P.; Nelson, J.H.; Johnston, J.; Mileva, A.; Tian, J.; Kammen, D.M. SWITCH-China: A Systems Approach to Decarbonizing China’s Power System. Environ. Sci. Technol. 2016, 50, 5467–5473. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- He, G.; Lin, J.; Sifuentes, F.; Liu, X.; Abhyankar, N.; Phadke, A. Rapid Cost Decrease of Renewables and Storage Accelerates the Decarbonization of China’s Power System. Nat. Commun. 2020, 11, 2486. [Google Scholar] [CrossRef] [PubMed]

- Li, B.; Ma, Z.; Hidalgo-Gonzalez, P.; Lathem, A.; Fedorova, N.; He, G.; Zhong, H.; Chen, M.; Kammen, D.M. Modeling the Impact of EVs in the Chinese Power System: Pathways for Implementing Emissions Reduction Commitments in the Power and Transportation Sectors. Energy Policy 2021, 149, 111962. [Google Scholar] [CrossRef]

- NEPLAN. Available online: http://ieeexplore.ieee.org/document/1687803/ (accessed on 24 July 2021).

- Hungerford, Z.; Bruce, A.; MacGill, I. The Value of Flexible Load in Power Systems with High Renewable Energy Penetration. Energy 2019, 188, 115960. [Google Scholar] [CrossRef]

- Ren, Y.; Zou, X.; Zhang, X. Bidding Model of Power Plant Company with Incomplete Information. Autom. Electr. Power Syst. 2003, 9, 11–14. [Google Scholar]

- Lei, B.; Wang, X.; Gao, Y.; Wang, X. Analysis on bidding strategy of independent power producer in days-ahead market. Autom. Electr. Power Syst. 2002, 26, 8–14. [Google Scholar]

- Wang, X.; Wang, X.; Chen, H. Fundamentals of Electricity Market; Xi’an Jiaotong University Press: Xi’an, China, 2003. [Google Scholar]

- Conejo, A.J.; Nogales, F.J.; Arroyo, J.M. Price-Taker Bidding Strategy under Price Uncertainty. IEEE Power Eng. Rev. 2002, 22, 57. [Google Scholar] [CrossRef]

- Wen, F.; David, A. Optimal Bidding Strategies and Modeling of Imperfect Information among Competitive Generators. IEEE Trans. Power Syst. 2002, 16, 15–21. [Google Scholar]

- Kang, D.-J.; Kim, B.H.; Hur, D. Supplier Bidding Strategy Based on Non-Cooperative Game Theory Concepts in Single Auction Power Pools. Electr. Power Syst. Res. 2007, 77, 630–636. [Google Scholar] [CrossRef]

- Jing, Z.; Yang, Y. Application of the EWA Algorithm in Electricity Market Simulation. Autom. Electr. Power Syst. 2010, 34, 46–50. [Google Scholar]

- Zhu, J. Study on Bidding Strategy of Generation Companies with Evolution Game Theory Based on Repast Platform; North China Electric Power University: Beijing, China, 2010. [Google Scholar]

- Zhu, J. Research on Bidding Strategy of Generator Based on Agent; Beijing Jiaotong University: Beijing, China, 2010. [Google Scholar]

- Ren, X. A Study on Bidding Behavior of Power Producers Based on Multi-Agent Simulation; North China Electric Power University: Beijing, China, 2009. [Google Scholar]

- Liang, Z. Simulation of Generation Side Power Market Bidding Trading System Based on MAS; North China Electric Power University: Beijing, China, 2012. [Google Scholar]

- Ghavidel, S.; Ghadi, M.J.; Azizivahed, A.; Aghaei, J.; Li, L.; Zhang, J. Risk-Constrained Bidding Strategy for a Joint Operation of Wind Power and CAES Aggregators. IEEE Trans. Sustain. Energy 2020, 11, 457–466. [Google Scholar] [CrossRef]

- Iria, J.; Soares, F.; Matos, M. Optimal Supply and Demand Bidding Strategy for an Aggregator of Small Prosumers. Appl. Energy 2018, 213, 658–669. [Google Scholar] [CrossRef]

- Dong, Y.; Dong, Z.; Zhao, T.; Ding, Z. A Strategic Day-Ahead Bidding Strategy and Operation for Battery Energy Storage System by Reinforcement Learning. Electr. Power Syst. Res. 2021, 196, 107229. [Google Scholar] [CrossRef]

- Cheng, L.; Liu, G.; Huang, H.; Wang, X.; Chen, Y.; Zhang, J.; Meng, A.; Yang, R.; Yu, T. Equilibrium Analysis of General N-Population Multi-Strategy Games for Generation-Side Long-Term Bidding: An Evolutionary Game Perspective. J. Clean. Prod. 2020, 276, 124123. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, J.; Sun, W.; Zhao, M. Optimal Day-Ahead Bidding Strategy for Electricity Retailer with Inner-Outer 2-Layer Model System Based on Stochastic Mixed-Integer Optimization. Math. Probl. Eng. 2019, 2019, 1–14. [Google Scholar] [CrossRef]

- Yang, M.; Ai, X.; Tang, L.; Guo, S.; Luo, G. Optimal Trading Strategy in Balancing Market for Electricity Retailer Considering Risk Aversion. Power Syst. Technol. 2016, 40, 3300–3309. [Google Scholar]

- Mirzaei, M.A.; Hemmati, M.; Zare, K.; Abapour, M.; Mohammadi-Ivatloo, B.; Marzband, M.; Anvari-Moghaddam, A. A Novel Hybrid Two-Stage Framework for Flexible Bidding Strategy of Reconfigurable Micro-Grid in Day-Ahead and Real-Time Markets. Int. J. Electr. Power Energy Syst. 2020, 123, 106293. [Google Scholar] [CrossRef]

- Jia, C.; Du, X. Optimization of power purchase strategy of power selling companies under medium and long-term trading mechanism. Electric Power 2019, 52, 140–147. [Google Scholar]

- Sun, B.; Wang, F.; Xie, J.; Sun, X. Electricity Retailer Trading Portfolio Optimization Considering Risk Assessment in Chinese Electricity Market. Electr. Power Syst. Res. 2021, 190, 106833. [Google Scholar] [CrossRef]

- Mashhour, E.; Moghaddas-Tafreshi, S.M. Bidding Strategy of Virtual Power Plant for Participating in Energy and Spinning Reserve Markets—Part I: Problem Formulation. IEEE Trans. Power Syst. 2011, 26, 949–956. [Google Scholar] [CrossRef]

- Sadeghi, S.; Jahangir, H.; Vatandoust, B.; Golkar, M.A.; Ahmadian, A.; Elkamel, A. Optimal Bidding Strategy of a Virtual Power Plant in Day-Ahead Energy and Frequency Regulation Markets: A Deep Learning-Based Approach. Int. J. Electr. Power Energy Syst. 2021, 127, 106646. [Google Scholar] [CrossRef]

- Nguyen, D.T.; Le, L.B. Optimal Bidding Strategy for Microgrids Considering Renewable Energy and Building Thermal Dynamics. IEEE Trans. Smart Grid 2014, 5, 1608–1620. [Google Scholar] [CrossRef]

- Wang, J.; Zhong, H.; Tang, W.; Rajagopal, R.; Xia, Q.; Kang, C.; Wang, Y. Optimal Bidding Strategy for Microgrids in Joint Energy and Ancillary Service Markets Considering Flexible Ramping Products. Appl. Energy 2017, 205, 294–303. [Google Scholar] [CrossRef]

- Fang, Y.; Zhao, S. Look-Ahead Bidding Strategy for Concentrating Solar Power Plants with Wind Farms. Energy 2020, 203, 117895. [Google Scholar] [CrossRef]

- Iria, J.; Soares, F.; Matos, M. Optimal Bidding Strategy for an Aggregator of Prosumers in Energy and Secondary Reserve Markets. Appl. Energy 2019, 238, 1361–1372. [Google Scholar] [CrossRef]

- Wang, Y.; Dvorkin, Y.; Fernandez-Blanco, R.; Xu, B.; Qiu, T.; Kirschen, D.S. Look-Ahead Bidding Strategy for Energy Storage. IEEE Trans. Sustain. Energy 2017, 8, 1106–1117. [Google Scholar] [CrossRef]

- Xie, Y.; Guo, W.; Wu, Q.; Wang, K. Robust MPC-Based Bidding Strategy for Wind Storage Systems in Real-Time Energy and Regulation Markets. Int. J. Electr. Power Energy Syst. 2021, 124, 106361. [Google Scholar] [CrossRef]

- Zheng, Y.; Yu, H.; Shao, Z.; Jian, L. Day-Ahead Bidding Strategy for Electric Vehicle Aggregator Enabling Multiple Agent Modes in Uncertain Electricity Markets. Appl. Energy 2020, 280, 115977. [Google Scholar] [CrossRef]

- Vagropoulos, S.I.; Bakirtzis, A.G. Optimal Bidding Strategy for Electric Vehicle Aggregators in Electricity Markets. IEEE Trans. Power Syst. 2013, 28, 4031–4041. [Google Scholar] [CrossRef]

- Bjorgan, R.; Liu, C.-C.; Lawarree, J. Financial Risk Management in a Competitive Electricity Market. IEEE Trans. Power Syst. 1999, 14, 1285–1291. [Google Scholar] [CrossRef]

- Chung, T.S.; Zhang, S.H.; Yu, C.W.; Wong, K.P. Electricity Market Risk Management Using Forward Contracts with Bilateral Options. IEE Proc. Gener. Transm. Distrib. 2003, 150, 588. [Google Scholar] [CrossRef]

- Spodniak, P.; Collan, M. Forward Risk Premia in Long-Term Transmission Rights: The Case of Electricity Price Area Differentials (EPAD) in the Nordic Electricity Market. Util. Policy 2018, 50, 194–206. [Google Scholar] [CrossRef] [Green Version]

- Zhong, J.; He, Y.; Wang, D.; Sun, Y.; He, T.; Peng, Y.; Yuan, T.; Luo, X. Review on market power regulation and mitigation measures in power market. Proc. CSEE 2018, 9. Available online: https://kns.cnki.net/KCMS/detail/detail.aspx?dbcode=CPFD&dbname=CPFDLAST2019&filename=JDSD201810001025&v= (accessed on 2 July 2021).

- Prabhakar Karthikeyan, S.; Jacob Raglend, I.; Kothari, D.P. A Review on Market Power in Deregulated Electricity Market. Int. J. Electr. Power Energy Syst. 2013, 48, 139–147. [Google Scholar] [CrossRef]

- Borenstein, S.; Bushnell, J.; Knittel, C.R. Market Power in Electricity Markets: Beyond Concentration Measures. Energy J. 1999, 20, 65–88. [Google Scholar] [CrossRef] [Green Version]

- Borenstein, S.; Bushnell, J.; Kahn, E.; Stoft, S. Market Power in California Electricity Markets. Util. Policy 1995, 5, 219–236. [Google Scholar] [CrossRef]

- Wolak, F.A. Measuring Unilateral Market Power in Wholesale Electricity Markets: The California Market, 1998–2000. Am. Econ. Rev. 2003, 93, 425–443. [Google Scholar] [CrossRef] [Green Version]

- Sweeting, A. Market Power in the England and Wales Wholesale Electricity Market 1995–2000. Econ. J. 2007, 117, 654–685. [Google Scholar] [CrossRef] [Green Version]

- Möst, D.; Genoese, M. Market Power in the German Wholesale Electricity Market. J. Energy Mark. 2009, 2, 47. [Google Scholar] [CrossRef]

- Shukla, U.K.; Thampy, A. Analysis of Competition and Market Power in the Wholesale Electricity Market in India. Energy Policy 2011, 39, 2699–2710. [Google Scholar] [CrossRef]

- Shang, N. Market Power Risk Assessment of Multi-Type Markets Participants Considering Reliability in Electricity Markets; Zhejiang University: Hangzhou, China, 2019. [Google Scholar]

- Dong, L.; Wang, S.; Huang, H.; Guo, H. Identification of Market Power Abuse in Spot Market of Chinese Electric Market. Proc. CSEE 2021, 1–11. [Google Scholar] [CrossRef]

- Xu, H.; Cheng, Z.; Zhang, H.; Dong, L.; Hua, H. Market Power Abuse Identification of Power Generation Enterprises Based on Improved Support Vector Machine. J. North China Electr. Power Univ. 2020, 47, 86–95. [Google Scholar]

- Dong; Wang; Liu; Ainiwaer; Nie Operation Health Assessment of Power Market Based on Improved Matter-Element Extension Cloud Model. Sustainability 2019, 11, 5470. [CrossRef] [Green Version]

- Wang, Z.; Zhang, Y.; Huang, K.; Wang, C. Robust Optimal Scheduling Model of Virtual Power Plant Combined Heat and Power Considering Multiple Flexible Loads. Electr. Power Constr. 2021, 42, 1–10. [Google Scholar]

- Abban, A.R.; Hasan, M.Z. Solar Energy Penetration and Volatility Transmission to Electricity Markets—An Australian Perspective. Econ. Anal. Policy 2021, 69, 434–449. [Google Scholar] [CrossRef]

- Hu, X.; Jaraitė, J.; Kažukauskas, A. The Effects of Wind Power on Electricity Markets: A Case Study of the Swedish Intraday Market. Energy Econ. 2021, 96, 105159. [Google Scholar] [CrossRef]

- Spodniak, P.; Ollikka, K.; Honkapuro, S. The Impact of Wind Power and Electricity Demand on the Relevance of Different Short-Term Electricity Markets: The Nordic Case. Appl. Energy 2021, 283, 116063. [Google Scholar] [CrossRef]

- Mays, J. Missing Incentives for Flexibility in Wholesale Electricity Markets. Energy Policy 2021, 149, 112010. [Google Scholar] [CrossRef]

- The European Parliament; The Council of the European Union. Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the Promotion of the Use of Energy from Renewable Sources and Amending and Subsequently Repealing Directives 2001/77/EC and 2003/30/EC; The European Parliament: Brussels, Belgium; The Council of the European Union: Brussels, Belgium, 2009. [Google Scholar]

- Banshwar, A.; Sharma, N.K.; Sood, Y.R.; Shrivastava, R. Renewable Energy Sources as a New Participant in Ancillary Service Markets. Energy Strategy Rev. 2017, 18, 106–120. [Google Scholar] [CrossRef]

- Godoy-González, D.; Gil, E.; Gutiérrez-Alcaraz, G. Ramping Ancillary Service for Cost-Based Electricity Markets with High Penetration of Variable Renewable Energy. Energy Econ. 2020, 85, 10455. [Google Scholar] [CrossRef]

- Goudarzi, H.; Rayati, M.; Sheikhi, A.; Ranjbar, A.M. A Clearing Mechanism for Joint Energy and Ancillary Services in Non-Convex Markets Considering High Penetration of Renewable Energy Sources. Int. J. Electr. Power Energy Syst. 2021, 129, 106817. [Google Scholar] [CrossRef]

- Zarnikau, J.; Tsai, C.H.; Woo, C.K. Determinants of the Wholesale Prices of Energy and Ancillary Services in the U.S. Midcontinent Electricity Market. Energy 2020, 195, 117051. [Google Scholar] [CrossRef]

- Banshwar, A.; Sharma, N.K.; Sood, Y.R.; Shrivastava, R. Market Based Procurement of Energy and Ancillary Services from Renewable Energy Sources in Deregulated Environment. Renew. Energy 2017, 101, 1390–1400. [Google Scholar] [CrossRef]

- Glass, E.; Glass, V. Enabling Supercapacitors to Compete for Ancillary Services: An Important Step towards 100 % Renewable Energy. Electr. J. 2020, 33, 106763. [Google Scholar] [CrossRef]

- Hu, Q.; Zhu, Z.; Bu, S.; Wing Chan, K.; Li, F. A Multi-Market Nanogrid P2P Energy and Ancillary Service Trading Paradigm: Mechanisms and Implementations. Appl. Energy 2021, 293, 116938. [Google Scholar] [CrossRef]

- Stürmer, B.; Theuretzbacher, F.; Saracevic, E. Opportunities for the Integration of Existing Biogas Plants into the Austrian Electricity Market. Renew. Sustain. Energy Rev. 2021, 138, 110548. [Google Scholar] [CrossRef]

- Arango-Aramburo, S.; Bernal-García, S.; Larsen, E.R. Renewable Energy Sources and the Cycles in Deregulated Electricity Markets. Energy 2021, 223, 120058. [Google Scholar] [CrossRef]

- Hasankhani, A.; Hakimi, S.M. Stochastic Energy Management of Smart Microgrid with Intermittent Renewable Energy Resources in Electricity Market. Energy 2021, 219, 119668. [Google Scholar] [CrossRef]

- Ambec, S.; Crampes, C. Real-Time Electricity Pricing to Balance Green Energy Intermittency. Energy Econ. 2021, 94, 105074. [Google Scholar] [CrossRef]

- Lianhe Ratings. Research Report and Prospect of Thermal Power Industry in 2020. Available online: https://pdf.dfcfw.com/pdf/H3_AP202101131450227605_1.pdf?1610555525000.pdf (accessed on 7 June 2021).

- National Development and Reform Commission (NDRC). Circular of the National Development and Reform Commission and the National Energy Administration on Carrying out the Transmission and Upgrading of Coal-Fired Power Units Nationwide. Available online: www.gov.cn/zhengce/zhengceku/2021-11/03/content_5648562.htm (accessed on 7 November 2021).

- Jian, Q.; Liu, X.; Yang, J.; Liu, C.; Wang, X.; Liu, D. Optimal Allocation of Power System Flexible Resources Considering Demand Response. Mod. Electr. Power 2021, 38, 286–296. [Google Scholar]

- Kazempour, J.; Hobbs, B.F. Value of Flexible Resources, Virtual Bidding, and Self-Scheduling in Two-Settlement Electricity Markets with Wind Generation—Part I: Principles and Competitive Model. IEEE Trans. Power Syst. 2018, 33, 749–775. [Google Scholar]

- Huang, B.; Hu, J.; Jiang, L.; Li, Q.; Feng, K.; Yuan, B. Application Value Assessment of Grid Side Energy Storage Under Typical Scenarios in China. Electr. Power 2021, 54, 158–165. [Google Scholar]

- Shi, J.; Guo, Y.; Sun, H.; Wu, C. Review of Research and Practice on Reserve Market. Proc. CSEE 2021, 41, 123–134+403. [Google Scholar]

- Willis, L.; Finney, J.; Ramon, G. Computing the Cost of Unbundled Services [Power Transmission]. IEEE Comput. Appl. Power 1996, 9, 16–21. [Google Scholar] [CrossRef]

- Sun, S.; Chi, D.; Yu, B.; Zhou, M. Building a new power market system and electricity price mechanism. Macroecon. Manag. 2021, 3, 71–77. [Google Scholar]

- Leng, Y.; Gu, W. Operating Mechanism of Australian Electric Financial Derivatives Market and Its Implications for Electricity Market Construction in China. Electr. Power 2021, 54, 36–43. [Google Scholar]

- van Koten, S. The Forward Premium in Electricity Markets: An Experimental Study. Energy Econ. 2021, 94, 105059. [Google Scholar] [CrossRef]

- Fang, X.; Hu, Q.; Bo, R.; Li, F. Redesigning Capacity Market to Include Flexibility via Ramp Constraints in High-Renewable Penetrated System. Int. J. Electr. Power Energy Syst. 2021, 128, 106677. [Google Scholar] [CrossRef]

- Liu, M.; Yang, L.; Gan, D. A survey on agent based electricity market simulation. Power Syst. Technol. 2005, 29, 76–80. [Google Scholar]

- Bao, T.; Wang, G.; Dai, Y. Future oriented experimental economics: Literature review and Prospect. Manag. World 2020, 36, 218–237. [Google Scholar]

- Duffy, J. Macroeconomics: A Survey of Laboratory Research. Handb. Exp. Econ. 2016, 2, 1–90. [Google Scholar]

- Binmore, K.; Klemperer, P. The Biggest Auction Ever: The Sale of the British 3G Telecom Licences. Econ. J. 2002, 112, C74–C96. [Google Scholar] [CrossRef] [Green Version]

- Arifovic, J.; Duffy, J.M.; Jiang, J.H. Adoption of a New Payment Method: Theory and Experimental Evidence; Bank of Canada Staff Working Paper; Bank of Canada: Ottawa, ON, Canada, 2017. [Google Scholar]

- Blinder, A.S.; Morgan, J. Do Monetary Policy Committees Need Leaders? A Report on an Experiment. Am. Econ. Rev. 2008, 98, 224–229. [Google Scholar] [CrossRef]

- Hommes, C.; Massaro, D.; Weber, M. Monetary Policy under Behavioral Expectations: Theory and Experiment. Eur. Econ. Rev. 2019, 118, 193–212. [Google Scholar] [CrossRef]

- Davis, D.D.; Holt, C.A. Experimental Economics; Princeton University Press: Princeton, NJ, USA, 1993. [Google Scholar]

- List, J.A.; Lucking-Reiley, D. Demand Reduction in Multiunit Auctions: Evidence from a Sportscard Field Experiment. Am. Econ. Rev. 2000, 90, 961–972. [Google Scholar] [CrossRef] [Green Version]

- Fan, R.; Ye, Q.; Du, J. Frontier Development of Agent—Based Computational Economics: A Survey. Econ. Rev. 2013, 2, 145–150. [Google Scholar]

- Mi, J.; Lin, R. How equity preference affects open innovation: A study based on Computational Economics. Chin. J. Manag. Sci. 2015, 23, 157–166. [Google Scholar]

- Arthur, W.B.; Holland, J.H.; Lebaron, B.; Palmer, R.; Taylor, P. Asset Pricing under Endogenous Expectation in an Artificial Stock Market; Working Papers; Santa Fe Institute: Santa Fe, NM, USA, 1996. [Google Scholar]

- Barrows, C.; Preston, E.; Staid, A.; Stephen, G.; Watson, J.-P.; Bloom, A.; Ehlen, A.; Ikaheimo, J.; Jorgenson, J.; Krishnamurthy, D.; et al. The IEEE Reliability Test System: A Proposed 2019 Update. IEEE Trans. Power Syst. 2020, 35, 119–127. [Google Scholar] [CrossRef]

- Gacitua, L.; Gallegos, P.; Henriquez-Auba, R.; Lorca, Á.; Negrete-Pincetic, M.; Olivares, D.; Valenzuela, A.; Wenzel, G. A Comprehensive Review on Expansion Planning: Models and Tools for Energy Policy Analysis. Renew. Sustain. Energy Rev. 2018, 98, 346–360. [Google Scholar] [CrossRef]

- Xu, Y.; Myhrvold, N.; Sivam, D.; Mueller, K.; Olsen, D.J.; Xia, B.; Livengood, D.; Hunt, V.; d’Orfeuil, B.R.; Muldrew, D.; et al. U.S. Test System with High Spatial and Temporal Resolution for Renewable Integration Studies. In Proceedings of the 2020 IEEE Power & Energy Society General Meeting (PESGM), Montreal, QC, Canada, 2–6 August 2020; pp. 1–5. [Google Scholar]

- Denholm, P.; Hand, M. Grid Flexibility and Storage Required to Achieve Very High Penetration of Variable Renewable Electricity. Energy Policy 2011, 39, 1817–1830. [Google Scholar] [CrossRef]

- Li, Z.; Chen, S.; Dong, W.; Liu, P.; Du, E.; Ma, L.; He, J. Low Carbon Transition Pathway of Power Sector Under Carbon Emission Constraints. Proc. CSEE 2021, 41, 3987–4001. [Google Scholar]

- Wang, B.; Xia, Y.; Xia, Q.; Zhang, H.; Han, H. Model and Methods of Generation and transmission scheduling of Inter-regional Power Grid via HVDC Tie-line. Autom. Electr. Power Syst. 2016, 40, 8–13+26. [Google Scholar]

- Li, X.; Zhang, G.; Guo, Z. N-1 principle steady state security restriction on power flow of transmission tie line group. Electr. Power Autom. Equip. 2004, 11, 10–13+17. [Google Scholar]

- Khoshjahan, M.; Moeini-Aghtaie, M.; Fotuhi-Firuzabad, M.; Dehghanian, P.; Mazaheri, H. Advanced Bidding Strategy for Participation of Energy Storage Systems in Joint Energy and Flexible Ramping Product Market. IET Gener. Transm. Distrib. 2020, 14, 5202–5210. [Google Scholar] [CrossRef]

- Castillo-Ramírez, A.; Mejía-Giraldo, D. Measuring Financial Impacts of the Renewable Energy Based Fiscal Policy in Colombia under Electricity Price Uncertainty. Sustainability 2021, 13, 2010. [Google Scholar] [CrossRef]

- Guo, W.; Liu, P.; Shu, X. Optimal Dispatching of Electric-Thermal Interconnected Virtual Power Plant Considering Market Trading Mechanism. J. Clean. Prod. 2021, 279, 123446. [Google Scholar] [CrossRef]

- Lasemi, M.A.; Arabkoohsar, A. Optimal Operating Strategy of High-Temperature Heat and Power Storage System Coupled with a Wind Farm in Energy Market. Energy 2020, 210, 118545. [Google Scholar] [CrossRef]

- Rentier, G.; Lelieveldt, H.; Kramer, G.J. Varieties of Coal-Fired Power Phase-out across Europe. Energy Policy 2019, 132, 620–632. [Google Scholar] [CrossRef]

- Trencher, G.; Healy, N.; Hasegawa, K.; Asuka, J. Discursive Resistance to Phasing out Coal-Fired Electricity: Narratives in Japan’s Coal Regime. Energy Policy 2019, 132, 782–796. [Google Scholar] [CrossRef]

- Webb, J.; de Silva, H.N.; Wilson, C. The Future of Coal and Renewable Power Generation in Australia: A Review of Market Trends. Econ. Anal. Policy 2020, 68, 363–378. [Google Scholar] [CrossRef]

- Muñoz, F.D.; Suazo-Martínez, C.; Pereira, E.; Moreno, R. Electricity Market Design for Low-Carbon and Flexible Systems: Room for Improvement in Chile. Energy Policy 2021, 148, 111997. [Google Scholar] [CrossRef]

- Das, P.; Mathuria, P.; Bhakar, R.; Mathur, J.; Kanudia, A.; Singh, A. Flexibility Requirement for Large-Scale Renewable Energy Integration in Indian Power System: Technology, Policy and Modeling Options. Energy Strategy Rev. 2020, 29, 100482. [Google Scholar] [CrossRef]

| Research on the Operation of the Power Market | References | |

|---|---|---|

| Price mechanism design | Regional marginal pricing | [29] |

| Locational marginal pricing | [30] | |

| Capacity pricing mechanism | [31,32,33,34] | |

| Ancillary service pricing mechanism | [35] | |

| Combined clearing of power energy and ancillary service | [36] | |

| Distributed trading mechanism | [37] | |

| Market structure design | [38] | |

| Market power | Evaluating metrics | [19,39,40,41,42,43,44,45,46] |

| Evaluating methods | [47,48,49,50] | |

| Demand response | [51,52,53,54] | |

| Market efficiency assessment | [19] | |

| Investment in power systems | [55,56] | |

| Environmental policy | [57,58,59] | |

| Market Players | Strategy Target | References |

|---|---|---|

| Traditional power producers | Medium- and long-term market | [88] |

| Day-ahead market | [89] | |

| Real-time market | [90] | |

| Day-ahead market and real-time market combined | [91] | |

| Electricity retailer | Day-ahead market | [92,93] |

| Virtual power plant | Day-ahead market and ancillary services | [94,95] |

| Microgrids | Day-ahead market | [96] |

| Day-ahead market and real-time market combined | [91] | |

| Electric energy market and ancillary services | [97,98] | |

| Prosumer | Day-ahead market | [86] |

| Day-ahead market and ancillary services | [99] | |

| Energy storage | Day-ahead market | [100] |

| Real-time market and ancillary services | [101] | |

| Electric vehicles | Day-ahead market | [102] |

| Day-ahead market and ancillary services | [103] |

| Parameters | Description |

|---|---|

| Structure of the power supply | Type, location, installed capacity and other properties. |

| Forecast of electricity output (accuracy) generated from renewable energy of the system | The reliability of the system can be verified by setting a proper coefficient of power generation using renewable energy units. Based on weather forecast data, the dispatch center estimates potential output from renewable resources and provides the power generation coefficient of new energy to market participants for reference. |

| Standby rate | The standby rate is the ratio of the gap between the system’s total available capacity and the peak load. It is an important index to measure the reliability of the power system [164]. |

| Number of nodes | The complexity of the power system can also be reflected by the number of nodes. The closer the location and number of nodes is set to the actual grid topology, the more effective the power system simulation will be. |

| Power generation schedule of units | Factors influencing the power generation schedule of the units include system operation factors and non-system operation factors. |

| Power flow | Excited by the potential of the power supply, electric current flows from the power supply to every load in the power system through distribution components, and thus power is distributed throughout the whole grid. |

| The constraint of power flow in N-1 transmission section | When grid topology operates normally according to the given constraint, if disconnecting any line in the section, power flow in the rest of the lines is not overloaded. The constraint of power flow in a section is the maximum allowable power current when the section is running normally [165]. If the power flow surpasses the limitation, a nodal price would be formed. |

| Constraint of active power balance | Active power balance means that active power on the generation side and the consumption side is equal. The frequency of the power system is directly related to the balance of active power, and the auxiliary services of frequency regulation can be referenced. |

| Constraint of reactive power balance | Reactive power balance is the condition that reactive power on the generation side and the consumption side is equal. When the reactive power is insufficient, the reactive compensation is required. |

| Plans for maintenance of power generation, transmission and transformation equipment | Plans for maintenance covers two types of equipment, including power generation equipment, as well as power transmission and transformation equipment. The maintenance plans for power distribution and transformation equipment affect the structure of power transmission for a short time. |

| System load forecasting (accuracy) | The dispatch center predicts the total load of the power system for several days based on data obtained about the system. The accuracy of system load forecasting directly affects the analysis of market supply and the demand of market participants, and then affects market quotation behavior. |

| Parameters | Description |

|---|---|

| Trading methods | Major trading methods include bilateral consultations, centralized bidding and listing transactions. The spot trading market is divided into the day-ahead market, the intra-day marker and the real-time market. A variety of trading methods can be combined according to the transaction cycle, thus new symbols can be built in to increase the diversity of market symbols. |

| Trading transactions | Depending on different types of markets, typical symbols include medium- and long-term (yearly, monthly, weekly) transactions, contract power transfer, power generation rights trading, spot trading and ancillary services trading. New trading instruments for renewable energy and flexible resources will be added in order to meet the needs of further construction in the power market. |

| Limitations on the declared price | Based on the relationship between demand and supply, in order to avoid market manipulation and vicious competition, minimum and maximum declared prices must be set for the direct trading of electricity in different transaction modes. Different ranges for price limitations can be set through power market simulation to verify the market’s capacity. |

| Rules for clearance | Major rules of clearance include high–low matching and unified clearance. High–low matching is the priority match between the highest spread on the demand side and the lowest spread on the supply side. Whether the spread pair matches can be judged by the following formula: n − Sm ≥ 0, match n − Sm < 0, not match where Ln is the spread pair on the demand side, while Sm represents the spread pair on the supply side. Unified clearance refers to the selection of the last pair of spread pairs that match successfully according to the principles of high–low matching. The arithmetic average of the selected pair will be designated as the closing spread of all participants. When studying the development degree and diversification of the power market, different rules of clearance and trading methods can be combined to conduct diversified trading. Thus, the market affordability can be tested. |

| Settlement mechanisms | Settlement is reached either at the marginal electricity price or at the actual declared price by power generations units: where Fm represents the cost of power purchases paid by the grid, Pi represents the power generation volume bid by the power producer (or electricity generation unit) i, and i refers to power producer. I is the total number of power producers, and Com represents the marginal electricity price of the system. |

| Changing rate of the balancing funds account | As the price fluctuations of electricity bought from the power market by the grid cannot be transmitted to power retail prices in time, a balancing funds account is built to link power sales prices to power purchase prices: where Vi is the changing rate of the funds in the balancing account, Fi represents the amount of balancing funds this year, while Fi−1 refers to the amount of balancing funds last year. |

| Market turnover rate | Market turnover rate is the ratio representing the number of market participants declaring during the statistical period (which can also be a transaction for one time) divided by the number of market subjects that finally complete the transaction. The turnover rate is used to analyze whether market competition is insufficient or judge collusion by market participants: where is the turnover rate, refers to the number of market subjects which finally complete the transaction, and Gi is number of market participants declaring during the statistical period. |

| HHI | The Herfindahl–Hirschman index (HHI) is a composite index that measures industrial concentration. It reflects the changes in market share, i.e., the dispersion of the size of manufacturers in the market: where Si is the market share occupied by market supplier i per trade sequence during the evaluation cycle, while N represents the number of suppliers in the market during the evaluation cycle. |

| Renewable energy subsidies | According to the effectiveness of the market mechanism and the development of new energy, the amount of renewable energy subsidy can be changed to verify the risks brought about by the marketization of renewable energy resources. |

| Deviation parameters | The parameters reflecting the deviation of power generation (more or less) on the generation side include the exemption range and the appraisal price. The parameters measuring the deviation of electricity consumption (more or less) also include the exemption range and the appraisal price. |

| Parameters | Description |

|---|---|

| Power producer, asset type and status constraints | This parameter covers the type of units and operating parameters of the power producer. When the user of the simulation system is the power producer, the power generation enterprise can develop its own strategies by simulating the trading strategy of its competitors based on market conditions. |

| Cost composition | Cost is an important basis for making transaction decisions. Power generation costs primarily cover start-up costs, empty operating costs, fuel costs, environmental costs, and other economic costs. Under China’s dual carbon reduction goal, environmental costs have become an important constraint on the development of thermal power enterprises. Power sales companies need to consider retail contract prices, wholesale prices and other related parameters. |

| Marginal revenue of the power generation unit | This parameter refers to the income earned through increasing or decreasing the power generation of the unit, and its relationship with the power generation and market price is: where is the marginal revenue of the power generation unit i, Gi refers to the output of unit i, and P is the electricity price in the power market. |

| Forecasts for market prices and power generation | A power plant forecasts its own power generation output based on its installed capacity. Combining this with market price forecasts, the power plant declares reasonable prices and a power generation plan. At the same time, the market price and power generation coefficient can also be set to verify the anti-jamming of the quoting strategy. |

| Power generation plans | Power generation enterprises make production plans based on existing contracts. Power market simulation provides users with a chance to choose the optimal solution from different generation plans so as to avoid market shocks. |

| Intelligent agent simulation | Through simulating the trading behaviors of competitors, intelligent agent simulation technology helps power producers to formulate their own trading strategies. By simulating the transactions of multiple participants, it can also help verify market results. Intelligent agents can be divided into rational and irrational, or radical and conservative. Commonly used parameters include the number of intelligent agents, learning mechanisms and feedback mechanisms. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dong, J.; Liu, D.; Dou, X.; Li, B.; Lv, S.; Jiang, Y.; Ma, T. Key Issues and Technical Applications in the Study of Power Markets as the System Adapts to the New Power System in China. Sustainability 2021, 13, 13409. https://doi.org/10.3390/su132313409

Dong J, Liu D, Dou X, Li B, Lv S, Jiang Y, Ma T. Key Issues and Technical Applications in the Study of Power Markets as the System Adapts to the New Power System in China. Sustainability. 2021; 13(23):13409. https://doi.org/10.3390/su132313409

Chicago/Turabian StyleDong, Jun, Dongran Liu, Xihao Dou, Bo Li, Shiyao Lv, Yuzheng Jiang, and Tongtao Ma. 2021. "Key Issues and Technical Applications in the Study of Power Markets as the System Adapts to the New Power System in China" Sustainability 13, no. 23: 13409. https://doi.org/10.3390/su132313409