Macroeconomic Effects of Entrepreneurship from an International Perspective

Abstract

:1. Introduction

2. Literature and Research Hypotheses

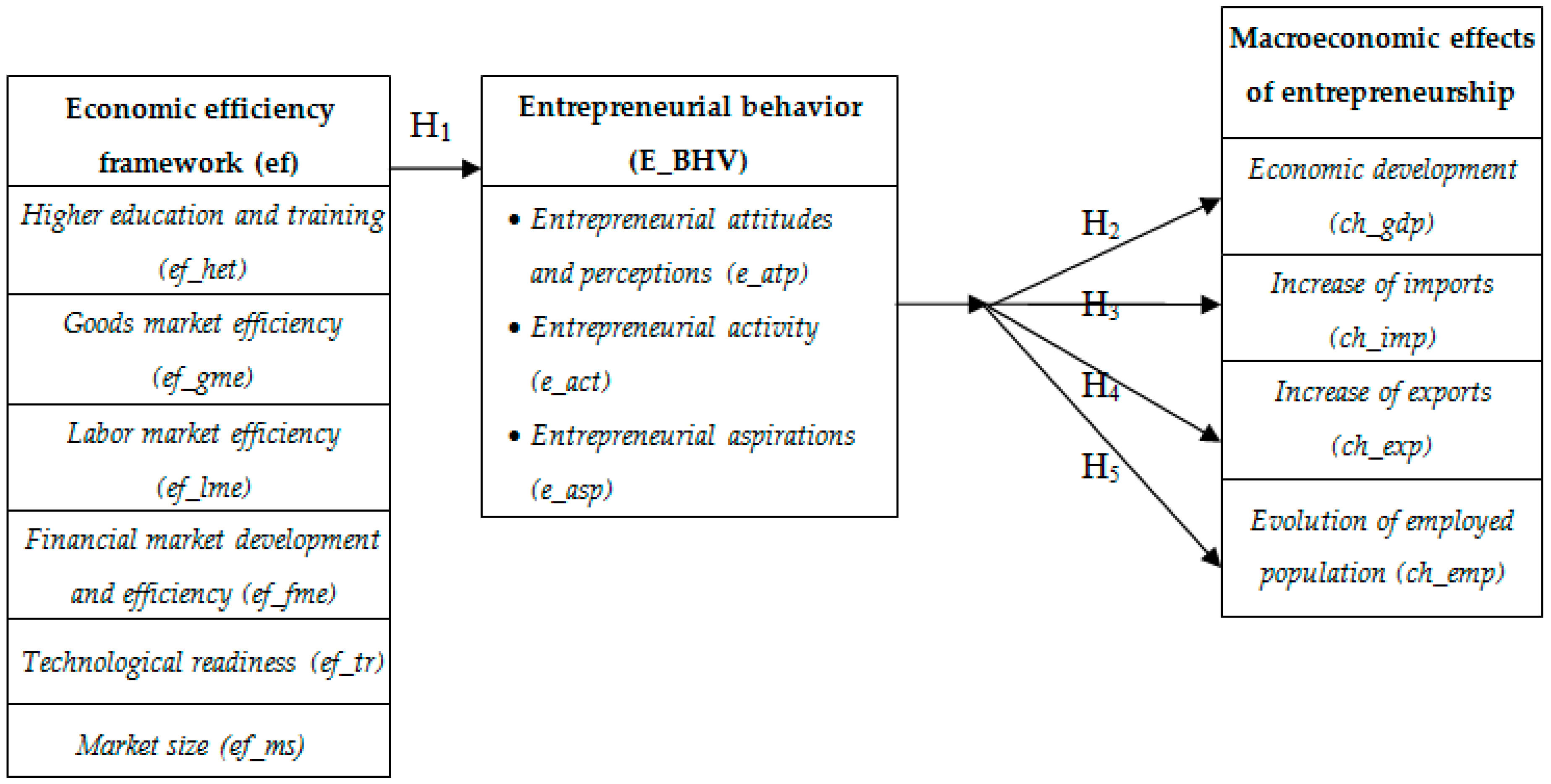

3. Conceptual Model

- The economic efficiency framework measures various aspects of the conditions and characteristics specific to the secondary and tertiary economic activity sectors that stimulate, sustain or hinder the entrepreneurial process. According to the World Economic Forum (2008) [50], the directly measurable and quantifiable variables refer to the: level of university education and training, level of goods market efficiency, level of labor market efficiency, the degree of financial market development and sophistication, level of technological readiness, and market size (Table 1), specific for the natural, social and economic components of the national business environment.

- The entrepreneurial behavior construct measures the dynamics of the entrepreneurial phenomenon at national level, considering people in the situation of starting a new business or managing a small- and medium-sized firms. According to the GEM Consortium [2,51], the dimensions and variables that build-up and operationalize this construct are:

- -

- The level of entrepreneurial attitudes involved eight variables: entrepreneurial intention rate, entrepreneurship as desirable career choice rate, fear of failure rate, media attention for entrepreneurship, high status successful entrepreneurship, know start-up entrepreneur rate, rate of perceived capabilities, and rate of perceived opportunities.

- -

- The level of entrepreneurial activities is composed of six variables: nascent entrepreneurship rate, new business ownership rate, total early-stage entrepreneurial activity, established business ownership rate, improvement-driven opportunity entrepreneurial activity, and necessity-driven entrepreneurial activity.

- -

- The level of entrepreneurial aspirations is formed by three variables: the relative rate of growth expectation early-stage entrepreneurial activity, rate of new product early-stage entrepreneurial activity, and the rate of international orientation early-stage entrepreneurial activity (Table 2).

- The construct regarding the macroeconomic effects of entrepreneurship measures the impact of entrepreneurial behavior on foreign trade, economic development and labor market in a country (Table 3). The dimensions and indicators that operationally build this construct are:

- -

- economic growth measured by the gross domestic product growth rate;

- -

- increase of imports measured by the variable change in volume of imports of goods and services;

- -

- increase of exports measured by the variable change in volume of exports of goods and services; and

- -

- evolution of the employed population measured by the variable growth of employment rate.

4. Data Analysis, Empirical Results and Discussion

5. Conclusions, Limits and Future Research Directions

Author Contributions

Conflicts of Interest

Appendix A

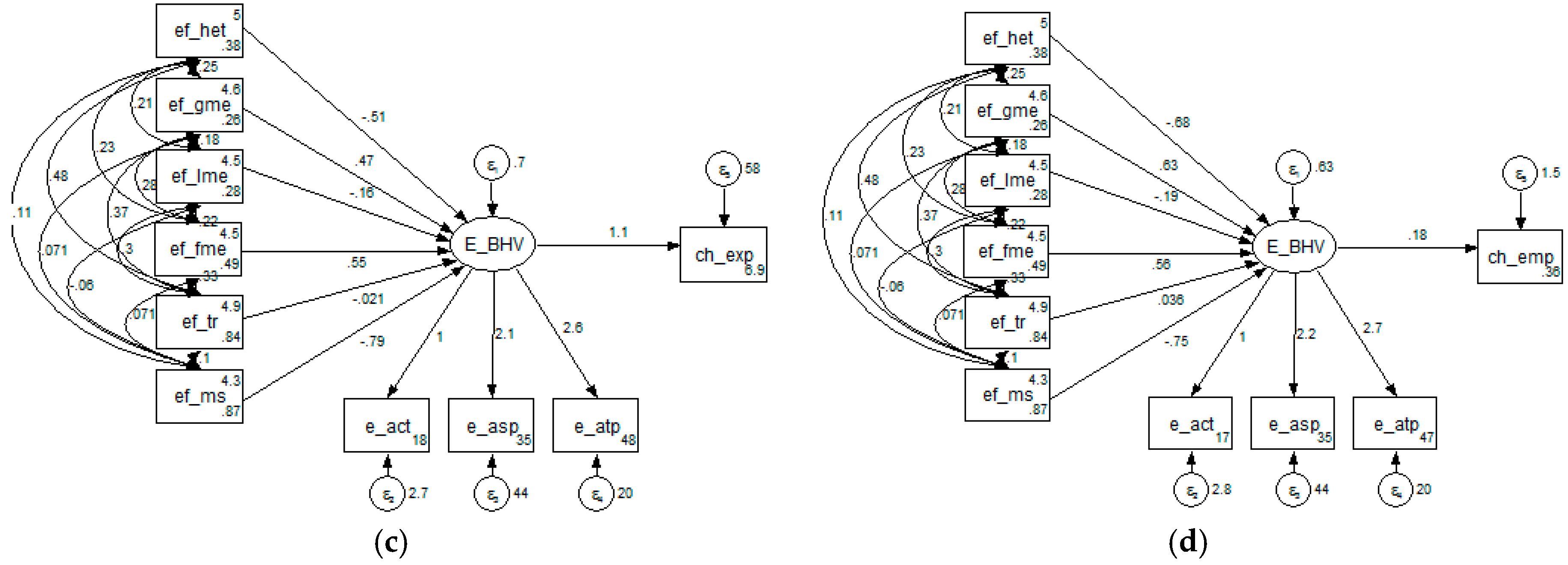

| Analyzed Relations | Model 1 | Model 2 | Model 3 | Model 4 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | ||

| E_BHV ← | ef_het | −0.722 | −2.07 | 0.038 | −0.694 | −1.99 | 0.046 | −0.718 | −2.04 | 0.041 | −0.701 | −2.00 | 0.045 |

| ef_gme | 0.496 | 1.02 | 0.308 | 0.384 | 0.80 | 0.422 | 0.394 | 0.80 | 0.426 | 0.399 | 0.82 | 0.410 | |

| ef_lme | −0.136 | −0.55 | 0.586 | −0.201 | −0.81 | 0.418 | −0.152 | −0.61 | 0.545 | −0.187 | −0.75 | 0.451 | |

| ef_fme | 0.545 | 2.22 | 0.026 | 0.632 | 2.63 | 0.008 | 0.564 | 2.30 | 0.022 | 0.611 | 2.54 | 0.011 | |

| ef_tr | 0.129 | 0.55 | 0.581 | 0.163 | 0.70 | 0.481 | 0.183 | 0.78 | 0.437 | 0.164 | 0.70 | 0.482 | |

| ef_ms | −0.789 | −5.85 | 0.000 | −0.796 | −5.92 | 0.000 | −0.818 | −6.12 | 0.000 | −0.801 | −5.98 | 0.000 | |

| e_act | ← E_BHV | 1 * | 1 * | 1 * | 1 * | ||||||||

| e_asp | 2.069 | 2.98 | 0.003 | 2.008 | 2.96 | 0.003 | 2.026 | 2.95 | 0.003 | 2.016 | 2.95 | 0.003 | |

| e_atp | 2.528 | 5.28 | 0.000 | 2.552 | 5.29 | 0.000 | 2.446 | 5.21 | 0.000 | 2.527 | 5.29 | 0.000 | |

| ch_gdp | ←E_BHV | 0.299 | 1.26 | 0.207 | |||||||||

| ch_imp | ←E_BHV | −0.295 | −0.53 | 0.559 | |||||||||

| ch_exp | ←E_BHV | 0.532 | 1.18 | 0.239 | |||||||||

| ch_emp | ←E_BHV | −0.005 | −0.07 | 0.944 | |||||||||

| Analyzed Relations | Model 1 | Model 2 | Model 3 | Model 4 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | ||

| E_BHV ← | ef_het | −0.763 | −2.08 | 0.037 | −0.721 | −2.00 | 0.046 | −0.832 | −2.32 | 0.020 | −0.555 | −1.55 | 0.121 |

| ef_gme | 0.420 | 0.85 | 0.396 | 0.402 | 0.83 | 0.409 | 0.340 | 0.68 | 0.496 | 0.363 | 0.80 | 0.422 | |

| ef_lme | −0.165 | −0.65 | 0.513 | −0.182 | −0.73 | 0.466 | −0.136 | −0.54 | 0.592 | −0.226 | −0.95 | 0.343 | |

| ef_fme | 0.572 | 2.28 | 0.023 | 0.601 | 2.47 | 0.013 | 0.550 | 2.22 | 0.026 | 0.674 | 2.94 | 0.003 | |

| ef_tr | 0.212 | 0.85 | 0.398 | 0.183 | 0.72 | 0.469 | 0.292 | 1.18 | 0.238 | 0.066 | 0.28 | 0.778 | |

| ef_ms | −0.808 | −6.03 | 0.000 | −0.806 | −5.96 | 0.000 | −0.821 | −6.18 | 0.000 | −0.766 | −5.55 | 0.000 | |

| e_act | ← E_BHV | 1 * | 1 * | 1 * | 1 * | ||||||||

| e_asp | 2.030 | 2.96 | 0.003 | 2.020 | 2.95 | 0.003 | 2.023 | 2.98 | 0.003 | 1.972 | 2.90 | 0.004 | |

| e_atp | 2.462 | 5.12 | 0.000 | 2.502 | 5.15 | 0.000 | 2.390 | 5.17 | 0.000 | 2.717 | 5.16 | 0.000 | |

| ch_gdp | ← E_BHV | 0.140 | 0.59 | 0.555 | |||||||||

| ch_imp | ← E_BHV | 0.118 | 0.21 | 0.832 | |||||||||

| ch_exp | ← E_BHV | 0.737 | 1.70 | 0.090 | |||||||||

| ch_emp | ← E_BHV | −0.115 | −1.30 | 0.192 | |||||||||

References

- Sala-I, M.X.; Blanke, J.; Drzeniek, M.; Geiger, T.; Mia, I. Global Competitiveness Report 2009–2010; World Economic Forum: Geneva, Switzerland, 2009; pp. 1–492. Available online: http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2009-10.pdf (accessed on 18 October 2016).

- Bosma, N.; Ács, Z.J.; Autio, E.; Coduras, A.; Levie, J. Global Entrepreneurship Monitor 2008—Executive Report; Babson College, Universidad del Desarrollo, London Business School, Global Entrepreneurship Research Consortium: London, UK, 2009; pp. 1–68. [Google Scholar]

- Schwab, K.; Porter, M. The Global Competitiveness Report 2008–2009; World Economic Forum: Geneva, Switzerland, 2008; pp. 1–500. Available online: https://www.weforum.org/reports/global-competitiveness-report-2008-2009 (accessed on 12 July 2016).

- Shane, S.; Venkataraman, S. The Promise of Entrepreneurship as a Field of Research. Acad. Manag. Rev. 2000, 25, 217–226. Available online: https://www.jstor.org/stable/259271 (accessed on 22 May 2016). [CrossRef]

- Kirzner, I.M. Competition and Entrepreneurship; The University of Chicago Press: Chicago, IL, USA; London, UK, 1973; pp. 1–242. [Google Scholar]

- Kirzner, I.M. Information-Knowledge and Action-Knowledge. Econ. J. Watch. 2005, 2, 75–81. Available online: https://econjwatch.org/file_download/70/2005-04-kirzner-sympos.pdf?mimetype=pdf (accessed on 18 October 2016).

- Facchini, F. Entrepreneur et Croissance Économique: Développements Récents. Revue D'écon. Ind. 2007, 119, 55–84. Available online: https://rei.revues.org/2033?lang=en (accessed on 10 June 2016). [CrossRef]

- Minniti, M.; Koppl, R. The Unitended Consequences of Entrepreneurship. J. Écon. Études Hum. 1999, 9, 567–586. Available online: https://www.degruyter.com/view/j/jeeh.1999.9.issue-4/jeeh-1999-0406/jeeh-1999-0406.xml (accessed on 18 October 2016). [CrossRef]

- Minniti, M. Entrepreneurship and network externalities. J. Econ. Behav. Organ. 2005, 57, 1–27. Available online: http://mail.imb.usu.ru/docs/Bank%20English_Transleted%20Articles/English/Enterprenurship/Entrepreneurship%20and%20network%20externalities.pdf (accessed on 18 October 2016). [CrossRef]

- Audretsch, D.B.; Keilbach, M.C.; Lehmann, E.E. Entrepreneurship and Economic Growth; Oxford University Press: New York, NY, USA, 2006; pp. 34–59. [Google Scholar]

- Nițu-Antonie, R.D. Entrepreneurship in an International Perspective. In Postdoctoral Studies in Economy; Romanian Academy Publishing House: Bucharest, Romania, 2013; Volume 6, pp. 1256–1317. [Google Scholar]

- Keh, H.T.; Foo, M.D.; Lim, B.C. Opportunity Evaluation under Risky Conditions: The Cognitive Processes of Entrepreneurs. Entrep. Theory Pract. 2002, 27, 125–140. Available online: http://onlinelibrary.wiley.com/doi/10.1111/1540-8520.00003/abstract (accessed on 12 July 2016). [CrossRef]

- Davidsson, P.; Delmar, F. High-growth Firms and their Contribution to Employment: The Case of Sweden 1987–96. In Entrepreneurship and the Growth of Firms; Davidsson, P., Delmar, F., Wiklund, J., Eds.; Edward Elgar: Cheltenham, UK, 2006; pp. 156–178. [Google Scholar]

- Audretsch, D.; Thurik, R. Linking Entrepreneurship to Growth. OECD Sci. Technol. Ind. Work. Pap. 2001, 2, 1–34. Available online: http://www.oecd-ilibrary.org/docserver/download/736170038056.pdf?expires=1498363434&id=id&accname=guest&checksum=AA42EA126C3562DE20D443D59BC12651 (accessed on 10 June 2016). [CrossRef]

- Baptista, R.; Escária, V.; Madruga, P. Entrepreneurship, regional development and job creation: The case of Portugal. Small Bus. Econ. 2008, 30, 49–58. Available online: https://link.springer.com/article/10.1007/s11187-007-9055-0 (accessed on19 January 2017). [CrossRef]

- Baptista, R.; Thurik, A. Relationship between Entrepreneurship and Employment: Is Portugal an Outlier? Technol. Soc. Chang. 2007, 75, 75–89. Available online: http://www.sciencedirect.com/science/article/pii/S0040162506000849 (accessed on 12 July 2016). [CrossRef]

- González-Pernía, J.L.; Peña-Legazkue, I. Export-oriented entrepreneurship and regional economic growth. Small Bus. Econ. 2015, 45, 505–522. Available online: http://link.springer.com/article/10.1007/s11187-015-9657-x (accessed on 5 March 2017). [CrossRef]

- Ravasi, D.; Turati, C. Exploring Entrepreneurial Learning: A Comparative Study of Technology Development Projects. J. Bus. Ventur. 2005, 20, 137–164. Available online: http://www.sciencedirect.com/science/article/pii/S0883902603001198 (accessed on 19 January 2017). [CrossRef]

- Newbert, S.L. New Firm Formation: A dynamic capability perspective. Small Bus. Manag. 2005, 43, 55–77. Available online: http://onlinelibrary.wiley.com/doi/10.1111/j.1540-627X.2004.00125.x/abstract (accessed on 12 July 2016). [CrossRef]

- Lumpkin, G.; Dess, G. Clarifying the Entrepreneurial Orientation Construct and Linking it to Performance. Acad. Manag. Rev. 1996, 21, 135–172. Available online: http://www.jstor.org/stable/258632 (accessed on 10 June 2016).

- Autio, E. Global Entrepreneurship Monitor: 2007 Global Report on High-Growth Entrepreneurship; Babson College: Babson Park, FL, USA; London Business School; Global Entrepreneurship Research Consortium: London, UK, 2007; pp. 1–48. [Google Scholar]

- Hessels, J. International Entrepreneurship: Value Creation across National Borders. Ph.D. Thesis, Erasmus Research Institute of Management Erasmus University, Rotterdam, The Netherlands, 2008. [Google Scholar]

- Feder, E.S. International Market, Entrepreneurial and Learning Orientations as Drivers of Firm Performance. Stud. Univ. Babes Bolyai. 2015, 60, 3–22. Available online: http://studia.ubbcluj.ro/download/pdf/919.pdf (accessed on 18 October 2016).

- Bosma, N.; Jones, K.; Autio, E.; Levie, J. Global Entrepreneurship Monitor 2007—Executive Report; Babson College: Babson Park, FL, USA; London Business School; Global Entrepreneurship Research Consortium: London, UK, 2008; pp. 1–66. [Google Scholar]

- Ács, Z.J.; Dana, L.P.; Jones, M.V. Toward New Horizons: The Internationalisation of Entrepreneurship. J. Int. Entrep. 2003, 1, 5–12. Available online: http://link.springer.com/article/10.1023/A%3A1023257414794 (accessed on 5 March 2017). [CrossRef]

- Morgan, R.E.; Strong, C.A. Market orientation and dimensions of strategic orientation. Eur. J. Market. 1998, 32, 1051–1073. Available online: http://www.emeraldinsight.com/doi/abs/10.1108/03090569810243712 (accessed on 19 January 2017). [CrossRef]

- Slater, S.; Narver, J. Does Competitive Environment Moderate the Market orientation—Performance Relationship? J. Market. 1994, 58, 46–55. Available online: http://www.jstor.org/stable/1252250 (accessed on 12 July 2016). [CrossRef]

- Deng, S.; Dart, J. Measuring Market Orientation: A Multi-Factor, Multi-Item Approach. J. Market. Manag. 1994, 10, 725–742. Available online: http://www.tandfonline.com/doi/abs/10.1080/0267257X.1994.9964318 (accessed on 18 October 2016). [CrossRef]

- Popescu, C.C.; Bostan, I.; Robu, I.B.; Maxim, A.; Maxim, L. An Analysis of the Determinants of Entrepreneurial Intentions among Students: A Romanian Case Study. Sustainability 2016, 8, 771. Available online: https://www.mdpi.com/2071-1050/8/8/771 (accessed on 5 March 2017). [CrossRef]

- Hosseininia, G.; Ramezani, A. Factors Influencing Sustainable Entrepreneurship in Small and Medium-Sized Enterprises in Iran: A Case Study of Food Industry. Sustainability 2016, 8, 1010. Available online: https://www.mdpi.com/2071-1050/8/10/1010 (accessed on 5 March 2017). [CrossRef]

- Kritikos, A.S. Entrepreneurs and their impact on jobs and economic growth. IZA World Labor 2014, 8, 1–10. Available online: https://wol.iza.org/uploads/articles/8/pdfs/entrepreneurs-and-their-impact-on-jobs-and-economic-growth.pdf (accessed on 5 March 2017). [CrossRef]

- Wong, P.K.; Ho, Y.P.; Autio, E. Entrepreneurship, Innovation and Economic Growth: Evidence from GEM Data. Small Bus. Econ. 2005, 24, 335–350. Available online: http://link.springer.com/article/10.1007/s11187-005-2000-1 (accessed on 18 October 2016). [CrossRef]

- Valliere, D.; Peterson, R. Entrepreneurship and economic growth: Evidence from emerging and developed countries. Entrep. Reg. Dev. 2009, 21, 459–480. Available online: http://www.tandfonline.com/doi/abs/10.1080/08985620802332723 (accessed on 12 July 2016). [CrossRef]

- Hessels, J.; van Stel, A. Entrepreneurship, export orientation, and economic growth. Small Bus. Econ. 2011, 37, 255–268. Available online: http://link.springer.com/article/10.1007/s11187-009-9233-3 (accessed on 5 March 2017). [CrossRef]

- González-Pernía, J.L.; Peña-Legazkue, I.; Vendrell-Herrero, F. Innovation, entrepreneurial activity and competitiveness at a sub-national level. Small Bus. Econ. 2012, 39, 561–574. Available online: http://link.springer.com/article/10.1007/s11187-011-9330-y (accessed on 10 June 2016). [CrossRef]

- Yoon, J.; Kim, D.S. Empirical Relationships among Technological Characteristics, Global Orientation, and Internationalisation of South Korean New Ventures. Sustainability 2016, 8, 1254. Available online: https://www.mdpi.com/2071-1050/8/12/1254 (accessed on 19 March 2017). [CrossRef]

- Li, Z.; Ding, T.; Li, J. Entrepreneurship and economic development in China: Evidence from a time-varying parameters stochastic volatility vector autoregressive model. Technol. Anal. Strateg. Manag. 2015, 27, 660–674. Available online: http://www.tandfonline.com/doi/abs/10.1080/09537325.2015.1034676?journalCode=ctas20 (accessed on 17 January 2017). [CrossRef]

- Li, H.; Yang, Z.; Yao, X.; Zhang, H.; Zhang, J. Entrepreneurship, private economy and growth: Evidence from China. China Econ. Rev. 2012, 23, 948–961. Available online: http://www.sciencedirect.com/science/article/pii/S1043951X1200051X (accessed on 26 July 2016). [CrossRef]

- Anyadike-Danes, M.; Bjuggren, C.M.; Gottschalk, S.; Hölzl, W.; Johansson, D.; Maliranta, M.; Myrann, A. Accounting for Job Growth: Disentangling Size and Age Effects in an International Cohort Comparison; Enterprise Research Centre: Coventry: Birmingham, UK, 2013; Available online: https://pdfs.semanticscholar.org/becb/77633eaf3ed91e76dd c5f33239d97b9bc793.pdf (accessed on 19 January 2017).

- Haltiwanger, J.C.; Jarmin, R.S.; Miranda, J. Who Creates Jobs? Small Versus Large Versus Young. Rev. Econ. Stat. 2013, 95, 347–361. Available online: http://www.mitpressjournals.org/doi/abs/10.1162/REST_a_00288 (accessed on 05 March 2017). [CrossRef]

- Baptista, R.; Preto, M.T. New firm formation and employment growth: Regional and business dynamics. Small Bus. Econ. 2011, 36, 419–442. Available online: http://link.springer.com/article/10.1007/s11187-009-9254-y (accessed on 10 June 2016). [CrossRef]

- Kuhn, J.M.; Malchow-Møller, N.; Sørensen, A. Job creation and job types—New evidence from Danish entrepreneurs. Eur. Econ. Rev. 2016, 86, 161–187. Available online: http://www.sciencedirect.com/science/article/pii/S0014292115001865 (accessed on 26 July 2016). [CrossRef]

- Mandelman, F.S.; Montes-Rojas, G.V. Is Self-employment and Micro-entrepreneurship a Desired Outcome? World Dev. 2009, 37, 1914–1925. Available online: http://www.sciencedirect.com/science/article/pii/S0305750X09000989 (accessed on 10 June 2016). [CrossRef]

- Naudé, W. Entrepreneurship, developing countries, and development economics: New approaches and insights. Small Bus. Econ. 2010, 34, 1–12. Available online: http://link.springer.com/article/10.1007/s11187-009-9198-2 (accessed on 05 March 2017). [CrossRef]

- Congregado, E.; Golpe, A.A.; Carmona, M. Is it a good policy to promote self-employment for job creation? Evidence from Spain. J. Policy Model. 2010, 32, 828–842. Available online: http://www.sciencedirect.com/science/article/pii/S0161893810000803 (accessed on 26 July 2016). [CrossRef]

- Niţu-Antonie, R.D.; Feder, E.S. Labour market dynamics as time-lagged effect of entrepreneurship in the case of Central and Eastern European countries. Proc. Econ. Financ. 2012, 3, 950–955. Available online: http://www.sciencedirect.com/science/article/pii/S2212567112002560 (accessed on 10 December 2012). [CrossRef]

- Fritsch, M.; Mueller, P.; Weyh, A. Direct and Indirect Effects of New Business Formation on Regional Employment. Appl. Econ. Lett. 2005, 12, 545–548. Available online: http://www.tandfonline.com/doi/abs/10.1080/13504850500142346?journalCode=rael20 (accessed on 10 June 2016). [CrossRef]

- Ács, Z.J.; Armington, C. Employment Growth and Entrepreneurial Activity in Cities. Reg. Stud. 2004, 38, 911–927. Available online: http://www.tandfonline.com/doi/abs/10.1080/0034340042000280938 (accessed on 20 August 2016). [CrossRef]

- Van Stel, A.; Storey, D. Link Between Firm Births and Job Creation: Is there a Upas Tree Effect? Reg. Stud. 2004, 38, 893–909. Available online: http://www.tandfonline.com/doi/abs/10.1080/0034340042000280929 (accessed on 20 August 2016). [CrossRef]

- World Economic Forum. Global Competitiveness Report. Available online: http://reports.weforum.org/global-competitiveness-index/ (accessed on 26 October 2016).

- GEM Consortium. Global Entrepreneurship Monitor, Global and Country Reports. Available online: http://www.gemconsortium.org/report (accessed on 25 October 2016).

- International Monetary Fund. World Economic Outlook Database. Available online: https://www.imf.org/external/pubs/ft/weo/2016/02/weodata/index.aspx (accessed on 25 October 2016).

- International Labour Organization. Key Indicators of the Labour Market. Available online: http://www.ilo.org/global/statistics-and-databases/research-and-databases/kilm/WCMS_422399/lang--en/index.htm (accessed on 28 August 2016).

- Mehmetoglu, M.; Jakobsen, T.G. Applied Statistics Using Stata: A Guide for the Social Sciences; SAGE Publications: London, UK, 2016; pp. 1–350. [Google Scholar]

- Zu, L. International Perspective on Sustainable Entrepreneurship. In Sustainable Entrepreneurship; Weidinger, C., Fischler, F., Schmidpeter, R., Eds.; Springer: Berlin/Heidelberg, Germany, 2013; pp. 67–100. [Google Scholar]

- Carod, J.M.A.; Solís, D.L.; Bofarull, M.M. New business formation and employment growth: Some evidence for the Spanish manufacturing industry. Small Bus. Econ. 2008, 30, 73–84. Available online: http://link.springer.com/article/10.1007/s11187-007-9051-4 (accessed on 29 August 2016). [CrossRef]

- Santini, C. Ecopreneurship and Ecopreneurs: Limits, Trends and Characteristics. Sustainability 2017, 9, 1–12. Available online: www.mdpi.com/2071-1050/9/4/492 (accessed on 23 May 2017). [CrossRef]

| Construct | Variables |

|---|---|

| Economic efficiency framework |

|

| Construct | Dimensions | Variables |

|---|---|---|

| Entrepreneurial behavior |

|

|

|

| |

|

|

| Construct | Dimensions | Variables |

|---|---|---|

| Macroeconomic effects of entrepreneurship |

|

|

|

| |

|

| |

|

|

| Constructs | Data Source |

|---|---|

| Economic efficiency ensuring framework | World Economic Forum-Global Competitiveness Report [50] |

| Entrepreneurial behavior | GEM Consortium-Global Entrepreneurship Monitor: global and national reports [51] |

| Gross domestic product (GDP); International openness of a country toward exports and imports; Employment rate | International Monetary Fund-World Economic Outlook Database [ 52]; International Monetary Fund-World Economic Outlook Database [52]; International Labour Organization-Key Indicators of the Labour Market Database [53] |

| Analyzed Relation | Model 1 | Model 2 | Model 3 | Model 4 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | ||

| E_BHV ← | ef_het | −0.499 | −1.57 | 0.115 | −0.642 | −1.81 | 0.070 | −0.511 | −1.44 | 0.150 | −0.682 | −2.04 | 0.042 |

| ef_gme | 0.806 | 1.92 | 0.055 | 0.459 | 0.96 | 0.337 | 0.467 | 1.01 | 0.315 | 0.625 | 1.36 | 0.175 | |

| ef_lme | −0.096 | −0.44 | 0.663 | −0.177 | −0.73 | 0.468 | −0.160 | −0.66 | 0.509 | −0.192 | −0.81 | 0.419 | |

| ef_fme | 0.457 | 2.02 | 0.043 | 0.590 | 2.48 | 0.013 | 0.546 | 2.32 | 0.020 | 0.562 | 2.40 | 0.016 | |

| ef_tr | −0.213 | −0.95 | 0.340 | 0.090 | 0.37 | 0.715 | −0.021 | −0.09 | 0.930 | 0.036 | 0.16 | 0.874 | |

| ef_ms | −0.670 | −4.74 | 0.000 | −0.792 | −5.86 | 0.000 | −0.786 | −5.83 | 0.000 | −0.753 | −5.53 | 0.000 | |

| e_act | ← E_BHV | 1 * | 1 * | 1 * | 1 * | ||||||||

| e_asp | 2.497 | 3.08 | 0.002 | 2.060 | 2.97 | 0.003 | 2.081 | 3.07 | 0.002 | 2.203 | 3.04 | 0.002 | |

| e_atp | 2.921 | 5.10 | 0.000 | 2.574 | 5.27 | 0.000 | 2.588 | 5.31 | 0.000 | 2.652 | 5.28 | 0.000 | |

| ch_gdp | ← E_BHV | 0.998 | 2.62 | 0.009 | |||||||||

| ch_imp | ← E_BHV | 0.510 | 0.84 | 0.401 | |||||||||

| ch_exp | ← E_BHV | 1.143 | 2.13 | 0.034 | |||||||||

| ch_emp | ← E_BHV | 0.179 | 2.09 | 0.037 | |||||||||

| R2 | 0.523 | 0.515 | 0.492 | 0.517 | |||||||||

| GoF | chi2_ms | 82.657 | 0.000 | 66.806 | 0.000 | 67.214 | 0.000 | 62.139 | 0.000 | ||||

| chi2_bs | 199.206 | 0.000 | 173.639 | 0.000 | 178.515 | 0.000 | 173.346 | 0.000 | |||||

| RMSEA | 0.097 | 0.000 | 0.084 | 0.006 | 0.085 | 0.006 | 0.080 | 0.015 | |||||

| AIC | 8764.992 | 9333.422 | 9201.156 | 7994.422 | |||||||||

| BIC | 8935.951 | 9504.381 | 9372.115 | 8165.381 | |||||||||

| CFI | 0.630 | 0.674 | 0.682 | 0.706 | |||||||||

| TLI | 0.445 | 0.511 | 0.523 | 0.559 | |||||||||

| Analyzed Relations | Model 1 | Model 2 | Model 3 | Model 4 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | ||

| E_BHV ← | ef_het | −0.911 | −2.56 | 0.010 | −0.814 | −2.35 | 0.019 | −0.889 | −2.70 | 0.007 | −0.331 | −0.85 | 0.398 |

| ef_gme | 0.587 | 1.15 | 0.248 | 0.477 | 0.98 | 0.326 | 0.496 | 1.07 | 0.283 | 0.309 | 0.72 | 0.471 | |

| ef_lme | −0.161 | −0.67 | 0.504 | −0.183 | −0.76 | 0.448 | −0.157 | −0.68 | 0.499 | −0.199 | −0.84 | 0.399 | |

| ef_fme | 0.446 | 1.57 | 0.116 | 0.534 | 2.10 | 0.035 | 0.498 | 2.02 | 0.044 | 0.693 | 3.19 | 0.001 | |

| ef_tr | 0.312 | 1.29 | 0.195 | 0.259 | 1.10 | 0.273 | 0.259 | 1.18 | 0.238 | −0.108 | −0.42 | 0.676 | |

| ef_ms | −0.808 | −5.95 | 0.000 | −0.818 | −6.12 | 0.000 | −0.809 | −6.04 | 0.000 | −0.691 | −4.28 | 0.000 | |

| e_act | ← E_BHV | 1 * | 1 * | 1 * | 1 * | ||||||||

| e_asp | 2.422 | 2.78 | 0.005 | 2.296 | 2.88 | 0.004 | 2.444 | 3.01 | 0.003 | 1.677 | 2.69 | 0.007 | |

| e_atp | 2.416 | 5.10 | 0.000 | 2.469 | 5.19 | 0.000 | 2.505 | 5.14 | 0.000 | 2.910 | 4.76 | 0.000 | |

| ch_gdp | ← E_BHV | 0.395 | 1.49 | 0.137 | |||||||||

| ch_imp | ← E_BHV | 0.715 | 1.23 | 0.217 | |||||||||

| ch_exp | ← E_BHV | 1.077 | 2.17 | 0.030 | |||||||||

| ch_emp | ← E_BHV | −0.186 | −1.73 | 0.083 | |||||||||

| Analyzed Relations | Model 1 | Model 2 | Model 3 | Model 4 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | ||

| E_BHV ← | ef_het | −0.899 | −3.19 | 0.001 | −0.714 | −2.28 | 0.023 | −0.703 | −2.46 | 0.014 | −0.586 | −1.60 | 0.110 |

| ef_gme | 1.271 | 3.45 | 0.001 | 0.824 | 1.78 | 0.076 | 1.044 | 2.68 | 0.007 | 0.314 | 0.66 | 0.506 | |

| ef_lme | −0.062 | −0.31 | 0.755 | −0.142 | −0.64 | 0.523 | −0.122 | −0.61 | 0.544 | −0.213 | −0.85 | 0.394 | |

| ef_fme | −0.022 | −0.08 | 0.935 | 0.370 | 1.40 | 0.160 | 0.273 | 1.15 | 0.250 | 0.674 | 2.89 | 0.004 | |

| ef_tr | 0.115 | 0.64 | 0.521 | 0.045 | 0.21 | 0.833 | −0.168 | −0.85 | 0.396 | 0.101 | 0.41 | 0.678 | |

| ef_ms | −0.644 | −3.54 | 0.000 | −0.770 | −5.47 | 0.000 | −0.680 | −4.51 | 0.000 | −0.765 | −5.38 | 0.000 | |

| e_act | ← E_BHV | 1 * | 1 * | 1 * | 1 * | ||||||||

| e_asp | 4.060 | 2.85 | 0.004 | 2.777 | 2.94 | 0.003 | 3.193 | 3.06 | 0.002 | 1.783 | 2.84 | 0.005 | |

| e_atp | 2.522 | 4.21 | 0.000 | 2.608 | 5.01 | 0.000 | 2.804 | 4.67 | 0.000 | 2.611 | 5.20 | 0.000 | |

| ch_gdp | ← E_BHV | 0.729 | 2.10 | 0.036 | |||||||||

| ch_imp | ← E_BHV | 0.829 | 1.94 | 0.053 | |||||||||

| ch_exp | ← E_BHV | 1.332 | 2.55 | 0.011 | |||||||||

| ch_emp | ← E_BHV | −0.066 | −1.19 | 0.236 | |||||||||

| Analyzed Relations | Model 1 | Model 2 | Model 3 | Model 4 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | Coef. | Z | P | ||

| E_BHV ← | ef_het | −0.917 | −3.18 | 0.001 | −0.813 | −2.59 | 0.010 | −0.861 | −2.82 | 0.005 | −0.713 | −2.02 | 0.043 |

| ef_gme | 1.089 | 2.75 | 0.006 | 0.760 | 1.68 | 0.093 | 0.864 | 2.00 | 0.046 | 0.415 | 0.85 | 0.393 | |

| ef_lme | −0.016 | −0.07 | 0.940 | −0.121 | −0.53 | 0.595 | −0.121 | −0.55 | 0.579 | −0.177 | −0.71 | 0.480 | |

| ef_fmd | 0.021 | 0.08 | 0.940 | 0.334 | 1.28 | 0.199 | 0.341 | 1.36 | 0.174 | 0.600 | 2.47 | 0.014 | |

| ef_tr | 0.184 | 0.96 | 0.336 | 0.170 | 0.81 | 0.417 | 0.033 | 0.16 | 0.873 | 0.164 | 0.71 | 0.480 | |

| ef_ms | −0.700 | −4.25 | 0.000 | −0.798 | −5.75 | 0.000 | −0.742 | −5.25 | 0.000 | −0.802 | −6.00 | 0.000 | |

| e_act | ← E_BHV | 1 * | 1 * | 1 * | 1 * | ||||||||

| e_asp | 3.557 | 3.03 | 0.002 | 2.754 | 3.09 | 0.002 | 2.840 | 3.05 | 0.002 | 2.047 | 2.88 | 0.004 | |

| e_atp | 2.431 | 4.48 | 0.000 | 2.473 | 4.99 | 0.000 | 2.626 | 4.98 | 0.000 | 2.525 | 5.29 | 0.000 | |

| ch_gdp | ← E_BHV | 0.675 | 2.47 | 0.013 | |||||||||

| ch_imp | ← E_BHV | 0.865 | 2.48 | 0.013 | |||||||||

| ch_exp | ← E_BHV | 0.877 | 2.60 | 0.009 | |||||||||

| ch_emp | ← E_BHV | 0.009 | 0.20 | 0.842 | |||||||||

| Studied Macroeconomic Effect Type of Analysis | Economic Growth | Increase of Imports | Increase of Exports | Evolution of Employed Population |

|---|---|---|---|---|

| Simultaneous influence | H1 partial valid H2 valid | H1 partial valid | H1 partial valid H4 valid | H1 partial valid H5 valid |

| 1-year delay | H1 partial valid | H1 partial valid | H1 partial valid | H1 partial valid |

| 2-year delay | H1 partial valid | H1 partial valid | H1 partial valid | H1 partial valid |

| 3-year delay | H1 partial valid | H1 partial valid | H1 partial valid H4 valid | H1 partial valid |

| 4-year delay | H1 partial valid H2 valid | H1 partial valid H3 valid | H1 partial valid H4 valid | H1 partial valid |

| 5-year delay | H1 partial valid H2 valid | H1 partial valid H3 valid | H1 partial valid H4 valid | H1 partial valid |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nițu-Antonie, R.D.; Feder, E.-S.; Munteanu, V.P. Macroeconomic Effects of Entrepreneurship from an International Perspective. Sustainability 2017, 9, 1159. https://doi.org/10.3390/su9071159

Nițu-Antonie RD, Feder E-S, Munteanu VP. Macroeconomic Effects of Entrepreneurship from an International Perspective. Sustainability. 2017; 9(7):1159. https://doi.org/10.3390/su9071159

Chicago/Turabian StyleNițu-Antonie, Renata Dana, Emőke-Szidónia Feder, and Valentin Partenie Munteanu. 2017. "Macroeconomic Effects of Entrepreneurship from an International Perspective" Sustainability 9, no. 7: 1159. https://doi.org/10.3390/su9071159

APA StyleNițu-Antonie, R. D., Feder, E.-S., & Munteanu, V. P. (2017). Macroeconomic Effects of Entrepreneurship from an International Perspective. Sustainability, 9(7), 1159. https://doi.org/10.3390/su9071159