Can Green Credit Policy Promote Firms’ Green Innovation? Evidence from China

Abstract

:1. Introduction

2. Background and Research Hypothesis

2.1. Background

2.2. Research Hypothesis

3. Research Design

3.1. Methodology

3.2. Sample Selection, Variable Descriptions, and Data Sources

4. Empirical Analysis

4.1. Baseline Regression

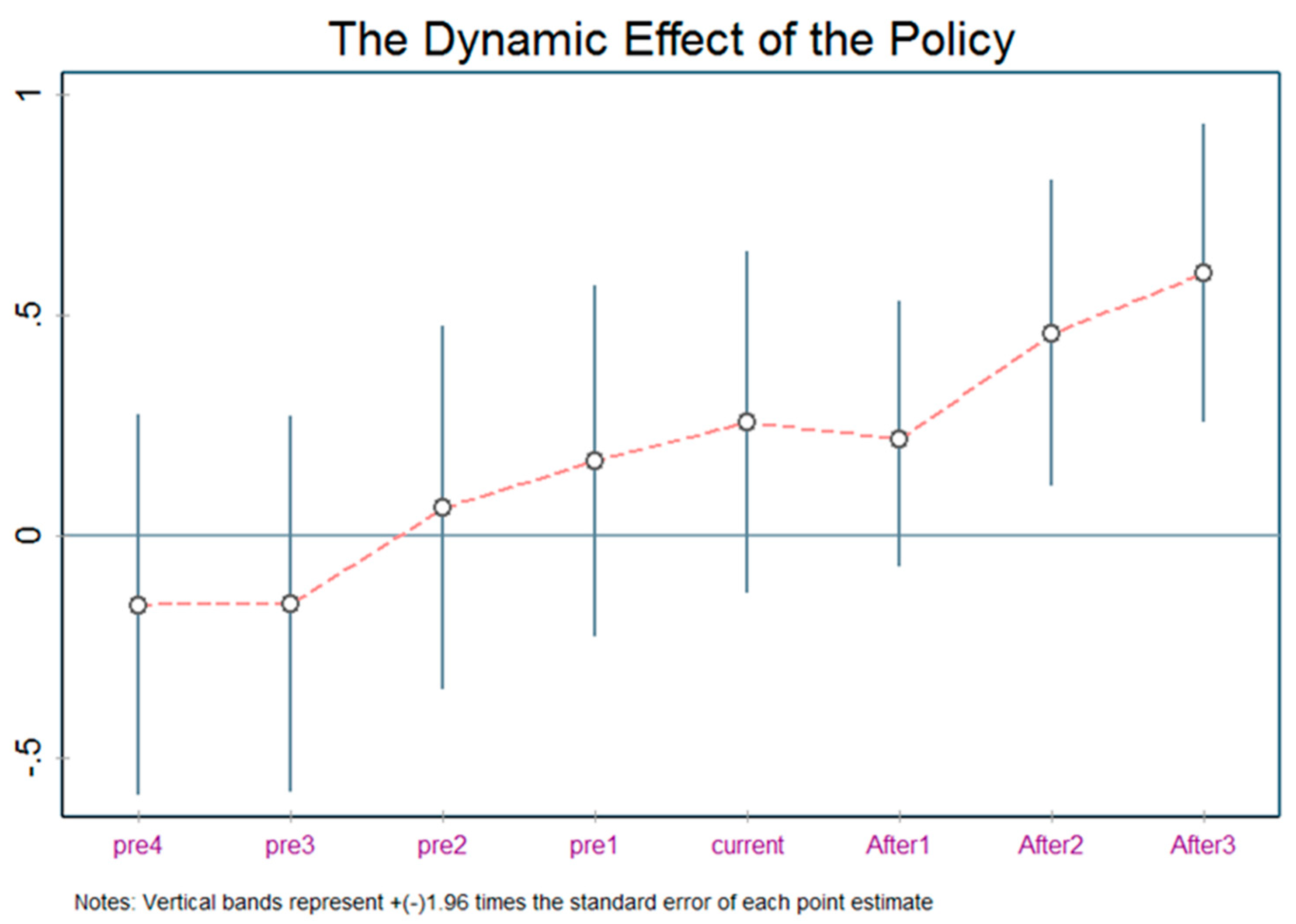

4.2. Parallel Trend Hypothesis and Dynamic Effects Test

4.3. Moderating Effects

5. Robustness Tests

5.1. Placebo Test

5.2. Replacement of the Explanatory Variable

6. Heterogeneity Analysis

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, K.-M.; Wen, Z.-G. Review and challenges of policies of environmental protection and sustainable development in China. J. Environ. Manag. 2008, 88, 1249–1261. [Google Scholar] [CrossRef]

- Gao, D.; Li, G.; Li, Y.; Gao, K. Does FDI improve green total factor energy efficiency under heterogeneous environmental regulation? Evidence from China. Environ. Sci. Pollut. Res. 2021, 1–14. [Google Scholar] [CrossRef]

- Braun, E.; Wield, D. Regulation as a means for the social control of technology. Technol. Anal. Strateg. Manag. 1994, 6, 259–272. [Google Scholar] [CrossRef]

- Sukoharsono, E.G. Green accounting in Indonesia: Accountability and environmental issues. Int. J. Account. Bus. Soc. 2007, 15, 21–60. [Google Scholar]

- Fraj, E.; Martínez, E.; Matute, J. Green marketing strategy and the firm’s performance: The moderating role of environmental culture. J. Strateg. Mark. 2011, 19, 339–355. [Google Scholar] [CrossRef]

- Cecere, G.; Corrocher, N.; Mancusi, M.L. Financial constraints and public funding of eco-innovation: Empirical evidence from European SMEs. Small Bus. Econ. 2020, 54, 285–302. [Google Scholar] [CrossRef] [Green Version]

- Wen, H.; Lee, C.-C.; Zhou, F. Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ. 2021, 94, 105099. [Google Scholar] [CrossRef]

- Zhang, B.; Wang, Y. The Effect of Green Finance on Energy Sustainable Development: A Case Study in China. Emerg. Mark. Financ. Trade 2021, 57, 3435–3454. [Google Scholar] [CrossRef]

- Hao, Y.; Wu, H. The Role of internet development on energy intensity in china: Evidence from a spatial econometric analysis. Asian Econ. Lett. 2021, 1, 17194. [Google Scholar] [CrossRef]

- Xu, X.; Li, J. Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J. Clean. Prod. 2020, 264, 121574. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Palmer, K. Environmental Regulation and Innovation: A Panel Data Study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Hamamoto, M. Environmental regulation and the productivity of Japanese manufacturing industries. Resour. Energy Econ. 2006, 28, 299–312. [Google Scholar] [CrossRef]

- Popp, D. International innovation and diffusion of air pollution control technologies: The effects of NOX and SO2 regulation in the US, Japan, and Germany. J. Environ. Econ. Manag. 2006, 51, 46–71. [Google Scholar] [CrossRef] [Green Version]

- Calel, R.; Dechezleprêtre, A. Environmental Policy and Directed Technological Change: Evidence from the European Carbon Market. Rev. Econ. Stat. 2016, 98, 173–191. [Google Scholar] [CrossRef] [Green Version]

- Ley, M.; Stucki, T.; Woerter, M. The Impact of Energy Prices on Green Innovation. Energy J. 2016, 37. [Google Scholar] [CrossRef] [Green Version]

- Cui, J.; Zhang, J.; Zheng, Y. Carbon pricing induces innovation: Evidence from China’s regional carbon market pilots. AEA Pap. Proc. 2018, 108, 453–457. [Google Scholar] [CrossRef] [Green Version]

- Liu, J.-Y.; Xia, Y.; Fan, Y.; Lin, S.-M.; Wu, J. Assessment of a green credit policy aimed at energy-intensive industries in China based on a financial CGE model. J. Clean. Prod. 2017, 163, 293–302. [Google Scholar] [CrossRef]

- Milani, S. The Impact of Environmental Policy Stringency on Industrial R&D Conditional on Pollution Intensity and Relocation Costs. Environ. Resour. Econ. 2017, 68, 595–620. [Google Scholar] [CrossRef]

- De Haas, R.; Popov, A.A. Finance and Carbon Emissions; European Central Bank: Frankfurt, Germany, 2019. [Google Scholar]

- Blackman, A.; Li, Z.; Liu, A.A. Efficacy of Command-and-Control and Market-Based Environmental Regulation in Developing Countries. Annu. Rev. Resour. Econ. 2018, 10, 381–404. [Google Scholar] [CrossRef] [Green Version]

- Qi, S.Z.; Lin, S.; Cui, J.B. Can environmental equity trading market induce green innovation?--Evidence based on data of green patents of listed companies in China. Econ. Res. 2018, 53, 129–143. [Google Scholar]

- Wang, W.; Wang, D.; Ni, W.; Zhang, C. The impact of carbon emissions trading on the directed technical change in China. J. Clean. Prod. 2020, 272, 122891. [Google Scholar] [CrossRef]

- Hu, J.; Pan, X.; Huang, Q. Quantity or quality? The impacts of environmental regulation on firms’ innovation–Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol. Forecast. Soc. Change 2020, 158, 120122. [Google Scholar] [CrossRef]

- D’Orazio, P. Mapping the emergence and diffusion of climate-related financial policies: Evidence from a cluster analysis on G20 countries. Int. Econ. 2022, 169, 135–147. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Wang, Z.; Huang, Z. Green loan and subsidy for promoting clean production innovation. J. Clean. Prod. 2018, 187, 421–431. [Google Scholar] [CrossRef]

- Wang, E.; Liu, X.; Wu, J.; Cai, D. Green Credit, Debt Maturity, and Corporate Investment—Evidence from China. Sustainability 2019, 11, 583. [Google Scholar] [CrossRef] [Green Version]

- Duan, K.; Ren, X.; Shi, Y.; Mishra, T.; Yan, C. The marginal impacts of energy prices on carbon price variations: Evidence from a quantile-on-quantile approach. Energy Econ. 2021, 95, 105131. [Google Scholar] [CrossRef]

- Hu, G.; Wang, X.; Wang, Y. Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Su, C.W.; Li, W.; Umar, M.; Lobonţ, O.R. Can green credit reduce the emissions of pollutants? Econ. Anal. Policy 2022, 74, 205–219. [Google Scholar] [CrossRef]

- Liu, X.; Wang, E.; Cai, D. Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ. Res. Lett. 2019, 29, 129–135. [Google Scholar] [CrossRef]

- Yao, S.; Pan, Y.; Sensoy, A.; Uddin, G.S.; Cheng, F. Green credit policy and firm performance: What we learn from China. Energy Econ. 2021, 101, 105415. [Google Scholar] [CrossRef]

- Wang, F.; Yang, S.; Reisner, A.; Liu, N. Does Green Credit Policy Work in China? The Correlation between Green Credit and Corporate Environmental Information Disclosure Quality. Sustainability 2019, 11, 733. [Google Scholar] [CrossRef] [Green Version]

- Guo, P. Financial policy innovation for social change: A case study of China’s green credit policy. Int. Rev. Sociol. 2014, 24, 69–76. [Google Scholar] [CrossRef]

- Gao, D.; Li, Y.; Yang, Q. Can pollution charges reform promote industrial SO2 emissions reduction?—Evidence from 189 China’s cities. Energy Environ. 2021, 32, 96–112. [Google Scholar] [CrossRef]

- Cole, M.A.; Elliott, R. FDI and the Capital Intensity of “Dirty” Sectors: A Missing Piece of the Pollution Haven Puzzle. Rev. Dev. Econ. 2005, 9, 530–548. [Google Scholar] [CrossRef]

- Gao, D.; Li, G.; Yu, J. Does digitization improve green total factor energy efficiency? Evidence from Chinese 213 cities. Energy 2022, 247, 123395. [Google Scholar] [CrossRef]

- Männasoo, K.; Meriküll, J. Credit constraints and R&D over the boom and bust: Firm-level evidence from Central and Eastern Europe. Econ. Syst. 2020, 44, 100747. [Google Scholar]

- Yang, J.; Ying, L.; Gao, M. The influence of intelligent manufacturing on financial performance and innovation performance: The case of China. Enterp. Inf. Syst. 2020, 14, 812–832. [Google Scholar] [CrossRef]

- Heckman, J.J. The common structure of statistical models of truncation, sample selection and limited dependent variables and a simple estimator for such models. In Annals of Economic and Social Measurement; NBER: Cambridge, MA, USA, 1976; Volume 5, Number 4; pp. 475–492. [Google Scholar]

- Rosenbaum, P.R.; Rubin, D.B. The central role of the propensity score in observational studies for causal effects. Biometrika 1983, 70, 41–55. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M. Corporate governance and green innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Cruz-Cázares, C.; Bayona-Sáez, C.; García-Marco, T. You can’t manage right what you can’t measure well: Technological innovation efficiency. Res. Policy 2013, 42, 1239–1250. [Google Scholar] [CrossRef]

- Tumelero, C.; Sbragia, R.; Evans, S. Cooperation in R & D and eco-innovations: The role in companies’ socioeconomic performance. J. Clean. Prod. 2019, 207, 1138–1149. [Google Scholar] [CrossRef]

- Colombo, M.G.; Croce, A.; Guerini, M. The effect of public subsidies on firms’ investment–cash flow sensitivity: Transient or persistent? Res. Policy 2013, 42, 1605–1623. [Google Scholar] [CrossRef]

- Kyere, M.; Ausloos, M. Corporate governance and firms financial performance in the United Kingdom. Int. J. Financ. Econ. 2021, 26, 1871–1885. [Google Scholar] [CrossRef]

- Cai, X.; Zhu, B.; Zhang, H.; Li, L.; Xie, M. Can direct environmental regulation promote green technology innovation in heavily polluting industries? Evidence from Chinese listed companies. Sci. Total Environ. 2020, 746, 140810. [Google Scholar] [CrossRef] [PubMed]

- Liu, Q.; Qiu, L.D. Intermediate input imports and innovations: Evidence from Chinese firms’ patent filings. J. Int. Econ. 2016, 103, 166–183. [Google Scholar] [CrossRef]

- Serfling, M. Firing Costs and Capital Structure Decisions. J. Financ. 2016, 71, 2239–2286. [Google Scholar] [CrossRef] [Green Version]

- Huergo, E.; Moreno, L. Subsidies or loans? Evaluating the impact of R&D support programmes. Res. Policy 2017, 46, 1198–1214. [Google Scholar] [CrossRef] [Green Version]

- Guo, Y.; Xia, X.; Zhang, S.; Zhang, D. Environmental Regulation, Government R&D Funding and Green Technology Innovation: Evidence from China Provincial Data. Sustainability 2018, 10, 940. [Google Scholar] [CrossRef] [Green Version]

- Su, Z.-Q.; Xiao, Z.; Yu, L. Do political connections enhance or impede corporate innovation? Int. Rev. Econ. Financ. 2019, 63, 94–110. [Google Scholar] [CrossRef]

- Su, D.W.; Lian, L.L. Does green credit affect the investment and financing behavior of heavily polluting enterprises? J. Financ. Res. 2018, 12, 123–137. [Google Scholar]

| Variables | Variable Description | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|---|

| N | Mean | sd | Min | Max | ||

| GTI | green innovation | 22,607 | 1.741 | 17.58 | 0 | 966 |

| Size | firm size | 22,607 | 22.22 | 1.644 | 10.84 | 31.04 |

| Debt | debt ratio | 22,607 | 0.506 | 1.668 | −0.195 | 142.7 |

| TobinQ | ratio of market value and liabilities | 22,607 | 2.904 | 101.2 | 0.684 | 14,810 |

| ROE | the return on net assets | 22,607 | 0.0632 | 0.586 | −45.48 | 28.65 |

| Employee | number of employees | 22,607 | 7.624 | 1.490 | 1.099 | 13.22 |

| Variables | DID | PSM-DID | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| GTI | GTI | GTI | GTI | |

| 0.247 ** | 0.281 ** | 0.296 ** | 0.329 *** | |

| (2.22) | (2.36) | (2.53) | (2.63) | |

| Size | 0.055 * | 0.057 *** | ||

| (1.79) | (2.85) | |||

| Debt | −0.042 | −0.048 | ||

| (−0.18) | (−0.21) | |||

| TobinQ | 0.003 *** | 0.001 ** | ||

| (3.15) | (2.03) | |||

| ROE | 0.005 * | 0.005 ** | ||

| (1.71) | (2.18) | |||

| employee | 0.046 * | 0.045 * | ||

| (1.82) | (1.81) | |||

| Constant | 0.175 * | 1.302 | 0.177 * | 1.336 |

| (1.80) | (0.99) | (1.83) | (1.08) | |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 22,607 | 22,607 | 20,301 | 20,301 |

| R-squared | 0.110 | 0.123 | 0.121 | 0.230 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| LR | RD | PSM-LR | PSM-RD | |

| −0.008 *** | 0.398 ** | −0.011 *** | 0.425 *** | |

| (−3.40) | (2.03) | (−3.46) | (3.78) | |

| Constant | −0.293 *** | 2.561 *** | −0.281 *** | 2.610 *** |

| (−10.95) | (5.59) | (−10.31) | (4.73) | |

| Control | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 22,607 | 22,607 | 20,115 | 20,026 |

| R-squared | 0.125 | 0.280 | 0.201 | 0.338 |

| Variables | DID | PSM-DID | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| UGTI | IGTI | UGTI | IGTI | |

| 0.162 ** | 0.084 *** | 0.226 *** | 0.120 *** | |

| (2.47) | (3.31) | (3.71) | (2.87) | |

| Constant | 0.257 *** | 0.083** | 7.886 ** | 6.538 ** |

| (3.85) | (2.35) | (2.04) | (2.14) | |

| Control | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 22,607 | 22,607 | 19,583 | 20,221 |

| R-squared | 0.108 | 0.216 | 0.119 | 0.299 |

| Variables | (1) | (2) | (1) | (2) |

|---|---|---|---|---|

| State-Owned | Non-State-Owned | L-Scale | S-Scale | |

| 0.545 *** | 0.103 | 0.436 ** | 0.332 | |

| (2.78) | (1.31) | (2.33) | (1.57) | |

| Constant | −2.812 *** | 1.910 | −2.812 ** | 1.910 *** |

| (−2.64) | (0.62) | (−2.04) | (3.26) | |

| Control | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 7495 | 15112 | 11297 | 11310 |

| R-squared | 0.226 | 0.314 | 0.326 | 0.314 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, D.; Mo, X.; Duan, K.; Li, Y. Can Green Credit Policy Promote Firms’ Green Innovation? Evidence from China. Sustainability 2022, 14, 3911. https://doi.org/10.3390/su14073911

Gao D, Mo X, Duan K, Li Y. Can Green Credit Policy Promote Firms’ Green Innovation? Evidence from China. Sustainability. 2022; 14(7):3911. https://doi.org/10.3390/su14073911

Chicago/Turabian StyleGao, Da, Xinlin Mo, Kun Duan, and Yi Li. 2022. "Can Green Credit Policy Promote Firms’ Green Innovation? Evidence from China" Sustainability 14, no. 7: 3911. https://doi.org/10.3390/su14073911