Investigating the Determinants of Financial Inclusion in BRICS Economies: Panel Data Analysis Using Fixed-Effect and Cross-Section Random Effect

Abstract

:1. Introduction

Theoretical Underpinning: The Intersection of FI and Economic Growth

2. Review of the Empirical Literature

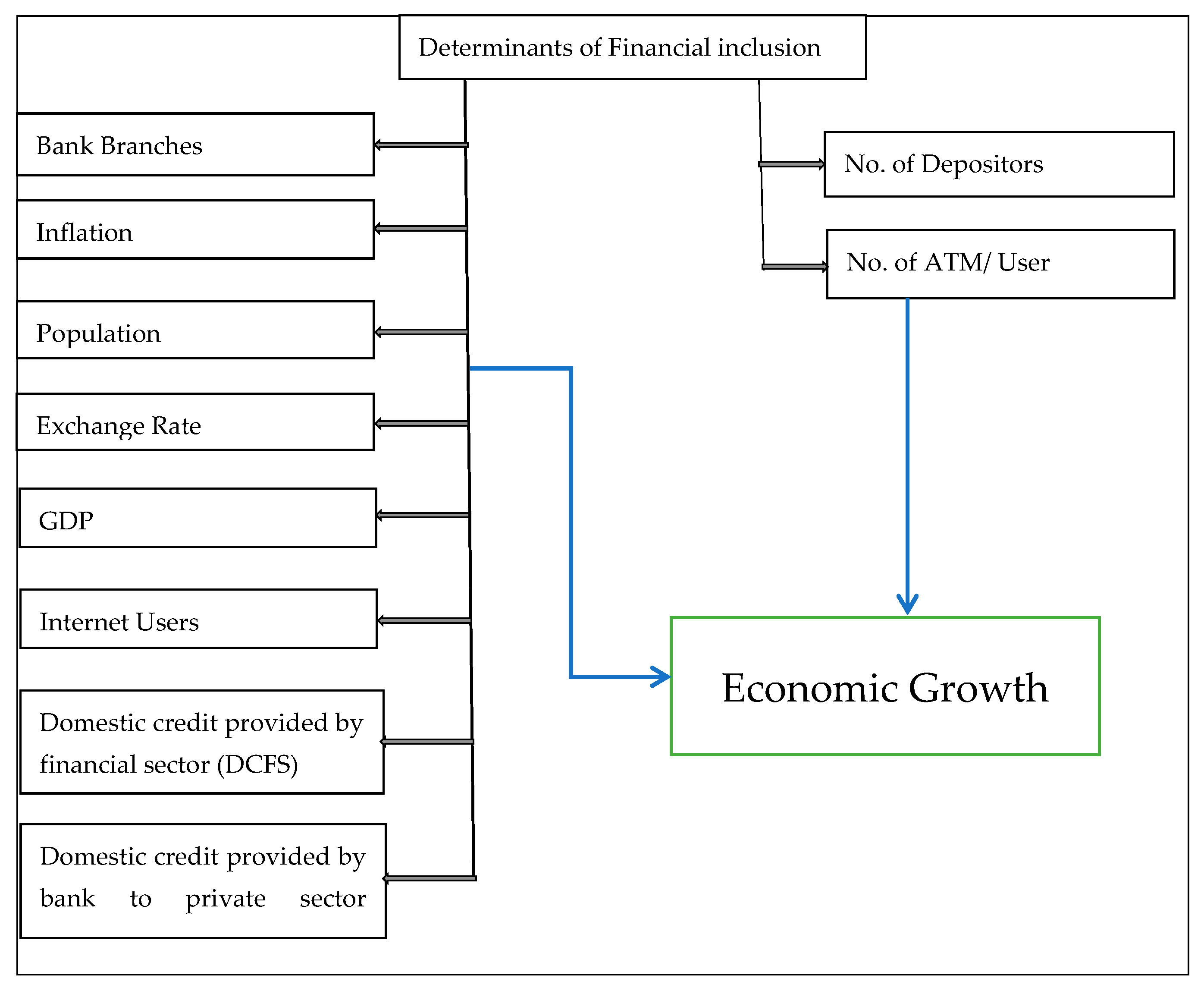

3. Research Methodology

3.1. Description of Data

| S.No. | Variable | Description | Independent or Dependent | Literature Support | Source of Data |

|---|---|---|---|---|---|

| 1 | Depositors (DEPO) | Natural logarithm of depositors | Dependent | Beck, Kunt and Peria [73], Kim et al. [8] | World bank database |

| 2 | ATM per User | No. of ATM/depositors | Dependent | Mbutor and Uba [71], Chatterjee [86], Kim et al. [8] | World bank database |

| 3 | Bank Branches (BB) | Natural logarithm no. of bank branches | Independent | Sarma [4,41,69] Kim et al. [8] | World bank database |

| 4 | Gross Domestic Product (GDP) | Natural logarithm of Gross Domestic Product | Independent | Dabla-Norris et al. [88]. Chibba [55], Omar and Inaba [84] | Global Findex |

| 5 | Exchange Rate (ER) | Exchange rate of USD of respective country’s currency | Independent | Mbutor and Uba [71] | Global Findex |

| 6 | Inflation Rate (IR) | Inflation rate in respective country | Independent | Chatterjee [86], Lenka and Bairwa [89] Mbutor and Uba [71], Kim et al. [8] | Global Findex |

| 7 | Internet User (IU) | Natural logarithm no. of internet user (IU) | Independent | Durai and Stella [90], Bayar et al. [91] | World bank database |

| 8. | Population (PoP) | Natural logarithm population in respective country | Independent | David et al. [92], Kim et al. [8] | World bank database |

| 9. | Domestic credit provided by financial sector (DCFS) | Natural logarithm domestic credit provided by financial sector (DCFS) | Independent | Chauvet and Jacolin [93], King and Levine [47] | Global Findex |

| 10. | Domestic credit provided by bank to private sector (DCBPS) | Natural logarithm of domestic credit provided by bank to private sector | Independent | Hannig and Jansen [94], Bhaskar [95] | World bank database |

3.2. Specification of Model

3.3. Panel Unit Root Estimation Technique

- Yit = αi + β1Xit + e………4αi (i = 1…n) is the intercept for each unit/country (n units/country-specific intercepts).

- Yit: dependent variable (DV), with i (unit) and t (time)

- Xit: one exogenous/explanatory variable.

- β1: coefficient (exogenous variable)

- e: error term

3.4. Panel Data Analysis with Cross-Section Random Effects (CSRE)

4. Econometric Results

5. Conclusions and Discussion

6. Practical Implications

7. Future Areas of Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aslan, G.; Deléchat, C.; Newiak, M.M.; Yang, M.F. Inequality in Financial Inclusion and Income Inequality; WP/17/236; International Monetary Fund: Washington, DC, USA, 2017. [Google Scholar]

- Gertler, P.; Levine, D.I.; Moretti, E. Do Microfinance Programs Help Families Insure Consumption Against Illness? Health Econ. 2009, 18, 257–273. [Google Scholar] [CrossRef] [PubMed]

- Abdu, E.; Adem, M. Determinants of financial inclusion in Afar Region: Evidence from selected woredas. Cogent Econ. Financ. 2021, 9, 1920149. [Google Scholar] [CrossRef]

- Sarma, M.; Pais, J. Financial inclusion and development: A cross country analysis annual conference of the human development and capability association. In Proceedings of the Annual Conference of the Human Development and Capability Association, New Delhi, India, 30 August–1 September 2008. [Google Scholar]

- Demirgüc-Kunt, A.; Klapper, L. Measuring financial inclusion: Explaining variation in use of financial services across and within countries. Brook. Pap. Econ. Act. 2013, 2013, 279–340. [Google Scholar] [CrossRef] [Green Version]

- Ghosh, J. Microfinance and the challenge of financial inclusion for development. Camb. J. Econ. 2013, 37, 1203–1219. [Google Scholar] [CrossRef] [Green Version]

- Cull, R.; Demirguc-Kunt, A.; Lyman, T. Financial Inclusion and Stability: What does Research Show? Consultative Group to Assist the Poor, 71305; CGAP: Washington, DC, USA, 2012; pp. 1–3. [Google Scholar]

- Kim, D.W.; Yu, J.S.; Hassan, M.K. Financial inclusion and economic growth in OIC countries. Res. Int. Bus. Financ. 2018, 43, 1–14. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa. Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Mitchell, K.; Scott, R.H. Public revenue, financial inclusion and value-added tax in Argentina. In Pesos or Plastic? Palgrave Pivot: Cham, Switzerland, 2019; pp. 33–58. [Google Scholar]

- Kumar, N. Financial inclusion and its determinants: Evidence from India. J. Financ. Econ. 2013, 5, 4–19. [Google Scholar] [CrossRef]

- Zins, A.; Weill, L. The determinants of financial inclusion in Africa. Rev. Dev. Financ. 2016, 6, 46–57. [Google Scholar] [CrossRef] [Green Version]

- Evans, O. Connecting the poor: The internet, mobile phones and financial inclusion in Africa. Digit Policy Regul. Gov. 2018, 20, 568–581. [Google Scholar] [CrossRef]

- Allen, F.; Carletti, E.; Cull, R.; Qian, J.Q.; Senbet, L.; Valenzuela, P. The African financial development and financial inclusion gaps. J. Afr. Econ. 2014, 23, 614–642. [Google Scholar] [CrossRef]

- Fungacova, Z.; Weill, L. Understanding fi nancial inclusion in China. China Econ. Rev. 2015, 34, 196–206. [Google Scholar] [CrossRef] [Green Version]

- Tsai, K.S. FinTech and Financial Inclusion in China; HKUST Institute for Emerging Market Studies: Kowloon, Hong Kong, 2017; Volume 20. [Google Scholar]

- Le, T.-H.; Le, H.-C.; Taghizadeh-Hesary, F. Does financial inclusion impact CO2 emissions? Evidence from Asia. Financ. Res. Lett. 2020, 34, 101451. [Google Scholar] [CrossRef]

- Umar, M.; Rizvi, S.K.A.; Naqvi, B. Dance with the devil? The nexus of fourthindustrial revolution, technological financial products and volatility spillovers in globalfinancial system. Technol. Forecast. Soc. Chang. 2021, 163, 120450. [Google Scholar] [CrossRef]

- Okoye, L.U.; Erin, O.; Modebe, N.J. Financial inclusion as a strategy for enhanced economic growth and development. J. Internet Bank. Commer. 2017, 2, 1–14. [Google Scholar]

- Evans, O.; Lawanson, O. A Multi-Sectoral Study of Financial Inclusion and Economic Output in Nigeria. Ovidius Univ. Ann. Ser. Econ. Sci. 2017, 17, 195–204. [Google Scholar]

- Sanderson, A.; Mutandwa, L.; Le Roux, P. A review of determinants of financial inclusion. Int. J. Financ. Econ. 2018, 8, 1. [Google Scholar]

- Soumare, I.; Tchana Tchana, F.; Kengne, T.M. Analysis of the determinants of financial inclusion in Central and West Africa. Transnatl. Corp. Rev. 2016, 8, 231–249. [Google Scholar]

- Motta, V.; Gonzalez Farias, L.E. Determinants of financial inclusion in Latin America and the Caribbean. Dev. Pract. 2022, 32, 1063–1077. [Google Scholar] [CrossRef]

- Eldomiaty, T.; Hammam, R.; El Bakry, R. Institutional determinants of financial inclusion: Evidence from world economies. Int. J. Dev. Issues. 2020, 19, 217–228. [Google Scholar] [CrossRef]

- Lotto, J. Examination of the status of financial inclusion and its determinants in Tanzania. Sustainability 2018, 10, 2873. [Google Scholar] [CrossRef] [Green Version]

- Balliester Reis, T. Socio-economic determinants of financial inclusion: An evaluation with a microdata multidimensional index. J. Int. Dev. 2022, 34, 587–611. [Google Scholar] [CrossRef]

- Galor, O.; Zeira, J. Income distribution and macroeconomics. Rev. Econ. Stud. 1993, 60, 35–52. [Google Scholar] [CrossRef] [Green Version]

- Claessens, S. Access to financial services: A review of the issues and public policy objectives. World Bank Res. Obs. 2006, 21, 207–240. [Google Scholar] [CrossRef] [Green Version]

- Allen, F.; Demirguc-Kunt, A.; Klapper, L.; Martinez Peria, M.S. The Foundations of Financial Inclusion: Understanding Ownership and Use of Formal Accounts. J. Financ. Intermediation 2016, 27, 1–30. [Google Scholar] [CrossRef]

- Dahiya, S.; Kumar, M. Linkage between Financial Inclusion and Economic Growth: An Empirical Study of the Emerging Indian Economy. Vision 2020, 24, 184–193. [Google Scholar] [CrossRef]

- Pradhan, R.P.; Arvin, M.B.; Nair, M.S.; Hall, J.H.; Bennett, S.E. Sustainable economic development in India: The dynamics between financial inclusion, ICT development, and economic growth. Technol. Forecast. Soc. Chang. 2021, 169, 120758. [Google Scholar] [CrossRef]

- Lee, C.C.; Wang, C.W.; Ho, S.J. Financial inclusion, financial innovation, and firms’ sales growth. Int. Rev. Econ. Financ. 2020, 66, 189–205. [Google Scholar] [CrossRef]

- Ul Ain, N.; Sabir, S.; Asghar, N. Financial inclusion and economic growth: Empirical evidence from selected developing economies. Rev. Dev. Econ. 2020, 6, 179–203. [Google Scholar] [CrossRef]

- Gebrehiwot, K.G.; Makina, D. Macroeconomic determinants of financial inclusion: Evidence using dynamic panel data analysis. In Extending Financial Inclusion in Africa; Academic Press: Cambridge, MA, USA, 2019; pp. 167–191. [Google Scholar]

- Wale, L.E.; Makina, D. Account ownership and use of financial services among individuals: Evidence from selected sub-Saharan African economies. African J. Econ. Manag. Stud. 2017, 8, 19–35. [Google Scholar] [CrossRef]

- Anzoategui, D.; Demirguc-Kunt, A.; Peria, M.S.M. Remittances and financial inclusion: Evidence from El Salvador. World Dev. 2014, 54, 338–349. [Google Scholar] [CrossRef] [Green Version]

- Wagle, U.R. The economic footing of the global poor, 1980-2005: The roles of economic growth, openness and political institutions. J. Int. Dev. 2012, 24, S173–S197. [Google Scholar] [CrossRef]

- Bencivenga, V.R.; Smith, B.D. Financial intermediation and endogenous growth. Rev. Econ. Stud. 1991, 58, 195–209. [Google Scholar] [CrossRef] [Green Version]

- Nanda, K.; Kaur, M. Financial inclusion and human development: A cross-country evidence. Manag. Labour Stud. 2016, 41, 127–153. [Google Scholar] [CrossRef]

- Camara, N.; Tuesta, D. Measuring financial inclusion: A multidimensional index. SSRN Electron. J. 2014. [Google Scholar] [CrossRef]

- Sarma, M. Measuring financial inclusion for Asian economies. In Financial Inclusion in Asia; Palgrave Macmillan: London, UK, 2016; pp. 3–34. [Google Scholar]

- Park, C.Y.; Mercado, R., Jr. Financial inclusion, poverty, and income inequality. Singap. Econ. Rev. 2018, 63, 185–206. [Google Scholar] [CrossRef]

- Chakravarty, S.R.; Pal, R. Financial inclusion in India: An axiomatic approach. J. Policy Model. 2013, 35, 813–837. [Google Scholar] [CrossRef]

- Demirguc-Kunt, A.; Klapper, L. Measuring Financial Inclusion: The global Findex Database; World Bank Policy Research Working Paper Series 6025; World Bank: Washington, DC, USA, 2012. [Google Scholar]

- Mani, M. Financial inclusion in South Asia—Relative standing, challenges and initiatives. South Asian Surv. 2016, 23, 158–179. [Google Scholar] [CrossRef]

- Schumpeter, J.A. Theorie Derwirt-Schaftlichenentwicklung; Dunker & Humblot: Leipzig, Germany, 1912. [Google Scholar]

- King, R.G.; Levine, R. Finance, entrepreneurship and growth: Theory and evidence. J. Monet. Econ. 1993, 32, 513–542. [Google Scholar] [CrossRef]

- Mckinnon, R.I. Money and Capital in Economic Development; Brookings Institution Press: Washington, DC, USA, 1973. [Google Scholar]

- Goldsmith, R. Financial Structure and Development; New Haven Yale University Press: New Haven, CT, USA, 1969. [Google Scholar]

- Collard, S. Toward financial inclusion in the UK: Progress and challenges. Public Money Manag. 2007, 27, 13–20. [Google Scholar] [CrossRef]

- Rajan, R.G.; Zingales, L. Banks and Markets: The Changing Character of European Finance. 2003. Available online: https://www.nber.org/system/files/working_papers/w9595/w9595.pdf (accessed on 10 November 2022).

- Zheng, C. An innovative MS-VAR model with integrated financial knowledge for measuring the impact of stock market bubbles on financial security. J. Innov. Knowl. 2022, 7, 100207. [Google Scholar] [CrossRef]

- Cheng, L.; Zhang, Y. Do able managers take more risks? J. Innov. Knowl. 2022, 7, 100182. [Google Scholar] [CrossRef]

- Chakrabarty, T.K. Rural income: Some evidence of effect of rural credit during last three decades. Reserve Bank India Occas. Pap. 2003, 24, 225–239. [Google Scholar]

- Chibba, M. Financial inclusion, poverty reduction and the millennium development goals. Eur. J. Dev. Res. 2009, 21, 213–230. [Google Scholar] [CrossRef]

- Wait, C.; Ruzive, T.P.; Roux, P.L. The Influence of Financial Market Development on Economic Growth in BRICSCountries. Int. J. Manag. Econ. 2017, 53, 7–24. [Google Scholar]

- Guru, B.K.; Yadav, I.S. Financial Development and Economic Growth: Panel Evidence from BRICS. J. Econ. Financ. Adm. Sci. 2019, 24, 113–126. [Google Scholar] [CrossRef] [Green Version]

- Olaniyi, E.; Adeoye, B. Determinants of financial inclusion in Africa: A dynamic panel data approach. Univ. Maurit. Res. J. 2016, 22, 310–336. [Google Scholar]

- Wang, X.; Guan, J. Financial inclusion: Measurement, spatial effects and influencing factors. Appl. Econ. 2017, 49, 1751–1762. [Google Scholar] [CrossRef]

- Boukhatem, J. Assessing the direct effect of financial development on poverty reduction in a panel of low-and middle-income countries. Res. Int. Bus. Financ. 2016, 37, 214–230. [Google Scholar] [CrossRef]

- Van der Werff, A.D.; Hogarth, J.M.; Peach, N.D. A cross-country analysis of financial inclusion within the OECD. Consum. Interests Annual. 2013, 59, 1–12. [Google Scholar]

- Lenka, S.K.; Sharma, R. Does financial inclusion spur economic growth in India? J. Dev. Areas 2017, 51, 215–228. [Google Scholar] [CrossRef]

- Sethi, D.; Acharya, D. Financial inclusion and economic growth linkage: Some cross country evidence. J. Financ. Econ. 2018, 10, 369–385. [Google Scholar] [CrossRef]

- Asuming, P.O.; Osei-Agyei, L.G.; Mohammed, J.I. Financial inclusion in sub-Saharan Africa: Recent trends and determinants. J. Afr. Bus. 2019, 20, 112–134. [Google Scholar] [CrossRef]

- Mehrotra, A.; Yetman, J. Financial Inclusion and optimal Monetary Policy; Bank for International Settlements: Basel, Switzerland, 2014; p. 476. [Google Scholar]

- Beck, T.; Cull, R. Banking in Africa; World Bank Policy Research Working Paper 6684; World Bank: Washington, DC, USA, 2013. [Google Scholar]

- Demirgüç-Kunt, A.; Klapper, L.F.; Singer, D. Financial Inclusion and Legal Discrimination against Women: Evidence from Developing Countries; World Bank Policy Research Working Paper; World Bank: Washington, DC, USA, 2013. [Google Scholar]

- Sophastienphong, K.; Kulathunga, A. Getting finance in South Asia 2009: Indicators and Analysis of the Commercial Banking Sector; World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Sarma, M. Index of Financial Inclusion; Working Paper No. 215; Indian Council for Research on International Economic Relations: New Delhi, India, 2008. [Google Scholar]

- Bourainy, M.E.; Salah, A.; Sherif, M.E. Assessing the impact of financial inclusion on inflation rate in developing countries. Open J. Soc. Sci. 2021, 9, 397–424. [Google Scholar] [CrossRef]

- Mbutor, O.; Uba, I. The Impact of Financial Inclusion on Monetary Policy in Nigeria. J. Econ. Int. Financ. 2013, 5, 318–326. [Google Scholar] [CrossRef] [Green Version]

- Beck, T.; Torre, A.D.L. The Basic Analysis of Access to Financial Services; WPS 4026, World Bank Memo; World Bank: Washington, DC, USA, 2006. [Google Scholar]

- Beck, T.; Demirgüç-Kunt, A.; Martinez-Peria, S. Reaching out: Access to and use of banking services across countries. J. Financ. Econ. 2007, 85, 234–266. [Google Scholar] [CrossRef] [Green Version]

- Australian Financial Centre Forum. Australia as a Financial Centre Building on our Strengths. 2009. Available online: https://trove.nla.gov.au/work/36802810 (accessed on 15 October 2022).

- Owen, A.L.; Pereira, J.M. Bank Concentration, Competition, and Financial Inclusion. Rev. Dev. Finance. 2018, 8, 1–17. [Google Scholar] [CrossRef]

- De Sousa, M.M. Financial Inclusion and Global Regulatory Standards: An Empirical Study Across Developing Economies. CIGI Working Paper No. 7. 2015. Available online: https://www.cigionline.org/static/documents/new_thinking_g20_no7.pdf (accessed on 20 October 2022).

- Hao, Z.; Zhang, X.; Wei, J. Research on the effect of enterprise financial flexibility on sustainable innovation. J. Innov. Knowl. 2022, 7, 100184. [Google Scholar] [CrossRef]

- Kpodar, K.; Andrianaivo, M. ICT, Financial Inclusion, and Growth Evidence from African Countries; IMF Working Papers; International Monetary Fund: Washington, DC, USA, 2011. [Google Scholar] [CrossRef]

- Ye, Y.; Chen, S.; Li, C. Financial technology as a driver of poverty alleviation in China: Evidence from an innovative regression approach. J. Innov. Knowl. 2022, 7, 100164. [Google Scholar] [CrossRef]

- Sha’ban, M.; Claudia Girardone, C.; Sarkisyan, A. Cross-country variation in financial inclusion: A global perspective. Eur. J. Financ. 2020, 26, 319–340. [Google Scholar] [CrossRef]

- Lenka, S.K.; Barik, R. Has expansion of mobile phone and internet use spurred financial inclusion in the SAARC countries? Financ. Innov. 2018, 4, 5. [Google Scholar] [CrossRef] [Green Version]

- Sharma, D. Nexus between financial inclusion and economic growth: Evidence from the emerging Indian economy. J. Financ. Econ. 2016, 8, 13–36. [Google Scholar] [CrossRef]

- Siddik, M.N.A. Does financial permeation induce economic growth? Evidence from SAARC countries. Glob. Bus. Rev. 2019, 097215091882495. [Google Scholar] [CrossRef]

- Omar, M.A.; Inaba, K. Does financial inclusion reduce poverty and income inequality in developing countries? A panel data analysis. J. Econ. Struct. 2020, 9, 9–37. [Google Scholar] [CrossRef]

- Olowofeso, E.O.; Adeleke, A.O.; Udoji, A.O. Impact of private sector credit on economic growth in Nigeria. CBN J. Appl. Stat. 2015, 6, 81–101. [Google Scholar]

- Chatterjee, A. Financial inclusion, information and communication technology diffusion, and economic growth: A panel data analysis. Inf. Technol. Dev. 2020, 26, 607–635. [Google Scholar] [CrossRef]

- Rojas-Suarez, L.; Amado, M. Understanding Latin America’s Financial Inclusion Gap; Center for Global Development Working Paper 367; Center for Global Development: Washington, DC, USA, 2014; Available online: http://www.cgdev.org/sites/default/files/latin-american-financial-inclusion-gap.pdf (accessed on 8 October 2022).

- Dabla-Norris, E.; Deng, Y.; Ivanova, A.; Karpowicz, I.; Unsal, F.D.; VanLeemput, E.; Wong, J.; Srinivasan, K. Financial Inclusion: Zooming in on Latin America; IMF Working Paper; International Monetary Fund: Washington, DC, USA, 2015. [Google Scholar]

- Lenka, S.K.; Bairwa, A.K. Does financial inclusion affect monetary policy in SAARC countries? Cogent Econ. Finance. 2016, 4, 1127011. [Google Scholar] [CrossRef] [Green Version]

- Durai, T.; Stella, G. Digital finance and its impact on financial inclusion. J. Emerg. Technol. Innov. 2019, 6, 122–127. [Google Scholar]

- Bayar, Y.; Gavriletea, M.D.; Păun, D. Impact of mobile phones and internet use on financial inclusion: Empirical evidence from the EU post-communist countries. Technol. Econ. Dev. Econ. 2021, 27, 722–741. [Google Scholar] [CrossRef]

- David, O.O.; Oluseyi, A.S.; Emmanuel, A. Empirical analysis of the determinants of financial inclusion in Nigeria: 1990-2016. J. Financ. Econ. 2018, 6, 19–25. [Google Scholar]

- Chauvet, L.; Jacolin, L. Financial inclusion, bank concentration, and firm performance. World Dev. 2017, 97, 1–13. [Google Scholar] [CrossRef]

- Hannig, A.; Jansen, S. Financial Inclusion and Financial Stability: Current Policy Issues; ADBI Working Paper Series No. 259; Asian Development Bank Institute: Tokyo, Japan, 2010. [Google Scholar]

- Bhaskar, P.V. Financial inclusion in India—An assessment. J. Financ. 2013, 2–3. Available online: https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/04FS090114SF.pdf (accessed on 14 August 2022).

- Levin, A.; Lin, C.F.; Chu, C.-S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Maddala, G.; Wu, S. A comparative study of unit root tests and a new factors. J. Econom. 1999, 122, 81–126. [Google Scholar]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Torres-Reyna, O. Panel Data Analysis Fixed and Random Effects Using Stata (v. 4.2). Data & Statistical Services. 2007. Available online: https://www.princeton.edu/~otorres/Panel101.pdf (accessed on 5 October 2022).

- Greene, W.H. Fixed and Random Effects in Nonlinear Models. NYU Working Paper No. EC-01-01. 2001. Available online: https://ssrn.com/abstract=1292666 (accessed on 14 September 2022).

- Kwiatkowski, D.; Phillips, P.C.B.; Schmidt, P.; Shin, Y. Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? J. Econom. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Bierens, H.J.; Guo, S. Testing stationarity and trend stationarity against the unit root hypothesis. Econom Rev. 1993, 12, 1–32. [Google Scholar] [CrossRef]

- Mutl, J.; Pfaffermayr, M. The Hausman test in a Cliff and Ord panel model. Econom. J. 2011, 14, 48–76. [Google Scholar] [CrossRef]

- Hausman, J.A. Specification tests in econometrics. Econom. J. Econom. Soc. 1978, 1251–1271. [Google Scholar] [CrossRef] [Green Version]

- Clark, T.S.; Linzer, D.A. Should I use fixed or random effects? Political Sci. Res. Meth. 2015, 3, 399–408. [Google Scholar] [CrossRef] [Green Version]

- Duncombe, R.; Boateng, R. Mobile phones and financial services in developing countries: A review of concepts, methods, issues, evidence and future research directions. Third World Q. 2009, 30, 1237–1258. [Google Scholar] [CrossRef]

- Chu, L. Determinants of financial inclusions: Comparing high, middle, and low–income countries. Econ. Bull. 2019, 39, 1449–1457. [Google Scholar]

- Tuesta, D.; Sorensen, G.; Haring, A.; Camara, N. Financial Inclusion and Its Determinants: The Case of Argentina. BBVA Research Working Paper No. 15/03. 2015. Available online: https://www.bbvaresearch.com/wp-content/uploads/2015/01/WP_15-03_Financial-Inclusion-in-Argentina.pdf (accessed on 25 October 2022).

- Bhuvana, M.; Vasantha, S.; Bharath, R. Information and Communication Technology (ICT)–A drive for financial inclusion. J. Chem. Pharm. Sci. 2016, 9, 1885–1889. [Google Scholar]

- Brandon, L.B. Beyond “fixed versus random effects”: A framework for improving substantive and statistical analysis of panel, time-series cross-sectional, and multilevel data, "political methodology conference. Soc. Political Methodol. 2008, 9, 1–23. [Google Scholar]

- Nasir, M.A.; Balsalobre-Lorente, D.; Huynh, T.L.D. Anchoring inflation expectations in the face of oil shocks & in the proximity of ZLB: A tale of two targeters. Energy Econ. 2020, 86, 1–28. [Google Scholar]

- Kohler, U.; Kreuter, F. Data Analysis Using Stata, 2nd ed.; Stata Press Books; StataCorp LP: College Station, TX, USA, 2009. [Google Scholar]

- Iqbal, B.A.; Sami, S. Role of banks in financial inclusion in India. Contad. Adm. 2017, 62, 644–656. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Financial Intermediation and Economic Development. In Capital Markets and Financial Intermediation; Cambridge University Press: Cambridge, UK, 1993; pp. 156–189. Available online: http://faculty.haas.berkeley.edu/ross_levine/Papers/1993_Book_Mayer_Intermediation.pdf (accessed on 2 September 2022).

- Dabla-Norris, E.; Ji, Y.; Townsend, R.; Unsal, U. Identifying Constraints to Financial Inclusion and Their Impact on GDP and Inequality (IMF Working Paper); International Monetary Fund: Washington, DC, USA, 2015. [Google Scholar]

| LLC | ATM | DCPFS | DCPSB | DEPO | ER | INFL | BB | GDP | IU | POP | ATM/User |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Without C and T | 1.19808 (0.8846) | 2.84695 (0.9978) | 0.95274 (0.8296) | 3.94267 (1.0000) | 0.96745 (0.8333) | −1.4728 (0.0704) | 7.29784 (1.0000) | 4.66632 (1.0000) | 8.63505 (1.0000) | 11.4892 (1.0000) | 0.80662 (0.7901) |

| With C | 6.6666 (1.0000) | 5.34001 (1.0000) | 0.81523 (0.7925) | 18.1093 (1.0000) | 7.22215 (1.0000) | −3.1003 (0.0010) | 3.07696 (0.9990) | −4.06938 (0.0000) | −5.32916 (0.0000) | 36.6246 (1.0000) | 179.727 (1.0000) |

| With C and T | 37.1606 (1.0000) | 12.3989 (1.0000) | 13.2268 (1.0000) | 25.9219 (1.0000) | 8.69718 (1.0000) | −2.9854 (0.0014) | 12.8400 (1.0000) | 7.04157 (1.0000) | 4.44680 (1.0000) | 2103.29 (1.0000) | 571.303 (1.0000) |

| Im, Pesaran and Shin | |||||||||||

| Without C and T | |||||||||||

| With C | 0.58515 (0.7208) | 1.69064 (0.9545) | −0.42671 (0.3348) | 6.36271 (1.0000) | 1.42691 (0.9232) | −2.53044 (0.0057) | 1.01126 (0.8441) | −2.39184 (0.0084) | −2.66975 (0.0038) | 4.87271 (1.0000) | −1.12864 (0.1295) |

| With C and T | 2.01280 (0.9779) | −0.11476 (0.4543) | 0.80769 (0.7904) | 2.26659 (0.9883) | 0.33478 (0.6311) | −1.64375 (0.0501) | 0.72765 (0.7666) | 0.64289 (0.7399) | −0.09343 (0.4628) | −1.23924 (0.1076) | 1.61997 (0.9474) |

| ADF | |||||||||||

| Without C and T | 1.29021 (0.9995) | 1.33730 (0.9994) | 3.80906 (0.9555) | 0.90730 (0.9999) | 2.63856 (0.9887) | 10.2073 (0.4225) | 2.61783 (0.9890) | 0.99557 (0.9998) | 0.02077 (1.0000) | 0.12635 (1.0000) | 4.82788 (0.9024) |

| With C | 10.4278 (0.4038) | 3.84149 (0.9542) | 13.3412 (0.2052) | 4.04089 (0.9455) | 3.54100 (0.9657) | 24.4425 (0.0065) | 1.01126 (0.8441) | −2.39184 (0.0084) | 30.0687 (0.0008) | 0.33955 (1.0000) | 15.6768 (0.1093) |

| With C and T | 3.02179 (0.9809) | 14.1422 (0.1666) | 11.2570 (0.3378) | 7.83733 (0.6447) | 6.68244 (0.7550) | 20.7143 (0.0232) | 0.72765 (0.7666) | 0.64289 (0.7399) | 14.3742 (0.1566) | 20.8800 (0.0219) | 6.75208 (0.7486) |

| PP | |||||||||||

| Without C and T | 29.1270 (0.0012) | 15.4556 (0.1163) | 10.4037 (0.4058) | 18.8968 (0.0416) | 16.4075 (0.0885) | 13.0559 (0.2206) | 6.93649 (0.7314) | 4.78824 (0.9049) | 4.32092 (0.9317) | 5.98884 (0.8162) | 40.0848 (0.0000) |

| With C | 34.1688 (0.0002) | 39.7516 (0.0000) | 43.4427 (0.0000) | 44.3710 (0.0000) | 35.9442 (0.0001) | 28.7323 (0.0014) | 36.2175 (0.0001) | 27.3641 (0.0023) | 23.9118 (0.0078) | 57.4836 (0.0000) | 55.7535 (0.0000) |

| With C and T | 46.9104 (0.0000) | 58.4410 (0.0000) | 62.2313 (0.0000) | 40.1362 (0.0000) | 60.2081 (0.0000) | 28.6216 (0.0014) | 43.3265 (0.0000) | 36.9007 (0.0001) | 80.0993 (0.0000) | 56.9510 (0.0000) | 19.7336 (0.0319) |

| LLC | ATM | DCPFS | DCPSB | DEPO | ER | INFL | BB | GDP | IU | POP | ATM/USER |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Without C and T | −2.81804 (0.0024) | −4.51705 (0.0000) | −5.01004 (0.0000) | 2.36869 (0.9911) | −4.99789 (0.0000) | −8.31360 (0.0000) | −2.26432 (0.0118) | −3.79540 (0.0001) | −4.28441 (0.0000) | 0.20579 (0.5815) | 7.31995 (0.0000) |

| With C | 40.9274 (1.0000) | 12.5357 (1.0000) | 14.0137 (1.0000) | 26.9693 (1.0000) | 10.7713 (1.0000) | −5.44396 (0.0000) | 13.7639 (1.0000) | 6.30723 (1.0000) | 8.92979 (1.0000) | 2374.23 (1.0000) | 668.597 (1.0000) |

| With C and T | 35.9735 (1.0000) | 13.8813 (1.0000) | 13.2249 (1.0000) | 62.1063 (1.0000) | 13.7106 (1.0000) | −6.50543 (0.0000) | 15.3341 (1.0000) | 7.87503 (1.0000) | 18.4844 (1.0000) | 141.823 (1.0000) | 752.513 (1.0000) |

| Im, Pesaran and Shin | |||||||||||

| Without C and T | |||||||||||

| With C | −0.45777 (0.3236) | −3.20043 (0.0007) | −2.05747 (0.0198) | 0.60310 (0.7268) | −1.75797 (0.0394) | −3.96392 (0.0000) | −1.75712 (0.0394) | −2.63346 (0.0042) | −2.50496 (0.0061) | −3.69523 (0.0001) | −0.93911 (0.1738) |

| With C and T | −0.78840 (0.2152) | −2.41456 (0.0079) | −2.27408 (0.0115) | 1.05672 (0.8547) | −0.32369 (0.3731) | −3.13261 (0.0009) | −1.42073 (0.0777) | −2.24169 (0.0125) | −0.94960 (0.1712) | 0.45522 (0.6755) | −0.82105 (0.2058) |

| ADF | |||||||||||

| Without C and T | 15.7901 (0.1058) | 29.1294 (0.0012) | 35.6639 (0.0001) | 17.0303 (0.0737) | 33.1368 (0.0003) | 60.0266 (0.0000) | 28.8920 (0.0013) | 33.4518 (0.0002) | 26.7645 (0.0028) | 12.1179 (0.2772) | 26.4407 (0.0032) |

| With C | 10.0062 (0.4399) | 28.7135 (0.0014) | 23.5864 (0.0088) | 10.8685 (0.3679) | 17.7364 (0.0596) | 33.8269 (0.0002) | 18.4819 (0.0474) | 24.4633 (0.0065) | 23.3056 (0.0097) | 32.1912 (0.0004) | 12.3081 (0.2650) |

| With C and T | 13.3659 (0.2039) | 22.9226 (0.0110) | 23.9728 (0.0077) | 4.86572 (0.9000) | 10.9790 (0.3592) | 28.4215 (0.0015) | 20.5404 (0.0245) | 22.9551 (0.0109) | 17.2800 (0.0684) | 9.86486 (0.2746) | 13.0062 (0.2233) |

| PP | |||||||||||

| Without C and T | 64.0861 (0.0000) | 68.7969 (0.0000) | 89.5589 (0.0000) | 53.4400 (0.0000) | 75.4641 (0.0000) | 71.8665 (0.0000) | 67.7947 (0.0000) | 65.6003 (0.0000) | 88.7803 (0.0000) | 73.4560 (0.0000) | 42.2895 (0.0000) |

| With C | 63.6961 (0.0000) | 78.2208 (0.0000) | 79.5951 (0.0000) | 58.6660 (0.0000) | 71.9093 (0.0000) | 51.2138 (0.0000) | 53.0021 (0.0000) | 66.3438 (0.0000) | 99.5154 (0.0000) | 56.7943 (0.0000) | 33.9392 (0.0002) |

| With C and T | 62.9860 (0.0000) | 82.0445 (0.0000) | 77.5300 (0.0000) | 57.7273 (0.0000) | 68.4164 (0.0000) | 54.0432 (0.0000) | 47.5186 (0.0000) | 77.9936 (0.0000) | 93.3361 (0.0000) | 55.2620 (0.0000) | 33.7663 (0.0002) |

| LLC | ATM | DCPFS | DCPSB | DEPO | ER | INFL | BB | GDP | IU | POP | ATM/ User |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Without C and T | −8.18609 (0.0000) | −10.3275 (0.0000) | −8.89980 (0.0000) | −4.03747 (0.0000) | −7.00968 (0.0000) | −11.0836 (0.0000) | −8.71464 (0.0000) | −11.3691 (0.0000) | −8.92335 (0.0000) | −22.9309 (0.0000) | −11.9405 (0.0000) |

| With C | 21.2301 (1.0000) | 5.24140 (1.0000) | 7.94936 (1.0000) | 52.3502 (1.0000) | 7.06820 (1.0000) | −8.82909 (0.0000) | 10.5664 (1.0000) | −2.01695 (0.0219) | 6.72571 (1.0000) | 2580.09 (1.0000) | 557.602 (1.0000) |

| With C and T | 20.9549 (1.0000) | 5.65905 (1.0000) | 9.90707 (1.0000) | 55.4134 (1.0000) | 7.52763 (1.0000) | −7.24729 (0.0000) | 13.5671 (1.0000) | −2.00431 (0.0225) | 9.46400 (1.0000) | 77.5186 (1.0000) | 615.695 (1.0000) |

| Im, Pesaran and Shin | |||||||||||

| Without C and T | |||||||||||

| With C | −4.45103 (0.0000) | −5.97929 (0.0000) | −4.56204 (0.0000) | −1.21276 (0.1126) | −2.90779 (0.0018) | −5.43773 (0.0000) | −4.41986 (0.0000) | −5.86351 (0.0000) | −4.89460 (0.0000) | −3.88355 (0.0001) | −3.79194 (0.0001) |

| With C and T | −2.55972 (0.0052) | −3.75924 (0.0001) | −2.19156 (0.0142) | −0.04195 (0.4833) | −1.08611 (0.1387) | −2.92360 (0.0017) | −2.54519 (0.0055) | −2.88170 (0.0020) | −2.90666 (0.0018) | −5.14313 (0.0000) | −1.62446 (0.0521) |

| ADF | |||||||||||

| Without C and T | 59.8919 (0.0000) | 78.0699 (0.0000) | 63.3855 (0.0000) | 32.1116 (0.0004) | 49.6085 (0.0000) | 74.5576 (0.0000) | 63.2309 (0.0000) | 65.5357 (0.0000) | 69.4423 (0.0000) | 65.6961 (0.0000) | 57.4444 (0.0000) |

| With C | 38.9131 (0.0000) | 48.4024 (0.0000) | 38.6851 (0.0000) | 15.8001 (0.1055) | 26.7450 (0.0029) | 44.9350 (0.0000) | 37.7208 (0.0000) | 46.1430 (0.0000) | 43.5374 (0.0000) | 36.8605 (0.0001) | 33.2521 (0.0002) |

| With C and T | 30.4908 (0.0007) | 35.6813 (0.0001) | 24.0469 (0.0075) | 10.3584 (0.4096) | 17.0121 (0.0741) | 29.9309 (0.0009) | 26.8375 (0.0028) | 28.6121 (0.0014) | 29.9999 (0.0009) | 32.1255 (0.0001) | 20.2019 (0.0274) |

| PP | |||||||||||

| Without C and T | 89.8553 (0.0000) | 96.0283 (0.0000) | 86.5876 (0.0000) | 61.6247 (0.0000) | 87.1887 (0.0000) | 92.5230 (0.0000) | 77.4615 (0.0000) | 95.2717 (0.0000) | 95.2111 (0.0000) | 60.1991 (0.0000) | 70.1315 (0.0000) |

| With C | 76.1645 (0.0000) | 108.656 (0.0000) | 96.8579 (0.0000) | 65.2886 (0.0000) | 77.3801 (0.0000) | 90.7456 (0.0000) | 72.5153 (0.0000) | 102.562 (0.0000) | 94.6752 (0.0000) | 56.2480 (0.0000) | 65.7413 (0.0000) |

| With C and T | 74.8204 (0.0000) | 91.5914 (0.0000) | 90.6683 (0.0000) | 60.5010 (0.0000) | 69.9152 (0.0000) | 70.0087 (0.0000) | 69.4405 (0.0000) | 81.2396 (0.0000) | 88.8257 (0.0000) | 56.2327 (0.0000) | 49.3571 (0.0000) |

| 5.1 Cross-Section Random Effect | 5.2 Fixed Effect | 5.3 Without Fixed and Random Effect | ||||

|---|---|---|---|---|---|---|

| Variable | Coefficient | t-Statistic | Coefficient | t-Statistic | Coefficient | t-Statistic |

| Domestic Credit to Financial Sector | 3.291181 | 1.102465 (0.2748) | 1.357233 | 0.381075 (0.7046) | 7.197453 | 2.9597 * (0.0045) |

| Domestic Credit to Private Sector | −8.281807 | −1.599206 (0.1152) | −3.325062 | −0.465988 (0.6431) | −14.01716 | −5.25137 * (0.0000) |

| Exchange Rate | −2.709269 | −0.919437 (0.3617) | −4.217192 | −1.253087 (0.2156) | −1.437202 | −0.548958 (0.5851) |

| Inflation Rate | −270.0783 | −0.284451 (0.7771) | −432.5921 | −0.431500 (0.6678) | −537.1401 | −0.522219 (0.6035) |

| No. of Bank Branches | 8.141914 | 0.779224 (0.4390) | 4.392642 | 0.398039 (0.6922) | 23.46507 | 2.27552 ** (0.0266) |

| Gross Domestic Product | −217.9722 | −1.7158 *** (0.0915) | −273.7548 | −1.719 *** (0.0913) | −384.5451 | −4.75780 * (0.0000) |

| Internet Users | 204.4143 | 3.563590 * (0.0007) | 225.1530 | 3.5733 * (0.0008) | 212.9717 | 3.5327 * (0.0008) |

| Population | 157.9973 | 2.211612 ** (0.0309) | 161.9981 | 1.954453 *** (0.0558) | 228.9801 | 4.8381 * (0.0000) |

| C | −3078.858 | −2.737549 * (0.0082) | −2816.191 | −2.150041 ** (0.0360) | −2347.067 | −3.1174 * (0.0028) |

| Cross-section random S.D./Rho | 257.5897 (0.6751) | |||||

| Idiosyncratic random S.D./Rho | 178.6883 (0.3249) | |||||

| R-squared | 0.403409 | 0.838095 | 0.782438 | |||

| Adjusted R-squared | 0.321121 | 0.802116 | 0.752429 | |||

| S.E. of regression | 181.0207 | 182.4858 | 204.1143 | |||

| F-statistic | 4.902385 (0.000118) | 23.29407 (0.000000) | 26.07382 (0.000000) | |||

| Akaike info criterion | 13.42357 | 13.59964 | ||||

| Schwarz criterion | 13.85135 | 13.89580 | ||||

| 6.1 Cross-Section Random Effect | 6.2 Fixed Effect | 6.3 Without Fixed and Random Effect | ||||

|---|---|---|---|---|---|---|

| Variable | Coefficient | t-Statistic | Coefficient | t-Statistic | Coefficient | t-Statistic |

| Domestic Credit to Financial Sector | −0.014457 | −1.754396 *** (0.0845) | −0.014520 | −1.500900 (0.1390) | −0.022003 | −3.189650 * (0.0023) |

| Domestic Credit to Private Sector | 0.033828 | 2.658788 ** (0.0100) | 0.036698 | 2.237329 ** (0.0293) | 0.037831 | 4.986724 * (0.0000) |

| Exchange Rate | 0.029540 | 3.730900 * (0.0004) | 0.027592 | 3.193083 * (0.0023) | 0.036897 | 4.957580 * (0.0000) |

| Inflation Rate | −2.516099 | −0.917280 (0.3627) | −2.927792 | −0.998179 (0.3225) | −1.205760 | −0.413739 (0.6805) |

| No. of Bank Branches | 0.025306 | 0.881366 (0.3816) | 0.028357 | 0.919545 (0.3618) | 0.012471 | 0.444567 (0.6582) |

| Gross Domestic Product | 1.317503 | 3.802321 * (0.0003) | 1.148383 | 2.664574 ** (0.0101) | 1.821702 | 8.131877 * (0.0000) |

| Internet Users | −0.247697 | −1.498354 (0.1393) | −0.203865 | −1.119164 (0.2678) | −0.351417 | −2.134441 ** (0.0369) |

| Population | −0.953691 | −4.847351 * (0.0000) | −0.904078 | −3.744875 * (0.0004) | −1.182962 | −8.823982 ** (0.0000) |

| C | 3.634187 | 1.175361 (0.2445) | 4.141161 | 1.133064 (0.2620) | 3.041411 | 1.425740 (0.1591) |

| Cross-section random S.D./Rho | 0.613498 (0.5793) | |||||

| Idiosyncratic random S.D./Rho | 0.522860 (0.4207) | |||||

| R-squared | 0.701333 | 0.874595 | 0.846138 | |||

| Adjusted R-squared | 0.661511 | 0.847723 | 0.825623 | |||

| S.E. of regression | 0.533436 | 0.542655 | 0.580700 | |||

| F-statistic | 17.61161 (0.000000) | 32.54622 (0.000000) | 41.24492 (0.000000) | |||

| Akaike info criterion | 1.783371 | 1.871941 | ||||

| Schwarz criterion | 2.204290 | 2.163347 | ||||

| Hypotheses | Model | ||

|---|---|---|---|

| 1 | 2 | 3 | |

| H1a | Supported | Supported | Supported |

| H1b | Supported | Supported | Supported |

| H2a | Not-Supported | Not-Supported | Not-Supported |

| H2b | Supported | Supported | Supported |

| H3a | Not-Supported | Not-Supported | Not-Supported |

| H3b | Supported | Supported | Supported |

| H4a | Supported | Supported | Supported |

| H4b | Not-Supported | Not-Supported | Not-Supported |

| H5a | Not-Supported | Not-Supported | Not-Supported |

| H5b | Supported | Supported | Supported |

| H6a | Supported | Supported | Supported |

| H6b | Not-Supported | Not-Supported | Not-Supported |

| H7a | Not-Supported | Not-Supported | Not-Supported |

| H7b | Supported | Supported | Supported |

| H8a | Supported | Supported | Supported |

| H8b | Not-Supported | Not-Supported | Not-Supported |

| Variable | Chi.Square-Statistics | Degree of Freedom | Prob. |

|---|---|---|---|

| ATM per User | 7.545030 | 8 | 0.4791 |

| Depositor | 6.030604 | 8 | 0.6438 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pandey, A.; Kiran, R.; Sharma, R.K. Investigating the Determinants of Financial Inclusion in BRICS Economies: Panel Data Analysis Using Fixed-Effect and Cross-Section Random Effect. Sustainability 2023, 15, 1603. https://doi.org/10.3390/su15021603

Pandey A, Kiran R, Sharma RK. Investigating the Determinants of Financial Inclusion in BRICS Economies: Panel Data Analysis Using Fixed-Effect and Cross-Section Random Effect. Sustainability. 2023; 15(2):1603. https://doi.org/10.3390/su15021603

Chicago/Turabian StylePandey, Amit, Ravi Kiran, and Rakesh Kumar Sharma. 2023. "Investigating the Determinants of Financial Inclusion in BRICS Economies: Panel Data Analysis Using Fixed-Effect and Cross-Section Random Effect" Sustainability 15, no. 2: 1603. https://doi.org/10.3390/su15021603