Abstract

Trust potentially affects the decision-makers’ behaviors and has a great influence on supply chain performances. We study the information sharing process considering trust in a two-tier supply chain with one upstream agent and two retailers, where the agent recommends ordered quantities (ROQ) to retailers and the retailer decides her/his ordered quantities according to the agent’s recommendation and self-collected information. There exist three types of information sharing patterns among the agent and two retailers, i.e., both retailers share their demand prediction (Pattern 1), one retailer shares her/his demand prediction (Pattern 2) and none of the retailers share their demand prediction (Pattern 3). Thus, we build corresponding mathematical models and analyze each party’s decision strategies in each pattern, respectively. The findings in this study show that sharing information can generally promote trust among enterprises in the entire supply chain and increase their profits in return. It is found that when the accuracies of the two retailers’ predicted demand differs, their behaviors of information sharing or not sharing significantly affect their expected profits. In Pattern 1 and Pattern 3, we find that retailers’ expected profits are negatively influenced by the agent’s accuracies of demand prediction. However, the retailer’s expected profits are positively linked to the agent’s accuracies of demand in Pattern 2. Consequently, we propose a series of strategies for retailers in different decision patterns after several simulation runs. In addition, we also find that the retailer whose prediction is less accurate can also gain more profits by un-sharing his/her demand prediction when the agent’s predict accuracy is between the two retailers.

1. Introduction

In industries, many retailers rely on local upstream agents to gather market information when supplying products to the local market, since local agents possess better demand information than the retailer because of their local connections. For example, Volkswagen commissioned its sale of cars in China to Shanghai Volkswagen, a local company in eastern China. Volkswagen obtains knowledge of Chinese consumer tastes, market size and demand information through the agent (Shanghai Volkswagen). The agent not only helps Volkswagen sell its products and facilitates the establishment of the reputation of its products but also lays the foundation for Volkswagen to build factories to manufacture cars. Meanwhile, to guarantee the benefits of the agent (Shanghai Volkswagen), Volkswagen does not allow cross sales among retailers (4s automobile shops) in different regions. In other words, 4s automobile shops cannot ignore the distribution agreements and the long-term benefits of its upstream agent, which will reduce prices and promote sales across different regions. For instance, the prices of a Passat in 4s automobile shops among different cities are different. Generally speaking, the modes of marketing in major cities such as Beijing, Shanghai, Guangzhou and Shenzhen are various, which results in cheap prices compared with other cities. Moreover, those 4s automobile shops run independently, and information cannot be shared among them. However, information sharing exists between the agent and retailer. Because the total capacity of manufacturers is limited, the problem of how agents distribute order quantity to 4s automobile shops in different regions will arise. In this paper, we specify the agent’s problem into mathematical models and explore how retailer demand prediction shares in the cooperation framework.

Information asymmetry is common in the supply chain because information holders have the intention to share unreal information to maximize their profits. Since the shared information is likely unreliable to the receiver, an information filter mechanism by trust has been recently introduced into the supply chain information sharing process and has also been proven to be helpful for supply chain cooperation [1]. Moreover, trust reflects the enterprise’s reliability, integrity, and ability to dynamically change over time, which is based on transaction history. Trust varies at a wide range of levels, from full trust to complete distrust. As for our motivation problem of Volkswagen, Shanghai Volkswagen recommends the order quantities to the 4s automobile shops. The 4s automobile shops’ reliance on the recommended order can be specified by trust. Because the automobile shops and Volkswagen can be generalized by retailers and agents, we analyze the trust-based information sharing process between one agent and two retailers. Additionally, because the retailer can choose or not choose information sharing with the agent, the information sharing process falls into three patterns: both retailers share demand prediction; one retailer shares demand prediction and none of the retailers share demand prediction. Information sharing might have different effects on the agent’s recommended ordered quantities ROQ decisions in different patterns, which influences the retailers’ trust towards the agent and their final order decisions. Therefore, we mathematically classify the supply chain parties’ decisions considering trust in demand information sharing and analyze the effects of demand prediction accuracy on the whole decision process.

The contribution of this study lies in that, (1) in the past literature about trust, many scholars adopted qualitative methods or statistical methods to find the factors that influence trust, and the models they proposed were about one supplier corresponding to one retailer. However, we increase the number of retailers to more than one, and analyze the role that trust plays by putting trust into the process of the transaction between the downstream and upstream enterprises and by investigating the upstream agent’s different strategies for distributing ROQ. We find that trust is related to the level of information sharing, transaction success rate, and the reputation of the company. We incorporate the trust value as a decision variable into the mathematical model and simulation; (2) According to the situations of information sharing, we build three models of the agent’s ROQ distribution. These models can be applied to the supply chain’s two parties (manufacturer and retailer) in multiple-period transactions. With this model, we can obtain a more accurate description of an agent’s role in regulating enterprises in the supply chain. We can also observe the changes of other parameters in the whole process of investigation.

The paper’s organization is as follows: in Section 2, we review the related literature. In Section 3, we formulate the multi-period trust updating model and the allocation ROQ model. In Section 4 and Section 5, we design the experiment and run different simulation scenarios. Then, the simulation results are analyzed. In the last section, we conclude the paper as well as consider any future work.

2. Literature Review

There have been some recent studies using model and simulation methods to analyze supply chain trust issues, but they are not common. For example, Taylor and Plambeck [2] considered a similar model in which the buyer and supplier had an informal agreement on required capacity. They concluded that the buyer would honor such an agreement because of the future value of cooperation. Ren et al. [3] considered a supply chain whose buyer shared his/her demand forecast with a supplier to facilitate the supplier’s decisions in building manufacturing capacity. The authors showed that if the relationship were long term, it would be optimal for the buyer to report the true forecast to the supplier to gain the supplier’s trust. Özalp et al. [1] studied the applications of trust in the information sharing process between the supplier and the manufacturer and proved that the manufacturer could effectively make capacity plans by levels of trust. Additionally, the higher the reputation of the retailer, the more confidence the supplier has in the retailer’s information. Chang et al. [4] presented a multi-criteria decision-making approach based on trust and reputation in the supply chain. They defined general trust indicators and designed a multi-dimensional trust and reputation model. Their simulation experiments demonstrated that the proposed trust and reputation model can effectively filter unfair ratings from the customers who did lie, and the proposed multi-criteria decision-making method can help customers make the right decisions. However, trust was not only associated with corporate reputation but was also closely related to other factors of the transaction object [5]. Han and Dong [6] Studied supply chain coordination with the trust-embedded cost-sharing contract. In a two-tier supply chain, a retailer and a supplier make their private demand forecasting individually. Panayides and Lun [7] investigated the effects of trust on innovativeness and supply chain performance. Laaksonen et al. [8] modelled the real cost structures of three customer–supplier relationships through a game theory approach. They considered that interfirm trust can decrease the transaction costs of the relationship, and they presented a pricing arrangement that partially compensates for the possible lack of mutual trust. Villena et al. [9] showed that trust follows an inverted-U shape with performance. Additionally, trust’s negative effects are more severe for those buyers that are highly dependent and operate in stable markets.

As for issues concerning information sharing in the supply chain, many scholars have investigated the influence of information sharing on the enterprises directly concerned, and believe that information sharing can reduce the vertical distortion of information along the supply chain, thereby improving the levels of inventory and reducing stock-out costs [10,11,12]. However, in fact, information sharing not only affects the members of the supply chain directly involved but also invites the interactive responses from the other members (i.e., those members who do not share information) of the supply chain. Moreover, some responses have negative effects. Lee and Whang [13] were the first to raise this problem. Lee et al. [14] and Zhang [15] discussed the value of information sharing from this angle. Lee first considered information sharing in a two-echelon supply chain comprising one manufacturer and two retailers when there existed Cournot competition between the retailers. Zhang considered demand information sharing in the supply chain consisting of a manufacturer and two suppliers. Park et al. [16] examined how power types form a causal partnership relationship within the supply chain, and performed an empirical investigation on how the partnerships influence supply chain management performance.

Generally speaking, the uncertainty of demand will exert great negative influence over a supply chain. How to weaken those negative effects has already become a hot issue in both theoretical research and business practices. Modern information technology can guarantee the convenience of information sharing between members of a supply chain. Many scholars, such as Lee et al. [14], and Li [17], have already done related research. The main conclusion of this research is that information sharing reduces commodity shortage and unsalable loss caused by the uncertainty of demand information, and improves the ordering of goods, thus facilitating a better formulation of the decision of production and inventory distribution and improving service levels, etc. Renna and Perrone [18] have studied how an allocation strategy that takes into account the whole supply chain’s perspective leads to a sustainable development of the clusters of suppliers.

As distinct from the above researchers who considered the uncertainty of demand and the cost of obtaining shared information, we mainly focus on the influence that information sharing in supply chain enterprises has on trust value. We also consider the profit of the retailer and the agent, rather than their costs. We will discuss questions such as these: Faced with several retailers’ different states of sharing information, which order quantity distribution approach should the agent adopt to maintain the trust value at a high level? At what time is the retailer willing to share information with the agent? Under which conditions can trust between the retailer and the agent remain at a high level? Is it possible that profit can also be maintained at a high level?

3. Model Formulation

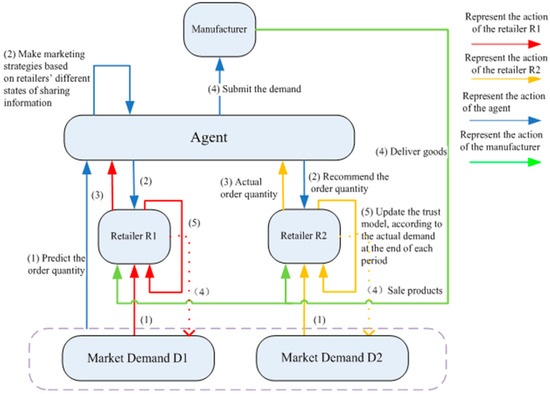

Specific transaction processes between the upstream and downstream enterprises in the supply chain of this study are as follows (Figure 1):

Figure 1.

The operation framework of the three-tier supply chain.

- (1)

- Two retailers sell homogeneous products to meet the different regional markets, and two markets are independent of each other. Retailer Ri predicts demand and figures out the optimal order quantity (OOQ) to maximize his/her utility, . The upstream agent also predicts demand and figures out his/her OOQ .

- (2)

- The upstream agent decides her marketing strategies according to retailers’ different states of sharing information, and recommends an order quantity to the retailers; this is denoted as , . Where θ is an increment, it can also be taken as an index of telling lies. Because of asymmetrical information, the agent intends to report unreal information to maximize her/his profit. is the agent’s ROQ for retailer Ri.

- (3)

- Then, the retailer adjusts his/her order quantity and decides on the final actual ordering quantity (AOQ) . The decision is made based on his OOQ , the agent’s ROQ , and his trust in the agent, .

- (4)

- After two retailers submit their order quantity to the manufacturer through the agent, the manufacturer produces the products and delivers them to retailers R1 and R2, respectively.

- (5)

- Finally, two retailers figure out the profit and compare the difference value between the recommended quantity and the actual demand , with the difference value between the optimized quantity and the actual demand at the end of the period, respectively. The difference value is used to update the trust value for the next period. We translate these dynamics into the model below.

3.1. Demand Prediction and Profit Model

Two different regional market demands are discrete random variables that are subject to the uniform distribution and the probability function , . Therefore, and are, respectively, the lower limit and the upper limit of the market demand. Since this paper focuses on the role of trust, and demands in each period are independent and do not involve time series, we simply consider the quantity of the predicted order, regardless of its manufacturing process, to make the result unaffected by setting a uniformly distributed demand [19].

The retailer ’s forecast is a discrete random variable, and it is subject to . When the market demand equals , , the C.D.F. (cumulative distribution function) of the retailer’s forecast is , and the standard deviation is , which represents the degree of accuracy of the retailer ’s prediction. The conditional probability density function is denoted by ; therein, i = 1, 2 [20].

It is assumed that the agent can see the whole market historical demand. Therefore, the agent can also predict the demand from the market demand in history; her/his forecast is a discrete random variable which is subject to . When the market demand is , the C.D.F of the agent’s forecast is ; the standard deviation is , which represents the degree of accuracy of the agent’s prediction, and the conditional probability density function is [20].

Under the condition of , the prediction of the agent is more accurate than that of the retailer. Under the condition of , the prediction of the retailer is more accurate than that of the agent. While under the condition of , the prediction of retailer R1 is more accurate than that of retailer R2.

There are some price symbols in our model: is production cost from the manufacturer; is the wholesale price that the manufacturer sells to the agent; is the agent price sold to the retailer; is the retailer’s selling price, ; is the salvage of one product; is shortage cost; these are all known constants. We assume that is the same as the two retailers, likewise, and Sr.

is the ordering quantity given by retailer Ri, i = 1, 2. Note that this is a generic notation, which will be replaced by the “actual” ordering quantity later on. The AOQ will be a weighted sum between the “optimal” ordering quantity (derived from maximizing the expected retailer’s profit function) and the “recommended” ordering quantity given by the agent. is the demand for retailer Ri. It is possible that demands for two different retailers are distinct due to location, advertisement, etc.

Thus, retailer Ri’s profit is:

Retailers R1 and R2 have a similar profit function with index “1” changed to “2”.

The manufacturer’s profit is:

Therein, is the total of AOQ from both retailers.

The agent’s profit is based on retailers paying the agent compensation through price difference between the retailer-paid and manufacturer-asked prices:

Because the retailers intend to maximize their profit, respectively, the retailers’ OOQ is:

where is given in Equation. (1).

For the same scenario, to maximize the retailer’s expected profit, the agent has a different OOQ because her/his forecast of demand is instead of . Therefore, the OOQ of the agent is:

where is given in Equation. (2). Note that and depend on and , respectively. Moreover, is the sum of two retailers’ profit because both retailers have the same pricing strategy.

As the agent also intends to overstate the demand, there is also an increment in the ROQ that the agent provides for the retailers; the increment can be formulated as . is the agent’s ROQ for retailer Ri. Generally, the agent will report a higher order quantity than the OOQ to increase her/his own profit. Therefore, the OOQ and the ROQ of the agent are not the same [20]. The ROQ of the agent is affected by many factors, such as the agent’s roles (benevolent or selfish), the commission coefficient that the manufacturer gives to the agent, and so on [19]. The increment here can also be taken as an index of telling lies. If the agent were selfish and short-sighted, her/his index of telling lies would be very high; if the agent were benevolent and far-sighted, his/her index of telling lies would not be high. Note that in this paper we study the impact of information sharing on trust, and we assume that agents are benevolent, so the increment of the agent’s ROQ is small enough to be ignored.

In period t, the retailer relies on his/her trust of the agent and decides on the AOQ according to his/her forecast and the agent’s ROQ. As suggested by [21,22], we assume that the retailer combines the two order quantities using a simple weighted average. Retailer Ri’s final AOQ is written as:

The more the retailer trusts the agent, the more weight he/she puts on her/his recommendation. The more the agent’s ROQ increases the retailer’s profit in the short term, the more trust a retailer gains as an agent. Hence, we use the retailer’s forecast and the agent’s ROQ to analyze the weight as a measure of the retailer’s trust in the agent.

3.2. ROQ Distribution Model

After the agent decides her/his marketing strategies according to retailers’ different states of information sharing, the agent recommends order quantity to retailers R1 and R2, respectively. There are three scenarios when the agent allocates ROQ to the two retailers: neither retailer shares information (including and ) of their forecast with the agent; only one of the two retailers shares that information with the agent; and both retailers share that information with the agent. We mainly investigate the influence that the agent’s allocation of ROQ has on the retailer’s trust value.

3.2.1. Pattern 1: None of the Retailers Share Demand Prediction

Neither retailer shares information (including and ) of their forecast with the agent. In this case, to make the allocation more precise, the agent, knowing no more than the information of the two retailers’ OOQ, has no alternative but to meet the conditions: minimal is the sum of the absolute values of differences of the two values of ROQ allocated to the two retailers from the corresponding OOQ of the two retailers.

Therein, means “approximate to”. .

are the actual variance of retailers’ forecast respectively. represents the weight of the agent’s allocation of the two retailers’ ROQ. Owing to the differences of prediction technologies, risk attitudes, and circumstances, the retailer’s forecasts of demands are always inconsistent. Moreover, the agent does not completely trust the retailer’s forecast and OOQ. Therefore, the agent will formulate strategies of allocating order quantity to the two retailers, according to the information of the retailers’ past record of OOQ. When it is the first transaction, , which indicates that the agent treats the two retailers alike in the beginning. Since the two retailers do not share predictive information with the agent, the agent does not know the actual variance of retailers’ forecast and cannot but predict through the sample variance of retailers’ forecast .

At time t,

Therein, , . is the final actual ordering quantity (AOQ) of the previous period. Taking the derivative of both sides of Formula (9) with respect to the variable , we can obtain ; and thus we can obtain that the values of the ROQ that the agent allocates to the two retailers are and , respectively.

3.2.2. Scenario 2: One Retailer Shares His/her Demand Prediction

One of the two retailers shares information about his/her forecast with the agent (assuming that R1 shares information). In this case, the agent knows R1’s predictive distribution in which the information concerning variance is implicit, and thus, the agent no longer needs to consider the weight. The ROQ that the agent allocates to the retailer should satisfy the requirement of minimal risk of loss.

In this paper, according to the definition of value at risk (VaR), we assume to be the loss function of the retailer’ return rate , and define as:

Here, we define loss variable as the opposite number of return rate, i.e., . With regard to confidence level , VaR is defined as the upper quartile in the loss distribution F, that is: .

Thus, , and thereupon we obtain a risk control coefficient: .

Here, is the inverse function of the loss distribution function , and it should be noted that such defined VaR is a positive number. VaR reflects the possible maximum loss of the retailer’s profit in a certain period with the given confidence level, i.e., the probability of real-life loss, which is bigger than VaR and is smaller than ; in other words, we can guarantee the probability of that asset loss will not exceed VaR. This risk control coefficient not only gives the size of market risk but also the size of the probability of asset loss. In a simulation experiment, the risk control coefficient is maintained between 85% and 95%.

For instance, we assume that R1 guarantees his/her loss of revenues with the probability of , and under this premise the ROQ of R2 can be obtained as follows:

The purpose of this formula is to make the difference of R2’s ROQ from the OOQ minimal. Finally, we can obtain the ROQ that the agent allocates to the two retailers, respectively ( and ).

3.2.3. Pattern 3: All Retailers Share Their Demand Prediction

Likewise, when both retailers share information with the agent, the agent knows the two retailers’ predictive distribution and the information concerning variance implicit in the predictive distribution. However, because the agent’s OOQ is always inconsistent with the two retailers’ OOQ, we hope to find a group of feasible solutions within the allowed range to minimize the risk of loss of the allocation of order quantity. Therefore, the following formula should be met:

3.3. Trust Model

To update the retailer’s trust in the agent, first the retailer needs to compare the absolute value of the deviation obtained by subtracting his/her forecast from the actual market demand with the absolute value of the deviation that is obtained by subtracting the agent’s ROQ. Then, the retailer finds out whose ROQ is more accurate, and can finally choose the trust updating model to update his/her trust. The agent whose ROQ is more accurate will obtain the retailer’s trust. We call this a “successful” transaction. An unsuccessful transaction is when the agent with the inaccurate order loses trust value. Jonker and Treur [23] proposed that there were several levels in of the state of trust, and transitioning from one state of trust to another depends on the comprehensive effect of trust-negative and trust-positive experiences of the agent. Similarly, whether the transaction is successful or not can be measured by the accuracy of the ROQ. According to the trust calculation method mentioned above, the trust updating model can be formulated as follows:

In this paper, reputation (named as the initial trust value) is the cumulative amount over the past years, and is a constant. Good reputation will promote trust because reputation is built on the basis of the reliability and consistency of past behavior.

Define as the distance between trust value to its centrer. is the adjusted distance to shift away from zero for not making the second component in Equation (13) into zero. represents the influence of the previous transaction on the current trust value. As suggested by Wang and Varadharajan [24], , is the initial trust value; means the weight of the initial trust value; represents a retailer’s cumulative trust, which is obtained from records of historical transactions; and is the weight of cumulative trust. Therein, . It can be easily inferred that the trust centre would appear when . In other words, trust between the two parties during the transaction would arrive at a state of balance in which there would be no complete trust or complete distrust [25,26]. represents the distance between the current trust value and the trust centre, and is to avoid the situation in which the trust value reaches 0.5, yet the overall trust value is zero. For example, when , , the trust value will remain unchanged. When , , the decreasing rate of the trust value will become lower when the previous trust value is approaching the minimal. When , , the increasing rate will become smaller when the previous trust value is approaching the maximal. Therefore, embodies how, if the time is closer to the present, the feedback information will be more credible. It will be a long process to reach a high credit level, and it will also require a long time to recover a high credit value when it has fallen to a very low level.

is the sensitivity parameter, representing the speed at which the retailer gains or loses trust towards the agent at a period . Setting the values of and can reflect that gaining trust requires quite a few successful transactions, yet losing trust requires only very few failure transactions. The literature on trust suggests that the rates of gain or loss of trust should not be symmetrical [27,28]. Typically, trust is more likely to be lost through negative experiences than regained through positive experiences.

Note that is the gap between the real demand (at time t) and the retailer’s predicted demand. Similarly, is the gap between the real demand (at time t) and the agent’s predicted demand. will be obviously more than [−1,1], so can ensure [−1,1]. , which reflects the influence on the trust value in each phase that the absolute value of what is obtained minus the predictive value of the agent from the actual demand, and the absolute value of what is obtained minus the predictive value of the retailer and the actual demand; the bigger the difference value between the absolute value of what is obtained minus the predictive value of the agent from the actual demand and the absolute value of what is obtained minus the predictive value of the retailer and the actual demand, the smaller the degree of the retailer’s trust towards the agent, and vice versa. For example, when , , and , , this shows that if the retailer predicts more accurately, the retailer would not trust the agent. Therefore, the ratio would be negative and the trust value would decrease. When , , and , , this shows that if the agent predicts more accurately, the retailer would trust the agent, so that the ratio would be positive and the trust value would increase.

4. Design of Experiments

In this paper, we mainly focus on the influence of information sharing on the trust among the agent and the two retailers. We will discuss specifically the following issues: (1) the influence that the difference between the predictive accuracy of the agent and that of the two retailers has on trust value; (2) the influence that the difference between the predictive accuracy and that of the two retailers has on profits; (3) the influence that the agent’s different approaches of ROQ has on the retailers’ trust value; (4) under different circumstances, which strategy of information sharing should the retailer adopt to maximize his profits?

To compute the agent’s ROQ distribution policy and the retailer’s trust updating, we make use of dynamic programming. However, model analysis and derivation are extremely burdensome, so we have to set a series of numerical simulations to analyze two retailers’ trust values and their profits in three different information sharing situations. Then, we used the MATLAB to run the simulation 60 times for each experiment. In the simulation, we have a study with some statistical validity, and each experiment was paired to obtain a t-test, and their p-value of less than 0.05 was gained (some results are shown in the Appendix A below). These results are statistically significant.

The values of the relevant parameters are set as follows:

The C.D.F. of the forecast from the retailers and the agent follows a beta distribution. We use the beta distribution because it has a very flexibly shaped distribution and is also amenable to Bayesian updating. The agent’s prediction accuracy is , where the normalized standard deviation is . The retailer’s prediction accuracy is , where the normalized standard deviation is .

The under-stock cost is and overstock cost is . Under-stock cost represents the loss of the retailer due to a unit shortage, whereas overstock cost represents the unit loss of the retailer if he/she has leftover inventory. We define , as the cost rate. It is the critical ratio formula of the newsvendor problem, and this formula is used to describe the relationship between the order quantity and the corresponding cost. represents that high under-stock cost will bring high penalty costs so that the prediction demand will be low. represents that high overstock costs will boost prediction demand.

The initial trust value is . We assume that retailers remain neutral during the first period in the transactions, when they have neither complete trust, nor complete distrust. The transaction period is , and the confidence level of VaR is . is the sensitivity parameter. The value of the trust-gaining index is , and the value of the trust-losing index is .

5. Experimental Results

Through the above descriptions of the problems, the establishment of models, and the setting of parameters, in this section, we mainly use the simulation approach to analyze the influence of the agent’s behavior on the retailer’s trust and profits after the agent has been affected by whether the two retailers share information or not.

5.1. The Agent Predicts More Accurately Than the Two Retailers

We set the two retailers’ initial trust values as follows: , period , cost rate , confidence level of the VaR . If the agent predicts more accurately than the retailers, i.e., , we have:

Observation 1.

When the agent predicts more accurately than the retailers, the two retailers’ trust values rise, and especially when only one retailer shares information, the trust value of the retailer who shares information (i.e., the trust value of the sharing retailer) rises more quickly than that of the one who does not.

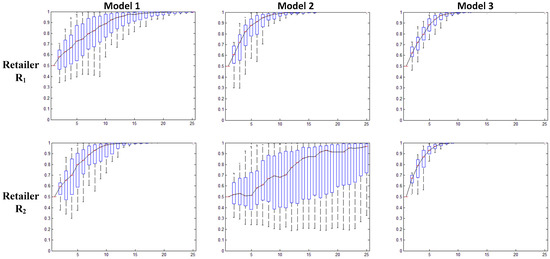

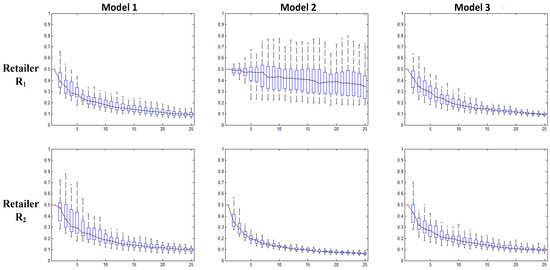

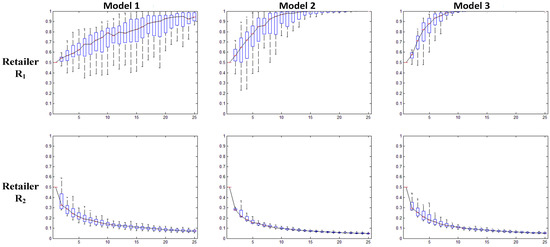

We will illustrate with the box-plot the relationship between the period and the retailer’s trust value towards the agent. The box-plot reveals the skewness and the degree of dispersion in the dataset, and helps to identify outliers. All the box-plots obtained in our experiments extend from the two sides of the rectangle box no farther than the inner limits, which indicates that all of the data are within the range of normal values.

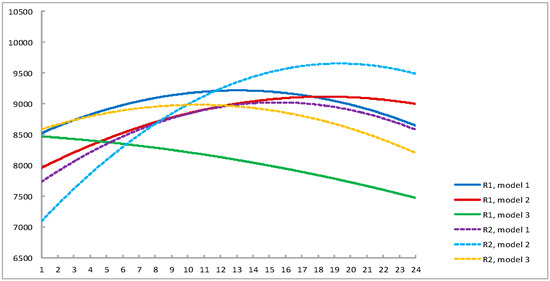

In Figure 2, we set the ratio of the agent’s predictive accuracy to that of the retailer . The three columns from left to right represent successively the following three circumstances: both retailers do not share predictive information (Model 1); only R1 shares predictive information (Model 2); both retailers share predictive information (Model 3). The top row represents the relationship between the period and R1’s trust value towards the agent, while the bottom row represents the relationship between the period and R2’s trust value towards the agent. In each subgraph, the horizontal coordinate represents the trust value, and the vertical coordinate represents the period. From the above figure, we can find that the agent’s ROQ is actually the calibration of the two retailers’ AOQ to make the two retailers’ AOQ closer to actual demand when the agent predicts more accurately than the retailers. Therefore, the curves of the two retailers’ trust values are upward. When there is one of the two retailers sharing information, the agent, thus knowing this retailer’s predictive function, will first consider distributing to this retailer the ROQ whose loss of risk is minimal, and only on this basis does the agent consider distributing the ROQ to the other retailer who does not share information. Therefore, the trust value of the sharing retailer rises more rapidly. As a whole, since the agent knows the two retailers’ predictive function, the agent considers making the total loss of risk minimum, as a result of which the trust value will rise still more rapidly than that in the first circumstance where neither retailer shares information.

Figure 2.

Retailers’ trust value under the three circumstances of information sharing σs/σr1 = σs/σr2 = 0.625.

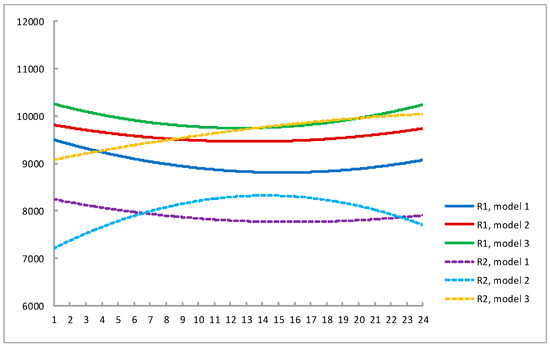

In Figure 3, the horizontal coordinate represents the transaction period, and the vertical coordinate represents the retailer’s profit. We can find that when neither retailer shares information with the agent, the two retailers’ profit trends in profit are almost the same. However, the two retailers’ total profits will be different, for the market circumstances that they face are different and their actual demand is not distributed within the same range.

Figure 3.

Retailers’ profits when the agent predicts more accurately.

When only R1 shares predictive information, R1’s profit first falls and then rises, while the profit of R2, who does not share information, first rises and then falls; the extreme points of R1’s curve and of R2’s curve almost appear at the same time. Since the sharing retailer obtains more precise ROQ and accordingly more precise AOQ after constant calibration (the extreme point of R1’s profit curve is at the 15th period of the transaction, and from Figure 2, R1’s trust value reaches the maximal in the meantime), his/her profit starts to increase simultaneously with the trust value reaching the maximal. On the contrary, the profit of the retailer who does not share information (i.e., the profit of the non-sharing retailer) will diminish accordingly because of the unstable trust value. In terms of a single retailer, sharing information leads to more profits than otherwise would be the case. Consequently, the non-sharing retailer prefers to share predictive information for the sake of long-term cooperation, even though he/she can gain more profits in short-term transactions.

5.2. Both Retailers Predict More Accurately Than the Agent

We set the two retailers’ initial trust value , period , cost rate , confidence level of the VaR . If the two retailers predict more accurately than the agent, i.e., , we have:

Observation 2.

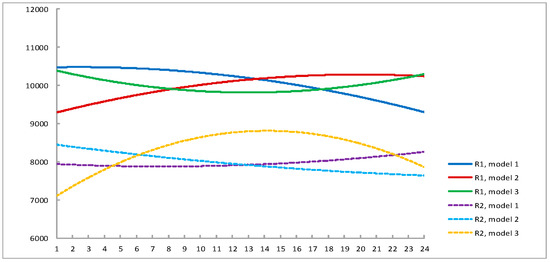

(1) When the agent predicts less accurately than the agent, both retailers’ trust values decline, but that of the sharing retailer declines more slowly. (2) When both retailers share information or neither retailer shares information, the profits decrease; when only one of the two retailers shares information, the two retailers’ profits increase.

In Figure 4, we set the ratio of the agent’s predictive accuracy to that of the retailer . Similar to Figure 2, in each subgraph, the horizontal coordinate represents the transaction period, and the vertical coordinate represents the trust value. From Figure 4, we find that all of the curves of the trust value are downward. However, when only R1 shares information, the agent, thus knowing this retailer’s predictive function, which may be inexact, will first consider distributing to him/her the ROQ of minimal risk of loss. Additionally, on this basis, the agent considers satisfying the non-sharing retailer. Therefore, the trust value of the sharing retailer declines very slowly. Since the forecast of the non-sharing retailer is becoming more and more devious from the agent’s ROQ, the trust value of the non-sharing retailer falls more rapidly. As a whole, when both retailers share predictive information, the agent, thus knowing the two retailers’ predictive function, will consider making the risk of loss minimal, which is equivalent to that the two retailers partaking of the risk of the agent’s inaccurate prediction. Consequently, the trust values of the two retailers fall almost at the same speed.

Figure 4.

Retailers’ trust value under the three circumstances of information sharing σs/σr1 = σs/σr2 = 2.5.

In Figure 5, the horizontal coordinate represents the transaction period, and the vertical coordinate represents the retailer’s profit. We can see that their profits are on a declining curve when neither retailer shares information. In the case where both retailers share information, the agent’s prediction is more inaccurate, which means that the two retailers share the risks of the agent. Thus, their profits show a downward trend; moreover, the profits decline more quickly. A more special occurrence is that when only R1 shares information with the agent, the two retailers’ profits first rise and then remain at a relatively high level; in addition, the profit of the non-sharing retailer rises faster than that of the sharing retailer. The agent can ensure that the profit of R1 who shares information will not diminish through controlling R1’s risks. Since the non-sharing retailer has relatively low trust values towards the agent, he/she will simply consider his/her own forecast in his/her actual ordering without the interference of the agent’s inaccurate prediction; thus the profit of the non-sharing retailer rises first at a high speed and then stabilizes at a high level.

Figure 5.

Retailers’ profits when the agent predicts less accurately.

In terms of R1 who shares information, his/her profit will increase when he/she shares information while the other retailer does not share information. However, when the other retailer also shares information, his/her profit will decrease rapidly. In terms of R2 who does not share information, non-sharing information can bring about more profits than sharing information. Through the following game matrix (Table 1), we can determine whether the two retailers sharing information is a mixed strategy game in which either of them expects the other party to share information and thus gains profit. The retailer, after many a transaction has been conducted and his trust value has decreased, will distance himself/herself from the poor agent whose prediction is inaccurate and will also try to look for a better agent. Meantime, the agent should shorten the distance between himself and the retailers by improving his/her ability of predicting the overall market and then making a more precise prediction.

Table 1.

The profit matrix of the two retailers.

5.3. The Agent Predicts More Accurately than One of the Two Retailers and Less Accurately Than the Other One

We set the two retailers’ initial trust value as follows: , period , cost rate and confidence level of VaR . We assume that the two retailers face the same range of market demand. Suppose that one retailer predicts more accurately than the agent and the other retailer less accurately than the agent, that is, σr1 < σs < σr2.

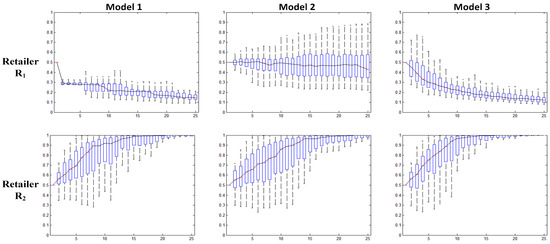

We set the ratio of the agent’s predictive accuracy to that of the sharing retailer , and this ratio represents that the agent predicts more accurately than R1. We set the ratio of the agent’s predictive accuracy to that of R2 , and this ratio represents that R2 predicts more accurately than the agent. As shown in Figure 6, the changes in the two retailers’ trust value are consistent with the results obtained in Observations 1 and 2.

Figure 6.

Retailers’ trust value under the three circumstances of information sharing, , and .

Observation 3.

(1) In the case where the agent predicts more accurately than one retailer and less accurately than the other one, if the retailer who predicts more accurately is willing to share information, and the retailer who predicts less accurately does not share information, the trust value of the retailer with the more accurate prediction will slope down slowly and his/her profit will also rise; (2) In the case where both retailers share information, the profit of the retailer with the more accurate prediction first decreases and then increases, while that of the retailer with the less accurate prediction first rises and then falls.

We set the ratio of the agent’s predictive accuracy to that of R1 who shares information , and this ratio represents that R1 predicts more accurately than the agent. We set the ratio of the agent to that of R2 who does not share information , and this ratio represents that the agent predicts more precisely than R2. Similar to Figure 2, in each subgraph, the horizontal coordinate represents the transaction period, and the vertical coordinate represents trust value. From Figure 7, we find that trust value changes more slowly in the case where neither retailer shares information than in the case where both retailers share information. However, when only R1 shares information, his/her trust value curve will slope down slowly and almost remain horizontal, which indicates that the agent firstly considers making R1’s risk of loss minimum, and the ROQ that the agent recommends to R1 will play the role of promoting trust.

Figure 7.

Retailers’ trust value under the three circumstances of information sharing, , and .

The profits of the two retailers are shown in Figure 8. The horizontal coordinate represents the transaction period, and the vertical coordinate represents the profit of the retailers. We find that in the case where neither retailer shares information, since the agent predicts more accurately than one retailer and less accurately than the other retailer, the profit of R1 who has a more precise prediction will decrease with the interference of the agent, whereas R2 who has inaccurate prediction, after obtaining the calibration of the agent, will see his/her profit rise.

Figure 8.

Retailers’ profits when the agent predicts more accurately than one retailer and less accurately than the other retailer.

In the case where R1 shares information and R2 does not share information, the agent considers firstly making R1’s risk of loss minimal, and consequently, the profit curve of R1 slopes up slowly and then stabilizes. Meanwhile, R2 loses the calibration from the agent, and thus, his/her profit begins to decrease.

Most especially, when both retailers share information, R1’s profit first decreases and then increases, and R2’s profit first rises and then falls, and the extreme points of their profit curve almost appear at the same time. In the beginning, the agent needs to consider making the total risk of loss minimal; thus, he/her will allocate the VaR of R2 who has inaccurate prediction to R1. However, when R1’s trust value reaches a minimum, he/she does in fact quit this alliance. In that case, R2 must bear the risks by himself/herself, and therefore, R2’s profit will finally decline.

As a whole, the profit of the retailer who has the more accurate prediction is always larger than that of the retailer with the inaccurate prediction. As a result, only if the retailer with the inaccurate prediction does not share information is he/her more likely to fish in troubled waters (acquire more profits). With regard to the retailer with the more precise prediction, “generously” sharing information is the best choice.

6. Conclusions

Cooperation between the upstream enterprise and downstream enterprise (e.g., agent and retailers) is a typical repetitive and dynamic game process. In game theory, the long-term and sincere cooperation is each party’s optimal choice. However, the problem is that even the best of friends must part. When one party determines not to cooperate because of interest conflicts and a broken promise, serious consequences may include the occurrence of opportunism and malevolent recommending behavor, as well as a possible huge outflow of supply chain capital and the ensuing endangering of the supply chain. Through quantitative research methods, we have investigated the influence of trust between the agent and many retailers in the supply chain, which have determined the recommended order strategies suitable for the agent of different roles, according to the two retailers’ three different approaches of sharing information about forecast. Based on previous studies, we have built a more reasonable trust value updating mechanism, which makes varying degrees of distinction between the gaining of trust value and the losing of trust value and can truly reflect the changes of trust value in the actual supply chain; we have also proposed a model of optimal distribution of ROQ on the basis of minimal VaR. This trust model and the distribution model apply to both sides of supply chain enterprises in multiple-period transactions and offer a more accurate description of the regulatory role that trust plays between upstream and downstream enterprises in the supply chain.

The indications of simulation results and analyses are as follows: (1) when the agent predicts more precisely than the retailers, trust value rises more rapidly in the case where the two retailers share information than in the case where neither retailer shares information. Particularly, when one retailer shares information, the trust value of the sharing retailer rises faster than that of the non-sharing retailer, and likewise, the former’s profit is greater than the latter’s profit. Overall, the non-sharing retailer gains more profits. However, the retailers prefer to share predictive information for the sake of long-term cooperation; (2) when the agent predicts less accurately than the two retailers, both retailers’ trust values fall, yet the trust value of the sharing retailer declines more slowly. When both retailers share information or neither retailer shares predictive information, their profits fall, while in the case where only one retailer shares information, the two retailers’ profits rise rather than fall. This indicates that if a retailer is an aggressive investor and is willing to share information, and if the other is a conservative investor and does not share information, the two retailers’ profits will be greater than that under the circumstances where both retailers share information or neither retailer shares information. In addition, after the market demand is released with the stimulus of the aggressive investor who braves the risks, the conservative investor will gain more profits; (3) in the case where the agent predicts more accurately than one retailer and less accurately than the other, if the retailer with the more precise prediction is willing to share his/her predictive information and the retailer with the inaccurate prediction does not share information, the trust value of the retailer who predicts more accurately will increase, and his/her profit will also rise. In the long run, with respect to the retailer with the inaccurate prediction, only if he/she does not share information, can he/she fish in troubled waters (acquire more profits)? With regard to the retailer with the more precise prediction, only “generously” sharing information can lead to a win-win result. Meanwhile, the agent in the supply chain should proceed step by step in the course of building the partnership with retailers, rather than be aimless and hasty.

In the actual supply chain, the case of one agent corresponding to several retailers also involves many game issues concerning costs and pricing. Therefore, we will later consider the game model of supply chain trust.

Acknowledgments

This work was supported in part by the National Natural Science Foundation of China (No. 71501128), Inter-discipline Foundation of Shanghai Jiao Tong University (No. 15JCZY05), Shandong Natural Science Foundation (No. ZR2015GM001), Scientific Research Starting Foundation of Hangzhou Dianzi University (No. KYS395617020). The author Fu X. also works in the Research Center of Information Technology & Economic and Social Development.

Author Contributions

Fu X. and Han G.H. conceived and designed the experiments; Fu X. performed the experiments; Fu X. and Han G.H. analyzed the data; Fu X. wrote the paper.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

We used the Matlab to run simulation 60 times in each experiment. Then a paired T-test is used to analyze the significance of the experimental results. We find that the value of p is smaller than 0.05 when the two retailers are in the corresponding distribution models. And there exists significant difference between trust values, which indicates that the difference between different retailers is statistically significant. Moreover, under different modes of the same retailer, the values of p is likewise smaller than 0.05, and trust values are significantly different, which demonstrates that the difference under different modes is also statistically significant and thus this research is worthwhile. The Observation 1’s results are shown in Table A1.

Table A1.

Paired Samples Test for Observation 1.

Table A1.

Paired Samples Test for Observation 1.

| Paired Differences | t | df | Sig. (2-Tailed) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean | Std. Deviation | Std. Error Mean | 95% Confidence Interval of the Difference | ||||||

| Lower | Upper | ||||||||

| Model 1 | R1–R2 | −0.03526 | 0.03659 | 0.00732 | −0.05036 | −0.02015 | −4.818 | 24 | 0.000 |

| Model 2 | R1–R2 | 0.03780 | 0.04524 | 0.00905 | 0.01913 | 0.05648 | 4.178 | 24 | 0.000 |

| Model 3 | R1–R2 | −0.01259 | 0.02293 | 0.00459 | −0.02205 | −0.00312 | −2.745 | 24 | 0.011 |

| R1 | Model 1–Model 2 | −0.05456 | 0.05964 | 0.01193 | −0.07917 | −0.02994 | −4.574 | 24 | 0.000 |

| R1 | Model 1–Model 3 | −0.05825 | 0.06373 | 0.01275 | −0.08456 | −0.03195 | −4.571 | 24 | 0.000 |

The other experiments have similar conclusion about the stated statistical validity when the same simulation running size is used. Observations 2 and 3’s results are shown in Table A2 and Table A3.

Table A2.

Paired Samples Test for Observation 2.

Table A2.

Paired Samples Test for Observation 2.

| Paired Differences | t | df | Sig. (2-Tailed) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean | Std. Deviation | Std. Error Mean | 95% Confidence Interval of the Difference | ||||||

| Lower | Upper | ||||||||

| Model 1 | R1–R2 | −0.01044 | 0.01724 | 0.00345 | −0.01756 | −0.00333 | −3.029 | 24 | 0.006 |

| Model 2 | R1–R2 | 0.27599 | 0.06870 | 0.01374 | 0.24763 | 0.30434 | 20.087 | 24 | 0.000 |

| Model 3 | R1–R2 | 0.00618 | 0.01106 | 0.00221 | 0.00161 | 0.01075 | 2.792 | 24 | 0.010 |

| R1 | Model 1–Model 2 | −0.23160 | 0.06376 | 0.01275 | −0.25792 | −0.20528 | −18.163 | 24 | 0.000 |

| R1 | Model 1–Model 3 | −0.00653 | 0.00974 | 0.00195 | −0.01055 | −0.00251 | −3.353 | 24 | 0.003 |

Table A3.

Paired Samples Test for Observation 3.

Table A3.

Paired Samples Test for Observation 3.

| Paired Differences | t | df | Sig. (2-Tailed) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean | Std. Deviation | Std. Error Mean | 95% Confidence Interval of the Difference | ||||||

| Lower | Upper | ||||||||

| Model 1 | R1–R2 | −0.65565 | 0.22430 | 0.04486 | −0.74824 | −0.56306 | −14.615 | 24 | 0.000 |

| Model 2 | R1–R2 | −0.37299 | 0.17917 | 0.03583 | −0.44695 | −0.29903 | −10.409 | 24 | 0.000 |

| Model 3 | R1–R2 | −0.67734 | 0.25751 | 0.05150 | −0.78364 | −0.57105 | −13.152 | 24 | 0.000 |

| R1 | Model 1–Model 2 | −0.25191 | 0.06425 | 0.01285 | −0.27843 | −0.22538 | −19.603 | 24 | 0.000 |

| R1 | Model 1–Model 3 | 0.25752 | 0.09025 | 0.01805 | 0.22027 | 0.29477 | 14.268 | 24 | 0.000 |

References

- Özer, Ö.; Zheng, Y. Trust in Forecast Information Sharing. Manag. Sci. 2011, 57, 1111–1137. [Google Scholar] [CrossRef]

- Taylor, T.A.; Plambeck, E.L. Supply Chain Relationships and Contracts: The Impact of Repeated Interaction on Capacity Investment and Procurement. Manag. Sci. 2007, 53, 1577–1593. [Google Scholar] [CrossRef]

- Ren, Z.J.; Cohen, M.A.; Ho, T.H.; Terwiesch, C. Information sharing in a long-term supply chain relationship: The role of customer review strategy. Oper. Res. 2010, 58, 81–93. [Google Scholar] [CrossRef]

- Chang, L.; Ouzrout, Y.; Nongaillard, A.; Bouras, A.; Zhou, J. Multi-criteria decision making based on trust and reputation in supply chain. Int. J. Prod. Econ. 2014, 147, 362–372. [Google Scholar] [CrossRef]

- Jøsang, A.; Presti, S. Analyzing the relationship between risk and trust. Trust Manag. 2004, 2995, 135–145. [Google Scholar]

- Han, G.H.; Dong, M. Trust-embedded coordination in supply chain information sharing. Int. J. Prod. Res. 2015, 53, 5624–5639. [Google Scholar] [CrossRef]

- Panayides, P.M.; Venus, L.Y.H. The impact of trust on innovativeness and supply chain performance. Int. J. Prod. Econ. 2009, 122, 35–46. [Google Scholar] [CrossRef]

- Laaksonen, T.; Jarimo, T.; Kulmala, H.I. Cooperative strategies in customer–supplier relationships: The role of interfirm trust. Int. J. Prod. Econ. 2009, 120, 79–87. [Google Scholar] [CrossRef]

- Villena, V.H.; Choi, T.Y.; Revilla, E. Revisiting Interorganizational Trust: Is More Always Better or Could More Be Worse? J. Manag. 2016. [Google Scholar] [CrossRef]

- Zhu, K.; Thonemann, U.W. Modeling the Benefits of Sharing Future Demand Information. Oper. Res. 2004, 52, 136–147. [Google Scholar] [CrossRef]

- Alves, H.; Ferreira, J.J.; Fernandes, C.I. Customer’s operant resources effects on co-creation activities. J. Innov. Knowl. 2016, 1, 69–80. [Google Scholar] [CrossRef]

- Lau, J.S.K.; Huang, G.Q.; Mak, K.L.; Liang, L. Distributed project scheduling with information sharing in supply chains: Part I an agent-based negotiation model. Int. J. Prod. Econ. 2005, 43, 4813–4838. [Google Scholar] [CrossRef]

- Lee, H.L.; Whang, S. Information sharing in a supply chain. Int. J. Technol. Manag. 2000, 20, 373–387. [Google Scholar] [CrossRef]

- Lee, H.L.; So, K.C.; Tang, C.S. The value of information sharing in a two level supply chain. Manag. Sci. 2000, 46, 626–643. [Google Scholar] [CrossRef]

- Zhang, H. Vertical information exchange in a supply chain with duopoly retailers. Prod. Oper. Manag. 2002, 11, 531–546. [Google Scholar] [CrossRef]

- Park, K.O.; Chang, H.; Jung, D.H. How Do Power Type and Partnership Quality Affect Supply Chain Management Performance? Sustainability 2017, 9, 127. [Google Scholar] [CrossRef]

- Li, L. Information sharing in a supply chain with horizontal competition. Manag. Sci. 2002, 48, 1196–1212. [Google Scholar] [CrossRef]

- Renna, P.; Perrone, G. Order allocation in a multiple suppliers-manufacturers environment within a dynamic cluster. Int. J. Adv. Manuf. Technol. 2015, 80, 171–182. [Google Scholar] [CrossRef]

- Fu, X.; Dong, M.; Liu, S.X.; Han, G.H. Trust based decisions in supply chains with an agent. Decis. Support Syst. 2016, 82, 35–46. [Google Scholar] [CrossRef]

- Ebrahim-Khanjari, N.; Hopp, W.; Iravani, S.M.R. Trust and Information Sharing in Supply Chains. Prod. Oper. Manag. 2012, 21, 444–464. [Google Scholar] [CrossRef]

- Fu, X.; Dong, M.; Han, G.H. Coordinating a trust-embedded two-tier supply chain by options with multiple transaction periods. Int. J. Prod. Res. 2017, 55, 2068–2082. [Google Scholar] [CrossRef]

- Clemen, R.; Winkler, R. Combining probability distributions from experts in risk analysis. Risk Anal. 1999, 19, 187–203. [Google Scholar] [CrossRef]

- Jonker, C.; Treur, J. Formal analysis of models for the dynamics of trust based on experiences. In European Workshop on Modelling Autonomous Agents in a Multi-Agent World; Lecture Notes in Computer Science; Springer: Berlin/Heidelberg, Germany, 1999; pp. 221–231. [Google Scholar]

- Wang, Y.; Varadharajan, V. Interaction Trust Evaluation in Decentralized Environments. In Proceedings of the 5th International Conference on Electronic Commerce and Web Technology, Zaragoza, Spain, 31 August–3 September 2004; Springer: Berlin, Germany, 2004; pp. 144–153. [Google Scholar]

- Paul, S. Risk Perception and Trust, Fundamentals of Risk Analysis and Risk Management; Lewis Publishers: Boca Raton, FL, USA, 1997; pp. 233–245. [Google Scholar]

- Lynch, R.; Jin, Z. Exploring the institutional perspective on international business expansion: Towards a more detailed conceptual framework. J. Innov. Knowl. 2016, 1, 117–124. [Google Scholar] [CrossRef]

- Wrightsman, L.S. Interpersonal Trust and Attitudes toward Human Nature. In Measures of Personality and Social Psycho-Logical Attitudes; Academic Press: San Diego, CA, USA, 1991; pp. 375–377. [Google Scholar]

- McKnight, D.H.; Chervany, N.L. The Meanings of Trust. Working Paper. 1996. Available online: http://www.misrc.umn.edu/workingpapers/fullpapers/1996/9604_040100.pdf (accessed on 28 April 2017).

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).