Predictive Sales and Operations Planning Based on a Statistical Treatment of Demand to Increase Efficiency: A Supply Chain Simulation Case Study

Abstract

:1. Introduction

- Gap 1—The integrated S&OP system approach: This approach focuses on how the S&OP process is part of an integrated planning system in which S&OP is one step in a hierarchy that transforms strategic planning into operational plans. Hence, these kinds of studies are absent in current S&OP research. Therefore, the association of S&OP with risk management is a key area for S&OP studies [22]. As a result, this gap seeks to develop holistic approaches to integrate the balance of demand and supply with strategic planning [23], as well as to develop operational measures and measurement approaches to operationally assess S&OP performance [22].

- Gap 2—S&OP in specific environments [22]:

- ○

- Industry: S&OP analysis across industries.

- ○

- Organizational: Impact of organizational characteristics on S&OP.

- ○

- Complexity: S&OP must handle different complex scenarios to manage dynamic supply chain complexity with such variations and uncertainty using, for example, scenario planning, which is a key capability of S&OP.

- Gap 3—Supply chain collaboration and marketing role: Less than 15% of papers related to supply–demand balancing are published in academic journals. In addition, in the marketing field, there are few S&OP studies. Considering the fundamental role that marketing and sales have in the demand side of the S&OP process, this lack of research studies in the field creates an opportunity. Therefore, this gap seeks future S&OP research to optimize supply chain collaboration, for which purpose marketing has a key role to play [23].

- Gap 4—Anticipate the effect of factors on demand: When performing S&OP for a supply chain, the producer must be able to identify and anticipate the effects on demand when a change in a factor, such as sales promotions, takes place. Studies in this area seek to estimate how and why demand will change over the planning horizon, depending on various factors [24].

- How can we design a methodological approach for an integrated and predictive S&OP approach that improves the planning stability and accuracy to manage resources efficiently and flexibly while ensuring adaptability to market dynamics?

- The integrated S&OP approach is able to predict the system´s behavior by increasing the forecasting quality, planning accuracy, and stability, as well as customer service level.

- System dynamics provides the necessary platform to test the predictive S&OP approach.

2. Fundamental Definitions

3. Methodology

- R Studio was used as a programming tool.

- The forecast, zoo, tseries, and changepoint packages were used to evaluate and adjust the series and predictions and obtain error measurements.

- Statistical treatment of potential future demand scenarios;

- Demand pattern state identification and demand planning, as well as adjusting existing demand patterns based on the deviation between real and expected data series;

- A forecasting method based on random number generation using historic data series of customer demand;

- Predictive sales and operations planning used to define the potential measures to increase efficiency based on the prediction of system’s behavior and thus prevent inefficiency to avoid corrective measures;

- The integration of strategic, tactical, and operational measures, activities, and indicators;

- Applying system dynamics as a useful tool for analyzing responses to what-if scenarios within a supply chain.

- A description of the current challenges of sales and operations planning;

- Designing a generic predictive methodology to optimize sales and operations planning oriented toward the customer service level based on the related decisions and actions needed to increase efficiency;

- The development of a simulation model that applies system dynamics to evaluate the impact of the developed predictive approach;

- Comparison of a predictive approach versus a classical approach.

4. Development and Simulation of a Predictive S&OP Methodology

4.1. Development of the Conceptual Model

- The development of a target system of indicators to evaluate forecasting quality, planning accuracy, and customer service level;

- Development of the conceptual predictive sales and operations planning model: development of the methodology for handling scenarios, detecting demand patterns, and generating random numbers for the demand scenarios;

- The development of a classical model for comparison: planning the characteristics and selection of forecasting techniques to compare with the developed S&OP model.

4.1.1. Target System

- The cumulated potential demand (units): the cumulative sum of the potential car units that can be ordered by the customers over the 1000 simulated days.

- The cumulated demand (units): the cumulative sum of the car units demanded by the customers over the 1000 simulated days. This is the result of the difference between the cumulated potential demand and the cumulated volume loss.

- The cumulated volume loss (units): the cumulative sum of the volume loss due to long customer order lead times.

- The cumulated quantity delivered (units): the cumulative sum of the car units delivered to end-customers over the 1000 simulated production days.

- The average quantity delivered on time per week (%): the average of the weekly fulfillment of delivery goals to end-customers.

- The average WIP stock (units): the average of the units in the warehouses during the manufacturer’s production process without considering the supplier and distributor.

- The average capacity utilization of the production plant (%): the average utilization of the available capacities of all production shops of the producer over the 1000 simulated production days.

- The average customer order lead time (days): the average days between the customer order and car delivery to the end-customer over the 1000 simulated production days.

- The average mean absolute deviation (MAD) per week (units): the average deviation between the real demand and forecast values for a week.

- The average order backlog (units): the average number of units in the backlog; the ordered units not yet delivered.

- The cumulated operational savings (M euros): the savings due to adjustments in employees and working shifts.

- Cumulated investment value (M euros): the cumulated investments made to increase the production capacities of the car manufacturer, as well as the supplier´s or distributor´s capacities based on contract agreements.

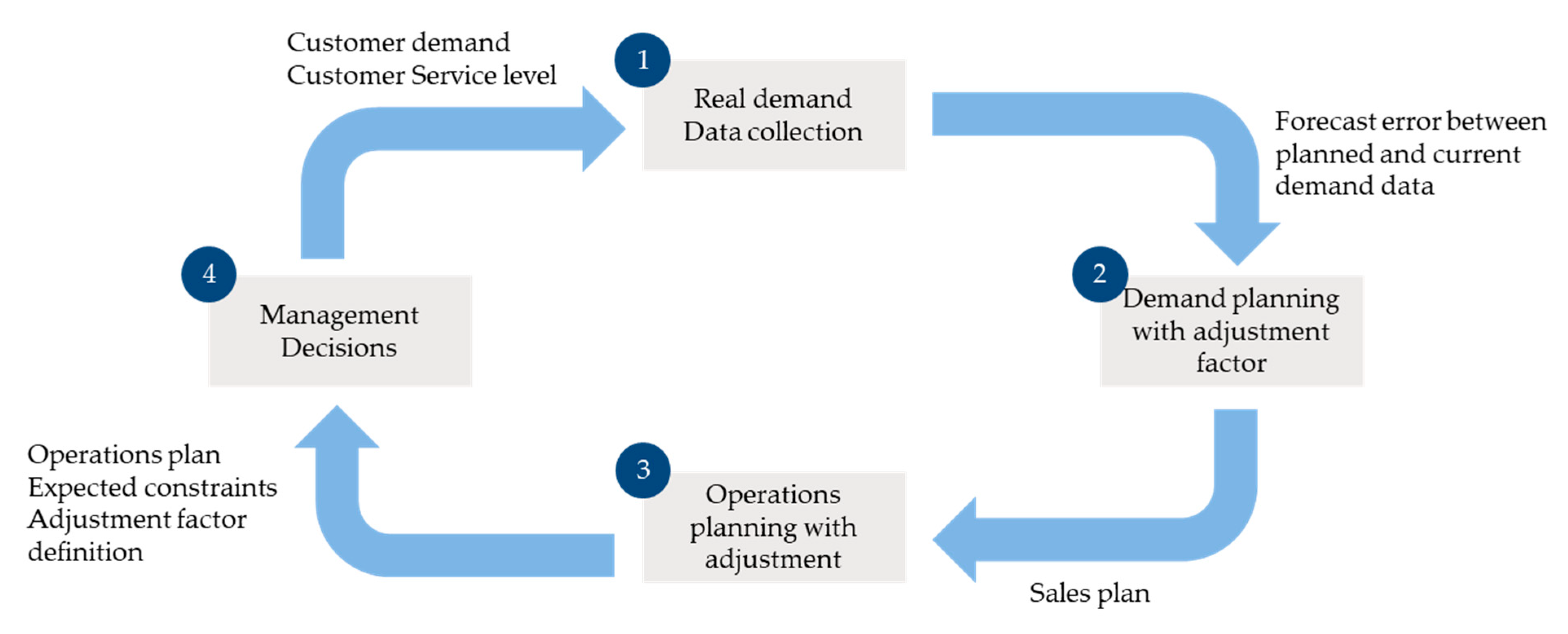

4.1.2. Development of the Conceptual Predictive Sales and Operations Planning Model

- A.

- Alignment of sales planning with demand scenarios: Most companies enact sales plans based on forecasting methods. However, many of these plans are not related to, or do not consider, the potential scenarios. In addition, many of them do not monitor the current scenario in each planning period based on the events that have taken place.

- B.

- Solution preparation in the long term: What-if scenarios have certain implications in sales and operations plans. Theses implications can be predicted to define preventive measures for increasing efficiency by acting in advance to avoid undesirable planning consequences and results. In this context, many companies do not analyze in depth the potential implications of future scenarios or do not define what can be done to prevent these implications. Therefore, such companies are forced to take corrective measures to maintain system stability.

- C.

- Decisions in the medium term: Many companies know that certain events have taken place, and will identify potential planning actions to prevent inefficiency. However, many of these plans end with delayed decisions due to bureaucracy and discoordination, or end with suboptimal decisions due to organizational structures, such as silos, with divergent goals and interests.

4.1.3. Definition of the S&OP Concept and Forecasting Techniques for Comparison

- Forecasts based on historical data;

- Sales plans based on forecasted values aggregated for a certain planning horizon;

- Operations plans defined by sales plans and the current system situation (the operations methods are the same as those for the predictive S&OP model);

- Demand pattern changes based on an analysis of historical data;

- The potential measures or investments to adapt capacities along the supply chain, which are not prepared or discussed with suppliers and/or distributors;

- The control limits for potential future decisions, which are not defined in advance.

4.2. Statistical Treatment of Demand for a Defined Case Study

4.2.1. Demand Case Study

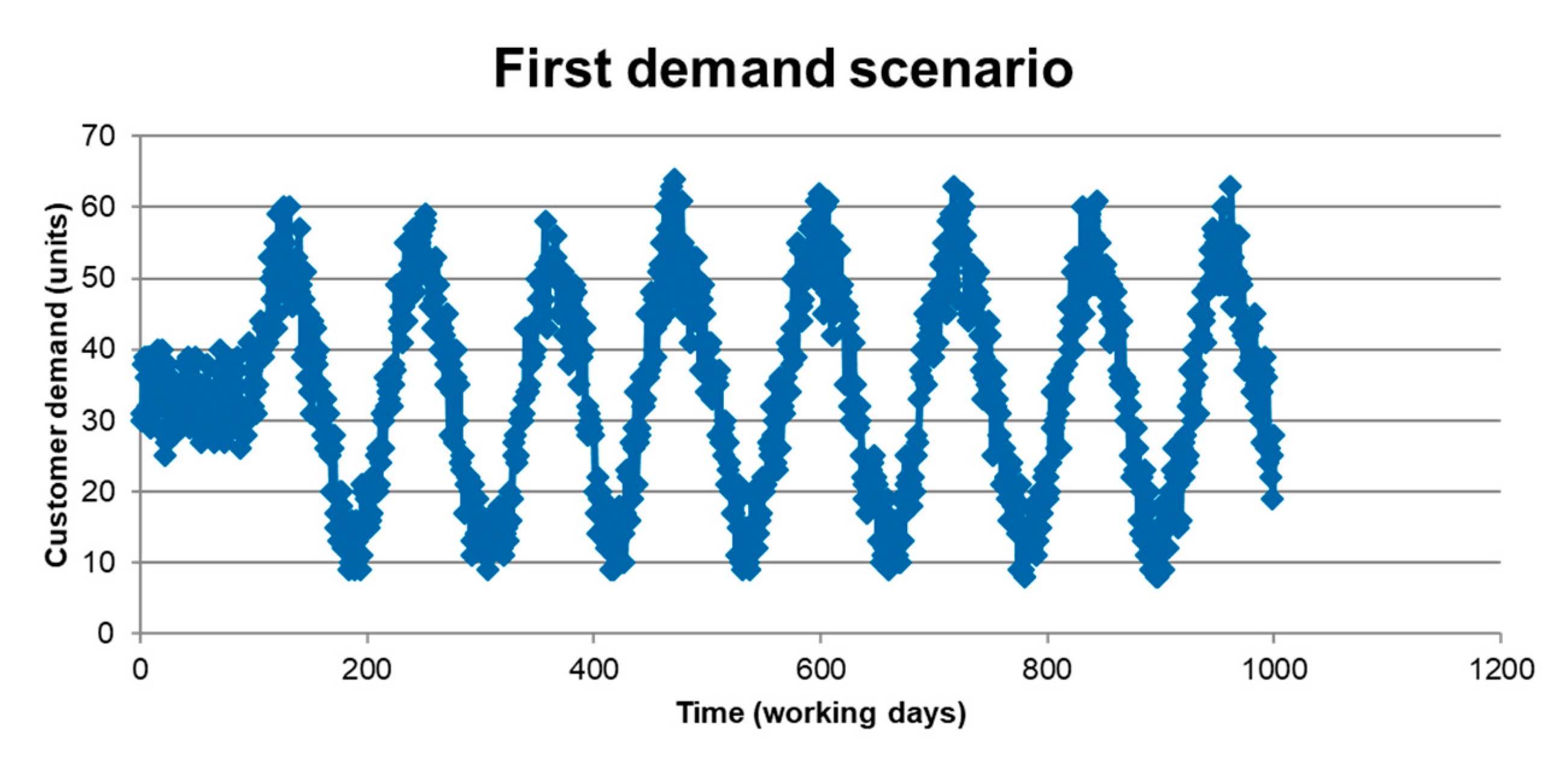

- The first demand scenario, or probable scenario, whose probability is 60%. As shown in Figure 6, it has an average demand value with a mean of 34 units ordered per day.

- The second demand scenario, or feasible scenario: 30% is the probability of occurrence for this scenario. As it can be seen in Figure 7, it has a minor decrease in average demand, compared to the first scenario, with a mean of around 32 units per day.

- The third demand scenario, or non-probable scenario: 10% is the probability of occurrence for this scenario. As it can be seen in Figure 8, it has more variability and a demand increase up to 39 units per day.

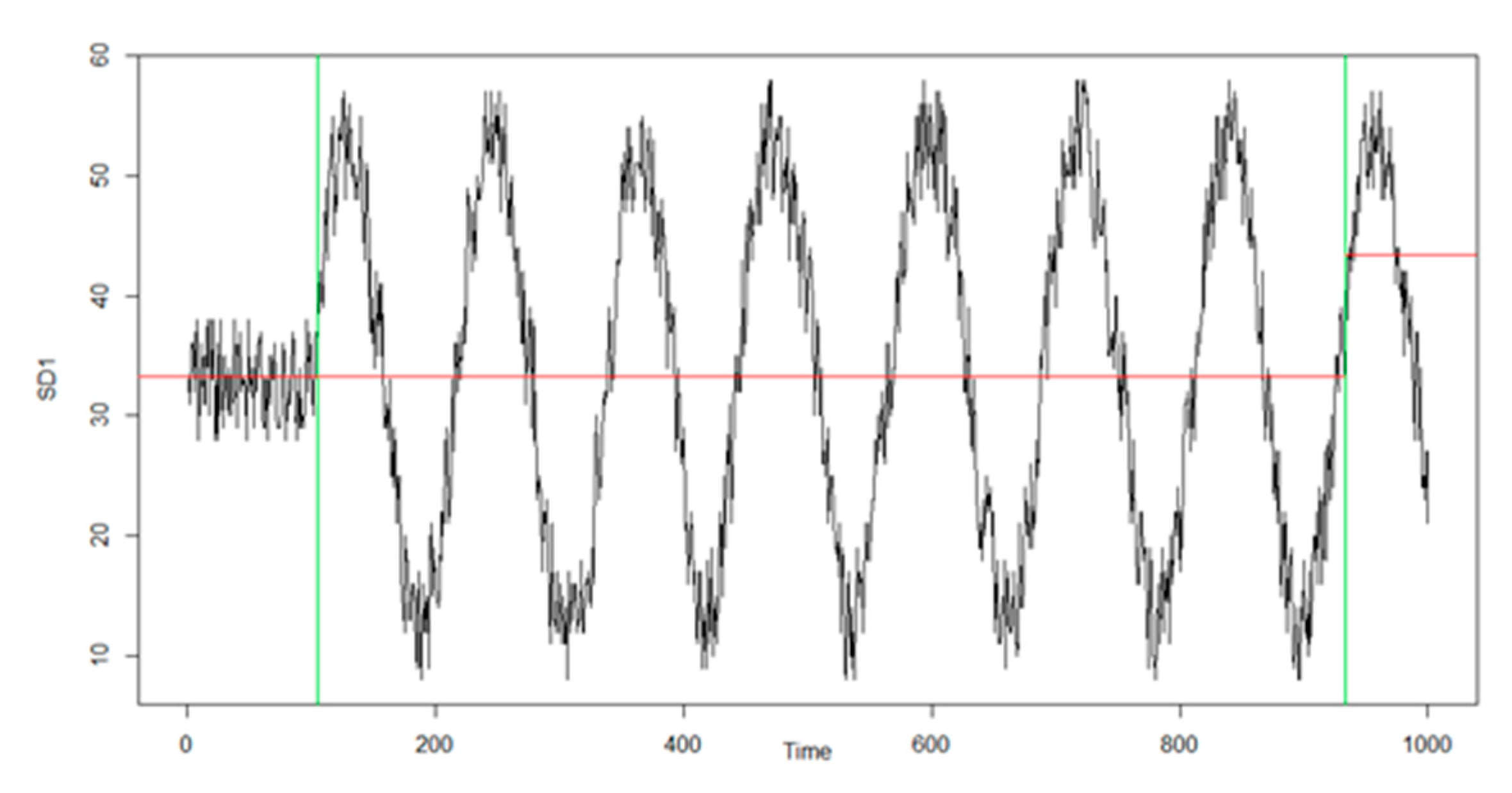

4.2.2. Statistical Treatment

- Calculation of the expected demand based on the different scenarios and their probability of occurrence;

- Statistical analysis of the weighted expected demand (WED) to identify demand patterns and their changes;

- Generation of suitable random numbers.

- Data: weighted expected demand (WED) data series;

- Test: augmented Dickey–Fuller test;

- Alternative hypothesis: stationary;

- Results:

- ○

- Dickey–Fuller = −3.7563;

- ○

- Lag order = 9;

- ○

- p-value = 0.02118.

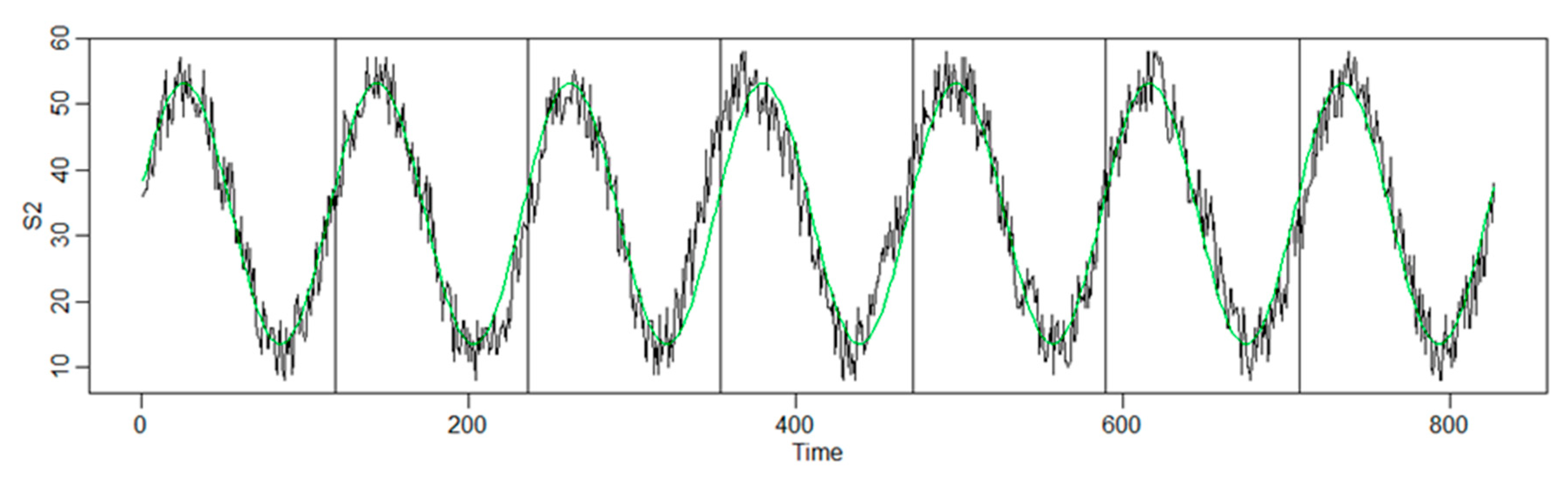

- A.

- Harmonic series: A first approximation due to the periodic and cyclical nature of the series, which consists of carrying out a harmonic regression and a spectral analysis of the series, considering that each point of the series can be decomposed into a sum of sines and cosines, where is the value of the series at each time t, and are the j harmonic coefficients of the series, and n is the period of the series:

- B.

- Autoregressive integrated moving average (ARIMA): An autoregressive model and moving averages of order p and q; ARIMA (p, q):

- C.

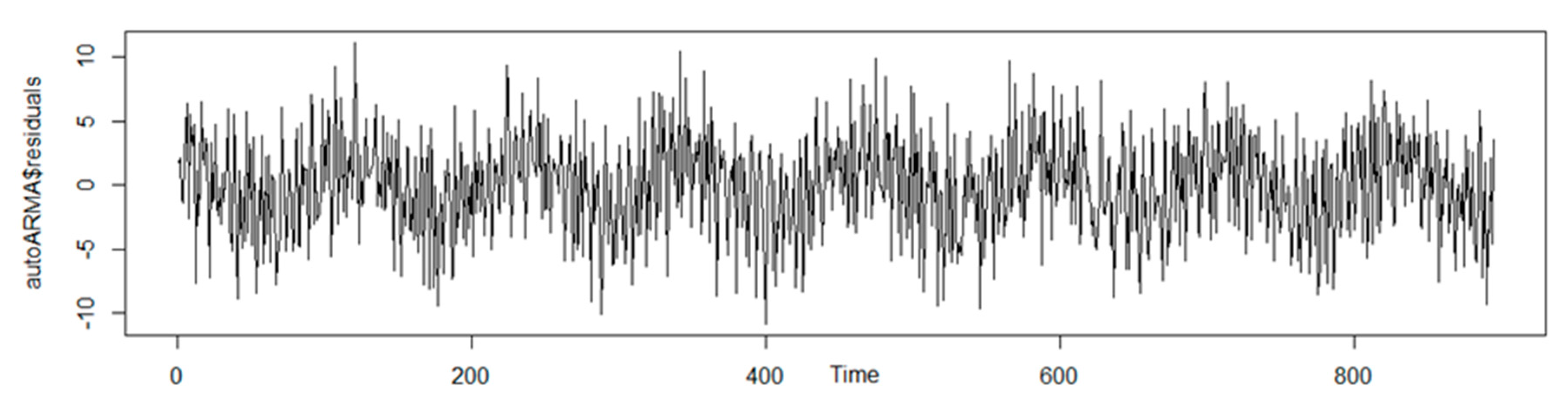

- Artificial neural networks (ARNNs) (p, P, k) m: Autoregressive neural networks (ARNNs) are used to determine the most appropriate parameters for the model and if there is a model that better fits the data. Lapedes and Farber [44] were the first to use a neural network for prediction purposes by applying a feedforward multilayer network. The autoregressive neural network model ARNN (p, P, k) m is equivalent to an ARIMA model (p, 0, 0) (P, 0, 0)m, where m is the seasonal component of the series, and k is the number of neurons in the hidden layer. The result achieved is an ARNN (25, 13, 1), which translates into an AR (25) with a component 13 to ensure seasonality, and a neuron is used in the hidden layer, which is equivalent to an ARIMA (25, 0, 0) (13, 0, 0)1. Likewise, a normality test is performed to determine if this layer corresponds to Gaussian noise (Shapiro–Wilks test (p-value = 0.7856) at ~N (0, 2.71)). This methodology confirms the results initially collected in the ACF (Auto Correlation function) and PACF (Partial Auto Correlation function) correlograms. Likewise, the absence of autocorrelations and dependence of the residuals are confirmed through the ACF correlogram in Figure 13, which is why it is concluded that this layer is Gaussian white noise:

4.2.3. Random Number Generation for Future Expected Demand

4.3. Simulation Case Study

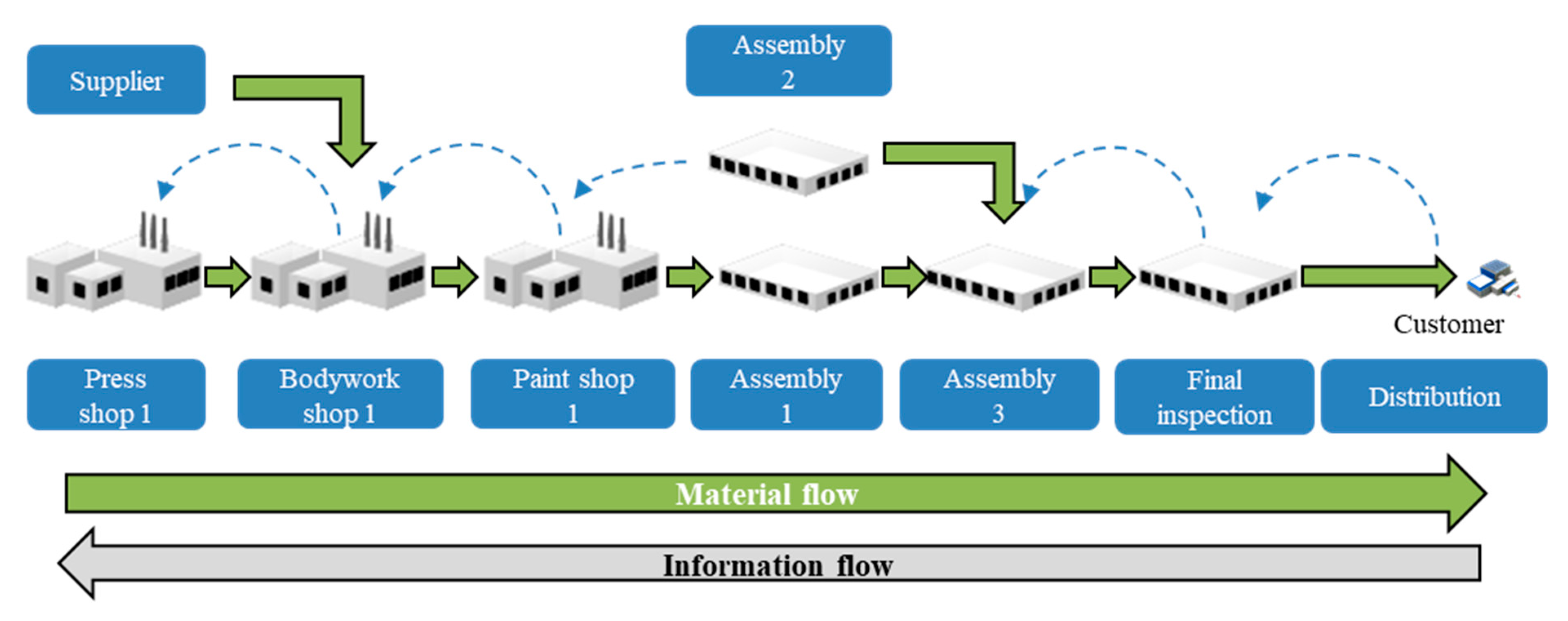

4.3.1. Design of the Supply Chain Flow and Planning Characteristics for a Manufacturer

- ○

- Supplier: A nominal capacity of 40 units per day. It delivers pressed pieces to the bodywork shop of the manufacturer;

- ○

- Press, bodywork, paint, pre-assembly or assembly 1, mechanical assembly shop or assembly 2, final assembly or assembly 3, and the final inspection shops: All of these shops have a nominal capacity of 36 units per day;

- ○

- Distributor: Has a nominal capacity of 40 units per day.

- ○

- Order backlog: At the beginning of the simulation, the model has a certain level of WIP units. In addition, the model presents ordered and undelivered car units at the beginning of the simulation. This value relates to 1320 car units ordered and waiting to be delivered to end-customers.

- ○

- Release of orders: The initiation of orders is controlled before production at press shop 1. This shop controls the number of orders that enter the production process. After the initiation of the production process, the planning logic is a push-strategy until reaching the end-customer. The release of orders depends on the order backlog, the customer order lead time, the nominal capacity of press shop 1, and the demand forecast. This process depends on the same four parameters for both models; however, the values of the parameters vary between both.

- ○

- Demand forecasting: Both models forecast future demands at different planning horizons. Both models forecast future demand values. However, the methods for determining these values vary. The predictive S&OP model uses the generated random numbers with the adjustment factor, while the classical approaches calculate the demand forecast based on formulas according to historical data.

- ○

- Demand planning: The same process for the aggregation of demand at different planning horizons. Long-term demand planning is calculated for one year, medium-term demand planning is performed for one month and three months, and short-term demand planning is obtained on a daily basis.

- ○

- Production planning: As mentioned in the order release section, the production planning strategy seeks to control the order release to ensure that the WIP units are sufficient to meet the promised customer order lead time and the promised weekly delivery goals. In this context, after production initiation, the logic involves a push-production strategy with intermediate stock between the production shops. As a result, the production output in each shop aims to be as large as possible. However, if demand is not high, the model ensures that the WIP units are not too numerous at the end of the supply chain process without a customer order. This model, therefore, seeks to avoid make-to-stock production while favoring make-to-order production—orders placed by the customer, and not internal or dealer orders. Therefore, in cyclical demands, there are periods with mid–low utilization of production capacities, with high utilization employed in other planning periods.

- ○

- Personal planning: both models use demand plans to determine the number of employees that require a planning period. Moreover, the flexibility of the employees can increase or decrease the capacity of shops by six units per day. Based on the production requirements, the system decides whether to increase the quantity of employees or to reduce it. As a result, operational expenses or savings can be obtained.

- ○

- Procurement planning: Both models receive procurement plans from the manufacturer based on the demand forecast.

- ○

- Distribution planning: Both models receive distribution plans from the manufacturer based on the WIP units following a push-strategy.

- ○

- Investment planning: Both models have the capability to decide upon new investments for new capacities at the supplier, the manufacturer, and the distributor level. However, the parameters and implementation time are different. The predictive S&OP model assesses the investment based on the control limits derived from the root cause analysis and preparation of solutions.

- ○

- For procurement management due to preagreements between supply chain parties:

- Supplier capacity expansion.

- Reduction of replenishment lead time due to a new warehouse or due to a new consignment stock due.

- ○

- For production management due to internal decision-making committees:

- Expanding production capacities.

- Changes in the quantity of employees.

- Expanding storage capacity.

- Changes in planning method and parameters for volume leveling.

- ○

- For distribution management due to preagreements between supply chain parties:

- New warehouse for reducing distribution lead times.

4.3.2. Assumptions and Restrictions

- Time restrictions: As this model considers from long-term to short-term horizons, four working years are simulated to evaluate influences in the short, medium, and long term. Assuming 250 working days per year, 1000 time periods are simulated.

- The existing product is in a mature stage of its lifecycle, with stable demand of 33 units per day in the first working days of the simulation.

- Production capacity has a nominal capacity of 36 units per day in three shifts at the beginning of the simulation for the manufacturer process, and 40 units per day for supplier and distribution. As a consequence, the model at initial time is able to supply, produce, and distribute based on the stable demand of 33 units per day, given a stable model at the beginning:

- ○

- During the simulation, two investment options for the manufacturer shops are considered: an increase of 9 units per day or an increase of 18 units per day.

- ○

- Two other investment options are also analyzed. These include capacity increases of 20 units per day for the supplier and distributor.

- Customer demand is read from Excel files.

- Volume loss depends on the customer demand level and the customer order lead time.

- Random numbers for future demand are read from Excel files.

- The simulation model considers sales losses starting from a customer order lead time greater than 60 days.

- The bodywork shop is assumed to need one unit of the supplier and one unit of press shop 1 to produce the body of the car.

- The order backlog is the same for both models at the beginning of the simulation.

- A car is a finished product after it initiates the distribution following the final inspection shop.

- The warehouses have no stock capacity limitations. It is assumed that outsourcing warehouses for stocks can be found nearby with extra-holding costs.

- There is no transport limitation between the different production stages. It is assumed that additional third-party logistics can be found.

- There is a limitation in production capacities and distribution capacities.

- A steady supply of materials for the press shop of the car manufacturer is provided.

- The available number of products is known at every moment of the production, inventory, and transport processes.

- This is a low volume automotive manufacturer, for which customer orders are not changeable.

- Order information along the supply chain is available.

- Data on historical demand are available for both models one day after the demand.

4.3.3. Demand Scenarios and Simulation Models

- First demand scenario or probable scenario.

- Second demand scenario or feasible scenario.

- Third demand scenario or non-probable scenario.

- There are two simulation models for comparison of the results:

- Predictive S&OP simulation model.

- Classical S&OP simulation model.

4.3.4. Simulation Model Validation

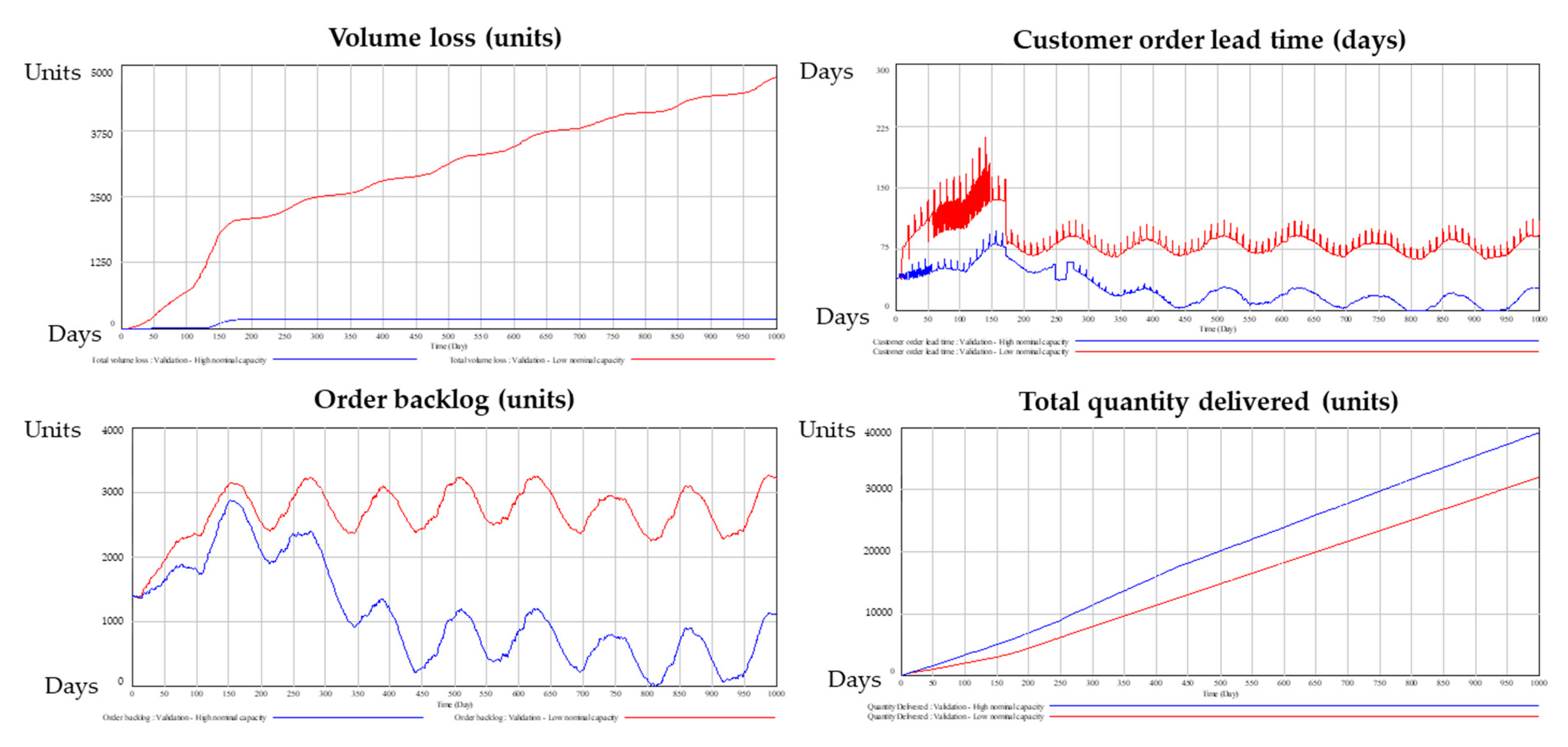

- For a lower nominal capacity (units per day), the customer order lead time, volume loss, and order backlog must be higher, and the total quantity delivered must be lower, as shown in Figure 15.

- For a lower customer demand (units per day), the customer order lead time, volume loss, and order backlog are lower, and the total quantity delivered must also be lower.

4.4. Simulation Results for the Case Study of an Automotive Plant

- The volume loss of 32 units versus 1320 units in the classical approach. This means that the predictive model can adapt itself to demand needs by not allowing the loss of customers and the associated orders.

- The total quantity delivered is more than 2000 additional units over the simulation period. Moreover, the quantity delivered on time is almost 20% higher than that in the classical approach. This means that the model can fulfill its commitments in terms of delivery quantity and date. As a result, the planning stability of this model in this scenario is higher than that in the classical S&OP model.

- The WIP stock along the manufacturer´s production process is almost 20 times lower for the predictive S&OP model, as it is able to regulate production and stocks by predicting the cyclical demand patterns.

- The customer order lead time is more than two times lower in the predictive S&OP model aligned with almost half of the average order backlog.

- The operational savings in the predictive S&OP model are higher due to this model’s ability to plan personal resources based on future demand needs.

- The capacity utilization level is higher for the predictive S&OP model because the investment in new capacities is 5.7, while for the classical S&OP model, this value is 14.7 million euros. This difference occurs because the predictive S&OP model is able to determine that no more capacity is needed to secure delivery on time (95.3%), and a delivery quantity of almost 1500 units more than the classical model can be secured.

- As the customer demand in this scenario is lower, and the predictive S&OP model optimizes resources and investments, the difference between the two models is not as high as that under the first demand scenario.

- In this scenario, the supply chain system is under stress due to cyclical demand with a high average; the predictive S&OP model is, however, able to achieve 97.0% on-time delivery while maintaining low stock levels, customer order lead times, and securing potential demand with only 131 car orders lost. This model also yields lower investments by almost six million euros alongside almost one million euros in operational savings compared to the classical S&OP model.

- As the customer demand in this scenario is higher than that in the previous two scenarios, and the predictive S&OP model optimizes resources and investments, the differences between the two models are greater than those under other scenarios.

5. Conclusions

- Using the new conceptual model for sales and operational planning, based on a statistical treatment of customer demand, planning stability and accuracy can be improved.

- The predictive S&OP model is able to predict potential inefficiencies, define causes, determine effective measures, and implement solutions, thus increasing the efficiency of resource utilization within a supply chain and securing the long-term viability of manufacturers.

- The predictive S&OP model enables manufacturers to improve their service levels, thus securing their entire potential customer demand.

- The abovementioned points demonstrate the need for such a system as a standard tool for managers in the future to increase the efficiency and adaptability of manufacturing organizations by following the principle of “predicting to define preventive measures to avoid correcting”.

- System dynamics provides the necessary platform to determine the cause–effect parametrization and thus obtain results relevant to the research purpose.

- The simulation of an automotive supply chain using the developed conceptual model offers better results than those obtained using currently-available S&OP approaches for dealing with different demand scenarios.

- A description of current research challenges related to sales and operations planning;

- The design of a generic predictive methodology to optimize sales and operations planning: This developed methodology combines demand scenarios, a statistical analysis of demand, forecasting techniques, random number generation, and system dynamics;

- The development of a simulation model that applies system dynamics to evaluate the impact of the developed predictive approach.

- The description of current practical challenges related to sales and operations planning;

- A predictive approach to identify planning challenges, prepare solutions, and implement these factors accordingly was proven to be key for increasing the competitiveness of organizations;

- This predictive model can serve as a fundamental tool for managers, especially for those facing uncertain situations with different potential demand scenarios and future events.

- Better customer service level.

- Lower customer order lead time.

- Higher planning stability.

- Lower stock level.

- Lower volume loss.

- Lower investments and higher operational savings.

- The methodology and simulation model were not proven in any organization.

- The complexity of the supply chain was partially built into the simulation model using the assumptions set.

- The organization structure, S&OP meetings, and interfaces between organizational areas were not considered in the simulation model.

- Information along the supply chain was assumed to be available.

Author Contributions

Funding

Conflicts of Interest

References

- Schuh, G.; Stich, V.; Wienholdt, H. Logistikmanagement; Springer: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Frazelle, E. Supply Chain Strategy: The Logistics of Supply Chain Management; McGraw Hill: New York, NY, USA, 2002; p. 117. [Google Scholar]

- Siller, U. Optimierung Globaler Distributionsnetzwerke: Grundlagen, Methodik, Praktische Anwendung; Gabler Verlag: Wiesbaden, Germany, 2011. [Google Scholar]

- Christopher, M. Logistics and Supply Chain Management; Logistics and Supply Chain Management Creating Value-Added Networks; Pearson Education Limited: Great Britain, UK, 2005. [Google Scholar]

- Wildemann, H. Entwicklungspfade der logistik. In Das Beste Der Logistik; Springer: Berlin/Heidelberg, Germany, 2008; pp. 161–172. [Google Scholar]

- Christopher, M. Logistics & Supply Chain Management Pearson Education; Pearson Education Limited: Harlow, UK, 2011. [Google Scholar]

- Jodlbauer, H. Produktionsoptimierung; Springer Science & Business: Berlin, Germany, 2008. [Google Scholar]

- Placzek, T.S. Optimal Shelf Availability: Analyse und Gestaltung Integrativer Logistikkonzepte in Konsumgüter-Supply Chains; Springer: Wiesbaden, Germany, 2007. [Google Scholar]

- Capgemini. Customer Back on Top of the Supply Chain Agenda in 2010. from Financial Crisis to Recovery: Does the Financial Crisis Still Dictate Supply Chain Agendas? Capgemini Consulting: Utrecht, The Netherlands, 2010. [Google Scholar]

- McKinsey. McKinsey: McKinsey on Supply Chain; Select Publications: Chicago, IL, USA, 2011. [Google Scholar]

- Sydow, J. Management von Netzwerkorganisationen–Zum stand der forschung. In Management von Netzwerkorganisationen; Springer: Berlin/Heidelberg, Germany, 2010; pp. 373–470. [Google Scholar]

- Ijioui, R.; Emmerich, H.; Ceyp, M.; Diercks, W. Supply chain event management als strategisches unternehmensführungskonzept. In Supply Chain Event Management: Konzepte, Prozesse, Erfolgsfaktoren Und Praxisbeispiele; Physica-Verlag: Berlin/Heidelberg, Germany, 2007; pp. 3–14. [Google Scholar]

- Bundesverband Logistik BVL. Studie Trends und Strategien in der Logistik 2008: Die Kernaussagen; Frank straube und hans-christian pfhol; Deutscher Verkehrs-Verlag: Bremen, Germany, 2008. [Google Scholar]

- Schikora, A. Anforderungen an Die Unternehmensführung im Turbulenten umfeld; Igel Verlag RWS: Hamburg, Germany, 2005. [Google Scholar]

- Pfohl, H. Logistiksysteme: Betriebswirtschaftliche Grundlagen; Springer: Berlin/Heidelberg, Germany, 2004. [Google Scholar]

- Wiendahl, H. Auftragsmanagement der Industriellen Produktion: Grundlagen, Konfiguration, Einführung; Springer: Berlin/Heidelberg, Germany, 2011. [Google Scholar]

- Meier, C. Echtzeitfähige Produktionsplanung und-Regelung in der Auftragsabwicklung des Maschinen-und Anlagenbaus; Apprimus-Verlag: Aachen, Germany, 2013. [Google Scholar]

- Fleisch, E.; Christ, O.; Dierkes, M. Die betriebswirtschaftliche vision des internets der dinge. In Das Internet Der Dinge; Springer: Berlin/Heidelberg, Germany, 2005; pp. 3–37. [Google Scholar]

- Hellmich, K.P. Kundenorientierte Auftragsabwicklung: Engpassorientierte Planung und Steuerung des Ressourceneinsatzes; Springer: Berlin/Heidelberg, Germany, 2003. [Google Scholar]

- Fischäder, H. Störungsmanagement in Netzwerkförmigen Produktionssystemen; Springer: Berlin/Heidelberg, Germany, 2007. [Google Scholar]

- Otto, A. Supply chain event management: Three perspectives. Int. J. Logist. Manag. 2003, 14, 1–13. [Google Scholar] [CrossRef]

- Kristensen, J.; Jonsson, P. Context-based sales and operations planning (S&OP) research. Int. J. Phys. Distrib. Logist. Manag. 2018, 48, 19–46. [Google Scholar]

- Ambrose, S.C.; Rutherford, B.N. Sales and Operations Planning (S&OP): A Group Effectiveness Approach. Acad. Market. Stud. J. 2016, 20. Available online: https://commons.erau.edu/publication/1121/ (accessed on 28 December 2020).

- Manikas, A.; Godfrey, M.; Skiver, R. Using Big Data to Predict Consumer Responses to Promotional Discounts as Part of Sales & Operations Planning. Int. J. Manag. Mark. Res. 2017, 10, 69–78. [Google Scholar]

- Dubey, R.; Gunasekaran, A.; Childe, S.J.; Blome, C.; Papadopoulos, T. Big data and predictive analytics and manufacturing performance: Integrating institutional theory, resource-based view and big data culture. Br. J. Manag. 2019, 30, 341–361. [Google Scholar] [CrossRef]

- Ylijoki, O. Guidelines for assessing the value of a predictive algorithm: A case study. J. Mark. Anal. 2018, 6, 19–26. [Google Scholar] [CrossRef]

- Kühnapfel, J.B. Vertriebsprognosen. In Vertriebscontrolling; Springer Gabler: Wiesbaden, Germany, 2014. [Google Scholar]

- Stadtler, H.; Kilger, C. Supply Chain Management and Advanced Planning; Springer: Berlin/Heidelberg, Germany, 2005; Volume 3. [Google Scholar]

- Campuzano, F.; Mula, J. Supply Chain Simulation: A System Dynamics Approach for Improving Performance; Springer Science & Business Media: Berlin, Germany, 2011; p. 23. [Google Scholar]

- Meisel, M.; Leber, T.; Ornetzeder, M.; Stachura, M.; Schiffleitner, A.; Kienesberger, G.; Wenninger, J.; Kupzog, F. Smart demand response scenarios. In Proceedings of the IEEE Africon ’11, Livingstone, Zambia, 13–15 September 2011; IEEE: New York, NY, USA, 2011; pp. 1–6. [Google Scholar]

- Suryani, E.; Chou, S.Y.; Hartono, R.; Chen, C.H. Demand scenario analysis and planned capacity expansion: A system dynamics framework. Simul. Model. Pract. Theory 2010, 18, 732–751. [Google Scholar] [CrossRef]

- Thupeng, W.M.; Thekiso, T.B. Changepoint analysis: A practical tool for detecting abrupt changes in rainfall and identifying periods of historical droughts: A case study of botswana. Bull. Math. Stat. Res. 2019, 7, 33–46. [Google Scholar]

- Jewell, S.; Fearnhead, P.; Witten, D. Testing for a Change in Mean After Changepoint Detection. arXiv 2019, arXiv:1910.04291. [Google Scholar]

- Schulte, C. Logistik: Wege zur Optimierung der Supply Chain; Vahlen: Munich, Germany, 2008. [Google Scholar]

- Pfohl, H. Logistiksysteme, Betriebswirtschaftliche Grundlagen, 8th ed.; Springer: Berlin/Heidelberg, Germany, 2010. [Google Scholar]

- Chopra, S.; Meindl, P. Supply chain management. strategy, planning & operation. In Das Summa Summarum des Management; Springer: Berlin/Heidelberg, Germany, 2007; pp. 265–275. [Google Scholar]

- Lapide, L. Sales and operations planning part II: Enabling technology. J. Bus. Forecast. 2004, 23, 18–20. [Google Scholar]

- Goodwin, P.; Önkal, D.; Thomson, M. Do forecasts expressed as prediction intervals improve production planning decisions? Eur. J. Oper. Res. 2010, 205, 195–201. [Google Scholar] [CrossRef]

- Coyle, R.G. System Dynamics Modelling: A Practical Approach; Chapman & Hall: London, UK, 2008. [Google Scholar]

- Meyer, J.C.; Sander, U.; Wetzchewald, P. Bestände Senken, Lieferservice Steigern-Ansatzpunkt Bestandsmanagement; FIR: Aachen, Germany, 2019. [Google Scholar]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Cran. 2019. Available online: https://cran.r-project.org/web/packages/tseries/tseries.pdf (accessed on 28 December 2020).

- Cran. 2016. Available online: https://cran.r-project.org/web/packages/changepoint/changepoint.pdf (accessed on 28 December 2020).

- Lapedes, A.; Farber, R. Nonlinear Signal Processing Using Neural Networks: Prediction and System Modelling; (No. LA-UR-87-2662; CONF-8706130-4); Los Alamos National Laboratory: Los Alamos, NM, USA, 1987. [Google Scholar]

- Wensing, T. Periodic Review Inventory Systems; Springer: Berlin, Germany, 2011; Volume 651. [Google Scholar]

| No. | Areas | Expected Inefficiencies Detected within the Scenarios | Cause of the Inefficiency | Potential Solutions | Simulation Model Example |

|---|---|---|---|---|---|

| 1 | Procurement | 1.1. Lack of Quantity 1.2. Lack of Quality 1.3. Delivery time or service level | 1.1. Capacity 1.2. Time constraints/stress factor 1.3. Lead time | 1.1. New contract for an increase in supplier´s capacity 1.2. Time horizon and specifications of procurement plans 1.3. Investment in consignment stock in producer´s plant | 1.1. Supplier capacity expansion 1.2. Time horizon 1.3. Lead time due to new consignment stock |

| 2 | Production | 2.1. Internal production capacity limitations 2.2. Personnel resources 2.3. Storage limitations 2.4. Lack of quality | 2.1. Production capacities 2.2. Quantity, training, and /or motivation 2.3. Production lead time or storage capacities 2.4. Existing equipment, time constraints, or volume | 2.1. Investments in new equipment, expanding existing capacities, or outsourcing production 2.2. Personnel acquisition, training, and leadership 2.3. Improvement of planning methodology, investments in new intermediate storage or expanding existing storage 2.4. New equipment, planning plans or volume leveling | 2.1. Investment in expanding production capacities 2.2. Quantity of employees 2.3. Investment in expanding storage capacity 2.4. Volume leveling |

| 3 | Distribution | 3.1. Delays and quantity received 3.2. Quality received 3.3. Storage problems leading to delays | 3.1. Transport capacity or lead time to end-customers 3.2. Storage capacity and/or transport means 3.3. Storage capacity | 3.1. New contract for capacity expansion or new distribution warehouses to reduce lead times 3.2. Investment in storage capacity or transport means 3.3. Expanding existing storage | 3.1–3.3. New warehouse for reducing lead times |

| No. | Changepoint Test Parameters | Mean | Variance |

|---|---|---|---|

| 1 | Changepoint Type | Change in mean | Change in variance |

| 2 | Test Statistics | Normal | Normal |

| 3 | Minimum Segment Length | 1 | 2 |

| 4 | Maximum no. of Changepoints | 1 | 1 |

| 5 | Changepoint Locations | 933 | 105 |

| Coefficients | Estimates | p-Value |

|---|---|---|

| a0 | 33.3482 | 0.000 |

| a1 | 3.9847 | 0.000 |

| b1 | 19.3899 | 0.000 |

| a2 | 0.2741 | 0.198 |

| b2 | −0.0055 | 0.979 |

| Mean | ||||

|---|---|---|---|---|

| 0.4743 | 0.2439 | 0.1682 | 0.0916 | 33.4616 |

| Prediction Value | CI 80% | CI 95% | ||

|---|---|---|---|---|

| 19,443 | 17,518 | 21,531 | 16,540 | 22,681 |

| 18,742 | 16,640 | 21,011 | 15,499 | 22,438 |

| 18,286 | 16,382 | 20,569 | 15,330 | 21,549 |

| 20,452 | 18,316 | 22,698 | 17,155 | 24,060 |

| 15,472 | 13,965 | 17,491 | 13,127 | 18,459 |

| 20,954 | 18,413 | 23,265 | 17,306 | 25,200 |

| No. | Demand Pattern | Period | Parameters | Method or Formula for Demand Data Generation |

|---|---|---|---|---|

| 1 | Stationary | 1–105 | Mean | Mean with random numbers between (−2, 2) |

| 2 | Cyclical 1 | 106–932 | ARIMA | ARIMA value + noise |

| 3 | Cyclical 2 | 933–1000 | ARIMA | ARIMA value + noise |

| No. | Area | Classical S&OP Model | Predictive S&OP Model |

|---|---|---|---|

| 1 | Demand scenarios |

|

|

| 2 | Forecasting techniques |

|

|

| 3 | Sales plan |

|

|

| 4 | Procurement, production, distribution and personal plans |

|

|

| 5 | Investment planning |

|

|

| No. | Key Performance Indicator (KPI) | Classical S&OP Simulation Model | Predictive S&OP Simulation Model |

|---|---|---|---|

| 1 | Cumulated potential demand (units) | 34,062 | 34,062 |

| 2 | Cumulated demand (units) | 32,742 | 34,030 |

| 3 | Cumulated volume loss (units) | 1320 | 32 |

| 4 | Cumulated quantity delivered (units) | 32,154 | 34,478 |

| 5 | Average quantity delivered on-time per week (%) | 77.3 | 95.9 |

| 6 | Average WIP stock (units) | 4374 | 278 |

| 7 | Average capacity utilization of the production plant (%) | 71.0 | 66.8 |

| 8 | Average customer order lead time (days) | 65.0 | 28.7 |

| 9 | Average mean absolute deviation (MAD) per week (units) | 28.5 | 17.0 |

| 10 | Average order backlog (units) | 1847 | 971 |

| 11 | Cumulated operational savings (M euros) | 0.1 | 0.8 |

| 12 | Cumulated investment value (M euros) | 14.7 | 14.4 |

| No. | Key Performance Indicator (KPI) | Classical S&OP Simulation Model | Predictive S&OP Simulation Model |

|---|---|---|---|

| 1 | Cumulated potential demand (units) | 32,174 | 32,174 |

| 2 | Cumulated demand (units) | 31,202 | 32,064 |

| 3 | Cumulated volume loss (units) | 972 | 110 |

| 4 | Cumulated quantity delivered (units) | 30,948 | 32,445 |

| 5 | Average quantity delivered on-time per week (%) | 76.6 | 95.3 |

| 6 | Average WIP stock (units) | 4159 | 267 |

| 7 | Average capacity utilization of the production plant (%) | 68.9 | 71.7 |

| 8 | Average customer order lead time (days) | 59.7 | 32.8 |

| 9 | Average mean absolute deviation (MAD) per week (units) | 31.5 | 20.0 |

| 10 | Average order backlog (units) | 1602 | 1004 |

| 11 | Cumulated operational savings (M euros) | 0.2 | 0.7 |

| 12 | Cumulated investment value (M euros) | 14.7 | 5.7 |

| No. | Key Performance Indicator (KPI) | Classical S&OP Simulation Model | Predictive S&OP Simulation Model |

|---|---|---|---|

| 1 | Cumulated potential demand (units) | 39,090 | 39,090 |

| 2 | Cumulated demand (units) | 34,780 | 38,959 |

| 3 | Cumulated volume loss (units) | 4310 | 131 |

| 4 | Cumulated quantity delivered (units) | 32,986 | 38,863 |

| 5 | Average quantity delivered on-time per week (%) | 75.6 | 97.0 |

| 6 | Average WIP stock (units) | 5512 | 350 |

| 7 | Average capacity utilization of the production plant (%) | 70.6 | 70.3 |

| 8 | Average customer order lead time (days) | 92.9 | 34.1 |

| 9 | Average mean absolute deviation (MAD) per week (units) | 78.5 | 66.0 |

| 10 | Average order backlog (units) | 2528 | 1327 |

| 11 | Cumulated operational savings (M euros) | 0.0 | 0.9 |

| 12 | Cumulated investment value (M euros) | 20.1 | 14.4 |

| No. | Key Performance Indicator (KPI) | Scenario 1—Probable | Scenario 2—Feasible | Scenario 3—Non-Probable |

|---|---|---|---|---|

| 1 | Cumulated potential demand (units) | Middle | Low | High |

| 2 | Cumulated demand (units) | Middle | Low | High |

| 3 | Cumulated volume loss (units) | Low | Middle | High |

| 4 | Cumulated quantity delivered (units) | Middle | Low | High |

| 5 | Average quantity delivered on-time per week (%) | Middle | Low | High |

| 6 | Average WIP stock (units) | Middle | Low | High |

| 7 | Average capacity utilization of the production plant (%) | Low | High | Middle |

| 8 | Average customer order lead time (days) | Low | Middle | High |

| 9 | Average mean absolute deviation (MAD) per week (units) | Low | Middle | High |

| 10 | Average order backlog (units) | Low | Middle | High |

| 11 | Cumulated operational savings (Mill. Euros) | Middle | Low | High |

| 12 | Cumulated investment value (M euros) | Middle | Low | Middle |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gallego-García, S.; García-García, M. Predictive Sales and Operations Planning Based on a Statistical Treatment of Demand to Increase Efficiency: A Supply Chain Simulation Case Study. Appl. Sci. 2021, 11, 233. https://doi.org/10.3390/app11010233

Gallego-García S, García-García M. Predictive Sales and Operations Planning Based on a Statistical Treatment of Demand to Increase Efficiency: A Supply Chain Simulation Case Study. Applied Sciences. 2021; 11(1):233. https://doi.org/10.3390/app11010233

Chicago/Turabian StyleGallego-García, Sergio, and Manuel García-García. 2021. "Predictive Sales and Operations Planning Based on a Statistical Treatment of Demand to Increase Efficiency: A Supply Chain Simulation Case Study" Applied Sciences 11, no. 1: 233. https://doi.org/10.3390/app11010233