A Quantitative Analysis of Decision-Making Risk Factors for Mega Infrastructure Projects in China

Abstract

:1. Introduction

2. Literature Review

2.1. Risk Studies on Government-Funded Projects

2.2. Research on Risk Management Methods for Megaprojects

2.3. Bayesian Modeling Research Applicable to Risk Assessment

3. Methodology and Data Presentation

3.1. Decision-Making Risk Factor Analysis

3.2. Model Development

3.3. Model Reasoning

4. Model Development

4.1. Factor Preparation

4.2. BBN Model Design

4.3. DBN Model Building

5. Analysis and Results

5.1. Sensitivity Analysis

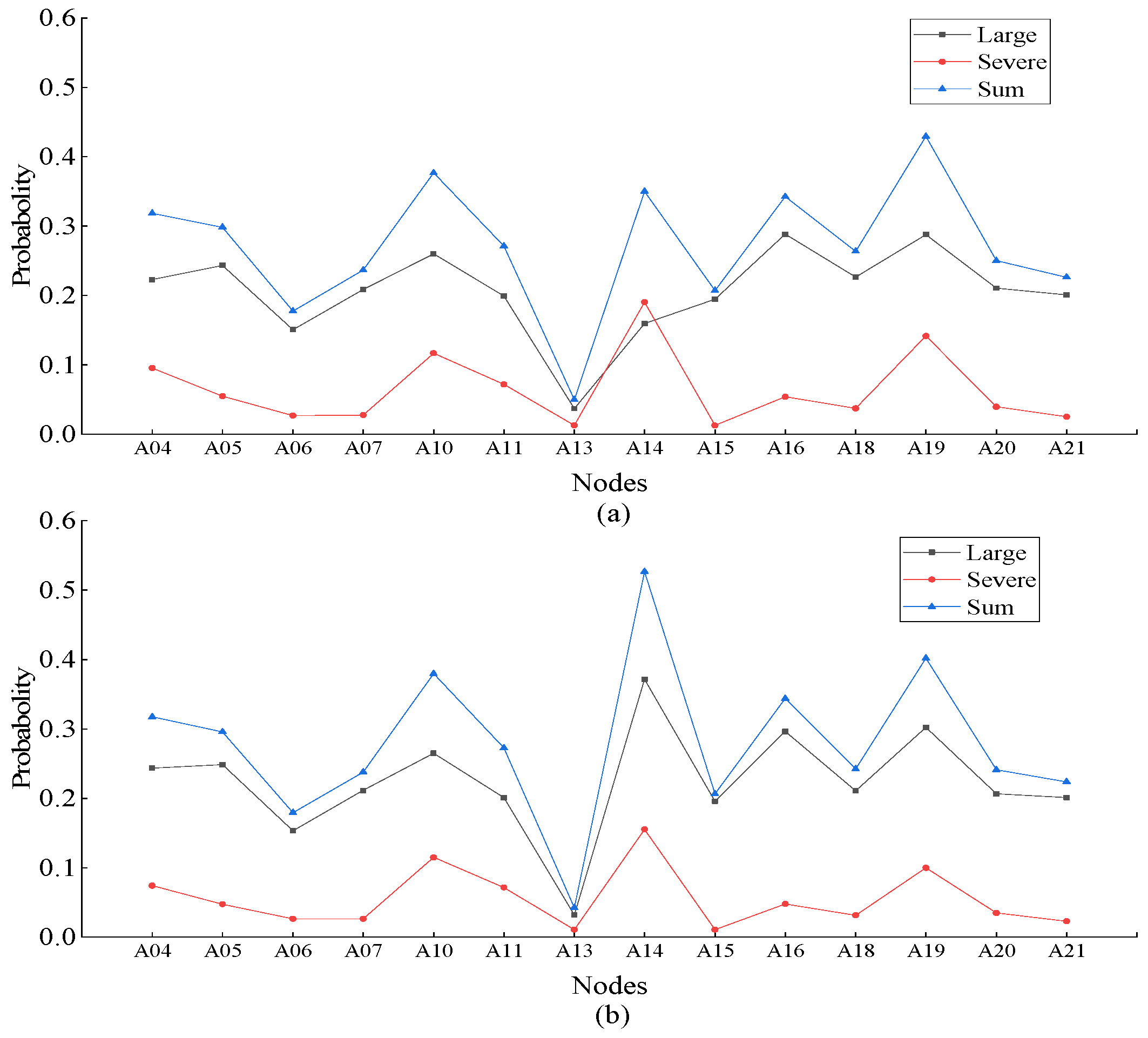

5.2. Influence Chain Analysis

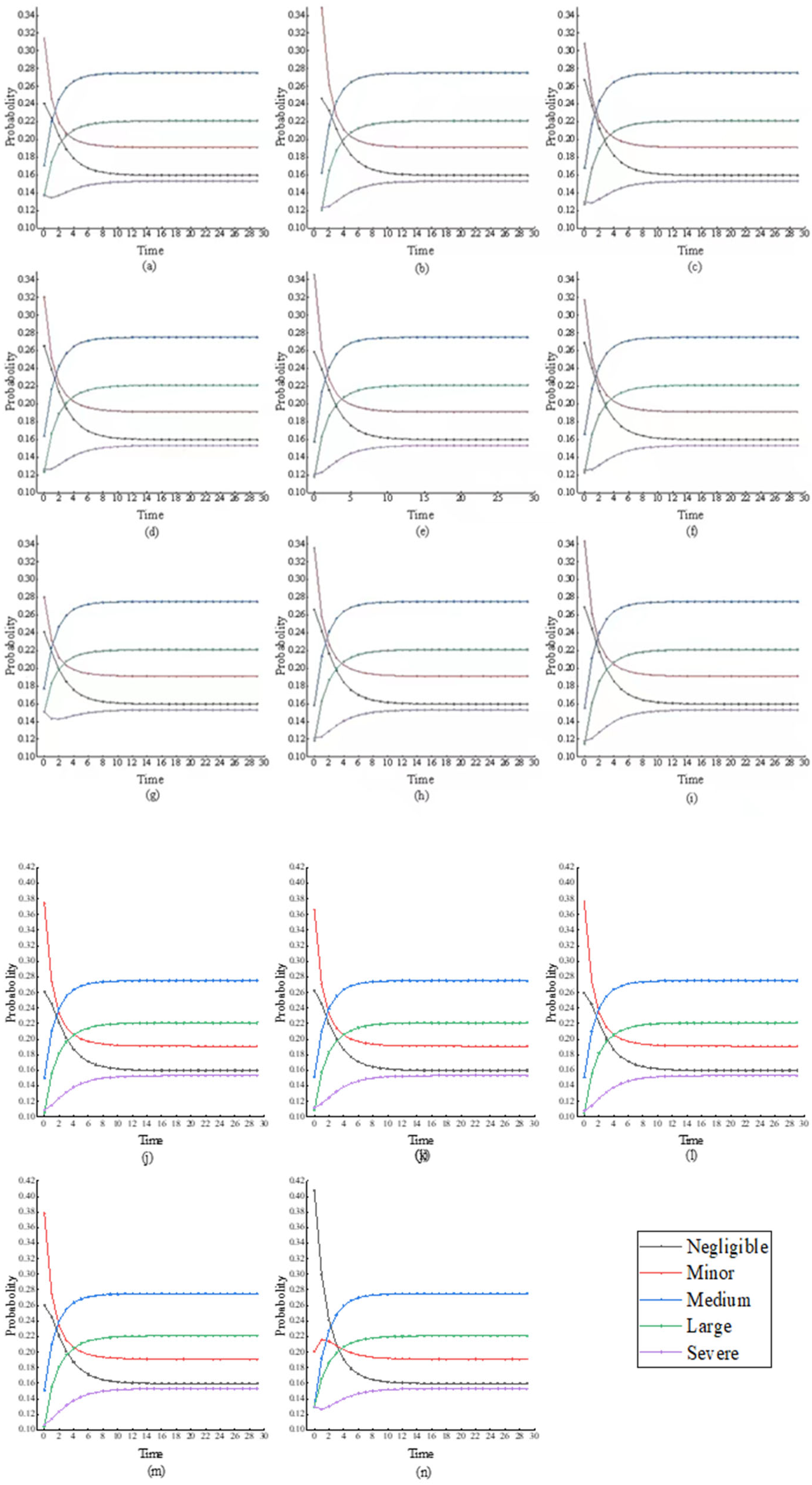

5.3. Predictive Analysis

5.4. Diagnostic Analysis

6. Discussion

6.1. Discussions of Findings

6.2. Model Application

6.3. Risk Governance Strategies

7. Conclusions and Future Works

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Questionnaire on Risks of Decision Making for Megaprojects under EPC + PPP

- Your sexA. MaleB. Female

- Your ageA. 20–30 yearsB. 31–40 yearsC. 41–50 yearsD. ≥51 years

- Your education backgroundA. BachelorB. MasterC. DoctoralD. Others

- Position in the type of project you are involved inA. Senior managementB. Middle managersC. Below middle levelD. Others

- Actual duration of the type of project you are involved inA. <5 yearsB. 6–10 yearsC. >10 years

| Item | Risk Factors | Risk-Sharing Results | ||||

| 1 | Product/Service prices A01 | 1 | 2 | 3 | 4 | 5 |

| 2 | Managerial operational level A02 | 1 | 2 | 3 | 4 | 5 |

| 3 | Market demand A03 | 1 | 2 | 3 | 4 | 5 |

| 4 | Integration of the bidding procedures of the two parties into one A04 | 1 | 2 | 3 | 4 | 5 |

| 5 | Financing costs A05 | 1 | 2 | 3 | 4 | 5 |

| 6 | Bidding competition A06 | 1 | 2 | 3 | 4 | 5 |

| 7 | Contract negotiation A07 | 1 | 2 | 3 | 4 | 5 |

| 8 | Completeness of contract documents A08 | 1 | 2 | 3 | 4 | 5 |

| 9 | Quality of design solution A09 | 1 | 2 | 3 | 4 | 5 |

| 10 | Access to finance A10 | 1 | 2 | 3 | 4 | 5 |

| 11 | Operating cost A11 | 1 | 2 | 3 | 4 | 5 |

| 12 | Adaptation of laws and regulations A12 | 1 | 2 | 3 | 4 | 5 |

| 13 | Governance of the relationship between the social capitalist and the government A13 | 1 | 2 | 3 | 4 | 5 |

| 14 | Project adaptation A14 | 1 | 2 | 3 | 4 | 5 |

| 15 | Selection of consortium members A15 | 1 | 2 | 3 | 4 | 5 |

| 16 | Multiple identities of social capitalists A16 | 1 | 2 | 3 | 4 | 5 |

| 17 | Decision-making interventions by governments A17 | 1 | 2 | 3 | 4 | 5 |

| 18 | Control structure A18 | 1 | 2 | 3 | 4 | 5 |

| 19 | Stakeholder needs A19 | 1 | 2 | 3 | 4 | 5 |

| 20 | Project schedule delay A20 | 1 | 2 | 3 | 4 | 5 |

| 21 | Construction cost overrun A21 | 1 | 2 | 3 | 4 | 5 |

| 22 | Engineering quality issues A22 | 1 | 2 | 3 | 4 | 5 |

References

- Global Infrastructure Hub. Available online: https://www.gihub.org/resources/publications/global-infrastructure-investment-index/ (accessed on 9 June 2023).

- Freelove, S.; Gramatki, I. Creating long-term social value on major infrastructure projects: A case study. Eng. Sustain. 2022, 175, 186–193. [Google Scholar] [CrossRef]

- Floricel, S.; Abdallah, S.; Hudon, P.-A.; Petit, M.-C.; Brunet, M. Exploring the patterns of convergence and divergence in the development of major infrastructure projects. Int. J. Proj. Manag. 2022, 44, 102433. [Google Scholar] [CrossRef]

- Hosny, H.E.; Ibrahim, A.H.; Eldars, E.A. Development of infrastructure projects sustainability assessment model. Environ. Dev. Sustain. 2021, 24, 7493–7531. [Google Scholar] [CrossRef]

- Guixia, G.; Fang, Z.; Rui, Z. A study on the bilateral moral hazard of PPP projects in China. Ind. Econ. Rev. 2022, 13, 147–160. [Google Scholar] [CrossRef]

- Goodenough, R.A.; Page, S.J. Evaluating the environmental impact of a major transport infrastructure project: The Channel Tunnel high-speed rail link. Appl. Geogr. 1994, 14, 26–50. [Google Scholar] [CrossRef]

- Hyun, S.; Park, D.; Tian, S. Infrastructure Bond Markets Development in Asia: Challenges and Solutions. Glob. Econ. Rev. 2017, 46, 351–371. [Google Scholar] [CrossRef]

- Hillier, J. Politics of The Ring: Limits to Public Participation in Engineering Practice. Int. J. Urban Reg. Res. 2018, 42, 334–356. [Google Scholar] [CrossRef]

- Zhang, Q. Risk Management in Offshore Towing and Installation of Immersed Tunnel Tubes. Tunn. Constr. 2015, 35, 1150–1156. [Google Scholar]

- Han, S.Z.; Long, X.X.; Shi, A. Constructing Theoretical System and Discourse System of Mega Infrastructure Construction Management with Chinese Characteristics. J. Manag. World 2019, 35, 2–16. [Google Scholar] [CrossRef]

- Furlong, C.; De Silva, S.; Gan, K.; Guthrie, L.; Considine, R. Risk management, financial evaluation and funding for wastewater and stormwater reuse projects. J. Environ. Manag. 2017, 191, 83–95. [Google Scholar] [CrossRef]

- Gebre, Y.K.; Demsis, B.A. Reasons for the Potential Implementation of Public-Private Partnerships in Ethiopian Road Infrastructure Provision. Adv. Civ. Eng. 2022, 2022, 4863210. [Google Scholar] [CrossRef]

- Liu, H.Y.; Tang, Y.K.; Chen, X.L.; Poznanska, J. The Determinants of Chinese Outward FDI in Countries Along “One Belt One Road”. Emerg. Mark. Financ. Trade 2017, 53, 1374–1387. [Google Scholar] [CrossRef]

- Zayed, T.; Amer, M.; Pan, J.Y. Assessing risk and uncertainty inherent in Chinese highway projects using AHP. Int. J. Proj. Manag. 2008, 26, 408–419. [Google Scholar] [CrossRef]

- Carbonara, N.; Costantino, N.; Gunnigan, L.; Pellegrino, R. Risk Management in Motorway PPP Projects: Empirical-based Guidelines. Transp. Rev. 2014, 35, 162–182. [Google Scholar] [CrossRef]

- Ozdoganm, I.D.; Birgonul, M.T. A decision support framework for project sponsors in the planning stage of build-operate-transfer (BOT) projects. Constr. Manag. Econ. 2010, 18, 343–353. [Google Scholar] [CrossRef]

- Iyer, K.C.; Sagheer, M. Hierarchical Structuring of PPP Risks Using Interpretative Structural Modeling. J. Constr. Eng. Manag. 2010, 136, 151–159. [Google Scholar] [CrossRef]

- Koulinas, G.K.; Demesouka, O.E.; Sidas, K.A.; Koulouriotis, D.E. A TOPSIS—Risk Matrix and Monte Carlo Expert System for Risk Assessment in Engineering Projects. Sustainability 2021, 13, 11277. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, R.; Huang, P.; Wang, X.; Wang, S. Risk evaluation of large-scale seawater desalination projects based on an integrated fuzzy comprehensive evaluation and analytic hierarchy process method. Desalination 2020, 478, 114286. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Vilutienė, T.; Turskis, Z.; Tamosaitienė, J. Contractor Selection For Construction Works By Applying SAW-G And Topsis Grey Techniques. J. Bus. Econ. Manag. 2010, 11, 34–55. [Google Scholar] [CrossRef]

- Valipour, A.; Yahaya, N.; Noor, N.M.; Mardani, A.; Antuchevičienė, J. A new hybrid fuzzy cybernetic analytic network process model to identify shared risks in PPP projects. Int. J. Strateg. Prop. Manag. 2016, 20, 409–426. [Google Scholar] [CrossRef]

- Dorfeshan, Y.; Taleizadeh, A.A.; Toloo, M. Assessment of risk-sharing ratio with considering budget constraint and distruption risk under a triangular Pythagorean fuzzy environment in public-private partnership projects. Expert Syst. Appl. 2022, 203, 117245. [Google Scholar] [CrossRef]

- Kardes, I.; Ozturk, A.; Cavusgil, S.T.; Cavusgil, E. Managing global megaprojects: Complexity and risk management. Int. Bus. Rev. 2013, 22, 905–917. [Google Scholar] [CrossRef]

- Sanchez, A.; Sanchez, J.; Cardona, R. Phylogenetic relationship according allergen sensitization pattern between 10 mites in a tropical area. Allergy 2017, 72, 545. [Google Scholar] [CrossRef]

- Cifrian, E.; Andrés, A.; Galán, B.; Viguri, J.R. Integration of different assessment approaches: Application to a project based learning engineering course. Educ. Chem. Eng. 2020, 31, 62–75. [Google Scholar] [CrossRef]

- Li, C.Z.; Hong, J.; Xue, F.; Shen, G.Q.; Xu, X.X.; Mok, M.K. Schedule risks in prefabrication housing production in Hong Kong: A social network analysis. J. Clean. Prod. 2016, 134, 482–494. [Google Scholar] [CrossRef]

- Miller, K.D. A framework for integrated risk management in international business. J. Int. Bus. Stud. 1992, 23, 311–331. [Google Scholar] [CrossRef]

- Gordon, C.; Mulley, C.; Stevens, N.; Daniels, R. How optimal was the sydney metro contract?: Comparison with international best practice. Res. Transp. Econ. 2013, 39, 239–246. [Google Scholar] [CrossRef]

- Ameyaw, E.E.; Chan, A.P. Evaluation and ranking of risk factors in public–private partnership water supply projects in developing countries using fuzzy synthetic evaluation approach. Expert Syst. Appl. 2015, 42, 5102–5116. [Google Scholar] [CrossRef]

- Spooner, S. An essay towards solving a problem in the doctrine of chances. Resonance 2003, 8, 80–88. [Google Scholar] [CrossRef]

- Pearl, J. Bayesian Networks: A Model of Self-Activated Memory for Evidential Reasoning. In Proceedings of the 7th Conference of the Cognitive Science Society, Irvine, CA, USA, 15–17 August 1985. [Google Scholar]

- Jose, S.; Louis, S.; Dascalu, S.; Liu, S. Transfer Learning-based Hybrid Approach for Bayesian Network Structure Learning. Int. J. Artif. Intell. Tools 2022, 31, 2260003. [Google Scholar] [CrossRef]

- Shuo, C.; Pazilai, M. Research on Reliability of Inverter System Based on Bond Graph and Dynamic Bayesian Network. J. China Three Gorges Univ. (Nat. Sci.) 2022, 44, 101–107. [Google Scholar] [CrossRef]

- Dabrowski, J.J.; Beyers, C.; de Villiers, J.P. Systemic banking crisis early warning systems using dynamic Bayesian networks. Expert Syst. Appl. 2016, 62, 225–242. [Google Scholar] [CrossRef]

- Amin, M.T.; Khan, F.; Imtiaz, S. Fault Detection and Pathway Analysis using a Dynamic Bayesian Network. Chem. Eng. Sci. 2019, 195, 777–790. [Google Scholar] [CrossRef]

- Sheidaei, A.; Foroushani, A.R.; Gohari, K.; Zeraati, H. A novel dynamic Bayesian network approach for data mining and survival data analysis. BMC Med. Inform. Decis. Mak. 2022, 22, 251. [Google Scholar] [CrossRef]

- Cuaya, G.; Munoz-Meléndez, A.; Carrera, L.N.; Morales, E.F.; Quinones, I.; Pérez, A.I.; Alessi, A. A dynamic Bayesian network for estimating the risk of falls from real gait data. Med. Biol. Eng. Comput. 2013, 51, 29–37. [Google Scholar] [CrossRef]

- Wu, X.; Liu, H.; Zhang, L.; Skibniewski, M.J.; Deng, Q.; Teng, J. A dynamic Bayesian network based approach to safety decision support in tunnel construction. Reliab. Eng. Syst. Saf. 2015, 134, 157–168. [Google Scholar] [CrossRef]

- Rizzi, F.; Khalil, M.; Jones, R.; Templeton, J.; Ostien, J.; Boyce, B. Bayesian modeling of inconsistent plastic response due to material variability. Comput. Methods Appl. Mech. Eng. 2019, 353, 183–200. [Google Scholar] [CrossRef]

- Duhr, C.; Huss, A.; Mazeliauskas, A.; Szafron, R. An analysis of Bayesian estimates for missing higher orders in perturbative calculations. J. High Energy Phys. 2021, 2021, 122. [Google Scholar] [CrossRef]

- Krane, H.P.; Olsson, N.O.E.; Rolstadås, A. How Project Manager-Project Owner Interaction Can Work within and Influence Project Risk Management. Proj. Manag. J. 2012, 43, 54–67. [Google Scholar] [CrossRef]

- Li, G.; Abbasi, A.; Ryan, M.J. A simulation-based risk interdependency network model for project risk assessment. Decison Support Syst. 2021, 148, 113602. [Google Scholar] [CrossRef]

- Cha, H.S.; Shin, K.Y. Predicting Project Cost Performance Level by Assessing Risk Factors of Building Construction in South Korea. J. Asian Archit. Build. Eng. 2012, 10, 437–444. [Google Scholar] [CrossRef]

- Aladag, H.; Isik, Z. The Effect of Stakeholder-Associated Risks in Mega-Engineering Projects: A Case Study of a PPP Airport Project. IEEE Trans. Eng. Manag. 2020, 67, 174–186. [Google Scholar] [CrossRef]

- Siraj, N.B.; Fayek, A.R. Risk Identification and Common Risks in Construction: Literature Review and Content Analysis. J. Constr. Eng. Manag. 2019, 145, 03119004. [Google Scholar] [CrossRef]

- Badawy, M.; Alqahtani, F.; Hafez, H. Identifying the risk factors affecting the overall cost risk in residential projects at the early stage. Ain Shams Eng. J. 2022, 13, 101586. [Google Scholar] [CrossRef]

- Abd Karim, N.A.; Abd Rahman, I.; Memmon, A.H.; Jamil, N.; Abd Azis, A.A. Significant Risk Factors in Construction Projects: Contractor’s Perception. In Proceedings of the 2012 IEEE Colloquium on Humanities, Science & Engineering Research, Kota Kinabalu, Malaysia, 3–4 December 2012. [Google Scholar]

- Bayat, M.; Khanzadi, M.; Nasirzadeh, F.; Chavoshian, A. Financial conflict resolution model in BOT contracts using bargaining game theory. Constr. Innov. 2020, 20, 18–42. [Google Scholar] [CrossRef]

- Wang, W.X.; Li, Q.M.; Deng, X.P.; Shen, L.F. Critical Influential Factors for Pricing in Urban Transportation Infrastructure PPP Project. In Proceedings of the 2008 International Conference on Management Science & Engineering (15th), Vols I and II, Long Beach, CA, USA, 10–12 September 2008. [Google Scholar] [CrossRef]

- Zhang, M.; Yao, M. Study on the evolutionary game of the three parties in the combined medical and health-care PPP project. Front. Public Health 2023, 11, 1072354. [Google Scholar] [CrossRef]

- Sanboskani, H.; El Asmar, M.; Azar, E. Green Building Contractors 2025: Analyzing and Forecasting Green Building Contractors’ Market Trends in the US. Sustainability 2022, 14, 8808. [Google Scholar] [CrossRef]

- Ghasemi, F.; Sari, M.H.M.; Yousefi, V.; Falsafi, R.; Tamošaitienė, J. Project Portfolio Risk Identification and Analysis, Considering Project Risk Interactions and Using Bayesian Networks. Sustainability 2018, 10, 1609. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Li, Y.; Rasoulinezhad, E.; Mortha, A.; Long, Y.; Lan, Y.; Zhang, Z.; Li, N.; Zhao, X.; Wang, Y. Green finance and the economic feasibility of hydrogen projects. Int. J. Hydrogen Energy 2022, 47, 24511–24522. [Google Scholar] [CrossRef]

- Jokar, E.; Aminnejad, B.; Lork, A. Assessing and Prioritizing Risks in Public-Private Partnership (PPP) Projects Using the Integration of Fuzzy Multi-Criteria Decision-Making Methods. Oper. Res. Perspect. 2021, 8, 100190. [Google Scholar] [CrossRef]

- Kreye, M.E.; Goh, Y.M.; Newnes, L.B. Uncertainty perception in bidding for Product-Service Systems under competition. J. Purch. Supply Manag. 2018, 24, 31–40. [Google Scholar] [CrossRef]

- Qiao, Y.; Labi, S.; Fricker, J.D. Does highway project bundling policy affect bidding competition? Insights from a mixed ordinal logistic model. Transp. Res. Part A Policy Pract. 2021, 145, 228–242. [Google Scholar] [CrossRef]

- Wang, Y.; Li, Q.; Zuo, J.; Bartsch, K. How Did Balance Loss Occur? A Cross-stakeholder Analysis of Risk Misallocation in a Sponge City PPP Project. Water Resour. Manag. 2022, 36, 5225–5240. [Google Scholar] [CrossRef]

- Branconi, C.V.; Loch, C.H. Contracting for major projects: Eight business levers for top management. Int. J. Proj. Manag. 2004, 22, 119–130. [Google Scholar] [CrossRef]

- Chen, Y.; Wu, Y.; Hajikazemi, S.; Yao, H.; Ebohon, O.J. To be or not to be: Why do transaction partners in construction industry avoid formulating agreements into contract documents? IOP Conf. Ser. Earth Environ. Sci. 2022, 1101, 052010. [Google Scholar] [CrossRef]

- Shaikh, H.H.; Zainun, N.Y.; Khahro, S.H. Claims in Construction Projects: A Comprehensive Literature Review. IOP Conf. Ser. Earth Environ. Sci. 2020, 498, 012095. [Google Scholar] [CrossRef]

- Almarri, K.; Aljarman, M.; Boussabaine, H. Emerging contractual and legal risks from the application of building information modelling. Eng. Constr. Archit. Manag. 2019, 26, 2307–2325. [Google Scholar] [CrossRef]

- Wuni, I.Y.; Shen, G.Q. Fuzzy modelling of the critical failure factors for modular integrated construction projects. J. Clean. Prod. 2020, 264, 121595. [Google Scholar] [CrossRef]

- Steffen, B. The importance of project finance for renewable energy projects. Energy Econ. 2018, 69, 280–294. [Google Scholar] [CrossRef]

- Sinha, A.K.; Jha, K.N. Financing constraints of public–private partnership projects in India. Eng. Constr. Archit. Manag. 2021, 28, 246–269. [Google Scholar] [CrossRef]

- Chowdhry, B. Financing land acquisition for infrastructure projects. Financ. Res. Lett. 2022, 47, 102656. [Google Scholar] [CrossRef]

- Welde, M. Demand and operating cost forecasting accuracy for toll road projects. Transp. Policy 2011, 18, 765–771. [Google Scholar] [CrossRef]

- Shi, S.S.; Yin, Y.F.; Guo, X.L. Optimal choice of capacity, toll and government guarantee for build-operate-transfer roads under asymmetric cost information. Transp. Res. Part B Methodol. 2016, 85, 56–69. [Google Scholar] [CrossRef]

- Riley, P. Engineering development and environmental law. Eng. Manag. J. 2000, 10, 85–87. [Google Scholar] [CrossRef]

- Rossler, P.E.; High, M.S. Products liability law and its implications for engineering practice. Eng. Manag. J. 2007, 19, 23–30. [Google Scholar] [CrossRef]

- Ozgur, E.F. Urban design projects and the planning process: The Kadikoy Old Market Area Revitalization Project and the Kartal Industrial Area Regeneration Project. Cities 2013, 31, 208–219. [Google Scholar] [CrossRef]

- Berezin, A.; Sergi, B.S.; Gorodnova, N. Efficiency Assessment of Public-Private Partnership (PPP) Projects: The Case of Russia. Sustainability 2018, 10, 3713. [Google Scholar] [CrossRef]

- Alahmadi, N.; Alghaseb, M. Challenging Tendering-Phase Factors in Public Construction Projects-A Delphi Study in Saudi Arabia. Buildings 2022, 12, 924. [Google Scholar] [CrossRef]

- Zheng, X.; Li, R.; Han, Y.L.; Xue, R.; Bai, L. The Dilemma of Operator Selection in Urban Rail Transit PPP Project Operations: A LASSO Approach. J. Constr. Eng. Manag. 2023, 149. [Google Scholar] [CrossRef]

- Demissew, A.; Abiy, F. Causes and Impacts of Delays in Ethiopian Public Construction Projects (Case on Debre Markos University Construction Projects). Adv. Civ. Eng. 2023, 2023, 14. [Google Scholar] [CrossRef]

- Feng, Q.; Wang, K.; Feng, Y.L.; Shi, X.J.; Rao, Y.L.; Wei, J. Incentives for Promoting Safety in the Chinese Construction Industry. Buildings 2023, 13, 1446. [Google Scholar] [CrossRef]

- Nakamura, P.E. Complex Project Management. Transdiscipl. Eng. Crossing Boundaries 2016, 4, 3–11. [Google Scholar] [CrossRef]

- Wang, H. Application of intelligent analysis based on project management in development decision-making of regional economic development. Appl. Artif. Intell. 2023, 37. [Google Scholar] [CrossRef]

- Aloysius, J.A. Membership in a research consortium: The project selection game. J. Econ. Behav. Organ. 1999, 40, 325–336. [Google Scholar] [CrossRef]

- Wang, Y.C.; Lv, L.; Geng, X.X.; Ren, L.Y.; Sun, R. Research on Cooperative Evolutionary Game of Design and Construction Consortium of Green Building Project under Design Change. Buildings 2023, 13, 1146. [Google Scholar] [CrossRef]

- Aznar, B.; Pellicer, E.; Davis, S.; Ballesteros-Pérez, P. Factors affecting contractor’s bidding success for international infrastructure projects in australia. J. Civ. Eng. Manag. 2017, 23, 880–889. [Google Scholar] [CrossRef]

- Toschi, L.; Ughetto, E.; Fronzetti Colladon, A. The identity of social impact; venture capitalists: Exploring social linguistic positioning and linguistic distinctiveness through text mining. Small Bus. Econ. 2023, 60, 1249–1280. [Google Scholar] [CrossRef]

- Teller, J.; Kock, A.; Gemünden, H.G. Risk Management in Project Portfolios is More than Managing Project Risks: A Contingency Perspective on Risk Management. Proj. Manag. J. 2014, 45, 67–80. [Google Scholar] [CrossRef]

- Müller, R.; Zhai, L.; Wang, A.Y. Governance and governmentality in projects: Profiles and relationships with success. Int. J. Proj. Manag. 2017, 35, 378–392. [Google Scholar] [CrossRef]

- Janssen, R.; de Graaf, R.; Smit, M.; Voordijk, H. Why local governments rarely use PPPs in their road development projects: Understanding the barriers. Int. J. Manag. Proj. Bus. 2015, 9, 33–52. [Google Scholar] [CrossRef]

- Hasan, M.A.; Nahiduzzaman, K.M.; Aldosary, A.S. Public participation in EIA: A comparative study of the projects run by government and non-governmental organizations. Environ. Impact Assess. Rev. 2018, 72, 12–24. [Google Scholar] [CrossRef]

- Barrutia, J.M.; Echebarria, C.; Aguado-Moralejo, I.; Apaolaza-Ibáñez, V.; Hartmann, P. Leading smart city projects: Government dynamic capabilities and public value creation. Technol. Forecast. Soc. Chang. 2022, 179, 121679. [Google Scholar] [CrossRef]

- Deep, S.; Bhoola, V.; Verma, S.; Ranasinghe, U. Identifying the risk factors in real estate construction projects: An analytical study to propose a control structure for decision-making. J. Financ. Manag. Prop. Constr. 2022, 27, 220–238. [Google Scholar] [CrossRef]

- Arshad, M.F.; Thaheem, M.J.; Nasir, A.R.; Malik, M.S.A. Contractual Risks of Building Information Modeling: Toward a Standardized Legal Framework for Design-Bid-Build Projects. J. Constr. Eng. Manag. 2019, 145, 04019010. [Google Scholar] [CrossRef]

- Mohammadi, S.; Birgonul, T. Preventing claims in green construction projects through investigating the components of contractual and legal risks. J. Clean. Prod. 2016, 139, 1078–1084. [Google Scholar] [CrossRef]

- Alaloul, W.S.; Liew, M.S.; Zawawi, N.A.W.A. Identification of coordination factors affecting building projects performance. Alex. Eng. J. 2016, 55, 2689–2698. [Google Scholar] [CrossRef]

- Rafeh, A.; Qureshi, M.U.; Hameed, A.; Rasool, A.M. Ranking and grouping of critical success factors for stakeholder management in construction projects. J. Asian Archit. Build. Eng. 2023, 1–14. [Google Scholar] [CrossRef]

- Xie, L.; Wu, S.; Chen, Y.; Chang, R.; Chen, X. A case-based reasoning approach for solving schedule delay problems in prefabricated construction projects. Autom. Constr. 2023, 154, 105028. [Google Scholar] [CrossRef]

- Ahmed, R.; Hussain, A.; Philbin, S.P. Moderating Effect of Senior Management Support on the Relationship between Schedule Delay Factors and Project Performance. Eng. Manag. J. 2022, 34, 374–393. [Google Scholar] [CrossRef]

- Plebankiewicz, E.; Wieczorek, D. Prediction of Cost Overrun Risk in Construction Projects. Sustainability 2020, 12, 9341. [Google Scholar] [CrossRef]

- Adam, A.; Josephson, P.-E.B.; Lindahl, G. Aggregation of factors causing cost overruns and time delays in large public construction projects: Trends and implications. Eng. Constr. Archit. Manag. 2017, 24, 393–406. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Gilbert, A.; Nugent, D. An international comparative assessment of construction cost overruns for electricity infrastructure. Energy Res. Soc. Sci. 2014, 3, 152–160. [Google Scholar] [CrossRef]

- Ugural, M.N. Material Selection with Value Engineering Technique- A Case Study in Construction Industry. Teh. Vjesn.-Tech. Gaz. 2023, 30, 292–301. [Google Scholar] [CrossRef]

- Ding, L.Y.; Li, K.M.; Zhou, Y.; Love, P.E.D. An IFC-inspection process model for infrastructure projects: Enabling real-time quality monitoring and control. Autom. Constr. 2017, 84, 96–110. [Google Scholar] [CrossRef]

- Amirkhani, H.; Rahmati, M.; Lucas, P.J.F.; Hommersom, A. Exploiting Experts’ Knowledge for Structure Learning of Bayesian Networks. IEEE Trans. Pattern Anal. Mach. Intell. 2017, 39, 2154–2170. [Google Scholar] [CrossRef]

- Wu, T.; Qian, H.; Liu, Z.; Zhou, J.; Zhou, A. Bi-objective evolutionary Bayesian network structure learning via skeleton constraint. Front. Comput. Sci. 2023, 17, 176350. [Google Scholar] [CrossRef]

- Li, T.; Chen, X.Y.; Qian, Y.M.; He, J.Y. Bayesian Inference for Predicting Rock Mass Rating Ahead of Tunnel-Face Excavation Integrating Multi-Source Information. IOP Conf. Ser. Earth Environ. Sci. 2021, 861, 052102. [Google Scholar] [CrossRef]

- Luo, L.; Zhang, L.; Wu, G. Bayesian belief network-based project complexity measurement considering causal relationships. J. Civ. Eng. Manag. 2020, 26, 200–215. [Google Scholar] [CrossRef]

- McCandless, L.C.; Gustafson, P. A comparison of Bayesian and Monte Carlo sensitivity analysis for unmeasured confounding. Stat. Med. 2017, 36, 2887–2901. [Google Scholar] [CrossRef]

- Zhao, J.L.; Cui, H.Y.; Wang, G.R.; Zhang, J.P.; Yang, R. Risk assessment of safety level in university laboratories using questionnaire and Bayesian network. J. Loss Prev. Process Ind. 2023, 83, 105054. [Google Scholar] [CrossRef]

- Bakshan, A.; Srour, I.; Chehab, G.; El-Fadel, M.; Karaziwan, J. Behavioral determinants towards enhancing construction waste management: A Bayesian Network analysis. Resour. Conserv. Recycl. 2017, 117, 274–284. [Google Scholar] [CrossRef]

- Mahdinia, M.; Mohammadfam, I.; Aghaei, H.; Aliabadi, M.M.; Fallah, H.; Soltanzadeh, A. Developing a Bayesian network model for improving chemical plant workers’ situation awareness. Theor. Issues Ergon. Sci. 2023, 24, 505–519. [Google Scholar] [CrossRef]

- Wong, M.L.; Lam, W.; Leung, K.S. Using evolutionary programming and minimum description length principle for data mining of Bayesian networks. IEEE Trans. Pattern Anal. Mach. Intell. 1999, 21, 174–178. [Google Scholar] [CrossRef]

- Sargent, R.G. Verification and validation of simulation models. J. Simul. 2013, 7, 12–24. [Google Scholar] [CrossRef]

- Li, H.M.; Huang, T.L.; Wang, X. Research on Bayesian Decision Theory in Pattern Recognition. In Proceedings of the Third International Conference on Genetic and Evolutionary Computing, Guilin, China, 14–17 October 2009; pp. 221–224. [Google Scholar] [CrossRef]

- Shiguihara, P.; Lopes, A.D.; Mauricio, D. Dynamic Bayesian Network Modeling, Learning, and Inference: A Survey. IEEE Access 2021, 9, 117639–117648. [Google Scholar] [CrossRef]

- Liu, Z.S.; Jiao, Y.Y.; Li, A.X.; Liu, X.M. Risk Assessment of Urban Rail Transit PPP Project Construction Based on Bayesian Network. Sustainability 2021, 13, 11507. [Google Scholar] [CrossRef]

- Nabawy, M.; Ofori, G.; Morcos, M.; Egbu, C. Risk identification framework in construction of Egyptian mega housing projects. Ain Shams Eng. J. 2021, 12, 2047–2056. [Google Scholar] [CrossRef]

- Ullah, S.; Mufti, N.A.; Saleem, M.Q.; Hussain, A.; Lodhi, R.N.; Asad, R. Identification of Factors Affecting Risk Appetite of Organizations in Selection of Mega Construction Projects. Buildings 2022, 12, 2. [Google Scholar] [CrossRef]

- Kimiagari, S.; Keivanpour, S. An interactive risk visualisation tool for large-scale and complex engineering and construction projects under uncertainty and interdependence. Int. J. Prod. Res. 2019, 57, 6827–6855. [Google Scholar] [CrossRef]

- Sambasivan, M.; Soon, Y.W. Causes and effects of delays in Malaysian construction industry. Int. J. Proj. Manag. 2007, 25, 517–526. [Google Scholar] [CrossRef]

- Assaf, S.A.; Al-Hejji, S. Causes of delay in large construction projects. Int. J. Proj. Manag. 2006, 24, 349–357. [Google Scholar] [CrossRef]

- Motaleb, O.; Kishk, M. An investigation into causes and effects of construction delays in UAE. In Proceedings of the 26th Annual Conference of the Association of Researchers in Construction Management, Leeds, UK, 6–8 September 2010. [Google Scholar]

- Aibinu, A.A.; Jagboro, G.O. The effects of construction delays on project delivery in Nigerian construction industry. Int. J. Proj. Manag. 2012, 20, 593–599. [Google Scholar] [CrossRef]

- Lee, J.-K. Cost Overrun and Cause in Korean Social Overhead Capital Projects: Roads, Rails, Airports, and Ports. J. Urban Plan. Dev. 2008, 134, 59–62. [Google Scholar] [CrossRef]

- Kaliba, C.; Muya, M.; Mumba, K. Cost escalation and schedule delays in road construction projects in Zambia. Int. J. Proj. Manag. 2009, 27, 522–531. [Google Scholar] [CrossRef]

- Stewart, W.R.; Shirvan, K. Construction schedule and cost risk for large and small light water reactors. Nucl. Eng. Des. 2023, 407, 112305. [Google Scholar] [CrossRef]

- Natawidjana, R.; Nurasiyah, S. Study of labor cost escalation in delay projects. J. Phys. Conf. Ser. 2020, 1469, 012034. [Google Scholar] [CrossRef]

- Daube, D.; Vollrath, S.; Alfen, H.W. A comparison of Project Finance and the Forfeiting Model as financing forms for PPP projects in Germany. Int. J. Proj. Manag. 2008, 26, 376–387. [Google Scholar] [CrossRef]

- Cavalieri, M.; Cristaudo, R.; Guccio, C. On the magnitude of cost overruns throughout the project life-cycle: An assessment for the Italian transport infrastructure projects. Transp. Policy 2019, 79, 21–36. [Google Scholar] [CrossRef]

- Liu, D.; Mo, W.F.; Yin, C.B. Impact of Rule Governance Mechanism on Project Performance in Public Rental Housing PPP Projects: Control Rights as a Moderating Variable. Discret. Dyn. Nat. Soc. 2021, 2021, 5557941. [Google Scholar] [CrossRef]

- Wembe, P.T. Managing stakeholders in EPCM projects in Africa by Western project managers. Int. J. Constr. Manag. 2022, 22, 2279–2289. [Google Scholar] [CrossRef]

| Risk Factors | Factor Description | References |

|---|---|---|

| Product/Service prices A01 | Fluctuations in product/service prices have resulted in a decrease in the realized benefits of the EPC + PPP project compared with the initially anticipated benefits. | Bayat [48]; Wang [49]; |

| Managerial operational level A02 | The presence of several identities within social capital parties might result in inadequate managerial performance or an inability to conform to established government protocols and rules, thus impeding the efficiency of project operations. | Krane [41]; Zhang [50]; |

| Market demand A03 | This pertains to the potential for disparities between market predictions and actual demand as a result of shifts in market demand caused by reasons beyond the scope of uniqueness risk. | Sanboskani [51]; |

| Integration of the bidding procedures of the two parties into one A04 | The PPP + EPC model requires social capitalists to assume investment and construction responsibilities. This is necessary because social capitalists often lack the capacity to invest in or construct certain aspects of the project. | Ghasemi [52]; |

| Financing costs A05 | Fluctuations in market interest rates and inflationary pressures contribute to elevated price levels, subsequently resulting in increased financing expenses. | Taghizadeh-Hesary [53]; Jokar [54]; |

| Bidding competition A06 | This encompasses bidding methods that are deemed unjust, unfair, and lacking transparency, as well as the provision of inadequate or intentionally misleading information regarding the bidding project. | Kreye [55]; Qiao [56]; |

| Contract negotiation A07 | The two assessments and one case lack comprehensive argumentation, depth, and exhibit inaccuracies and confusing delineations. | Wang [57]; Branconi [58]; |

| Completeness of contract documents A08 | The presence of incomplete contracts in the domains of investment, construction, operation, and maintenance, coupled with ambiguous delineation of rights, responsibilities, and benefits, along with inequitable contractual provisions, have given rise to challenges pertaining to contractual documentation. | Cha [43]; Chen [59]; Shaikh [60]; Almarri [61]; |

| Quality of design solution A09 | In the lump-sum package model, the validation of the design program’s cost compression and adherence to requirements is insufficiently supported by social capital. | Wuni [62]; |

| Access to finance A10 | The inability to obtain financing within the designated timeframe, attributed to factors such as social capital or local debt, leads to the withdrawal of social capital and the subsequent stagnation of the project. | Steffen [63]; Sinha [64]; Chowdhry [65]; |

| Operating cost A11 | Government-mandated enhancements in service standards, escalations in operating expenses, and various market environment elements contribute to the occurrence of operating cost overruns and revenue decreases. | Welde [66]; Shi [67]; |

| Adaptation of laws and regulations A12 | The term primarily pertains to the potential risk arising from the implementation, dissemination, modification, and reinterpretation of laws and regulations, as well as the insufficiency of pertinent legal frameworks. | Riley [68]; Rossler [69]; Ozgur [70]; Berezin [71]; Alahmadi [72]; |

| Governance of the relationship between the social capitalist and the government A13 | Within the framework of the PPP and Entrepreneurial Public–Private Cooperation (PPP + EPC) model, the social capitalist assumes several roles, possesses many viewpoints, and harbors diverse interests during interactions with the government. | Zheng [73]; Demissew [74]; Feng [75]; |

| Project adaptation A14 | The potential impact on the successful implementation of EPC + PPP projects should be taken into account in light of potential alterations in key government decisionmakers or the formulation of novel policies or economic development strategies. | Nakamura [76]; Wang [77]; |

| Selection of consortium members A15 | The process of selecting consortium members has not undergone thorough and comprehensive evaluation, including factors such as company reputation, economic strength, and performance competence. | Siraj [45]; Aloysius [78]; Wang [79]; Aznar [80] |

| Multiple identities of social capitalists A16 | The Social Capital Party’s management capacity, organizational and coordination abilities, and overall project management proficiency are not commensurate with the complex role of being an investor, general contractor, and operator. | Aladag [44]; Toschi [81]; Teller [82]; |

| Decision-making interventions by governments A17 | The government’s delays in initiating the project can be attributed to various factors, including procedural irregularities, bureaucratic tendencies, limited operational experience and capacity, inadequate preparation, and information asymmetry. | Müller [83]; Janssen [84]; Hasan [85]; Barrutia [86]; |

| Control structure A18 | The absence of trust in government implementing agencies has resulted in a biased approach towards the design of the cooperation mechanism. This has hindered the social capital party’s ability to effectively fulfill its role as the project’s legal entity. | Deep [87]; Arshad [88]; Mohammadi [89]; |

| Stakeholder needs A19 | The stakeholder approach to the PPP + EPC model of social capital investment and construction portfolio model lacks comprehensive understanding, resulting in resistance and a failure to achieve optimal alignment with the diverse demands of stakeholders. | Alaloul [90]; Rafeh [91]; |

| Project schedule delay A20 | Insufficient readiness in the preliminary phase of the PPP initiative resulted in a halt in building progress. Subsequently, the project encountered delays during the construction phase, leading to its inability to meet the predetermined deadline and contractual period. | Xie [92]; Ahmed [93]; |

| Construction cost overrun A21 | The occurrence of construction cost overruns can be attributed to various factors, including escalations in raw material prices, labor expenses, and uncertainties arising from the preliminary design papers. | Cha [43]; Plebankiewicz [94]; Adam [95]; Sovacool [96]; |

| Engineering quality issues A22 | Social capital has the dual role of investor and design–build contractor. This situation hinders the establishment of effective supervision and constraints on the contractor’s construction process, ultimately resulting in quality issues. | Abd Karim [47]; Ugural [97]; Ding [98]; |

| Sample Category | Variant | Sample Size | Percentage (%) |

|---|---|---|---|

| Sex | Male | 175 | 94.1 |

| Female | 11 | 5.1 | |

| Age | 20~30 years | 45 | 24.2 |

| 31~40 years | 60 | 32.3 | |

| 41~50 years | 64 | 34.4 | |

| >50 years | 17 | 9.1 | |

| Educational background | Bachelor | 136 | 73.1 |

| Master | 26 | 14.0 | |

| Doctoral | 4 | 2.2 | |

| Others | 20 | 10.8 | |

| Working experience | Less than 5 years | 117 | 49.16 |

| 6~10 years | 43 | 18.30 | |

| More than 10 years | 75 | 31.91 | |

| Project position | Senior management | 35 | 18.8% |

| Middle management | 97 | 52.2% | |

| Below middle level | 50 | 26.9% | |

| Others | 4 | 2.1% |

| Risk Node | Statistical Results (%) | ||||

|---|---|---|---|---|---|

| Negligible Impact | Minor Impact | Medium Impact | Large Impact | Severe Impact | |

| Product/Service prices A01 | 20.1 | 12.7 | 27.52 | 24.34 | 15.34 |

| Managerial operational level A02 | 12.7 | 21.17 | 28.06 | 31.21 | 6.86 |

| Market demand A03 | 10.56 | 12.72 | 42.38 | 30.68 | 3.66 |

| Integration of the bidding procedures of the two parties into one A04 | 14.28 | 26.99 | 26.99 | 24.34 | 7.4 |

| Financing costs A05 | 14.27 | 20.64 | 35.51 | 24.84 | 4.74 |

| Bidding competition A06 | 20.62 | 24.38 | 37.08 | 15.31 | 2.61 |

| Contract negotiation A07 | 22.22 | 20.13 | 33.88 | 21.14 | 2.63 |

| Completeness of contract documents A08 | 47.99 | 12.46 | 27.85 | 5.85 | 5.85 |

| Quality of design solution A09 | 36.34 | 34.84 | 24.83 | 2.96 | 1.03 |

| Access to finance A10 | 53.62 | 32.34 | 11.06 | 2.55 | 0.43 |

| Operating cost A11 | 17.95 | 17.95 | 36.86 | 20.11 | 7.13 |

| Adaptation of laws and regulations A12 | 16.23 | 14.15 | 37.77 | 27.86 | 3.99 |

| Governance of the relationship between the social capitalist and the government A13 | 20.07 | 15.35 | 26.61 | 26.49 | 11.48 |

| Project adaptation A14 | 6.71 | 7.54 | 16.93 | 54.74 | 14.08 |

| Selection of consortium members A15 | 16.35 | 25.21 | 43.2 | 12.96 | 2.28 |

| Multiple identities of social capitalists A16 | 33.56 | 24.18 | 25.91 | 12.47 | 3.88 |

| Decision-making interventions by governments A17 | 26.25 | 30.05 | 20.61 | 17.76 | 5.33 |

| Control structure A18 | 22.9 | 22.82 | 27.72 | 23.01 | 3.55 |

| Stakeholder needs A19 | 20.92 | 25.79 | 36.46 | 15.87 | 0.96 |

| Project schedule delay A20 | 62.8 | 25.92 | 7.96 | 2.64 | 0.68 |

| Construction cost overrun A21 | 36.81 | 28.02 | 27.63 | 6.55 | 0.99 |

| Engineering quality issues A22 | 24.86 | 13.22 | 36.68 | 22.65 | 2.59 |

| Decision-Making Risk Node (t − 1) | Decision-Making Risk Node (t) | ||||

|---|---|---|---|---|---|

| Negligible (t) | Minor (t) | Medium (t) | Large (t) | Severe (t) | |

| Negligible (t − 1) | 0.06 | 0.02 | 0.10 | 0.07 | 0.03 |

| Minor (t − 1) | 0.02 | 0.50 | 0.15 | 0.10 | 0.05 |

| Medium (t − 1) | 0.05 | 0.15 | 0.65 | 0.10 | 0.05 |

| Large (t − 1) | 0.04 | 0.08 | 0.13 | 0.60 | 0.15 |

| Severe (t − 1) | 0.02 | 0.03 | 0.15 | 0.20 | 0.60 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, J.; Luo, L.; Sa, R.; Zhou, W.; Yu, Z. A Quantitative Analysis of Decision-Making Risk Factors for Mega Infrastructure Projects in China. Sustainability 2023, 15, 15301. https://doi.org/10.3390/su152115301

Wang J, Luo L, Sa R, Zhou W, Yu Z. A Quantitative Analysis of Decision-Making Risk Factors for Mega Infrastructure Projects in China. Sustainability. 2023; 15(21):15301. https://doi.org/10.3390/su152115301

Chicago/Turabian StyleWang, Jianwang, Lan Luo, Rina Sa, Wei Zhou, and Zihan Yu. 2023. "A Quantitative Analysis of Decision-Making Risk Factors for Mega Infrastructure Projects in China" Sustainability 15, no. 21: 15301. https://doi.org/10.3390/su152115301