Opportunities for Industry 4.0 to Support Remanufacturing

Abstract

:1. Introduction

2. Literature Review

- Products are durable and usually contain high-value materials;

- The technology cycle is stable and longer than the useful life cycle;

- Restoration technologies are available;

- Products have the potential to be leased or delivered as a service rather than as hardware.

- The availability of computing power and connectivity,

- The advancement of analytic capability (e.g., artificial intelligence),

- The introduction of new patterns of human and machine interaction (e.g., augmented reality systems), and

- The advent of technologies that ease the transformation of digital data into physical objects (e.g., additive manufacturing and rapid prototyping).

- The vertical networking of small production systems, such as smart factories and smart products;

- The horizontal integration of global value creation networks, such as new business and cooperation models;

- Through-engineering across the product design, product use, and EOL stages;

- Exponential acceleration of technologies.

3. Smart Remanufacturing in the Digital Age

3.1. Smart Life Cycle Data

3.2. Smart Factory

3.3. Smart Services

4. Case Illustrations

4.1. Smart Repair Cell

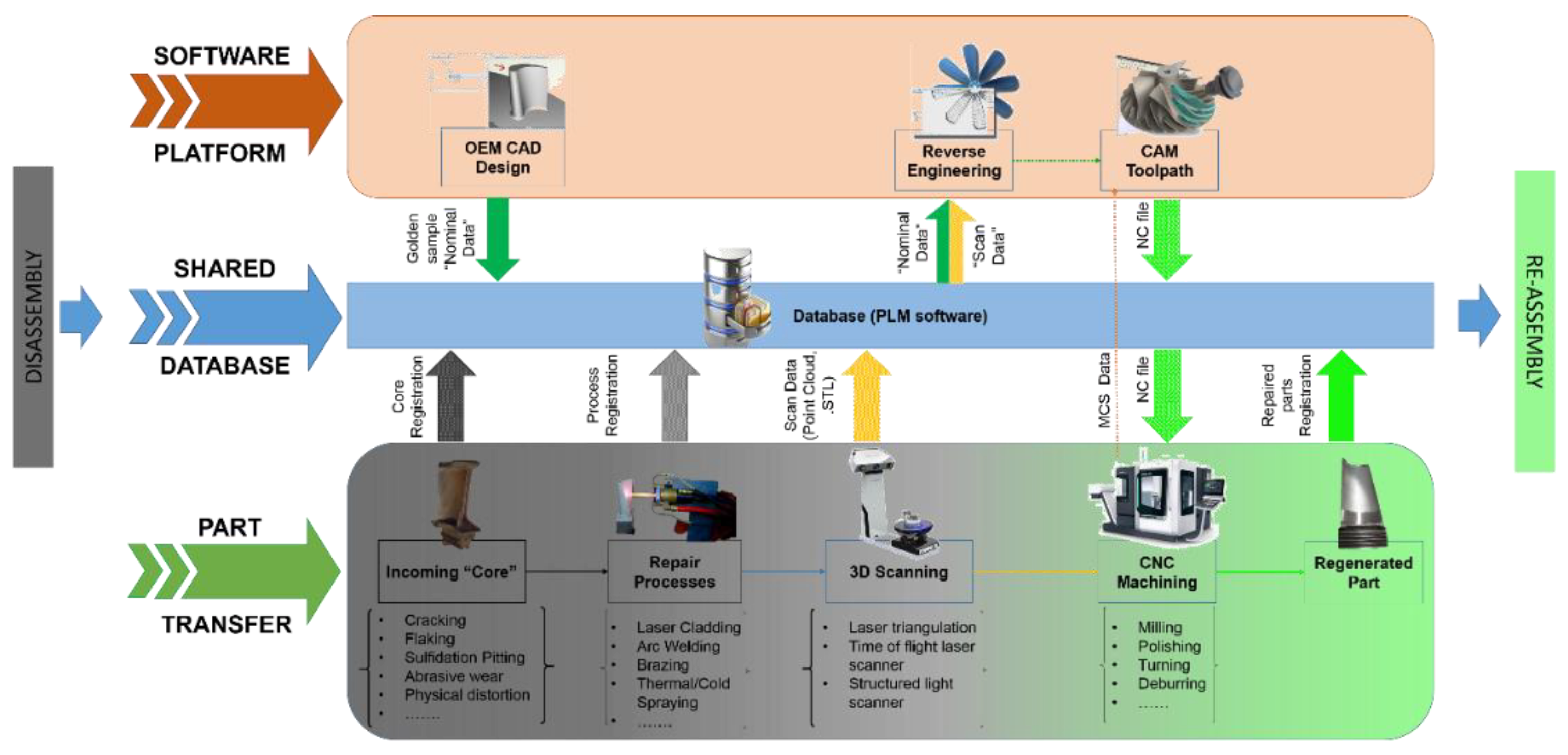

- Shared database—in this layer, all virtual data pertaining to every individual repaired component are stored and organized based on the design and existing repair information. By organizing the repair data, backtracking the core’s repair process history and failure information is a well-established process.

- Software platform—this layer defines all the software tasks related to the data flow and machine-to-machine communication channels. With a common software platform, high-speed computations are carried out both in real time and offline, helping seamless data transfer between machines without any loss in data quality.

- Physical process—this layer of the smart cell defines the actual repair tasks to be carried out on the core. Since the process requires physical transfer of the component and its storage container across the actual repair processes, it relies heavily on factory automation to conform to Industry 4.0 standards.

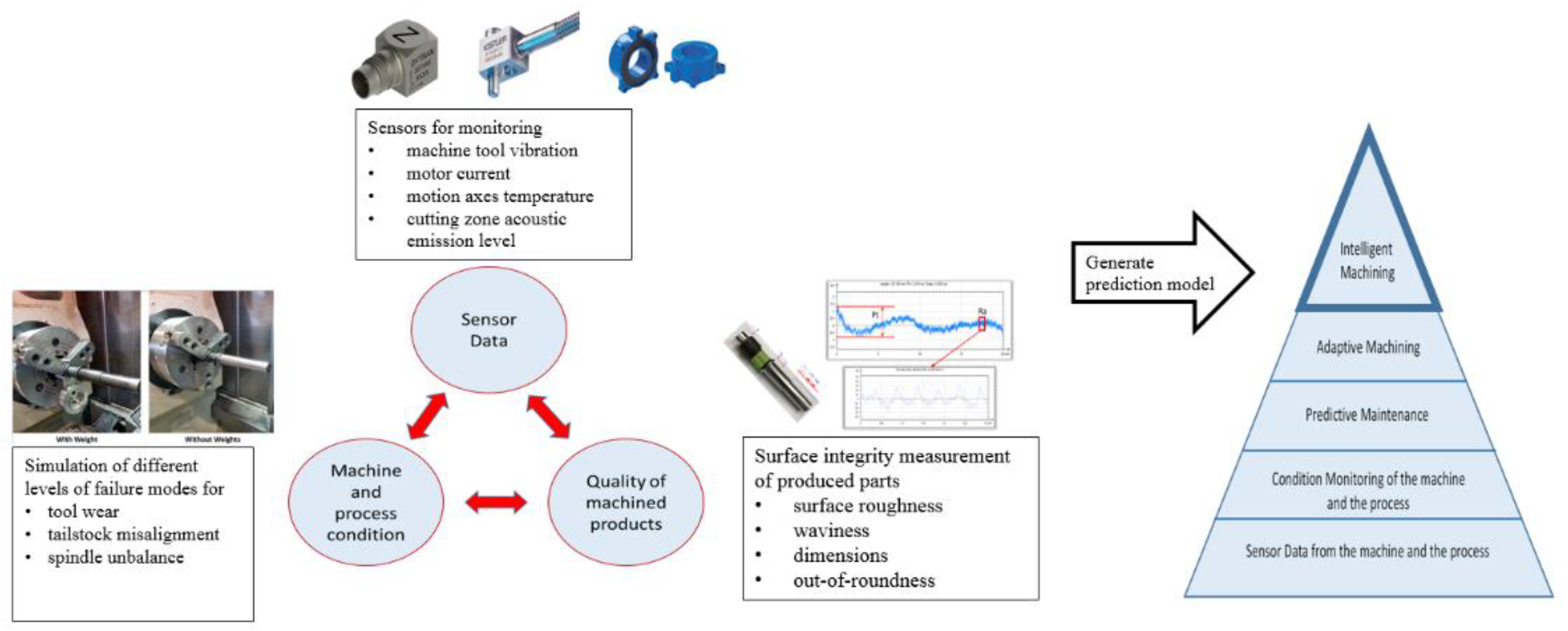

4.2. Sensorized Machines for Intelligent Machining

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- World Economic Forum. Towards the Circular Economy: Accelerating the Scale-up across Global Supply Chains. 2014. Available online: http://reports.weforum.org/toward-the-circular-economy-accelerating-the-scale-up-across-global-supply-chains/ (accessed on 28 June 2018).

- Circular Economy, Ellen Macarthur Foundation. 2018. Available online: https://www.ellenmacarthurfoundation.org/circular-economy (accessed on 28 June 2018).

- Parker, D.; Riley, K.; Robinson, S.; Symington, H.; Tewson, J.; Jansson, K.; Ramkumar, S.; Peck, D. Remanufacturing Market Study. 2015. Available online: http://www.remanufacturing.eu/assets/pdfs/remanufacturing-market-study.pdf (accessed on 28 June 2018).

- APSRG & APMG, Triple Win—The Social, Economic and Environmental Case for Remanufacturing. 2014. Available online: http://www.policyconnect.org.uk/apsrg/sites/site_apsrg/files/triple_win_-the_social_economic_and_environmental_case_for_remanufacturing.pdf (accessed on 28 June 2018).

- Kurilova-Palisaitiene, J.; Lindkvist, L.; Sundin, E. Towards facilitating circular product life-cycle information flow via remanufacturing. Procedia CIRP 2015, 29, 780–785. [Google Scholar] [CrossRef]

- Statham, S. Remanufacturing Towards a More Sustainable Future. In Electronics-Enabled Products Knowledge-Transfer Network; Loughborough University: Loughboroug, UK, 2006. [Google Scholar]

- PwC. Industry 4.0: Building the Digital Enterprise. 2015. Available online: https://www.pwc.com/gx/en/industries/industries-4.0/landing-page/industry-4.0-building-your-digital-enterprise-april-2016.pdf (accessed on 28 June 2018).

- Koch, V.; Kuge, S.; Geissbauer, R.; Schrauf, S. Industry 4.0: Opportunities and Challenges of the Industrial Internet. 2015. Available online: https://www.strategyand.pwc.com/media/file/Industry4.0.pdf (accessed on 28 June 2018).

- Nasr, N.; Thurston, M. Remanufacturing: A key enabler to sustainable product systems. In Proceedings of the 13th CIRP International Conference on Life-Cycle Engineering, Leuven, Belgium, 31 May–2 June 2006; pp. 15–18. [Google Scholar]

- Amezquita, T.; Hammond, R.; Salazar, M.; Bras, B. Characterizing the remanufacturability of engineering systems. In Proceedings of the ASME Advances in Design Automation Conference, Boston, MA, USA, 17–20 September 1995; pp. 271–278. [Google Scholar]

- Ijomah, W.; McMahon, C.; Hammond, G.; Newman, S. Development of robust design-for-remanufacturing guidelines to further the aims of sustainable development. Int. J. Prod. Res. 2007, 45, 4513–4536. [Google Scholar] [CrossRef]

- Sundin, E. Product and Process Design for Successful Remanufacturing. Ph.D. Thesis, Linköping University, Linköping, Sweden, 2004. [Google Scholar]

- Anderson, D.M. Design for Manufacturability: How to Use Concurrent Engineering to Rapidly Develop Low-Cost, High-Quality Products for Lean Production; CRC Press: Boca Raton, FL, USA, 2014. [Google Scholar]

- Calleja-Ochoa, A.; Gonzalez-Barrio, H.; Polvorosa-Teijeiro, R.; Ortega-Rodriguez, N.; Lopez-de-Lacalle-Marcaide, L.N. Multitasking machines: evolution, resources, processes and scheduling. DYNA 2017, 92, 637–642. [Google Scholar]

- Urbikain, G.; Perez, J.M.; López de Lacalle, L.N.; Andueza, A. Combination of friction drilling and form tapping processes on dissimilar materials for making nutless joints. Proc. Inst. Mech. Eng. Part B 2018, 232, 1007–1020. [Google Scholar] [CrossRef]

- Pereira, O.; Martín-Alfonso, J.E.; Rodríguez, A.; Calleja, A.; Fernández-Valdivielso, A.; de Lacalle, L.L. Sustainability analysis of lubricant oils for minimum quantity lubrication based on their tribo-rheological performance. J. Clean. Prod. 2017, 164, 1419–1429. [Google Scholar] [CrossRef]

- Guidat, T.; Barquet, A.P.; Widera, H.; Rozenfeld, H.; Seliger, G. Guidelines for the definition of innovative industrial product-service systems (PSS) business models for remanufacturing. Procedia CIRP 2014, 16, 193–198. [Google Scholar] [CrossRef]

- Rese, M.; Everhartz, J. Condition Monitoring of Industrial Product Service Systems–Helpful selling argument or potential marketing pitfall? In The Philosopher’s Stone for Sustainability; Springer: Berlin/Heidelberg, Germany, 2013; pp. 493–497. [Google Scholar]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, S.; M. R., A.R.; Kaminski, J.; Pepin, H. Opportunities for Industry 4.0 to Support Remanufacturing. Appl. Sci. 2018, 8, 1177. https://doi.org/10.3390/app8071177

Yang S, M. R. AR, Kaminski J, Pepin H. Opportunities for Industry 4.0 to Support Remanufacturing. Applied Sciences. 2018; 8(7):1177. https://doi.org/10.3390/app8071177

Chicago/Turabian StyleYang, Shanshan, Aravind Raghavendra M. R., Jacek Kaminski, and Helene Pepin. 2018. "Opportunities for Industry 4.0 to Support Remanufacturing" Applied Sciences 8, no. 7: 1177. https://doi.org/10.3390/app8071177