The Impact of Production and Operations Management Practices in Improving Organizational Performance: The Mediating Role of Supply Chain Integration

Abstract

:1. Introduction

- What is the effect of POM practices on SCM integration and organizational financial performance?

- Does SCM integration mediate the relationship between POM practices and organizational performance?

2. Literature Review and Hypothesis

2.1. Theoretical Framework

2.2. POM Practices and SCM Integration

2.3. POM Practices and Organizational Financial Performance

2.4. SCM Integration and Organizational Financial Performance

2.5. The Mediation Effect of SCM Integration

3. Methodology

3.1. Sample and Data Collection Procedure

3.2. Measurement

3.3. Common Method Variance

3.4. Statistical and Analytic Approaches

4. Analysis and Results

4.1. Measurement Model Assessment

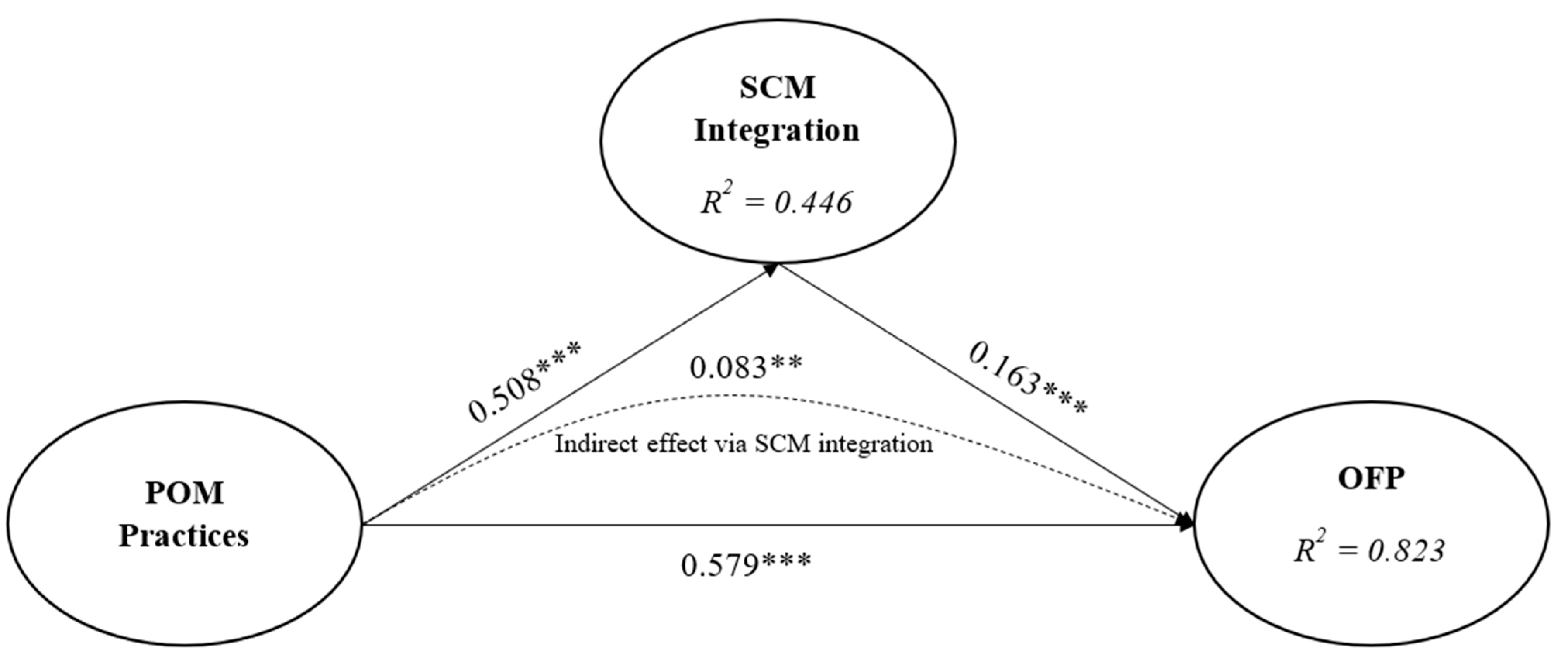

4.2. Structural Model Assessment

5. Discussion and Implications

5.1. Discussion

5.2. Theoretical Implication

5.3. Managerial Implications

5.4. Limitations and Directions for Future Research

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kouvelis, P.; Chambers, C.; Wang, H. Supply Chain Management Research and Production and Operations Management: Review, Trends, and Opportunities. Prod. Oper. Manag. 2006, 15, 449–469. [Google Scholar] [CrossRef]

- Mentzer, J.T.; Stank, T.P.; Esper, T.L. Supply Chain Management and Its Relationship to Logistics, Marketing, Production, and Operations Management. J. Bus. Logist. 2008, 29, 31–46. [Google Scholar] [CrossRef]

- Helmold, M.; Terry, B. Operations Management 4.0. In Operations and Supply Management 4.0: Industry Insights, Case Studies and Best Practices; Helmold, M., Terry, B., Eds.; Future of Business and Finance; Springer International Publishing: Cham, Switzerland, 2021; pp. 21–34. ISBN 978-3-030-68696-3. [Google Scholar]

- Mentzer, J.T.; DeWitt, W.; Keebler, J.S.; Min, S.; Nix, N.W.; Smith, C.D.; Zacharia, Z.G. Defining Supply Chain Management. J. Bus. Logist. 2001, 22, 1–25. [Google Scholar] [CrossRef]

- Ivanov, D.; Tsipoulanidis, A.; Schönberger, J. Basics of Supply Chain and Operations Management. In Global Supply Chain and Operations Management: A Decision-Oriented Introduction to the Creation of Value; Ivanov, D., Tsipoulanidis, A., Schönberger, J., Eds.; Springer Texts in Business and Economics; Springer International Publishing: Cham, Switzerland, 2021; pp. 3–19. ISBN 978-3-030-72331-6. [Google Scholar]

- Islami, X. How to Integrate Organizational Instruments? The Mediation of HRM Practices Effect on Organizational Performance by SCM Practices. Prod. Manuf. Res. 2021, 9, 206–240. [Google Scholar] [CrossRef]

- Dolgui, A.; Proth, J.-M. Supply Chain Engineering: Useful Methods and Techniques; Springer: London, UK; Dordrecht, The Netherlands; Heidelberg, Germany; New York, NY, USA, 2010; ISBN 978-1-84996-016-8. [Google Scholar]

- Gimenez, C.; Ventura, E. Logistics-production, Logistics-marketing and External Integration: Their Impact on Performance. Int. J. Oper. Prod. Manag. 2005, 25, 20–38. [Google Scholar] [CrossRef]

- Sarkar, M.; Chung, B.D. Flexible Work-in-Process Production System in Supply Chain Management under Quality Improvement. Int. J. Prod. Res. 2020, 58, 3821–3838. [Google Scholar] [CrossRef]

- Chandra, C.; Kumar, S. Supply Chain Management in Theory and Practice:A Passing Fad or a Fundamental Change? Ind. Manag. Data Syst. 2000, 100, 100–114. [Google Scholar] [CrossRef]

- Emeagwali, O.L.; Aljuhmani, H.Y. Introductory Chapter: Strategic Management—A Dynamic Approach. In Strategic Management: A Dynamic View; IntechOpen: London, UK, 2019; ISBN 978-1-83962-505-3. [Google Scholar]

- Mostepaniuk, A.; Nasr, E.; Awwad, R.I.; Hamdan, S.; Aljuhmani, H.Y. Managing a Relationship between Corporate Social Responsibility and Sustainability: A Systematic Review. Sustainability 2022, 14, 11203. [Google Scholar] [CrossRef]

- Chang, W.; Ellinger, A.E.; Kim, K.; Franke, G.R. Supply Chain Integration and Firm Financial Performance: A Meta-Analysis of Positional Advantage Mediation and Moderating Factors. Eur. Manag. J. 2016, 34, 282–295. [Google Scholar] [CrossRef]

- Flynn, B.B.; Huo, B.; Zhao, X. The Impact of Supply Chain Integration on Performance: A Contingency and Configuration Approach. J. Oper. Manag. 2010, 28, 58–71. [Google Scholar] [CrossRef]

- Dao, A.M.; Walker, B.; Strickler, C. Impact of Operations Management Practices on Firm Performance: An Empirical Analysis at Vietnam’s Mechanical Firms. Int. J. Bus. Appl. Sci. 2020, 9, 14–21. [Google Scholar]

- Sharma, S.; Modgil, S. TQM, SCM and Operational Performance: An Empirical Study of Indian Pharmaceutical Industry. Bus. Process Manag. J. 2019, 26, 331–370. [Google Scholar] [CrossRef]

- Kannan, V.R.; Tan, K.C. Just in Time, Total Quality Management, and Supply Chain Management: Understanding Their Linkages and Impact on Business Performance. Omega 2005, 33, 153–162. [Google Scholar] [CrossRef]

- Qi, Y.; Huo, B.; Wang, Z.; Yeung, H.Y.J. The Impact of Operations and Supply Chain Strategies on Integration and Performance. Int. J. Prod. Econ. 2017, 185, 162–174. [Google Scholar] [CrossRef]

- Zhang, M.; Guo, H.; Huo, B.; Zhao, X.; Huang, J. Linking Supply Chain Quality Integration with Mass Customization and Product Modularity. Int. J. Prod. Econ. 2019, 207, 227–235. [Google Scholar] [CrossRef]

- Iqbal, T. The Effect of Operations Management Practices on the Competitive Advantages of SMEs: A Mediating Role of Supply Chain Management Practices. Uncertain Supply Chain. Manag. 2020, 8, 649–662. [Google Scholar] [CrossRef]

- Gupta, M.; Gupta, S. Influence of National Cultures on Operations Management and Supply Chain Management Practices—A Research Agenda. Prod. Oper. Manag. 2019, 28, 2681–2698. [Google Scholar] [CrossRef]

- Kotzab, H.; Bäumler, I.; Gerken, P. The Big Picture on Supply Chain Integration—Insights from a Bibliometric Analysis. Supply Chain. Manag. Int. J. 2021, 28, 25–54. [Google Scholar] [CrossRef]

- Danese, P.; Molinaro, M.; Romano, P. Investigating Fit in Supply Chain Integration: A Systematic Literature Review on Context, Practices, Performance Links. J. Purch. Supply Manag. 2020, 26, 100634. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Chahal, H.; Gupta, M.; Bhan, N.; Cheng, T.C.E. Operations Management Research Grounded in the Resource-Based View: A Meta-Analysis. Int. J. Prod. Econ. 2020, 230, 107805. [Google Scholar] [CrossRef]

- Hitt, M.A.; Xu, K.; Carnes, C.M. Resource Based Theory in Operations Management Research. J. Oper. Manag. 2016, 41, 77–94. [Google Scholar] [CrossRef]

- Bromiley, P.; Rau, D. Operations Management and the Resource Based View: Another View. J. Oper. Manag. 2016, 41, 95–106. [Google Scholar] [CrossRef]

- Skinner, W. Manufacturing—Missing Link in Corporate Strategy. Harv. Bus. Rev. 1969, 39, 704–719. [Google Scholar]

- Perez-Franco, R.; Phadnis, S.; Caplice, C.; Sheffi, Y. Rethinking Supply Chain Strategy as a Conceptual System. Int. J. Prod. Econ. 2016, 182, 384–396. [Google Scholar] [CrossRef]

- Macchion, L.; Moretto, A.; Caniato, F.; Caridi, M.; Danese, P.; Vinelli, A. Production and Supply Network Strategies within the Fashion Industry. Int. J. Prod. Econ. 2015, 163, 173–188. [Google Scholar] [CrossRef]

- Oakland, J.S. Total Quality Management and Operational Excellence: Text with Cases, 4th ed.; Routledge: New York, NY, USA, 2014; ISBN 978-0-415-63550-9. [Google Scholar]

- Lambert, D.; Stock, J.R.; Ellram, L.M. Fundamentals of Logistics Management, 1st ed.; McGraw-Hill/Irwin: Boston, MA, USA, 1997; ISBN 978-0-256-14117-7. [Google Scholar]

- Womack, J.P.; Jones, D.T.; Roos, D. The Machine That Changed the World; Rawson Associates: New York, NY, USA, 1990; ISBN 978-0-89256-350-0. [Google Scholar]

- Hayes, R.H.; Wheelwright, S.C. Restoring Our Competitive Edge: Competing through Manufacturing, 1st ed.; Wiley: New York, NY, USA, 1984; ISBN 978-0-471-05159-6. [Google Scholar]

- Zhou, L.; Jiang, Z.; Geng, N.; Niu, Y.; Cui, F.; Liu, K.; Qi, N. Production and Operations Management for Intelligent Manufacturing: A Systematic Literature Review. Int. J. Prod. Res. 2022, 60, 808–846. [Google Scholar] [CrossRef]

- Velasco Acosta, A.P.; Mascle, C.; Baptiste, P. Applicability of Demand-Driven MRP in a Complex Manufacturing Environment. Int. J. Prod. Res. 2020, 58, 4233–4245. [Google Scholar] [CrossRef]

- Miclo, R.; Lauras, M.; Fontanili, F.; Lamothe, J.; Melnyk, S.A. Demand Driven MRP: Assessment of a New Approach to Materials Management. Int. J. Prod. Res. 2019, 57, 166–181. [Google Scholar] [CrossRef]

- Alzoubi, H.M.; In’airat, M.; Ahmed, G. Investigating the Impact of Total Quality Management Practices and Six Sigma Processes to Enhance the Quality and Reduce the Cost of Quality: The Case of Dubai. Int. J. Bus. Excell. 2022, 27, 94–109. [Google Scholar] [CrossRef]

- Kumar, P.; Maiti, J.; Gunasekaran, A. Impact of Quality Management Systems on Firm Performance. Int. J. Qual. Reliab. Manag. 2018, 35, 1034–1059. [Google Scholar] [CrossRef]

- Al-Hyari, K. Lean Bundles within Jordanian Manufacturing SMEs and Their Effect on Business Performance. Probl. Perspect. Manag. 2020, 18, 302–315. [Google Scholar] [CrossRef]

- Thai, V.; Jie, F. The Impact of Total Quality Management and Supply Chain Integration on Firm Performance of Container Shipping Companies in Singapore. Asia Pac. J. Mark. Logist. 2018, 30, 605–626. [Google Scholar] [CrossRef]

- Tarn, J.M.; Yen, D.C.; Beaumont, M. Exploring the Rationales for ERP and SCM Integration. Ind. Manag. Data Syst. 2002, 102, 26–34. [Google Scholar] [CrossRef]

- Tarigan, Z.J.H.; Siagian, H.; Jie, F. Impact of Enhanced Enterprise Resource Planning (ERP) on Firm Performance through Green Supply Chain Management. Sustainability 2021, 13, 4358. [Google Scholar] [CrossRef]

- Sundtoft Hald, K.; Mouritsen, J. Enterprise Resource Planning, Operations and Management: Enabling and Constraining ERP and the Role of the Production and Operations Manager. Int. J. Oper. Prod. Manag. 2013, 33, 1075–1104. [Google Scholar] [CrossRef]

- Moyano-Fuentes, J.; Maqueira-Marín, J.M.; Martínez-Jurado, P.J.; Sacristán-Díaz, M. Extending Lean Management along the Supply Chain: Impact on Efficiency. J. Manuf. Technol. Manag. 2020, 32, 63–84. [Google Scholar] [CrossRef]

- Csiki, O.; Demeter, K.; Losonci, D. How to Improve Firm Performance?—The Role of Production Capabilities and Routines. Int. J. Oper. Prod. Manag. 2023, 43, 1–26. [Google Scholar] [CrossRef]

- Fullerton, R.R.; McWatters, C.S.; Fawson, C. An Examination of the Relationships between JIT and Financial Performance. J. Oper. Manag. 2003, 21, 383–404. [Google Scholar] [CrossRef]

- Sheng, H.; Feng, T.; Liu, L. The Influence of Digital Transformation on Low-Carbon Operations Management Practices and Performance: Does CEO Ambivalence Matter? Int. J. Prod. Res. 2023, 61, 6215–6229. [Google Scholar] [CrossRef]

- Frohlich, M.T.; Westbrook, R. Arcs of Integration: An International Study of Supply Chain Strategies. J. Oper. Manag. 2001, 19, 185–200. [Google Scholar] [CrossRef]

- Narasimhan, R.; Kim, S.W. Effect of Supply Chain Integration on the Relationship between Diversification and Performance: Evidence from Japanese and Korean Firms. J. Oper. Manag. 2002, 20, 303–323. [Google Scholar] [CrossRef]

- Droge, C.; Jayaram, J.; Vickery, S.K. The Effects of Internal versus External Integration Practices on Time-Based Performance and Overall Firm Performance. J. Oper. Manag. 2004, 22, 557–573. [Google Scholar] [CrossRef]

- Zhao, G.; Feng, T.; Wang, D. Is More Supply Chain Integration Always Beneficial to Financial Performance? Ind. Mark. Manag. 2015, 45, 162–172. [Google Scholar] [CrossRef]

- Swink, M.; Narasimhan, R.; Wang, C. Managing beyond the Factory Walls: Effects of Four Types of Strategic Integration on Manufacturing Plant Performance. J. Oper. Manag. 2007, 25, 148–164. [Google Scholar] [CrossRef]

- Ayoub, H.F.; Abdallah, A.B.; Suifan, T.S. The Effect of Supply Chain Integration on Technical Innovation in Jordan: The Mediating Role of Knowledge Management. Benchmarking Int. J. 2017, 24, 594–616. [Google Scholar] [CrossRef]

- Marty, J. Consumer/User/Customer Integration in Supply Chain Management: A Review and Bibliometric Analysis. Supply Chain. Forum Int. J. 2022, 23, 181–196. [Google Scholar] [CrossRef]

- Huo, B.; Zhao, X.; Lai, F. Supply Chain Quality Integration: Antecedents and Consequences. IEEE Trans. Eng. Manag. 2014, 61, 38–51. [Google Scholar] [CrossRef]

- Soares, A.; Soltani, E.; Liao, Y.-Y. The Influence of Supply Chain Quality Management Practices on Quality Performance: An Empirical Investigation. Supply Chain. Manag. Int. J. 2017, 22, 122–144. [Google Scholar] [CrossRef]

- Abdallah, A.B.; Alhyari, S.; Alfar, N.A. Exploring the Impact of Supply Chain Quality Management on Market Performance: The Mediating Roles of Supply Chain Integration and Operational Performance. Bus. Process Manag. J. 2023, 29, 1159–1183. [Google Scholar] [CrossRef]

- Siagian, H.; Tarigan, Z.J.H.; Jie, F. Supply Chain Integration Enables Resilience, Flexibility, and Innovation to Improve Business Performance in COVID-19 Era. Sustainability 2021, 13, 4669. [Google Scholar] [CrossRef]

- Alsafadi, Y.; Aljuhmani, H.Y. The Influence of Entrepreneurial Innovations in Building Competitive Advantage: The Mediating Role of Entrepreneurial Thinking. Kybernetes 2023. ahead of print. [Google Scholar] [CrossRef]

- Huo, B. The Impact of Supply Chain Integration on Company Performance: An Organizational Capability Perspective. Supply Chain. Manag. Int. J. 2012, 17, 596–610. [Google Scholar] [CrossRef]

- Schoenherr, T.; Swink, M. Revisiting the Arcs of Integration: Cross-Validations and Extensions. J. Oper. Manag. 2012, 30, 99–115. [Google Scholar] [CrossRef]

- Verona, G. A Resource-Based View of Product Development. AMR 1999, 24, 132–142. [Google Scholar] [CrossRef]

- Kim, D.-Y. Relationship between Supply Chain Integration and Performance. Oper. Manag. Res. 2013, 6, 74–90. [Google Scholar] [CrossRef]

- Afshan, N.; Mandal, P.; Gunasekaran, A.; Motwani, J. Mediating Role of Immediate Performance Outcomes between Supply Chain Integration and Firm Performance. Asia Pac. J. Mark. Logist. 2021, 34, 669–687. [Google Scholar] [CrossRef]

- Wong, C.Y.; Wong, C.W.Y.; Boon-itt, S. Do Arcs of Integration Differ across Industries? Methodology Extension and Empirical Evidence from Thailand. Int. J. Prod. Econ. 2017, 183, 223–234. [Google Scholar] [CrossRef]

- Demeter, K.; Szász, L.; Rácz, B.-G. The Impact of Subsidiaries’ Internal and External Integration on Operational Performance. Int. J. Prod. Econ. 2016, 182, 73–85. [Google Scholar] [CrossRef]

- Kim, S.W. An Investigation on the Direct and Indirect Effect of Supply Chain Integration on Firm Performance. Int. J. Prod. Econ. 2009, 119, 328–346. [Google Scholar] [CrossRef]

- Koufteros, X.; Vonderembse, M.; Jayaram, J. Internal and External Integration for Product Development: The Contingency Effects of Uncertainty, Equivocality, and Platform Strategy. Decis. Sci. 2005, 36, 97–133. [Google Scholar] [CrossRef]

- Yu, W.; Jacobs, M.A.; Salisbury, W.D.; Enns, H. The Effects of Supply Chain Integration on Customer Satisfaction and Financial Performance: An Organizational Learning Perspective. Int. J. Prod. Econ. 2013, 146, 346–358. [Google Scholar] [CrossRef]

- Ataseven, C.; Nair, A. Assessment of Supply Chain Integration and Performance Relationships: A Meta-Analytic Investigation of the Literature. Int. J. Prod. Econ. 2017, 185, 252–265. [Google Scholar] [CrossRef]

- Syed, M.W.; Li, J.Z.; Junaid, M.; Ye, X.; Ziaullah, M. An Empirical Examination of Sustainable Supply Chain Risk and Integration Practices: A Performance-Based Evidence from Pakistan. Sustainability 2019, 11, 5334. [Google Scholar] [CrossRef]

- Pakurár, M.; Haddad, H.; Nagy, J.; Popp, J.; Oláh, J. The Impact of Supply Chain Integration and Internal Control on Financial Performance in the Jordanian Banking Sector. Sustainability 2019, 11, 1248. [Google Scholar] [CrossRef]

- Zhao, X.; Wang, P.; Pal, R. The Effects of Agro-Food Supply Chain Integration on Product Quality and Financial Performance: Evidence from Chinese Agro-Food Processing Business. Int. J. Prod. Econ. 2021, 231, 107832. [Google Scholar] [CrossRef]

- Liu, A.; Liu, H.; Gu, J. Linking Business Model Design and Operational Performance: The Mediating Role of Supply Chain Integration. Ind. Mark. Manag. 2021, 96, 60–70. [Google Scholar] [CrossRef]

- Kumar, V.; Jabarzadeh, Y.; Jeihouni, P.; Garza-Reyes, J.A. Learning Orientation and Innovation Performance: The Mediating Role of Operations Strategy and Supply Chain Integration. Supply Chain. Manag. Int. J. 2020, 25, 457–474. [Google Scholar] [CrossRef]

- Seyoum, B. Product Modularity and Performance in the Global Auto Industry in China: The Mediating Roles of Supply Chain Integration and Firm Relative Positional Advantage. Asia Pac. Bus. Rev. 2021, 27, 651–676. [Google Scholar] [CrossRef]

- Kwamega, M.; Li, D.; Abrokwah, E. Supply Chain Management Practices and Agribusiness Firms’ Performance: Mediating Role of Supply Chain Integration. S. Afr. J. Bus. Manag. 2018, 49, a317. [Google Scholar] [CrossRef]

- JCI Jordan Chamber of Industry. Available online: https://jci.org.jo/Chamber/sectors (accessed on 21 January 2022).

- Aljuhmani, H.Y.; Emeagwali, O.L.; Ababneh, B. The Relationships between CEOs’ Psychological Attributes, Top Management Team Behavioral Integration and Firm Performance. IJOTB 2021, 24, 126–145. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common Method Biases in Behavioral Research: A Critical Review of the Literature and Recommended Remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

- Aljuhmani, H.Y.; Emeagwali, O.L.; Ababneh, B. Revisiting the Miles and Snow Typology of Organizational Strategy: Uncovering Interrelationships between Strategic Decision-Making and Public Organizational Performance. Int. Rev. Public Adm. 2021, 26, 209–229. [Google Scholar] [CrossRef]

- Harman, H.H. Modern Factor Analysis, 3rd ed.; Revised; University of Chicago Press: Chicago, IL, USA, 1976; ISBN 978-0-226-31652-9. [Google Scholar]

- Shah, R.; Goldstein, S.M. Use of Structural Equation Modeling in Operations Management Research: Looking Back and Forward. J. Oper. Manag. 2006, 24, 148–169. [Google Scholar] [CrossRef]

- Kline, R.B. Principles and Practice of Structural Equation Modeling, 4th ed.; The Guilford Press: New York, NY, USA, 2015; ISBN 978-1-4625-2334-4. [Google Scholar]

- Bollen, K.A. Structural Equations with Latent Variables: Bollen/Structural Equations with Latent Variables; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 1989; ISBN 978-1-118-61917-9. [Google Scholar]

- Byrne, B.M. Structural Equation Modeling with AMOS: Basic Concepts, Applications, and Programming, 3rd ed.; Routledge: New York, NY, USA, 2016; ISBN 978-1-315-75742-1. [Google Scholar]

- Hu, L.; Bentler, P.M. Cutoff Criteria for Fit Indexes in Covariance Structure Analysis: Conventional Criteria versus New Alternatives. Struct. Equ. Model. Multidiscip. J. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Anderson, J.C.; Gerbing, D.W. Structural Equation Modeling in Practice: A Review and Recommended Two-Step Approach. Psychol. Bull. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Pearson: Upper Saddle River, NJ, USA, 2009; ISBN 978-0-13-813263-7. [Google Scholar]

- Bagozzi, R.P.; Yi, Y. On the Evaluation of Structural Equation Models. JAMS 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Nunnally, J.C. An Overview of Psychological Measurement. In Clinical Diagnosis of Mental Disorders; Wolman, B.B., Ed.; Springer US: Boston, MA, USA, 1978; pp. 97–146. ISBN 978-1-4684-2492-8. [Google Scholar]

- Aljuhmani, H.Y.; Ababneh, B.; Emeagwali, L.; Elrehail, H. Strategic Stances and Organizational Performance: Are Strategic Performance Measurement Systems the Missing Link? Asia-Pac. J. Bus. Adm. 2022. ahead of print. [Google Scholar] [CrossRef]

- Hayes, A.F. Beyond Baron and Kenny: Statistical Mediation Analysis in the New Millennium. Commun. Monogr. 2009, 76, 408–420. [Google Scholar] [CrossRef]

- Arend, R.J. Mobius’ Edge: Infinite Regress in the Resource-Based and Dynamic Capabilities Views. Strateg. Organ. 2015, 13, 75–85. [Google Scholar] [CrossRef]

- Barney, J.B.; Ketchen, D.J.; Wright, M. Bold Voices and New Opportunities: An Expanded Research Agenda for the Resource-Based View. J. Manag. 2021, 47, 1677–1683. [Google Scholar] [CrossRef]

- Xu, D.; Huo, B.; Sun, L. Relationships between Intra-Organizational Resources, Supply Chain Integration and Business Performance: An Extended Resource-Based View. Ind. Manag. Data Syst. 2014, 114, 1186–1206. [Google Scholar] [CrossRef]

- Liao, S.-H.; Hu, D.-C.; Chen, S.-T. Supply Chain Integration, Capability and Performance—A Business-to-Business Network Cooperation. J. Bus. Ind. Mark. 2021, 37, 1127–1137. [Google Scholar] [CrossRef]

- Stank, T.P.; Keller, S.B.; Daugherty, P.J. Supply Chain Collaboration and Logistical Service Performance. J. Bus. Logist. 2001, 22, 29–48. [Google Scholar] [CrossRef]

- Chen, M.; Liu, H.; Wei, S.; Gu, J. Top Managers’ Managerial Ties, Supply Chain Integration, and Firm Performance in China: A Social Capital Perspective. Ind. Mark. Manag. 2018, 74, 205–214. [Google Scholar] [CrossRef]

- Emeagwali, O.L.; Aljuhmani, H.Y. Strategic Management: A Dynamic View; IntechOpen: London, UK, 2019; ISBN 978-1-83962-504-6. [Google Scholar]

- Donaldson, L. The Contingency Theory of Organizations, 1st ed.; SAGE Publications, Inc: Thousand Oaks, CA, USA, 2001; ISBN 978-0-7619-1574-4. [Google Scholar]

- Sousa, R.; Voss, C.A. Contingency Research in Operations Management Practices. J. Oper. Manag. 2008, 26, 697–713. [Google Scholar] [CrossRef]

- Barney, J.B. Purchasing, Supply Chain Management and Sustained Competitive Advantage: The Relevance of Resource-Based Theory. J. Supply Chain. Manag. 2012, 48, 3–6. [Google Scholar] [CrossRef]

- Kaur, M.; Singh, K.; Singh, D. Synergetic Success Factors of Total Quality Management (TQM) and Supply Chain Management (SCM): A Literature Review. Int. J. Qual. Reliab. Manag. 2019, 36, 842–863. [Google Scholar] [CrossRef]

- Li, S.; Huo, B.; Han, Z. A Literature Review towards Theories and Conceptual Models of Empirical Studies on Supply Chain Integration and Performance. Int. J. Prod. Econ. 2022, 250, 108625. [Google Scholar] [CrossRef]

- Ferreira, J.; Coelho, A. Dynamic Capabilities, Innovation and Branding Capabilities and Their Impact on Competitive Advantage and SME’s Performance in Portugal: The Moderating Effects of Entrepreneurial Orientation. Int. J. Innov. Sci. 2020, 12, 255–286. [Google Scholar] [CrossRef]

- Gutierrez-Gutierrez, L.J.; Barrales-Molina, V.; Kaynak, H. The Role of Human Resource-Related Quality Management Practices in New Product Development: A Dynamic Capability Perspective. Int. J. Oper. Prod. Manag. 2018, 38, 43–66. [Google Scholar] [CrossRef]

- Pereira, V.; Bamel, U. Extending the Resource and Knowledge Based View: A Critical Analysis into Its Theoretical Evolution and Future Research Directions. J. Bus. Res. 2021, 132, 557–570. [Google Scholar] [CrossRef]

- Huo, B.; Gu, M.; Jiang, B. China-Related POM Research: Literature Review and Suggestions for Future Research. Int. J. Prod. Econ. 2018, 203, 134–153. [Google Scholar] [CrossRef]

- Germain, R.; Iyer, K.N.S. The Interaction of Internal and Downstream Integration and Its Association with Performance. J. Bus. Logist. 2006, 27, 29–52. [Google Scholar] [CrossRef]

| Measures | Item | Frequency | Percentage (%) |

|---|---|---|---|

| Gender | Male | 126 | 60.3% |

| Female | 83 | 39.7% | |

| Age | Less than 30 years old | 7 | 3.3% |

| 31–40 | 80 | 38.3% | |

| 41–50 | 87 | 41.6% | |

| 51–60 | 21 | 10.0% | |

| More than 60 years old | 14 | 6.7% | |

| Job Position | Operations manager | 58 | 27.8% |

| Supply chain manager | 53 | 25.4% | |

| Plant manager | 40 | 19.1% | |

| Quality manager | 36 | 17.2% | |

| Others | 22 | 10.5% | |

| Experience | Less than 5 years | 49 | 23.4% |

| 5–less than 10 | 63 | 30.1% | |

| 10–less than 15 | 40 | 19.1% | |

| 15–less than 20 | 35 | 16.7% | |

| 20 and above | 22 | 10.5% | |

| Industry sector | Pharmaceutical and medical | 14 | 6.7% |

| Chemical and cosmetic | 34 | 16.3% | |

| Food and beverages | 48 | 23.0% | |

| Leather and garment | 17 | 8.1% | |

| Plastic and rubber | 21 | 10.0% | |

| Electrical and IT | 35 | 16.7% | |

| Machinery and hardware | 30 | 14.4% | |

| Others | 10 | 4.8% | |

| Number of employees | Less than 100 | 58 | 27.8% |

| 100–less than 200 | 122 | 58.4% | |

| 200–less than 300 | 14 | 6.7% | |

| 300 and above | 15 | 7.2% | |

| Total | 209 | 100% | |

| First-Order Constructs | Second-Order Constructs | Items | Mean | Std. dev. | Factor Loadings | Cronbach’s Alpha Values | CR | AVE |

|---|---|---|---|---|---|---|---|---|

| Total Quality Management (TQM) | 0.72 | 0.75 | 0.52 | |||||

| TQM1 | 3.72 | 0.91 | 0.74 | |||||

| TQM2 | 3.76 | 0.99 | 0.65 | |||||

| TQM3 | 3.60 | 0.98 | 0.67 | |||||

| TQM4 * | 3.77 | 2.38 | - | |||||

| TQM5 | 3.69 | 1.04 | 0.66 | |||||

| Just-in-Time Inventory (JIT) | 0.71 | 0.73 | 0.54 | |||||

| JIT1 | 3.18 | 1.14 | 0.78 | |||||

| JIT2 | 3.19 | 1.17 | 0.60 | |||||

| JIT3 | 3.13 | 1.09 | 0.61 | |||||

| Process and Capacity Design (PCD) | 0.74 | 0.77 | 0.53 | |||||

| PCD1 | 4.01 | 1.01 | 0.64 | |||||

| PCD2 * | 2.57 | 1.42 | - | |||||

| PCD3 | 4.02 | 1.05 | 0.90 | |||||

| PCD4 | 3.61 | 1.06 | 0.69 | |||||

| Production and Operations Management (POM) | 0.73 | 0.76 | 0.53 | |||||

| TQM | 3.71 | 0.87 | 0.92 | |||||

| JIT | 3.16 | 0.90 | 0.67 | |||||

| PCD | 3.55 | 0.75 | 0.51 | |||||

| Supply Chain Management Integration (SCI) | 0.92 | 0.93 | 0.57 | |||||

| SCI1 | 3.00 | 1.09 | 0.68 | |||||

| SCI2 | 3.30 | 1.11 | 0.79 | |||||

| SCI3 | 3.41 | 1.09 | 0.76 | |||||

| SCI4 | 3.44 | 1.05 | 0.75 | |||||

| SCI5 | 3.39 | 1.14 | 0.85 | |||||

| SCI6 | 3.29 | 1.15 | 0.83 | |||||

| SCI7 | 3.26 | 1.08 | 0.78 | |||||

| SCI8 | 3.28 | 1.01 | 0.63 | |||||

| SCI9 | 3.29 | 1.10 | 0.77 | |||||

| SCI10 | 3.36 | 1.07 | 0.79 | |||||

| Organizational Financial Performance (OFP) | 0.80 | 0.82 | 0.56 | |||||

| OFP1 | 3.01 | 1.19 | 0.78 | |||||

| OFP2 | 3.29 | 1.06 | 0.75 | |||||

| OFP3 | 3.62 | 1.16 | 0.71 |

| Factors | 1 | 2 | 3 |

|---|---|---|---|

| 1. Supply chain management integration | 0.747 | ||

| 2. Organizational financial performance | 0.557 *** | 0.749 | |

| 3. Production and operations management | 0.556 *** | 0.725 *** | 0.722 |

| Direct Effect | Standardized Coefficients | Standard Errors | t-Values | p-Values | Decision |

|---|---|---|---|---|---|

| H1: POM practices → SCM integration | 0.508 *** | 0.067 | 8.488 | 0.001 | Supported |

| H2: POM practices → OFP | 0.579 *** | 0.095 | 10.853 | 0.001 | Supported |

| H3: SCM integration → OFP | 0.163 *** | 0.063 | 4.161 | 0.001 | Supported |

| Hypothesized Path | Indirect Effect | Lower Bound | Upper Bound | p-Values | Results |

|---|---|---|---|---|---|

| H4: POM practices → SCM integration → OFP | 0.083 ** | 0.075 | 0.243 | 0.002 | Supported |

| Total: POM practices → OFP | 0.662 *** | 0.576 | 0.759 | 0.001 | Partial mediation |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Salah, A.; Çağlar, D.; Zoubi, K. The Impact of Production and Operations Management Practices in Improving Organizational Performance: The Mediating Role of Supply Chain Integration. Sustainability 2023, 15, 15140. https://doi.org/10.3390/su152015140

Salah A, Çağlar D, Zoubi K. The Impact of Production and Operations Management Practices in Improving Organizational Performance: The Mediating Role of Supply Chain Integration. Sustainability. 2023; 15(20):15140. https://doi.org/10.3390/su152015140

Chicago/Turabian StyleSalah, Ammar, Dilber Çağlar, and Khaled Zoubi. 2023. "The Impact of Production and Operations Management Practices in Improving Organizational Performance: The Mediating Role of Supply Chain Integration" Sustainability 15, no. 20: 15140. https://doi.org/10.3390/su152015140