Recycling Decisions in 2020, 2030, and 2040—When Can Substantial NdFeB Extraction be Expected in the EU?

Abstract

:1. Introduction

2. NdFeB Magnets

3. Theoretical Recycling Potential of NdFeB Magnets in the European Union until 2040

3.1. Key Assumptions for the Considered Applications

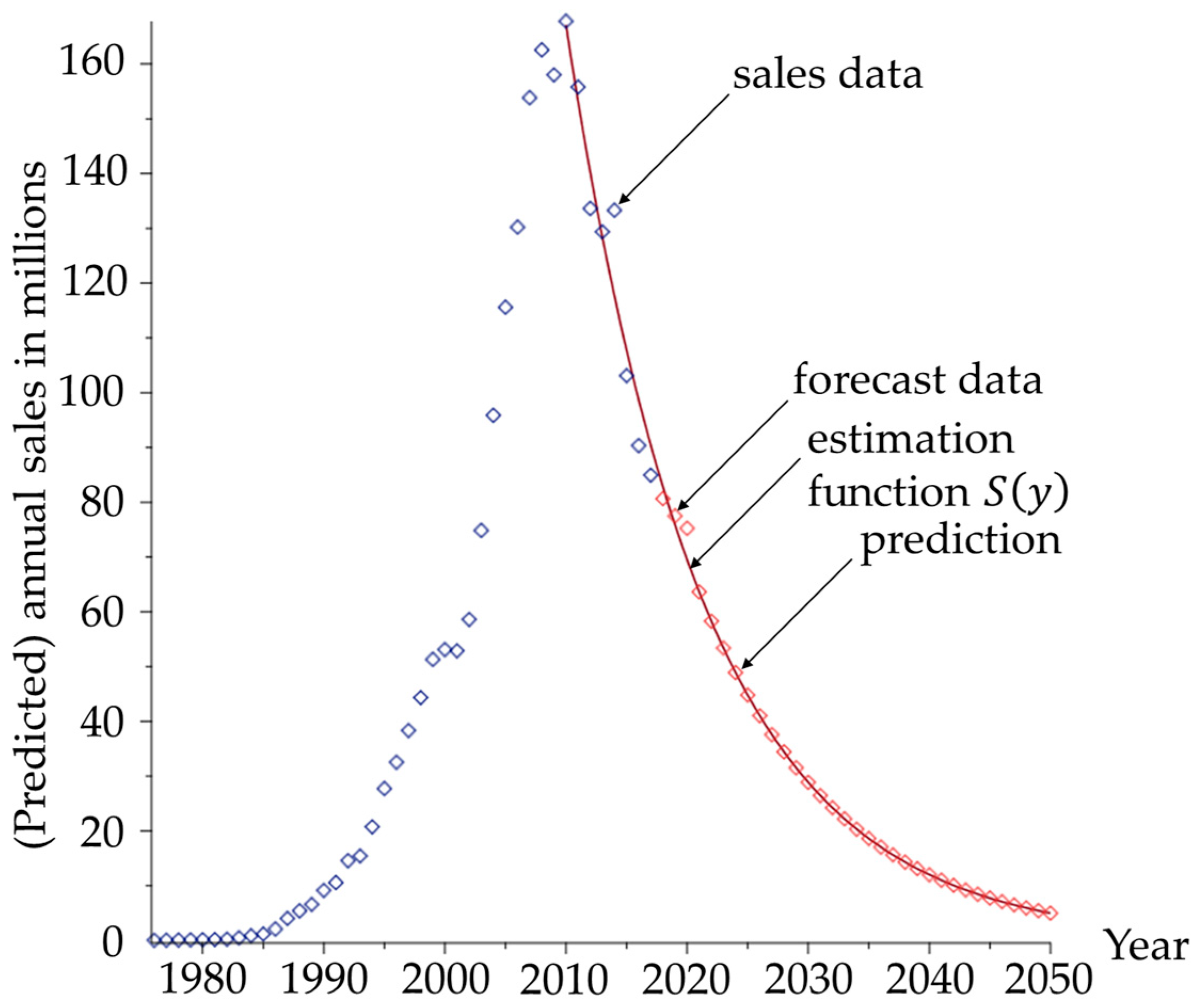

3.2. Methodology for the Prediction of Sales Data

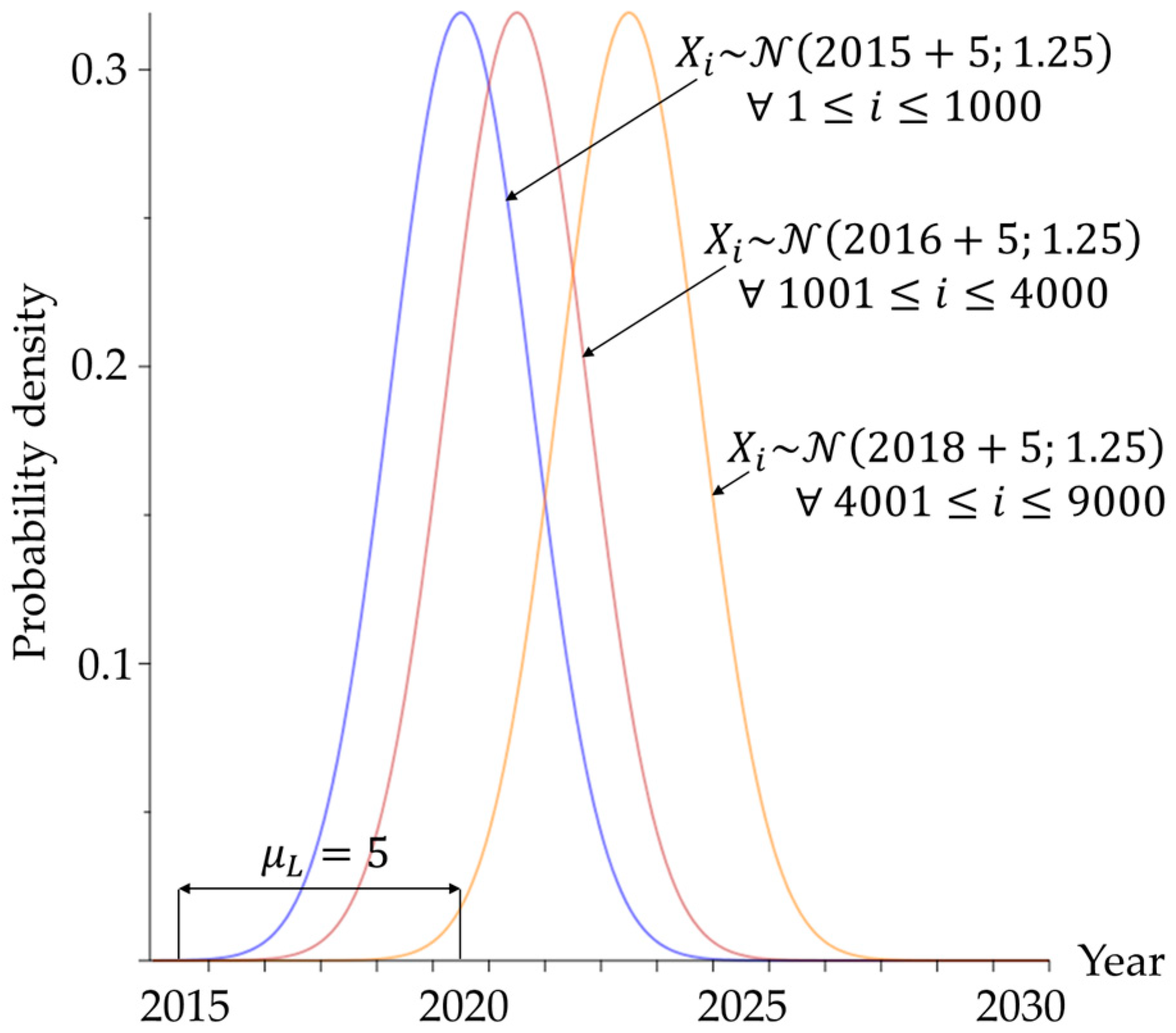

3.3. Methodology for the Calculation of Return Flows

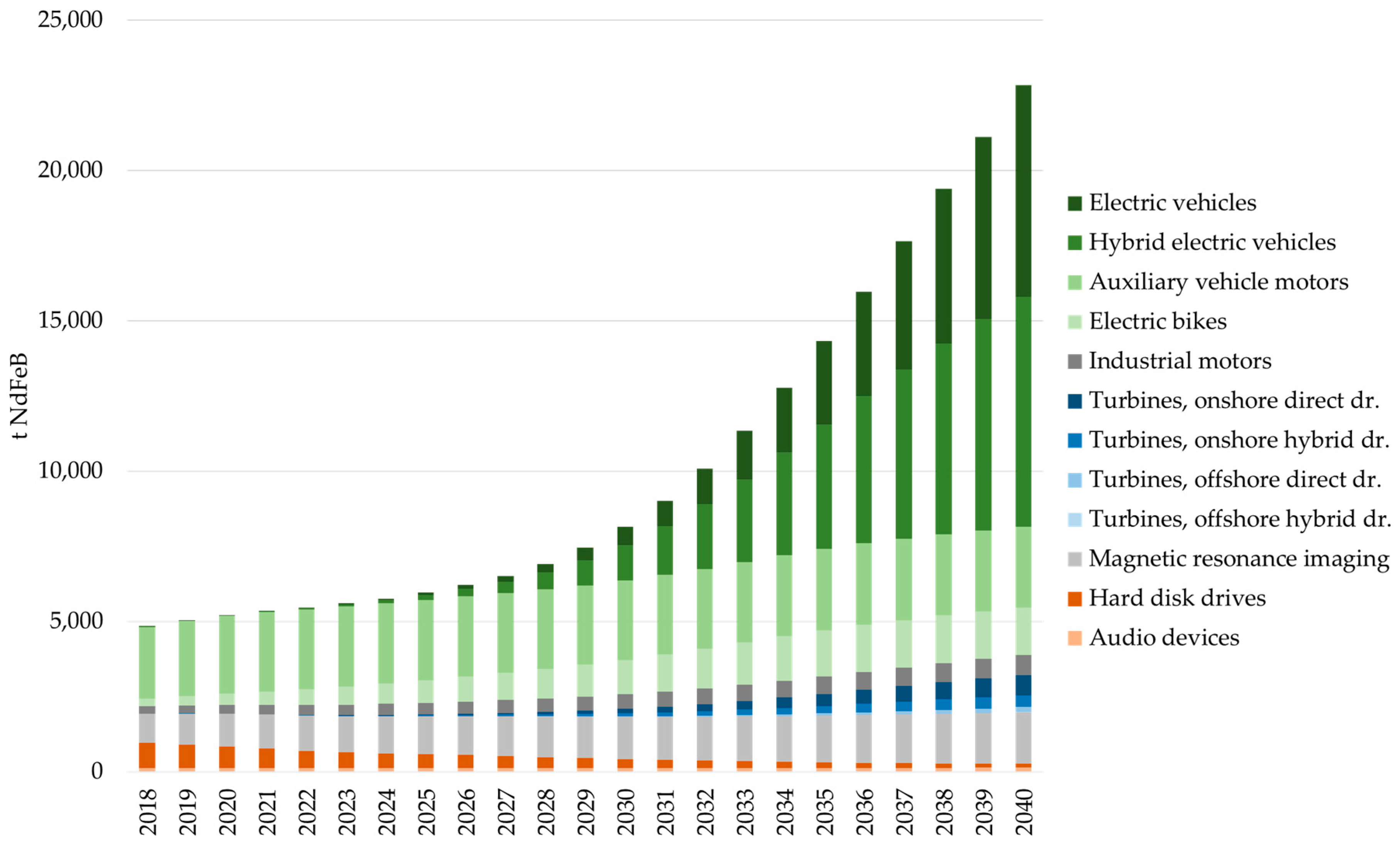

3.4. Results

4. Estimation of the Practical Recycling Potential in the European Union until 2040

4.1. Assumptions for the Practical Recycling Scenario

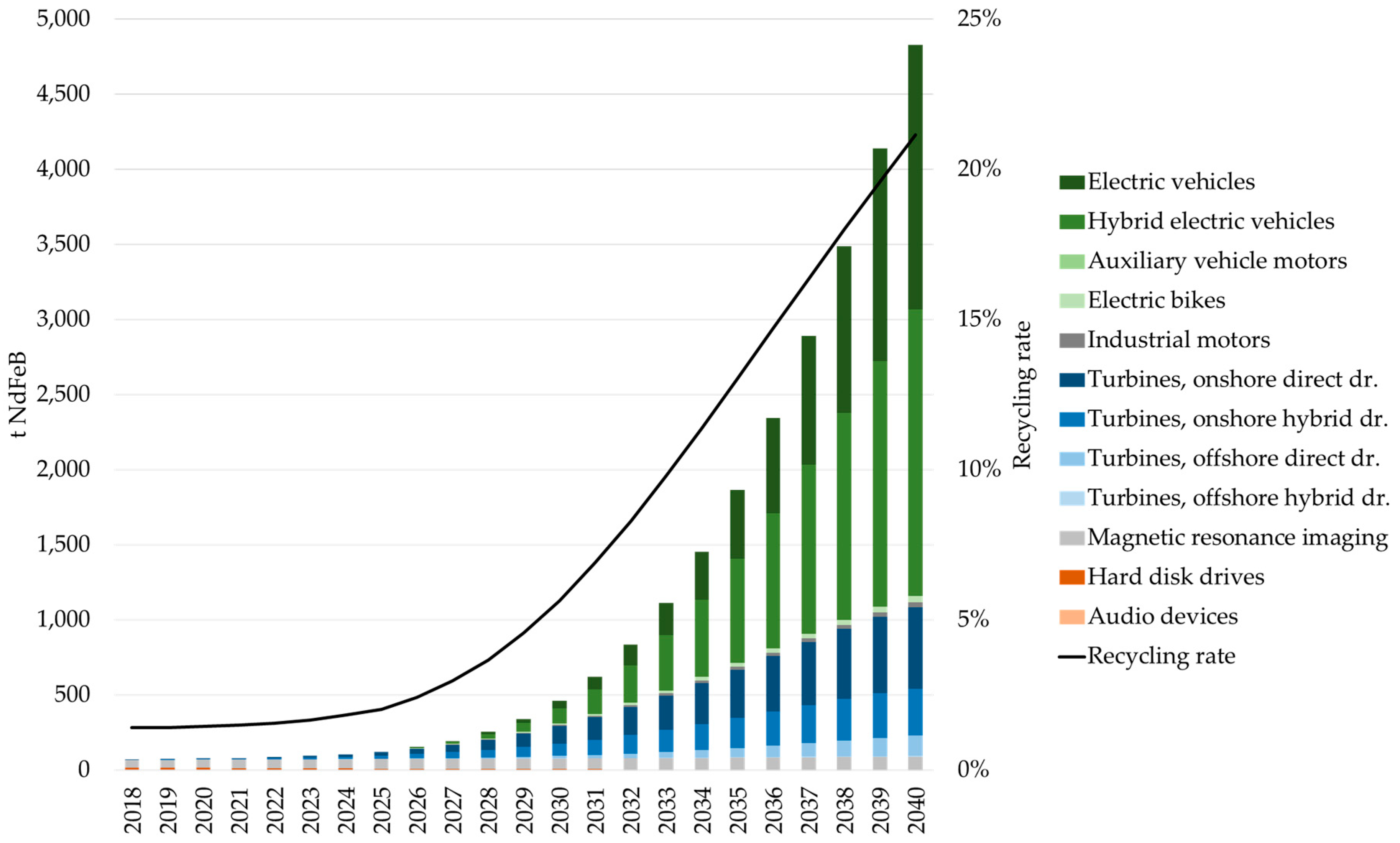

4.2. Possible Scenario for the Availability of NdFeB Scrap in the EU

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Ober, J.A. Mineral Commodity Summaries. 2018. Available online: https://pubs.er.usgs.gov/publication/70194932 (accessed on 18 October 2018).

- Schüler-Zhou, Y. Chinas Rohstoffpolitik Für Seltene Erden. 2018. Available online: https://www.giga-hamburg.de/en/publication/chinas-rohstoffpolitik-f%C3%BCr-seltene-erden (accessed on 18 October 2018).

- Rare Earth Elements: A Review of Production, Processing, Recycling, and Associated Environmental Issues. 2012. Available online: https://nepis.epa.gov/Exe/ZyPURL.cgi?Dockey=P100EUBC.txt (accessed on 26 September 2018).

- Elsner, H. Seltene Erden–Stand heute. In Proceedings of the GDMB Special Metals Expert Committee, Schwäbisch Gmünd, Germany, 8 October 2015. [Google Scholar]

- Binnemans, K.; Jones, P.T.; Blanpain, B.; van Gerven, T.; Yang, Y.; Walton, A.; Buchert, M. Recycling of rare earths: A critical review. J. Clean. Prod. 2013, 51, 1–22. [Google Scholar] [CrossRef]

- Lucas, J.; Lucas, P.; Le Mercier, T.; Rollat, A.; Davenport, W. Rare Earth Recycle; Elsevier: Amsterdam, The Netherlands, 2015; pp. 333–350. [Google Scholar]

- Jowitt, S.M.; Werner, T.T.; Weng, Z.; Mudd, G.M. Recycling of the rare earth elements. Curr. Opin. Green Sustain. Chem. 2018, 13, 1–7. [Google Scholar] [CrossRef]

- Yang, Y.; Walton, A.; Sheridan, R.; Güth, K.; Gauß, R.; Gutfleisch, O.; Buchert, M.; Steenari, B.-M.; van Gerven, T.; Jones, P.T.; et al. REE recovery from end-of-life NdFeB permanent magnet scrap: A critical review. J. Sustain. Metall. 2017, 3, 122–149. [Google Scholar] [CrossRef]

- Glöser-Chahoud, S.; Pfaff, M.; Tercero Espinoza, L.A.; Faulstich, M. Dynamische materialfluss-analyse der magnetwerkstoffe neodym und dysprosium in Deutschland. In Proceedings of the 4th Symposium Rohstoffeffizienz und Rohstoffeinnovationen, Tutzing, Germany, 17–18 February 2016; Teipel, U., Reller, A., Eds.; Fraunhofer Verlag: Stuttgart, Germany, 2016; pp. 258–288. [Google Scholar]

- Marscheider-Weidemann, F.; Langkau, S.; Hummen, T.; Erdmann, L.; Tercero Espinoza, L.A.; Angerer, G.; Marwede, M.; Benecke, S. Rohstoffe Für Zukunftstechnologien 2016; Deutsche Rohstoffagentur (DERA) in der Bundesanstalt für Geowissenschaften und Rohstoffe (BGR): Berlin, Germany, 2016. [Google Scholar]

- Globale Verwendungsstrukturen der Magnetwerkstoffe Neodym und Dysprosium: Eine szenariobasierte Analyse der Auswirkung der Diffusion der Elektromobilität auf den Bedarf an Seltenen Erden. Available online: http://hdl.handle.net/10419/142767 (accessed on 18 October 2018).

- Global and China NdFeB Industry Report, 2015–2018. Available online: https://www.giiresearch.com/report/rinc312750-global-china-ndfeb-industry-report.html (accessed on 18 October 2018).

- Katter, M. Entwicklungstrends bei pulvermetallurgisch hergestellten Seltenerd-Dauermagneten. Fraunhofer Workshop Magnetwerkstoffe–vom Design bis zum Recycling. Available online: http://www.pulvermetallurgie.com/cms/File/Anmeldung_interaktiv.pdf (accessed on 23 October 2018).

- Elwert, T.; Clausthal University of Technology, Clausthal-Zellerfeld, Germany. Anon. Magnet Industry Expert. Personal communication, 2015. [Google Scholar]

- Elwert, T.; Goldmann, D.; Roemer, F.; Schwarz, S. Recycling of NdFeB magnets from electric drive motors of (hybrid) electric vehicles. J. Sustain. Metall. 2017, 3, 108–121. [Google Scholar] [CrossRef]

- Global EV Outlook 2017. 2017. Available online: https://www.iea.org/publications/freepublications/publication/GlobalEVOutlook2017.pdf (accessed on 18 October 2018).

- Prognose der Anteile verschiedener Automobil-Antriebsarten an den Kfz-Neuzulassungen in der Europäischen Union in den Jahren 2016 bis 2030. Available online: https://de.statista.com/statistik/daten/studie/666782/umfrage/automobil-antriebsarten-in-der-eu-prognose/ (accessed on 11 September 2018).

- Number of New Car Registrations in Germany from 1955 to 2019 (In Millions). Available online: https://www.statista.com/statistics/587730/new-car-registrations-germany/ (accessed on 11 September 2018).

- EU Passenger Car Production. Available online: https://www.acea.be/statistics/article/eu-passenger-car-production (accessed on 11 September 2018).

- The Automobile Industry Pocket Guide. Available online: https://www.acea.be/uploads/publications/ACEA_Pocket_Guide_2018-2019.pdf (accessed on 13 September 2018).

- Elwert, T.; Schwarz, S.; Bergamos, M.; Kammer, U. Entwicklung einer industriell umsetzbaren recycling-technologiekette für NdFeB-magnete—Semarec. In Recycling und Rohstoffe; Thiel, S., Thomé-Kozmiensky, E., Goldmann, D., Eds.; Thomé-Kozmiensky Verlag GmbH: Nietwerder, Germany, 2018; pp. 253–271. [Google Scholar]

- Number of electric bicycles sold in the European Union (EU) from 2006 to 2016, (in 1000 units). Available online: https://www.statista.com/statistics/397765/electric-bicycle-sales-in-the-european-union-eu/ (accessed on 11 September 2018).

- Bicycle Market 2017 Edition: Industry and Market Profile. Available online: http://www.conebi.eu/wp-content/uploads/2018/09/European-Bicyle-Industry-and-Market-Profile-2017-with-2016-data-update-September-2018.pdf (accessed on 11 September 2018).

- Zweirad-Industrie-Verband. Zahlen—Daten—Fakten zum Deutschen E-Bike-Markt 2017: E-Bikes mit Rekordzuwächsen. Available online: https://www.ziv-zweirad.de/fileadmin/redakteure/Downloads/Marktdaten/PM_2018_13.03._E-Bike-Markt_2017.pdf (accessed on 11 September 2018).

- Buchert, M.; Manhart, A.; Sutter, J. Untersuchung zu Seltenen Erden: Permanentmagnete im industriellen Einsatz in Baden-Württemberg: Freiburg. 2014. Available online: https://www.oeko.de//oekodoc/2053/2014-630-de.pdf (accessed on 18 October 2018).

- United Nations Conference on Trade and Development. Gross Domestic Product: Total and per Capita, Current and Constant (2010) Prices, Annual. Available online: http://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=96 (accessed on 11 September 2018).

- Wind in Power 2017: Annual Combined Onshore and Offshore Wind Energy Statistics. Available online: https://windeurope.org/wp-content/uploads/files/about-wind/statistics/WindEurope-Annual-Statistics-2017.pdf (accessed on 11 September 2018).

- Global Offshore Wind Farms Database. Available online: https://www.4coffshore.com/windfarms/ (accessed on 11 September 2018).

- Serrano-González, J.; Lacal-Arántegui, R. Technological evolution of onshore wind turbines-a market-based analysis. Wind Energy 2016, 19, 2171–2187. [Google Scholar] [CrossRef] [Green Version]

- Renewables 2017—Analysis and Forecasts to 2022. 2017. Available online: https://www.iea.org/publications/renewables2017/ (accessed on 18 October 2018).

- World Energy Outlook 2017. 2017. Available online: https://www.iea.org/weo2017/ (accessed on 18 October 2018).

- Wind Energy in Europe: Scenarios for 2030. Available online: https://windeurope.org/wp-content/uploads/files/about-wind/reports/Wind-energy-in-Europe-Scenarios-for-2030.pdf (accessed on 11 September 2018).

- Zepf, V. Das verkannte recyclingpotential der seltenen erden—quantitative ergebnisse für neodym in Deutschland. In Recycling und Rohstoffe; Thomé-Kozmiensky, K.J., Goldmann, D., Eds.; Thomé-Kozmiensky Verlag GmbH: Nietwerder, Germany, 2015; pp. 463–476. [Google Scholar]

- Elwert, T.; Hoffmann, M.; Schwarz, S. Can recycling of NdFeB magnets be expected in Europe before 2030? In EMC 2017 Proceedings; Waschki, U., Ed.; GDMB Verlag GmbH: Clausthal-Zellerfeld, Germany, 2017; Volume 3, pp. 1263–1278. [Google Scholar]

- WDC Unit Shipments of Hard Disk Drives (HDD) Worldwide by Size from 2013 to 2014 (In Millions). Available online: https://www.statista.com/statistics/407893/wdc-global-shipment-figures-for-hard-disk-drives/ (accessed on 11 September 2018).

- Worldwide Unit Shipments of Hard Disk drives (HDD) from 1976 to 2020 (In Millions). Available online: https://www.statista.com/statistics/398951/global-shipment-figures-for-hard-disk-drives/ (accessed on 11 September 2018).

- Schulze, R.; Buchert, M. Estimates of global REE recycling potentials from NdFeB magnet material. Resour. Conserv. Recycl. 2016, 113, 12–27. [Google Scholar] [CrossRef]

- Weinert, J.; VanGelder, E. Encyclopedia of Electrochemical Power Sources; Elsevier: Amsterdam, The Netherlands, 2009; pp. 292–301. [Google Scholar]

- Hoenderdaal, S.; Tercero Espinoza, L.; Marscheider-Weidemann, F.; Graus, W. Can a dysprosium shortage threaten green energy technologies? Energy 2013, 49, 344–355. [Google Scholar] [CrossRef]

- Lacal Arántegui, R.; Serrano González, J. The Technology, Market and Economic Aspects of Wind Energy in Europe. 2015. Available online: https://www.evwind.es/2015/06/26/the-technology-market-and-economic-aspects-of-wind-energy/52993 (accessed on 18 October 2018).

- Sriram Radhakrishnan. MRI System Market by Architecture Type (Open MRI and Close MRI), by Field Strength (High field system, Medium field system and Low Field System)—Global Opportunity Analysis and Industry Forecast 2014–2022. 2016. Available online: https://www.giiresearch.com/report/amr676714-mri-system-market-by-architecture-type-open-mri.html (accessed on 18 October 2018).

- Shipments of Hard and Solid State Disk (HDD/SSD) Drives Worldwide from 2015 to 2021 (In Millions). Available online: https://www.statista.com/statistics/285474/hdds-and-ssds-in-pcs-global-shipments-2012-2017/ (accessed on 29 September 2018).

- Elwert, T.; Clausthal University of Technology, Clausthal-Zellerfeld, Germany. Anon. Scrap Industry Expert. (Innova Recycling GmbH, Goslar, Germany). Personal communication, 2016. [Google Scholar]

- Elwert, T.; Clausthal University of Technology, Clausthal-Zellerfeld, Germany. Anon. WEEE Recycling Expert. (ELPRO Elektronik-Produkt Recycling GmbH, Braunschweig, Germany). Personal communication, 2016. [Google Scholar]

- Walachowicz, F.; March, A.; Fiedler, S.; Buchert, M.; Sutter, J.; Merz, C. Recycling von Elektromotoren—MORE: Ökobilanz der Recyclingverfahren. 2014. Available online: https://www.researchgate.net/publication/272809889_Recycling_von_Elektromotoren_MOtor_REcycling_-_MORE (accessed on 18 October 2018).

- Kohlmeyer, R.; Sander, K.; Jung, M.; Wagner, L. Klärung des verbleibs von außer betrieb gesetzten fahrzeugen. In Recycling und Rohstoffe; Thomé-Kozmiensky, K.J., Thiel, S., Thomé-Kozmiensky, E., Goldmann, D., Eds.; Thomé-Kozmiensky Verlag GmbH: Nietwerder, Germany, 2017; pp. 285–304. [Google Scholar]

- Elwert, T.; Clausthal University of Technology, Clausthal-Zellerfeld, Germany. Anon. Recycling Industry Expert. (Siemens AG, München, Germany). Personal communication, 2018. [Google Scholar]

| Application | Average Magnet Content | Nd/Dy [%] 3 | µL; σL [a] 4 | Sales Data Sources | |

|---|---|---|---|---|---|

| Electric Vehicles | 2500 g | [15] | 27/5 | 15; 3.75 | [16,17,18,19] |

| Hybrid Electric Vehicles | 1500 g | [15] | 27/5 | 15; 3.75 | [16,17,18,19] |

| Auxiliary Vehicle Motors | 175 g | [9] | 29/3 | 15; 3.75 | [20] |

| Electric Bikes | 270 g | [21] | 29/3 | 5; 1.25 | [22,23,24] |

| Industrial Motors 1 | - | 28/4 | - | [25,26] | |

| Wind Turbines, Direct Drive 2 | 650 kg/MW | [11] | 28/4 | 22; 5.50 | [27,28,29,30,31,32] |

| Wind Turbines, Hybrid Drive 2 | 160 kg/MW | [11] | 28/4 | 22; 5.50 | [27,28,29,30,31,32] |

| Magnetic Resonance Imaging | 2.5 t | [33] | 31/1 | 12; 3.00 | [11,34] |

| Hard Disk Drives | 5.67 g | [21] | 32/0 | 6; 1.50 | [26,35,36] |

| Audio Devices 1 | - | 32/0 | - | [34] | |

| Application | Theoretical Potential Returns [t NdFeB] | Estimated Realistic Returns [t NdFeB] | |

|---|---|---|---|

| Electric Vehicles | 36,336 | 7097 | (28%) |

| Hybrid Electric Vehicles | 49,320 | 9140 | (36%) |

| Auxiliary Vehicle Motors | 60,861 | 0 | (0%) |

| Electric Bikes | 23,832 | 292 | (1%) |

| Industrial Motors | 10,575 | 232 | (1%) |

| Wind Turbines, Direct Drive | 5776 | 4678 | (18%) |

| Wind Turbines, Hybrid Drive | 3066 | 2483 | (10%) |

| Magnetic Resonance Imaging | 31,585 | 1579 | (6%) |

| Hard Disk Drives | 8704 | 174 | (1%) |

| Audio Devices | 2836 | 0 | (0%) |

| Total | 232,891 | 25,675 | (100%) |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Reimer, M.V.; Schenk-Mathes, H.Y.; Hoffmann, M.F.; Elwert, T. Recycling Decisions in 2020, 2030, and 2040—When Can Substantial NdFeB Extraction be Expected in the EU? Metals 2018, 8, 867. https://doi.org/10.3390/met8110867

Reimer MV, Schenk-Mathes HY, Hoffmann MF, Elwert T. Recycling Decisions in 2020, 2030, and 2040—When Can Substantial NdFeB Extraction be Expected in the EU? Metals. 2018; 8(11):867. https://doi.org/10.3390/met8110867

Chicago/Turabian StyleReimer, Maximilian V., Heike Y. Schenk-Mathes, Matthias F. Hoffmann, and Tobias Elwert. 2018. "Recycling Decisions in 2020, 2030, and 2040—When Can Substantial NdFeB Extraction be Expected in the EU?" Metals 8, no. 11: 867. https://doi.org/10.3390/met8110867