Transport Emissions and Energy Consumption Impacts of Private Capital Investment in Public Transport

Abstract

:1. Introduction

2. Research Methodology

2.1. Overview of SD Theory and Its Use in Transport and Environmental Studies

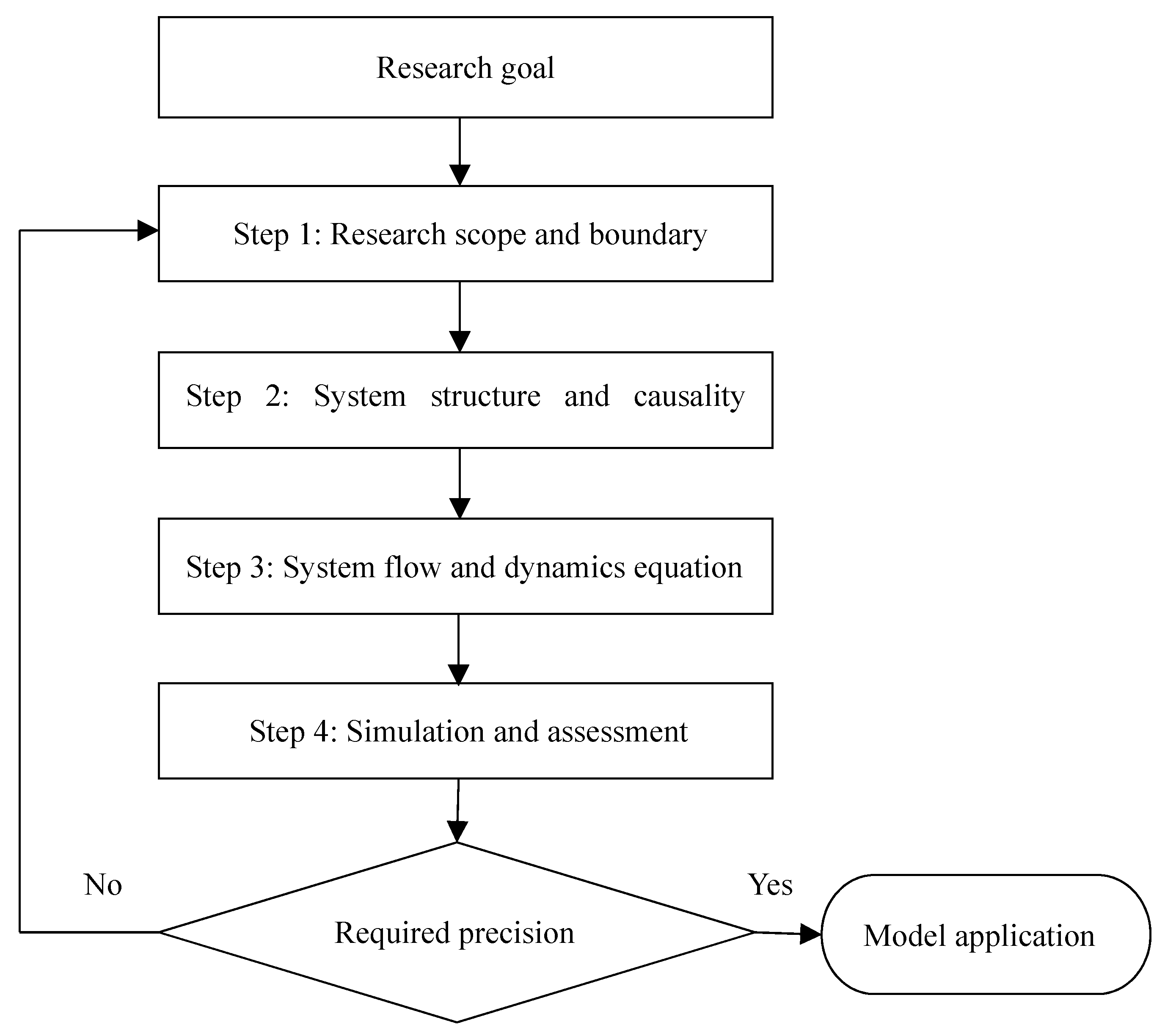

2.2. Modeling Process

3. Passenger Value Investment Model in Public Transport

4. Private Capital Investment SD Model in Public Transport

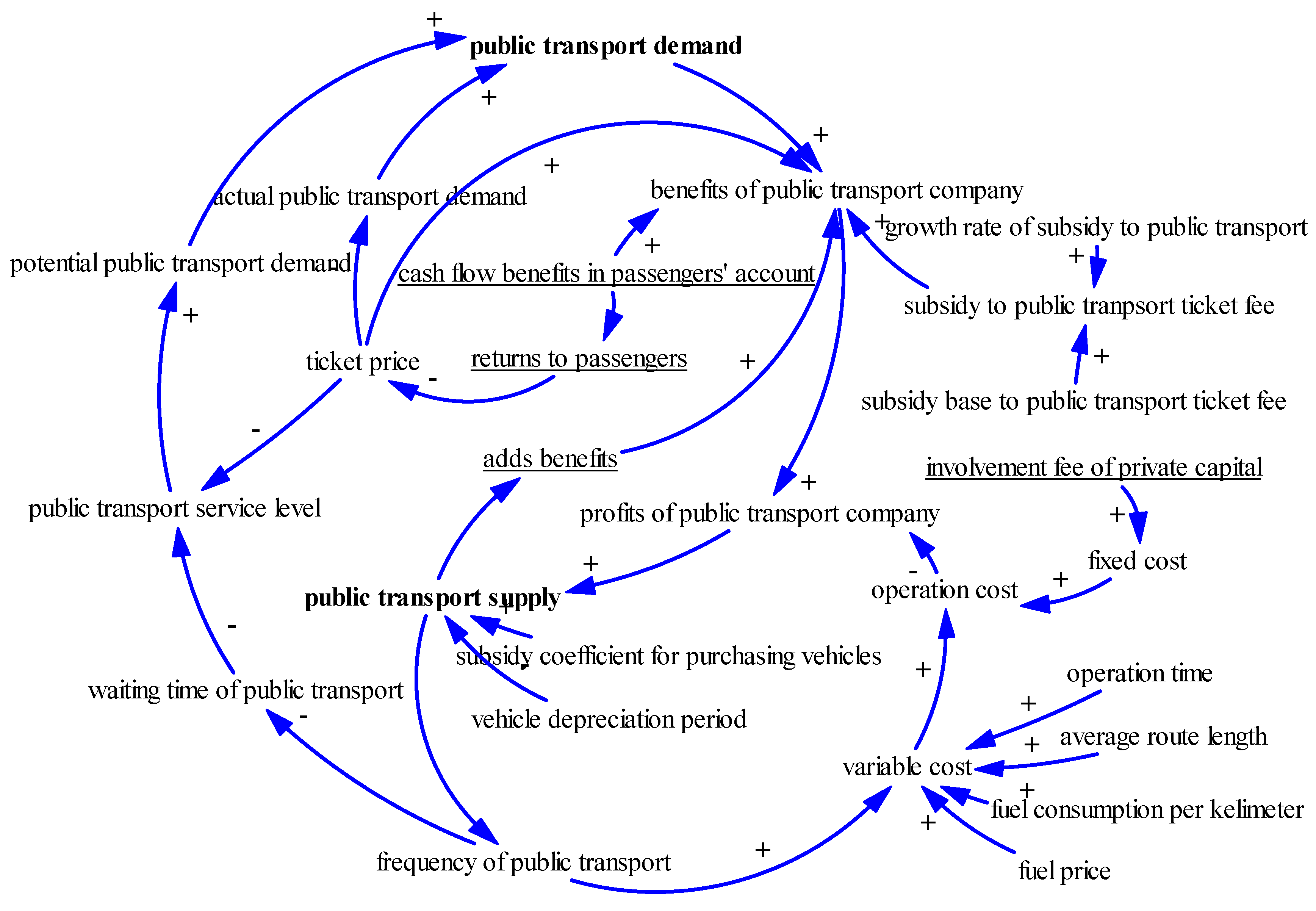

4.1. Private Capital Investment SD Model Construction in Public Transport

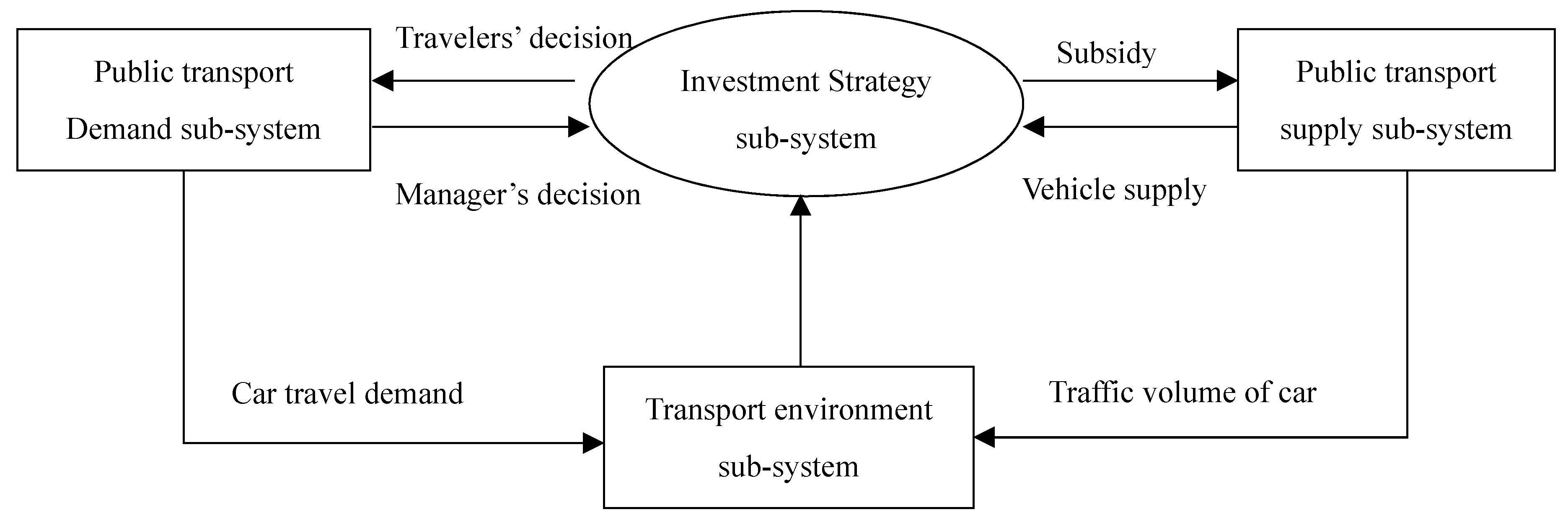

4.1.1. System Structure and Causalities of Private Capital Investments in Public Transport

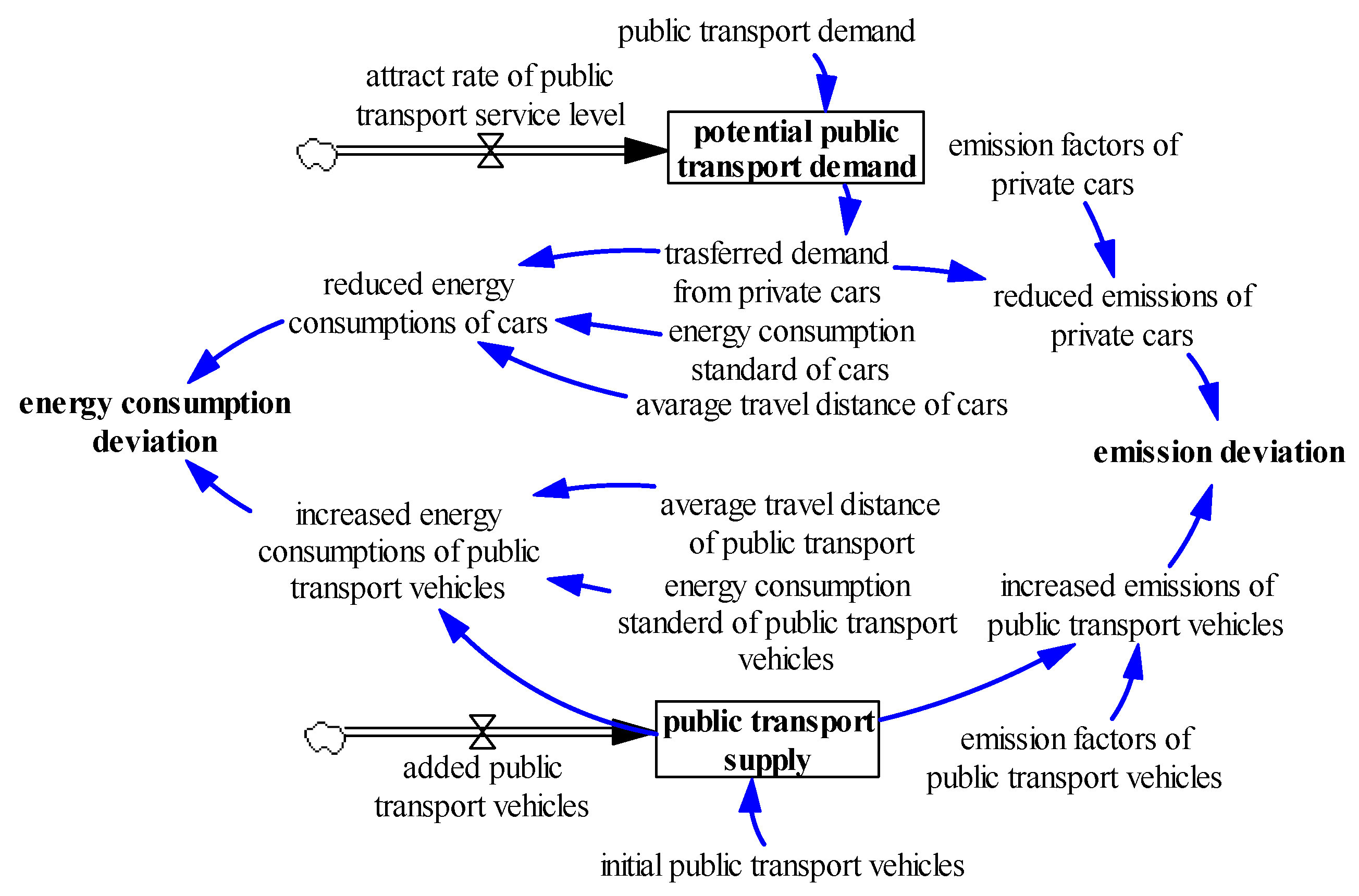

4.1.2. System Flow and Dynamic Equations of Private Capital Investments in Public Transport

4.2. SD Model Simulation and Validation

5. Case Study

5.1. Case Introduction

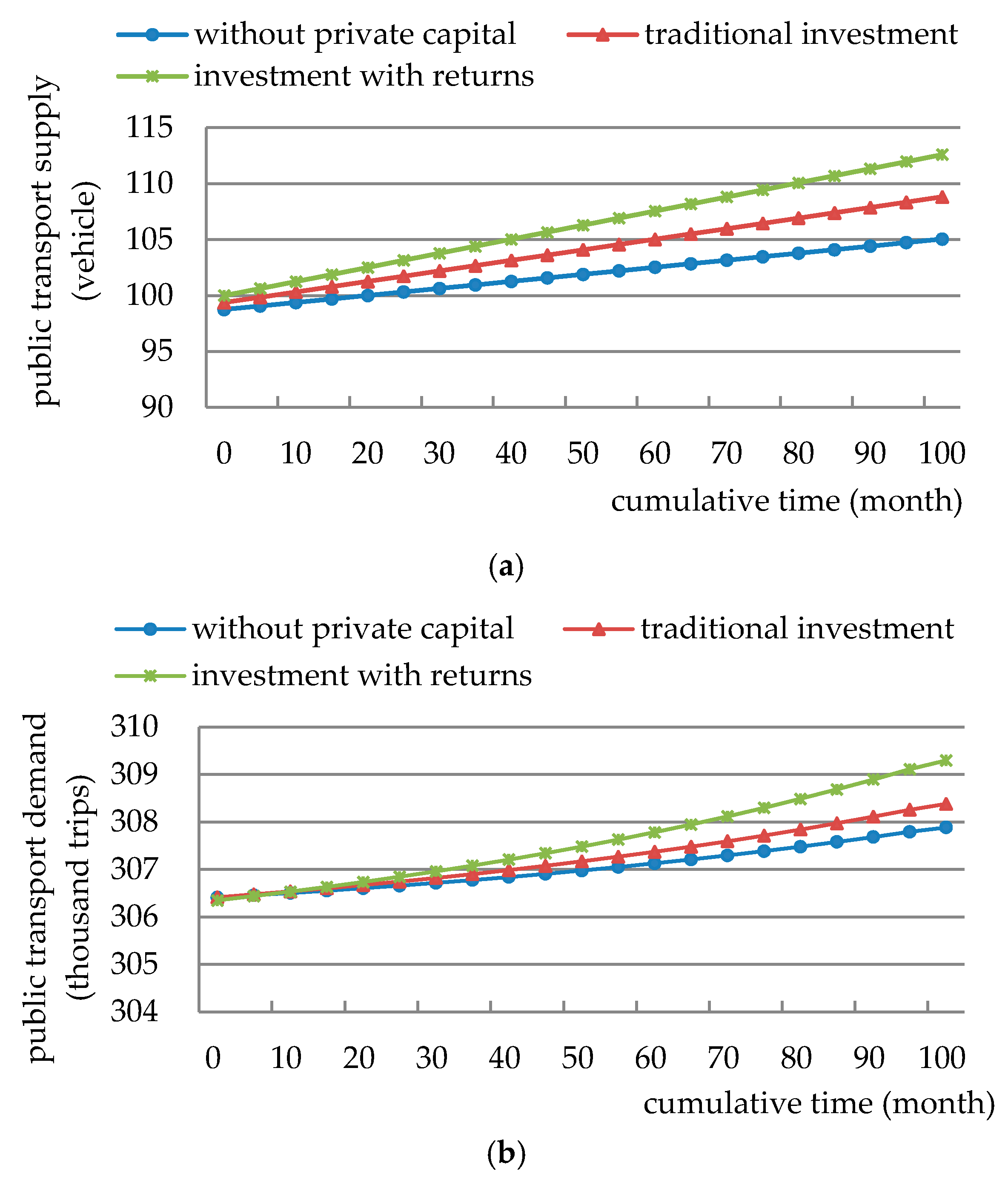

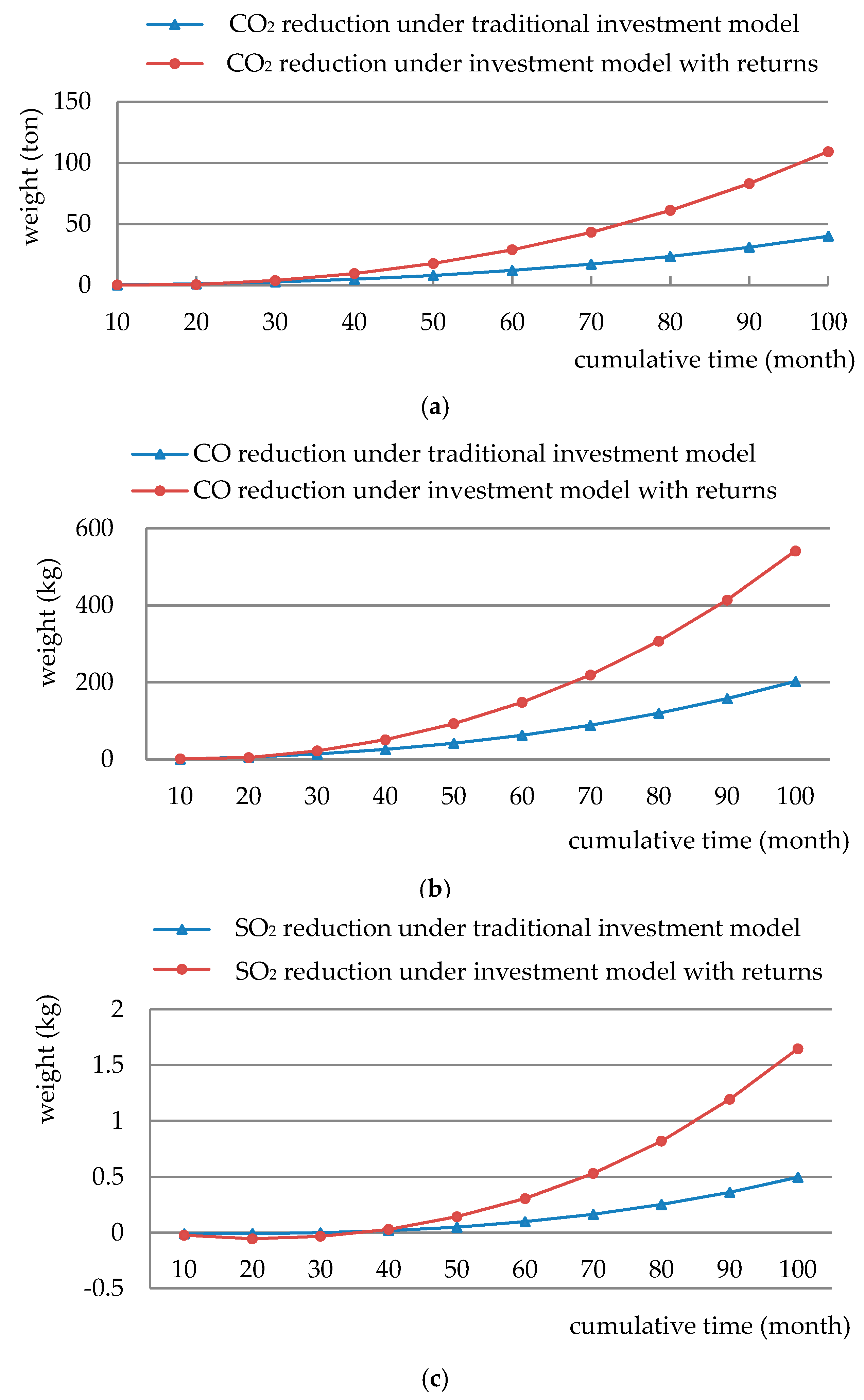

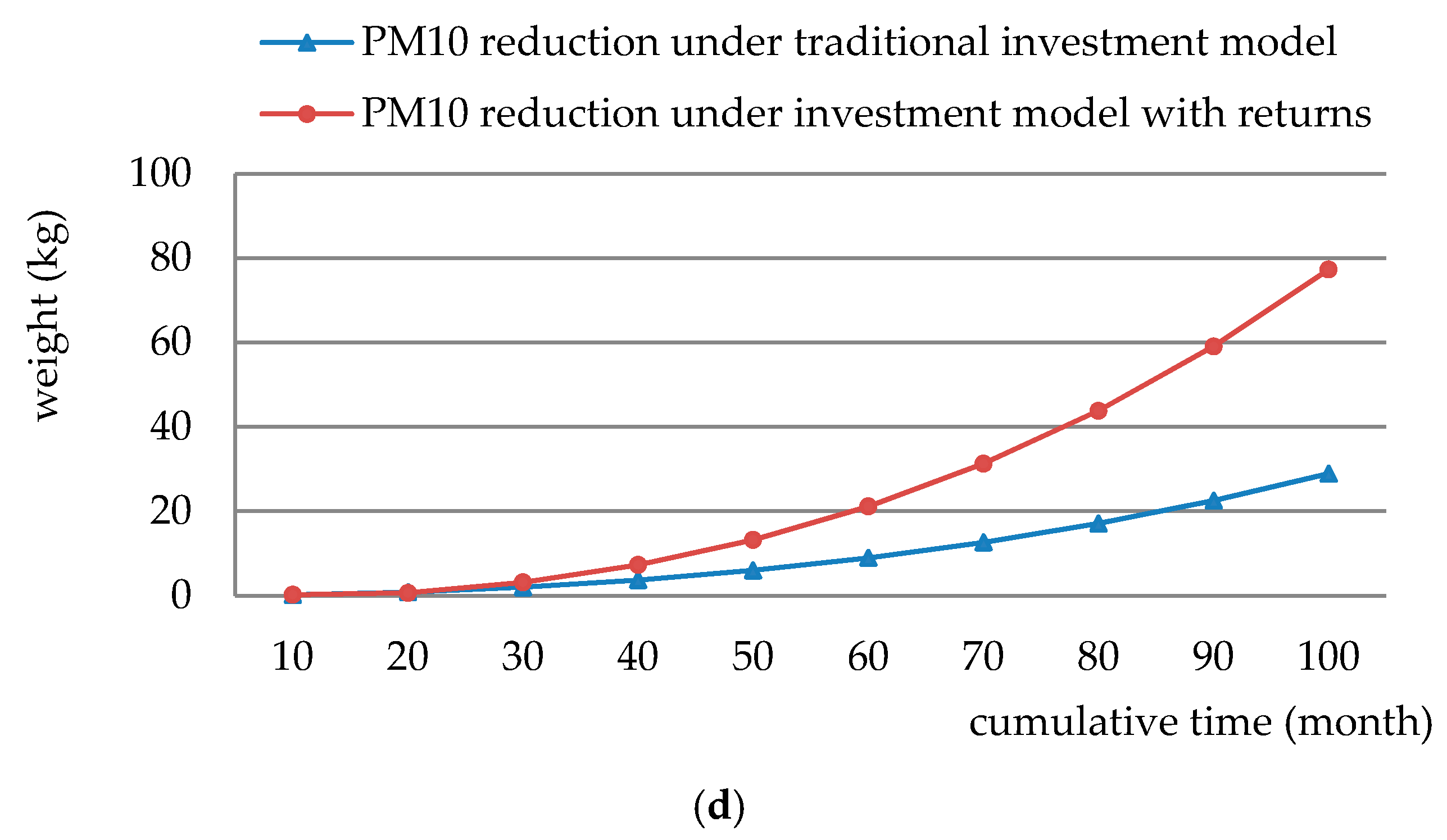

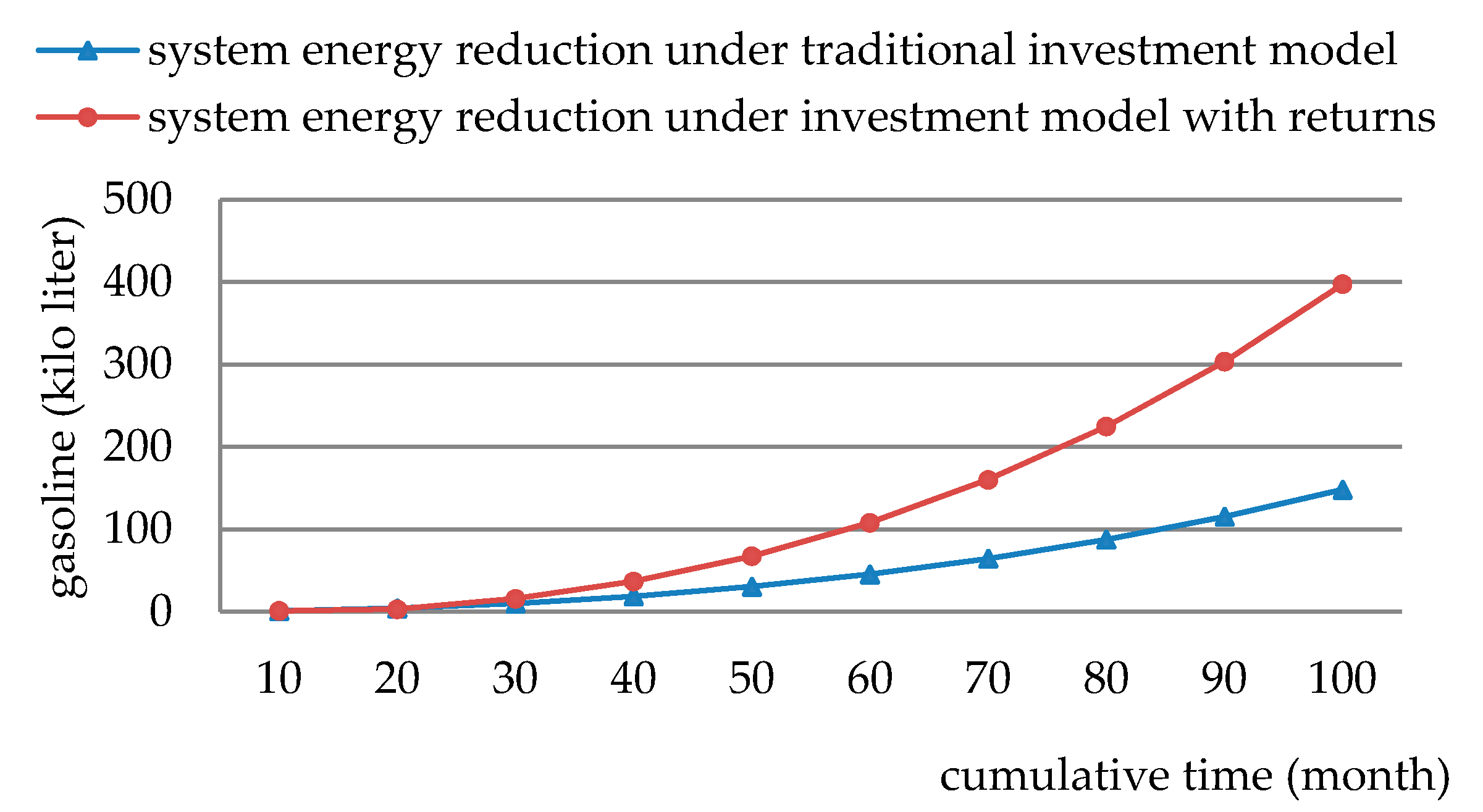

5.2. Simulation Results and Environmental Impact Analyses

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Malandraki, G.; Papamichail, I.; Papageorgiou, M.; Dinopoulou, V. Simulation and Evaluation of a Public Transport Priority Methodology. Transp. Res. Procedia 2015, 6, 402–410. [Google Scholar] [CrossRef]

- Xue, Y.; Guan, H.; Correy, J.; Qin, H.; Han, Y.; Ma, J. Bilevel Programming Model of Private Capital Investment in Urban Public Transportation: Case Study of Jinan City. Math. Probl. Eng. 2015, 2015, 498121. [Google Scholar] [CrossRef]

- Xue, Y.; Guan, H.; Corey, J.; Wei, H.; Yan, H. Quantifying a Financially Sustainable Strategy of Public Transport: Private Capital Investment Considering Passenger Value. Sustainability 2017, 9, 269. [Google Scholar] [CrossRef]

- Chan, A.P.C.; Lam, P.T.I.; Chan, D.W.M.; Cheung, E.; Ke, Y. Privileges and attractions for private sector involvement in PPP projects. In Challenges, Opportunities and Solutions in Structural Engineering and Construction-Ghafooi; Ghafoori, N., Ed.; Taylor & Francis Group: London, UK, 2010; pp. 751–755. [Google Scholar]

- Costa, A.; Fernandes, R. Urban public transport in Europe: Technology diffusion and market organization. Transp. Res. Part A 2012, 46, 269–284. [Google Scholar] [CrossRef]

- Matsunaka, R.; Oba, T.; Nakagawa, D.; Nagao, M.; Nawrocki, J. Internatioal comparison of the relationship between urban structure and the service level of urban public transportation—A comprehensive analysis in local cities in Japan, France and Germany. Transp. Policy 2013, 30, 26–39. [Google Scholar] [CrossRef] [Green Version]

- Medda, F.R.; Carbonaro, G.; Davis, S.L. Public private partnerships in transportation: Some insights from the European experience. IATSS Res. 2013, 36, 83–87. [Google Scholar] [CrossRef]

- Osei-Kyei, R.; Chan, A.P.C. Review of studies on the Critical Success Factors for Public-Private Partnership (PPP) projects from 1990 to 2013. Int. J. Proj. Manag. 2015, 33, 1335–1346. [Google Scholar] [CrossRef]

- English, L.M. Public Private Partnerships in Australia: An Overview of Their Nature, Purpose, Incidence and Oversight. UMSW Law J. 2006, 29, 250–263. [Google Scholar]

- Group, W.B. Public-Private Partnerships Reference Guide-Version 2.0; World Bank: Washington, DC, USA, 2014. [Google Scholar]

- Rouhani, O.M.; Niemeier, D. Resolving the property right of transportation emissions through public-private partnerships. Transp. Res. Part D Transp. Environ. 2014, 31, 48–60. [Google Scholar] [CrossRef]

- De Los Rios-Carmenado, I.; Ortuno, M.; Rivera, M. Private-Public Partnership as a Tool to Promote Entrepreneurship for Sustainable Development: WWP Torrearte Experience. Sustainability 2016, 8, 199. [Google Scholar] [CrossRef]

- Bidne, D.; Kirby, A.; Luvela, L.J.; Shattuck, B.; Standley, S.; Welker, S. The Value for Money Analysis: A Guide for More Effective PSC and PPP Evaluation. Available online: http://www.ncppp.org/wp-content/uploads/2013/03/PS-051012ValueForMoney-paper.pdf (accessed on 26 September 2017).

- Takim, R.; Ismail, K.; Nawawi, A.H.; Jaafar, A. The Malaysian Private Finance Initiative and Value for Money. Asian Soc. Sci. 2009, 5, 103–111. [Google Scholar] [CrossRef]

- Ho, P.H.K. Development of Public Private Partnerships (PPPs) in China. Available online: http://www.icoste.org/Roundup1206/HoPaper.pdf (accessed on 26 September 2017).

- Zhang, S.; Chan A P, C.; Feng, Y.; Duan, H.; Ke, Y. Critical review on PPP Research—A search from the Chinese and International Journals. Int. J. Proj. Manag. 2016, 34, 597–612. [Google Scholar] [CrossRef]

- Mounter, N.; Annema J, A.; van Wee, B. Managing the insolvable limitations of cost-benefit analysis: Results of an interview based study. Transportation 2015, 42, 277–302. [Google Scholar] [CrossRef]

- Soomro, M.A.; Zhang, X. Value for Money Drivers in Transportation Public Private Partnerships. In Proceedings of the 24th International Project Management Association (IMPA) World Congress, Istanbul, Turkey, 1–3 November 2010. [Google Scholar]

- Morallos, D.; Amekudzi, A. A Review of Value-for-Money Analysis for Comparing Public-Private Partnerships with Traditional Procurements. In Proceedings of the Transportation Research Board 87th Annnual Meeting, Washington, DC, USA, 13–17 January 2008. [Google Scholar]

- Peng, W.; Cui, Q.; Lu, Y.; Huang, L. Achieving Value for Money: An Analytic Review of Studies on Public Private Partnerships. In Proceedings of the Construction Research Congress 2014, Atlanta, GA, USA, 19–21 May 2014. [Google Scholar]

- Miller, P.; de Barros, A.G.; Kattan, L.; Wirasinghe, S.C. Public Transportation and Sustainability: A Review. KSCE J. Civ. Eng. 2016, 20, 1076–1083. [Google Scholar] [CrossRef]

- Liu, S.; Triantis, K.P.; Sarangi, S. A framework for evaluating the dynamic impacts of a congestion pricing policy for a transportation socioeconomic system. Transp. Res. Part A Policy Pract. 2010, 44, 596–608. [Google Scholar] [CrossRef]

- Egimez, G.; Tatari, O. A dynamic modelling approach to highway sustainability: Srategies to reduce overall impact. Transp. Res. Part A 2012, 46, 1086–1096. [Google Scholar]

- Sterman, J. System dynamics modeling: Tools for learning in a complex world. Calif. Manag. Rev. 2001, 43, 8–25. [Google Scholar] [CrossRef]

- Forrester, J.W. 479 Industrial Dynamics; Wiley-Interscience: New York, NY, USA, 1961. [Google Scholar]

- Wang, J.; Lu, H.; Peng, H. System dynamics model of urban transportation system and its application. J. Transp. Syst. Eng. Inf. Technol. 2008, 8, 83–89. [Google Scholar] [CrossRef]

- Fong, W.; Matsumoto, H.; Lun, Y. Application of system dynamics model as decision making tool in urban planning process toward stabilizing carbon dioxide emissions from cities. Build. Environ. 2009, 44, 1528–1537. [Google Scholar] [CrossRef]

- Baldoni, F.; Falsini, D.; Taibi, E. A system dynamics energy model for a sustainable transportation system. In Proceedings of the 28th International Conference of the System Dynamics Society, Seoul, Korea, 25–29 July 2010. [Google Scholar]

- Guanglin, S. Research on Price Linkage Strategy of Public Transport of City. Ph.D. Thesis, Harbin Institute of Technology, Harbin, China, 2013. (In Chinese). [Google Scholar]

| Variable Type | Variable | Unit | Symbol | Illustration |

|---|---|---|---|---|

| Level variable | Public transport supply | vehicle | Operation vehicles of public transport | |

| Potential demand | trip | Transfer amount from other travel mode | ||

| Public transport demand | trip | Actual and potential public transport demand | ||

| Rate variable | Attract rate of public transport service level | Public transport demand at different service levels; it presents the fitting slope between public transport demand and service levels | ||

| Vehicle depreciation rate | The ratio of depreciation value to total vehicle value | |||

| Added vehicles | vehicle | The added public transport vehicles per year | ||

| Auxiliary variable | Benefits of public transport company | Yuan | Sum of fare income, ad income, subsidies, and cash flow benefits in passengers’ accounts | |

| subsidy | Yuan | Government subsidy to public transport | ||

| Profits of public transport company | Yuan | Benefits of public transport company minus cost | ||

| Departure frequency | Bus/hour | Departure frequency of public transport | ||

| Variable cost | Yuan | Related to operation time, route length, fuel consumption and fuel price | ||

| Operation cost | Yuan | Variable cost plus fixed cost | ||

| Waiting time | hour | Average waiting time of public transport | ||

| Service level | A function of ticket price and travel time of public transport [29] | |||

| Difference of service levels | Difference between actual and respected public transport service levels | |||

| Benefits of cash flow in passengers’ accounts | Yuan | Benefits of cash flow in passengers’ account through investment in other fields | ||

| Returns to passengers | Yuan | Some of cash flow benefits returned to passengers | ||

| Adds benefits | Yuan | Adds benefits of public transport | ||

| Actual public transport demand | trip | Actual travel demand of public transport | ||

| constant | Subsidy base | Yuan | Original subsidy amount to public transport | |

| Subsidy growth rate | Growth rate of subsidy to public transport ticket fee | |||

| Subsidy coefficient of vehicle purchase | Ratio of subsidy to total vehicle price | |||

| Involvement fee | Yuan/day | Involvement fee of private capital | ||

| Time value of passengers | Yuan/hour | Related to passengers’ average income per hour | ||

| Fixed operation cost | Yuan | Fixed operation cost of public transport | ||

| Respected service level | The service level passengers respect | |||

| Public transport route length | km | Average route length of public transport | ||

| Fuel consumption of public transport | Liter/Km | Average fuel consumption of public transport | ||

| Fuel price 1 () | Yuan/liter | Market price minus fuel subsidy |

| Variable | Initial Value |

|---|---|

| Potential public transport demand | 0 |

| Public transport supply | 100 vehicles |

| Subsidy base to public transport ticket fee | 10,000 Yuan |

| Growth rate of subsidy to public transport | 1% |

| Time value of public transport passengers | 30 Yuan/h |

| Fixed operation cost | 20,000 Yuan/month |

| Subsidy coefficient for purchasing vehicles | 0.6% |

| Fuel price | 6 Yuan/L |

| Average route length | 15 km |

| Fuel consumption per kilometer for public transport vehicles | 0.3 L/km |

| Respected public transport service level | 4 |

| Average operation time of public transport | 360 h/month/vehicle |

| Validation Parameter (Level Variable) | Simulation Results | Statistic Results | Relative Error |

|---|---|---|---|

| Public transport demand (trip/month) | 306,450 | 322,000 | –4.83% |

| Public transport supply (vehicles amount) | 97 | 100 | –3% |

| Parameter | Survey Value | Parameter | Survey Value |

|---|---|---|---|

| Car travel demand | 1.80 million trips/day | Public transport demand | 2.40 million trips/day |

| Average car carrying capacity | 1.5 persons/vehicle | Average passenger capacity | 70 persons/vehicle |

| Average travel mileage of car | 10.6 km | Average travel mileage of public transport | 11 km |

| Average speed of private car | 21 km/h | Average speed of public transport | 17 km/h |

| Average fuel consumption of private car | 0.07 L/km |

| Vehicle Type | Fuel Type | Emission Standards | Emission Factor (g/km) | |||

|---|---|---|---|---|---|---|

| CO2 | CO | SO2 | PM10 | |||

| Car | Gasoline | Euro IV | 322.3 | 1.4 | 0.01 | 0.2 |

| Euro V | 322.3 | 1.4 | 0.01 | 0.2 | ||

| Bus | Gasoline | Euro IV | 1072.8 | 0.3 | 0.30 | 0.1 |

| Euro V | 1072.8 | 0.3 | 0.30 | 0.1 | ||

| CNG | Euro III | 1254.8 | 1.0 | 0.00 | 0.1 | |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xue, Y.; Guan, H.; Corey, J.; Zhang, B.; Yan, H.; Han, Y.; Qin, H. Transport Emissions and Energy Consumption Impacts of Private Capital Investment in Public Transport. Sustainability 2017, 9, 1760. https://doi.org/10.3390/su9101760

Xue Y, Guan H, Corey J, Zhang B, Yan H, Han Y, Qin H. Transport Emissions and Energy Consumption Impacts of Private Capital Investment in Public Transport. Sustainability. 2017; 9(10):1760. https://doi.org/10.3390/su9101760

Chicago/Turabian StyleXue, Yunqiang, Hongzhi Guan, Jonathan Corey, Bing Zhang, Hai Yan, Yan Han, and Huanmei Qin. 2017. "Transport Emissions and Energy Consumption Impacts of Private Capital Investment in Public Transport" Sustainability 9, no. 10: 1760. https://doi.org/10.3390/su9101760