Taxpayer’s Perception to Tax Payment in Kind System in Support of SMEs’ Sustainability: Case of the South Korean Government’s Valuation of Unlisted Stocks

Abstract

:1. Introduction

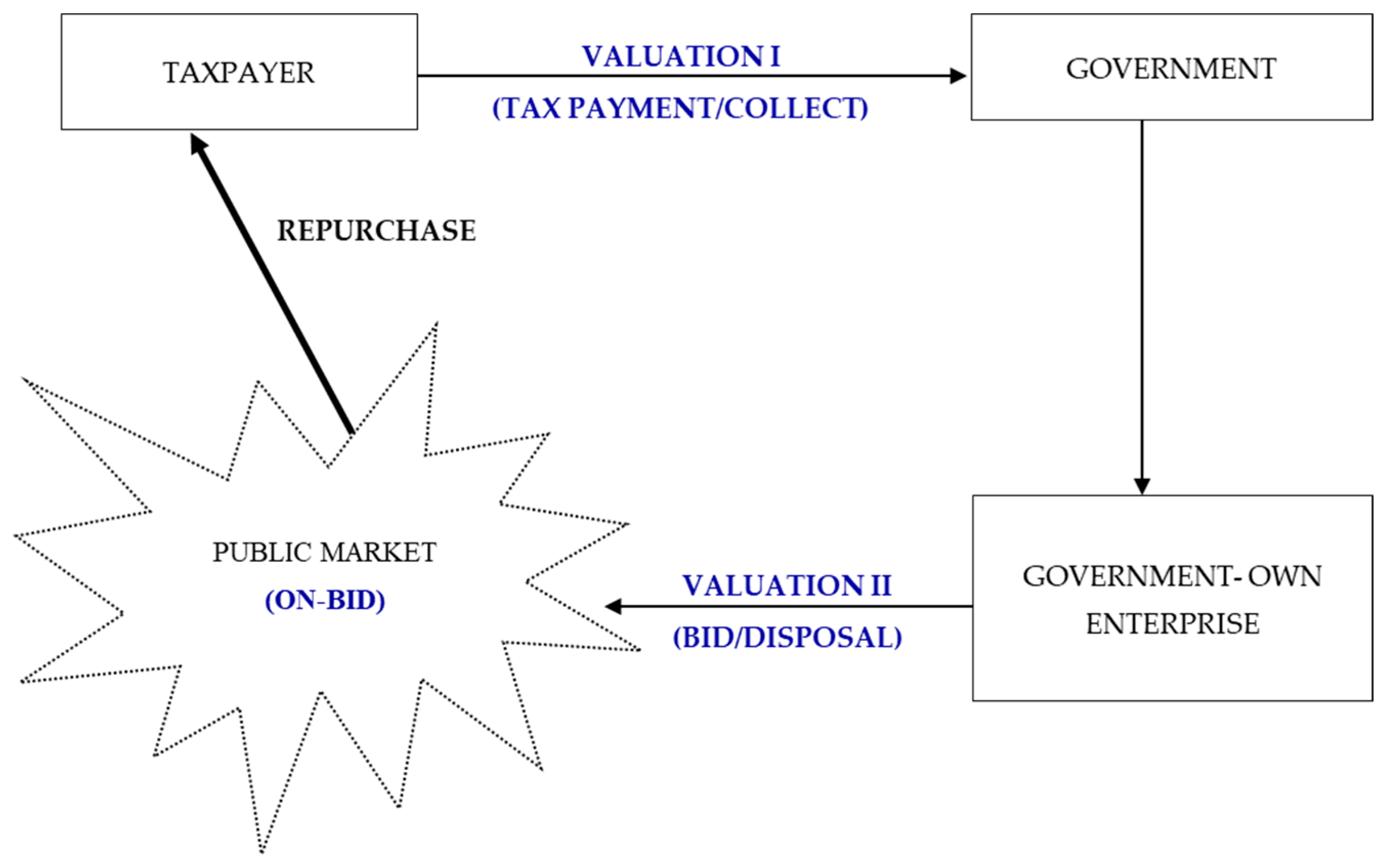

2. Tax Payment in Kind System and Research Question

2.1. System of Tax Payment in Kind

2.2. Research Question

3. Materials and Methods

3.1. Research Model

3.2. Sample Selection

4. Analysis and Results

4.1. Descriptive Statistics and Correlation

4.2. Results of T-test and Ordered Probit Regression Analysis:

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Lenin, V.I. The tax in kind. Collect. Works 1965, 32, 329–365. [Google Scholar]

- Griffin, W.L.; Lacewell, R.D. Long-run implications of a tax in kind to reduce supply and increase income: Comment. Am. J. Agric. Econ. 1973, 55, 670–674. [Google Scholar] [CrossRef]

- Kim, K.S.; Yoon, S.M. A study on problems and improvements of valuation method for payment of tax in non-listed stock. Korean Tax. Res. 2016, 33, 95–123. (In Korean) [Google Scholar] [CrossRef]

- Lee, J.; Kim, H.J.; Ahn, M.J. The willingness of e-Government service adoption by business users: The role of offline service quality and trust in technology. Gov. Inform. Q. 2011, 28, 222–230. [Google Scholar] [CrossRef]

- Barth, M.E.; Clinch, G.; Israeli, D. What do accruals tell us about future cash flows? Rev. Account. Stud. 2016, 21, 768–807. [Google Scholar] [CrossRef]

- Hitchen, E.L.; Hitchen, E.L.; Nylund, P.A.; Nylund, P.A.; Ferràs, X.; Ferràs, X.; Mussons, S. Social media: Open innovation in SMEs finds new support. J. Bus. Strateg. 2017, 38, 21–29. [Google Scholar] [CrossRef]

- Ohlson, J. A. Earnings, book values, and dividends in equity valuation. Contemp. Account. Res. 1995, 11, 661–687. [Google Scholar] [CrossRef]

- Chang, O.H.; Nichols, D.R.; Schultz, J.J. Taxpayer attitudes toward tax audit risk. J. Econ. Psychol. 1987, 8, 299–309. [Google Scholar] [CrossRef]

- Heady, E.O. Tax in kind to reduce supply and increase income without government payments and marketing quotas. Am. J. Agric. Econ. 1971, 53, 441–447. [Google Scholar] [CrossRef]

- Barnes, P. Stock market scams, shell companies, penny shares, boiler rooms and cold calling: The UK experience. Int. J. Law Crime Justice 2017, 48, 50–64. [Google Scholar] [CrossRef]

- Alvaredo, F.; Garbinti, B.; Piketty, T. On the share of inheritance in aggregate wealth: Europe and the USA, 1900–2010. Economica 2017, 84, 239–260. [Google Scholar] [CrossRef]

- Hamilton, J.L. Market information and price dispersion: Unlisted stocks and NASDAQ. J. Econ. Bus. 1987, 39, 67–80. [Google Scholar] [CrossRef]

- Gassen, J.; Uwe Fülbier, R.; Sellhorn, T. International differences in conditional conservatism—the role of unconditional conservatism and income smoothing. Eur. Account. Rev. 2006, 15, 527–564. [Google Scholar] [CrossRef]

- Hung, S.Y.; Chang, C.M.; Yu, T.J. Determinants of user acceptance of the e-Government services: The case of online tax filing and payment system. Govern. Inform. Q. 2006, 23, 97–122. [Google Scholar] [CrossRef]

- Reichheld, F.F.; Sasser, W.E. Zero defection: Quality comes to service. Harvard Bus. Rev. 1990, 68, 105–111. [Google Scholar]

- Rusbult, A.; Farrel, D. A longitudinal test of the investment model: The impact on job commitment and turnover of variation in rewards, cost alternatives and investment. J. Appl. Psychol. 1983, 68, 429–438. [Google Scholar] [CrossRef]

- Jung, H.S. Relationship between Influential Factors of Making Decision Process and Repurchase Intention. Master’s Thesis, Changwon National University, Changwon, Korea, 2004. (In Korean). [Google Scholar]

- Li, Z.; Liu, P.Z.; Wang, W.; Xu, C. Using support vector machine models for crash injury severity analysis. Accid. Anal. Prev. 2012, 45, 478–486. [Google Scholar] [CrossRef] [PubMed]

- Anarkooli, A.J.; Hosseinpour, M.; Kardar, A. Investigation of factors affecting the injury severity of single-vehicle rollover crashes: a random-effects generalized ordered probit model. Accid. Anal. Prev. 2017, 106, 399–410. [Google Scholar] [CrossRef] [PubMed]

- Likert, R. The method of constructing an attitude scale. In Readings in Attitude Theory and Measurement; Wiley: Hoboken, NJ, USA, 1967; pp. 90–95. [Google Scholar]

| Career Years | Tax professional | Experienced Taxpayer | Total |

|---|---|---|---|

| Less than 5 years | 54 | 12 | 66 (33.50%) |

| 5–7 years | 11 | 9 | 20 (10.15%) |

| 7−10 years | 17 | 7 | 24 (12.18%) |

| 10–15 years | 17 | 11 | 28 (14.21%) |

| More than 15 years | 32 | 27 | 59 (29.95%) |

| Total | 131 | 66 | 197 (100.00%) |

| Variables | Mean | Std | Min | Q1 | Med. | Q3 | Max | |

|---|---|---|---|---|---|---|---|---|

| All respondents (n = 197) | Repurchase_Price | 3.701 | 1.737 | 1 | 2 | 4 | 5 | 6 |

| Experienced_Taxpayer | 0.335 | 0.473 | 0 | 0 | 0 | 1 | 1 | |

| Tax_Avoidance | 0.629 | 0.484 | 0 | 0 | 1 | 1 | 1 | |

| GiftTax_Adoption | 0.208 | 0.407 | 0 | 0 | 0 | 0 | 1 | |

| TPKS_Favorable | 0.848 | 0.36 | 0 | 1 | 1 | 1 | 1 | |

| Additional_Exp | 3.518 | 1.095 | 1 | 3 | 4 | 4 | 6 | |

| Career | 2.944 | 1.679 | 0 | 1 | 3 | 5 | 5 | |

| Experienced Taxpayers (n = 66) | Repurchase_Price | 2.470 | 2.017 | 1 | 1 | 1 | 4 | 6 |

| Initial_Valuation | 3.485 | 1.243 | 0 | 3 | 4 | 4 | 5 | |

| Tax_Adivce | 0.924 | 0.267 | 0 | 1 | 1 | 1 | 1 | |

| Tax_Avoidance | 0.652 | 0.480 | 0 | 0 | 1 | 1 | 1 | |

| GiftTax_Adoption | 0.091 | 0.290 | 0 | 0 | 0 | 0 | 1 | |

| TPKS_Favorable | 0.652 | 0.480 | 0 | 0 | 1 | 1 | 1 | |

| Additional_Exp | 3.303 | 0.928 | 1 | 3 | 3 | 4 | 6 | |

| Career | 3.409 | 1.617 | 0 | 2 | 4 | 5 | 5 | |

| Variables | Repurchase_Price | Initial_Valuation | Tax_Adivce | Tax_Avoidance | GiftTax_Adoption | TPKS_Favorable | Additional_Exp |

|---|---|---|---|---|---|---|---|

| Initial_Valuation | −0.086 (0.492) | 1 | |||||

| Tax_Advice | 0.153 (0.220) | −0.027 (0.831) | 1 | ||||

| Tax_Avoidance | 0.251 ** (0.042) | −0.048 (0.704) | 0.031 (0.805) | 1 | |||

| GiftTax_Adoption | 0.163 (0.192) | 0.132 (0.291) | −0.109 (0.385) | 0.010 (0.936) | 1 | ||

| TPKS_Favorable | 0.243 ** (0.049) | −0.049 (0.694) | 0.219 * (0.078) | 0.068 (0.587) | −0.104 (0.406) | 1 | |

| Additional_Exp | 0.045 (0.723) | −0.022 (0.862) | 0.271 ** (0.028) | 0.132 (0.289) | −0.101 (0.422) | 0.413 *** (0.001) | 1 |

| Career | 0.049 (0.698) | 0.03 (0.812) | −0.177 (0.156) | 0.028 (0.824) | 0.018 (0.887) | −0.074 (0.557) | 0.028 (0.824) |

| Variables | Tax professionals | Experienced Taxpayers | Difference | |||

|---|---|---|---|---|---|---|

| Mean (a) | Std. Dev | Mean (b) | Std. Dev | Mean (a−b) | t-stat. | |

| Validity of TPKS | 2.466 | 2.295 | 3.015 | 2.77 | −0.55 *** | −3.67 |

| TPKS Favorable | 1.588 | 0.667 | 2.136 | 0.857 | −0.549 *** | −4.94 |

| Repurchase Price | 4.321 | 1.165 | 2.470 | 2.017 | 1.851 *** | 8.15 |

| Variables | Exp. Sign | Coefficient | Waldχ2 |

|---|---|---|---|

| Experienced_Taxpayer | +/− | −0.942 *** | 13.94 |

| Tax_Avoidance | +/− | 0.674 *** | 12.85 |

| GiftTax_Adoption | +/− | 0.640 *** | 8.18 |

| TPKS_Favorable | +/− | −0.097 | 0.17 |

| Additional_Exp | +/− | 0.200 ** | 7.94 |

| Career | +/− | −0.008 | 0.03 |

| Intercepts(1-6) | included | ||

| Log Likelihood | −308.591 | ||

| Number of sample | 197 | ||

| Variable | Expected Sign | Coefficient | Waldχ2 |

|---|---|---|---|

| Initial_Valuation | +/− | −0.146 ** | 7.17 |

| Tax_Advice | +/− | 1.323 * | 3.55 |

| Tax_Avoidance | +/− | 0.779 ** | 5.17 |

| GiftTax_Adoption | +/− | 0.527 | 0.92 |

| TPKS_Favorable | +/− | −0.615 * | 2.58 |

| Additional_Exp | +/− | 0.348 * | 3.66 |

| Career | +/− | 0.129 | 1.30 |

| Intercepts(1-6) | included | ||

| Log Likelihood | −82.201 | ||

| Number of sample | 66 | ||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, K.; Yoon, S. Taxpayer’s Perception to Tax Payment in Kind System in Support of SMEs’ Sustainability: Case of the South Korean Government’s Valuation of Unlisted Stocks. Sustainability 2017, 9, 1523. https://doi.org/10.3390/su9091523

Kim K, Yoon S. Taxpayer’s Perception to Tax Payment in Kind System in Support of SMEs’ Sustainability: Case of the South Korean Government’s Valuation of Unlisted Stocks. Sustainability. 2017; 9(9):1523. https://doi.org/10.3390/su9091523

Chicago/Turabian StyleKim, KapSoon, and SungMan Yoon. 2017. "Taxpayer’s Perception to Tax Payment in Kind System in Support of SMEs’ Sustainability: Case of the South Korean Government’s Valuation of Unlisted Stocks" Sustainability 9, no. 9: 1523. https://doi.org/10.3390/su9091523