Optimization of Multi-Port Empty Container Repositioning under Uncertain Environments

Abstract

:1. Introduction

2. Literature Review

3. Model Hypotheses and Formulation

3.1. Model Hypotheses

- (1)

- The supply of empty containers to a port only consists of three portions: shipping company transportation, repositioning from other ports and container leasing.

- (2)

- Every empty container considered in this paper belongs to the 20-feet-long type.

- (3)

- The ports are operating in normal conditions, without considering abnormal situations such as port interruption.

- (4)

- The leasing company can offer empty containers without a limitation on the amount.

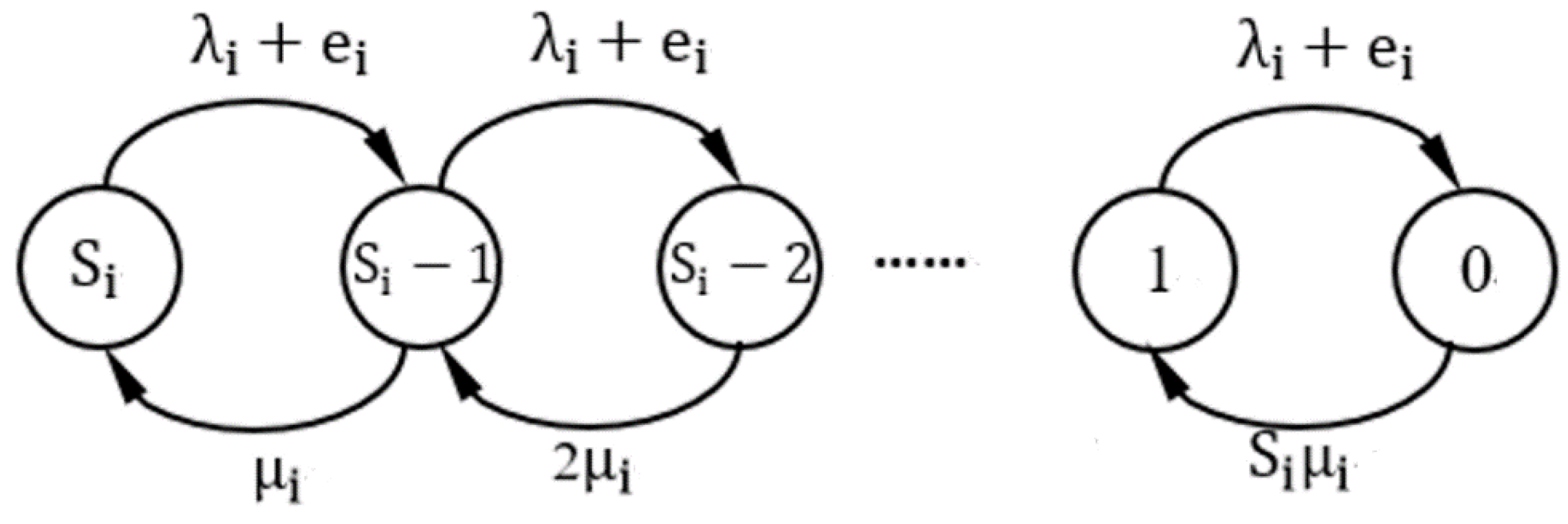

3.2. Model of a Port’s Empty Containers under the Repositioning Strategy

3.3. Model of a Port’s Empty Containers under the Non-Repositioning Strategy

4. Model Solving

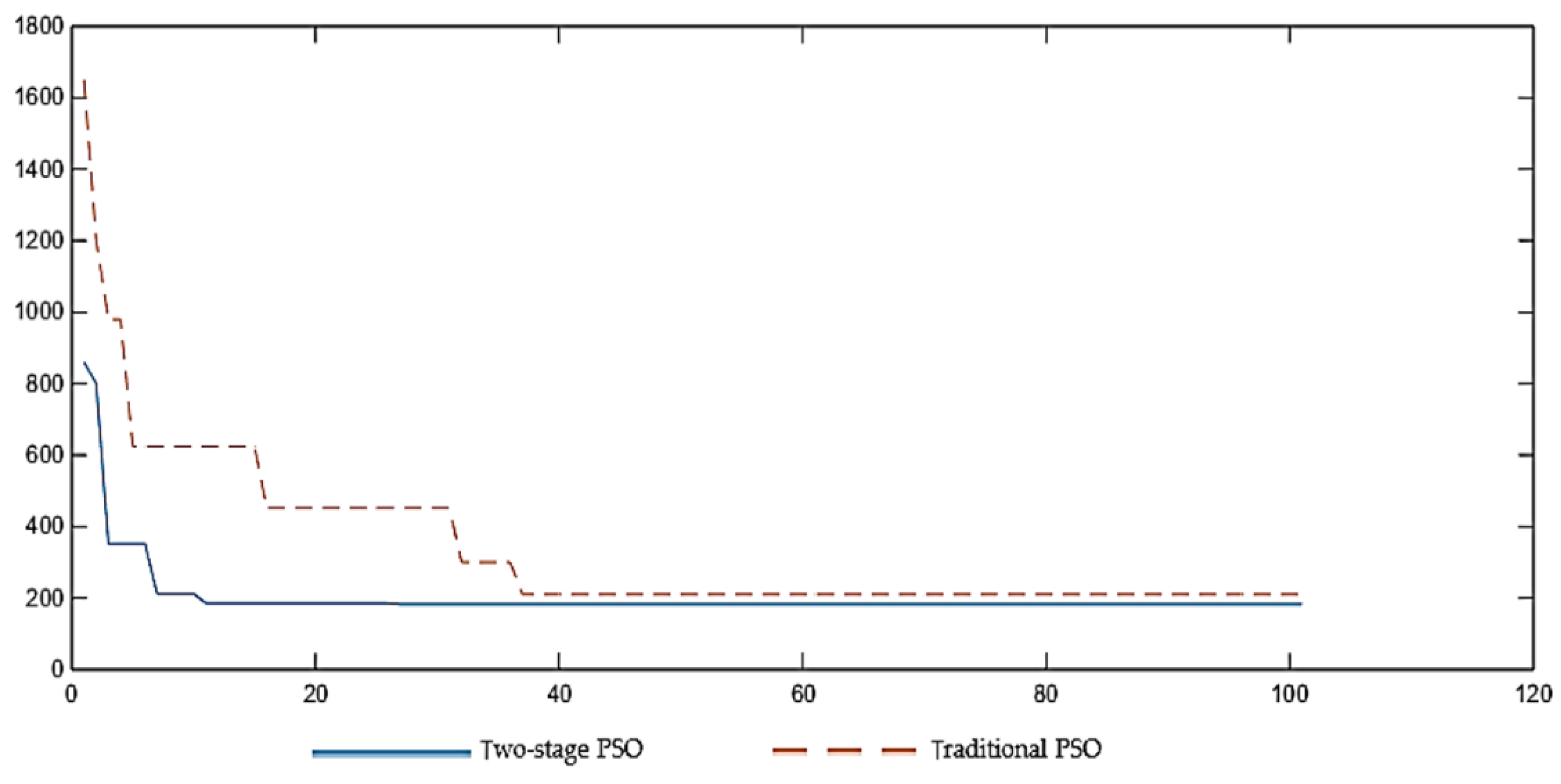

4.1. Two-Stage PSO Algorithm

4.2. Calculation of , , and under the Repositioning Strategy

5. Computational Experiments

5.1. Analysis of the Result of the Solution

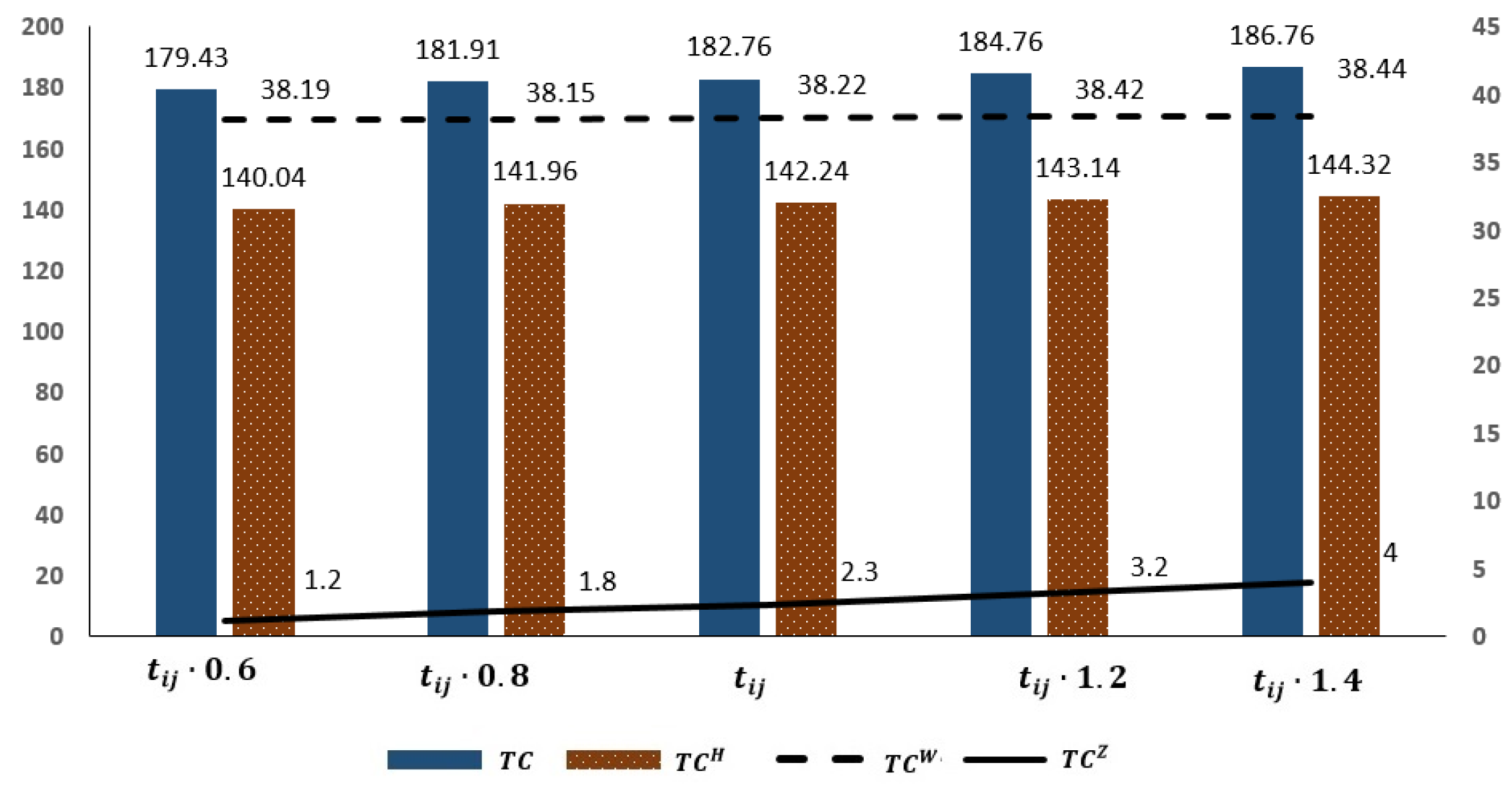

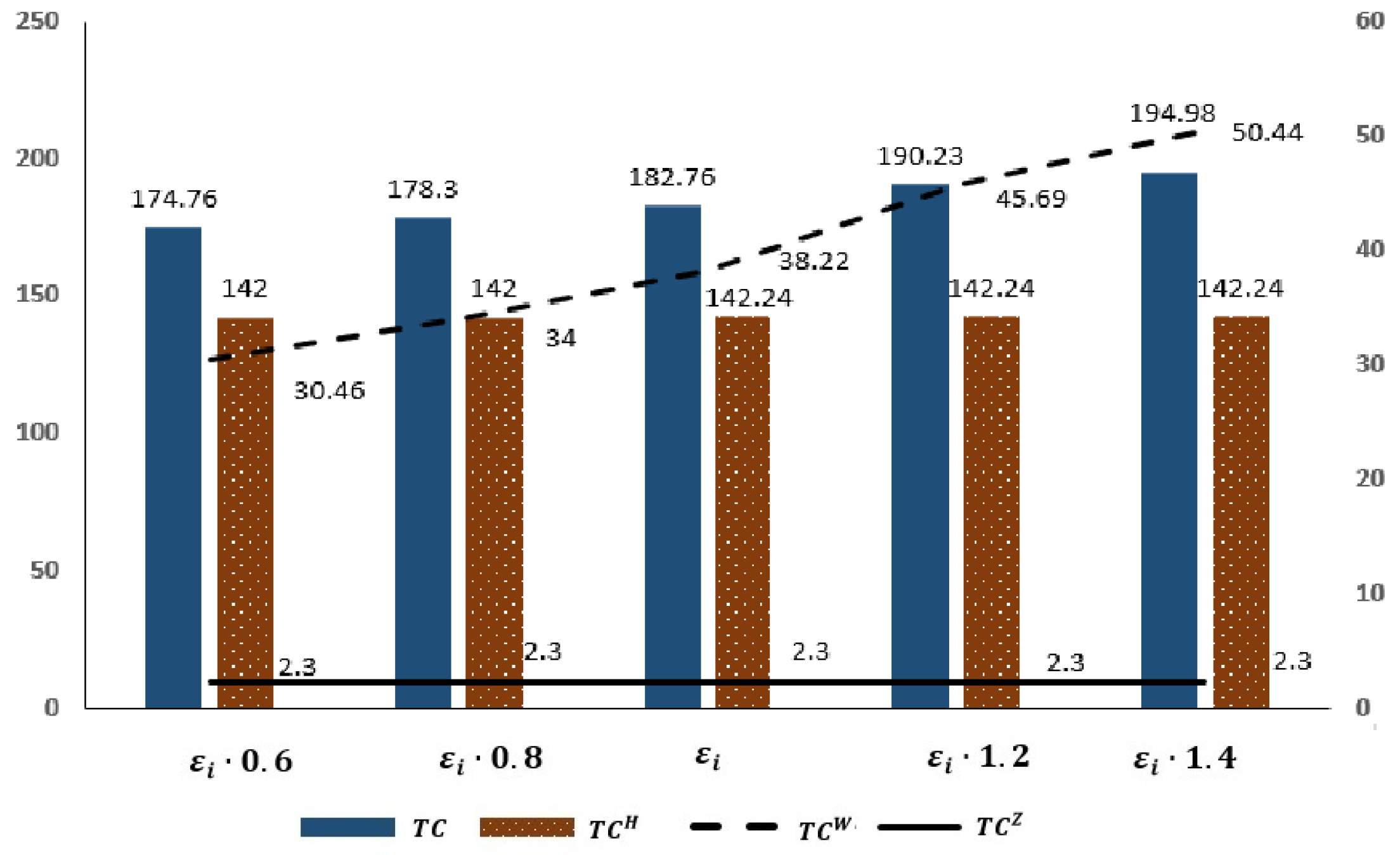

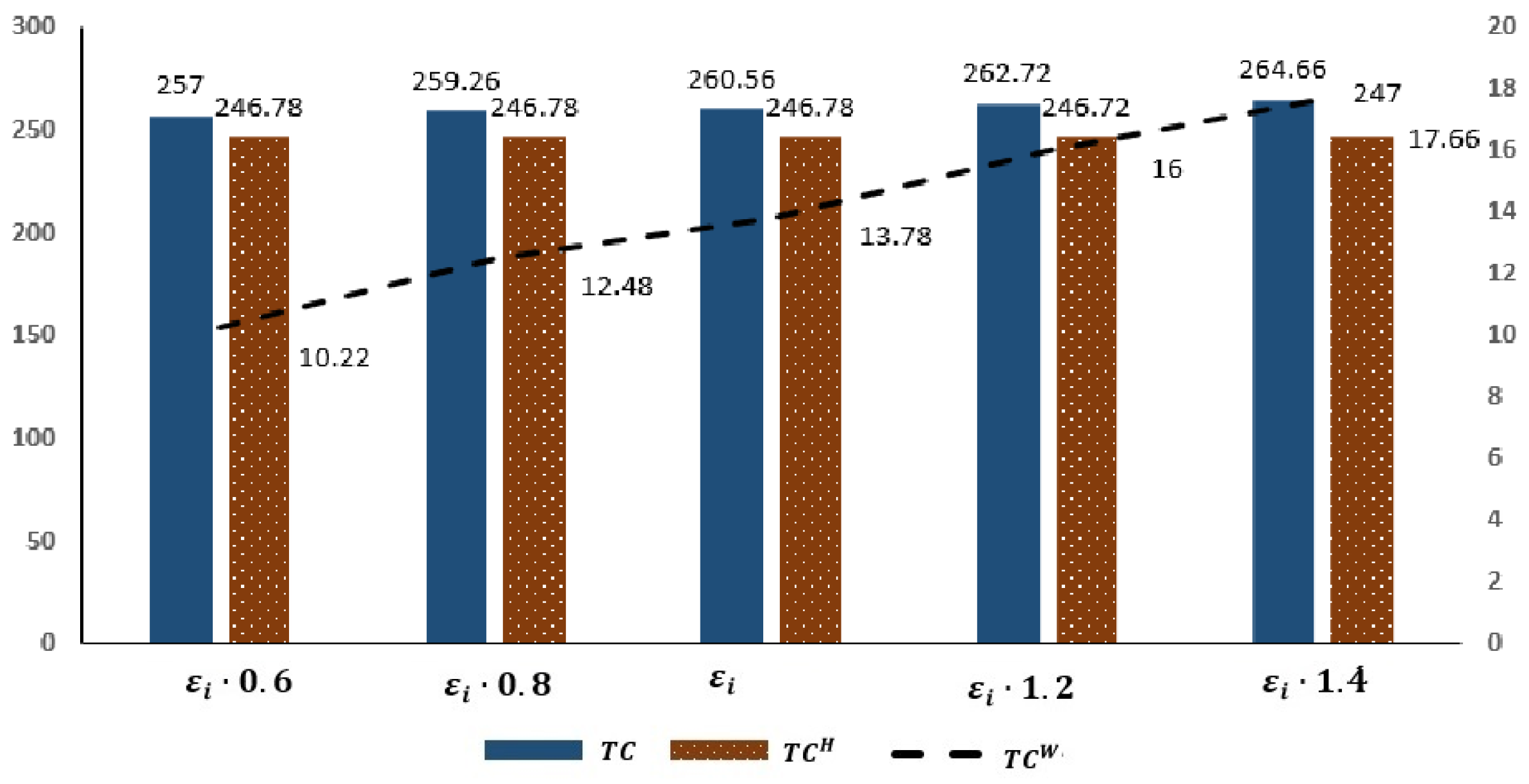

5.2. Sensitivity Analysis

6. Conclusions

- The ports’ total cost, storage cost and empty container storage capacity under the repositioning strategy are lower than those under the non-repositioning strategy, but the empty container leasing cost and repositioning cost are higher than those under the non-repositioning strategy.

- The main component of the total cost of empty containers in the port is the cost of empty container storage. The change in the storage fees of empty containers has the greatest impact on the total cost of empty containers. The increase in the transportation time of empty containers between ports will lead to an increase in the empty container repositioning fee under the repositioning strategy, but it has little impact on the port’s storage costs and lease costs and will not affect the port’s operation under the non-repositioning strategy. When the storage fee of empty containers increases, regardless of whether the port adopts a reposition or non-repositioning strategy, the port’s empty container storage cost will increase significantly anyway, and the empty container leasing and reposition costs will also increase slightly. When the leasing fee of empty containers increases, under both reposition and non-repositioning strategies, the leasing cost of empty containers in the port will increase significantly, but the impact on the total cost is not significant.

Author Contributions

Funding

Conflicts of Interest

Abbreviation

| Variables: | |

| The number of empty containers obeying the positive etheric distribution supply of port i. | |

| The number of empty containers to port i transferred from other ports. | |

| The empty container storage of port i. | |

| The number of empty containers obeying the positive etheric distribution demand of port i. | |

| The proportion of port i depending on its own empty container storage to meet the demand. | |

| The proportion of port i depending on other ports to transfer empty containers to meet the demand. | |

| The proportion of port i depending on empty container lease to meet the demand. | |

| The probability that the empty container storage capacity of port i is m. | |

| The total cost. | |

| Empty container storage cost. | |

| Empty container reposition cost. | |

| Empty container lease cost. | |

| Parameters: | |

| I | The number of ports. |

| Container storage fee per empty container for port i. | |

| Container lease fee per empty container for port i. | |

| The fee of one empty container transferred from port i to port , and is reposition fee per unit time. | |

| Waiting time limit for empty container demand of port i. | |

| v | The space of one empty container. |

| Upper limit of empty container storage space of port i. | |

| The x-th priority origin port of an empty container when port i lacks containers. | |

| The probability of port q as the origin of empty containers to port i. | |

| Sum of empty container transportation and handling time from port i to j. | |

| Empty container transportation and handling time from leasing company to port i. | |

References

- Zhou, Y.; Chen, S.; Chen, M. Global value chain, regional trade networks and Sino-EU FTA. Struct. Chang. Econ. Dyn. 2019, 50, 26–38. [Google Scholar] [CrossRef]

- Song, D.M.; Panayides, P.M. Maritime Logistics: A Complete Guide to Effective Shipping and Port Management; Kogan Page: London, UK, 2012. [Google Scholar]

- Lind, M.; Ward, R.; Jensen, H.H.; Chua, C.P.; Simha, A.; Karlsson, J.; Göthberg, L.; Penttinen, T.; Theodosiou, D.P. The future of shipping: Collaboration through digital data sharing. In Maritime Informatics; Progress in IS; Springer: Cham, Switzerland, 2021; pp. 137–149. [Google Scholar] [CrossRef]

- Chen, L.; Nan, G.; Li, M.; Feng, B.; Liu, Q. Manufacturer’s online selling strategies under spillovers from online to offline sales. J. Oper. Res. Soc. 2022. [Google Scholar] [CrossRef]

- Elmi, Z.; Singh, P.; Meriga, V.K.; Goniewicz, K.; Borowska-Stefańska, M.; Wiśniewski, S.; Dulebenets, M.A. Uncertainties in Liner Shipping and Ship Schedule Recovery: A State-of-the-Art Review. J. Mar. Sci. Eng. 2022, 10, 563. [Google Scholar] [CrossRef]

- UNCTAD. United Nations conference on trade and development. In Review of Maritime Transport; United Nations: Geneva, Switzerland, 2020; Available online: https://unctad.org/system/files/official-document/rmt2020_en.pdf (accessed on 18 November 2020).

- Jeong, Y.; Saha, S.; Chatterjee, D.; Moon, I. Direct shipping service routes with an empty container management strategy. Transp. Res. Part E Logist. Transp. Rev. 2018, 118, 123–142. [Google Scholar] [CrossRef]

- Tang, Y.; Chen, S.; Feng, Y.; Zhu, X. Optimization of multi- period empty container repositioning and renting in CHINA RAILWAY Express based on container sharing strategy. Eur. Transp. Res. Rev. 2021, 13, 42. [Google Scholar] [CrossRef]

- Cai, J.; Li, Y.; Yin, Y.; Wang, X.; Lalith, E.; Jin, Z. Optimization on the multi-period empty container repositioning problem in regional port cluster based upon inventory control strategies. Soft Comput. 2022, 26, 6715–6738. [Google Scholar] [CrossRef]

- Dulebenets, M.A. Multi-objective collaborative agreements amongst shipping lines and marine terminal operators for sustainable and environmental-friendly ship schedule design. J. Clean. Prod. 2022, 342, 130897. [Google Scholar] [CrossRef]

- Abioye, O.F.; Dulebenets, M.A.; Kavoosi, M.; Pasha, J.; Theophilus, O. Vessel Schedule Recovery in Liner Shipping: Modeling Alternative Recovery Options. IEEE Trans. Intell. Transp. Syst. 2021, 10, 6420–6434. [Google Scholar] [CrossRef]

- Romano, A.; Yang, Z. Decarbonisation of shipping: A state of the art survey for 2000–2020. Ocean Coast. Manag. 2021, 214, 105936. [Google Scholar] [CrossRef]

- Kavoosi, M.; Dulebenets, M.A.; Abioye, O.F.; Pasha, J.; Wang, H.; Chi, H. An Augmented Self-Adaptive Parameter Control in Evolutionary Computation: A Case Study for the Berth Scheduling Problem. Adv. Eng. Inform. 2019, 42, 100972. [Google Scholar] [CrossRef]

- CAx. 2021. Available online: https://container-xchange.com/features/cax (accessed on 4 April 2022).

- Chen, J.; Zhang, S.; Xu, L.; Wan, Z.; Fei, Y.; Zheng, T. Identification of key factors of ship detention under port state control. Mar. Policy 2019, 102, 21–27. [Google Scholar] [CrossRef]

- Xiao, G.; Wang, T.; Chen, X.; Zhou, L. Evaluation of Ship Pollutant Emissions in the Ports of Los Angeles and Long Beach. J. Mater. Sci. Eng. 2022, 10, 1206. [Google Scholar] [CrossRef]

- Jiang, X.; Lee, L.; Chew, E.P.; Han, Y.; Tan, K.C. A container yard storage strategy for improving land utilization and operation efficiency in a transshipment hub port. Eur. J. Oper. Res. 2012, 221, 64–73. [Google Scholar] [CrossRef]

- Koichi, S.; Konings, R.; Imai, A. Combinable containers: A container innovation to save container fleet and empty container repositioning costs. Transp. Res. Part E Logist. Transp. Rev. 2019, 130, 248–272. [Google Scholar] [CrossRef]

- Yap, W.; Lam, J. 80 million-twenty-foot-equivalent-unit container port? Sustainability issues in port and coastal development. Ocean Coast. Manag. 2013, 71, 13–25. [Google Scholar] [CrossRef]

- Jula, H.; Chassiakos, A.; Ioannou, P. Port dynamic empty container reuse. Transp. Res. Part E Logist. Transp. Rev. 2006, 42, 43–60. [Google Scholar] [CrossRef]

- Bernat, N.S.; Schulte, F.; Voß, S.; Böse, J. Empty container management at ports considering pollution, repair options and street-turns. Math. Probl. Eng. 2016, 2016, 3847163. [Google Scholar] [CrossRef] [Green Version]

- Song, W.; Liu, D.; Rong, W. Optimization of Passenger-like Container Train Running Plan Considering Empty Container Dispatch. Sustainability 2022, 14, 4697. [Google Scholar] [CrossRef]

- Gelareh, S.; Meng, Q. A novel modeling approach for the fleet deployment problem within a short-term planning horizon. Transp. Res. Part E Logist. Transp. Rev. 2010, 46, 76–89. [Google Scholar] [CrossRef]

- Choong, S.T.; Cole, M.H.; Kutanoglu, E. Empty container management for intermodal transportation networks. Transp. Res. Part E Logist. Transp. Rev. 2002, 38, 423–438. [Google Scholar] [CrossRef]

- Wang, B.; Wang, Z. Research on the Optimization of Intermodal Empty Container Reposition of Land-carriage. J. Transp. Syst. Eng. Inf. Technol. 2007, 7, 29–33. [Google Scholar] [CrossRef]

- Li, J.A.; Leung, S.C.H.; Wu, Y.; Liu, K. Allocation of empty containers between multi-ports. Eur. J. Oper. Res. 2007, 182, 400–412. [Google Scholar] [CrossRef]

- Lei, T.L.; Church, R.L. Locating short-term empty-container storage facilities to support port operations: A user optimal approach. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 738–754. [Google Scholar] [CrossRef]

- Shintani, K.; Konings, R.; Imai, A. The impact of foldable containers on container fleet management costs in hinterland transport. Transp. Res. Part E Logist. Transp. Rev. 2010, 46, 750–763. [Google Scholar] [CrossRef]

- Goh, S.H. The impact of foldable ocean containers on back haul shippers and carbon emissions. Transp. Res. Part D Transp. Environ. 2019, 67, 514–527. [Google Scholar] [CrossRef]

- Moon, I.; Ngoc, A.D.; Konings, R. Foldable and standard containers in empty container repositioning. Transp. Res. Part E Logist. Transp. Rev. 2013, 49, 107–124. [Google Scholar] [CrossRef]

- Yu, J.; Tang, G.; Song, X.; Yu, X.; Qi, Y.; Li, D.; Zhang, Y. Ship arrival prediction and its value on daily container terminal operation. Ocean Eng. 2018, 157, 73–86. [Google Scholar] [CrossRef]

- Zhou, C.; Wang, W.; Li, H. Container reshuffling considered space allocation problem in container terminals. Transp. Res. Part E Logist. Transp. Rev. 2020, 136, 101869. [Google Scholar] [CrossRef]

- Escudero-Santana, A.; Munuzuri, J.; Cortés, P.; Onieva, L. The one container drayage problem with soft time windows. Res. Transp. Econ. 2020, 2, 100884. [Google Scholar] [CrossRef]

- Luo, T.; Chang, D.; Xu, Z. Forwarder’s Empty Container Ordering and Coordination Considering Option Trading in the Container Transportation Service Chain. Comput. Ind. Eng. 2021, 156, 107251. [Google Scholar] [CrossRef]

- Crainic, T.G.; Gendreau, M.; Dejax, P.A. Dynamic and stochastic models for the allocation of empty containers. Oper. Res. 1993, 41, 102–126. [Google Scholar] [CrossRef]

- Erera, A.L.; Morales, J.C.; Savelsbergh, M. Robust optimization for empty repositioning problems. Oper. Res. 2009, 57, 468–483. [Google Scholar] [CrossRef] [Green Version]

- Francesco, M.D.; Lai, M.; Zuddas, P. Maritime repositioning of empty containers under uncertain port disruptions. Comput. Ind. Eng. 2013, 64, 827–837. [Google Scholar] [CrossRef]

- Luo, T.; Chang, D. Empty container repositioning strategy in intermodal transport with demand switching. Adv. Eng. Inform. 2019, 40, 1–13. [Google Scholar] [CrossRef]

- Lee, S.; Moon, I. Robust empty container repositioning considering foldable containers. Eur. J. Oper. Res. 2020, 280, 909–925. [Google Scholar] [CrossRef]

- Sarmadi, K.; Amiri-Aref, M.; Dong, J.X. Integrated strategic and operational planning of dry port container networks in a stochastic environment. Transp. Res. Part B Methodol. 2020, 139, 132–164. [Google Scholar] [CrossRef]

- Kim, K.H.; Kim, K.Y. Optimal price schedules for storage of inbound containers. Transp. Res. Part B Methodol. 2007, 41, 892–905. [Google Scholar] [CrossRef]

- Lee, C.Y.; Yu, M. Inbound container storage price competition between the container terminal and a remote container yard. Flex. Serv. Manuf. J. 2012, 24, 320–348. [Google Scholar] [CrossRef]

- Qiu, X.; Lam, J.; Huang, G.Q. A bilevel storage pricing model for outbound containers in a dry port system. Transp. Res. Part E Logist. Transp. Rev. 2015, 73, 65–83. [Google Scholar] [CrossRef]

- Alfandari, L.; Davidović, T.; Furini, F.; Ljubić, I.; Maraš, V.; Martin, S. Tighter MIP models for barge container ship routing. Omega 2019, 82, 38–54. [Google Scholar] [CrossRef]

- Kurtuluş, E. Optimizing Inland Container Logistics and Dry Port Location-Allocation from an Environmental Perspective. Res. Transp. Bus. Manag. 2022, 3, 100839. [Google Scholar] [CrossRef]

- Baştuğ, S.; Haralambides, H.; Esmer, S.; Eminoğlu, E. Port competitiveness: Do container terminal operators and liner shipping companies see eye to eye? Mar. Policy 2022, 135, 104866. [Google Scholar] [CrossRef]

- Jain, M.; Saihjpal, V.; Singh, N.; Singh, S.B. An Overview of Variants and Advancements of PSO Algorithm. Appl. Sci. 2022, 12, 8392. [Google Scholar] [CrossRef]

- Asghari, M.; Afshari, H.; Mirzapour Al-e-hashem, S.M.J.; Fathollahi-Fard, A.M.; Dulebenets, M.A. Pricing and advertising decisions in a direct-sales closed-loop supply chain. Comput. Ind. Eng. 2022, 171, 108439. [Google Scholar] [CrossRef]

- Ren, X.; Liu, S.; Yu, X.; Dong, X. A method for state-of-charge estimation of lithium-ion batteries based on PSO-LSTM. Energy 2021, 234, 121236. [Google Scholar] [CrossRef]

| Port | Port 1 (Taicang Port) | Port 2 (Nantong Port) | Port 3 (Zhangjiagang Port) |

|---|---|---|---|

| Port 1 (Taicang Port) | 0 | 24 | 53 |

| Port 2 (Nantong Port) | 24 | 0 | 19 |

| Port 3 (Zhangjiagang Port) | 53 | 19 | 0 |

| Port | Port 1 (Taicang Port) | Port 2 (Nantong Port) | Port 3 (Zhangjiagang Port) |

|---|---|---|---|

| Port 1 (Taicang Port) | 0 | 5.5 | 7.3 |

| Port 2 (Nantong Port) | 5.5 | 0 | 5.2 |

| Port 3 (Zhangjiagang Port) | 7.3 | 5.2 | 0 |

| Parameters | Port 1 | Port 2 | Port 3 |

|---|---|---|---|

| (USD/K) | 83.3 | 83.3 | 83.3 |

| (USD/K) | 2380 | 2380 | 2380 |

| (h) | 96 | 96 | 96 |

| 293 | 84 | 36 | |

| 4.5 | 4.5 | 4.5 |

| Repositioning Strategy | Non-Repositioning Strategy | |

|---|---|---|

| (K) | 182.76 | 260.56 |

| (K) | 142.24 | 246.78 |

| (K) | 2.30 | - |

| (K) | 38.22 | 13.78 |

| (K) | 642,242 | 844,666 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, J.; Tang, X.; Wang, C.; Xu, C.; Wei, J. Optimization of Multi-Port Empty Container Repositioning under Uncertain Environments. Sustainability 2022, 14, 13255. https://doi.org/10.3390/su142013255

Song J, Tang X, Wang C, Xu C, Wei J. Optimization of Multi-Port Empty Container Repositioning under Uncertain Environments. Sustainability. 2022; 14(20):13255. https://doi.org/10.3390/su142013255

Chicago/Turabian StyleSong, Jingyao, Xin Tang, Chuanxu Wang, Changyan Xu, and Junyi Wei. 2022. "Optimization of Multi-Port Empty Container Repositioning under Uncertain Environments" Sustainability 14, no. 20: 13255. https://doi.org/10.3390/su142013255