Digital Transformation Management of Supply Chain Firms Based on Big Data from DeFi Social Media Profiles

Abstract

:1. Introduction

1.1. Supply Chain Firms’ Digital Transformation Importance

1.2. Financial Performance of Firms’ Digital Transformation through Emerging Technologies Adoption (DeFi)

1.3. Digital Transformation, Big Data, and Social Media Analytics

2. Materials and Methods

- In the first stage, a comprehensive statistical analysis, which includes correlation and SLR models (simple linear regression) based on the collected big data from the social media profiles and websites of the sample’s firms, shows the potential strong relationships between DeFi social media and supply chain performance metrics. Moreover, the deployment of a diagnostic model for both the DeFi and the supply chain websites is being provided in the same stage. For this model, the capitalization of Fuzzy Cognitive Mapping processes took place to present a map of the potential relationships among the study’s entities.

- The next stage of the methodological context concerns the development of a hybrid simulation model that utilizes both Agent-Based Modeling (ABM) and System Dynamics (SD) procedures. Decision Support Systems (DSS) enable the modeling process the authors need to capitalize to simulate the variation in the online behavior of DeFi platforms and supply chain firms’ websites and social media profile visitors.

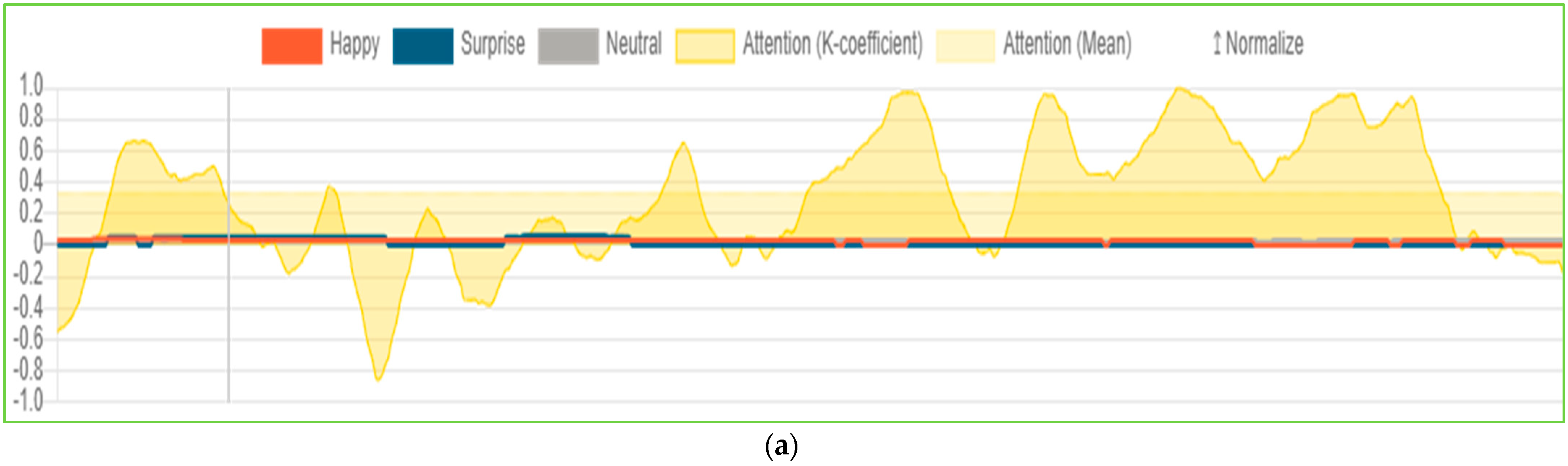

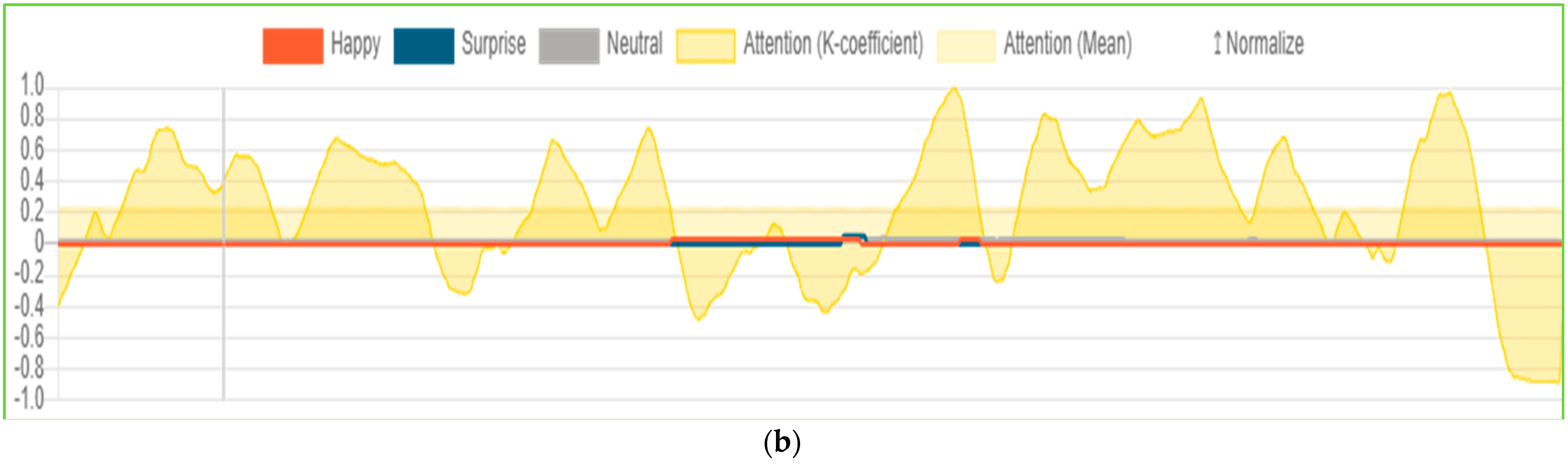

- In the last stage, a cognitive neuromarketing model is deployed, where 21 participants of various ages and income categories are summoned to observe the social media profile of the most-known DeFi platform for 30 s (the Twitter profile of Binance was the one selected). With this model, some of the research hypotheses that refer to DeFi platforms’ performance will be answered, while further insights from the behavior of the social media profile’s visitors will emerge.

2.1. Theoretical Framework and Research Hypotheses

2.2. Research Sample and Data Gathering

| Metrics | Description of the Big Data and Social Media Analytics |

|---|---|

| Organic Traffic | Organic traffic is generated by individuals looking for a particular good or service; increasing the number of such visitors on-page is an excellent approach to locating qualified leads and improving revenue [48]. |

| Organic Costs | The amount of expenses linked with a firm’s activities to generate website traffic through unpaid search results [50]. |

| Paid Costs | The amount of expenses linked with a firm’s activities to generate website traffic through paid search results [50]. |

| Bounce Rate | The amount of website visits that terminate their session with a web page, shortly after entering it. |

| Post Impressions | The assortment of times a profile’s posts appeared on someone’s display within the specified period. The total number of instances a profile’s posts, home page, advertising, stories, and so on have been viewed by visitors [66]. |

| Engagement (%) | Engagement measures how well a profile invites people to contribute. Firms may employ this statistic to analyze the effectiveness of profiles of various categories as well as their rivals [66] because all fundamental data are available, and interactions are adjusted for the number of fans. |

| Total Followers | The total amount of people who liked or followed the profile or account. The number of followers indicates how vast and recognized a profile is and how far it could expand organically [66]. |

| Followers Growth | The proportion of the increase in followers throughout the initial and final day of the chosen timeframe. Every day in the historical graph represents the change from the initial day of the specified period [66]. |

| Post Interaction (%) | Average post engagement per follower each post. Interactions include likes, hearts, haha, and other emoticons, in addition to comments, shares, and retweets [66]. |

3. Results

3.1. Statistical Analysis

3.2. Fuzzy Cognitive Mapping Model

3.3. Hybrid Model Deployment

3.4. Cognitive Neuromarketing Model

4. Discussion

5. Conclusions

5.1. Theoretical and Practical Implications

5.2. Limitations

5.3. Future Work

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Java Coding Route of Anylogic |

|---|

| @Override @AnyLogicInternalCodegenAPI public void enterState( short _state, boolean _destination ) { switch( _state ) { case CryptoTradeVisitors: // (Simple state (not composite)) statechart.setActiveState_xjal( CryptoTradeVisitors ); transition.start(); transition1.start(); return; case NewCryptoVisitors: // (Simple state (not composite)) statechart.setActiveState_xjal( NewCryptoVisitors ); { newCryptoVisitors++ ;} transition3.start(); return; case CryptoBounceRate: // (Simple state (not composite)) statechart.setActiveState_xjal( CryptoBounceRate ); { SMpostImpressions = normal(198170.48 , 376508.88); SMengagement = normal(0.12,0.19); SMtotalFollowers = normal(47403.33,549.72); SMfollowersGrowth = normal(3549.10,6044.04); SMpostInteraction = normal(0.54,0.8); cryptoBounceRate = SMpostImpressions*(−6.996) + SMengagement*(3.944) + SMtotalFollowers*(0.755) + SMfollowersGrowth*(28.345) + SMpostInteraction*(−26.086) ;} transition2.start(); transition5.start(); return; case CryptoSocialMediaProfile: // (Simple state (not composite)) statechart.setActiveState_xjal( CryptoSocialMediaProfile ); { socialMediaAnalytics = SMpostImpressions + SMengagement + SMtotalFollowers + SMfollowersGrowth + SMpostInteraction ;} transition7.start(); return; case CryptoOrganicTraffic: // (Simple state (not composite)) statechart.setActiveState_xjal( CryptoOrganicTraffic ); { cryptoOrganicTraffic = SMpostImpressions*(−2.914) + SMengagement*(−1.280) + SMtotalFollowers*(4.349) + SMfollowersGrowth*(−1.055) + SMpostInteraction*(0.057) ;} transition8.start(); return; case SupplyChainNewCustomers: // (Simple state (not composite)) statechart.setActiveState_xjal( SupplyChainNewCustomers ); { supplyChainNewCustomers = SMpostImpressions*(16.064) + SMengagement*(−8.434) + SMtotalFollowers*(−11.549) + SMfollowersGrowth*(−2.889) + SMpostInteraction*(7.379); supplyChainPaidCosts = SMpostImpressions*(−11.754) + SMengagement*(4.452) + SMtotalFollowers*(12.337) + SMfollowersGrowth*(−4.480) + SMpostInteraction*(0.353); supplyChainOrganicCosts = SMpostImpressions*(−23.853) + SMengagement*(5.965) + SMtotalFollowers*(21.607) + SMfollowersGrowth*(5.068) + SMpostInteraction*(−9.768) ;} transition11.start(); return; case SupplyChainBounceRate: // (Simple state (not composite)) statechart.setActiveState_xjal( SupplyChainBounceRate ); transition6.start(); return; case OldCryptoVisitors: // (Simple state (not composite)) statechart.setActiveState_xjal( OldCryptoVisitors ); { oldCryptoVisitors++ ;} transition4.start(); return; default: super.enterState( _state, _destination ); return; } } |

References

- Kutnjak, A.; Pihiri, I.; Tomičić Furjan, M. Digital transformation case studies across industries–literature review. In Proceedings of the 2019 42nd International Convention on Information and Communication Technology, Electronics and Microelectronics (MIPRO), Opatija, Croatia, 20–24 May 2019; IEEE: New York, NY, USA, 2019; pp. 1293–1298. [Google Scholar] [CrossRef]

- Nasiri, M.; Ukko, J.; Saunila, M.; Rantala, T. Managing the digital supply chain: The role of smart technologies. Technovation 2020, 96, 102121. [Google Scholar] [CrossRef]

- Stachová, K.; Stacho, Z.; Cagáňová, D.; Stareček, A. Use of Digital Technologies for Intensifying Knowledge Sharing. Appl. Sci. 2020, 10, 4281. [Google Scholar] [CrossRef]

- Diéssica, O.-D.; Maqueira-Marín, J.M.; Moyano-Fuentes, J. The link between information and digital technologies of industry 4.0 and agile supply chain: Mapping current research and establishing new research avenues. Comput. Ind. Eng. 2022, 167, 108000. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Göçer, F. Digital supply chain: Literature review and a proposed framework for future research. Comput. Ind. 2018, 97, 157–177. [Google Scholar] [CrossRef]

- Behl, A.; Gaur, J.; Pereira, V.; Yadav, R.; Benjamin Laker, B. Role of big data analytics capabilities to improve sustainable competitive advantage of MSME service firms during COVID-19–A multi-theoretical approach. J. Bus. Res. 2022, 148, 378–389. [Google Scholar] [CrossRef]

- Knudsen, E.S.; Lien, L.B.; Timmermans, B.; Belik, I.; Pandey, S. Stability in turbulent times? The effect of digitalization on the sustainability of competitive advantage. J. Bus. Res. 2021, 128, 360–369. [Google Scholar] [CrossRef]

- Chen, H.Y.; Das, A.; Ivanov, D. Building resilience and managing post-disruption supply chain recovery: Lessons from the information and communication technology industry. Int. J. Inf. Manag. 2019, 49, 330–342. [Google Scholar] [CrossRef]

- Paul, S.K.; Chowdhury, P.; Moktadir, M.A.; Lau, K.H. Supply chain recovery challenges in the wake of COVID-19 pandemic. J. Bus. Res. 2021, 136, 316–329. [Google Scholar] [CrossRef] [PubMed]

- Urbinati, A.; Chiaroni, D.; Chiesa, V.; Frattini, F. The role of digital technologies in open innovation processes: An exploratory multiple case study analysis. R&D Manag. 2020, 50, 136–160. [Google Scholar] [CrossRef]

- Wimelius, H.; Mathiassen, L.; Holmstrom, J.; Keil, M. A paradoxical perspective on technology renewal in digital transformation. Inf. Syst. J. 2021, 31, 198–225. [Google Scholar] [CrossRef]

- Xue, L.; Zhang, Q.Y.; Zhang, X.M.; Li, C.Y. Can digital transformation promote green technology innovation? Sustainability 2022, 14, 7497. [Google Scholar] [CrossRef]

- Wu, T.; Chen, B.B.; Shao, Y.X.; Lu, H.X. Enable digital transformation: Entrepreneurial leadership, ambidextrous learning and organisational performance. Tech. Anal. Strat. Manag. 2021, 33, 1389–1403. [Google Scholar] [CrossRef]

- Skeldon, P. Global Number of Ecommerce Users Jumps 10% in 2020 and Will Hit 3.8bn This Year: Study. 2021. Available online: https://bit.ly/3apDnz8 (accessed on 10 August 2023).

- George, G.; Haas, M.R.; Pentland, A. Big data and management: From the Editors. Acad. Manag. J. 2014, 57, 321–326. Available online: https://ink.library.smu.edu.sg/lkcsb_research/4621 (accessed on 11 August 2023). [CrossRef]

- Attaran, M. Digital technology enablers and their implications for supply chain management. Supply Chain. Forum Int. J. 2020, 21, 158–172. [Google Scholar] [CrossRef]

- Yang, M.; Fu, M.; Zhang, Z. The adoption of digital technologies in supply chains: Drivers, process and impact. Technol. Forecast. Soc. Chang. 2021, 169, 120795. [Google Scholar] [CrossRef]

- Busulwa, R.; Pickering, M.; Mao, I. Digital transformation and hospitality management competencies: Toward an integrative framework. Int. J. Hosp. Manag. 2022, 102, 103132. [Google Scholar] [CrossRef]

- He, X.; Hu, W.; Li, W.; Hu, R. Digital transformation, technological innovation, and operational resilience of port firms in case of supply chain disruption. Mar. Pollut. Bull. 2023, 190, 114811. [Google Scholar] [CrossRef]

- Hughes, L.; Dwivedi, Y.K.; Misra, S.K.; Rana, N.P.; Raghavan, V.; Akella, V. Blockchain research, practice and policy: Applications, benefits, limitations, emerging research themes and research agenda. Int. J. Inf. Manag. 2019, 49, 114–129. [Google Scholar] [CrossRef]

- Morkunas, V.J.; Paschen, J.; Boon, E. How blockchain technologies impact your business model. Bus. Horiz. 2019, 62, 295–306. [Google Scholar] [CrossRef]

- Lee, K.; Azmi, N.; Hanaysha, J.; Alzoubi, H.; Alshurideh, M. The effect of digital supply chain on organizational performance: An empirical study in Malaysia manufacturing industry. Uncertain Supply Chain. Manag. 2022, 10, 495–510. [Google Scholar] [CrossRef]

- Far, S.B.; Rad, A.I.; Asaar, M.R. Blockchain and its derived technologies shape the future generation of digital businesses: A focus on decentralized finance and the Metaverse. Data Sci. Manag. 2023, 6, 183–197. [Google Scholar] [CrossRef]

- On, Y.; Reardon, A.J. What digital banks can learn from decentralised finance. J. Digit. Banking 2021, 5, 255–263. [Google Scholar]

- Liu, Z. Literature review of supply chain finance based on blockchain perspective. Open J. Bus. Manag. 2020, 9, 419–429. [Google Scholar] [CrossRef]

- Lahkani, M.J.; Wang, S.; Urbański, M.; Egorova, M. Sustainable B2B E-Commerce and Blockchain-Based Supply Chain Finance. Sustainability 2020, 12, 3968. [Google Scholar] [CrossRef]

- Allen, F.; Gu, X.; Jagtiani, J. Fintech, cryptocurrencies, and CBDC: Financial structural transformation in China. J. Int. Money Financ. 2022, 124, 102625. [Google Scholar] [CrossRef]

- Schueffel, P. DeFi: Decentralized Finance-An Introduction and Overview. J. Innov. Manag. 2021, 9, 1–9. [Google Scholar] [CrossRef]

- Wronka, C. Financial crime in the decentralized finance ecosystem: New challenges for compliance. J. Financ. Crime 2023, 30, 97–113. [Google Scholar] [CrossRef]

- Raja Santhi, A.; Muthuswamy, P. Influence of Blockchain Technology in Manufacturing Supply Chain and Logistics. Logistics 2022, 6, 15. [Google Scholar] [CrossRef]

- Seyedan, M.; Mafakheri, F. Predictive big data analytics for supply chain demand forecasting: Methods, applications, and research opportunities. J. Big Data 2020, 7, 1–22. [Google Scholar] [CrossRef]

- Bag, S.; Wood, L.C.; Xu, L.; Dhamija, P.; Kayikci, Y. Big data analytics as an operational excellence approach to enhance sustainable supply chain performance. Resour. Conserv. Recycl. 2020, 153, 104559. [Google Scholar] [CrossRef]

- Saura, J.R.; Palos-Sánchez, P.; Cerdá Suárez, L.M. Understanding the Digital Marketing Environment with KPIs and Web Analytics. Future Internet 2017, 9, 76. [Google Scholar] [CrossRef]

- Drivas, I.C.; Kouis, D.; Kyriaki-Manessi, D.; Giannakopoulou, F. Social Media Analytics and Metrics for Improving Users Engagement. Knowledge 2022, 2, 225–242. [Google Scholar] [CrossRef]

- Choi, T.-M.; Guo, S.; Luo, S. When blockchain meets social-media: Will the result benefit social media analytics for supply chain operations management? Transp. Res. Part E Logist. Transp. Rev. 2020, 135, 101860. [Google Scholar] [CrossRef]

- Dolgui, A.; Ivanov, D. 5G in digital supply chain and operations management: Fostering flexibility, end-to-end connectivity and real-time visibility through internet-of-everything. Int. J. Prod. Res. 2022, 60, 442–451. [Google Scholar] [CrossRef]

- Maheshwari, S.; Gautam, P.; Jaggi, C.K. Role of Big Data Analytics in supply chain management: Current trends and future perspectives. Int. J. Prod. Res. 2021, 59, 1875–1900. [Google Scholar] [CrossRef]

- Grover, P.; Kar, A.K.; Dwivedi, Y.K. Understanding artificial intelligence adoption in operations management: Insights from the review of academic literature and social media discussions. Ann. Oper. Res. 2022, 308, 177–213. [Google Scholar] [CrossRef]

- Mappesona, H.; Ikhsani, K.; Ali, H. Customer purchase decision model, supply chain management and customer satisfaction: Product quality and promotion analysis. Int. J. Supply Chain. Manag. 2020, 9, 592–600. Available online: https://core.ac.uk/download/pdf/288291233.pdf (accessed on 30 August 2023).

- Sivarajah, U.; Irani, Z.; Gupta, S.; Mahroof, K. Role of big data and social media analytics for business to business sustainability: A participatory web context. Ind. Mark. Manag. 2020, 86, 163–179. [Google Scholar] [CrossRef]

- Muhammad, A.; Ibrahim, M.; Ikramuddin, I.; Syahputra, H. The role of digital marketing platforms on supply chain management for customer satisfaction and loyalty in small and medium enterprises (SMEs) at Indonesia. Int. J. Supply Chain. Manag. 2020, 9, 1210–1220. Available online: https://core.ac.uk/download/pdf/328146431.pdf (accessed on 30 August 2023).

- Ranjan, J.; Foropon, C. Big data analytics in building the competitive intelligence of organizations. Int. J. Inf. Manag. 2021, 56, 102231. [Google Scholar] [CrossRef]

- Silva, S.C.; Duarte, P.A.O.; Almeida, S.R. How companies evaluate the ROI of social media marketing programmes: Insights from B2B and B2C. J. Bus. Ind. Mark. 2020, 35, 2097–2110. [Google Scholar] [CrossRef]

- Tavana, M.; Shaabani, A.; Raeesi Vanani, I.; Kumar Gangadhari, R. A Review of Digital Transformation on Supply Chain Process Management Using Text Mining. Processes 2022, 10, 842. [Google Scholar] [CrossRef]

- Kostakis, P.; Kargas, A. Big-Data Management: A Driver for Digital Transformation? Information 2021, 12, 411. [Google Scholar] [CrossRef]

- Fukui, T. A systems approach to big data technology applied to supply chain. In Proceedings of the 2016 IEEE International Conference on Big Data (Big Data), Washington, DC, USA, 5–8 December 2016; pp. 3732–3736. [Google Scholar] [CrossRef]

- Kache, F.; Seuring, S. Challenges and opportunities of digital information at the intersection of Big Data Analytics and supply chain management. Int. J. Oper. Prod. Manag. 2017, 37, 10–36. [Google Scholar] [CrossRef]

- Forbes. 15 Low-Cost Tactics to Increase Organic Traffic. 2022. Available online: https://www.forbes.com/sites/forbesbusinesscouncil/2022/11/10/15-low-cost-tactics-to-increase-organic-traffic/ (accessed on 9 August 2023).

- Poulos, M.; Korfiatis, N.; Papavlassopoulos, S. Assessing stationarity in web analytics: A study of bounce rates. Expert Syst. 2019, 37, e12502. [Google Scholar] [CrossRef]

- Lynch, O. The Case for Organic Traffic vs. Paid Traffic. 2023. Available online: https://cheq.ai/blog/organic-traffic-vs-paid-traffic-2/ (accessed on 9 August 2023).

- Griswold, M. The Gartner Supply Chain Top 25 for 2022. 2022. Available online: https://www.gartner.com/en/articles/the-gartner-supply-chain-top-25-for-2022#:~:text=This%20year%2C%20Cisco%20retains%20the,and%20creating%20supply%20chain%20ecosystems (accessed on 16 June 2023).

- Pepi, K. 8 Best DeFi Apps to Try in 2023. 2022. Available online: https://www.business2community.com/cryptocurrency/best-defi-apps (accessed on 16 June 2023).

- Cisco Systems. 2023. Available online: https://www.cisco.com/ (accessed on 12 June 2023).

- Schneider Electric. 2023. Available online: https://www.se.com/ (accessed on 12 June 2023).

- Colgate-Palmolive. 2023. Available online: https://www.colgatepalmolive.com/ (accessed on 12 June 2023).

- Johnson & Johnson. 2023. Available online: https://www.jnj.com/ (accessed on 12 June 2023).

- Pepsico. 2023. Available online: https://www.pepsico.com/ (accessed on 12 June 2023).

- Binance. 2023. Available online: https://www.binance.com/ (accessed on 12 June 2023).

- Coinbase. 2023. Available online: https://www.coinbase.com/ (accessed on 12 June 2023).

- Crypto. 2023. Available online: https://crypto.com/ (accessed on 12 June 2023).

- DeFi Swap. 2023. Available online: https://defiswap.io/ (accessed on 12 June 2023).

- AQRU. 2023. Available online: https://aqru.io/ (accessed on 12 June 2023).

- Semrush. 2023. Available online: https://www.semrush.com/ (accessed on 12 June 2023).

- Fanpage Karma. 2023. Available online: https://www.fanpagekarma.com/ (accessed on 12 June 2023).

- Realeye. 2023. Available online: https://www.realeye.io/ (accessed on 30 June 2023).

- Fanpage Karma Academy. Metrics Overview. 2023. Available online: https://academy.fanpagekarma.com/en/metrics/ (accessed on 9 August 2023).

- MentalModeler. 2022. Available online: https://dev.mentalmodeler.com/ (accessed on 16 June 2023).

- Migkos, S.P.; Sakas, D.P.; Giannakopoulos, N.T.; Konteos, G.; Metsiou, A. Analyzing Greece 2010 Memorandum’s Impact on Macroeconomic and Financial Figures through FCM. Economies 2022, 10, 178. [Google Scholar] [CrossRef]

- Mpelogianni, V.; Groumpos, P.P. Re-approaching fuzzy cognitive maps to increase the knowledge of a system. AI Soc. 2018, 33, 175–188. [Google Scholar] [CrossRef]

- Retzlaff, C.O.; Ziefle, M.; Calero-Valdez, A. The history of agent-based modeling in the social sciences. In Digital Human Modeling and Applications in Health, Safety, Ergonomics and Risk Management. Human Body, Motion and Behavior; Duffy, V.G., Ed.; HCII 2021; Lecture Notes in Computer Science; Springer: Cham, Switzerland, 2021; p. 12777. [Google Scholar] [CrossRef]

- Anylogic. 2022. Available online: https://www.anylogic.com/ (accessed on 22 June 2023).

- Sakas, D.P.; Giannakopoulos, N.T.; Trivellas, P. Exploring affiliate marketing’s impact on customers’ brand engagement and vulnerability in the online banking service sector. Int. J. Bank Mark. 2023. ahead-of-print. [Google Scholar] [CrossRef]

- Sarishma, D.; Sangwan, S.; Tomar, R.; Srivastava, R. A Review on Cognitive Computational Neuroscience: Overview, Models, and Applications. In Innovative Trends in Computational Intelligence. EAI/Springer Innovations in Communication and Computing; Tomar, R., Hina, M.D., Zitouni, R., Ramdane-Cherif, A., Eds.; Springer: Cham, Switzerland, 2022. [Google Scholar] [CrossRef]

- Rawnaque, F.S.; Rahman, K.M.; Anwar, S.F.; Vaidyanathan, R.; Chau, T.; Sarker, F.; Al Mamun, K.A. Technological advancements and opportunities in Neuromarketing: A systematic review. Brain Inf. 2020, 7, 10. [Google Scholar] [CrossRef]

- Barbierato, E.; Berti, D.; Ranfagni, S.; Hernández-Álvarez, L.; Bernetti, I. Wine label design proposals: An eye-tracking study to analyze consumers’ visual attention and preferences. Int. J. Wine Bus. Res. 2023, 35, 365–389. [Google Scholar] [CrossRef]

- Casado-Aranda, L.-A.; Sánchez-Fernández, J.; Ibáñez-Zapata, J.-A. Evaluating Communication Effectiveness Through Eye Tracking: Benefits, State of the Art, and Unresolved Questions. Int. J. Bus. Commun. 2020, 60, 24–61. [Google Scholar] [CrossRef]

- Lieskovská, E.; Jakubec, M.; Jarina, R.; Chmulík, M. A Review on Speech Emotion Recognition Using Deep Learning and Attention Mechanism. Electronics 2021, 10, 1163. [Google Scholar] [CrossRef]

- Farnoush, A.; Gupta, A.; Dolarsara, H.A.; Paradice, D.; Rao, S. Going beyond intent to adopt Blockchain: An analytics approach to understand board member and financial health characteristics. Ann. Oper. Res. 2022, 308, 93–123. [Google Scholar] [CrossRef]

- Hasan, M.R.; Shiming, D.; Islam, M.A.; Hossain, M.Z. Operational efficiency effects of blockchain technology implementation in firms: Evidence from China. Rev. Int. Bus. Strategy 2020, 30, 163–181. [Google Scholar] [CrossRef]

- Stroumpoulis, A.; Kopanaki, E. Theoretical Perspectives on Sustainable Supply Chain Management and Digital Transformation: A Literature Review and a Conceptual Framework. Sustainability 2022, 14, 4862. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T.; Kanellos, N.; Migkos, S.P. Innovative Cryptocurrency Trade Websites’ Marketing Strategy Refinement, via Digital Behavior. IEEE Access 2022, 10, 63163–63176. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T.; Nasiopoulos, D.K.; Kanellos, N.; Tsoulfas, G.T. Assessing the Efficacy of Cryptocurrency Applications’ Affiliate Marketing Process on Supply Chain Firms’ Website Visibility. Sustainability 2023, 15, 7326. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T.; Terzi, M.C.; Kamperos, I.D.G.; Kanellos, N. What is the connection between Fintechs’ video marketing and their vulnerable customers’ brand engagement during crises? Int. J. Bank Mark. 2023. ahead-of-print. [Google Scholar] [CrossRef]

| Metrics | Mean | Min | Max | Std. Deviation |

|---|---|---|---|---|

| Supply Chain Firms (SC) | ||||

| Organic Costs | 24,437,840.08 | 17,760,939.00 | 30,389,621.00 | 4,516,413.75 |

| Paid Costs | 1,363,788.42 | 717,103.00 | 2,676,244.00 | 500,493.54 |

| Bounce Rate | 0.62 | 0.57 | 0.65 | 0.03 |

| New Customers | 15,888,074.43 | 13,230,273.00 | 18,363,549.00 | 1,812,070.90 |

| Decentralized Finance (DF) | ||||

| Organic Traffic | 53,389,414.83 | 43,390,849.00 | 60,687,631.00 | 5,058,999.21 |

| Bounce Rate | 0.63 | 0.57 | 0.71 | 0.04 |

| Post Impressions | 376,508.88 | 49,215.00 | 550,628.00 | 198,170.48 |

| Engagement (%) | 19.00 | 3.00 | 34.00 | 0.12 |

| Total Followers | 47,403.33 | 46,480.00 | 47,900.00 | 549.72 |

| Followers Growth | 6044.04 | 1012.00 | 10,884.00 | 3549.10 |

| Post Interaction (%) | 8.00 | 1.00 | 16.00 | 5.40 |

| SC Organic Costs | SC Paid Costs | SC Bounce Rate | SC New Customers | DF Organic Traffic | DF Bounce Rate | DF Post Impressions | DF Engagement | DF Total Followers | DF Followers Growth | DF Post Interaction | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SC Organic Costs | 1 | −0.349 | −0.459 | −0.554 | 0.170 | −0.407 | −0.823 * | −0.846 * | −0.804 | −0.831 * | −0.819 * |

| SC Paid Costs | −0.349 | 1 | 0.163 | 0.016 | −0.026 | −0.061 | 0.882 * | 0.898 * | 0.892 * | 0.880 * | 0.883 * |

| SC Bounce Rate | −0.459 | 0.163 | 1 | 0.877 ** | −0.222 | 0.260 | 0.576 | 0.334 | 0.577 | 0.374 | 0.313 |

| SC New Customers | −0.554 | 0.016 | 0.877 ** | 1 | −0.345 | 0.177 | 0.423 | 0.294 | 0.423 | 0.350 | 0.322 |

| DF Organic Traffic | 0.170 | −0.026 | −0.222 | −0.345 | 1 | −0.402 | −0.748 | −0.904 * | −0.741 | −0.887 * | −0.908 * |

| DF Bounce Rate | −0.407 | −0.061 | 0.260 | 0.177 | −0.402 | 1 | 0.285 | 0.289 | 0.266 | 0.303 | 0.266 |

| DF Post Impressions | −0.823 * | 0.882 * | 0.576 | 0.423 | −0.748 | 0.285 | 1 | 0.956 ** | 0.999 ** | 0.954 ** | 0.931 ** |

| DF Engagement | −0.846 * | 0.898 * | 0.334 | 0.294 | −0.904 * | 0.289 | 0.956 ** | 1 | 0.955 ** | 0.992 ** | 0.989 ** |

| DF Total Followers | −0.804 | 0.892 * | 0.577 | 0.423 | −0.741 | 0.266 | 0.999 ** | 0.955 ** | 1 | 0.957 ** | 0.935 ** |

| DF Followers Growth | −0.831 * | 0.880 * | 0.374 | 0.350 | −0.887 * | 0.303 | 0.954 ** | 0.992 ** | 0.957 ** | 1 | 0.997 ** |

| DF Post Interaction | −0.819 * | 0.883 * | 0.313 | 0.322 | −0.908 * | 0.266 | 0.931 ** | 0.989 ** | 0.935 ** | 0.997 ** | 1 |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Constant | − | 1.000 | - | 0.000 ** |

| Post Impressions | −2.914 | 0.000 ** | ||

| Engagement | −1.280 | 0.000 ** | ||

| Total Followers | 4.349 | 0.000 ** | ||

| Followers Growth | −1.055 | 0.000 ** | ||

| Post Interaction | 0.057 | 0.000 ** |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Constant | - | 1.000 | - | 0.000 ** |

| Post Impressions | −6.996 | 0.000 ** | ||

| Engagement | 3.944 | 0.000 ** | ||

| Total Followers | 0.755 | 0.000 ** | ||

| Followers Growth | 28.345 | 0.000 ** | ||

| Post Interaction | −26.086 | 0.000 ** |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Constant | - | 1.000 | - | 0.000 ** |

| Post Impressions | −23.853 | 0.000 ** | ||

| Engagement | 5.965 | 0.000 ** | ||

| Total Followers | 21.607 | 0.000 ** | ||

| Followers Growth | 5.068 | 0.000 ** | ||

| Post Interaction | −9.768 | 0.000 ** |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Constant | - | 1.000 | - | 0.000 ** |

| Post Impressions | −11.754 | 0.000 ** | ||

| Engagement | 4.452 | 0.000 ** | ||

| Total Followers | 12.337 | 0.000 ** | ||

| Followers Growth | −4.480 | 0.000 ** | ||

| Post Interaction | 0.353 | 0.000 ** |

| Variables | Standardized Coefficient | R2 | F | p-Value |

|---|---|---|---|---|

| Constant | - | 1.000 | - | 0.000 ** |

| Post Impressions | 16.064 | 0.000 ** | ||

| Engagement | −8.434 | 0.000 ** | ||

| Total Followers | −11.549 | 0.000 ** | ||

| Followers Growth | −2.889 | 0.000 ** | ||

| Post Interaction | 7.379 | 0.000 ** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sakas, D.P.; Giannakopoulos, N.T.; Terzi, M.C.; Kanellos, N.; Liontakis, A. Digital Transformation Management of Supply Chain Firms Based on Big Data from DeFi Social Media Profiles. Electronics 2023, 12, 4219. https://doi.org/10.3390/electronics12204219

Sakas DP, Giannakopoulos NT, Terzi MC, Kanellos N, Liontakis A. Digital Transformation Management of Supply Chain Firms Based on Big Data from DeFi Social Media Profiles. Electronics. 2023; 12(20):4219. https://doi.org/10.3390/electronics12204219

Chicago/Turabian StyleSakas, Damianos P., Nikolaos T. Giannakopoulos, Marina C. Terzi, Nikos Kanellos, and Angelos Liontakis. 2023. "Digital Transformation Management of Supply Chain Firms Based on Big Data from DeFi Social Media Profiles" Electronics 12, no. 20: 4219. https://doi.org/10.3390/electronics12204219